At least Chris Bishop sleeps in a well made bed

At least Chris Bishop sleeps in a well made bed

Written By:

weka - Date published:

8:26 am, April 17th, 2024 - 85 comments

Categories: national, national/act government, tenants' rights -

Tags: blam blam blam, renting

RNZ: Government announces pet bond policy for renters

The government has announced a two-week pet bond and obligations for tenants to pay for damage their animals cause in a bid to make renting with an animal easier.

It intends changing the Residential Tenancies Act next month in a bid to give pet owners more choice when trying to find a rental.

Housing Minister Chris Bishop and his dog, Ladyhawke, made the announcement alongside ACT leader and Regulations Minister David Seymour.

“He was confident tenants wouldn’t mind paying extra (set at a maximum of two weeks’ rent) if it meant their pet could move in too.”

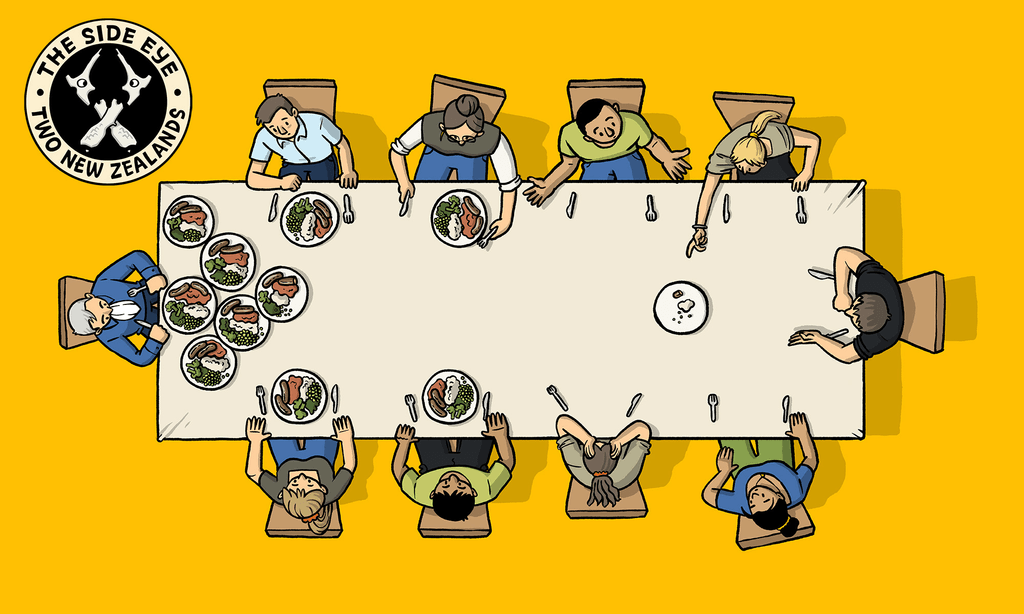

Tenants already pay a bond to cover damage beyond wear and tear. Bonds can be up to four weeks rent. As a guide, the current mean Auckland rent is $610 per week. That’s up to $2,440 bond. Add an extra 50% of $1,220 pet bond, equals $3,660. There’s no housing crisis, poverty, large numbers of people living below the poverty line in New Zealand. We all sleep in a well made bed, right?

The announcement was all so cute with the dogs and the smooth PR. But where did this come from? Oh look, property investors. NZH in May last year: Tenancy Tribunal pet ruling sparks fears landlords won’t be able to stop tenants owning animals

The rulings stated the Residential Tenancies Act does not contain any law banning tenants from owning pets and hence clauses barring animals are not automatically enforceable.

That’s led the NZ Property Investors Foundation lobby group to get legal advice as they seek to ensure no-pet clauses remain valid, while Renters United is keen to see no-pet clauses banned.

Having a decent home is a human right. For people that have pets, finding rental housing can be challenging. Doubly so for those on low incomes or who are cash strapped. Higher returns on property investment shouldn’t take precedent over decent home rights, community stability, and having enough money to live on. Given the rate of capital gains in the past 20 years, I’m really wondering what it is about New Zealand that is so mean spirited we think non-home owners should pay for the privilege of living with a dog or cat or guinea pigs.

Related Posts

85 comments on “At least Chris Bishop sleeps in a well made bed ”

- Comments are now closed

- Comments are now closed

Recent Comments

- roblogic on

- joe90 on

- Ad to Muttonbird on

- alwyn to Bearded Git on

- Bearded Git to Ad on

- alwyn to Muttonbird on

- bwaghorn to Muttonbird on

- Bearded Git to Ad on

- Bearded Git to Muttonbird on

- Muttonbird on

- Psycho Milt to lprent on

- Psycho Milt to AB on

- thinker on

- Res Publica to Bearded Git on

- Muttonbird to alwyn on

- Ad on

- Ad to Bearded Git on

- Karolyn_IS to Karolyn_IS on

- AB to Visubversa on

- SPC to Karolyn_IS on

- Graeme to Bearded Git on

- Obtrectator to newsense on

- tWig on

- newsense on

- Karolyn_IS to weka on

- Psycho Milt to Visubversa on

- weka to Karolyn_IS on

- Karolyn_IS to Ad on

- Karolyn_IS to weka on

- alwyn to Muttonbird on

- weka to Visubversa on

- weka to Karolyn_IS on

- Visubversa on

- Karolyn_IS to weka on

- weka to Karolyn_IS on

- Bearded Git on

- Bearded Git to Res Publica on

- Karolyn_IS to tWig on

- Karolyn_IS to weka on

- Ad on

- Stephen D on

- Tony Veitch to SPC on

- Adrian on

- Psycho Milt on

- Res Publica on

- gsays on

- Tony Veitch on

- Tony Veitch on

- Muttonbird to alwyn on

- SPC on

Recent Posts

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Incognito

-

by lprent

-

by Mountain Tui

-

by mickysavage

-

by Incognito

-

by Mountain Tui

-

by advantage

-

by Guest post

-

by mickysavage

-

by lprent

-

by weka

-

by advantage

-

by Guest post

-

by Incognito

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Guest post

-

by Guest post

-

by advantage

-

by mickysavage

- Skeptical Science New Research for Week #16 2025

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...5 hours ago

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...5 hours ago - Whatever Happened to Cactus Kate?

