National: looking after those in need

National: looking after those in need

Written By:

James Henderson - Date published:

10:51 am, June 11th, 2012 - 22 comments

Categories: benefits, tax -

Tags:

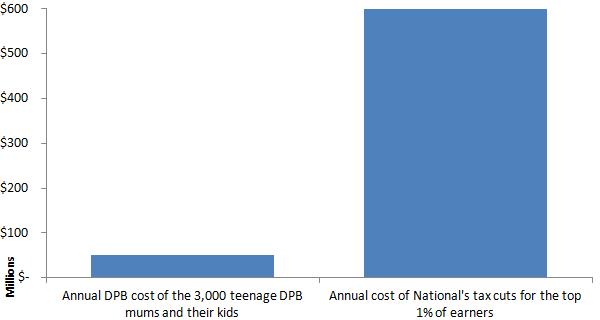

When Righties say we can’t afford to support solo mums, what do they think we can afford instead?

Cost of DPB for the 3,000 teenage solo mums and their kids: $50 million

Cost of DPB for the 3,000 teenage solo mums and their kids: $50 million

Cost of tax cuts for the top 1% of earners under National: $600 million

Sources: MSD benefit fact-sheets, Budget Crown expense tables, IRD income distributions of individual customers

Related Posts

22 comments on “National: looking after those in need ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Mike the Lefty to joe90 on

- Traveller to Phillip ure on

- SPC to Phillip ure on

- Phillip ure to Traveller on

- Traveller to Phillip ure on

- Phillip ure to David on

- joe90 to Mike the Lefty on

- Phillip ure to Anne on

- Tabletennis to joe90 on

- joe90 to Tabletennis on

- SPC to James Thrace on

- veutoviper to James Thrace on

- Delia on

- Delia to James Thrace on

- Tabletennis to SPC on

- SPC on

- SPC to Tabletennis on

- Dolomedes III to Adrian on

- Tabletennis on

- Reality on

- Drowsy M. Kram to Ad on

- joe90 on

- Descendant Of Smith to Adrian on

- Adrian on

- Visubversa to Sanctuary on

- Obtrectator to Joe90 on

- Joe90 on

- Joe90 on

- Ad on

- SPC on

- SPC on

- SPC on

- roblogic on

- joe90 on

Recent Posts

-

by mickysavage

-

by weka

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by Guest post

-

by mickysavage

-

by lprent

-

by mickysavage

- How to Share Computer Audio on Zoom

Zoom is a video conferencing service that allows you to share your screen, webcam, and audio with other participants. In addition to sharing your own audio, you can also share the audio from your computer with other participants. This can be useful for playing music, sharing presentations with audio, or ...Gareth’s WorldBy admin3 hours ago

Zoom is a video conferencing service that allows you to share your screen, webcam, and audio with other participants. In addition to sharing your own audio, you can also share the audio from your computer with other participants. This can be useful for playing music, sharing presentations with audio, or ...Gareth’s WorldBy admin3 hours ago - How Long Does It Take to Build a Computer?

Building your own computer can be a rewarding and cost-effective way to get a high-performance machine tailored to your specific needs. However, it also requires careful planning and execution, and one of the most important factors to consider is the time it will take. The exact time it takes to ...Gareth’s WorldBy admin3 hours ago

Building your own computer can be a rewarding and cost-effective way to get a high-performance machine tailored to your specific needs. However, it also requires careful planning and execution, and one of the most important factors to consider is the time it will take. The exact time it takes to ...Gareth’s WorldBy admin3 hours ago - How to Put Your Computer to Sleep

Sleep mode is a power-saving state that allows your computer to quickly resume operation without having to boot up from scratch. This can be useful if you need to step away from your computer for a short period of time but don’t want to shut it down completely. There are ...Gareth’s WorldBy admin3 hours ago

Sleep mode is a power-saving state that allows your computer to quickly resume operation without having to boot up from scratch. This can be useful if you need to step away from your computer for a short period of time but don’t want to shut it down completely. There are ...Gareth’s WorldBy admin3 hours ago - What is Computer-Assisted Translation (CAT)?

Introduction Computer-Assisted Translation (CAT) has revolutionized the field of translation by harnessing the power of technology to assist human translators in their work. This innovative approach combines specialized software with human expertise to improve the efficiency, accuracy, and consistency of translations. In this comprehensive article, we will delve into the ...Gareth’s WorldBy admin3 hours ago

Introduction Computer-Assisted Translation (CAT) has revolutionized the field of translation by harnessing the power of technology to assist human translators in their work. This innovative approach combines specialized software with human expertise to improve the efficiency, accuracy, and consistency of translations. In this comprehensive article, we will delve into the ...Gareth’s WorldBy admin3 hours ago - iPad vs. Tablet Computers A Comprehensive Guide to Differences

In today’s digital age, mobile devices have become an indispensable part of our daily lives. Among the vast array of portable computing options available, iPads and tablet computers stand out as two prominent contenders. While both offer similar functionalities, there are subtle yet significant differences between these two devices. This ...Gareth’s WorldBy admin4 hours ago

In today’s digital age, mobile devices have become an indispensable part of our daily lives. Among the vast array of portable computing options available, iPads and tablet computers stand out as two prominent contenders. While both offer similar functionalities, there are subtle yet significant differences between these two devices. This ...Gareth’s WorldBy admin4 hours ago - How Are Computers Made?

A computer is an electronic device that can be programmed to carry out a set of instructions. The basic components of a computer are the processor, memory, storage, input devices, and output devices. The Processor The processor, also known as the central processing unit (CPU), is the brain of the ...Gareth’s WorldBy admin4 hours ago

A computer is an electronic device that can be programmed to carry out a set of instructions. The basic components of a computer are the processor, memory, storage, input devices, and output devices. The Processor The processor, also known as the central processing unit (CPU), is the brain of the ...Gareth’s WorldBy admin4 hours ago - How to Add Voice Memos from iPhone to Computer

Voice Memos is a convenient app on your iPhone that allows you to quickly record and store audio snippets. These recordings can be useful for a variety of purposes, such as taking notes, capturing ideas, or recording interviews. While you can listen to your voice memos on your iPhone, you ...Gareth’s WorldBy admin4 hours ago

Voice Memos is a convenient app on your iPhone that allows you to quickly record and store audio snippets. These recordings can be useful for a variety of purposes, such as taking notes, capturing ideas, or recording interviews. While you can listen to your voice memos on your iPhone, you ...Gareth’s WorldBy admin4 hours ago - Why My Laptop Screen Has Lines on It: A Comprehensive Guide

Laptop screens are essential for interacting with our devices and accessing information. However, when lines appear on the screen, it can be frustrating and disrupt productivity. Understanding the underlying causes of these lines is crucial for finding effective solutions. Types of Screen Lines Horizontal lines: Also known as scan ...Gareth’s WorldBy admin4 hours ago

Laptop screens are essential for interacting with our devices and accessing information. However, when lines appear on the screen, it can be frustrating and disrupt productivity. Understanding the underlying causes of these lines is crucial for finding effective solutions. Types of Screen Lines Horizontal lines: Also known as scan ...Gareth’s WorldBy admin4 hours ago - How to Right-Click on a Laptop

Right-clicking is a common and essential computer operation that allows users to access additional options and settings. While most desktop computers have dedicated right-click buttons on their mice, laptops often do not have these buttons due to space limitations. This article will provide a comprehensive guide on how to right-click ...Gareth’s WorldBy admin4 hours ago

Right-clicking is a common and essential computer operation that allows users to access additional options and settings. While most desktop computers have dedicated right-click buttons on their mice, laptops often do not have these buttons due to space limitations. This article will provide a comprehensive guide on how to right-click ...Gareth’s WorldBy admin4 hours ago - Where is the Power Button on an ASUS Laptop?

