Why We Need Universalism, Not Tax Cuts, To Solve The Cost-Of-Living Crisis

Why We Need Universalism, Not Tax Cuts, To Solve The Cost-Of-Living Crisis

Written By:

Incognito - Date published:

8:24 am, June 1st, 2023 - 64 comments

Categories: benefits, budget 2023, cost of living, equality, inequality, tax, welfare -

Tags: redistribution, tax cuts, universalism, wealth distribution

In recent years, many people in Aotearoa – New Zealand have been struggling with the rising costs of living, especially in areas such as housing, health care, education, and transport. These costs have outpaced the growth of wages and incomes, making it harder for people to afford their basic needs and aspirations and many of us are feeling the pinch. This has led to a widespread sense of frustration and dissatisfaction among the population, and to a demand for policy solutions that can address this crisis. Arguably, the Government has made only small steps towards this in Budget-2023 that will only alleviate the economic pressures for some but certainly not all people – there was not enough fiscal wriggle room to please everyone.

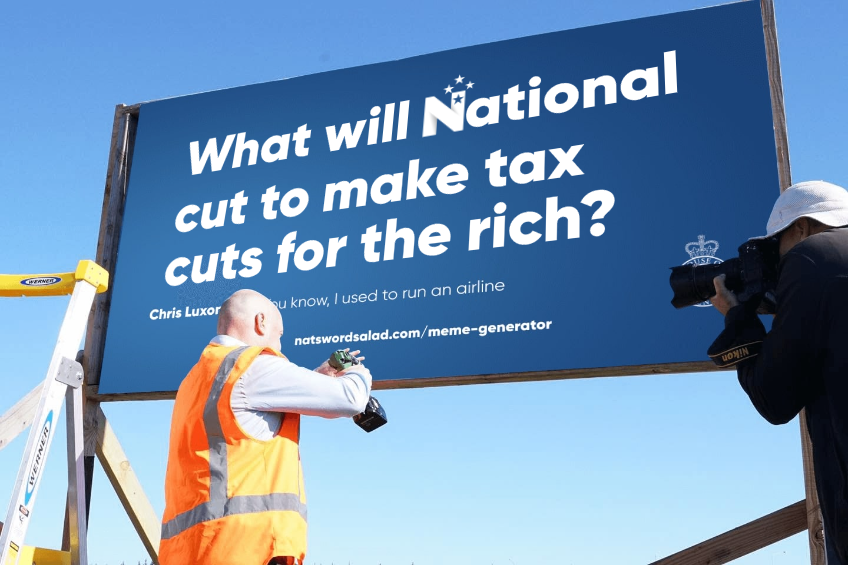

Some politicians and pundits say that tax cuts are the answer. They argue that tax cuts can stimulate economic growth, increase disposable income, and reduce government intervention. They claim that tax cuts can benefit everyone, especially the middle class who are feeling the squeeze of the cost-of-living crisis. Obviously, there is some truth in their claims.

But tax cuts may not be the best solution for this problem. In fact, tax cuts may have negative effects on two important values that underpin a fair and prosperous society: inequality and universalism.

Inequality is the gap between the rich and the poor, or how income and wealth are distributed in a society. Universalism is the extent to which social benefits are available to all citizens regardless of their income or other factors.

Sam Sachdeva wrote (https://www.newsroom.co.nz/8things/budget-2023-hipkins-pragmatic-push-puts-national-in-tight-spot) that Chris Hipkins is continuing with Labour’s inclination towards universalism in entitlements.

Inequality and universalism are closely related to each other, and they are influenced by the design and implementation of welfare policies. Welfare policies can be either universal or targeted. Universal welfare policies provide social benefits to all citizens regardless of their income or other criteria. Targeted welfare policies provide social benefits only to the poor or the neediest groups based on means testing or other criteria. One might think that targeted welfare policies are more effective and efficient in reducing poverty and inequality than universal welfare policies. After all, targeting the poor means that more resources are directed to those who need them the most, right?

Wrong!

This is where the paradox of redistribution comes in. The paradox of redistribution is a concept that was proposed by two Swedish scholars, Walter Korpi and Joakim Palme, in a famous paper published in 1998 (https://www.econstor.eu/bitstream/10419/160846/1/lis-wps-174.pdf).1 They argued that welfare states that target social benefits exclusively at the poor tend to achieve less redistribution and reduce less income inequality and poverty than welfare states that provide universal social benefits to all citizens.

This may seem counterintuitive, but Korpi and Palme explained that targeting the poor has several drawbacks that undermine its redistributive potential. For example:

- Targeting the poor may reduce the size of the redistributive budget, as it may generate less public support and political legitimacy for social spending, especially among the middle and upper classes who do not benefit from it.

- Targeting the poor may increase the administrative costs and complexity of delivering social benefits, as it may require more means testing, monitoring, and verification procedures to identify and reach the eligible recipients. This also puts a burden on the recipients to provide accurate and up-to-date data to the appropriate agencies & departments often with a threat of punitive measures.

- Targeting the poor may create disincentives and stigma for the recipients of social benefits, as it may reduce their work incentives, erode their social rights, and expose them to social discrimination and exclusion. For example, the ‘social investment’ proposal by Bill English that was criticised for this (https://www.beehive.govt.nz/speech/launch-‘social-investment-new-zealand-policy-experiment’).

