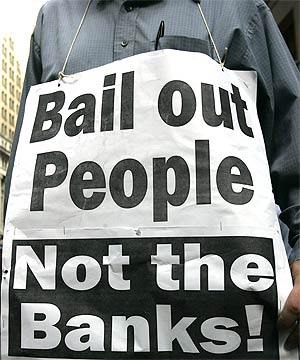

Nice

Nice

Written By:

Tane - Date published:

9:08 am, September 30th, 2008 - 45 comments

Categories: economy, International -

Tags:

45 comments on “Nice ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Cinder to Visubversa on

- adam on

- Drowsy M. Kram to weka on

- Jan Rivers to lprent on

- adam on

- Ad to UncookedSelachimorpha on

- SPC on

- Bob McCoskrie to weka on

- SPC to tsmithfield on

- Chris Pook to Anker on

- Hunter Thompson II to Michael P on

- UncookedSelachimorpha to joe90 on

- weka to Drowsy M. Kram on

- SPC to Michael Scott on

- Drowsy M. Kram to ianmac on

- Psycho Milt to weka on

- joe90 to Michael Scott on

- Michael Scott to Stephen D on

- Shanreagh on

- tWig on

- Michael P on

- roblogic on

- tsmithfield on

- weka on

- roblogic to Robert Guyton on

- roblogic to Robert Guyton on

- ianmac on

- ianmac to Robert Guyton on

- weka to Robert Guyton on

- Robert Guyton to weka on

- weka to Robert Guyton on

- Robert Guyton to roblogic on

- Robert Guyton to roblogic on

- Shanreagh to James Thrace on

- weka to Robert Guyton on

- roblogic on

- Traveller on

- roblogic to Robert Guyton on

- Anker to Nic the NZer on

- roblogic on

- Traveller to Robert Guyton on

- Visubversa to Joanne Perkins on

- Drowsy M. Kram to weka on

- Robert Guyton to Robert Guyton on

- James Thrace to No-Skates on

- weka to Robert Guyton on

- Ad on

- Robert Guyton to mpledger on

- Molly to Joanne Perkins on

- Robert Guyton to weka on

- mpledger to Robert Guyton on

- Robert Guyton to Joanne Perkins on

- Michael P to Robert Guyton on

- Joanne Perkins to Robert Guyton on

- Robert Guyton to weka on

- weka to Robert Guyton on

- roblogic on

- roblogic on

- SPC on

- Robert Guyton to roblogic on

- Robert Guyton to weka on

- Cinder to Robert Guyton on

- roblogic to Robert Guyton on

- francesca on

- weka to Robert Guyton on

- Robert Guyton to Molly on

- Robert Guyton to weka on

- Molly to Robert Guyton on

- weka to Robert Guyton on

- weka on

- Robert Guyton to Molly on

- Psycho Milt to lprent on

- roblogic on

- Ad to Robert Guyton on

- Robert Guyton to Ad on

- Ad to Robert Guyton on

- Molly on

- Robert Guyton to Traveller on

- adam on

- No-Skates to James Thrace on

- Traveller on

- Nic the NZer to lprent on

- lprent to Psycho Milt on

- weka to Psycho Milt on

- Psycho Milt to weka on

- Psycho Milt to lprent on

Recent Posts

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by Guest post

-

by mickysavage

-

by lprent

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by mickysavage

- Bernard's six-stack of substacks at 6:26 pm

Tonight’s six-stack includes: launching his substack with a bunch of his previous documentaries, including this 1992 interview with Dame Whina Cooper. and here crew give climate activists plenty to do, including this call to submit against the Fast Track Approvals bill. writes brilliantly here on his substack ...The KakaBy Bernard Hickey8 hours ago

Tonight’s six-stack includes: launching his substack with a bunch of his previous documentaries, including this 1992 interview with Dame Whina Cooper. and here crew give climate activists plenty to do, including this call to submit against the Fast Track Approvals bill. writes brilliantly here on his substack ...The KakaBy Bernard Hickey8 hours ago - At a glance – Is the science settled?

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...8 hours ago

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...8 hours ago - Apposite Quotations.10 hours ago

- What’s a life worth now?

You're in the mall when you hear it: some kind of popping sound in the distance, kids with fireworks, maybe. But then a moment of eerie stillness is followed by more of the fireworks sound and there’s also screaming and shrieking and now here come people running for their lives.Does ...More Than A FeildingBy David Slack10 hours ago

You're in the mall when you hear it: some kind of popping sound in the distance, kids with fireworks, maybe. But then a moment of eerie stillness is followed by more of the fireworks sound and there’s also screaming and shrieking and now here come people running for their lives.Does ...More Than A FeildingBy David Slack10 hours ago - Howling at the Moon

Karl du Fresne writes – There’s a crisis in the news media and the media are blaming it on everyone except themselves. Culpability is being deflected elsewhere – mainly to the hapless Minister of Communications, Melissa Lee, and the big social media platforms that are accused of hoovering ...Point of OrderBy poonzteam544312 hours ago

Karl du Fresne writes – There’s a crisis in the news media and the media are blaming it on everyone except themselves. Culpability is being deflected elsewhere – mainly to the hapless Minister of Communications, Melissa Lee, and the big social media platforms that are accused of hoovering ...Point of OrderBy poonzteam544312 hours ago - Newshub is Dead.

I don’t normally send out two newsletters in a day but I figured I’d say something about… the news. If two newsletters is a bit much then maybe just skip one, I don’t want to overload people. Alternatively if you’d be interested in sometimes receiving multiple, smaller updates from me, ...Nick’s KōreroBy Nick Rockel12 hours ago

I don’t normally send out two newsletters in a day but I figured I’d say something about… the news. If two newsletters is a bit much then maybe just skip one, I don’t want to overload people. Alternatively if you’d be interested in sometimes receiving multiple, smaller updates from me, ...Nick’s KōreroBy Nick Rockel12 hours ago - Seymour is chuffed about cutting early-learning red tape – but we hear, too, that Jones has loose...

Buzz from the Beehive David Seymour and Winston Peters today signalled that at least two ministers of the Crown might be in Wellington today. Seymour (as Associate Minister of Education) announced the removal of more red tape, this time to make it easier for new early learning services to be ...Point of OrderBy Bob Edlin12 hours ago

Buzz from the Beehive David Seymour and Winston Peters today signalled that at least two ministers of the Crown might be in Wellington today. Seymour (as Associate Minister of Education) announced the removal of more red tape, this time to make it easier for new early learning services to be ...Point of OrderBy Bob Edlin12 hours ago - Bryce Edwards: Will politicians let democracy die in the darkness?

Politicians across the political spectrum are implicated in the New Zealand media’s failing health. Either through neglect or incompetent interventions, successive governments have failed to regulate, foster, and allow a healthy Fourth Estate that can adequately hold politicians and the powerful to account. Our political system is suffering from the ...Democracy ProjectBy bryce.edwards14 hours ago

Politicians across the political spectrum are implicated in the New Zealand media’s failing health. Either through neglect or incompetent interventions, successive governments have failed to regulate, foster, and allow a healthy Fourth Estate that can adequately hold politicians and the powerful to account. Our political system is suffering from the ...Democracy ProjectBy bryce.edwards14 hours ago - Was Hawkesby entirely wrong?

David Farrar writes – The Broadcasting Standards Authority ruled: Comments by radio host Kate Hawkesby suggesting Māori and Pacific patients were being prioritised for surgery due to their ethnicity were misleading and discriminatory, the Broadcasting Standards Authority has found. It is a fact such patients are prioritised. ...Point of OrderBy poonzteam544315 hours ago

David Farrar writes – The Broadcasting Standards Authority ruled: Comments by radio host Kate Hawkesby suggesting Māori and Pacific patients were being prioritised for surgery due to their ethnicity were misleading and discriminatory, the Broadcasting Standards Authority has found. It is a fact such patients are prioritised. ...Point of OrderBy poonzteam544315 hours ago - PRC shadow looms as the Solomons head for election

PRC and its proxies in Solomons have been preparing for these elections for a long time. A lot of money, effort and intelligence have gone into ensuring an outcome that won’t compromise Beijing’s plans. Cleo Paskall writes – On April 17th the Solomon Islands, a country of ...Point of OrderBy poonzteam544315 hours ago

PRC and its proxies in Solomons have been preparing for these elections for a long time. A lot of money, effort and intelligence have gone into ensuring an outcome that won’t compromise Beijing’s plans. Cleo Paskall writes – On April 17th the Solomon Islands, a country of ...Point of OrderBy poonzteam544315 hours ago - Climate Change: Criminal ecocide

We are in the middle of a climate crisis. Last year was (again) the hottest year on record. NOAA has just announced another global coral bleaching event. Floods are threatening UK food security. So naturally, Shane Jones wants to make it easier to mine coal: Resources Minister Shane Jones ...No Right TurnBy Idiot/Savant15 hours ago

We are in the middle of a climate crisis. Last year was (again) the hottest year on record. NOAA has just announced another global coral bleaching event. Floods are threatening UK food security. So naturally, Shane Jones wants to make it easier to mine coal: Resources Minister Shane Jones ...No Right TurnBy Idiot/Savant15 hours ago - Is saving one minute of a politician's time worth nearly $1 billion?

