What we were doing wasn’t working.

What we were doing wasn’t working.

Written By:

KJT - Date published:

6:32 am, April 15th, 2020 - 112 comments

Categories: capitalism, Economy, Environment, Financial markets, Free Trade, Keynes, monetary policy, overseas investment, Privatisation -

Tags:

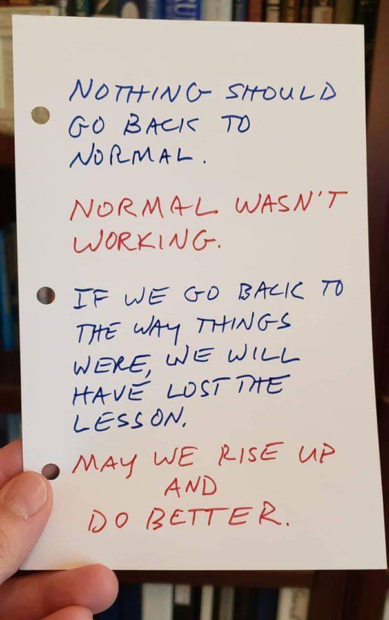

After the lockdown, it is tempting to try and go back to what we had before. To the familiar and comfortable, especially for us that were comfortable. Forgetting that for so many, things were anything but, comfortable.

That won’t be happening. “Before” no longer exists.

Coronavirus has shown the fragility, lack of resilience and failings in our current systems.

Exponential and Continual growth in the use of resources is not possible. The earth, it’s resources and the energy we can use, have hard limits.. Society and the economy has to be structured to allow a steady state economy, where resource use is within sustainable limits.

Our present monetary and economic system relies on exponential growth, to work.

Other ways are possible. https://en.wikipedia.org/wiki/Doughnut_(economic_model)

Having a tangible product such as gold, power or boulders, as a basis for a currency is not necessary to gain a steady state economy. All of these .are just a means, of ensuring faith and confidence in the value of a countries money.

The real basis of money is the amount of goods and services you can buy with it. If there is more money than the goods and services available you will have inflation, eventually, whatever the basis of monetary value. And vis-versa of course with deflation. Borrowing is a charge on goods and services (work) to be done in future.

Those of us saving for retirement, with monetary investments such as Kiwi-saver should consider, unless we invest in future productivity and efficiency of production, future workers and efficiency in energy and resource use, we will simply cause inflation when we spend those savings back into NZ. That is, if our savings haven’t disappeared into a US market failure.

It will be the big investors, insider traders, who will be left standing when the musical chairs stop. Not us!

Many, looking at their shrinking Kiwi saver balance now, will be questioning the wisdom of privatising super.

Some commentators have mentioned the idea of a money hockey stick.

The growth of debt interest owed is exponential and now far exceeds the ability of any possible future production of goods and services to service the debts.

US debt, and most countries, now is far in excess of any possibility of repayment with any estimation of the future earning power. (China has been investing as much of their US dollars in tangible assets as possible before the inevitable inflation makes them worthless). So much money has been paid, into inflating financial instruments, and share buybacks, that have no relationship whatsoever to the productive economy.

The finance industry is extracting a greater and greater share of the real economy, 90% of the price of all goods is now owed to financial firms. A Ponzi scheme.

A reasonable level of inflation under our present system is mostly beneficial. The owners of large amounts of financial capital would have us believe that it is always bad because it erodes their wealth. The same people do not seem to have a problem, with excessive inflation in the price of necessities, and their own return on capital.

In fact inflation benefits young working age borrowers, provided wages keep pace. It is a natural regulating mechanism against owners of capital taking too large a share, and the expansion of the money supply, inherent in money as a commodity.

For us to exist without exponential growth in the use of resources we have to stop exponential growth as a requirement for a functioning financial system.

This means money must become a means of exchange only.

We must remove the commodity value of money. No interest, no financial derivatives, and no charges for use of money.

Remove the means of using money to make money. Accumulating more wealth can then only happen if you work, or start something which has value in the future. A productive business, education, health, (Future labour force) sustainable land use, energy or other resources. Not through owning money.

This is a big step and very hard to do politically and unilaterally.

The protests from banking interests, and those who have managed to accumulate most of our wealth, will make the last 30 years of fight back, from the financial burglars, seem like a playfight.

We can take some steps, towards a steady state more sustainable economy, on our own though….

Expanding Kiwibank, to undercut private banks and start to take back control of our money supply from private banking, is a logical first step. Reducing the capital haemorrhage.

Support Government that has not been bought and paid for by international corporate interests. From one that is only interested in extracting as much wealth as possible from us, before it is all gone, to one that has a vision for the future.

A financial transactions and/or capital flows tax, to discourage money speculation and offshore currency speculation.

The predatory Capital investment, mostly from offshore, that has loaded our companies with so much excessive debt, to make short term profits, that they cannot sustain four weeks of lost earnings.

Capital gains taxes . Can be rebated for the family home to a certain value, and for local productive investment. Make investing in NZ’s more attractive than land speculation, overseas securities or local finance scams.. Prices of speculative investments will probably drop, some inevitably with the present economic contraction, leaving some people with negative equity. Banks as one of the contributors who profited from the situation, should be made to bear the change in equity along with other investors.

A genuine emissions tax, which can be made economically neutral by spending on energy and resource efficiency in New Zealand, or by giving it back as a general tax rebate.

Change the RBA away from the current single focus on inflation, allowing our dollar to drop to a natural level against overseas currencies, helping both exporters, job creation and manufacturer’s within NZ. (Fighting inflation with interest rates is like fighting a fire with petrol. Works briefly and then there is an explosion.).

Refuse to enter trade agreements that constrain what NZ can do on its own.

An expanding population also requires growth. Increasing the standard of education of women and free contraception are both proven, ethical and non-coercive answers to slow increasing population.

Increasing New Zealands population, 20% in 16 years, by immigration, or increasing birth rates, to give an illusion of economic growth, is obviously not an answer.

Government can spend money into the economy for sustainable energy and efficient resource use. (Invest in the future of New Zealand) There is no reason why we cannot borrow against ourselves, as an investment for our kids future, instead of paying interest to a private bank. Such spending is no more inflationary than borrowing from an overseas bank.

Increasing equality, will make such solutions more politically acceptable, as there will be less pain to the majority in the transition..

There will be plenty of spare capacity, in our economy, for some time to come.

Lastly. Look at “just transitions” to a more sustainable future, so workers, including those who do the unpaid work in our society, are not loaded with all the costs of changes. https://www.mbie.govt.nz/business-and-employment/economic-development/just-transition/ while others, who haven’t contributed, run away with the profit.