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...5 hours ago

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...5 hours ago - Sovereign capability can benefit Australia—up to a point

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah6 hours ago

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah6 hours ago - David Seymour’s Charter School Rort

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...7 hours ago

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...7 hours ago - Flexibility and awareness will help India deal with Trump (again)

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan7 hours ago

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan7 hours ago - Inflation data confirms real terms minimum wage cut

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield8 hours ago

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield8 hours ago - Climate Change: Kicking the can down the road again

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant9 hours ago

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant9 hours ago - The Spirit for Australia: why Canberra should pursue the B-2 bomber

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen10 hours ago

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen10 hours ago - A bit more unpicking of RB spending and the Funding Agreement

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell11 hours ago

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell11 hours ago - A successful COP31 needs Pacific countries at the table

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson12 hours ago

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson12 hours ago - Brown unveils unfunded health plan for small NZ

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey13 hours ago

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey13 hours ago - Artificial Intelligence in the Workplace

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield14 hours ago

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield14 hours ago - NZ Must Undertake a Peacekeeping Role in Trump’s Wars

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...14 hours ago

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...14 hours ago - Donald Trump’s first three months: rude, raucous and rogue

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell15 hours ago

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell15 hours ago - Gordon Campbell On The Left’s Electability Crisis, And The Abundance Ecotopia

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor22 hours ago

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor22 hours ago - Taiwan: the sponge that soaks up Chinese power

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill1 day ago

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill1 day ago - Women in combat roles strengthen our defence force

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker1 day ago

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker1 day ago - China targets Canada’s election—and may be targeting Australia’s

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn1 day ago

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn1 day ago - Climate Adam: Climate Scientist Reacts to Elon Musk

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...1 day ago

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...1 day ago - Rattus Interneticus: Otago’s Internet Saga

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2211 day ago

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2211 day ago - Spin (and obfuscation)

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell1 day ago

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell1 day ago - Little’s pitch

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant1 day ago

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant1 day ago - Our Rough Beast.

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...1 day ago

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...1 day ago - What does India Want? What is New Zealand willing to give?

1 day ago

- President Trump is redefining America’s international role, and Australia has influence

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King2 days ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King2 days ago - Simeon Brown Gaslights Doctors

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī2 days ago

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī2 days ago - ACT’s “Tough on Crime” Facade Crumbles with Jago’s Appeal

2 days ago

- Judith Collins’ Hypocrisy: War Drums Over Welfare

Judith Collins is a seasoned master at political hypocrisy. As New Zealand’s Defence Minister, she's recently been banging the war drum, announcing a jaw-dropping $12 billion boost to the defence budget over the next four years, all while the coalition of chaos cries poor over housing, health, and education.Apparently, there’s ...2 days ago

Judith Collins is a seasoned master at political hypocrisy. As New Zealand’s Defence Minister, she's recently been banging the war drum, announcing a jaw-dropping $12 billion boost to the defence budget over the next four years, all while the coalition of chaos cries poor over housing, health, and education.Apparently, there’s ...2 days ago - Making the most of it

I’m on the London Overground watching what the phones people are holding are doing to their faces: The man-bun guy who could not be less impressed by what he's seeing but cannot stop reading; the woman who's impatient for a response; the one who’s frowning; the one who’s puzzled; the ...More Than A FeildingBy David Slack2 days ago

I’m on the London Overground watching what the phones people are holding are doing to their faces: The man-bun guy who could not be less impressed by what he's seeing but cannot stop reading; the woman who's impatient for a response; the one who’s frowning; the one who’s puzzled; the ...More Than A FeildingBy David Slack2 days ago - Maranga Ake

You don't have no prescriptionYou don't have to take no pillsYou don't have no prescriptionAnd baby don't have to take no pillsIf you come to see meDoctor Brown will cure your ills.Songwriters: Waymon Glasco.Dr Luxon. Image: David and Grok.First, they came for the Bottom FeedersAnd I did not speak outBecause ...Nick’s KōreroBy Nick Rockel2 days ago

You don't have no prescriptionYou don't have to take no pillsYou don't have no prescriptionAnd baby don't have to take no pillsIf you come to see meDoctor Brown will cure your ills.Songwriters: Waymon Glasco.Dr Luxon. Image: David and Grok.First, they came for the Bottom FeedersAnd I did not speak outBecause ...Nick’s KōreroBy Nick Rockel2 days ago - Bernard’s Dawn Chorus & Pick ‘n’ Mix for Wednesday, April 16

The Health Minister says the striking doctors already “well remunerated,” and are “walking away from” and “hurting” their patients. File photo: Lynn GrievesonLong stories short from our political economy on Wednesday, April 16:Simeon Brown has attacked1 doctors striking for more than a 1.5% pay rise as already “well remunerated,” even ...The KakaBy Bernard Hickey2 days ago

The Health Minister says the striking doctors already “well remunerated,” and are “walking away from” and “hurting” their patients. File photo: Lynn GrievesonLong stories short from our political economy on Wednesday, April 16:Simeon Brown has attacked1 doctors striking for more than a 1.5% pay rise as already “well remunerated,” even ...The KakaBy Bernard Hickey2 days ago - Strengthening Australia’s space cooperation with South Korea