On the other hand, universal social benefits have several advantages that enhance their redistributive potential. For example:

- Universal social benefits may increase the size of the redistributive budget, as they may generate more public support and political legitimacy for social spending, also among the middle and upper classes who also benefit from it.

- Universal social benefits may reduce the administrative costs and complexity of delivering social benefits, as they may require less means testing, monitoring, and verification procedures.

- Universal social benefits may create incentives and dignity for the recipients of social benefits, as they may increase their work incentives, strengthen their social rights, and promote their social integration and inclusion.

Based on these arguments, Korpi and Palme concluded that universalism is a more effective strategy of equality than targeting. However, there have been subsequent challenges of Korpi and Palme’s paradox, mostly in academic circles. It is a relevant and important topic that has implications for policy design and evaluation in New Zealand.

Indeed, as Sam Sachdeva wrote:

Helpfully, universal benefits are also easier to sell to the wider population, and more difficult to scrap.

There are examples, of course, that show that New Zealand’s version of universalism has not achieved equity of outcomes for all, and that targeting has often been associated with negative consequences. Moreover, New Zealand’s tax system has also been criticised for being regressive and favouring wealth accumulation over income generation. Thomas Piketty, a renowned economist who has been advocating reforms to combat inequality, argues that inequality is bad for economic prosperity, as it undermines social cohesion, democratic participation, and human development.

So, what does this mean for tax cuts?

Tax cuts are often seen as a way to stimulate economic growth, increase disposable income, and reduce government intervention & interference. However, tax cuts may also have negative effects on inequality and universalism, such as:

- Tax cuts may reduce the revenue available for social spending, which may lead to lower coverage and generosity of social benefits, or higher public debt.

- Tax cuts may benefit the rich more than the poor, as they may be based on income brackets, tax deductions, or tax credits that favour higher earners.

- Tax cuts may undermine the public support and political legitimacy for universal social benefits, as they may create a perception that everyone should pay less and receive less from the government. This seems the core NACT reasoning and argument (or excuse?) for their political existence. (NB certainly ACT is cosying up in bed with The Taxpayers’ Union and National regularly joins them for a threesome)

Therefore, tax cuts may not be the best solution for addressing the cost-of-living crisis or improving the well-being of the population. Rather, it may be more effective and fair to invest in universal social benefits that can provide adequate and accessible support to all citizens, especially those who are most vulnerable or disadvantaged.

Of course, this does not mean that universalism is always superior to targeting or that tax cuts are always negative. There may be situations where targeting or tax cuts are justified or necessary depending on context or specific objectives. However, the point is to recognise pros & cons, have a constructive debate about it, and make informed & balanced decisions based on evidence, values, and principles that we, or most of us, can subscribe to and get behind.

This is why universalism matters. Universalism is not only a moral principle or an ethical ideal. It is also a practical strategy or an effective tool for achieving greater equality & well-being in society. It is not a Utopian dream or an unrealistic goal but a realistic possibility and an achievable outcome.

Universalism is not only good for you; it is good for everyone!

1In footnote 30: “In New Zealand private savings for old age in the form of home ownership has been encouraged (Davidson 1994).”

Related Posts

64 comments on “Why We Need Universalism, Not Tax Cuts, To Solve The Cost-Of-Living Crisis ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Muttonbird to alwyn on

- Karolyn_IS to AB on

- SPC to Psycho Milt on

- alwyn to Bearded Git on

- Bearded Git to alwyn on

- roblogic on

- joe90 on

- Ad to Muttonbird on

- alwyn to Bearded Git on

- Bearded Git to Ad on

- alwyn to Muttonbird on

- bwaghorn to Muttonbird on

- Bearded Git to Ad on

- Bearded Git to Muttonbird on

- Muttonbird on

- Psycho Milt to lprent on

- Psycho Milt to AB on

- thinker on

- Res Publica to Bearded Git on

- Muttonbird to alwyn on

- Ad on

- Ad to Bearded Git on

- Karolyn_IS to Karolyn_IS on

- AB to Visubversa on

- SPC to Karolyn_IS on

- Graeme to Bearded Git on

- Obtrectator to newsense on

Recent Posts

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Incognito

-

by lprent

-

by Mountain Tui

-

by mickysavage

-

by Incognito

-

by Mountain Tui

-

by advantage

-

by Guest post

-

by mickysavage

-

by lprent

-

by weka

-

by advantage

-

by Guest post

-

by Incognito

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Guest post

-

by Guest post

-

by advantage

-

by mickysavage

- Is Shane Jones The Most Corrupt Politician in New Zealand?

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...3 hours ago

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...3 hours ago - Good Friday

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel4 hours ago

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel4 hours ago - Luxon Turns A Blind Eye to Homelessness

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...5 hours ago

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...5 hours ago - The Hoon around the week to April 18

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey6 hours ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey6 hours ago - Simeon Brown Has Caused The Doctor’s Strike

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...6 hours ago

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...6 hours ago - Skeptical Science New Research for Week #16 2025

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...19 hours ago

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...19 hours ago - Whatever Happened to Cactus Kate?