Is speeding up the trip to and from Wellington airport by 12 minutes worth spending up more than $10 billion? Photo: Lynn Grieveson / The KākāTL;DR: The six news items that stood out to me in the last day to 8:26 am today are:The Lead: Transport Minister Simeon Brown announced ...The KakaBy Bernard Hickey17 hours ago

Is speeding up the trip to and from Wellington airport by 12 minutes worth spending up more than $10 billion? Photo: Lynn Grieveson / The KākāTL;DR: The six news items that stood out to me in the last day to 8:26 am today are:The Lead: Transport Minister Simeon Brown announced ...The KakaBy Bernard Hickey17 hours ago - Long Tunnel or Long Con?

Yesterday it was revealed that Transport Minister had asked Waka Kotahi to look at the options for a long tunnel through Wellington. State Highway 1 (SH1) through Wellington City is heavily congested at peak times and while planning continues on the duplicate Mt Victoria Tunnel and Basin Reserve project, the ...Greater AucklandBy Matt L19 hours ago

Yesterday it was revealed that Transport Minister had asked Waka Kotahi to look at the options for a long tunnel through Wellington. State Highway 1 (SH1) through Wellington City is heavily congested at peak times and while planning continues on the duplicate Mt Victoria Tunnel and Basin Reserve project, the ...Greater AucklandBy Matt L19 hours ago - Smoke And Mirrors.

You're a fraud, and you know itBut it's too good to throw it all awayAnyone would do the sameYou've got 'em goingAnd you're careful not to show itSometimes you even fool yourself a bitIt's like magicBut it's always been a smoke and mirrors gameAnyone would do the sameForty six billion ...Nick’s KōreroBy Nick Rockel20 hours ago

You're a fraud, and you know itBut it's too good to throw it all awayAnyone would do the sameYou've got 'em goingAnd you're careful not to show itSometimes you even fool yourself a bitIt's like magicBut it's always been a smoke and mirrors gameAnyone would do the sameForty six billion ...Nick’s KōreroBy Nick Rockel20 hours ago - What is Mexico doing about climate change?

This is a re-post from Yale Climate Connections The June general election in Mexico could mark a turning point in ensuring that the country’s climate policies better reflect the desire of its citizens to address the climate crisis, with both leading presidential candidates expressing support for renewable energy. Mexico is the ...22 hours ago

This is a re-post from Yale Climate Connections The June general election in Mexico could mark a turning point in ensuring that the country’s climate policies better reflect the desire of its citizens to address the climate crisis, with both leading presidential candidates expressing support for renewable energy. Mexico is the ...22 hours ago - State of humanity, 2024

2024, it feels, keeps presenting us with ever more challenges, ever more dismay.Do you give up yet? It seems to ask.No? How about this? Or this?How about this?When I say 2024 I really mean the state of humanity in 2024.Saturday night, we watched Civil War because that is one terrifying cliff we've ...More Than A FeildingBy David Slack1 day ago

2024, it feels, keeps presenting us with ever more challenges, ever more dismay.Do you give up yet? It seems to ask.No? How about this? Or this?How about this?When I say 2024 I really mean the state of humanity in 2024.Saturday night, we watched Civil War because that is one terrifying cliff we've ...More Than A FeildingBy David Slack1 day ago - Govt’s Wellington tunnel vision aims to ease the way to the airport (but zealous promoters of cycl...

Buzz from the Beehive A pet project and governmental tunnel vision jump out from the latest batch of ministerial announcements. The government is keen to assure us of its concern for the wellbeing of our pets. It will be introducing pet bonds in a change to the Residential Tenancies Act ...Point of OrderBy Bob Edlin1 day ago

Buzz from the Beehive A pet project and governmental tunnel vision jump out from the latest batch of ministerial announcements. The government is keen to assure us of its concern for the wellbeing of our pets. It will be introducing pet bonds in a change to the Residential Tenancies Act ...Point of OrderBy Bob Edlin1 day ago - The case for cultural connectedness

A recent report generated from a Growing Up in New Zealand (GUiNZ) survey of 1,224 rangatahi Māori aged 11-12 found: Cultural connectedness was associated with fewer depression symptoms, anxiety symptoms and better quality of life. That sounds cut and dry. But further into the report the following appears: Cultural connectedness is ...Point of OrderBy poonzteam54432 days ago

A recent report generated from a Growing Up in New Zealand (GUiNZ) survey of 1,224 rangatahi Māori aged 11-12 found: Cultural connectedness was associated with fewer depression symptoms, anxiety symptoms and better quality of life. That sounds cut and dry. But further into the report the following appears: Cultural connectedness is ...Point of OrderBy poonzteam54432 days ago - Useful context on public sector job cuts

David Farrar writes – The Herald reports: From the gory details of job-cuts news, you’d think the public service was being eviscerated. While the media’s view of the cuts is incomplete, it’s also true that departments have been leaking the particulars faster than a Wellington ...Point of OrderBy poonzteam54432 days ago

David Farrar writes – The Herald reports: From the gory details of job-cuts news, you’d think the public service was being eviscerated. While the media’s view of the cuts is incomplete, it’s also true that departments have been leaking the particulars faster than a Wellington ...Point of OrderBy poonzteam54432 days ago - Gordon Campbell On When Racism Comes Disguised As Anti-racism

Remember the good old days, back when New Zealand had a PM who could think and speak calmly and intelligently in whole sentences without blustering? Even while Iran’s drones and missiles were still being launched, Helen Clark was live on TVNZ expertly summing up the latest crisis in the Middle ...Gordon CampbellBy lyndon2 days ago

Remember the good old days, back when New Zealand had a PM who could think and speak calmly and intelligently in whole sentences without blustering? Even while Iran’s drones and missiles were still being launched, Helen Clark was live on TVNZ expertly summing up the latest crisis in the Middle ...Gordon CampbellBy lyndon2 days ago - Govt ignored economic analysis of smokefree reversalThe KakaBy Bernard Hickey2 days ago

- True Blue.

True loveYou're the one I'm dreaming ofYour heart fits me like a gloveAnd I'm gonna be true blueBaby, I love youI’ve written about the job cuts in our news media last week. The impact on individuals, and the loss to Aotearoa of voices covering our news from different angles.That by ...Nick’s KōreroBy Nick Rockel2 days ago

True loveYou're the one I'm dreaming ofYour heart fits me like a gloveAnd I'm gonna be true blueBaby, I love youI’ve written about the job cuts in our news media last week. The impact on individuals, and the loss to Aotearoa of voices covering our news from different angles.That by ...Nick’s KōreroBy Nick Rockel2 days ago - Who is running New Zealand’s foreign policy?

While commentators, including former Prime Minister Helen Clark, are noting a subtle shift in New Zealand’s foreign policy, which now places more emphasis on the United States, many have missed a key element of the shift. What National said before the election is not what the government is doing now. ...PolitikBy Richard Harman2 days ago

While commentators, including former Prime Minister Helen Clark, are noting a subtle shift in New Zealand’s foreign policy, which now places more emphasis on the United States, many have missed a key element of the shift. What National said before the election is not what the government is doing now. ...PolitikBy Richard Harman2 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #15

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 7, 2024 thru Sat, April 13, 2024. Story of the week Our story of the week is about adults in the room setting terms and conditions of ...2 days ago

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 7, 2024 thru Sat, April 13, 2024. Story of the week Our story of the week is about adults in the room setting terms and conditions of ...2 days ago - Feline Friends and Fragile Fauna The Complexities of Cats in New Zealand’s Conservation Efforts

Cats, with their independent spirit and beguiling purrs, have captured the hearts of humans for millennia. In New Zealand, felines are no exception, boasting the highest national cat ownership rate globally [definition cat nz cat foundation]. An estimated 1.134 million pet cats grace Kiwi households, compared to 683,000 dogs ...