Powering up and shutting down your ASUS laptop is an essential task for any laptop user. Locating the power button can sometimes be a hassle, especially if you’re new to ASUS laptops. This article will provide a comprehensive guide on where to find the power button on different ASUS laptop ...Gareth’s WorldBy admin4 hours ago

Powering up and shutting down your ASUS laptop is an essential task for any laptop user. Locating the power button can sometimes be a hassle, especially if you’re new to ASUS laptops. This article will provide a comprehensive guide on where to find the power button on different ASUS laptop ...Gareth’s WorldBy admin4 hours ago - How to Start a Dell Laptop: A Comprehensive Guide

Dell laptops are renowned for their reliability, performance, and versatility. Whether you’re a student, a professional, or just someone who needs a reliable computing device, a Dell laptop can meet your needs. However, if you’re new to Dell laptops, you may be wondering how to get started. In this comprehensive ...Gareth’s WorldBy admin4 hours ago

Dell laptops are renowned for their reliability, performance, and versatility. Whether you’re a student, a professional, or just someone who needs a reliable computing device, a Dell laptop can meet your needs. However, if you’re new to Dell laptops, you may be wondering how to get started. In this comprehensive ...Gareth’s WorldBy admin4 hours ago - Bryce Edwards: Serious populist discontent is bubbling up in New Zealand

Two-thirds of the country think that “New Zealand’s economy is rigged to advantage the rich and powerful”. They also believe that “New Zealand needs a strong leader to take the country back from the rich and powerful”. These are just two of a handful of stunning new survey results released ...Democracy ProjectBy bryce.edwards4 hours ago

Two-thirds of the country think that “New Zealand’s economy is rigged to advantage the rich and powerful”. They also believe that “New Zealand needs a strong leader to take the country back from the rich and powerful”. These are just two of a handful of stunning new survey results released ...Democracy ProjectBy bryce.edwards4 hours ago - How to Take a Screenshot on an Asus Laptop A Comprehensive Guide with Detailed Instructions and Illu...

In today’s digital world, screenshots have become an indispensable tool for communication and documentation. Whether you need to capture an important email, preserve a website page, or share an error message, screenshots allow you to quickly and easily preserve digital information. If you’re an Asus laptop user, there are several ...Gareth’s WorldBy admin4 hours ago

In today’s digital world, screenshots have become an indispensable tool for communication and documentation. Whether you need to capture an important email, preserve a website page, or share an error message, screenshots allow you to quickly and easily preserve digital information. If you’re an Asus laptop user, there are several ...Gareth’s WorldBy admin4 hours ago - How to Factory Reset Gateway Laptop A Comprehensive Guide

A factory reset restores your Gateway laptop to its original factory settings, erasing all data, apps, and personalizations. This can be necessary to resolve software issues, remove viruses, or prepare your laptop for sale or transfer. Here’s a step-by-step guide on how to factory reset your Gateway laptop: Method 1: ...Gareth’s WorldBy admin4 hours ago

A factory reset restores your Gateway laptop to its original factory settings, erasing all data, apps, and personalizations. This can be necessary to resolve software issues, remove viruses, or prepare your laptop for sale or transfer. Here’s a step-by-step guide on how to factory reset your Gateway laptop: Method 1: ...Gareth’s WorldBy admin4 hours ago - The Folly Of Impermanence.

“You talking about me?” The neoliberal denigration of the past was nowhere more unrelenting than in its depiction of the public service. The Post Office and the Railways were held up as being both irremediably inefficient and scandalously over-manned. Playwright Roger Hall’s “Glide Time” caricatures were presented as accurate depictions of ...6 hours ago

“You talking about me?” The neoliberal denigration of the past was nowhere more unrelenting than in its depiction of the public service. The Post Office and the Railways were held up as being both irremediably inefficient and scandalously over-manned. Playwright Roger Hall’s “Glide Time” caricatures were presented as accurate depictions of ...6 hours ago - A crisis of ambition

Roger Partridge writes – When the Coalition Government took office last October, it inherited a country on a precipice. With persistent inflation, decades of insipid productivity growth and crises in healthcare, education, housing and law and order, it is no exaggeration to suggest New Zealand’s first-world status was ...Point of OrderBy poonzteam54437 hours ago

Roger Partridge writes – When the Coalition Government took office last October, it inherited a country on a precipice. With persistent inflation, decades of insipid productivity growth and crises in healthcare, education, housing and law and order, it is no exaggeration to suggest New Zealand’s first-world status was ...Point of OrderBy poonzteam54437 hours ago - Have 308 people in the Education Ministry’s Curriculum Development Team spent over $100m on a 60-p...

Rob MacCulloch writes – In 2022, the Curriculum Centre at the Ministry of Education employed 308 staff, according to an Official Information Request. Earlier this week it was announced 202 of those staff were being cut. When you look up “The New Zealand Curriculum” on the Ministry of ...Point of OrderBy poonzteam54437 hours ago

Rob MacCulloch writes – In 2022, the Curriculum Centre at the Ministry of Education employed 308 staff, according to an Official Information Request. Earlier this week it was announced 202 of those staff were being cut. When you look up “The New Zealand Curriculum” on the Ministry of ...Point of OrderBy poonzteam54437 hours ago - 'This bill is dangerous for the environment and our democracy'

Chris Bishop’s bill has stirred up a hornets nest of opposition. Photo: Lynn Grieveson for The KākāTL;DR: The six things that stood out to me in Aotearoa’s political economy around housing, poverty and climate from the last day included:A crescendo of opposition to the Government’s Fast Track Approvals Bill is ...The KakaBy Bernard Hickey7 hours ago

Chris Bishop’s bill has stirred up a hornets nest of opposition. Photo: Lynn Grieveson for The KākāTL;DR: The six things that stood out to me in Aotearoa’s political economy around housing, poverty and climate from the last day included:A crescendo of opposition to the Government’s Fast Track Approvals Bill is ...The KakaBy Bernard Hickey7 hours ago - The Bank of our Tamariki and Mokopuna.

Monday left me brokenTuesday, I was through with hopingWednesday, my empty arms were openThursday, waiting for love, waiting for loveThe end of another week that left many of us asking WTF? What on earth has NZ gotten itself into and how on earth could people have voluntarily signed up for ...Nick’s KōreroBy Nick Rockel9 hours ago

Monday left me brokenTuesday, I was through with hopingWednesday, my empty arms were openThursday, waiting for love, waiting for loveThe end of another week that left many of us asking WTF? What on earth has NZ gotten itself into and how on earth could people have voluntarily signed up for ...Nick’s KōreroBy Nick Rockel9 hours ago - The worth of it all

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.State of humanity, 20242024, it feels, keeps presenting us with ever more challenges, ever more dismay.Do you give up yet? It seems to ask.No? How about this? Or this?How about this?Full story Share ...More Than A FeildingBy David Slack12 hours ago

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.State of humanity, 20242024, it feels, keeps presenting us with ever more challenges, ever more dismay.Do you give up yet? It seems to ask.No? How about this? Or this?How about this?Full story Share ...More Than A FeildingBy David Slack12 hours ago - What is the Hardest Sport in the World?

Determining the hardest sport in the world is a subjective matter, as the difficulty level can vary depending on individual abilities, physical attributes, and experience. However, based on various factors including physical demands, technical skills, mental fortitude, and overall accomplishment, here is an exploration of some of the most challenging ...Gareth’s WorldBy admin14 hours ago

Determining the hardest sport in the world is a subjective matter, as the difficulty level can vary depending on individual abilities, physical attributes, and experience. However, based on various factors including physical demands, technical skills, mental fortitude, and overall accomplishment, here is an exploration of some of the most challenging ...Gareth’s WorldBy admin14 hours ago - What is the Most Expensive Sport?