Related Posts

112 comments on “What we were doing wasn’t working. ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Bearded Git to Tiger Mountain on

- Res Publica to mikesh on

- mikesh to Belladonna on

- francesca to Belladonna on

- DS on

- Gareth Wilson to mikesh on

- Incognito to Phillip ure on

- Phillip ure to David on

- SPC on

- Phillip ure on

- SPC on

- Georgecom on

- Nic the NZer to Bill Drees on

- mikesh to Res Publica on

- mikesh to Belladonna on

- weka on

- weka to Bill Drees on

- David to Phillip ure on

- Dennis Frank on

- SPC on

- Belladonna to mikesh on

- mikesh to Res Publica on

- mikesh to Belladonna on

- Drowsy M. Kram to Res Publica on

- mikesh to Belladonna on

- Visubversa on

- Hunter Thompson II to Ad on

- Res Publica to Drowsy M. Kram on

- Stephen D to Belladonna on

- Bill Drees to weka on

- Phillip ure to David on

- weka to Bill Drees on

- Bill Drees to weka on

- tWig on

- Drowsy M. Kram to Res Publica on

- Tiger Mountain to Drowsy M. Kram on

- Belladonna to Res Publica on

- Res Publica to aj on

- Belladonna to Dennis Frank on

- Res Publica to Stephen D on

- Belladonna to mikesh on

- Drowsy M. Kram to gsays on

- Belladonna to mikesh on

- Belladonna to mikesh on

- weka to Bill Drees on

- Belladonna to mikesh on

- francesca on

- Stephen D to Res Publica on

- Res Publica to mikesh on

- Res Publica to mikesh on

- Phillip ure to tc on

- Res Publica to SPC on

- Dennis Frank to Belladonna on

- Nigel Haworth to lprent on

- mikesh to Belladonna on

- gsays to Bill Drees on

- mikesh to Belladonna on

- mikesh to Belladonna on

- mikesh to Bill Drees on

- Bill Drees on

Recent Posts

-

by mickysavage

-

by Guest post

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by advantage

-

by Incognito

-

by mickysavage

-

by weka

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by advantage

-

by Guest post

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Incognito

-

by mickysavage

- Australia surveys volatile and unpredictable geoeconomics

The international economics of Australia’s budget are pervaded by a Voldemort-like figure. The He-Who-Must-Not-Be-Named is Donald Trump, firing up trade wars, churning global finance and smashing the rules-based order. The closest the budget papers come ...The StrategistBy Graeme Dobell10 hours ago

The international economics of Australia’s budget are pervaded by a Voldemort-like figure. The He-Who-Must-Not-Be-Named is Donald Trump, firing up trade wars, churning global finance and smashing the rules-based order. The closest the budget papers come ...The StrategistBy Graeme Dobell10 hours ago - The five-domains update

Sea state Australian assembly of the first Multi Ammunition Softkill System (MASS) shipsets for the Royal Australian Navy began this month at Rheinmetall’s Military Vehicle Centre of Excellence in Redbank, Queensland. The ship protection system, ...The StrategistBy Linus Cohen, Astrid Young and Alice Wai11 hours ago

Sea state Australian assembly of the first Multi Ammunition Softkill System (MASS) shipsets for the Royal Australian Navy began this month at Rheinmetall’s Military Vehicle Centre of Excellence in Redbank, Queensland. The ship protection system, ...The StrategistBy Linus Cohen, Astrid Young and Alice Wai11 hours ago - The five-domains update

Sea state Australian assembly of the first Multi Ammunition Softkill System (MASS) shipsets for the Royal Australian Navy began this month at Rheinmetall’s Military Vehicle Centre of Excellence in Redbank, Queensland. The ship protection system, ...The StrategistBy Linus Cohen, Astrid Young and Alice Wai11 hours ago

Sea state Australian assembly of the first Multi Ammunition Softkill System (MASS) shipsets for the Royal Australian Navy began this month at Rheinmetall’s Military Vehicle Centre of Excellence in Redbank, Queensland. The ship protection system, ...The StrategistBy Linus Cohen, Astrid Young and Alice Wai11 hours ago - Signalling Deliberate Reckless Disregard.

Some thoughts on the Signal Houthi Principal’s Committee chat group conversation reported by Jeff Goldberg at The Atlantic. It is obviously a major security breach. But there are several dimensions to it worth examining. 1) Signal is an unsecured open source platform that although encrypted can easily be hacked by ...KiwipoliticoBy Pablo12 hours ago

Some thoughts on the Signal Houthi Principal’s Committee chat group conversation reported by Jeff Goldberg at The Atlantic. It is obviously a major security breach. But there are several dimensions to it worth examining. 1) Signal is an unsecured open source platform that although encrypted can easily be hacked by ...KiwipoliticoBy Pablo12 hours ago - Economic security and geostrategic competition: fostering resilience and innovation

Australia and other democracies have once again turned to China to solve their economic problems, while the reliability of the United States as an alliance partner is, erroneously, being called into question. We risk forgetting ...The StrategistBy James Corera16 hours ago

Australia and other democracies have once again turned to China to solve their economic problems, while the reliability of the United States as an alliance partner is, erroneously, being called into question. We risk forgetting ...The StrategistBy James Corera16 hours ago - Wednesday 26 March

Machines will take over more jobs at Immigration New Zealand under a multi-million-dollar upgrade that will mean decisions to approve visas will be automated – decisions to reject applications will continue to be taken by staff. Health New Zealand’s commitment to boosting specialist palliative care for dying children is under ...NZCTUBy Jack McDonald18 hours ago

Machines will take over more jobs at Immigration New Zealand under a multi-million-dollar upgrade that will mean decisions to approve visas will be automated – decisions to reject applications will continue to be taken by staff. Health New Zealand’s commitment to boosting specialist palliative care for dying children is under ...NZCTUBy Jack McDonald18 hours ago - She Works Hard For The Money

She works hard for the moneySo hard for it, honeyShe works hard for the moneySo you better treat her rightSongwriters: Michael Omartian / Donna A. SummerMorena, I’m pleased to bring you a guest newsletter today by long-time unionist and community activist Lyndy McIntyre. Lyndy has been active in the Living ...Nick’s KōreroBy Nick Rockel18 hours ago

She works hard for the moneySo hard for it, honeyShe works hard for the moneySo you better treat her rightSongwriters: Michael Omartian / Donna A. SummerMorena, I’m pleased to bring you a guest newsletter today by long-time unionist and community activist Lyndy McIntyre. Lyndy has been active in the Living ...Nick’s KōreroBy Nick Rockel18 hours ago - The dangerous collapse of US strategic sealift capacity

The US Transportation Command’s Military Sealift Command (MSC), the subordinate organisation responsible for strategic sealift, is unprepared for the high intensity fighting of a war over Taiwan. In the event of such a war, combat ...The StrategistBy Andrew Rolander19 hours ago

The US Transportation Command’s Military Sealift Command (MSC), the subordinate organisation responsible for strategic sealift, is unprepared for the high intensity fighting of a war over Taiwan. In the event of such a war, combat ...The StrategistBy Andrew Rolander19 hours ago - Stadium Unfeasibility

Tomorrow Auckland’s Councillors will decide on the next steps in the city’s ongoing stadium debate, and it appears one option is technically feasible but isn’t financially feasible while the other one might be financially feasible but not be technically feasible. As a quick reminder, the mMayor started this process as ...Greater AucklandBy Matt L19 hours ago

Tomorrow Auckland’s Councillors will decide on the next steps in the city’s ongoing stadium debate, and it appears one option is technically feasible but isn’t financially feasible while the other one might be financially feasible but not be technically feasible. As a quick reminder, the mMayor started this process as ...Greater AucklandBy Matt L19 hours ago - Bernard’s Picks ‘n’ Mixes on Wednesday, March 26

In short in our political economy around housing, climate and poverty on March 26:Three Kāinga Ora plots zoned for 17 homes and 900m from Ellerslie rail station are being offered to land-bankers and luxury home builders by agent Rawdon Christie.Chris Bishop’s new RMA bills don’t include treaty principles, even though ...The KakaBy Bernard Hickey20 hours ago

In short in our political economy around housing, climate and poverty on March 26:Three Kāinga Ora plots zoned for 17 homes and 900m from Ellerslie rail station are being offered to land-bankers and luxury home builders by agent Rawdon Christie.Chris Bishop’s new RMA bills don’t include treaty principles, even though ...The KakaBy Bernard Hickey20 hours ago - James (Jim) Grenon & Sinead Boucher’s Worlds Affect Us All

Stuff’s Sinead Boucher and NZME Takeover Leader James (Jim) GrenoonStuff Promotes Brooke Van VeldenYesterday, I came across an incredulous article by Stuff’s Kelly Dennett.It was a piece basically promoting David Seymour’s confidante and political ally, ACT’s #2, Brooke Van Velden. I admit I read the whole piece, incredulous at its ...Mountain TuiBy Mountain Tūī21 hours ago