Gareth’s WorldBy admin2 days ago - Or is that just they want us to think?

Nice guy, that Peter Williams. Amiable, a calm air of no-nonsense capability, a winning smile. Everything you look for in a TV presenter and newsreader.I used to see him sometimes when I went to TVNZ to be a talking head or a panellist and we would yarn. Nice guy, that ...More Than A FeildingBy David Slack3 days ago

Nice guy, that Peter Williams. Amiable, a calm air of no-nonsense capability, a winning smile. Everything you look for in a TV presenter and newsreader.I used to see him sometimes when I went to TVNZ to be a talking head or a panellist and we would yarn. Nice guy, that ...More Than A FeildingBy David Slack3 days ago - Fact Brief – Did global warming stop in 1998?

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. This fact brief was written by Sue Bin Park in collaboration with members from our Skeptical Science team. You can submit claims you think need checking via the tipline. Did global warming stop in ...3 days ago

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. This fact brief was written by Sue Bin Park in collaboration with members from our Skeptical Science team. You can submit claims you think need checking via the tipline. Did global warming stop in ...3 days ago - Arguing over a moot point.

I have been following recent debates in the corporate and social media about whether it is a good idea for NZ to join what is known as “AUKUS Pillar Two.” AUKUS is the Australian-UK-US nuclear submarine building agreement in which … Continue reading → ...KiwipoliticoBy Pablo3 days ago

I have been following recent debates in the corporate and social media about whether it is a good idea for NZ to join what is known as “AUKUS Pillar Two.” AUKUS is the Australian-UK-US nuclear submarine building agreement in which … Continue reading → ...KiwipoliticoBy Pablo3 days ago - No Longer Trusted: Ageing Boomers, Laurie & Les, Talk Politics.3 days ago

- Mortgage rates at 10% anyone?

No – nothing about that in PM Luxon’s nine-point plan to improve the lives of New Zealanders. But beyond our shores Jamie Dimon, the long-serving head of global bank J.P. Morgan Chase, reckons that the chances of a goldilocks soft landing for the economy are “a lot lower” than the ...Point of OrderBy xtrdnry4 days ago

No – nothing about that in PM Luxon’s nine-point plan to improve the lives of New Zealanders. But beyond our shores Jamie Dimon, the long-serving head of global bank J.P. Morgan Chase, reckons that the chances of a goldilocks soft landing for the economy are “a lot lower” than the ...Point of OrderBy xtrdnry4 days ago - Sad tales from the left

Michael Bassett writes – Have you noticed the odd way in which the media are handling the government’s crackdown on surplus employees in the Public Service? Very few reporters mention the crazy way in which State Service numbers rocketed ahead by more than 16,000 during Labour’s six years, ...Point of OrderBy poonzteam54434 days ago

Michael Bassett writes – Have you noticed the odd way in which the media are handling the government’s crackdown on surplus employees in the Public Service? Very few reporters mention the crazy way in which State Service numbers rocketed ahead by more than 16,000 during Labour’s six years, ...Point of OrderBy poonzteam54434 days ago - In Whose Best Interests?

On The Spot: The question Q+A host, Jack Tame, put to the Workplace & Safety Minister, Act’s Brooke van Velden, was disarmingly simple: “Are income tax cuts right now in the best interests of lowering inflation?”JACK TAME has tested another MP on his Sunday morning current affairs show, Q+A. Minister for Workplace ...4 days ago

On The Spot: The question Q+A host, Jack Tame, put to the Workplace & Safety Minister, Act’s Brooke van Velden, was disarmingly simple: “Are income tax cuts right now in the best interests of lowering inflation?”JACK TAME has tested another MP on his Sunday morning current affairs show, Q+A. Minister for Workplace ...4 days ago - Don’t Question, Don’t Complain.

It has to start somewhereIt has to start sometimeWhat better place than here?What better time than now?So it turns out that I owe you all an apology.It seems that all of the terrible things this government is doing, impacting the lives of many, aren’t necessarily ‘bad’ per se. Those things ...Nick’s KōreroBy Nick Rockel4 days ago

It has to start somewhereIt has to start sometimeWhat better place than here?What better time than now?So it turns out that I owe you all an apology.It seems that all of the terrible things this government is doing, impacting the lives of many, aren’t necessarily ‘bad’ per se. Those things ...Nick’s KōreroBy Nick Rockel4 days ago - Auckland faces 25% water inflation shock

Three Waters became a focus of anti-Government protests under Labour, but its dumping by the new Government hasn’t solved councils’ funding problems and will eventually hit the back pockets of everyone. Photo: Lynn Grieveson/Getty ImagesTL;DR: The six news items that stood out to me at 8:06 am today are:The Government ...The KakaBy Bernard Hickey4 days ago

Three Waters became a focus of anti-Government protests under Labour, but its dumping by the new Government hasn’t solved councils’ funding problems and will eventually hit the back pockets of everyone. Photo: Lynn Grieveson/Getty ImagesTL;DR: The six news items that stood out to me at 8:06 am today are:The Government ...The KakaBy Bernard Hickey4 days ago - Small accomplishments and large ironiesMore Than A FeildingBy David Slack4 days ago

- The Song of Saqua: Volume VII

In order to catch up to the actual progress of the D&D campaign, I present you with another couple of sessions. These were actually held back to back, on a Monday and Tuesday evening. Session XV Alas, Goatslayer had another lycanthropic transformation… though this time, he ran off into the ...A Phuulish FellowBy strda2214 days ago

In order to catch up to the actual progress of the D&D campaign, I present you with another couple of sessions. These were actually held back to back, on a Monday and Tuesday evening. Session XV Alas, Goatslayer had another lycanthropic transformation… though this time, he ran off into the ...A Phuulish FellowBy strda2214 days ago - Accelerating the Growth Rate?

There is a constant theme from the economic commentariat that New Zealand needs to lift its economic growth rate, coupled with policies which they are certain will attain that objective. Their prescriptions are usually characterised by two features. First, they tend to be in their advocate’s self-interest. Second, they are ...PunditBy Brian Easton4 days ago

There is a constant theme from the economic commentariat that New Zealand needs to lift its economic growth rate, coupled with policies which they are certain will attain that objective. Their prescriptions are usually characterised by two features. First, they tend to be in their advocate’s self-interest. Second, they are ...PunditBy Brian Easton4 days ago - The only thing we have to fear is tenants themselves

1. Which of these acronyms describes the experience of travelling on a Cook Strait ferry?a. ROROb. FOMOc. RAROd. FMLAramoana, first boat ever boarded by More Than A Feilding, four weeks after the Wahine disaster2. What is the acronym for the experience of watching the government risking a $200 million break ...More Than A FeildingBy David Slack4 days ago

1. Which of these acronyms describes the experience of travelling on a Cook Strait ferry?a. ROROb. FOMOc. RAROd. FMLAramoana, first boat ever boarded by More Than A Feilding, four weeks after the Wahine disaster2. What is the acronym for the experience of watching the government risking a $200 million break ...More Than A FeildingBy David Slack4 days ago - Peters talks of NZ “renewing its connections with the world” – but who knew we had been discon...

Buzz from the Beehive The thrust of the country’s foreign affairs policy and its relationship with the United States have been addressed in four statements from the Beehive over the past 24 hours. Foreign Affairs Minister Winston Peters somewhat curiously spoke of New Zealand “renewing its connections with a world ...Point of OrderBy Bob Edlin5 days ago

Buzz from the Beehive The thrust of the country’s foreign affairs policy and its relationship with the United States have been addressed in four statements from the Beehive over the past 24 hours. Foreign Affairs Minister Winston Peters somewhat curiously spoke of New Zealand “renewing its connections with a world ...Point of OrderBy Bob Edlin5 days ago - Muldoonism, solar farms, and legitimacy

NewsHub had an article yesterday about progress on Aotearoa's largest solar farm, at "The Point" in the Mackenzie Country. 420MW, right next to a grid connection and transmission infrastructure, and next to dams - meaning it can work in tandem with them to maximise water storage. Its exactly the sort ...No Right TurnBy Idiot/Savant5 days ago

NewsHub had an article yesterday about progress on Aotearoa's largest solar farm, at "The Point" in the Mackenzie Country. 420MW, right next to a grid connection and transmission infrastructure, and next to dams - meaning it can work in tandem with them to maximise water storage. Its exactly the sort ...No Right TurnBy Idiot/Savant5 days ago - NZTA does not know how much it spends on cones

Barrie Saunders writes – Astonishing as it may seem NZTA does not know either how much it spends on road cones as part of its Temporary Traffic Management system, or even how many companies it uses to supply and manage the cones. See my Official Information Act request ...Point of OrderBy poonzteam54435 days ago

Barrie Saunders writes – Astonishing as it may seem NZTA does not know either how much it spends on road cones as part of its Temporary Traffic Management system, or even how many companies it uses to supply and manage the cones. See my Official Information Act request ...Point of OrderBy poonzteam54435 days ago - If this is Back on Track – let's not.