The allure of sport transcends age, culture, and geographical boundaries. It captivates hearts, ignites passions, and provides unparalleled entertainment. Behind the spectacle, however, lies a fascinating world of financial investment and expenditure. Among the vast array of competitive pursuits, one question looms large: which sport carries the hefty title of ...Gareth’s WorldBy admin14 hours ago

The allure of sport transcends age, culture, and geographical boundaries. It captivates hearts, ignites passions, and provides unparalleled entertainment. Behind the spectacle, however, lies a fascinating world of financial investment and expenditure. Among the vast array of competitive pursuits, one question looms large: which sport carries the hefty title of ...Gareth’s WorldBy admin14 hours ago - Pickleball On the Cusp of Olympic Glory

Introduction Pickleball, a rapidly growing paddle sport, has captured the hearts and imaginations of millions around the world. Its blend of tennis, badminton, and table tennis elements has made it a favorite among players of all ages and skill levels. As the sport’s popularity continues to surge, the question on ...Gareth’s WorldBy admin14 hours ago

Introduction Pickleball, a rapidly growing paddle sport, has captured the hearts and imaginations of millions around the world. Its blend of tennis, badminton, and table tennis elements has made it a favorite among players of all ages and skill levels. As the sport’s popularity continues to surge, the question on ...Gareth’s WorldBy admin14 hours ago - The Origin and Evolution of Soccer Unveiling the Genius Behind the World’s Most Popular Sport

Abstract: Soccer, the global phenomenon captivating millions worldwide, has a rich history that spans centuries. Its origins trace back to ancient civilizations, but the modern version we know and love emerged through a complex interplay of cultural influences and innovations. This article delves into the fascinating journey of soccer’s evolution, ...Gareth’s WorldBy admin14 hours ago

Abstract: Soccer, the global phenomenon captivating millions worldwide, has a rich history that spans centuries. Its origins trace back to ancient civilizations, but the modern version we know and love emerged through a complex interplay of cultural influences and innovations. This article delves into the fascinating journey of soccer’s evolution, ...Gareth’s WorldBy admin14 hours ago - How Much to Tint Car Windows A Comprehensive Guide

Tinting car windows offers numerous benefits, including enhanced privacy, reduced glare, UV protection, and a more stylish look for your vehicle. However, the cost of window tinting can vary significantly depending on several factors. This article provides a comprehensive guide to help you understand how much you can expect to ...Gareth’s WorldBy admin14 hours ago

Tinting car windows offers numerous benefits, including enhanced privacy, reduced glare, UV protection, and a more stylish look for your vehicle. However, the cost of window tinting can vary significantly depending on several factors. This article provides a comprehensive guide to help you understand how much you can expect to ...Gareth’s WorldBy admin14 hours ago - Why Does My Car Smell Like Gas? A Comprehensive Guide to Diagnosing and Fixing the Issue

The pungent smell of gasoline in your car can be an alarming and potentially dangerous problem. Not only is the odor unpleasant, but it can also indicate a serious issue with your vehicle’s fuel system. In this article, we will explore the various reasons why your car may smell like ...Gareth’s WorldBy admin14 hours ago

The pungent smell of gasoline in your car can be an alarming and potentially dangerous problem. Not only is the odor unpleasant, but it can also indicate a serious issue with your vehicle’s fuel system. In this article, we will explore the various reasons why your car may smell like ...Gareth’s WorldBy admin14 hours ago - How to Remove Tree Sap from Car A Comprehensive Guide

Tree sap can be a sticky, unsightly mess on your car’s exterior. It can be difficult to remove, but with the right techniques and products, you can restore your car to its former glory. Understanding Tree Sap Tree sap is a thick, viscous liquid produced by trees to seal wounds ...Gareth’s WorldBy admin14 hours ago

Tree sap can be a sticky, unsightly mess on your car’s exterior. It can be difficult to remove, but with the right techniques and products, you can restore your car to its former glory. Understanding Tree Sap Tree sap is a thick, viscous liquid produced by trees to seal wounds ...Gareth’s WorldBy admin14 hours ago - How Much Paint Do You Need to Paint a Car?

The amount of paint needed to paint a car depends on a number of factors, including the size of the car, the number of coats you plan to apply, and the type of paint you are using. In general, you will need between 1 and 2 gallons of paint for ...Gareth’s WorldBy admin14 hours ago

The amount of paint needed to paint a car depends on a number of factors, including the size of the car, the number of coats you plan to apply, and the type of paint you are using. In general, you will need between 1 and 2 gallons of paint for ...Gareth’s WorldBy admin14 hours ago - Can You Jump a Car in the Rain? Safety Precautions and Essential Steps

Jump-starting a car is a common task that can be performed even in adverse weather conditions like rain. However, safety precautions and proper techniques are crucial to avoid potential hazards. This comprehensive guide will provide detailed instructions on how to safely jump a car in the rain, ensuring both your ...Gareth’s WorldBy admin14 hours ago

Jump-starting a car is a common task that can be performed even in adverse weather conditions like rain. However, safety precautions and proper techniques are crucial to avoid potential hazards. This comprehensive guide will provide detailed instructions on how to safely jump a car in the rain, ensuring both your ...Gareth’s WorldBy admin14 hours ago - Can taxpayers be confident PIJF cash was spent wisely?

Graham Adams writes about the $55m media fund — When Patrick Gower was asked by Mike Hosking last week what he would say to the many Newstalk ZB callers who allege the Labour government bribed media with $55 million of taxpayers’ money via the Public Interest Journalism Fund — and ...Point of OrderBy gadams100020 hours ago

Graham Adams writes about the $55m media fund — When Patrick Gower was asked by Mike Hosking last week what he would say to the many Newstalk ZB callers who allege the Labour government bribed media with $55 million of taxpayers’ money via the Public Interest Journalism Fund — and ...Point of OrderBy gadams100020 hours ago - EGU2024 – An intense week of joining sessions virtually

Note: this blog post has been put together over the course of the week I followed the happenings at the conference virtually. Should recordings of the Great Debates and possibly Union Symposia mentioned below, be released sometime after the conference ends, I'll include links to the ones I participated in. ...22 hours ago

Note: this blog post has been put together over the course of the week I followed the happenings at the conference virtually. Should recordings of the Great Debates and possibly Union Symposia mentioned below, be released sometime after the conference ends, I'll include links to the ones I participated in. ...22 hours ago - Submission on “Fast Track Approvals Bill”

The following was my submission made on the “Fast Track Approvals Bill”. This potential law will give three Ministers unchecked powers, un-paralled since the days of Robert Muldoon’s “Think Big” projects.The submission is written a bit tongue-in-cheek. But it’s irreverent because the FTAB is in itself not worthy of respect. ...Frankly SpeakingBy Frank Macskasy23 hours ago

The following was my submission made on the “Fast Track Approvals Bill”. This potential law will give three Ministers unchecked powers, un-paralled since the days of Robert Muldoon’s “Think Big” projects.The submission is written a bit tongue-in-cheek. But it’s irreverent because the FTAB is in itself not worthy of respect. ...Frankly SpeakingBy Frank Macskasy23 hours ago - The Case for a Universal Family Benefit

One Could Reduce Child Poverty At No Fiscal CostFollowing the Richardson/Shipley 1990 ‘redesign of the welfare state’ – which eliminated the universal Family Benefit and doubled the rate of child poverty – various income supplements for families have been added, the best known being ‘Working for Families’, introduced in 2005. ...PunditBy Brian Easton1 day ago

One Could Reduce Child Poverty At No Fiscal CostFollowing the Richardson/Shipley 1990 ‘redesign of the welfare state’ – which eliminated the universal Family Benefit and doubled the rate of child poverty – various income supplements for families have been added, the best known being ‘Working for Families’, introduced in 2005. ...PunditBy Brian Easton1 day ago - A who’s who of New Zealand’s dodgiest companies

Submissions on National's corrupt Muldoonist fast-track law are due today (have you submitted?), and just hours before they close, Infrastructure Minister Chris Bishop has been forced to release the list of companies he invited to apply. I've spent the last hour going through it in an epic thread of bleats, ...No Right TurnBy Idiot/Savant1 day ago

Submissions on National's corrupt Muldoonist fast-track law are due today (have you submitted?), and just hours before they close, Infrastructure Minister Chris Bishop has been forced to release the list of companies he invited to apply. I've spent the last hour going through it in an epic thread of bleats, ...No Right TurnBy Idiot/Savant1 day ago - On Lee’s watch, Economic Development seems to be stuck on scoring points from promoting sporting e...