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...19 hours ago

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...19 hours ago - Sovereign capability can benefit Australia—up to a point

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah20 hours ago

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah20 hours ago - David Seymour’s Charter School Rort

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...20 hours ago

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...20 hours ago - Flexibility and awareness will help India deal with Trump (again)

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan21 hours ago

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan21 hours ago - Inflation data confirms real terms minimum wage cut

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield22 hours ago

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield22 hours ago - Climate Change: Kicking the can down the road again

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant23 hours ago

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant23 hours ago - The Spirit for Australia: why Canberra should pursue the B-2 bomber

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen1 day ago

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen1 day ago - A bit more unpicking of RB spending and the Funding Agreement

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell1 day ago

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell1 day ago - A successful COP31 needs Pacific countries at the table

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson1 day ago

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson1 day ago - Brown unveils unfunded health plan for small NZ

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey1 day ago

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey1 day ago - Artificial Intelligence in the Workplace

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield1 day ago

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield1 day ago - NZ Must Undertake a Peacekeeping Role in Trump’s Wars

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...1 day ago

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...1 day ago - Donald Trump’s first three months: rude, raucous and rogue

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell1 day ago

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell1 day ago - Gordon Campbell On The Left’s Electability Crisis, And The Abundance Ecotopia

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor1 day ago

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor1 day ago - Taiwan: the sponge that soaks up Chinese power

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill2 days ago

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill2 days ago - Women in combat roles strengthen our defence force

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker2 days ago

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker2 days ago - China targets Canada’s election—and may be targeting Australia’s

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn2 days ago

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn2 days ago - Climate Adam: Climate Scientist Reacts to Elon Musk

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...2 days ago

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...2 days ago - Rattus Interneticus: Otago’s Internet Saga

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2212 days ago

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2212 days ago - Spin (and obfuscation)

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell2 days ago

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell2 days ago - Little’s pitch

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant2 days ago

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant2 days ago - Our Rough Beast.

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...2 days ago

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...2 days ago - What does India Want? What is New Zealand willing to give?

2 days ago

- President Trump is redefining America’s international role, and Australia has influence

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King2 days ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King2 days ago - Simeon Brown Gaslights Doctors

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī2 days ago

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī2 days ago - ACT’s “Tough on Crime” Facade Crumbles with Jago’s Appeal

2 days ago

- Judith Collins’ Hypocrisy: War Drums Over Welfare

Judith Collins is a seasoned master at political hypocrisy. As New Zealand’s Defence Minister, she's recently been banging the war drum, announcing a jaw-dropping $12 billion boost to the defence budget over the next four years, all while the coalition of chaos cries poor over housing, health, and education.Apparently, there’s ...2 days ago

Judith Collins is a seasoned master at political hypocrisy. As New Zealand’s Defence Minister, she's recently been banging the war drum, announcing a jaw-dropping $12 billion boost to the defence budget over the next four years, all while the coalition of chaos cries poor over housing, health, and education.Apparently, there’s ...2 days ago - Making the most of it

I’m on the London Overground watching what the phones people are holding are doing to their faces: The man-bun guy who could not be less impressed by what he's seeing but cannot stop reading; the woman who's impatient for a response; the one who’s frowning; the one who’s puzzled; the ...More Than A FeildingBy David Slack2 days ago

I’m on the London Overground watching what the phones people are holding are doing to their faces: The man-bun guy who could not be less impressed by what he's seeing but cannot stop reading; the woman who's impatient for a response; the one who’s frowning; the one who’s puzzled; the ...More Than A FeildingBy David Slack2 days ago - Maranga Ake

You don't have no prescriptionYou don't have to take no pillsYou don't have no prescriptionAnd baby don't have to take no pillsIf you come to see meDoctor Brown will cure your ills.Songwriters: Waymon Glasco.Dr Luxon. Image: David and Grok.First, they came for the Bottom FeedersAnd I did not speak outBecause ...Nick’s KōreroBy Nick Rockel2 days ago

You don't have no prescriptionYou don't have to take no pillsYou don't have no prescriptionAnd baby don't have to take no pillsIf you come to see meDoctor Brown will cure your ills.Songwriters: Waymon Glasco.Dr Luxon. Image: David and Grok.First, they came for the Bottom FeedersAnd I did not speak outBecause ...Nick’s KōreroBy Nick Rockel2 days ago - Bernard’s Dawn Chorus & Pick ‘n’ Mix for Wednesday, April 16

The Health Minister says the striking doctors already “well remunerated,” and are “walking away from” and “hurting” their patients. File photo: Lynn GrievesonLong stories short from our political economy on Wednesday, April 16:Simeon Brown has attacked1 doctors striking for more than a 1.5% pay rise as already “well remunerated,” even ...The KakaBy Bernard Hickey2 days ago

The Health Minister says the striking doctors already “well remunerated,” and are “walking away from” and “hurting” their patients. File photo: Lynn GrievesonLong stories short from our political economy on Wednesday, April 16:Simeon Brown has attacked1 doctors striking for more than a 1.5% pay rise as already “well remunerated,” even ...The KakaBy Bernard Hickey2 days ago - Strengthening Australia’s space cooperation with South Korea

The time is ripe for Australia and South Korea to strengthen cooperation in space, through embarking on joint projects and initiatives that offer practical outcomes for both countries. This is the finding of a new ...The StrategistBy Malcolm Davis2 days ago