The time is ripe for Australia and South Korea to strengthen cooperation in space, through embarking on joint projects and initiatives that offer practical outcomes for both countries. This is the finding of a new ...The StrategistBy Malcolm Davis2 days ago

The time is ripe for Australia and South Korea to strengthen cooperation in space, through embarking on joint projects and initiatives that offer practical outcomes for both countries. This is the finding of a new ...The StrategistBy Malcolm Davis2 days ago - They Can Only Talk About One Thing

Hi,When Trump raised tariffs against China to 145%, he destined many small businesses to annihilation. The Daily podcast captured the mass chaos by zooming in and talking to one person, Beth Benike, a small-business owner who will likely lose her home very soon.She pointed out that no, she wasn’t surprised ...David FarrierBy David Farrier2 days ago

Hi,When Trump raised tariffs against China to 145%, he destined many small businesses to annihilation. The Daily podcast captured the mass chaos by zooming in and talking to one person, Beth Benike, a small-business owner who will likely lose her home very soon.She pointed out that no, she wasn’t surprised ...David FarrierBy David Farrier2 days ago - National’s Inflation Shame: Kiwis Pay the Price

National’s handling of inflation and the cost-of-living crisis is an utter shambles and a gutless betrayal of every Kiwi scraping by. The Coalition of Chaos Ministers strut around preaching about how effective their policies are, but really all they're doing is perpetuating a cruel and sick joke of undelivered promises, ...2 days ago

National’s handling of inflation and the cost-of-living crisis is an utter shambles and a gutless betrayal of every Kiwi scraping by. The Coalition of Chaos Ministers strut around preaching about how effective their policies are, but really all they're doing is perpetuating a cruel and sick joke of undelivered promises, ...2 days ago - Winston’s Mate Rhys Williams Has Been Unmasked

Most people wouldn't have heard of a little worm like Rhys Williams, a so-called businessman and former NZ First member, who has recently been unmasked as the venomous troll behind a relentless online campaign targeting Green Party MP Benjamin Doyle.According to reports, Williams has been slinging mud at Doyle under ...2 days ago

Most people wouldn't have heard of a little worm like Rhys Williams, a so-called businessman and former NZ First member, who has recently been unmasked as the venomous troll behind a relentless online campaign targeting Green Party MP Benjamin Doyle.According to reports, Williams has been slinging mud at Doyle under ...2 days ago - Idiocy, Opportunity

Illustration credit: Jonathan McHugh (New Statesman)The other day, a subscriber said they were unsubscribing because they needed “some good news”.I empathised. Don’t we all.I skimmed a NZME article about the impacts of tariffs this morning with analysis from Kiwibank’s Jarrod Kerr. Kerr, their Chief Economist, suggested another recession is the ...Mountain TuiBy Mountain Tūī2 days ago

Illustration credit: Jonathan McHugh (New Statesman)The other day, a subscriber said they were unsubscribing because they needed “some good news”.I empathised. Don’t we all.I skimmed a NZME article about the impacts of tariffs this morning with analysis from Kiwibank’s Jarrod Kerr. Kerr, their Chief Economist, suggested another recession is the ...Mountain TuiBy Mountain Tūī2 days ago - US allies must band together in weapons development

Let’s assume, as prudence demands we assume, that the United States will not at any predictable time go back to being its old, reliable self. This means its allies must be prepared indefinitely to lean ...The StrategistBy Bill Sweetman2 days ago

Let’s assume, as prudence demands we assume, that the United States will not at any predictable time go back to being its old, reliable self. This means its allies must be prepared indefinitely to lean ...The StrategistBy Bill Sweetman2 days ago - I’ve been reading

Over the last three rather tumultuous US trade policy weeks, I’ve read these four books. I started with Irwin (whose book had sat on my pile for years, consulted from time to time but not read) in a week of lots of flights and hanging around airports/hotels, and then one ...Croaking CassandraBy Michael Reddell2 days ago

Over the last three rather tumultuous US trade policy weeks, I’ve read these four books. I started with Irwin (whose book had sat on my pile for years, consulted from time to time but not read) in a week of lots of flights and hanging around airports/hotels, and then one ...Croaking CassandraBy Michael Reddell2 days ago - This is not the time for increasing Indonesia’s defence spending

Indonesia could do without an increase in military spending that the Ministry of Defence is proposing. The country has more pressing issues, including public welfare and human rights. Moreover, the transparency and accountability to justify ...The StrategistBy Yokie Rahmad Isjchwansyah2 days ago

Indonesia could do without an increase in military spending that the Ministry of Defence is proposing. The country has more pressing issues, including public welfare and human rights. Moreover, the transparency and accountability to justify ...The StrategistBy Yokie Rahmad Isjchwansyah2 days ago - FSU Supports Chris Milne’s Right to Make Death Threats

2 days ago

- Winston is inciting terrorism

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant2 days ago

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant2 days ago - Winston is inciting terrorism

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant2 days ago

That's the conclusion of a report into security risks against Green MP Benjamin Doyle, in the wake of Winston Peters' waging a homophobic hate-campaign against them: GRC’s report said a “hostility network” of politicians, commentators, conspiracy theorists, alternative media outlets and those opposed to the rainbow community had produced ...No Right TurnBy Idiot/Savant2 days ago - Why has Hamish Campbell Gone Into Hiding?

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...2 days ago

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...2 days ago - Why has Hamish Campbell Gone Into Hiding?