Buzz from the Beehive A few days ago, Point of Order suggested the media must be musing “on why Melissa is mute”. Our article reported that people working in the beleaguered media industry have cause to yearn for a minister as busy as Melissa Lee’s ministerial colleagues and we drew ...Point of OrderBy Bob Edlin1 day ago

Buzz from the Beehive A few days ago, Point of Order suggested the media must be musing “on why Melissa is mute”. Our article reported that people working in the beleaguered media industry have cause to yearn for a minister as busy as Melissa Lee’s ministerial colleagues and we drew ...Point of OrderBy Bob Edlin1 day ago - New Zealand has never been closed for business

1. What was The Curse of Jim Bolger?a. Winston Peters b. Soon after shaking his hand, world leaders would mysteriously lose office or shuffle off this mortal coilc. Could never shake off the Mother of All Budgetsd. Dandruff2. True or false? The Chairman of a Kiwi export business has asked the ...More Than A FeildingBy David Slack1 day ago

1. What was The Curse of Jim Bolger?a. Winston Peters b. Soon after shaking his hand, world leaders would mysteriously lose office or shuffle off this mortal coilc. Could never shake off the Mother of All Budgetsd. Dandruff2. True or false? The Chairman of a Kiwi export business has asked the ...More Than A FeildingBy David Slack1 day ago - Stop the panic – we’ve been here before

Jack Vowles writes – New Zealand is said to be suffering from ‘serious populist discontent’. An IPSOS MORI survey has reported that we have an increasing preference for strong leaders, think that the economy is rigged toward the rich and powerful, and political elites are ignoring ‘hard-working people’. ...Point of OrderBy poonzteam54431 day ago

Jack Vowles writes – New Zealand is said to be suffering from ‘serious populist discontent’. An IPSOS MORI survey has reported that we have an increasing preference for strong leaders, think that the economy is rigged toward the rich and powerful, and political elites are ignoring ‘hard-working people’. ...Point of OrderBy poonzteam54431 day ago - Melissa Lee and the media: ending the quest

Chris Trotter writes – MELISSA LEE should be deprived of her ministerial warrant. Her handling – or non-handling – of the crisis engulfing the New Zealand news media has been woeful. The fate of New Zealand’s two linear television networks, a question which the Minister of Broadcasting, Communications ...Point of OrderBy Bob Edlin1 day ago

Chris Trotter writes – MELISSA LEE should be deprived of her ministerial warrant. Her handling – or non-handling – of the crisis engulfing the New Zealand news media has been woeful. The fate of New Zealand’s two linear television networks, a question which the Minister of Broadcasting, Communications ...Point of OrderBy Bob Edlin1 day ago - The Hoon around the week to April 19TL;DR: The podcast above features co-hosts and , along with regular guests Robert Patman on Gaza and AUKUS II, and on climate change.The six things that mattered in Aotearoa’s political economy that we wrote and spoke about via The Kākā and elsewhere for paying subscribers in the ...The KakaBy Bernard Hickey1 day ago

- The ‘Humpty Dumpty’ end result of dismantling our environmental protectionsPolicymakers rarely wish to make plain or visible their desire to dismantle environmental policy, least of all to the young. Photo: Lynn GrievesonTL;DR: Here’s the top five news items of note in climate news for Aotearoa-NZ this week, and a discussion above between Bernard Hickey and The Kākā’s climate correspondent ...The KakaBy Bernard Hickey1 day ago

- Nicola's Salad Days.

I like to keep an eye on what’s happening in places like the UK, the US, and over the ditch with our good mates the Aussies. Let’s call them AUKUS, for want of a better collective term. More on that in a bit.It used to be, not long ago, that ...Nick’s KōreroBy Nick Rockel1 day ago

I like to keep an eye on what’s happening in places like the UK, the US, and over the ditch with our good mates the Aussies. Let’s call them AUKUS, for want of a better collective term. More on that in a bit.It used to be, not long ago, that ...Nick’s KōreroBy Nick Rockel1 day ago - Study sees climate change baking in 19% lower global income by 2050The KakaBy Bernard Hickey1 day ago

- Weekly Roundup 19-April-2024

It’s Friday again. Here’s some of the things that caught our attention this week. This Week on Greater Auckland On Tuesday Matt covered at the government looking into a long tunnel for Wellington. On Wednesday we ran a post from Oscar Simms on some lessons from Texas. AT’s ...Greater AucklandBy Matt L1 day ago

It’s Friday again. Here’s some of the things that caught our attention this week. This Week on Greater Auckland On Tuesday Matt covered at the government looking into a long tunnel for Wellington. On Wednesday we ran a post from Oscar Simms on some lessons from Texas. AT’s ...Greater AucklandBy Matt L1 day ago - Jack Vowles: Stop the panic – we’ve been here before

New Zealand is said to be suffering from ‘serious populist discontent’. An IPSOS MORI survey has reported that we have an increasing preference for strong leaders, think that the economy is rigged toward the rich and powerful, and political elites are ignoring ‘hard-working people’. The data is from February this ...Democracy ProjectBy bryce.edwards2 days ago

New Zealand is said to be suffering from ‘serious populist discontent’. An IPSOS MORI survey has reported that we have an increasing preference for strong leaders, think that the economy is rigged toward the rich and powerful, and political elites are ignoring ‘hard-working people’. The data is from February this ...Democracy ProjectBy bryce.edwards2 days ago - Clearing up confusion (or trying to)

Foreign Minister Winston Peters is understood to be planning a major speech within the next fortnight to clear up the confusion over whether or not New Zealand might join the AUKUS submarine project. So far, there have been conflicting signals from the Government. RNZ reported the Prime Minister yesterday in ...PolitikBy Richard Harman2 days ago

Foreign Minister Winston Peters is understood to be planning a major speech within the next fortnight to clear up the confusion over whether or not New Zealand might join the AUKUS submarine project. So far, there have been conflicting signals from the Government. RNZ reported the Prime Minister yesterday in ...PolitikBy Richard Harman2 days ago - How to Retrieve Deleted Call Log iPhone Without Computer

How to Retrieve Deleted Call Log on iPhone Without a Computer: A Step–by–Step Guide Losing your iPhone call history can be frustrating, especially when you need to find a specific number or recall an important conversation. But before you panic, know that there are ways to retrieve deleted call logs on your iPhone, even without a computer. This guide will explore various methods, ranging from simple checks to utilizing iCloud backups and third–party applications. So, let‘s dive in and recover those lost calls! 1. Check Recently Deleted Folder: Apple understands that accidental deletions happen. That‘s why they introduced the “Recently Deleted“ folder for various apps, including the Phone app. This folder acts as a safety net, storing deleted call logs for up to 30 days before permanently erasing them. Here‘s how to check it: Open the Phone app on your iPhone. Tap on the “Recents“ tab at the bottom. Scroll to the top and tap on “Edit“. Select “Show Recently Deleted“. Browse the list to find the call logs you want to recover. Tap on the desired call log and choose “Recover“ to restore it to your call history. 2. Restore from iCloud Backup: If you regularly back up your iPhone to iCloud, you might be able to retrieve your deleted call log from a previous backup. However, keep in mind that this process will restore your entire phone to the state it was in at the time of the backup, potentially erasing any data added since then. Here‘s how to restore from an iCloud backup: Go to Settings > General > Reset. Choose “Erase All Content and Settings“. Follow the on–screen instructions. Your iPhone will restart and show the initial setup screen. Choose “Restore from iCloud Backup“ during the setup process. Select the relevant backup that contains your deleted call log. Wait for the restoration process to complete. 3. Explore Third–Party Apps (with Caution): ...Gareth’s WorldBy admin2 days ago