The time is ripe for Australia and South Korea to strengthen cooperation in space, through embarking on joint projects and initiatives that offer practical outcomes for both countries. This is the finding of a new ...The StrategistBy Malcolm Davis2 days ago - They Can Only Talk About One Thing

Hi,When Trump raised tariffs against China to 145%, he destined many small businesses to annihilation. The Daily podcast captured the mass chaos by zooming in and talking to one person, Beth Benike, a small-business owner who will likely lose her home very soon.She pointed out that no, she wasn’t surprised ...David FarrierBy David Farrier2 days ago

Hi,When Trump raised tariffs against China to 145%, he destined many small businesses to annihilation. The Daily podcast captured the mass chaos by zooming in and talking to one person, Beth Benike, a small-business owner who will likely lose her home very soon.She pointed out that no, she wasn’t surprised ...David FarrierBy David Farrier2 days ago - National’s Inflation Shame: Kiwis Pay the Price

National’s handling of inflation and the cost-of-living crisis is an utter shambles and a gutless betrayal of every Kiwi scraping by. The Coalition of Chaos Ministers strut around preaching about how effective their policies are, but really all they're doing is perpetuating a cruel and sick joke of undelivered promises, ...2 days ago

National’s handling of inflation and the cost-of-living crisis is an utter shambles and a gutless betrayal of every Kiwi scraping by. The Coalition of Chaos Ministers strut around preaching about how effective their policies are, but really all they're doing is perpetuating a cruel and sick joke of undelivered promises, ...2 days ago - Winston’s Mate Rhys Williams Has Been Unmasked

Most people wouldn't have heard of a little worm like Rhys Williams, a so-called businessman and former NZ First member, who has recently been unmasked as the venomous troll behind a relentless online campaign targeting Green Party MP Benjamin Doyle.According to reports, Williams has been slinging mud at Doyle under ...3 days ago

Most people wouldn't have heard of a little worm like Rhys Williams, a so-called businessman and former NZ First member, who has recently been unmasked as the venomous troll behind a relentless online campaign targeting Green Party MP Benjamin Doyle.According to reports, Williams has been slinging mud at Doyle under ...3 days ago - Idiocy, Opportunity

Illustration credit: Jonathan McHugh (New Statesman)The other day, a subscriber said they were unsubscribing because they needed “some good news”.I empathised. Don’t we all.I skimmed a NZME article about the impacts of tariffs this morning with analysis from Kiwibank’s Jarrod Kerr. Kerr, their Chief Economist, suggested another recession is the ...Mountain TuiBy Mountain Tūī3 days ago

Illustration credit: Jonathan McHugh (New Statesman)The other day, a subscriber said they were unsubscribing because they needed “some good news”.I empathised. Don’t we all.I skimmed a NZME article about the impacts of tariffs this morning with analysis from Kiwibank’s Jarrod Kerr. Kerr, their Chief Economist, suggested another recession is the ...Mountain TuiBy Mountain Tūī3 days ago - US allies must band together in weapons development

Let’s assume, as prudence demands we assume, that the United States will not at any predictable time go back to being its old, reliable self. This means its allies must be prepared indefinitely to lean ...The StrategistBy Bill Sweetman3 days ago

Let’s assume, as prudence demands we assume, that the United States will not at any predictable time go back to being its old, reliable self. This means its allies must be prepared indefinitely to lean ...The StrategistBy Bill Sweetman3 days ago - I’ve been reading

Over the last three rather tumultuous US trade policy weeks, I’ve read these four books. I started with Irwin (whose book had sat on my pile for years, consulted from time to time but not read) in a week of lots of flights and hanging around airports/hotels, and then one ...Croaking CassandraBy Michael Reddell3 days ago

Over the last three rather tumultuous US trade policy weeks, I’ve read these four books. I started with Irwin (whose book had sat on my pile for years, consulted from time to time but not read) in a week of lots of flights and hanging around airports/hotels, and then one ...Croaking CassandraBy Michael Reddell3 days ago - This is not the time for increasing Indonesia’s defence spending

Indonesia could do without an increase in military spending that the Ministry of Defence is proposing. The country has more pressing issues, including public welfare and human rights. Moreover, the transparency and accountability to justify ...The StrategistBy Yokie Rahmad Isjchwansyah3 days ago

Indonesia could do without an increase in military spending that the Ministry of Defence is proposing. The country has more pressing issues, including public welfare and human rights. Moreover, the transparency and accountability to justify ...The StrategistBy Yokie Rahmad Isjchwansyah3 days ago - FSU Supports Chris Milne’s Right to Make Death Threats

3 days ago

- Winston is inciting terrorism

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant3 days ago

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant3 days ago - Winston is inciting terrorism

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant3 days ago

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant3 days ago - Why has Hamish Campbell Gone Into Hiding?

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...3 days ago

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...3 days ago - Why has Hamish Campbell Gone Into Hiding?