I used to want to plant bombs at the Last Night of the PromsBut now you'll find me with the baby, in the bathroom,With that big shell, listening for the sound of the sea,The baby and meI stayed in bed, alone, uncertainThen I met you, you drew the curtainThe sun ...Nick’s KōreroBy Nick Rockel5 days ago

I used to want to plant bombs at the Last Night of the PromsBut now you'll find me with the baby, in the bathroom,With that big shell, listening for the sound of the sea,The baby and meI stayed in bed, alone, uncertainThen I met you, you drew the curtainThe sun ...Nick’s KōreroBy Nick Rockel5 days ago - Welfare: Just two timid targets from the National government

Lindsay Mitchell writes – The National Government has announced just two targets for the Ministry of Social Development. They are: – to reduce the number of people receiving Jobseeker Support by 50,000 to 140,000 by June 2029, and – (alongside HUD) to reduce the number of households in emergency ...Point of OrderBy Bob Edlin5 days ago

Lindsay Mitchell writes – The National Government has announced just two targets for the Ministry of Social Development. They are: – to reduce the number of people receiving Jobseeker Support by 50,000 to 140,000 by June 2029, and – (alongside HUD) to reduce the number of households in emergency ...Point of OrderBy Bob Edlin5 days ago - The Hoon around the week to April 12Photo: Lynn Grieveson / The KākāTL;DR: The podcast above features co-hosts Bernard Hickey and Peter Bale, along with regular guests Robert Patman on Gaza and AUKUS II, Merja Myllylahti on AUT’s trust in news report, Awhi’s Holly Bennett on a watered-down voluntary code for lobbyists, plus special guest Patrick Gower ...The KakaBy Bernard Hickey5 days ago

- A Dead Internet?

Hi,Four years ago I wrote about a train engineer who derailed his train near the port in Los Angeles.He was attempting to slam thousands of tonnes of screaming metal into a docked Navy hospital ship, because he thought it was involved in some shady government conspiracy theory. He thought it ...David FarrierBy David Farrier5 days ago

Hi,Four years ago I wrote about a train engineer who derailed his train near the port in Los Angeles.He was attempting to slam thousands of tonnes of screaming metal into a docked Navy hospital ship, because he thought it was involved in some shady government conspiracy theory. He thought it ...David FarrierBy David Farrier5 days ago - Weekly Roundup 12-April-2024

Welcome back to another Friday. Here’s some articles that caught our attention this week. This Week in Greater Auckland On Wednesday Matt looked at the latest with the Airport to Botany project. On Thursday Matt covered the revelation that Auckland Transport have to subsidise towing illegally parked cars. ...Greater AucklandBy Greater Auckland5 days ago

Welcome back to another Friday. Here’s some articles that caught our attention this week. This Week in Greater Auckland On Wednesday Matt looked at the latest with the Airport to Botany project. On Thursday Matt covered the revelation that Auckland Transport have to subsidise towing illegally parked cars. ...Greater AucklandBy Greater Auckland5 days ago - Weekly Roundup 12-April-2024

Welcome back to another Friday. Here’s some articles that caught our attention this week. This Week in Greater Auckland On Wednesday Matt looked at the latest with the Airport to Botany project. On Thursday Matt covered the revelation that Auckland Transport have to subsidise towing illegally parked cars. ...Greater AucklandBy Greater Auckland5 days ago

Welcome back to another Friday. Here’s some articles that caught our attention this week. This Week in Greater Auckland On Wednesday Matt looked at the latest with the Airport to Botany project. On Thursday Matt covered the revelation that Auckland Transport have to subsidise towing illegally parked cars. ...Greater AucklandBy Greater Auckland5 days ago - Antarctic heat spike shocks climate scientistsA ‘Regime Shift’ could raise sea levels sooner than anticipated. Has a tipping point been triggered in the Antarctic? Photo: Juan Barreto/Getty Images TL;DR: Here’s the top six news items of note in climate news for Aotearoa-NZ this week, and a discussion above that was recorded yesterday afternoon between and ...The KakaBy Bernard Hickey5 days ago

- Skeptical Science New Research for Week #15 2024

Open access notables Global carbon emissions in 2023, Liu et al., Nature Reviews Earth & Environment Annual global CO2 emissions dropped markedly in 2020 owing to the COVID-19 pandemic, decreasing by 5.8% relative to 2019 (ref. 1). There were hopes that green economic stimulus packages during the COVD crisis might mark the beginning ...5 days ago

Open access notables Global carbon emissions in 2023, Liu et al., Nature Reviews Earth & Environment Annual global CO2 emissions dropped markedly in 2020 owing to the COVID-19 pandemic, decreasing by 5.8% relative to 2019 (ref. 1). There were hopes that green economic stimulus packages during the COVD crisis might mark the beginning ...5 days ago - Everything will be just fine

In our earlier days of national self-loathing, we made a special place for the attitude derided as she’ll be right.You don't hear many people younger than age Boomer using that particular expression these days. But that doesn’t mean there are not younger people in possession of such an attitude.The likes of ...More Than A FeildingBy David Slack5 days ago

In our earlier days of national self-loathing, we made a special place for the attitude derided as she’ll be right.You don't hear many people younger than age Boomer using that particular expression these days. But that doesn’t mean there are not younger people in possession of such an attitude.The likes of ...More Than A FeildingBy David Slack5 days ago - Farmers and landlords are given news intended to lift their confidence – but the media must muse o...

Buzz from the Beehive People working in the beleaguered media industry have cause to yearn for a minister as busy as Todd McClay and his associates have been in recent days. But if they check out the Beehive website for a list of Melissa Lee’s announcements, pronouncements, speeches and what-have-you ...Point of OrderBy Bob Edlin5 days ago

Buzz from the Beehive People working in the beleaguered media industry have cause to yearn for a minister as busy as Todd McClay and his associates have been in recent days. But if they check out the Beehive website for a list of Melissa Lee’s announcements, pronouncements, speeches and what-have-you ...Point of OrderBy Bob Edlin5 days ago - National’s war on renters

When the National government came into office, it complained of a "war on landlords". It's response? Start a war on renters instead: The changes include re-introducing 90-day "no cause" terminations for periodic tenancies, meaning landlords can end a periodic tenancy without giving any reason. [...] Landlords will now only ...No Right TurnBy Idiot/Savant6 days ago

When the National government came into office, it complained of a "war on landlords". It's response? Start a war on renters instead: The changes include re-introducing 90-day "no cause" terminations for periodic tenancies, meaning landlords can end a periodic tenancy without giving any reason. [...] Landlords will now only ...No Right TurnBy Idiot/Savant6 days ago - Drawn

A ballot for two Member's Bills was held today, and the following bills were drawn: Repeal of Good Friday and Easter Sunday as Restricted Trading Days (Shop Trading and Sale of Alcohol) Amendment Bill (Cameron Luxton) Consumer Guarantees (Right to Repair) Amendment Bill (Marama Davidson) The ...No Right TurnBy Idiot/Savant6 days ago

A ballot for two Member's Bills was held today, and the following bills were drawn: Repeal of Good Friday and Easter Sunday as Restricted Trading Days (Shop Trading and Sale of Alcohol) Amendment Bill (Cameron Luxton) Consumer Guarantees (Right to Repair) Amendment Bill (Marama Davidson) The ...No Right TurnBy Idiot/Savant6 days ago - At last some science

Ele Ludemann writes – Is getting rid of plastic really good for the environment? Substituting plastics with alternative materials is likely to result in increased GHG emissions, according to research from the University of Sheffield. The study by Dr. Fanran Meng from Sheffield’s Department of Chemical and Biological Engineering, ...Point of OrderBy poonzteam54436 days ago