How to Retrieve Deleted Call Log on iPhone Without a Computer: A Step–by–Step Guide Losing your iPhone call history can be frustrating, especially when you need to find a specific number or recall an important conversation. But before you panic, know that there are ways to retrieve deleted call logs on your iPhone, even without a computer. This guide will explore various methods, ranging from simple checks to utilizing iCloud backups and third–party applications. So, let‘s dive in and recover those lost calls! 1. Check Recently Deleted Folder: Apple understands that accidental deletions happen. That‘s why they introduced the “Recently Deleted“ folder for various apps, including the Phone app. This folder acts as a safety net, storing deleted call logs for up to 30 days before permanently erasing them. Here‘s how to check it: Open the Phone app on your iPhone. Tap on the “Recents“ tab at the bottom. Scroll to the top and tap on “Edit“. Select “Show Recently Deleted“. Browse the list to find the call logs you want to recover. Tap on the desired call log and choose “Recover“ to restore it to your call history. 2. Restore from iCloud Backup: If you regularly back up your iPhone to iCloud, you might be able to retrieve your deleted call log from a previous backup. However, keep in mind that this process will restore your entire phone to the state it was in at the time of the backup, potentially erasing any data added since then. Here‘s how to restore from an iCloud backup: Go to Settings > General > Reset. Choose “Erase All Content and Settings“. Follow the on–screen instructions. Your iPhone will restart and show the initial setup screen. Choose “Restore from iCloud Backup“ during the setup process. Select the relevant backup that contains your deleted call log. Wait for the restoration process to complete. 3. Explore Third–Party Apps (with Caution): ...Gareth’s WorldBy admin2 days ago - How to Factory Reset iPhone without Computer: A Comprehensive Guide to Restoring your Device

Life throws curveballs, and sometimes, those curveballs necessitate wiping your iPhone clean and starting anew. Whether you’re facing persistent software glitches, preparing to sell your device, or simply wanting a fresh start, knowing how to factory reset iPhone without a computer is a valuable skill. While using a computer with ...Gareth’s WorldBy admin2 days ago

Life throws curveballs, and sometimes, those curveballs necessitate wiping your iPhone clean and starting anew. Whether you’re facing persistent software glitches, preparing to sell your device, or simply wanting a fresh start, knowing how to factory reset iPhone without a computer is a valuable skill. While using a computer with ...Gareth’s WorldBy admin2 days ago - How to Call Someone on a Computer: A Guide to Voice and Video Communication in the Digital Age

Gone are the days when communication was limited to landline phones and physical proximity. Today, computers have become powerful tools for connecting with people across the globe through voice and video calls. But with a plethora of applications and methods available, how to call someone on a computer might seem ...Gareth’s WorldBy admin2 days ago

Gone are the days when communication was limited to landline phones and physical proximity. Today, computers have become powerful tools for connecting with people across the globe through voice and video calls. But with a plethora of applications and methods available, how to call someone on a computer might seem ...Gareth’s WorldBy admin2 days ago - Skeptical Science New Research for Week #16 2024

Open access notables Glacial isostatic adjustment reduces past and future Arctic subsea permafrost, Creel et al., Nature Communications: Sea-level rise submerges terrestrial permafrost in the Arctic, turning it into subsea permafrost. Subsea permafrost underlies ~ 1.8 million km2 of Arctic continental shelf, with thicknesses in places exceeding 700 m. Sea-level variations over glacial-interglacial cycles control ...2 days ago

Open access notables Glacial isostatic adjustment reduces past and future Arctic subsea permafrost, Creel et al., Nature Communications: Sea-level rise submerges terrestrial permafrost in the Arctic, turning it into subsea permafrost. Subsea permafrost underlies ~ 1.8 million km2 of Arctic continental shelf, with thicknesses in places exceeding 700 m. Sea-level variations over glacial-interglacial cycles control ...2 days ago - Where on a Computer is the Operating System Generally Stored? Delving into the Digital Home of your ...

The operating system (OS) is the heart and soul of a computer, orchestrating every action and interaction between hardware and software. But have you ever wondered where on a computer is the operating system generally stored? The answer lies in the intricate dance between hardware and software components, particularly within ...Gareth’s WorldBy admin2 days ago

The operating system (OS) is the heart and soul of a computer, orchestrating every action and interaction between hardware and software. But have you ever wondered where on a computer is the operating system generally stored? The answer lies in the intricate dance between hardware and software components, particularly within ...Gareth’s WorldBy admin2 days ago - How Many Watts Does a Laptop Use? Understanding Power Consumption and Efficiency

Laptops have become essential tools for work, entertainment, and communication, offering portability and functionality. However, with rising energy costs and growing environmental concerns, understanding a laptop’s power consumption is more important than ever. So, how many watts does a laptop use? The answer, unfortunately, isn’t straightforward. It depends on several ...Gareth’s WorldBy admin2 days ago

Laptops have become essential tools for work, entertainment, and communication, offering portability and functionality. However, with rising energy costs and growing environmental concerns, understanding a laptop’s power consumption is more important than ever. So, how many watts does a laptop use? The answer, unfortunately, isn’t straightforward. It depends on several ...Gareth’s WorldBy admin2 days ago - How to Screen Record on a Dell Laptop A Guide to Capturing Your Screen with Ease

Screen recording has become an essential tool for various purposes, such as creating tutorials, capturing gameplay footage, recording online meetings, or sharing information with others. Fortunately, Dell laptops offer several built-in and external options for screen recording, catering to different needs and preferences. This guide will explore various methods on ...Gareth’s WorldBy admin2 days ago

Screen recording has become an essential tool for various purposes, such as creating tutorials, capturing gameplay footage, recording online meetings, or sharing information with others. Fortunately, Dell laptops offer several built-in and external options for screen recording, catering to different needs and preferences. This guide will explore various methods on ...Gareth’s WorldBy admin2 days ago - How Much Does it Cost to Fix a Laptop Screen? Navigating Repair Options and Costs

A cracked or damaged laptop screen can be a frustrating experience, impacting productivity and enjoyment. Fortunately, laptop screen repair is a common service offered by various repair shops and technicians. However, the cost of fixing a laptop screen can vary significantly depending on several factors. This article delves into the ...Gareth’s WorldBy admin2 days ago

A cracked or damaged laptop screen can be a frustrating experience, impacting productivity and enjoyment. Fortunately, laptop screen repair is a common service offered by various repair shops and technicians. However, the cost of fixing a laptop screen can vary significantly depending on several factors. This article delves into the ...Gareth’s WorldBy admin2 days ago - How Long Do Gaming Laptops Last? Demystifying Lifespan and Maximizing Longevity

Gaming laptops represent a significant investment for passionate gamers, offering portability and powerful performance for immersive gaming experiences. However, a common concern among potential buyers is their lifespan. Unlike desktop PCs, which allow for easier component upgrades, gaming laptops have inherent limitations due to their compact and integrated design. This ...Gareth’s WorldBy admin2 days ago

Gaming laptops represent a significant investment for passionate gamers, offering portability and powerful performance for immersive gaming experiences. However, a common concern among potential buyers is their lifespan. Unlike desktop PCs, which allow for easier component upgrades, gaming laptops have inherent limitations due to their compact and integrated design. This ...Gareth’s WorldBy admin2 days ago - Climate Change: Turning the tide

The annual inventory report of New Zealand's greenhouse gas emissions has been released, showing that gross emissions have dropped for the third year in a row, to 78.4 million tons: All-told gross emissions have decreased by over 6 million tons since the Zero Carbon Act was passed in 2019. ...No Right TurnBy Idiot/Savant2 days ago

The annual inventory report of New Zealand's greenhouse gas emissions has been released, showing that gross emissions have dropped for the third year in a row, to 78.4 million tons: All-told gross emissions have decreased by over 6 million tons since the Zero Carbon Act was passed in 2019. ...No Right TurnBy Idiot/Savant2 days ago - How to Unlock Your Computer A Comprehensive Guide to Regaining Access

Experiencing a locked computer can be frustrating, especially when you need access to your files and applications urgently. The methods to unlock your computer will vary depending on the specific situation and the type of lock you encounter. This guide will explore various scenarios and provide step-by-step instructions on how ...Gareth’s WorldBy admin2 days ago

Experiencing a locked computer can be frustrating, especially when you need access to your files and applications urgently. The methods to unlock your computer will vary depending on the specific situation and the type of lock you encounter. This guide will explore various scenarios and provide step-by-step instructions on how ...Gareth’s WorldBy admin2 days ago - Faxing from Your Computer A Modern Guide to Sending Documents Digitally