Stuff’s Sinead Boucher and NZME Takeover Leader James (Jim) GrenoonStuff Promotes Brooke Van VeldenYesterday, I came across an incredulous article by Stuff’s Kelly Dennett.It was a piece basically promoting David Seymour’s confidante and political ally, ACT’s #2, Brooke Van Velden. I admit I read the whole piece, incredulous at its ...Mountain TuiBy Mountain Tūī21 hours ago - Gordon Campbell On The Americanising Of NZ’s Public Health System

One of the odd aspects of the government’s plan to Americanise the public health system – i.e by making healthcare access more reliant on user pay charges and private health insurance – is that it is happening in plain sight. Earlier this year, the official briefing papers to incoming Heath ...WerewolfBy ScoopEditor1 day ago

One of the odd aspects of the government’s plan to Americanise the public health system – i.e by making healthcare access more reliant on user pay charges and private health insurance – is that it is happening in plain sight. Earlier this year, the official briefing papers to incoming Heath ...WerewolfBy ScoopEditor1 day ago - Defence budget doesn’t match the threat Australia faces

When Australian Treasurer Jim Chalmers stood at the dispatch box this evening to announce the 2025–26 Budget, he confirmed our worst fears about the government’s commitment to resourcing the Defence budget commensurate with the dangers ...The StrategistBy Marc Ablong and Marcus Schultz1 day ago

When Australian Treasurer Jim Chalmers stood at the dispatch box this evening to announce the 2025–26 Budget, he confirmed our worst fears about the government’s commitment to resourcing the Defence budget commensurate with the dangers ...The StrategistBy Marc Ablong and Marcus Schultz1 day ago - It’s time for the ADF to train in Asia-Pacific languages

The proposed negotiation of an Australia–Papua New Guinea defence treaty will falter unless the Australian Defence Force embraces cultural intelligence and starts being more strategic with teaching languages—starting with Tok Pisin, the most widely spoken language in ...The StrategistBy Samuel White1 day ago

The proposed negotiation of an Australia–Papua New Guinea defence treaty will falter unless the Australian Defence Force embraces cultural intelligence and starts being more strategic with teaching languages—starting with Tok Pisin, the most widely spoken language in ...The StrategistBy Samuel White1 day ago - Here is the news at 4.30

Bishop ignores pawnPoor old Tama Potaka says he didn't know the new RMA legislation would be tossing out the Treaty clause.However, RMA Minister Bishop says it's all good and no worries because the new RMA will still recognise Māori rights; it's just that the government prefers specific role descriptions over ...More Than A FeildingBy David Slack1 day ago

Bishop ignores pawnPoor old Tama Potaka says he didn't know the new RMA legislation would be tossing out the Treaty clause.However, RMA Minister Bishop says it's all good and no worries because the new RMA will still recognise Māori rights; it's just that the government prefers specific role descriptions over ...More Than A FeildingBy David Slack1 day ago - China’s shadow fleet threatens Indo-Pacific communications

China is using increasingly sophisticated grey-zone tactics against subsea cables in the waters around Taiwan, using a shadow-fleet playbook that could be expanded across the Indo-Pacific. On 25 February, Taiwan’s coast guard detained the Hong Tai ...The StrategistBy Mercedes Page1 day ago

China is using increasingly sophisticated grey-zone tactics against subsea cables in the waters around Taiwan, using a shadow-fleet playbook that could be expanded across the Indo-Pacific. On 25 February, Taiwan’s coast guard detained the Hong Tai ...The StrategistBy Mercedes Page1 day ago - Improving OIA enforcement

Yesterday The Post had a long exit interview with outgoing Ombudsman Peter Boshier, in which he complains about delinquent agencies which "haven't changed and haven't taken our moral authority on board". He talks about the limits of the Ombudsman's power of persuasion - its only power - and the need ...No Right TurnBy Idiot/Savant2 days ago

Yesterday The Post had a long exit interview with outgoing Ombudsman Peter Boshier, in which he complains about delinquent agencies which "haven't changed and haven't taken our moral authority on board". He talks about the limits of the Ombudsman's power of persuasion - its only power - and the need ...No Right TurnBy Idiot/Savant2 days ago - A Fist, an American Flag, and Fire

Hi,Two stories have been playing over and over in my mind today, and I wanted to send you this Webworm as an excuse to get your thoughts in the comments.Because I adore the community here, and I want your sanity to weigh in.A safe space to chat, pull our hair ...David FarrierBy David Farrier2 days ago

Hi,Two stories have been playing over and over in my mind today, and I wanted to send you this Webworm as an excuse to get your thoughts in the comments.Because I adore the community here, and I want your sanity to weigh in.A safe space to chat, pull our hair ...David FarrierBy David Farrier2 days ago - Tuesday 25 March

A new employment survey shows that labour market pessimism has deepened as workers worry about holding to their job, the difficulty in finding jobs, and slowing wage growth. Nurses working in primary care will get an 8 percent pay increase this year, but it still leaves them lagging behind their ...NZCTUBy Jack McDonald2 days ago

A new employment survey shows that labour market pessimism has deepened as workers worry about holding to their job, the difficulty in finding jobs, and slowing wage growth. Nurses working in primary care will get an 8 percent pay increase this year, but it still leaves them lagging behind their ...NZCTUBy Jack McDonald2 days ago - Big Gun

Big gunBig gun number oneBig gunBig gun kick the hell out of youSongwriters: Ascencio / Marrow.On Sunday, I wrote about the Prime Minister’s interview in India with Maiki Sherman and certainly didn’t think I’d be writing about another of his interviews two days later.I’d been thinking of writing about something ...Nick’s KōreroBy Nick Rockel2 days ago

Big gunBig gun number oneBig gunBig gun kick the hell out of youSongwriters: Ascencio / Marrow.On Sunday, I wrote about the Prime Minister’s interview in India with Maiki Sherman and certainly didn’t think I’d be writing about another of his interviews two days later.I’d been thinking of writing about something ...Nick’s KōreroBy Nick Rockel2 days ago - Economic security and geostrategic competition: tariffs don’t equal coercion

The Trump administration’s decision to impose tariffs on Australian aluminium and steel has surprised the country. This has caused some to question the logic of the Australia-United States alliance and risks legitimising China’s economic coercion. ...The StrategistBy James Corera2 days ago

The Trump administration’s decision to impose tariffs on Australian aluminium and steel has surprised the country. This has caused some to question the logic of the Australia-United States alliance and risks legitimising China’s economic coercion. ...The StrategistBy James Corera2 days ago - NZ Government, an Atlas Network puppet, intent on ruining public healthcare

OPINION & ANALYSIS:At the heart of everything we see in this government is simplicity. Things are simpler than they appear. Mountain Tui is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Behind all the public relations, marketing spin, corporate overlay e.g. ...Mountain TuiBy Mountain Tūī2 days ago

OPINION & ANALYSIS:At the heart of everything we see in this government is simplicity. Things are simpler than they appear. Mountain Tui is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Behind all the public relations, marketing spin, corporate overlay e.g. ...Mountain TuiBy Mountain Tūī2 days ago - China will need 10,000GW of wind and solar by 2060

This is a re-post from Carbon Brief by Wang Zhongying, chief national expert, China Energy Transformation Programme of the Energy Research Institute, and Kaare Sandholt, chief international expert, China Energy Transformation Programme of the Energy Research Institute China will need to install around 10,000 gigawatts (GW) of wind and solar capacity ...2 days ago

This is a re-post from Carbon Brief by Wang Zhongying, chief national expert, China Energy Transformation Programme of the Energy Research Institute, and Kaare Sandholt, chief international expert, China Energy Transformation Programme of the Energy Research Institute China will need to install around 10,000 gigawatts (GW) of wind and solar capacity ...2 days ago - Bernard’s Picks ‘n’ Mixes for Tuesday, March 26