Ele Ludemann writes – Is getting rid of plastic really good for the environment? Substituting plastics with alternative materials is likely to result in increased GHG emissions, according to research from the University of Sheffield. The study by Dr. Fanran Meng from Sheffield’s Department of Chemical and Biological Engineering, ...Point of OrderBy poonzteam54436 days ago - Something important: the curious death of the School Strike 4 Climate Movement

The Christchurch Mosque Massacres, Covid-19, deep political disillusionment, and the jealous cruelty of the intersectionists: all had a part to play in causing School Strike 4 Climate’s bright bubble of hope and passion to burst. But, while it floated above us, it was something that mattered. Something Important. ...Point of OrderBy poonzteam54436 days ago

The Christchurch Mosque Massacres, Covid-19, deep political disillusionment, and the jealous cruelty of the intersectionists: all had a part to play in causing School Strike 4 Climate’s bright bubble of hope and passion to burst. But, while it floated above us, it was something that mattered. Something Important. ...Point of OrderBy poonzteam54436 days ago - The day the TV media died…

Peter Dunne writes – April 10 is a dramatic day in New Zealand’s history. On April 10, 1919, the preliminary results of a referendum showed that New Zealanders had narrowly voted for prohibition by a majority of around 13,000 votes. However, when the votes of soldiers still overseas ...Point of OrderBy poonzteam54436 days ago

Peter Dunne writes – April 10 is a dramatic day in New Zealand’s history. On April 10, 1919, the preliminary results of a referendum showed that New Zealanders had narrowly voted for prohibition by a majority of around 13,000 votes. However, when the votes of soldiers still overseas ...Point of OrderBy poonzteam54436 days ago - What's the point in Melissa Lee?

While making coffee this morning I listened to Paddy Gower from Newshub being interviewed on RNZ. It was painful listening. His hurt and love for that organisation, its closure confirmed yesterday, quite evident.As we do when something really matters, he hasn’t giving up hope. Paddy talked about the taonga that ...Nick’s KōreroBy Nick Rockel6 days ago

While making coffee this morning I listened to Paddy Gower from Newshub being interviewed on RNZ. It was painful listening. His hurt and love for that organisation, its closure confirmed yesterday, quite evident.As we do when something really matters, he hasn’t giving up hope. Paddy talked about the taonga that ...Nick’s KōreroBy Nick Rockel6 days ago - Bernard's Top 10 'pick 'n' mix' at 10:10 am on Thursday, April 11

TL;DR: Here’s the 10 news and other links elsewhere that stood out for me over the last day, as at 10:10 am on Wednesday, April 10:Photo by Iva Rajović on UnsplashMust-read: As more than half of the nation’s investigative journalists are sacked, Newsroom’s Tim Murphy shows what it takes to ...The KakaBy Bernard Hickey6 days ago

TL;DR: Here’s the 10 news and other links elsewhere that stood out for me over the last day, as at 10:10 am on Wednesday, April 10:Photo by Iva Rajović on UnsplashMust-read: As more than half of the nation’s investigative journalists are sacked, Newsroom’s Tim Murphy shows what it takes to ...The KakaBy Bernard Hickey6 days ago - Gordon Campbell On Winston Peters’ Pathetic Speech At The UN

Good grief, Winston Peters. Tens of thousands of Gazans have been slaughtered, two million are on the brink of starvation and what does our Foreign Minister choose to talk about at the UN? The 75 year old issue of whether the five permanent members should continue to have veto powers ...Gordon CampbellBy lyndon6 days ago

Good grief, Winston Peters. Tens of thousands of Gazans have been slaughtered, two million are on the brink of starvation and what does our Foreign Minister choose to talk about at the UN? The 75 year old issue of whether the five permanent members should continue to have veto powers ...Gordon CampbellBy lyndon6 days ago - Subsidising illegal parking

Hopefully finally over his obsession with raised crossings, the Herald’s Bernard Orsman has found something to actually be outraged at. Auckland ratepayers are subsidising the cost of towing, storing and releasing cars across the city to the tune of $15 million over five years. Under a quirk in the law, ...Greater AucklandBy Matt L6 days ago

Hopefully finally over his obsession with raised crossings, the Herald’s Bernard Orsman has found something to actually be outraged at. Auckland ratepayers are subsidising the cost of towing, storing and releasing cars across the city to the tune of $15 million over five years. Under a quirk in the law, ...Greater AucklandBy Matt L6 days ago - When 'going for growth' actually means saying no to new social homes

TL;DR: These six things stood out to me over the last day in Aotearoa-NZ’s political economy, as of 7:06 am on Thursday, April 11:The Government has refused a community housing provider’s plea for funding to help build 42 apartments in Hamilton because it said a $100 million fund was used ...The KakaBy Bernard Hickey6 days ago

TL;DR: These six things stood out to me over the last day in Aotearoa-NZ’s political economy, as of 7:06 am on Thursday, April 11:The Government has refused a community housing provider’s plea for funding to help build 42 apartments in Hamilton because it said a $100 million fund was used ...The KakaBy Bernard Hickey6 days ago - https://www.politik.co.nz/?p=12733

As the public sector redundancies rolled on, with the Department of Conservation saying yesterday it was cutting 130 positions, a Select Committee got an insight into the complexities and challenges of cutting the Government’s workforce. Immigration New Zealand chiefs along with their Minister, Erica Stanford, appeared before Parliament’s Education and ...PolitikBy Richard Harman6 days ago

As the public sector redundancies rolled on, with the Department of Conservation saying yesterday it was cutting 130 positions, a Select Committee got an insight into the complexities and challenges of cutting the Government’s workforce. Immigration New Zealand chiefs along with their Minister, Erica Stanford, appeared before Parliament’s Education and ...PolitikBy Richard Harman6 days ago - Bernard's six-stack of substacks at 6:06 pm on Wednesday, April 10

TL;DR: Six substacks that stood out to me in the last day:Explaining is winning for journalists wanting to regain trust, writes is his excellent substack. from highlights Aotearoa-NZ’s greenwashing problem in this weekly substack. writes about salt via his substack titled: The Second Soul, Part I ...The KakaBy Bernard Hickey6 days ago

TL;DR: Six substacks that stood out to me in the last day:Explaining is winning for journalists wanting to regain trust, writes is his excellent substack. from highlights Aotearoa-NZ’s greenwashing problem in this weekly substack. writes about salt via his substack titled: The Second Soul, Part I ...The KakaBy Bernard Hickey6 days ago - EGU2024 – Picking and chosing sessions to attend virtually

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 15 to 19. I decided to join the event virtually this year for the full week and I've already picked several sessions I plan to ...6 days ago

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 15 to 19. I decided to join the event virtually this year for the full week and I've already picked several sessions I plan to ...6 days ago - But here's my point about the large irony in what Luxon is saying

Grim old week in the media business, eh? And it’s only Wednesday, to rework an old upbeat line of poor old Neil Roberts.One of the larger dark ironies of it all has been the line the Prime Minister is serving up to anyone asking him about the sorry state of ...More Than A FeildingBy David Slack6 days ago

Grim old week in the media business, eh? And it’s only Wednesday, to rework an old upbeat line of poor old Neil Roberts.One of the larger dark ironies of it all has been the line the Prime Minister is serving up to anyone asking him about the sorry state of ...More Than A FeildingBy David Slack6 days ago - Govt gives farmers something to talk about (regarding environmental issues) at those woolshed meetin...

Buzz from the Beehive Hard on the heels of three rurally oriented ministers launching the first of their woolshed meetings, the government brought good news to farmers on the environmental front. First, Agriculture Minister Todd McClay announced an additional $18 million is being committed to reduce agricultural emissions. Not all ...Point of OrderBy Bob Edlin6 days ago

Buzz from the Beehive Hard on the heels of three rurally oriented ministers launching the first of their woolshed meetings, the government brought good news to farmers on the environmental front. First, Agriculture Minister Todd McClay announced an additional $18 million is being committed to reduce agricultural emissions. Not all ...Point of OrderBy Bob Edlin6 days ago - Climate change violates human rights

That's the ruling of the European Court of Human Rights today: Weak government climate policies violate fundamental human rights, the European court of human rights has ruled. In a landmark decision on one of three major climate cases, the first such rulings by an international court, the ECHR raised ...No Right TurnBy Idiot/Savant7 days ago

That's the ruling of the European Court of Human Rights today: Weak government climate policies violate fundamental human rights, the European court of human rights has ruled. In a landmark decision on one of three major climate cases, the first such rulings by an international court, the ECHR raised ...No Right TurnBy Idiot/Savant7 days ago - Which govt departments have grown the most?