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...3 days ago

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...3 days ago - The Government is cutting, just as the economic recovery is stalling

The economy is not doing what it was supposed to when PM Christopher Luxon said in January it was ‘going for growth.’ Photo: Lynn Grieveson / The KākāLong stories short from our political economy on Tuesday, April 15:New Zealand’s economic recovery is stalling, according to business surveys, retail spending and ...The KakaBy Bernard Hickey3 days ago

The economy is not doing what it was supposed to when PM Christopher Luxon said in January it was ‘going for growth.’ Photo: Lynn Grieveson / The KākāLong stories short from our political economy on Tuesday, April 15:New Zealand’s economic recovery is stalling, according to business surveys, retail spending and ...The KakaBy Bernard Hickey3 days ago - For a safer Symonds Street

This is a guest post by Lewis Creed, managing editor of the University of Auckland student publication Craccum, which is currently running a campaign for a safer Symonds Street in the wake of a horrific recent crash. The post has two parts: 1) Craccum’s original call for safety (6 ...Greater AucklandBy Guest Post3 days ago

This is a guest post by Lewis Creed, managing editor of the University of Auckland student publication Craccum, which is currently running a campaign for a safer Symonds Street in the wake of a horrific recent crash. The post has two parts: 1) Craccum’s original call for safety (6 ...Greater AucklandBy Guest Post3 days ago - Tuesday 15 April

NZCTU President Richard Wagstaff has published an opinion piece which makes the case for a different approach to economic development, as proposed in the CTU’s Aotearoa Reimagined programme. The number of people studying to become teachers has jumped after several years of low enrolment. The coalition has directed Health New ...NZCTUBy Jack McDonald3 days ago

NZCTU President Richard Wagstaff has published an opinion piece which makes the case for a different approach to economic development, as proposed in the CTU’s Aotearoa Reimagined programme. The number of people studying to become teachers has jumped after several years of low enrolment. The coalition has directed Health New ...NZCTUBy Jack McDonald3 days ago - As China’s AI industry grows, Australia must support its own

The growth of China’s AI industry gives it great influence over emerging technologies. That creates security risks for countries using those technologies. So, Australia must foster its own domestic AI industry to protect its interests. ...The StrategistBy Hassan Gad3 days ago

The growth of China’s AI industry gives it great influence over emerging technologies. That creates security risks for countries using those technologies. So, Australia must foster its own domestic AI industry to protect its interests. ...The StrategistBy Hassan Gad3 days ago - Luxon’s Economic Mismanagement

Unfortunately we have another National Party government in power at the moment, and as a consequence, another economic dumpster fire taking hold. Inflation’s hurting Kiwis, and instead of providing relief, National is fiddling while wallets burn.Prime Minister Chris Luxon's response is a tired remix of tax cuts for the rich ...3 days ago

Unfortunately we have another National Party government in power at the moment, and as a consequence, another economic dumpster fire taking hold. Inflation’s hurting Kiwis, and instead of providing relief, National is fiddling while wallets burn.Prime Minister Chris Luxon's response is a tired remix of tax cuts for the rich ...3 days ago - Girls and Boys

Girls who are boys who like boys to be girlsWho do boys like they're girls, who do girls like they're boysAlways should be someone you really loveSongwriters: Damon Albarn / Graham Leslie Coxon / Alexander Rowntree David / Alexander James Steven.Last month, I wrote about the Birds and Bees being ...Nick’s KōreroBy Nick Rockel3 days ago

Girls who are boys who like boys to be girlsWho do boys like they're girls, who do girls like they're boysAlways should be someone you really loveSongwriters: Damon Albarn / Graham Leslie Coxon / Alexander Rowntree David / Alexander James Steven.Last month, I wrote about the Birds and Bees being ...Nick’s KōreroBy Nick Rockel3 days ago - Australia can learn from Britain on cyber governance

Australia needs to reevaluate its security priorities and establish a more dynamic regulatory framework for cybersecurity. To advance in this area, it can learn from Britain’s Cyber Security and Resilience Bill, which presents a compelling ...The StrategistBy Andrew Horton and George Hlaing3 days ago

Australia needs to reevaluate its security priorities and establish a more dynamic regulatory framework for cybersecurity. To advance in this area, it can learn from Britain’s Cyber Security and Resilience Bill, which presents a compelling ...The StrategistBy Andrew Horton and George Hlaing3 days ago - Gordon Campbell On Why The US Stands To Lose The Tariff Wars

Deputy PM Winston Peters likes nothing more than to portray himself as the only wise old head while everyone else is losing theirs. Yet this time, his “old master” routine isn’t working. What global trade is experiencing is more than the usual swings and roundabouts of market sentiment. President Donald ...Gordon CampbellBy ScoopEditor4 days ago

Deputy PM Winston Peters likes nothing more than to portray himself as the only wise old head while everyone else is losing theirs. Yet this time, his “old master” routine isn’t working. What global trade is experiencing is more than the usual swings and roundabouts of market sentiment. President Donald ...Gordon CampbellBy ScoopEditor4 days ago - Why is there no progress in Ukrainian war peace talks?