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey2 days ago

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey2 days ago - Most people want a people-friendly city

With many of Auckland’s political and bureaucratic leaders bowing down to vocal minorities and consistently failing to reallocate space to people in our city, recent news overseas has prompted me to point out something important. It is extremely popular to make car-dominated cities nicer, by freeing up space for people. ...Greater AucklandBy Connor Sharp2 days ago

With many of Auckland’s political and bureaucratic leaders bowing down to vocal minorities and consistently failing to reallocate space to people in our city, recent news overseas has prompted me to point out something important. It is extremely popular to make car-dominated cities nicer, by freeing up space for people. ...Greater AucklandBy Connor Sharp2 days ago - Indonesia wants an aircraft carrier. No one knows why

When it comes to fleet modernisation programme, the Indonesian navy seems to be biting off more than it can chew. It is not even clear why the navy is taking the bite. The news that ...The StrategistBy Gilang Kembara2 days ago

When it comes to fleet modernisation programme, the Indonesian navy seems to be biting off more than it can chew. It is not even clear why the navy is taking the bite. The news that ...The StrategistBy Gilang Kembara2 days ago - tag:blogger.com,1999:blog-3753486518085091399.post-2287094456929079731

2 days ago

- Australia should work with South Korea to secure undersea cables

South Korea and Australia should enhance their cooperation to secure submarine cables, which carry more than 95 percent of global data traffic. As tensions in the Indo-Pacific intensify, these vital connections face risks from cyber ...The StrategistBy Jihoon Yu2 days ago

South Korea and Australia should enhance their cooperation to secure submarine cables, which carry more than 95 percent of global data traffic. As tensions in the Indo-Pacific intensify, these vital connections face risks from cyber ...The StrategistBy Jihoon Yu2 days ago - Parliament says “no” to transparency

The Parliament Bill Committee has reported back on the Parliament Bill. As usual, they recommend no substantive changes, all decisions having been made in advance and in secret before the bill was introduced - but there are some minor tweaks around oversight of the new parliamentary security powers, which will ...No Right TurnBy Idiot/Savant2 days ago

The Parliament Bill Committee has reported back on the Parliament Bill. As usual, they recommend no substantive changes, all decisions having been made in advance and in secret before the bill was introduced - but there are some minor tweaks around oversight of the new parliamentary security powers, which will ...No Right TurnBy Idiot/Savant2 days ago - Bolt from the blue: what we know (and don’t know) about the US’s powerful F-47 fighter

When the F-47 enters service, at a date to be disclosed, it will be a new factor in US air warfare. A decision to proceed with development, deferred since July, was unexpectedly announced on 21 ...The StrategistBy Bill Sweetman2 days ago

When the F-47 enters service, at a date to be disclosed, it will be a new factor in US air warfare. A decision to proceed with development, deferred since July, was unexpectedly announced on 21 ...The StrategistBy Bill Sweetman2 days ago - Yesterday Once More

All my best memoriesCome back clearly to meSome can even make me cry.Just like beforeIt's yesterday once more.Songwriters: Richard Lynn Carpenter / John BettisYesterday, Winston Peters gave a State of the Nation speech in which he declared War on the Woke, described peaceful protesters as fascists, said he’d take our ...Nick’s KōreroBy Nick Rockel3 days ago

All my best memoriesCome back clearly to meSome can even make me cry.Just like beforeIt's yesterday once more.Songwriters: Richard Lynn Carpenter / John BettisYesterday, Winston Peters gave a State of the Nation speech in which he declared War on the Woke, described peaceful protesters as fascists, said he’d take our ...Nick’s KōreroBy Nick Rockel3 days ago - Can we now find out who the real Vladimir Putin is?

Regardless of our opinions about the politicians involved, I believe that every rational person should welcome the reestablishment of contacts between the USA and the Russian Federation. While this is only the beginning and there are no guarantees of success, it does create the opportunity to address issues ...Open ParachuteBy Ken3 days ago

Regardless of our opinions about the politicians involved, I believe that every rational person should welcome the reestablishment of contacts between the USA and the Russian Federation. While this is only the beginning and there are no guarantees of success, it does create the opportunity to address issues ...Open ParachuteBy Ken3 days ago - The transatlantic world will never be the same

Once upon a time, the United States saw the contest between democracy and authoritarianism as a singularly defining issue. It was this outlook, forged in the crucible of World War II, that created such strong ...The StrategistBy Carl Bildt3 days ago

Once upon a time, the United States saw the contest between democracy and authoritarianism as a singularly defining issue. It was this outlook, forged in the crucible of World War II, that created such strong ...The StrategistBy Carl Bildt3 days ago - 30% of doctors leave NZ after graduation

A pre-Covid protest about medical staffing shortages outside the Beehive. Since then the situation has only worsened, with 30% of doctors trained here now migrating within a decade. File Photo: Lynn GrievesonMōrena. Long stories shortest: The news this morning is dominated by the crises cascading through our health system after ...The KakaBy Bernard Hickey3 days ago

A pre-Covid protest about medical staffing shortages outside the Beehive. Since then the situation has only worsened, with 30% of doctors trained here now migrating within a decade. File Photo: Lynn GrievesonMōrena. Long stories shortest: The news this morning is dominated by the crises cascading through our health system after ...The KakaBy Bernard Hickey3 days ago - Monday 24 March

Bargaining between the PSA and Oranga Tamariki over the collective agreement is intensifying – with more strike action likely, while the Employment Relations Authority has ordered facilitation. More than 850 laboratory staff are walking off their jobs in a week of rolling strike action. Union coverage CTU: Confidence in ...NZCTUBy Jack McDonald3 days ago

Bargaining between the PSA and Oranga Tamariki over the collective agreement is intensifying – with more strike action likely, while the Employment Relations Authority has ordered facilitation. More than 850 laboratory staff are walking off their jobs in a week of rolling strike action. Union coverage CTU: Confidence in ...NZCTUBy Jack McDonald3 days ago - The permanent Australia-China contest in the South Pacific

Foreign Minister Penny Wong in 2024 said that ‘we’re in a state of permanent contest in the Pacific—that’s the reality.’ China’s arrogance hurts it in the South Pacific. Mark that as a strong Australian card ...The StrategistBy Graeme Dobell3 days ago

Foreign Minister Penny Wong in 2024 said that ‘we’re in a state of permanent contest in the Pacific—that’s the reality.’ China’s arrogance hurts it in the South Pacific. Mark that as a strong Australian card ...The StrategistBy Graeme Dobell3 days ago - Bernard’s Picks ‘n’ Mixes on Monday, March 24

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey3 days ago

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey3 days ago - Gordon Campbell on Israel’s murderous relapse, and Peters’ sad decline

In the past week, Israel has reverted to slaughtering civilians, starving children and welshing on the terms of the peace deal negotiated earlier this year. The IDF’s current offensive seems to be intended to render Gaza unlivable, preparatory (perhaps) to re-occupation by Israeli settlers. The short term demands for the ...WerewolfBy ScoopEditor3 days ago

In the past week, Israel has reverted to slaughtering civilians, starving children and welshing on the terms of the peace deal negotiated earlier this year. The IDF’s current offensive seems to be intended to render Gaza unlivable, preparatory (perhaps) to re-occupation by Israeli settlers. The short term demands for the ...WerewolfBy ScoopEditor3 days ago - 2025 SkS Weekly Climate Change & Global Warming News Roundup #12

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, March 16, 2025 thru Sat, March 22, 2025. This week's roundup is again published by category and sorted by number of articles included in each. We are still interested ...3 days ago