David Farrar writes – There has been a 34% increase over six years in the size of the public service, in terms of EFTS. But not all agencies have grown by the same proportion. Here are the 10 with the largest relative increases between 2017 and ...Point of OrderBy poonzteam54437 days ago

David Farrar writes – There has been a 34% increase over six years in the size of the public service, in terms of EFTS. But not all agencies have grown by the same proportion. Here are the 10 with the largest relative increases between 2017 and ...Point of OrderBy poonzteam54437 days ago - What’s to blame for the public’s plummeting trust in the media?

Bryce Edwards writes – The media is in crisis, as New Zealand audiences flee from traditional sources of news and information. The latest survey results on the public’s attitude to the media shows plummeting trust. And New Zealand now leads the world in terms of those who want ...Point of OrderBy poonzteam54437 days ago

Bryce Edwards writes – The media is in crisis, as New Zealand audiences flee from traditional sources of news and information. The latest survey results on the public’s attitude to the media shows plummeting trust. And New Zealand now leads the world in terms of those who want ...Point of OrderBy poonzteam54437 days ago - Something Important: The Curious Death of the School Strike 4 Climate Movement.

The Hope That Failed: The Christchurch Mosque Massacres, Covid-19, deep political disillusionment, and the jealous cruelty of the intersectionists: all had a part to play in causing School Strike 4 Climate’s bright bubble of hope and passion to burst. But, while it floated above us, it was something that mattered. Something ...7 days ago

The Hope That Failed: The Christchurch Mosque Massacres, Covid-19, deep political disillusionment, and the jealous cruelty of the intersectionists: all had a part to play in causing School Strike 4 Climate’s bright bubble of hope and passion to burst. But, while it floated above us, it was something that mattered. Something ...7 days ago - Cow Farts and Cancer Sticks.

What do you do if you’re a new government minister and the science is in. All of the evidence and facts are clear, but they’re not to your liking? They’re inconsistent with your policy positions and/or your spending priorities.Well, first off you could just stand back and watch as the ...Nick’s KōreroBy Nick Rockel7 days ago

What do you do if you’re a new government minister and the science is in. All of the evidence and facts are clear, but they’re not to your liking? They’re inconsistent with your policy positions and/or your spending priorities.Well, first off you could just stand back and watch as the ...Nick’s KōreroBy Nick Rockel7 days ago - Member’s Day

Today is a Member's day. First up is James Shaw's New Zealand Bill of Rights (Right to Sustainable Environment) Amendment Bill, which does exactly what it says on the label. Despite solid backing in international law and from lawyers and NGOs, National will likely vote it down out of pure ...No Right TurnBy Idiot/Savant7 days ago

Today is a Member's day. First up is James Shaw's New Zealand Bill of Rights (Right to Sustainable Environment) Amendment Bill, which does exactly what it says on the label. Despite solid backing in international law and from lawyers and NGOs, National will likely vote it down out of pure ...No Right TurnBy Idiot/Savant7 days ago - Bernard's Top 10 'pick 'n' mix' at 10:10 am on Wednesday, April 10The KakaBy Bernard Hickey7 days ago

- What’s happening with Airport to Botany

One of the few public transport projects the current government have said they support is the Airport to Botany project (A2B) and it’s one we haven’t covered in a while so worth looking at where things are at. A business case for the project was completed in 2021 before being ...Greater AucklandBy Matt L7 days ago

One of the few public transport projects the current government have said they support is the Airport to Botany project (A2B) and it’s one we haven’t covered in a while so worth looking at where things are at. A business case for the project was completed in 2021 before being ...Greater AucklandBy Matt L7 days ago - Bishop more popular than Luxon in Curia poll

Count the Chrises: Chris Bishop (2nd from right) is moving up in the popularity polls. Photo: Lynn Grieveson / The KākāTL;DR: These six things stood out to me over the last day in Aotearoa-NZ’s political economy, as of 7:06 am on Wednesday, April 10:The National/ACT/NZ First coalition Government’s opinion poll ...The KakaBy Bernard Hickey7 days ago

Count the Chrises: Chris Bishop (2nd from right) is moving up in the popularity polls. Photo: Lynn Grieveson / The KākāTL;DR: These six things stood out to me over the last day in Aotearoa-NZ’s political economy, as of 7:06 am on Wednesday, April 10:The National/ACT/NZ First coalition Government’s opinion poll ...The KakaBy Bernard Hickey7 days ago

Related Posts

- Release: Quick, submit – stop Govt’s dodgy approvals bill

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...13 hours ago

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...13 hours ago - Government throws coal on the climate crisis fire

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...15 hours ago

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...15 hours ago - Release: Public transport costs to double as National looks at unaffordable roading project instead

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...1 day ago

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...1 day ago - Release: Cost of living in Auckland still not a priority

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...2 days ago

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...2 days ago - Greens look to fast-track submissions on harmful law

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...5 days ago

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...5 days ago - Release: Govt should stop making people’s lives harder and build more homes

The National Government’s proposed changes to the Residential Tenancies Act will mean tenants can be turfed from their homes by landlords with little notice, Labour housing spokesperson Kieran McAnulty said. ...5 days ago

The National Government’s proposed changes to the Residential Tenancies Act will mean tenants can be turfed from their homes by landlords with little notice, Labour housing spokesperson Kieran McAnulty said. ...5 days ago - Release: Melissa Lee missing in action on media

The action Melissa Lee promised to protect democracy and the media sector is missing, Media and Communications spokesperson Willie Jackson said. ...6 days ago

The action Melissa Lee promised to protect democracy and the media sector is missing, Media and Communications spokesperson Willie Jackson said. ...6 days ago - Landlord Government leaves little hope for renters6 days ago

- Opportunity to build a more sustainable economy

Green Party co-leader Marama Davidson is calling on all parties to support a common-sense change that’s great for the planet and great for consumers after her member’s bill was drawn from the ballot today. ...6 days ago

Green Party co-leader Marama Davidson is calling on all parties to support a common-sense change that’s great for the planet and great for consumers after her member’s bill was drawn from the ballot today. ...6 days ago - Significant step forward in fixing cruel and unjust past

A significant milestone has been reached in the fight to strike an anti-Pasifika and unfair law from the country’s books after Teanau Tuiono’s members’ bill passed its first reading. ...6 days ago

A significant milestone has been reached in the fight to strike an anti-Pasifika and unfair law from the country’s books after Teanau Tuiono’s members’ bill passed its first reading. ...6 days ago - Missed opportunity but NZ will surely one day recognise the right to a sustainable environment

New Zealand has today missed the opportunity to uphold the right to a clean, healthy, and sustainable environment, says James Shaw after his member’s bill was voted down in its first reading. ...6 days ago

New Zealand has today missed the opportunity to uphold the right to a clean, healthy, and sustainable environment, says James Shaw after his member’s bill was voted down in its first reading. ...6 days ago - Release: Don’t cut our lunches – clear message sent to Government

Tens of thousands of people are demanding the Government commits to fully funding free and healthy school lunches. ...7 days ago

Tens of thousands of people are demanding the Government commits to fully funding free and healthy school lunches. ...7 days ago - Release: Govt makes U-turn on Suicide Prevention Office

Labour welcomes the Government’s U-turn on the closure of the Suicide Prevention Office, says Labour Mental Health spokesperson Ingrid Leary. ...1 week ago

Labour welcomes the Government’s U-turn on the closure of the Suicide Prevention Office, says Labour Mental Health spokesperson Ingrid Leary. ...1 week ago - CCC issues warning over further climate delay

Today’s advice from the Climate Change Commission paints a sobering reality of the challenge we face in combating climate change, especially in light of recent Government policy announcements. ...1 week ago

Today’s advice from the Climate Change Commission paints a sobering reality of the challenge we face in combating climate change, especially in light of recent Government policy announcements. ...1 week ago - Luxon targets are lousy example of leadership1 week ago

- Luxon targets lame and lousy example of leadership1 week ago

- Release: Commitment to disability communities missing from Govt priorities

Minister for Disability Issues Penny Simmonds appears to have delayed a report back to Cabinet on the progress New Zealand is making against international obligations for disabled New Zealanders. ...1 week ago