While the world has largely transitioned to digital communication, faxing still holds relevance in certain industries and situations. Fortunately, gone are the days of bulky fax machines and dedicated phone lines. Today, you can easily send and receive faxes directly from your computer, offering a convenient and efficient way to ...Gareth’s WorldBy admin2 days ago

While the world has largely transitioned to digital communication, faxing still holds relevance in certain industries and situations. Fortunately, gone are the days of bulky fax machines and dedicated phone lines. Today, you can easily send and receive faxes directly from your computer, offering a convenient and efficient way to ...Gareth’s WorldBy admin2 days ago - Protecting Your Home Computer A Guide to Cyber Awareness

In our increasingly digital world, home computers have become essential tools for work, communication, entertainment, and more. However, this increased reliance on technology also exposes us to various cyber threats. Understanding these threats and taking proactive steps to protect your home computer is crucial for safeguarding your personal information, finances, ...Gareth’s WorldBy admin2 days ago

In our increasingly digital world, home computers have become essential tools for work, communication, entertainment, and more. However, this increased reliance on technology also exposes us to various cyber threats. Understanding these threats and taking proactive steps to protect your home computer is crucial for safeguarding your personal information, finances, ...Gareth’s WorldBy admin2 days ago - Server-Based Computing Powering the Modern Digital Landscape

In the ever-evolving world of technology, server-based computing has emerged as a cornerstone of modern digital infrastructure. This article delves into the concept of server-based computing, exploring its various forms, benefits, challenges, and its impact on the way we work and interact with technology. Understanding Server-Based Computing: At its core, ...Gareth’s WorldBy admin2 days ago

In the ever-evolving world of technology, server-based computing has emerged as a cornerstone of modern digital infrastructure. This article delves into the concept of server-based computing, exploring its various forms, benefits, challenges, and its impact on the way we work and interact with technology. Understanding Server-Based Computing: At its core, ...Gareth’s WorldBy admin2 days ago - Vroom vroom go the big red trucks

The absolute brass neck of this guy.We want more medical doctors, not more spin doctors, Luxon was saying a couple of weeks ago, and now we’re told the guy has seven salaried adults on TikTok duty. Sorry, doing social media. The absolute brass neck of it. The irony that the ...More Than A FeildingBy David Slack2 days ago

The absolute brass neck of this guy.We want more medical doctors, not more spin doctors, Luxon was saying a couple of weeks ago, and now we’re told the guy has seven salaried adults on TikTok duty. Sorry, doing social media. The absolute brass neck of it. The irony that the ...More Than A FeildingBy David Slack2 days ago - Jones finds $410,000 to help the government muscle in on a spat project

Buzz from the Beehive Oceans and Fisheries Minister Shane Jones relishes spatting and eagerly takes issue with environmentalists who criticise his enthusiasm for resource development. He relishes helping the fishing industry too. And so today, while the media are making much of the latest culling in the public service to ...Point of OrderBy Bob Edlin2 days ago

Buzz from the Beehive Oceans and Fisheries Minister Shane Jones relishes spatting and eagerly takes issue with environmentalists who criticise his enthusiasm for resource development. He relishes helping the fishing industry too. And so today, while the media are making much of the latest culling in the public service to ...Point of OrderBy Bob Edlin2 days ago - Again, hate crimes are not necessarily terrorism.

Having written, taught and worked for the US government on issues involving unconventional warfare and terrorism for 30-odd years, two things irritate me the most when the subject is discussed in public. The first is the Johnny-come-lately academics-turned-media commentators who … Continue reading → ...KiwipoliticoBy Pablo2 days ago

Having written, taught and worked for the US government on issues involving unconventional warfare and terrorism for 30-odd years, two things irritate me the most when the subject is discussed in public. The first is the Johnny-come-lately academics-turned-media commentators who … Continue reading → ...KiwipoliticoBy Pablo2 days ago - Despair – construction consenting edition

Eric Crampton writes – Kainga Ora is the government’s house building agency. It’s been building a lot of social housing. Kainga Ora has its own (but independent) consenting authority, Consentium. It’s a neat idea. Rather than have to deal with building consents across each different territorial authority, Kainga Ora ...Point of OrderBy poonzteam54432 days ago

Eric Crampton writes – Kainga Ora is the government’s house building agency. It’s been building a lot of social housing. Kainga Ora has its own (but independent) consenting authority, Consentium. It’s a neat idea. Rather than have to deal with building consents across each different territorial authority, Kainga Ora ...Point of OrderBy poonzteam54432 days ago - Coalition promises – will the Govt keep the commitment to keep Kiwis equal before the law?

Muriel Newman writes – The Coalition Government says it is moving with speed to deliver campaign promises and reverse the damage done by Labour. One of their key commitments is to “defend the principle that New Zealanders are equal before the law.” To achieve this, they have pledged they “will not advance ...Point of OrderBy poonzteam54432 days ago

Muriel Newman writes – The Coalition Government says it is moving with speed to deliver campaign promises and reverse the damage done by Labour. One of their key commitments is to “defend the principle that New Zealanders are equal before the law.” To achieve this, they have pledged they “will not advance ...Point of OrderBy poonzteam54432 days ago - An impermanent public service is a guarantee of very little else but failure

Chris Trotter writes – The absence of anything resembling a fightback from the public servants currently losing their jobs is interesting. State-sector workers’ collective fatalism in the face of Coalition cutbacks indicates a surprisingly broad acceptance of impermanence in the workplace. Fifty years ago, lay-offs in the thousands ...Point of OrderBy poonzteam54432 days ago

Chris Trotter writes – The absence of anything resembling a fightback from the public servants currently losing their jobs is interesting. State-sector workers’ collective fatalism in the face of Coalition cutbacks indicates a surprisingly broad acceptance of impermanence in the workplace. Fifty years ago, lay-offs in the thousands ...Point of OrderBy poonzteam54432 days ago - What happens after the war – Mariupol

Mariupol, on the Azov Sea coast, was one of the first cities to suffer almost complete destruction after the start of the Ukraine War started in late February 2022. We remember the scenes of absolute destruction of the houses and city structures. The deaths of innocent civilians – many of ...Open ParachuteBy Ken2 days ago

Mariupol, on the Azov Sea coast, was one of the first cities to suffer almost complete destruction after the start of the Ukraine War started in late February 2022. We remember the scenes of absolute destruction of the houses and city structures. The deaths of innocent civilians – many of ...Open ParachuteBy Ken2 days ago - Babies and benefits – no good news

Lindsay Mitchell writes – Ten years ago, I wrote the following in a Listener column: Every year around one in five new-born babies will be reliant on their caregivers benefit by Christmas. This pattern has persisted from at least 1993. For Maori the number jumps to over one in three. ...Point of OrderBy poonzteam54432 days ago

Lindsay Mitchell writes – Ten years ago, I wrote the following in a Listener column: Every year around one in five new-born babies will be reliant on their caregivers benefit by Christmas. This pattern has persisted from at least 1993. For Maori the number jumps to over one in three. ...Point of OrderBy poonzteam54432 days ago - Should the RBNZ be looking through climate inflation?The KakaBy Bernard Hickey2 days ago

- Bernard's pick 'n' mix of the news links

The top six news links I’ve seen elsewhere in the last 24 hours, as of 9:16 am on Thursday, April 18 are:Housing: Tauranga residents living in boats, vans RNZ Checkpoint Louise TernouthHousing: Waikato councillor says wastewater plant issues could hold up Sleepyhead building a massive company town Waikato Times Stephen ...The KakaBy Bernard Hickey2 days ago

The top six news links I’ve seen elsewhere in the last 24 hours, as of 9:16 am on Thursday, April 18 are:Housing: Tauranga residents living in boats, vans RNZ Checkpoint Louise TernouthHousing: Waikato councillor says wastewater plant issues could hold up Sleepyhead building a massive company town Waikato Times Stephen ...The KakaBy Bernard Hickey2 days ago - Gordon Campbell on the public sector carnage, and misogyny as terrorism

It’s a simple deal. We pay taxes in order to finance the social services we want and need. The carnage now occurring across the public sector though, is breaking that contract. Over 3,000 jobs have been lost so far. Many are in crucial areas like Education where the impact of ...Gordon CampbellBy lyndon2 days ago