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, March 16, 2025 thru Sat, March 22, 2025. This week's roundup is again published by category and sorted by number of articles included in each. We are still interested ...3 days ago - Bullying a Chess Bot: More Martinian Shenanigans

In recent months, I have garnered copious amusement playing Martin, chess.com’s infamously terrible Chess AI. Alas, it is not how it once was, when he would cheerfully ignore freely offered material. Martin has grown better since I first stumbled upon him. I still remain frustrated at his capture-happy determination to ...A Phuulish FellowBy strda2213 days ago

In recent months, I have garnered copious amusement playing Martin, chess.com’s infamously terrible Chess AI. Alas, it is not how it once was, when he would cheerfully ignore freely offered material. Martin has grown better since I first stumbled upon him. I still remain frustrated at his capture-happy determination to ...A Phuulish FellowBy strda2213 days ago - Indian Summer

Every time that I see ya,A lightning bolt fills the room,The underbelly of Paris,She sings her favourite tune,She'll drink you under the table,She'll show you a trick or two,But every time that I left her,I missed the things she would doSongwriters: Kelly JonesThis morning, I posted - Are you excited ...Nick’s KōreroBy Nick Rockel4 days ago

Every time that I see ya,A lightning bolt fills the room,The underbelly of Paris,She sings her favourite tune,She'll drink you under the table,She'll show you a trick or two,But every time that I left her,I missed the things she would doSongwriters: Kelly JonesThis morning, I posted - Are you excited ...Nick’s KōreroBy Nick Rockel4 days ago - Bernard’s Soliloquy for the week to March 23

Long stories shortest this week in our political economy: Standard & Poor’s judged the Government’s council finance reforms a failure. Professional investors showed the Government they want it to borrow more, not less. GDP bounced out of recession by more than forecast in the December quarter, but data for the ...The KakaBy Bernard Hickey4 days ago

Long stories shortest this week in our political economy: Standard & Poor’s judged the Government’s council finance reforms a failure. Professional investors showed the Government they want it to borrow more, not less. GDP bounced out of recession by more than forecast in the December quarter, but data for the ...The KakaBy Bernard Hickey4 days ago - Making sense of it all

Each day at 4:30 my brother calls in at the rest home to see Dad. My visits can be months apart. Five minutes after you've left, he’ll have forgotten you were there, but every time, his face lights up and it’s a warm happy visit.Tim takes care of almost everything ...More Than A FeildingBy David Slack4 days ago

Each day at 4:30 my brother calls in at the rest home to see Dad. My visits can be months apart. Five minutes after you've left, he’ll have forgotten you were there, but every time, his face lights up and it’s a warm happy visit.Tim takes care of almost everything ...More Than A FeildingBy David Slack4 days ago - A Response to ACT’s MRA-Style Rant

On the 19th of March, ACT announced they would be running candidates in this year’s local government elections. Accompanying that call for “common-sense kiwis” was an anti-woke essay typifying the views they expect their candidates to hold. I have included that part of their mailer, Free Press, in its entirety. ...Sapphi’s SubstackBy Stephanie Cullen4 days ago

On the 19th of March, ACT announced they would be running candidates in this year’s local government elections. Accompanying that call for “common-sense kiwis” was an anti-woke essay typifying the views they expect their candidates to hold. I have included that part of their mailer, Free Press, in its entirety. ...Sapphi’s SubstackBy Stephanie Cullen4 days ago - Spread a Little Happiness

Even when the darkest clouds are in the skyYou mustn't sigh and you mustn't crySpread a little happiness as you go byPlease tryWhat's the use of worrying and feeling blue?When days are long keep on smiling throughSpread a little happiness 'til dreams come trueSongwriters: Vivian Ellis / Clifford Grey / ...Nick’s KōreroBy Nick Rockel5 days ago

Even when the darkest clouds are in the skyYou mustn't sigh and you mustn't crySpread a little happiness as you go byPlease tryWhat's the use of worrying and feeling blue?When days are long keep on smiling throughSpread a little happiness 'til dreams come trueSongwriters: Vivian Ellis / Clifford Grey / ...Nick’s KōreroBy Nick Rockel5 days ago - Pick ‘n’ Mix at 6am on Saturday, March 22

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey5 days ago

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey5 days ago - Siding with the Right Of the Right

ACT up the game on division politicsEmmerson’s take on David Seymour’s claim Jesus would have supported ACTACT’s announcement it is moving into local politics is a logical next step for a party that is waging its battle on picking up the aggrieved.It’s a numbers game, and as long as the ...Mountain TuiBy Mountain Tūī5 days ago

ACT up the game on division politicsEmmerson’s take on David Seymour’s claim Jesus would have supported ACTACT’s announcement it is moving into local politics is a logical next step for a party that is waging its battle on picking up the aggrieved.It’s a numbers game, and as long as the ...Mountain TuiBy Mountain Tūī5 days ago - Jam tomorrow, butter next week

1. What will be the slogan of the next butter ad campaign?a. You’re worth itb. Once it hits $20, we can do something about the riversc. I can’t believe it’s the price of butter d. None of the above Read more ...More Than A FeildingBy David Slack5 days ago

1. What will be the slogan of the next butter ad campaign?a. You’re worth itb. Once it hits $20, we can do something about the riversc. I can’t believe it’s the price of butter d. None of the above Read more ...More Than A FeildingBy David Slack5 days ago - Why Do Cryptocurrencies Appear to Be So Valuable?

It is said that economists know the price of everything and the value of nothing. That may be an exaggeration but an even better response is to point out economists do know the difference. They did not at first. Classical economics thought that the price of something reflected the objective ...PunditBy Brian Easton5 days ago

It is said that economists know the price of everything and the value of nothing. That may be an exaggeration but an even better response is to point out economists do know the difference. They did not at first. Classical economics thought that the price of something reflected the objective ...PunditBy Brian Easton5 days ago - Awful optics: political fighting in Taiwan stalls part of defence budget rise

Political fighting in Taiwan is delaying some of an increase in defence spending and creating an appearance of lack of national resolve that can only damage the island’s relationship with the Trump administration. The main ...The StrategistBy Jane Rickards5 days ago

Political fighting in Taiwan is delaying some of an increase in defence spending and creating an appearance of lack of national resolve that can only damage the island’s relationship with the Trump administration. The main ...The StrategistBy Jane Rickards5 days ago - The Independent Intelligence Review is finally out, and it’s a worthy sequel

The unclassified version of the 2024 Independent Intelligence Review (IIR) was released today. It’s a welcome and worthy sequel to its 2017 predecessor, with an ambitious set of recommendations for enhancements to Australia’s national intelligence ...The StrategistBy Chris Taylor5 days ago

The unclassified version of the 2024 Independent Intelligence Review (IIR) was released today. It’s a welcome and worthy sequel to its 2017 predecessor, with an ambitious set of recommendations for enhancements to Australia’s national intelligence ...The StrategistBy Chris Taylor5 days ago - Law, culture, and the OIA

Yesterday outgoing Ombudsman Peter Boshier published a report, Reflections on the Official Information Act, on his way out the door. The report repeated his favoured mantra that the Act was "fundamentally sound", all problems were issues of culture, and that no legislative change was needed (and especially no changes to ...No Right TurnBy Idiot/Savant5 days ago

Yesterday outgoing Ombudsman Peter Boshier published a report, Reflections on the Official Information Act, on his way out the door. The report repeated his favoured mantra that the Act was "fundamentally sound", all problems were issues of culture, and that no legislative change was needed (and especially no changes to ...No Right TurnBy Idiot/Savant5 days ago - A new US humanitarian agency must operate without political blinders

The United States government is considering replacing USAID with a new agency, the US Agency for International Humanitarian Assistance (USIHA), according to documents published by POLITICO. Under the proposed design, the agency will fail its ...The StrategistBy Mike Copage5 days ago

The United States government is considering replacing USAID with a new agency, the US Agency for International Humanitarian Assistance (USIHA), according to documents published by POLITICO. Under the proposed design, the agency will fail its ...The StrategistBy Mike Copage5 days ago - Worming Through Dangerous Times

David FarrierBy David Farrier6 days ago

- Why is the Govt so afraid of borrowing?