Minister for Disability Issues Penny Simmonds appears to have delayed a report back to Cabinet on the progress New Zealand is making against international obligations for disabled New Zealanders. ...1 week ago - Methane target review is dangerous duplication

The Government’s newly announced review of methane emissions reduction targets hints at its desire to delay Aotearoa New Zealand’s urgent transition to a climate safe future, the Green Party said. ...2 weeks ago

The Government’s newly announced review of methane emissions reduction targets hints at its desire to delay Aotearoa New Zealand’s urgent transition to a climate safe future, the Green Party said. ...2 weeks ago - Release: Government must commit to school building project for disabled students

The Government must commit to the Maitai School building project for students with high and complex needs, to ensure disabled students from the top of the South Island have somewhere to learn. ...2 weeks ago

The Government must commit to the Maitai School building project for students with high and complex needs, to ensure disabled students from the top of the South Island have somewhere to learn. ...2 weeks ago - Release: National must take mental health seriously

Mental Health Minister Matt Doocey and his Government colleagues have made a meal of their mental health commitments, showing how flimsy their efforts to champion the issue truly are, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago

Mental Health Minister Matt Doocey and his Government colleagues have made a meal of their mental health commitments, showing how flimsy their efforts to champion the issue truly are, says Labour Mental Health spokesperson Ingrid Leary. ...2 weeks ago - Referendums for Māori wards a racist step backwards

The Government's imposed referendum on Māori wards is a racist step backwards for Māori representation, and disregards Te Tiriti o Waitangi. ...2 weeks ago

The Government's imposed referendum on Māori wards is a racist step backwards for Māori representation, and disregards Te Tiriti o Waitangi. ...2 weeks ago - Release: Job losses at Health not worth it for tax cuts

New Zealand will feel the harm of the National Government’s reckless cuts to jobs at the health ministry for generations, says Ayesha Verrall. ...2 weeks ago

New Zealand will feel the harm of the National Government’s reckless cuts to jobs at the health ministry for generations, says Ayesha Verrall. ...2 weeks ago - Press release: No Māori initiatives in Government’s nothing plan

Māori are yet to see anything from this Government except cuts, reversals and taking our people backwards, Māori Development spokesperson Willie Jackson said. ...2 weeks ago

Māori are yet to see anything from this Government except cuts, reversals and taking our people backwards, Māori Development spokesperson Willie Jackson said. ...2 weeks ago - Thirty six point PR spin2 weeks ago

- Thirty six point PR spin2 weeks ago

- Thirty six point PR spin2 weeks ago

- Release: Social housing off Government’s to-do list

The Coalition Government’s refusal to commit to ongoing funding for social housing is seeing the sector pull back on developments and families watch their dreams of securing a home fade away, says Labour Housing spokesperson Kieran McAnulty. ...2 weeks ago

The Coalition Government’s refusal to commit to ongoing funding for social housing is seeing the sector pull back on developments and families watch their dreams of securing a home fade away, says Labour Housing spokesperson Kieran McAnulty. ...2 weeks ago - Release: Less money in most people’s pockets this April

Changes to minimum wage and benefit indexation means many New Zealanders will get less this year, as the Government gives a big tax break to landlords instead. ...2 weeks ago

Changes to minimum wage and benefit indexation means many New Zealanders will get less this year, as the Government gives a big tax break to landlords instead. ...2 weeks ago - Release: Simeon Brown shortchanges Aucklanders

The Coalition Government’s plan to ‘get Auckland moving’ is a cuts cover-up that will ultimately cost Aucklanders more to move around the city, says Labour Auckland Issues spokesperson Shanan Halbert. ...3 weeks ago

The Coalition Government’s plan to ‘get Auckland moving’ is a cuts cover-up that will ultimately cost Aucklanders more to move around the city, says Labour Auckland Issues spokesperson Shanan Halbert. ...3 weeks ago - MPP cuts unforgivable

Slashing the Ministry of Pacific Peoples by 40% will have a devastating impact on pacific communities and further highlights how little this government cares about anything other than cutting taxes for the wealthiest few. ...3 weeks ago

Slashing the Ministry of Pacific Peoples by 40% will have a devastating impact on pacific communities and further highlights how little this government cares about anything other than cutting taxes for the wealthiest few. ...3 weeks ago - Release: Time to call time on greyhound racing3 weeks ago

Related Posts

- Patterson promoting NZ’s wool sector at International Congress

Associate Agriculture Minister Mark Patterson is speaking at the International Wool Textile Organisation Congress in Adelaide, promoting New Zealand wool, and outlining the coalition Government’s support for the revitalisation the sector. "New Zealand’s wool exports reached $400 million in the year to 30 June 2023, and the coalition Government ...BeehiveBy beehive.govt.nz15 hours ago

Associate Agriculture Minister Mark Patterson is speaking at the International Wool Textile Organisation Congress in Adelaide, promoting New Zealand wool, and outlining the coalition Government’s support for the revitalisation the sector. "New Zealand’s wool exports reached $400 million in the year to 30 June 2023, and the coalition Government ...BeehiveBy beehive.govt.nz15 hours ago - Removing red tape to help early learners thrive

The Government is making legislative changes to make it easier for new early learning services to be established, and for existing services to operate, Associate Education Minister David Seymour says. The changes involve repealing the network approval provisions that apply when someone wants to establish a new early learning service, ...BeehiveBy beehive.govt.nz18 hours ago

The Government is making legislative changes to make it easier for new early learning services to be established, and for existing services to operate, Associate Education Minister David Seymour says. The changes involve repealing the network approval provisions that apply when someone wants to establish a new early learning service, ...BeehiveBy beehive.govt.nz18 hours ago - McClay reaffirms strong NZ-China trade relationship

Trade, Agriculture and Forestry Minister Todd McClay has concluded productive discussions with ministerial counterparts in Beijing today, in support of the New Zealand-China trade and economic relationship. “My meeting with Commerce Minister Wang Wentao reaffirmed the complementary nature of the bilateral trade relationship, with our Free Trade Agreement at its ...BeehiveBy beehive.govt.nz1 day ago

Trade, Agriculture and Forestry Minister Todd McClay has concluded productive discussions with ministerial counterparts in Beijing today, in support of the New Zealand-China trade and economic relationship. “My meeting with Commerce Minister Wang Wentao reaffirmed the complementary nature of the bilateral trade relationship, with our Free Trade Agreement at its ...BeehiveBy beehive.govt.nz1 day ago - Prime Minister Luxon acknowledges legacy of Singapore Prime Minister Lee

Prime Minister Christopher Luxon today paid tribute to Singapore’s outgoing Prime Minister Lee Hsien Loong. Meeting in Singapore today immediately before Prime Minister Lee announced he was stepping down, Prime Minister Luxon warmly acknowledged his counterpart’s almost twenty years as leader, and the enduring legacy he has left for Singapore and South East ...BeehiveBy beehive.govt.nz1 day ago

Prime Minister Christopher Luxon today paid tribute to Singapore’s outgoing Prime Minister Lee Hsien Loong. Meeting in Singapore today immediately before Prime Minister Lee announced he was stepping down, Prime Minister Luxon warmly acknowledged his counterpart’s almost twenty years as leader, and the enduring legacy he has left for Singapore and South East ...BeehiveBy beehive.govt.nz1 day ago - PMs Luxon and Lee deepen Singapore-NZ ties

Prime Minister Christopher Luxon held a bilateral meeting today with Singapore Prime Minister Lee Hsien Loong. While in Singapore as part of his visit to South East Asia this week, Prime Minister Luxon also met with Singapore President Tharman Shanmugaratnam and will meet with Deputy Prime Minister Lawrence Wong. During today’s meeting, Prime Minister Luxon ...BeehiveBy beehive.govt.nz1 day ago

Prime Minister Christopher Luxon held a bilateral meeting today with Singapore Prime Minister Lee Hsien Loong. While in Singapore as part of his visit to South East Asia this week, Prime Minister Luxon also met with Singapore President Tharman Shanmugaratnam and will meet with Deputy Prime Minister Lawrence Wong. During today’s meeting, Prime Minister Luxon ...BeehiveBy beehive.govt.nz1 day ago - Antarctica New Zealand Board appointments

Foreign Minister Winston Peters has made further appointments to the Board of Antarctica New Zealand as part of a continued effort to ensure the Scott Base Redevelopment project is delivered in a cost-effective and efficient manner. The Minister has appointed Neville Harris as a new member of the Board. Mr ...BeehiveBy beehive.govt.nz1 day ago