It’s a simple deal. We pay taxes in order to finance the social services we want and need. The carnage now occurring across the public sector though, is breaking that contract. Over 3,000 jobs have been lost so far. Many are in crucial areas like Education where the impact of ...Gordon CampbellBy lyndon2 days ago - Meeting the Master Baiters

Hi,A friend had their 40th over the weekend and decided to theme it after Curb Your Enthusiasm fashion icon Susie Greene. Captured in my tiny kitchen before I left the house, I ending up evoking a mix of old lesbian and Hillary Clinton — both unintentional.Me vs Hillary ClintonIf you’re ...David FarrierBy David Farrier3 days ago

Hi,A friend had their 40th over the weekend and decided to theme it after Curb Your Enthusiasm fashion icon Susie Greene. Captured in my tiny kitchen before I left the house, I ending up evoking a mix of old lesbian and Hillary Clinton — both unintentional.Me vs Hillary ClintonIf you’re ...David FarrierBy David Farrier3 days ago - How extreme was the Earth's temperature in 2023

This is a re-post from Andrew Dessler at the Climate Brink blog In 2023, the Earth reached temperature levels unprecedented in modern times. Given that, it’s reasonable to ask: What’s going on? There’s been lots of discussions by scientists about whether this is just the normal progression of global warming or if something ...3 days ago

This is a re-post from Andrew Dessler at the Climate Brink blog In 2023, the Earth reached temperature levels unprecedented in modern times. Given that, it’s reasonable to ask: What’s going on? There’s been lots of discussions by scientists about whether this is just the normal progression of global warming or if something ...3 days ago - Backbone, revisited

The schools are on holiday and the sun is shining in the seaside village and all day long I have been seeing bunches of bikes; Mums, Dads, teens and toddlers chattering, laughing, happy, having a bloody great time together. Cheers, AT, for the bits of lane you’ve added lately around the ...More Than A FeildingBy David Slack3 days ago

The schools are on holiday and the sun is shining in the seaside village and all day long I have been seeing bunches of bikes; Mums, Dads, teens and toddlers chattering, laughing, happy, having a bloody great time together. Cheers, AT, for the bits of lane you’ve added lately around the ...More Than A FeildingBy David Slack3 days ago - Ministers are not above the law

Today in our National-led authoritarian nightmare: Shane Jones thinks Ministers should be above the law: New Zealand First MP Shane Jones is accusing the Waitangi Tribunal of over-stepping its mandate by subpoenaing a minister for its urgent hearing on the Oranga Tamariki claim. The tribunal is looking into the ...No Right TurnBy Idiot/Savant3 days ago

Today in our National-led authoritarian nightmare: Shane Jones thinks Ministers should be above the law: New Zealand First MP Shane Jones is accusing the Waitangi Tribunal of over-stepping its mandate by subpoenaing a minister for its urgent hearing on the Oranga Tamariki claim. The tribunal is looking into the ...No Right TurnBy Idiot/Savant3 days ago - What’s the outfit you can hear going down the gurgler? Probably it’s David Parker’s Oceans Sec...

Buzz from the Beehive Point of Order first heard of the Oceans Secretariat in June 2021, when David Parker (remember him?) announced a multi-agency approach to protecting New Zealand’s marine ecosystems and fisheries. Parker (holding the Environment, and Oceans and Fisheries portfolios) broke the news at the annual Forest & ...Point of OrderBy Bob Edlin3 days ago

Buzz from the Beehive Point of Order first heard of the Oceans Secretariat in June 2021, when David Parker (remember him?) announced a multi-agency approach to protecting New Zealand’s marine ecosystems and fisheries. Parker (holding the Environment, and Oceans and Fisheries portfolios) broke the news at the annual Forest & ...Point of OrderBy Bob Edlin3 days ago

Related Posts

- Fast-track submissions period must be extended

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...1 day ago

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...1 day ago - Release: Progress on climate will be undone by Govt

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...1 day ago

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...1 day ago - Release: Dark day for Kiwi kids as a third of Govt cuts affect them

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 days ago

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 days ago - Release: Alarm as Government signals further blow to school lunches

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...3 days ago

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...3 days ago - Release: Quick, submit – stop Govt’s dodgy approvals bill

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...4 days ago

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...4 days ago - Government throws coal on the climate crisis fire

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...4 days ago

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...4 days ago - Release: Public transport costs to double as National looks at unaffordable roading project instead

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...5 days ago

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...5 days ago - Release: Cost of living in Auckland still not a priority

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...5 days ago

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...5 days ago - Greens look to fast-track submissions on harmful law

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...1 week ago

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...1 week ago - Release: Govt should stop making people’s lives harder and build more homes

The National Government’s proposed changes to the Residential Tenancies Act will mean tenants can be turfed from their homes by landlords with little notice, Labour housing spokesperson Kieran McAnulty said. ...1 week ago

The National Government’s proposed changes to the Residential Tenancies Act will mean tenants can be turfed from their homes by landlords with little notice, Labour housing spokesperson Kieran McAnulty said. ...1 week ago - Release: Melissa Lee missing in action on media

The action Melissa Lee promised to protect democracy and the media sector is missing, Media and Communications spokesperson Willie Jackson said. ...1 week ago

The action Melissa Lee promised to protect democracy and the media sector is missing, Media and Communications spokesperson Willie Jackson said. ...1 week ago - Landlord Government leaves little hope for renters1 week ago

- Opportunity to build a more sustainable economy

Green Party co-leader Marama Davidson is calling on all parties to support a common-sense change that’s great for the planet and great for consumers after her member’s bill was drawn from the ballot today. ...1 week ago

Green Party co-leader Marama Davidson is calling on all parties to support a common-sense change that’s great for the planet and great for consumers after her member’s bill was drawn from the ballot today. ...1 week ago - Significant step forward in fixing cruel and unjust past

A significant milestone has been reached in the fight to strike an anti-Pasifika and unfair law from the country’s books after Teanau Tuiono’s members’ bill passed its first reading. ...1 week ago

A significant milestone has been reached in the fight to strike an anti-Pasifika and unfair law from the country’s books after Teanau Tuiono’s members’ bill passed its first reading. ...1 week ago - Missed opportunity but NZ will surely one day recognise the right to a sustainable environment

New Zealand has today missed the opportunity to uphold the right to a clean, healthy, and sustainable environment, says James Shaw after his member’s bill was voted down in its first reading. ...1 week ago

New Zealand has today missed the opportunity to uphold the right to a clean, healthy, and sustainable environment, says James Shaw after his member’s bill was voted down in its first reading. ...1 week ago - Release: Don’t cut our lunches – clear message sent to Government

Tens of thousands of people are demanding the Government commits to fully funding free and healthy school lunches. ...1 week ago

Tens of thousands of people are demanding the Government commits to fully funding free and healthy school lunches. ...1 week ago - Release: Govt makes U-turn on Suicide Prevention Office

Labour welcomes the Government’s U-turn on the closure of the Suicide Prevention Office, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago

Labour welcomes the Government’s U-turn on the closure of the Suicide Prevention Office, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago - CCC issues warning over further climate delay

Today’s advice from the Climate Change Commission paints a sobering reality of the challenge we face in combating climate change, especially in light of recent Government policy announcements. ...2 weeks ago

Today’s advice from the Climate Change Commission paints a sobering reality of the challenge we face in combating climate change, especially in light of recent Government policy announcements. ...2 weeks ago - Luxon targets lame and lousy example of leadership2 weeks ago

- Luxon targets are lousy example of leadership2 weeks ago

- Release: Commitment to disability communities missing from Govt priorities

Minister for Disability Issues Penny Simmonds appears to have delayed a report back to Cabinet on the progress New Zealand is making against international obligations for disabled New Zealanders. ...2 weeks ago

Minister for Disability Issues Penny Simmonds appears to have delayed a report back to Cabinet on the progress New Zealand is making against international obligations for disabled New Zealanders. ...2 weeks ago - Methane target review is dangerous duplication