Mōrena. Long stories shortest: Professional investors who are paid a lot of money to be careful about lending to the New Zealand Government think it is wonderful place to put their money. Yet the Government itself is so afraid of borrowing more that it is happy to kill its own ...The KakaBy Bernard Hickey6 days ago

Mōrena. Long stories shortest: Professional investors who are paid a lot of money to be careful about lending to the New Zealand Government think it is wonderful place to put their money. Yet the Government itself is so afraid of borrowing more that it is happy to kill its own ...The KakaBy Bernard Hickey6 days ago - The future of the Combined Space Operations initiative

As space becomes more contested, Australia should play a key role with its partners in the Combined Space Operations (CSpO) initiative to safeguard the space domain. Australia, Britain, Canada and the United States signed the ...The StrategistBy Malcolm Davis6 days ago

As space becomes more contested, Australia should play a key role with its partners in the Combined Space Operations (CSpO) initiative to safeguard the space domain. Australia, Britain, Canada and the United States signed the ...The StrategistBy Malcolm Davis6 days ago - Dave’s Cats

Ooh you're a cool catComing on strong with all the chit chatOoh you're alrightHanging out and stealing all the limelightOoh messing with the beat of my heart yeah!Songwriters: Freddie Mercury / John Deacon.It would be a tad ironic; I can see it now. “Yeah, I didn’t unsubscribe when he said ...Nick’s KōreroBy Nick Rockel6 days ago

Ooh you're a cool catComing on strong with all the chit chatOoh you're alrightHanging out and stealing all the limelightOoh messing with the beat of my heart yeah!Songwriters: Freddie Mercury / John Deacon.It would be a tad ironic; I can see it now. “Yeah, I didn’t unsubscribe when he said ...Nick’s KōreroBy Nick Rockel6 days ago - Friday 21 March

The PSA are calling the Prime Minister a hypocrite for committing to increase defence spending while hundreds of more civilian New Zealand Defence Force jobs are set to be cut as part of a major restructure. The number of companies being investigated for people trafficking in New Zealand has skyrocketed ...NZCTUBy Jack McDonald6 days ago

The PSA are calling the Prime Minister a hypocrite for committing to increase defence spending while hundreds of more civilian New Zealand Defence Force jobs are set to be cut as part of a major restructure. The number of companies being investigated for people trafficking in New Zealand has skyrocketed ...NZCTUBy Jack McDonald6 days ago - Weekly Roundup 21-March-2025

Another Friday, hope everyone’s enjoyed their week as we head toward the autumn equinox. Here’s another roundup of stories that caught our eye on the subject of cities and what makes them even better. This week in Greater Auckland On Monday, Connor took a look at how Auckland ...Greater AucklandBy Greater Auckland6 days ago

Another Friday, hope everyone’s enjoyed their week as we head toward the autumn equinox. Here’s another roundup of stories that caught our eye on the subject of cities and what makes them even better. This week in Greater Auckland On Monday, Connor took a look at how Auckland ...Greater AucklandBy Greater Auckland6 days ago - A special Hoon with Michael Wolff, author of four books on Donald Trump

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking with special guest author Michael Wolff, who has just published his fourth book about Donald Trump: ‘All or Nothing’.Here’s Peter’s writeup of the interview.The Kākā by Bernard Hickey Hoon: Trumpism ...The KakaBy Bernard Hickey6 days ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking with special guest author Michael Wolff, who has just published his fourth book about Donald Trump: ‘All or Nothing’.Here’s Peter’s writeup of the interview.The Kākā by Bernard Hickey Hoon: Trumpism ...The KakaBy Bernard Hickey6 days ago - Hoon: Trumpism dies with Trump says Wolff

The KakaBy Peter Bale6 days ago

- The ADF reserve system is obsolete. We need a dramatically expanded force

Australia needs to radically reorganise its reserves system to create a latent military force that is much larger, better trained and equipped and deployable within days—not decades. Our current reserve system is not fit for ...The StrategistBy Ross Babbage6 days ago

Australia needs to radically reorganise its reserves system to create a latent military force that is much larger, better trained and equipped and deployable within days—not decades. Our current reserve system is not fit for ...The StrategistBy Ross Babbage6 days ago - Pick ‘n’ Mix at 6am on Friday, March 21

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey6 days ago

Here’s my selection1 of scoops, breaking news, news, analyses, deep-dives, features, interviews, Op-Eds, editorials and cartoons from around Aotearoa’s political economy on housing, climate and poverty from RNZ, 1News, The Post-$2, The Press−$, Newsroom/$3, NZ Herald/$, Stuff, BusinessDesk/$, Politik-$, NBR-$, Reuters, FT/$, WSJ/$, Bloomberg/$, New York Times/$, Washington Post/$, Wired/$, ...The KakaBy Bernard Hickey6 days ago - Against All Reason: William Blake and the Private Fantasy Mythology

I have argued before that one ought to be careful in retrospectively allocating texts into genres. Mary Shelley’s Frankenstein (1818) only looks like science-fiction because a science-fiction genre subsequently developed. Without H.G. Wells, would Frankenstein be considered science-fiction? No, it probably wouldn’t. Viewed in the context of its time, Frankenstein ...A Phuulish FellowBy strda2216 days ago

I have argued before that one ought to be careful in retrospectively allocating texts into genres. Mary Shelley’s Frankenstein (1818) only looks like science-fiction because a science-fiction genre subsequently developed. Without H.G. Wells, would Frankenstein be considered science-fiction? No, it probably wouldn’t. Viewed in the context of its time, Frankenstein ...A Phuulish FellowBy strda2216 days ago - Skeptical Science New Research for Week #12 2025

Open access notables The severe 2020 coral bleaching event in the tropical Atlantic linked to marine heatwaves, Rodrigues et al., Communications Earth & Environment: Marine heatwaves can amplify the vulnerabilities of regional marine ecosystems and jeopardise local economies and food resources. Here, we show that marine heatwaves in the tropical ...6 days ago

Open access notables The severe 2020 coral bleaching event in the tropical Atlantic linked to marine heatwaves, Rodrigues et al., Communications Earth & Environment: Marine heatwaves can amplify the vulnerabilities of regional marine ecosystems and jeopardise local economies and food resources. Here, we show that marine heatwaves in the tropical ...6 days ago - Elbridge Colby’s vision: blocking China

Elbridge Colby’s senate confirmation hearing in early March holds more important implications for US partners than most observers in Canberra, Wellington or Suva realise. As President Donald Trump’s nominee for under secretary of defence for ...The StrategistBy Gregory Brown6 days ago

Elbridge Colby’s senate confirmation hearing in early March holds more important implications for US partners than most observers in Canberra, Wellington or Suva realise. As President Donald Trump’s nominee for under secretary of defence for ...The StrategistBy Gregory Brown6 days ago - China’s military spending rises should prompt regional budget responses

China’s defence budget is rising heftily yet again. The 2025 rise will be 7.2 percent, the same as in 2024, the government said on 5 March. But the allocation, officially US$245 billion, is just the ...The StrategistBy Rajeswari Pillai Rajagopalan6 days ago

China’s defence budget is rising heftily yet again. The 2025 rise will be 7.2 percent, the same as in 2024, the government said on 5 March. But the allocation, officially US$245 billion, is just the ...The StrategistBy Rajeswari Pillai Rajagopalan6 days ago - Pressure grows for commonsense correction on safe local speeds

Concern is growing about wide-ranging local repercussions of the new Setting of Speed Limits rule, rewritten in 2024 by former transport minister Simeon Brown. In particular, there’s growing fears about what this means for children in particular. A key paradox of the new rule is that NZTA-controlled roads have the ...Greater AucklandBy Greater Auckland6 days ago

Concern is growing about wide-ranging local repercussions of the new Setting of Speed Limits rule, rewritten in 2024 by former transport minister Simeon Brown. In particular, there’s growing fears about what this means for children in particular. A key paradox of the new rule is that NZTA-controlled roads have the ...Greater AucklandBy Greater Auckland6 days ago - Luxon’s Guests.