Foreign Minister Winston Peters has made further appointments to the Board of Antarctica New Zealand as part of a continued effort to ensure the Scott Base Redevelopment project is delivered in a cost-effective and efficient manner. The Minister has appointed Neville Harris as a new member of the Board. Mr ...BeehiveBy beehive.govt.nz1 day ago - Finance Minister travels to Washington DC

Finance Minister Nicola Willis will travel to the United States on Tuesday to attend a meeting of the Five Finance Ministers group, with counterparts from Australia, the United States, Canada, and the United Kingdom. “I am looking forward to meeting with our Five Finance partners on how we can work ...BeehiveBy beehive.govt.nz1 day ago

Finance Minister Nicola Willis will travel to the United States on Tuesday to attend a meeting of the Five Finance Ministers group, with counterparts from Australia, the United States, Canada, and the United Kingdom. “I am looking forward to meeting with our Five Finance partners on how we can work ...BeehiveBy beehive.govt.nz1 day ago - Pet bonds a win/win for renters and landlords

The coalition Government has today announced purrfect and pawsitive changes to the Residential Tenancies Act to give tenants with pets greater choice when looking for a rental property, says Housing Minister Chris Bishop. “Pets are important members of many Kiwi families. It’s estimated that around 64 per cent of New ...BeehiveBy beehive.govt.nz2 days ago

The coalition Government has today announced purrfect and pawsitive changes to the Residential Tenancies Act to give tenants with pets greater choice when looking for a rental property, says Housing Minister Chris Bishop. “Pets are important members of many Kiwi families. It’s estimated that around 64 per cent of New ...BeehiveBy beehive.govt.nz2 days ago - Long Tunnel for SH1 Wellington being considered

State Highway 1 (SH1) through Wellington City is heavily congested at peak times and while planning continues on the duplicate Mt Victoria Tunnel and Basin Reserve project, the Government has also asked NZ Transport Agency (NZTA) to consider and provide advice on a Long Tunnel option, Transport Minister Simeon Brown ...BeehiveBy beehive.govt.nz2 days ago

State Highway 1 (SH1) through Wellington City is heavily congested at peak times and while planning continues on the duplicate Mt Victoria Tunnel and Basin Reserve project, the Government has also asked NZ Transport Agency (NZTA) to consider and provide advice on a Long Tunnel option, Transport Minister Simeon Brown ...BeehiveBy beehive.govt.nz2 days ago - New Zealand condemns Iranian strikes

Prime Minister Christopher Luxon and Foreign Minister Winston Peters have condemned Iran’s shocking and illegal strikes against Israel. “These attacks are a major challenge to peace and stability in a region already under enormous pressure," Mr Luxon says. "We are deeply concerned that miscalculation on any side could ...BeehiveBy beehive.govt.nz2 days ago

Prime Minister Christopher Luxon and Foreign Minister Winston Peters have condemned Iran’s shocking and illegal strikes against Israel. “These attacks are a major challenge to peace and stability in a region already under enormous pressure," Mr Luxon says. "We are deeply concerned that miscalculation on any side could ...BeehiveBy beehive.govt.nz2 days ago - Huge interest in Government’s infrastructure plans

Hundreds of people in little over a week have turned out in Northland to hear Regional Development Minister Shane Jones speak about plans for boosting the regional economy through infrastructure. About 200 people from the infrastructure and associated sectors attended an event headlined by Mr Jones in Whangarei today. Last ...BeehiveBy beehive.govt.nz4 days ago

Hundreds of people in little over a week have turned out in Northland to hear Regional Development Minister Shane Jones speak about plans for boosting the regional economy through infrastructure. About 200 people from the infrastructure and associated sectors attended an event headlined by Mr Jones in Whangarei today. Last ...BeehiveBy beehive.govt.nz4 days ago - Health Minister thanks outgoing Health New Zealand Chair

Health Minister Dr Shane Reti has today thanked outgoing Health New Zealand – Te Whatu Ora Chair Dame Karen Poutasi for her service on the Board. “Dame Karen tendered her resignation as Chair and as a member of the Board today,” says Dr Reti. “I have asked her to ...BeehiveBy beehive.govt.nz4 days ago

Health Minister Dr Shane Reti has today thanked outgoing Health New Zealand – Te Whatu Ora Chair Dame Karen Poutasi for her service on the Board. “Dame Karen tendered her resignation as Chair and as a member of the Board today,” says Dr Reti. “I have asked her to ...BeehiveBy beehive.govt.nz4 days ago - Roads of National Significance planning underway

The NZ Transport Agency (NZTA) has signalled their proposed delivery approach for the Government’s 15 Roads of National Significance (RoNS), with the release of the State Highway Investment Proposal (SHIP) today, Transport Minister Simeon Brown says. “Boosting economic growth and productivity is a key part of the Government’s plan to ...BeehiveBy beehive.govt.nz5 days ago

The NZ Transport Agency (NZTA) has signalled their proposed delivery approach for the Government’s 15 Roads of National Significance (RoNS), with the release of the State Highway Investment Proposal (SHIP) today, Transport Minister Simeon Brown says. “Boosting economic growth and productivity is a key part of the Government’s plan to ...BeehiveBy beehive.govt.nz5 days ago - Navigating an unstable global environment

New Zealand is renewing its connections with a world facing urgent challenges by pursuing an active, energetic foreign policy, Foreign Minister Winston Peters says. “Our country faces the most unstable global environment in decades,” Mr Peters says at the conclusion of two weeks of engagements in Egypt, Europe and the United States. “We cannot afford to sit back in splendid ...BeehiveBy beehive.govt.nz5 days ago

New Zealand is renewing its connections with a world facing urgent challenges by pursuing an active, energetic foreign policy, Foreign Minister Winston Peters says. “Our country faces the most unstable global environment in decades,” Mr Peters says at the conclusion of two weeks of engagements in Egypt, Europe and the United States. “We cannot afford to sit back in splendid ...BeehiveBy beehive.govt.nz5 days ago - NZ welcomes Australian Governor-General

Prime Minister Christopher Luxon has announced the Australian Governor-General, His Excellency General The Honourable David Hurley and his wife Her Excellency Mrs Linda Hurley, will make a State visit to New Zealand from Tuesday 16 April to Thursday 18 April. The visit reciprocates the State visit of former Governor-General Dame Patsy Reddy ...BeehiveBy beehive.govt.nz5 days ago

Prime Minister Christopher Luxon has announced the Australian Governor-General, His Excellency General The Honourable David Hurley and his wife Her Excellency Mrs Linda Hurley, will make a State visit to New Zealand from Tuesday 16 April to Thursday 18 April. The visit reciprocates the State visit of former Governor-General Dame Patsy Reddy ...BeehiveBy beehive.govt.nz5 days ago - Pseudoephedrine back on shelves for Winter

Associate Health Minister David Seymour has announced that Medsafe has approved 11 cold and flu medicines containing pseudoephedrine. Pharmaceutical suppliers have indicated they may be able to supply the first products in June. “This is much earlier than the original expectation of medicines being available by 2025. The Government recognised ...BeehiveBy beehive.govt.nz5 days ago

Associate Health Minister David Seymour has announced that Medsafe has approved 11 cold and flu medicines containing pseudoephedrine. Pharmaceutical suppliers have indicated they may be able to supply the first products in June. “This is much earlier than the original expectation of medicines being available by 2025. The Government recognised ...BeehiveBy beehive.govt.nz5 days ago - NZ and the US: an ever closer partnership

New Zealand and the United States have recommitted to their strategic partnership in Washington DC today, pledging to work ever more closely together in support of shared values and interests, Foreign Minister Winston Peters says. “The strategic environment that New Zealand and the United States face is considerably more ...BeehiveBy beehive.govt.nz5 days ago

New Zealand and the United States have recommitted to their strategic partnership in Washington DC today, pledging to work ever more closely together in support of shared values and interests, Foreign Minister Winston Peters says. “The strategic environment that New Zealand and the United States face is considerably more ...BeehiveBy beehive.govt.nz5 days ago - Joint US and NZ declaration

April 11, 2024 Joint Declaration by United States Secretary of State the Honorable Antony J. Blinken and New Zealand Minister of Foreign Affairs the Right Honourable Winston Peters We met today in Washington, D.C. to recommit to the historic partnership between our two countries and the principles that underpin it—rule ...BeehiveBy beehive.govt.nz5 days ago