The Government’s newly announced review of methane emissions reduction targets hints at its desire to delay Aotearoa New Zealand’s urgent transition to a climate safe future, the Green Party said. ...2 weeks ago

The Government’s newly announced review of methane emissions reduction targets hints at its desire to delay Aotearoa New Zealand’s urgent transition to a climate safe future, the Green Party said. ...2 weeks ago - Release: Government must commit to school building project for disabled students

The Government must commit to the Maitai School building project for students with high and complex needs, to ensure disabled students from the top of the South Island have somewhere to learn. ...2 weeks ago

The Government must commit to the Maitai School building project for students with high and complex needs, to ensure disabled students from the top of the South Island have somewhere to learn. ...2 weeks ago - Release: National must take mental health seriously

Mental Health Minister Matt Doocey and his Government colleagues have made a meal of their mental health commitments, showing how flimsy their efforts to champion the issue truly are, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago

Mental Health Minister Matt Doocey and his Government colleagues have made a meal of their mental health commitments, showing how flimsy their efforts to champion the issue truly are, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago - Referendums for Māori wards a racist step backwards

The Government's imposed referendum on Māori wards is a racist step backwards for Māori representation, and disregards Te Tiriti o Waitangi. ...2 weeks ago

The Government's imposed referendum on Māori wards is a racist step backwards for Māori representation, and disregards Te Tiriti o Waitangi. ...2 weeks ago - Release: Job losses at Health not worth it for tax cuts

New Zealand will feel the harm of the National Government’s reckless cuts to jobs at the health ministry for generations, says Ayesha Verrall. ...2 weeks ago

New Zealand will feel the harm of the National Government’s reckless cuts to jobs at the health ministry for generations, says Ayesha Verrall. ...2 weeks ago - Press release: No Māori initiatives in Government’s nothing plan

Māori are yet to see anything from this Government except cuts, reversals and taking our people backwards, Māori Development spokesperson Willie Jackson said. ...2 weeks ago

Māori are yet to see anything from this Government except cuts, reversals and taking our people backwards, Māori Development spokesperson Willie Jackson said. ...2 weeks ago - Thirty six point PR spin3 weeks ago

- Thirty six point PR spin3 weeks ago

- Thirty six point PR spin3 weeks ago

- Release: Social housing off Government’s to-do list

The Coalition Government’s refusal to commit to ongoing funding for social housing is seeing the sector pull back on developments and families watch their dreams of securing a home fade away, says Labour Housing spokesperson Kieran McAnulty. ...3 weeks ago

The Coalition Government’s refusal to commit to ongoing funding for social housing is seeing the sector pull back on developments and families watch their dreams of securing a home fade away, says Labour Housing spokesperson Kieran McAnulty. ...3 weeks ago

Related Posts

- PM’s South East Asia mission does the business

Prime Minister Christopher Luxon has completed a successful trip to Singapore, Thailand and the Philippines, deepening relationships and capitalising on opportunities. Mr Luxon was accompanied by a business delegation and says the choice of countries represents the priority the New Zealand Government places on South East Asia, and our relationships in ...BeehiveBy beehive.govt.nz10 hours ago

Prime Minister Christopher Luxon has completed a successful trip to Singapore, Thailand and the Philippines, deepening relationships and capitalising on opportunities. Mr Luxon was accompanied by a business delegation and says the choice of countries represents the priority the New Zealand Government places on South East Asia, and our relationships in ...BeehiveBy beehive.govt.nz10 hours ago - $41m to support clean energy in South East Asia

New Zealand is demonstrating its commitment to reducing global greenhouse emissions, and supporting clean energy transition in South East Asia, through a contribution of NZ$41 million (US$25 million) in climate finance to the Asian Development Bank (ADB)-led Energy Transition Mechanism (ETM). Prime Minister Christopher Luxon and Climate Change Minister Simon Watts announced ...BeehiveBy beehive.govt.nz1 day ago

New Zealand is demonstrating its commitment to reducing global greenhouse emissions, and supporting clean energy transition in South East Asia, through a contribution of NZ$41 million (US$25 million) in climate finance to the Asian Development Bank (ADB)-led Energy Transition Mechanism (ETM). Prime Minister Christopher Luxon and Climate Change Minister Simon Watts announced ...BeehiveBy beehive.govt.nz1 day ago - Minister releases Fast-track stakeholder list

The Government is today releasing a list of organisations who received letters about the Fast-track applications process, says RMA Reform Minister Chris Bishop. “Recently Ministers and agencies have received a series of OIA requests for a list of organisations to whom I wrote with information on applying to have a ...BeehiveBy beehive.govt.nz1 day ago

The Government is today releasing a list of organisations who received letters about the Fast-track applications process, says RMA Reform Minister Chris Bishop. “Recently Ministers and agencies have received a series of OIA requests for a list of organisations to whom I wrote with information on applying to have a ...BeehiveBy beehive.govt.nz1 day ago - Judicial appointments announced

Attorney-General Judith Collins today announced the appointment of Wellington Barrister David Jonathan Boldt as a Judge of the High Court, and the Honourable Justice Matthew Palmer as a Judge of the Court of Appeal. Justice Boldt graduated with an LLB from Victoria University of Wellington in 1990, and also holds ...BeehiveBy beehive.govt.nz1 day ago

Attorney-General Judith Collins today announced the appointment of Wellington Barrister David Jonathan Boldt as a Judge of the High Court, and the Honourable Justice Matthew Palmer as a Judge of the Court of Appeal. Justice Boldt graduated with an LLB from Victoria University of Wellington in 1990, and also holds ...BeehiveBy beehive.govt.nz1 day ago - Education Minister heads to major teaching summit in Singapore

Education Minister Erica Stanford will lead the New Zealand delegation at the 2024 International Summit on the Teaching Profession (ISTP) held in Singapore. The delegation includes representatives from the Post Primary Teachers’ Association (PPTA) Te Wehengarua and the New Zealand Educational Institute (NZEI) Te Riu Roa. The summit is co-hosted ...BeehiveBy beehive.govt.nz1 day ago

Education Minister Erica Stanford will lead the New Zealand delegation at the 2024 International Summit on the Teaching Profession (ISTP) held in Singapore. The delegation includes representatives from the Post Primary Teachers’ Association (PPTA) Te Wehengarua and the New Zealand Educational Institute (NZEI) Te Riu Roa. The summit is co-hosted ...BeehiveBy beehive.govt.nz1 day ago - Value of stopbank project proven during cyclone

A stopbank upgrade project in Tairawhiti partly funded by the Government has increased flood resilience for around 7000ha of residential and horticultural land so far, Regional Development Minister Shane Jones says. Mr Jones today attended a dawn service in Gisborne to mark the end of the first stage of the ...BeehiveBy beehive.govt.nz1 day ago

A stopbank upgrade project in Tairawhiti partly funded by the Government has increased flood resilience for around 7000ha of residential and horticultural land so far, Regional Development Minister Shane Jones says. Mr Jones today attended a dawn service in Gisborne to mark the end of the first stage of the ...BeehiveBy beehive.govt.nz1 day ago - Anzac commemorations, Türkiye relationship focus of visit

Foreign Affairs Minister Winston Peters will represent the Government at Anzac Day commemorations on the Gallipoli Peninsula next week and engage with senior representatives of the Turkish government in Istanbul. “The Gallipoli campaign is a defining event in our history. It will be a privilege to share the occasion ...BeehiveBy beehive.govt.nz1 day ago

Foreign Affairs Minister Winston Peters will represent the Government at Anzac Day commemorations on the Gallipoli Peninsula next week and engage with senior representatives of the Turkish government in Istanbul. “The Gallipoli campaign is a defining event in our history. It will be a privilege to share the occasion ...BeehiveBy beehive.govt.nz1 day ago - Minister to Europe for OECD meeting, Anzac Day

Science, Innovation and Technology and Defence Minister Judith Collins will next week attend the OECD Science and Technology Ministerial conference in Paris and Anzac Day commemorations in Belgium. “Science, innovation and technology have a major role to play in rebuilding our economy and achieving better health, environmental and social outcomes ...BeehiveBy beehive.govt.nz1 day ago