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...2 days ago

National Party MP Hamish Campbell’s ties to the secretive Two By Twos "church" raises serious questions that are not being answered. This shadowy group, currently being investigated by the FBI for numerous cases of child abuse, hides behind a facade of faith while Campbell dodges scrutiny, claiming it’s a “private ...2 days ago - The Government is cutting, just as the economic recovery is stalling

The economy is not doing what it was supposed to when PM Christopher Luxon said in January it was ‘going for growth.’ Photo: Lynn Grieveson / The KākāLong stories short from our political economy on Tuesday, April 15:New Zealand’s economic recovery is stalling, according to business surveys, retail spending and ...The KakaBy Bernard Hickey2 days ago

The economy is not doing what it was supposed to when PM Christopher Luxon said in January it was ‘going for growth.’ Photo: Lynn Grieveson / The KākāLong stories short from our political economy on Tuesday, April 15:New Zealand’s economic recovery is stalling, according to business surveys, retail spending and ...The KakaBy Bernard Hickey2 days ago - For a safer Symonds Street

This is a guest post by Lewis Creed, managing editor of the University of Auckland student publication Craccum, which is currently running a campaign for a safer Symonds Street in the wake of a horrific recent crash. The post has two parts: 1) Craccum’s original call for safety (6 ...Greater AucklandBy Guest Post2 days ago

This is a guest post by Lewis Creed, managing editor of the University of Auckland student publication Craccum, which is currently running a campaign for a safer Symonds Street in the wake of a horrific recent crash. The post has two parts: 1) Craccum’s original call for safety (6 ...Greater AucklandBy Guest Post2 days ago - Tuesday 15 April

NZCTU President Richard Wagstaff has published an opinion piece which makes the case for a different approach to economic development, as proposed in the CTU’s Aotearoa Reimagined programme. The number of people studying to become teachers has jumped after several years of low enrolment. The coalition has directed Health New ...NZCTUBy Jack McDonald3 days ago

NZCTU President Richard Wagstaff has published an opinion piece which makes the case for a different approach to economic development, as proposed in the CTU’s Aotearoa Reimagined programme. The number of people studying to become teachers has jumped after several years of low enrolment. The coalition has directed Health New ...NZCTUBy Jack McDonald3 days ago - As China’s AI industry grows, Australia must support its own

The growth of China’s AI industry gives it great influence over emerging technologies. That creates security risks for countries using those technologies. So, Australia must foster its own domestic AI industry to protect its interests. ...The StrategistBy Hassan Gad3 days ago

The growth of China’s AI industry gives it great influence over emerging technologies. That creates security risks for countries using those technologies. So, Australia must foster its own domestic AI industry to protect its interests. ...The StrategistBy Hassan Gad3 days ago - Luxon’s Economic Mismanagement

Unfortunately we have another National Party government in power at the moment, and as a consequence, another economic dumpster fire taking hold. Inflation’s hurting Kiwis, and instead of providing relief, National is fiddling while wallets burn.Prime Minister Chris Luxon's response is a tired remix of tax cuts for the rich ...3 days ago

Unfortunately we have another National Party government in power at the moment, and as a consequence, another economic dumpster fire taking hold. Inflation’s hurting Kiwis, and instead of providing relief, National is fiddling while wallets burn.Prime Minister Chris Luxon's response is a tired remix of tax cuts for the rich ...3 days ago - Girls and Boys

Girls who are boys who like boys to be girlsWho do boys like they're girls, who do girls like they're boysAlways should be someone you really loveSongwriters: Damon Albarn / Graham Leslie Coxon / Alexander Rowntree David / Alexander James Steven.Last month, I wrote about the Birds and Bees being ...Nick’s KōreroBy Nick Rockel3 days ago

Girls who are boys who like boys to be girlsWho do boys like they're girls, who do girls like they're boysAlways should be someone you really loveSongwriters: Damon Albarn / Graham Leslie Coxon / Alexander Rowntree David / Alexander James Steven.Last month, I wrote about the Birds and Bees being ...Nick’s KōreroBy Nick Rockel3 days ago - Australia can learn from Britain on cyber governance

Australia needs to reevaluate its security priorities and establish a more dynamic regulatory framework for cybersecurity. To advance in this area, it can learn from Britain’s Cyber Security and Resilience Bill, which presents a compelling ...The StrategistBy Andrew Horton and George Hlaing3 days ago

Australia needs to reevaluate its security priorities and establish a more dynamic regulatory framework for cybersecurity. To advance in this area, it can learn from Britain’s Cyber Security and Resilience Bill, which presents a compelling ...The StrategistBy Andrew Horton and George Hlaing3 days ago - Gordon Campbell On Why The US Stands To Lose The Tariff Wars

Deputy PM Winston Peters likes nothing more than to portray himself as the only wise old head while everyone else is losing theirs. Yet this time, his “old master” routine isn’t working. What global trade is experiencing is more than the usual swings and roundabouts of market sentiment. President Donald ...Gordon CampbellBy ScoopEditor3 days ago

Deputy PM Winston Peters likes nothing more than to portray himself as the only wise old head while everyone else is losing theirs. Yet this time, his “old master” routine isn’t working. What global trade is experiencing is more than the usual swings and roundabouts of market sentiment. President Donald ...Gordon CampbellBy ScoopEditor3 days ago - Why is there no progress in Ukrainian war peace talks?

President Trump’s hopes of ending the war in Ukraine seemed more driven by ego than realistic analysis. Professor Vladimir Brovkin’s latest video above highlights the internal conflicts within the USA, Russia, Europe, and Ukraine, which are currently hindering peace talks and clarity. Brovkin pointed out major contradictions within ...Open ParachuteBy Ken3 days ago

President Trump’s hopes of ending the war in Ukraine seemed more driven by ego than realistic analysis. Professor Vladimir Brovkin’s latest video above highlights the internal conflicts within the USA, Russia, Europe, and Ukraine, which are currently hindering peace talks and clarity. Brovkin pointed out major contradictions within ...Open ParachuteBy Ken3 days ago - Ani O’Brien has Zero Credibility

In the cesspool that is often New Zealand’s online political discourse, few figures wield their influence as destructively as Ani O’Brien. Masquerading as a champion of free speech and women’s rights, O’Brien’s campaigns are a masterclass in bad faith, built on a foundation of lies, selective outrage, and a knack ...3 days ago