Speilmeister: Christopher Luxon’s prime-ministerial pitches notwithstanding, are institutions with billions of dollars at their disposal really going to invest them in a country so obviously in a deep funk?HAVING WOOED THE WORLD’s investors, what, if anything, has New Zealand won? Did Christopher Luxon’s guests board their private jets fizzing with enthusiasm for ...6 days ago

Speilmeister: Christopher Luxon’s prime-ministerial pitches notwithstanding, are institutions with billions of dollars at their disposal really going to invest them in a country so obviously in a deep funk?HAVING WOOED THE WORLD’s investors, what, if anything, has New Zealand won? Did Christopher Luxon’s guests board their private jets fizzing with enthusiasm for ...6 days ago - S&P downgrades 18 councils, blaming Govt

Christchurch City Council is one of 18 councils and three council-controlled organisations (CCOs) downgraded by ratings agency S&P. Photo: Lynn Grieveson / The KākāMōrena. Long stories shortest: Standard & Poor’s has cut the credit ratings of 18 councils, blaming the new Government’s abrupt reversal of 3 Waters, cuts to capital ...The KakaBy Bernard Hickey7 days ago

Christchurch City Council is one of 18 councils and three council-controlled organisations (CCOs) downgraded by ratings agency S&P. Photo: Lynn Grieveson / The KākāMōrena. Long stories shortest: Standard & Poor’s has cut the credit ratings of 18 councils, blaming the new Government’s abrupt reversal of 3 Waters, cuts to capital ...The KakaBy Bernard Hickey7 days ago - Recession ends – Economic challenges remain

Figures released by Statistics New Zealand today showed that the economy grew by 0.7% ending the very deep recession seen over the past year, said NZCTU Te Kauae Kaimahi Economist Craig Renney. “Even though GDP grew in the three months to December, our economy is still 1.1% smaller than it ...NZCTUBy Jeremiah Boniface7 days ago

Figures released by Statistics New Zealand today showed that the economy grew by 0.7% ending the very deep recession seen over the past year, said NZCTU Te Kauae Kaimahi Economist Craig Renney. “Even though GDP grew in the three months to December, our economy is still 1.1% smaller than it ...NZCTUBy Jeremiah Boniface7 days ago - Maybe there’s a connection?

What is going on with the price of butter?, RNZ, 19 march 2025: If you have bought butter recently you might have noticed something - it is a lot more expensive. Stats NZ said last week that the price of butter was up 60 percent in February compared to ...No Right TurnBy Idiot/Savant7 days ago

What is going on with the price of butter?, RNZ, 19 march 2025: If you have bought butter recently you might have noticed something - it is a lot more expensive. Stats NZ said last week that the price of butter was up 60 percent in February compared to ...No Right TurnBy Idiot/Savant7 days ago - I, too, got a few things wrong

I agree with Will Leben, who wrote in The Strategist about his mistakes, that an important element of being a commentator is being accountable and taking responsibility for things you got wrong. In that spirit, ...The StrategistBy Melissa Conley Tyler7 days ago

I agree with Will Leben, who wrote in The Strategist about his mistakes, that an important element of being a commentator is being accountable and taking responsibility for things you got wrong. In that spirit, ...The StrategistBy Melissa Conley Tyler7 days ago - Commandments & Cures

You’d beDrunk by noon, no one would knowJust like the pandemicWithout the sourdoughIf I were there, I’d find a wayTo get treated for hysteriaEvery dayLyrics Riki Lindhome.A varied selection today in Nick’s Kōrero:Thou shalt have no other gods - with Christopher Luxon.Doctors should be seen and not heard - with ...Nick’s KōreroBy Nick Rockel7 days ago

You’d beDrunk by noon, no one would knowJust like the pandemicWithout the sourdoughIf I were there, I’d find a wayTo get treated for hysteriaEvery dayLyrics Riki Lindhome.A varied selection today in Nick’s Kōrero:Thou shalt have no other gods - with Christopher Luxon.Doctors should be seen and not heard - with ...Nick’s KōreroBy Nick Rockel7 days ago - Australia needs greater defence self-reliance, and extra funding

Two recent foreign challenges suggest that Australia needs urgently to increase its level of defence self-reliance and to ensure that the increased funding that this would require is available. First, the circumnavigation of our continent ...The StrategistBy Paul Dibb and Richard Brabin-Smith7 days ago

Two recent foreign challenges suggest that Australia needs urgently to increase its level of defence self-reliance and to ensure that the increased funding that this would require is available. First, the circumnavigation of our continent ...The StrategistBy Paul Dibb and Richard Brabin-Smith7 days ago

Related Posts

- Release: Kiwis lose faith in job market

Confidence in the job market has continued to drop to its lowest level in five years as more New Zealanders feel uncertain about finding work, keeping their jobs, and getting decent pay, according to the latest Westpac-McDermott Miller Employment Confidence Index. ...19 hours ago

Confidence in the job market has continued to drop to its lowest level in five years as more New Zealanders feel uncertain about finding work, keeping their jobs, and getting decent pay, according to the latest Westpac-McDermott Miller Employment Confidence Index. ...19 hours ago - Greens question Govt commitment to environmental protection with RMA reform

The Greens are calling on the Government to follow through on their vague promises of environmental protection in their Resource Management Act (RMA) reform. ...2 days ago

The Greens are calling on the Government to follow through on their vague promises of environmental protection in their Resource Management Act (RMA) reform. ...2 days ago - Release: Govt must tackle meth use crisis

New data shows methamphetamine use is spiralling out of control while the Government sits on its hands. ...3 days ago

New data shows methamphetamine use is spiralling out of control while the Government sits on its hands. ...3 days ago - “Make New Zealand First Again”

“Make New Zealand First Again” Ladies and gentlemen, First of all, thank you for being here today. We know your lives are busy and you are working harder and longer than you ever have, and there are many calls on your time, so thank you for the chance to speak ...4 days ago

“Make New Zealand First Again” Ladies and gentlemen, First of all, thank you for being here today. We know your lives are busy and you are working harder and longer than you ever have, and there are many calls on your time, so thank you for the chance to speak ...4 days ago - Release: Govt’s continued lack of action on Gaza condemned

Hundreds more Palestinians have died in recent days as Israel’s assault on Gaza continues and humanitarian aid, including food and medicine, is blocked. ...5 days ago

Hundreds more Palestinians have died in recent days as Israel’s assault on Gaza continues and humanitarian aid, including food and medicine, is blocked. ...5 days ago - Release: National at sea over Defence jobs

National is looking to cut hundreds of jobs at New Zealand’s Defence Force, while at the same time it talks up plans to increase focus and spending in Defence. ...6 days ago

National is looking to cut hundreds of jobs at New Zealand’s Defence Force, while at the same time it talks up plans to increase focus and spending in Defence. ...6 days ago - Release: National standards returning by stealth

It’s been revealed that the Government is secretly trying to bring back a ‘one-size fits all’ standardised test – a decision that has shocked school principals. ...7 days ago

It’s been revealed that the Government is secretly trying to bring back a ‘one-size fits all’ standardised test – a decision that has shocked school principals. ...7 days ago - Release: Kiwis still struggling as economy stumbles along