President Trump’s hopes of ending the war in Ukraine seemed more driven by ego than realistic analysis. Professor Vladimir Brovkin’s latest video above highlights the internal conflicts within the USA, Russia, Europe, and Ukraine, which are currently hindering peace talks and clarity. Brovkin pointed out major contradictions within ...Open ParachuteBy Ken4 days ago

President Trump’s hopes of ending the war in Ukraine seemed more driven by ego than realistic analysis. Professor Vladimir Brovkin’s latest video above highlights the internal conflicts within the USA, Russia, Europe, and Ukraine, which are currently hindering peace talks and clarity. Brovkin pointed out major contradictions within ...Open ParachuteBy Ken4 days ago - Ani O’Brien has Zero Credibility

In the cesspool that is often New Zealand’s online political discourse, few figures wield their influence as destructively as Ani O’Brien. Masquerading as a champion of free speech and women’s rights, O’Brien’s campaigns are a masterclass in bad faith, built on a foundation of lies, selective outrage, and a knack ...4 days ago

In the cesspool that is often New Zealand’s online political discourse, few figures wield their influence as destructively as Ani O’Brien. Masquerading as a champion of free speech and women’s rights, O’Brien’s campaigns are a masterclass in bad faith, built on a foundation of lies, selective outrage, and a knack ...4 days ago - Australian policy does need more Asia—more Southeast Asia

The international challenge confronting Australia today is unparalleled, at least since the 1940s. It requires what the late Brendan Sargeant, a defence analyst, called strategic imagination. We need more than shrewd economic manoeuvring and a ...The StrategistBy Anthony Milner4 days ago

The international challenge confronting Australia today is unparalleled, at least since the 1940s. It requires what the late Brendan Sargeant, a defence analyst, called strategic imagination. We need more than shrewd economic manoeuvring and a ...The StrategistBy Anthony Milner4 days ago - EGU2025 – Picking and chosing sessions to attend on site in Vienna

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 27 to May 2. This year, I'll join the event on site in Vienna for the full week and I've already picked several sessions I plan ...4 days ago

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 27 to May 2. This year, I'll join the event on site in Vienna for the full week and I've already picked several sessions I plan ...4 days ago - Bookshelf: How China sees things

Here’s a book that looks not in at China but out from China. David Daokui Li’s China’s World View: Demystifying China to Prevent Global Conflict is a refreshing offering in that Li is very much ...The StrategistBy John West4 days ago

Here’s a book that looks not in at China but out from China. David Daokui Li’s China’s World View: Demystifying China to Prevent Global Conflict is a refreshing offering in that Li is very much ...The StrategistBy John West4 days ago - The Mirage of Chris Luxon’s Pre-Election Promises

The New Zealand National Party has long mastered the art of crafting messaging that resonates with a large number of desperate, often white middle-class, voters. From their 2023 campaign mantra of “getting our country back on track” to promises of economic revival, safer streets, and better education, their rhetoric paints ...4 days ago

The New Zealand National Party has long mastered the art of crafting messaging that resonates with a large number of desperate, often white middle-class, voters. From their 2023 campaign mantra of “getting our country back on track” to promises of economic revival, safer streets, and better education, their rhetoric paints ...4 days ago - To counter anti-democratic propaganda, step up funding for ABC International

A global contest of ideas is underway, and democracy as an ideal is at stake. Democracies must respond by lifting support for public service media with an international footprint. With the recent decision by the ...The StrategistBy Claire Gorman4 days ago

A global contest of ideas is underway, and democracy as an ideal is at stake. Democracies must respond by lifting support for public service media with an international footprint. With the recent decision by the ...The StrategistBy Claire Gorman4 days ago - What was the story re Orr’s resignation?

It is almost six weeks since the shock announcement early on the afternoon of Wednesday 5 March that the Governor of the Reserve Bank, Adrian Orr, was resigning effective 31 March, and that in fact he had already left and an acting Governor was already in place. Orr had been ...Croaking CassandraBy Michael Reddell4 days ago

It is almost six weeks since the shock announcement early on the afternoon of Wednesday 5 March that the Governor of the Reserve Bank, Adrian Orr, was resigning effective 31 March, and that in fact he had already left and an acting Governor was already in place. Orr had been ...Croaking CassandraBy Michael Reddell4 days ago - Monday 14 April

The PSA surveyed more than 900 of its members, with 55 percent of respondents saying AI is used at their place of work, despite most workers not being in trained in how to use the technology safely. Figures to be released on Thursday are expected to show inflation has risen ...NZCTUBy Jack McDonald4 days ago

The PSA surveyed more than 900 of its members, with 55 percent of respondents saying AI is used at their place of work, despite most workers not being in trained in how to use the technology safely. Figures to be released on Thursday are expected to show inflation has risen ...NZCTUBy Jack McDonald4 days ago - How to spot AI influence in Australia’s election campaign

Be on guard for AI-powered messaging and disinformation in the campaign for Australia’s 3 May election. And be aware that parties can use AI to sharpen their campaigning, zeroing in on issues that the technology ...The StrategistBy Niusha Shafiabady4 days ago

Be on guard for AI-powered messaging and disinformation in the campaign for Australia’s 3 May election. And be aware that parties can use AI to sharpen their campaigning, zeroing in on issues that the technology ...The StrategistBy Niusha Shafiabady4 days ago - David Seymour – Arsehole of the Week

Strap yourselves in, folks, it’s time for another round of Arsehole of the Week, and this week’s golden derrière trophy goes to—drumroll, please—David Seymour, the ACT Party’s resident genius who thought, “You know what we need? A shiny new Treaty Principles Bill to "fix" all that pesky Māori-Crown partnership nonsense ...4 days ago