In the cesspool that is often New Zealand’s online political discourse, few figures wield their influence as destructively as Ani O’Brien. Masquerading as a champion of free speech and women’s rights, O’Brien’s campaigns are a masterclass in bad faith, built on a foundation of lies, selective outrage, and a knack ...3 days ago - Australian policy does need more Asia—more Southeast Asia

The international challenge confronting Australia today is unparalleled, at least since the 1940s. It requires what the late Brendan Sargeant, a defence analyst, called strategic imagination. We need more than shrewd economic manoeuvring and a ...The StrategistBy Anthony Milner3 days ago

The international challenge confronting Australia today is unparalleled, at least since the 1940s. It requires what the late Brendan Sargeant, a defence analyst, called strategic imagination. We need more than shrewd economic manoeuvring and a ...The StrategistBy Anthony Milner3 days ago - EGU2025 – Picking and chosing sessions to attend on site in Vienna

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 27 to May 2. This year, I'll join the event on site in Vienna for the full week and I've already picked several sessions I plan ...3 days ago

This year's General Assembly of the European Geosciences Union (EGU) will take place as a fully hybrid conference in both Vienna and online from April 27 to May 2. This year, I'll join the event on site in Vienna for the full week and I've already picked several sessions I plan ...3 days ago - Bookshelf: How China sees things

Here’s a book that looks not in at China but out from China. David Daokui Li’s China’s World View: Demystifying China to Prevent Global Conflict is a refreshing offering in that Li is very much ...The StrategistBy John West3 days ago

Here’s a book that looks not in at China but out from China. David Daokui Li’s China’s World View: Demystifying China to Prevent Global Conflict is a refreshing offering in that Li is very much ...The StrategistBy John West3 days ago - The Mirage of Chris Luxon’s Pre-Election Promises

The New Zealand National Party has long mastered the art of crafting messaging that resonates with a large number of desperate, often white middle-class, voters. From their 2023 campaign mantra of “getting our country back on track” to promises of economic revival, safer streets, and better education, their rhetoric paints ...3 days ago

The New Zealand National Party has long mastered the art of crafting messaging that resonates with a large number of desperate, often white middle-class, voters. From their 2023 campaign mantra of “getting our country back on track” to promises of economic revival, safer streets, and better education, their rhetoric paints ...3 days ago - To counter anti-democratic propaganda, step up funding for ABC International

A global contest of ideas is underway, and democracy as an ideal is at stake. Democracies must respond by lifting support for public service media with an international footprint. With the recent decision by the ...The StrategistBy Claire Gorman3 days ago

A global contest of ideas is underway, and democracy as an ideal is at stake. Democracies must respond by lifting support for public service media with an international footprint. With the recent decision by the ...The StrategistBy Claire Gorman3 days ago - What was the story re Orr’s resignation?

It is almost six weeks since the shock announcement early on the afternoon of Wednesday 5 March that the Governor of the Reserve Bank, Adrian Orr, was resigning effective 31 March, and that in fact he had already left and an acting Governor was already in place. Orr had been ...Croaking CassandraBy Michael Reddell3 days ago

It is almost six weeks since the shock announcement early on the afternoon of Wednesday 5 March that the Governor of the Reserve Bank, Adrian Orr, was resigning effective 31 March, and that in fact he had already left and an acting Governor was already in place. Orr had been ...Croaking CassandraBy Michael Reddell3 days ago - Monday 14 April

The PSA surveyed more than 900 of its members, with 55 percent of respondents saying AI is used at their place of work, despite most workers not being in trained in how to use the technology safely. Figures to be released on Thursday are expected to show inflation has risen ...NZCTUBy Jack McDonald4 days ago

The PSA surveyed more than 900 of its members, with 55 percent of respondents saying AI is used at their place of work, despite most workers not being in trained in how to use the technology safely. Figures to be released on Thursday are expected to show inflation has risen ...NZCTUBy Jack McDonald4 days ago - How to spot AI influence in Australia’s election campaign

Be on guard for AI-powered messaging and disinformation in the campaign for Australia’s 3 May election. And be aware that parties can use AI to sharpen their campaigning, zeroing in on issues that the technology ...The StrategistBy Niusha Shafiabady4 days ago

Be on guard for AI-powered messaging and disinformation in the campaign for Australia’s 3 May election. And be aware that parties can use AI to sharpen their campaigning, zeroing in on issues that the technology ...The StrategistBy Niusha Shafiabady4 days ago - David Seymour – Arsehole of the Week

Strap yourselves in, folks, it’s time for another round of Arsehole of the Week, and this week’s golden derrière trophy goes to—drumroll, please—David Seymour, the ACT Party’s resident genius who thought, “You know what we need? A shiny new Treaty Principles Bill to "fix" all that pesky Māori-Crown partnership nonsense ...4 days ago

Strap yourselves in, folks, it’s time for another round of Arsehole of the Week, and this week’s golden derrière trophy goes to—drumroll, please—David Seymour, the ACT Party’s resident genius who thought, “You know what we need? A shiny new Treaty Principles Bill to "fix" all that pesky Māori-Crown partnership nonsense ...4 days ago - Bernard’s Dawn Chorus and Pick ‘n’ Mix for Monday, April 14

Apple Store, Shanghai. Trump wants all iPhones to be made in the USM but experts say that is impossible. Photo: Getty ImagesLong stories shortist from our political economy on Monday, April 14:Donald Trump’s exemption on tariffs on phones and computers is temporary, and he wants all iPhones made in the ...The KakaBy Bernard Hickey4 days ago

Apple Store, Shanghai. Trump wants all iPhones to be made in the USM but experts say that is impossible. Photo: Getty ImagesLong stories shortist from our political economy on Monday, April 14:Donald Trump’s exemption on tariffs on phones and computers is temporary, and he wants all iPhones made in the ...The KakaBy Bernard Hickey4 days ago - Unmasking the National Party’s Fascism

Kia ora, readers. It’s time to pull back the curtain on some uncomfortable truths about New Zealand’s political landscape. The National Party, often cloaked in the guise of "sensible centrism," has, at times, veered into territory that smells suspiciously like fascism. Now, before you roll your eyes and mutter about hyperbole, ...4 days ago

Kia ora, readers. It’s time to pull back the curtain on some uncomfortable truths about New Zealand’s political landscape. The National Party, often cloaked in the guise of "sensible centrism," has, at times, veered into territory that smells suspiciously like fascism. Now, before you roll your eyes and mutter about hyperbole, ...4 days ago - Open Letter to Auckland Transport about Project K

This is a letter we will be sending to Auckland Transport to ask they return to the original consulted plans on the Karanga-a-Hape Station precinct integration project, after they released significant changes to designs last week. If you would like to be added as a signatory, please reach out to ...Greater AucklandBy Connor Sharp4 days ago

This is a letter we will be sending to Auckland Transport to ask they return to the original consulted plans on the Karanga-a-Hape Station precinct integration project, after they released significant changes to designs last week. If you would like to be added as a signatory, please reach out to ...Greater AucklandBy Connor Sharp4 days ago - The gas plan that’s sailing Australia into strategic peril

Australia’s east coast is facing a gas crisis, as the country exports most of the gas it produces. Although it’s a major producer, Australia faces a risk of domestic liquefied natural gas (LNG) supply shortfalls ...The StrategistBy Henry Campbell and Raelene Lockhorst4 days ago

Australia’s east coast is facing a gas crisis, as the country exports most of the gas it produces. Although it’s a major producer, Australia faces a risk of domestic liquefied natural gas (LNG) supply shortfalls ...The StrategistBy Henry Campbell and Raelene Lockhorst4 days ago - Amateur Hour!

Overnight, Donald J. Trump, America’s 47th President, and only the second President since 1893 to win non-consecutive terms, rolled back more of his “no exemptions, no negotiations” & “no big deal” tariffs.Smartphones, computers, and other electronics1 are now exempt from the 125% levies imposed on imports from China; they retain ...Mountain TuiBy Mountain Tūī4 days ago

Overnight, Donald J. Trump, America’s 47th President, and only the second President since 1893 to win non-consecutive terms, rolled back more of his “no exemptions, no negotiations” & “no big deal” tariffs.Smartphones, computers, and other electronics1 are now exempt from the 125% levies imposed on imports from China; they retain ...Mountain TuiBy Mountain Tūī4 days ago - 2025 SkS Weekly Climate Change & Global Warming News Roundup #15

A listing of 36 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 6, 2025 thru Sat, April 12, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...4 days ago

A listing of 36 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 6, 2025 thru Sat, April 12, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...4 days ago - World Domination

Just one year of loveIs better than a lifetime aloneOne sentimental moment in your armsIs like a shooting star right through my heartIt's always a rainy day without youI'm a prisoner of love inside youI'm falling apart all around you, yeahSongwriter: John Deacon.Morena folks, it feels like it’s been quite ...Nick’s KōreroBy Nick Rockel5 days ago

Just one year of loveIs better than a lifetime aloneOne sentimental moment in your armsIs like a shooting star right through my heartIt's always a rainy day without youI'm a prisoner of love inside youI'm falling apart all around you, yeahSongwriter: John Deacon.Morena folks, it feels like it’s been quite ...Nick’s KōreroBy Nick Rockel5 days ago - “I think I was, at that time, the only girl in Taranaki who ever wrote a line”

“It's a history of colonial ruin, not a history of colonial progress,” says Michele Leggott, of the Harris family.We’re talking about Groundwork: The Art and Writing of Emily Cumming Harris, in which she and Catherine Field-Dodgson recall a near-forgotten and fascinating life, the female speck in the history of texts.Emily’s ...More Than A FeildingBy David Slack5 days ago

“It's a history of colonial ruin, not a history of colonial progress,” says Michele Leggott, of the Harris family.We’re talking about Groundwork: The Art and Writing of Emily Cumming Harris, in which she and Catherine Field-Dodgson recall a near-forgotten and fascinating life, the female speck in the history of texts.Emily’s ...More Than A FeildingBy David Slack5 days ago - Fact brief – Is the sun responsible for global warming?

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is the sun responsible for global warming? Greenhouse gas emissions from human activities, not solar variability, is responsible for the global warming observed ...5 days ago

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is the sun responsible for global warming? Greenhouse gas emissions from human activities, not solar variability, is responsible for the global warming observed ...5 days ago - A Baptism in the Forest: Accepted

Hitherto, 2025 has not been great in terms of luck on the short story front (or on the personal front. Several acquaintances have sadly passed away in the last few days). But I can report one story acceptance today. In fact, it’s quite the impressive acceptance, being my second ‘professional ...A Phuulish FellowBy strda2215 days ago

Hitherto, 2025 has not been great in terms of luck on the short story front (or on the personal front. Several acquaintances have sadly passed away in the last few days). But I can report one story acceptance today. In fact, it’s quite the impressive acceptance, being my second ‘professional ...A Phuulish FellowBy strda2215 days ago - Bernard’s Saturday Soliloquy for the week to April 12

Six long stories short from our political economy in the week to Saturday, April 12:Donald Trump exploded a neutron bomb under 80 years of globalisation, but Nicola Willis said the Government would cut operational and capital spending even more to achieve a Budget surplus by 2027/28. That even tighter fiscal ...The KakaBy Bernard Hickey6 days ago

Six long stories short from our political economy in the week to Saturday, April 12:Donald Trump exploded a neutron bomb under 80 years of globalisation, but Nicola Willis said the Government would cut operational and capital spending even more to achieve a Budget surplus by 2027/28. That even tighter fiscal ...The KakaBy Bernard Hickey6 days ago - Budget 2025: delivering for whom?