Strap yourselves in, folks, it’s time for another round of Arsehole of the Week, and this week’s golden derrière trophy goes to—drumroll, please—David Seymour, the ACT Party’s resident genius who thought, “You know what we need? A shiny new Treaty Principles Bill to "fix" all that pesky Māori-Crown partnership nonsense ...4 days ago - Bernard’s Dawn Chorus and Pick ‘n’ Mix for Monday, April 14

Apple Store, Shanghai. Trump wants all iPhones to be made in the USM but experts say that is impossible. Photo: Getty ImagesLong stories shortist from our political economy on Monday, April 14:Donald Trump’s exemption on tariffs on phones and computers is temporary, and he wants all iPhones made in the ...The KakaBy Bernard Hickey4 days ago

Apple Store, Shanghai. Trump wants all iPhones to be made in the USM but experts say that is impossible. Photo: Getty ImagesLong stories shortist from our political economy on Monday, April 14:Donald Trump’s exemption on tariffs on phones and computers is temporary, and he wants all iPhones made in the ...The KakaBy Bernard Hickey4 days ago - Unmasking the National Party’s Fascism

Kia ora, readers. It’s time to pull back the curtain on some uncomfortable truths about New Zealand’s political landscape. The National Party, often cloaked in the guise of "sensible centrism," has, at times, veered into territory that smells suspiciously like fascism. Now, before you roll your eyes and mutter about hyperbole, ...4 days ago

Kia ora, readers. It’s time to pull back the curtain on some uncomfortable truths about New Zealand’s political landscape. The National Party, often cloaked in the guise of "sensible centrism," has, at times, veered into territory that smells suspiciously like fascism. Now, before you roll your eyes and mutter about hyperbole, ...4 days ago - Open Letter to Auckland Transport about Project K

This is a letter we will be sending to Auckland Transport to ask they return to the original consulted plans on the Karanga-a-Hape Station precinct integration project, after they released significant changes to designs last week. If you would like to be added as a signatory, please reach out to ...Greater AucklandBy Connor Sharp4 days ago

This is a letter we will be sending to Auckland Transport to ask they return to the original consulted plans on the Karanga-a-Hape Station precinct integration project, after they released significant changes to designs last week. If you would like to be added as a signatory, please reach out to ...Greater AucklandBy Connor Sharp4 days ago - The gas plan that’s sailing Australia into strategic peril

Australia’s east coast is facing a gas crisis, as the country exports most of the gas it produces. Although it’s a major producer, Australia faces a risk of domestic liquefied natural gas (LNG) supply shortfalls ...The StrategistBy Henry Campbell and Raelene Lockhorst4 days ago

Australia’s east coast is facing a gas crisis, as the country exports most of the gas it produces. Although it’s a major producer, Australia faces a risk of domestic liquefied natural gas (LNG) supply shortfalls ...The StrategistBy Henry Campbell and Raelene Lockhorst4 days ago - Amateur Hour!

Overnight, Donald J. Trump, America’s 47th President, and only the second President since 1893 to win non-consecutive terms, rolled back more of his “no exemptions, no negotiations” & “no big deal” tariffs.Smartphones, computers, and other electronics1 are now exempt from the 125% levies imposed on imports from China; they retain ...Mountain TuiBy Mountain Tūī5 days ago

Overnight, Donald J. Trump, America’s 47th President, and only the second President since 1893 to win non-consecutive terms, rolled back more of his “no exemptions, no negotiations” & “no big deal” tariffs.Smartphones, computers, and other electronics1 are now exempt from the 125% levies imposed on imports from China; they retain ...Mountain TuiBy Mountain Tūī5 days ago - 2025 SkS Weekly Climate Change & Global Warming News Roundup #15

A listing of 36 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 6, 2025 thru Sat, April 12, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...5 days ago

A listing of 36 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 6, 2025 thru Sat, April 12, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...5 days ago - World Domination

Just one year of loveIs better than a lifetime aloneOne sentimental moment in your armsIs like a shooting star right through my heartIt's always a rainy day without youI'm a prisoner of love inside youI'm falling apart all around you, yeahSongwriter: John Deacon.Morena folks, it feels like it’s been quite ...Nick’s KōreroBy Nick Rockel5 days ago

Just one year of loveIs better than a lifetime aloneOne sentimental moment in your armsIs like a shooting star right through my heartIt's always a rainy day without youI'm a prisoner of love inside youI'm falling apart all around you, yeahSongwriter: John Deacon.Morena folks, it feels like it’s been quite ...Nick’s KōreroBy Nick Rockel5 days ago

Related Posts

- Release: Boot camps blog post fails to provide clarity

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...23 hours ago

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...23 hours ago - Release: Inflation rises and families feel the squeeze

24 hours ago

- Release: Govt doesn’t know how to fund new hospitals

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...2 days ago

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...2 days ago - Release: $10 million for only 215 students in charter schools

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...2 days ago

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...2 days ago - Release: Food prices further stretching the family budget

Families already stretched by rising costs will struggle with the news food prices are going up again. ...3 days ago

Families already stretched by rising costs will struggle with the news food prices are going up again. ...3 days ago - Release: Mental health staff and patients at risk without plan

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...4 days ago

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...4 days ago - Release: Driver licensing proposal doesn’t put safety first