On 22 May, the coalition government will release its budget for 2025, which it says will focus on "boosting economic growth, improving social outcomes, controlling government spending, and investing in long-term infrastructure.” But who, really, is this budget designed to serve? What values and visions for Aotearoa New Zealand lie ...6 days ago

On 22 May, the coalition government will release its budget for 2025, which it says will focus on "boosting economic growth, improving social outcomes, controlling government spending, and investing in long-term infrastructure.” But who, really, is this budget designed to serve? What values and visions for Aotearoa New Zealand lie ...6 days ago

Related Posts

- Release: Boot camps blog post fails to provide clarity

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...9 hours ago

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...9 hours ago - Release: Inflation rises and families feel the squeeze

10 hours ago

- Release: Govt doesn’t know how to fund new hospitals

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 day ago

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 day ago - Release: $10 million for only 215 students in charter schools

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 day ago

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 day ago - Release: Food prices further stretching the family budget

Families already stretched by rising costs will struggle with the news food prices are going up again. ...2 days ago

Families already stretched by rising costs will struggle with the news food prices are going up again. ...2 days ago - Release: Mental health staff and patients at risk without plan

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...3 days ago

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...3 days ago - Release: Driver licensing proposal doesn’t put safety first

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...3 days ago

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...3 days ago - Release: Students struggling as Govt sits on hands

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...6 days ago

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...6 days ago - Release: More must be done to stop children going hungry

More children are going hungry and statistics showing children in material hardship continue to get worse. ...6 days ago

More children are going hungry and statistics showing children in material hardship continue to get worse. ...6 days ago - Greens continue to call for Pacific Visa Waiver

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...6 days ago

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...6 days ago - More children going hungry under Coalition govt

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...7 days ago

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...7 days ago - Release: Longer wait for treatment under National

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...7 days ago

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...7 days ago - Ka mate te Pire- Ka ora te mana o Te Tiriti o Waitangi me te iwi Māori

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...1 week ago

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...1 week ago - Chris Hipkins speech: Treaty Principles Bill second reading

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...1 week ago

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...1 week ago - Release: End to the Treaty Principles Bill, but challenges remain ahead for Aotearoa

1 week ago

- Ka mate te Pire, ka ora Te Tiriti o Waitangi – Treaty Principles Bill dead, Te Tiriti o Waitangi m...

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...1 week ago

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...1 week ago - Member’s Bill an opportunity for climate action

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...1 week ago

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...1 week ago - Release: Bill to make trading laws fairer passes first hurdle

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...1 week ago

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...1 week ago - Release: Reserve Bank acts while Govt shrugs

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...1 week ago

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...1 week ago - Release: Property Law Amendment Bill pulled from ballot

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...1 week ago

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...1 week ago - Release: More children at risk of losing family connections

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...1 week ago

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...1 week ago - Release: David Parker made a difference – Hipkins

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...1 week ago

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...1 week ago - Release: David Parker to step down from Parliament

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...1 week ago

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...1 week ago - Release: Flaws in Govt’s climate strategy will cost us money

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...1 week ago

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...1 week ago - Green Party differing view on the Treaty Principles Bill

1 week ago

- Te Pāti Māori Urges Governor-General to Block Repeal of 7AA

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...2 weeks ago

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...2 weeks ago - Release: Abortion care quietly shelved amid staff shortage

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...2 weeks ago

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...2 weeks ago - Release: Govt guts Kāinga Ora, third of workforce under axe

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...2 weeks ago

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...2 weeks ago - Release: Thousands of submissions excluded from Treaty Principles Bill report

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...2 weeks ago

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...2 weeks ago - Release: Uncertainty remains over the impact of tariffs

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...2 weeks ago

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...2 weeks ago - Release: Worst February for building consents in over a decade

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 weeks ago

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 weeks ago - Release: Labour supports Willie Apiata’s selfless act

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 weeks ago

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 weeks ago - Te Pāti Māori MPs Denied Fundamental Rights in Privileges Committee Hearing

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...2 weeks ago

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...2 weeks ago - Release: Govt health and safety changes put workers at risk

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...2 weeks ago

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...2 weeks ago - Release: Kiwis worse off this April thanks to Govt choices

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...2 weeks ago

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...2 weeks ago - Release: Three more years for Interislander ferries

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...2 weeks ago

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...2 weeks ago - Release: Myanmar junta must stop the airstrikes

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...3 weeks ago

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...3 weeks ago - Release: National failing to deliver on supermarkets

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...3 weeks ago

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...3 weeks ago

Related Posts

- Grattan on Friday: Peter Dutton’s tax indexation ‘aspiration’ has merit – so why didn’t we...

Source: The Conversation (Au and NZ) – By Michelle Grattan, Professorial Fellow, University of Canberra Peter Dutton, now seriously on the back foot, has made an extraordinarily big “aspirational” commitment at the back end of this campaign. He says he wants to see a move to indexing personal income ...Evening ReportBy The Conversation1 hour ago

Source: The Conversation (Au and NZ) – By Michelle Grattan, Professorial Fellow, University of Canberra Peter Dutton, now seriously on the back foot, has made an extraordinarily big “aspirational” commitment at the back end of this campaign. He says he wants to see a move to indexing personal income ...Evening ReportBy The Conversation1 hour ago - Keith Rankin Essay – Barbecued Hamburgers and Churchill’s Bestie

Essay by Keith Rankin. Operation Gomorrah may have been the most cynical event of World War Two (WW2). Not only did the name fully convey the intent of the war crimes about to be committed, it, also represented the single biggest 24-hour murder toll for the European war that I ...Evening ReportBy Keith Rankin2 hours ago