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...4 days ago

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...4 days ago - Release: Students struggling as Govt sits on hands

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...7 days ago

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...7 days ago - Release: More must be done to stop children going hungry

More children are going hungry and statistics showing children in material hardship continue to get worse. ...1 week ago

More children are going hungry and statistics showing children in material hardship continue to get worse. ...1 week ago - Greens continue to call for Pacific Visa Waiver

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...1 week ago

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...1 week ago - More children going hungry under Coalition govt

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...1 week ago

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...1 week ago - Release: Longer wait for treatment under National

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...1 week ago

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...1 week ago - Ka mate te Pire- Ka ora te mana o Te Tiriti o Waitangi me te iwi Māori

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...1 week ago

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...1 week ago - Chris Hipkins speech: Treaty Principles Bill second reading

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...1 week ago

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...1 week ago - Release: End to the Treaty Principles Bill, but challenges remain ahead for Aotearoa

1 week ago

- Ka mate te Pire, ka ora Te Tiriti o Waitangi – Treaty Principles Bill dead, Te Tiriti o Waitangi m...

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...1 week ago

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...1 week ago - Member’s Bill an opportunity for climate action

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...1 week ago

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...1 week ago - Release: Bill to make trading laws fairer passes first hurdle

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...1 week ago

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...1 week ago - Release: Reserve Bank acts while Govt shrugs

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...1 week ago

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...1 week ago - Release: Property Law Amendment Bill pulled from ballot

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...1 week ago

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...1 week ago - Release: More children at risk of losing family connections

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...1 week ago

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...1 week ago - Release: David Parker made a difference – Hipkins

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...1 week ago

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...1 week ago - Release: David Parker to step down from Parliament

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...1 week ago

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...1 week ago - Release: Flaws in Govt’s climate strategy will cost us money

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...2 weeks ago

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...2 weeks ago - Green Party differing view on the Treaty Principles Bill

2 weeks ago

- Te Pāti Māori Urges Governor-General to Block Repeal of 7AA

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...2 weeks ago

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...2 weeks ago - Release: Abortion care quietly shelved amid staff shortage

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...2 weeks ago

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...2 weeks ago - Release: Govt guts Kāinga Ora, third of workforce under axe

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...2 weeks ago

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...2 weeks ago - Release: Thousands of submissions excluded from Treaty Principles Bill report

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...2 weeks ago

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...2 weeks ago - Release: Uncertainty remains over the impact of tariffs

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...2 weeks ago

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...2 weeks ago - Release: Worst February for building consents in over a decade

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 weeks ago

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 weeks ago - Release: Labour supports Willie Apiata’s selfless act

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 weeks ago

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 weeks ago - Te Pāti Māori MPs Denied Fundamental Rights in Privileges Committee Hearing

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...2 weeks ago

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...2 weeks ago - Release: Govt health and safety changes put workers at risk

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...3 weeks ago

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...3 weeks ago - Release: Kiwis worse off this April thanks to Govt choices

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...3 weeks ago

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...3 weeks ago - Release: Three more years for Interislander ferries

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...3 weeks ago

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...3 weeks ago - Release: Myanmar junta must stop the airstrikes

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...3 weeks ago

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...3 weeks ago - Release: National failing to deliver on supermarkets

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...3 weeks ago

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...3 weeks ago

Related Posts

- The Friday Poem: ‘How to Make a Terrorist’ by Tusiata Avia

A new poem by Tusiata Avia. How to make a terrorist First make a whistling sound which is the sound of a bomb just before it lands on a house. Then make an exploding sound which is the sound of the bomb which kills a father, decapitates a mother, roasts ...The SpinoffBy Tusiata Avia1 hour ago

A new poem by Tusiata Avia. How to make a terrorist First make a whistling sound which is the sound of a bomb just before it lands on a house. Then make an exploding sound which is the sound of the bomb which kills a father, decapitates a mother, roasts ...The SpinoffBy Tusiata Avia1 hour ago - Compulsory consent education proposed for schools

3 hours ago

- Energy and shipping decisions needed before meatworks – Chatham Islands mayor

Monique Croon says energy and shipping decisions are needed before a meatworks supported by the government can proceed. ...7 hours ago

Monique Croon says energy and shipping decisions are needed before a meatworks supported by the government can proceed. ...7 hours ago - Watch live: the 2025 NZ Scrabble Masters

The top-rated Scrabble players in the country go head-to-head this Easter weekend. Watch games live from 9.30am on the stream below. How does it all work? The Masters is different to most Scrabble tournaments in that it’s invitational, open only to the top-rated players in the country. The ...The SpinoffBy Calum Henderson7 hours ago

The top-rated Scrabble players in the country go head-to-head this Easter weekend. Watch games live from 9.30am on the stream below. How does it all work? The Masters is different to most Scrabble tournaments in that it’s invitational, open only to the top-rated players in the country. The ...The SpinoffBy Calum Henderson7 hours ago - Film adaptations of Jane Austen novels ranked from worst to best

Books editor Claire Mabey appraises all the Austen-adapted films from 1990 onwards to separate the delightful from the duds. For the purists, read our ranking of Jane Austen’s novels here. It is a truth universally acknowledged that not everything is created equal. Since 1990 there have been 12 attempts to ...The SpinoffBy Claire Mabey8 hours ago