Essay by Keith Rankin. Operation Gomorrah may have been the most cynical event of World War Two (WW2). Not only did the name fully convey the intent of the war crimes about to be committed, it, also represented the single biggest 24-hour murder toll for the European war that I ...Evening ReportBy Keith Rankin2 hours ago - Public toilets could be the jewels in our cities’ crowns – if only governments would listen

Source: The Conversation (Au and NZ) – By Christian Tietz, Senior Lecturer in Industrial Design, UNSW Sydney A New South Wales Senate inquiry into public toilets is underway, looking into the provision, design and maintenance of public toilets across the state. Whenever I mention this inquiry, however, everyone nervously ...Evening ReportBy The Conversation4 hours ago

Source: The Conversation (Au and NZ) – By Christian Tietz, Senior Lecturer in Industrial Design, UNSW Sydney A New South Wales Senate inquiry into public toilets is underway, looking into the provision, design and maintenance of public toilets across the state. Whenever I mention this inquiry, however, everyone nervously ...Evening ReportBy The Conversation4 hours ago - Bad news – why Australia is losing a generation of journalists

Shrinking budgets and job insecurity means there are fewer opportunities for young journalists, and that’s bad news, especially in regional Australia, reports 360info ANALYSIS: By Jee Young Lee of the University of Canberra Australia risks losing a generation of young journalists, particularly in the regions where they face the closure ...Evening ReportBy Asia Pacific Report5 hours ago

Shrinking budgets and job insecurity means there are fewer opportunities for young journalists, and that’s bad news, especially in regional Australia, reports 360info ANALYSIS: By Jee Young Lee of the University of Canberra Australia risks losing a generation of young journalists, particularly in the regions where they face the closure ...Evening ReportBy Asia Pacific Report5 hours ago - Why do scientists want to spend billions on a 70-year project in an enormous tunnel under the Swiss ...

Source: The Conversation (Au and NZ) – By Tessa Charles, Accelerator Physicist, Monash University An artist’s impression of the tunnel of the proposed Future Circular Collider. CERN The Large Hadron Collider has been responsible for astounding advances in physics: the discovery of the elusive, long-sought Higgs boson as well as ...Evening ReportBy The Conversation5 hours ago

Source: The Conversation (Au and NZ) – By Tessa Charles, Accelerator Physicist, Monash University An artist’s impression of the tunnel of the proposed Future Circular Collider. CERN The Large Hadron Collider has been responsible for astounding advances in physics: the discovery of the elusive, long-sought Higgs boson as well as ...Evening ReportBy The Conversation5 hours ago - Could you accidentally sign a contract by texting an emoji? Here’s what the law says

Source: The Conversation (Au and NZ) – By Jennifer McKay, Professor in Business Law, University of South Australia Parkova/Shutterstock Could someone take you to court over an agreement you made – or at least appeared to make – by sending a “

Source: The Conversation (Au and NZ) – By Jennifer McKay, Professor in Business Law, University of South Australia Parkova/Shutterstock Could someone take you to court over an agreement you made – or at least appeared to make – by sending a “”? Emojis can have more legal weight ...

Evening ReportBy The Conversation5 hours ago - Why healthy eating may be the best way to reduce food waste

Source: The Conversation (Au and NZ) – By Trang Nguyen, Postdoctoral Research Fellow, Centre for Global Food and Resources, University of Adelaide Stokkete, Shutterstock Australians waste around 7.68 million tonnes of food a year. This costs the economy an estimated A$36.6 billion and households up to $2,500 annually. ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Trang Nguyen, Postdoctoral Research Fellow, Centre for Global Food and Resources, University of Adelaide Stokkete, Shutterstock Australians waste around 7.68 million tonnes of food a year. This costs the economy an estimated A$36.6 billion and households up to $2,500 annually. ...Evening ReportBy The Conversation6 hours ago - Government Takes Fight Against Poverty To People In Poverty

Pushing people off income support doesn’t make the job market fairer or more accessible. It just assumes success is possible while unemployment rises and support systems become harder to navigate. ...6 hours ago

Pushing people off income support doesn’t make the job market fairer or more accessible. It just assumes success is possible while unemployment rises and support systems become harder to navigate. ...6 hours ago - The Boy in the Water update: Coroner to release findings

A year since the inquest into the death of Gore three-year-old Lachlan Jones began and the Coroner has completed his provisional findings. Interested parties have been provided with a copy of Coroner Ho’s provisional findings and have until May 16 to respond.The Coroner has indicated the final decision will be delivered on June 3 in Invercargill, citing high ...NewsroomBy Bonnie Sumner6 hours ago

A year since the inquest into the death of Gore three-year-old Lachlan Jones began and the Coroner has completed his provisional findings. Interested parties have been provided with a copy of Coroner Ho’s provisional findings and have until May 16 to respond.The Coroner has indicated the final decision will be delivered on June 3 in Invercargill, citing high ...NewsroomBy Bonnie Sumner6 hours ago - Why can’t I keep still after intense exercise?

Source: The Conversation (Au and NZ) – By Ken Nosaka, Professor of Exercise and Sports Science, Edith Cowan University Drazen Zigic/Shutterstock Do you ever feel like you can’t stop moving after you’ve pushed yourself exercising? Maybe you find yourself walking around in circles when you come off the pitch, ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Ken Nosaka, Professor of Exercise and Sports Science, Edith Cowan University Drazen Zigic/Shutterstock Do you ever feel like you can’t stop moving after you’ve pushed yourself exercising? Maybe you find yourself walking around in circles when you come off the pitch, ...Evening ReportBy The Conversation6 hours ago - ‘We get bucketloads of homework’: young people speak about what it’s like to start high school