Kiwis aren’t feeling any better off despite figures showing a very slight growth in GDP in the December quarter. ...7 days ago

Kiwis aren’t feeling any better off despite figures showing a very slight growth in GDP in the December quarter. ...7 days ago - Greens call for compassionate release of Dean Wickliffe

The Green Party is calling for the compassionate release of Dean Wickliffe, a 77-year-old kaumātua on hunger strike at the Spring Hill Corrections Facility, after visiting him at the prison. ...1 week ago

The Green Party is calling for the compassionate release of Dean Wickliffe, a 77-year-old kaumātua on hunger strike at the Spring Hill Corrections Facility, after visiting him at the prison. ...1 week ago - Another failed ETS auction, another indictment on the Govt’s climate credibility

The ETS auction’s failure today is yet another clear sign that the Government is failing us all on climate action. ...1 week ago

The ETS auction’s failure today is yet another clear sign that the Government is failing us all on climate action. ...1 week ago - Release: Luxon quick to give away principled position on nukes

Christopher Luxon seems to have thrown New Zealand’s principled anti-nuclear advocacy under a bus. ...1 week ago

Christopher Luxon seems to have thrown New Zealand’s principled anti-nuclear advocacy under a bus. ...1 week ago - NZ must act on Israel’s slaughter of children

The Green Party is calling on Government MPs to support Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence and illegal actions in Palestine, following another day of appalling violence against civilians in Gaza. ...1 week ago

The Green Party is calling on Government MPs to support Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence and illegal actions in Palestine, following another day of appalling violence against civilians in Gaza. ...1 week ago - Release: Still no certainty for disability communities

One year on from the Government’s abrupt and callous changes to disability funding, the community still has no idea what the future holds. ...1 week ago

One year on from the Government’s abrupt and callous changes to disability funding, the community still has no idea what the future holds. ...1 week ago - Green Party backs volunteer firefighters in their call for ACC recognition

The Green Party stands in support of volunteer firefighters petitioning the Government to step up and change legislation to provide volunteers the same ACC coverage and benefits as their paid counterparts. ...1 week ago

The Green Party stands in support of volunteer firefighters petitioning the Government to step up and change legislation to provide volunteers the same ACC coverage and benefits as their paid counterparts. ...1 week ago - Stand Up for Palestine: A Call to Action Against Israels Treacherous Attack

At 2.30am local time, Israel launched a treacherous attack on Gaza killing more than 300 defenceless civilians while they slept. Many of them were children. This followed a more than 2 week-long blockade by Israel on the entry of all goods and aid into Gaza. Israel deliberately targeted densely populated ...1 week ago

At 2.30am local time, Israel launched a treacherous attack on Gaza killing more than 300 defenceless civilians while they slept. Many of them were children. This followed a more than 2 week-long blockade by Israel on the entry of all goods and aid into Gaza. Israel deliberately targeted densely populated ...1 week ago - MP Views: Living Strong, The Economy, Servicing Our Nation, The Golden Egg, and 4 Year Terms

Living Strong, Aging Well There is much discussion around the health of our older New Zealanders and how we can age well. In reality, the delivery of health services accounts for only a relatively small percentage of health outcomes as we age. Significantly, dry warm housing, nutrition, exercise, social connection, ...1 week ago

Living Strong, Aging Well There is much discussion around the health of our older New Zealanders and how we can age well. In reality, the delivery of health services accounts for only a relatively small percentage of health outcomes as we age. Significantly, dry warm housing, nutrition, exercise, social connection, ...1 week ago - Shane Jones has no shame

Shane Jones’ display on Q&A showed how out of touch he and this Government are with our communities and how in sync they are with companies with little concern for people and planet. ...2 weeks ago

Shane Jones’ display on Q&A showed how out of touch he and this Government are with our communities and how in sync they are with companies with little concern for people and planet. ...2 weeks ago - Release: National botches health funding numbers

Health Minister Simeon Brown’s claim that the Government has put $16.68 billion into the health system over three years is wrong. ...2 weeks ago

Health Minister Simeon Brown’s claim that the Government has put $16.68 billion into the health system over three years is wrong. ...2 weeks ago - Government tramples on the rights of disabled migrant children

The Green Party is condemning the Government’s move to tighten access to visas for disabled children. ...2 weeks ago

The Green Party is condemning the Government’s move to tighten access to visas for disabled children. ...2 weeks ago - Release: Auckland needs second harbour crossing

Labour supports Minister Chris Bishop’s call for input on the second Waitematā Harbour crossing. ...2 weeks ago

Labour supports Minister Chris Bishop’s call for input on the second Waitematā Harbour crossing. ...2 weeks ago - Speech: Barbara Edmonds’ speech to NZ Investment Summit 2025

I am grateful to have the opportunity to speak to you today about how we make overseas investment work for all New Zealanders. ...2 weeks ago

I am grateful to have the opportunity to speak to you today about how we make overseas investment work for all New Zealanders. ...2 weeks ago - Release: Labour does not support PPPs for prisons

Labour does not support the private ownership of core infrastructure like schools, hospitals and prisons, which will only see worse outcomes for Kiwis. ...2 weeks ago

Labour does not support the private ownership of core infrastructure like schools, hospitals and prisons, which will only see worse outcomes for Kiwis. ...2 weeks ago - Dunedin Futures report should be a wake-up call

The newly released report on the South Dunedin Future Programme must be a wake-up call for our Government. ...2 weeks ago

The newly released report on the South Dunedin Future Programme must be a wake-up call for our Government. ...2 weeks ago - Release: Members’ Bill makes wage theft a crime

Workers will now be able to go to the Police and report their employer if they are not being paid wages they’re owed. ...2 weeks ago

Workers will now be able to go to the Police and report their employer if they are not being paid wages they’re owed. ...2 weeks ago - Missed opportunity to stop the stealing of Māori land

The Green Party is disappointed the Government voted down Hūhana Lyndon’s member’s Bill, which would have prevented further alienation of Māori land through the Public Works Act. ...2 weeks ago

The Green Party is disappointed the Government voted down Hūhana Lyndon’s member’s Bill, which would have prevented further alienation of Māori land through the Public Works Act. ...2 weeks ago - Release: Labour supports sanctions against Israel’s illegal occupation

The Labour Party will support Chloe Swarbrick’s member’s bill which would allow sanctions against Israel for its illegal occupation of the Palestinian Territories. ...2 weeks ago

The Labour Party will support Chloe Swarbrick’s member’s bill which would allow sanctions against Israel for its illegal occupation of the Palestinian Territories. ...2 weeks ago - Release: Govt procurement plan cuts wages and trashes the environment

The Government’s new procurement rules are a blatant attack on workers and the environment, showing once again that National’s priorities are completely out of touch with everyday Kiwis. ...2 weeks ago

The Government’s new procurement rules are a blatant attack on workers and the environment, showing once again that National’s priorities are completely out of touch with everyday Kiwis. ...2 weeks ago - Procurement proposals pose risk to people and planet

The Green Party is concerned by the impact the Government’s proposed changes to procurement processes could have on people and planet. ...2 weeks ago

The Green Party is concerned by the impact the Government’s proposed changes to procurement processes could have on people and planet. ...2 weeks ago - Just six Government MPs needed to pass Unlawful Occupation of Palestine Sanctions Bill

With Labour and Te Pāti Māori’s official support, Opposition parties are officially aligned to progress Green Party co-leader Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence in Palestine. ...2 weeks ago

With Labour and Te Pāti Māori’s official support, Opposition parties are officially aligned to progress Green Party co-leader Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence in Palestine. ...2 weeks ago - Release: Labour’s approach to Māori economy benefits all

Under Labour, the Māori economy went from strength to strength according to the latest report released by MBIE. ...2 weeks ago

Under Labour, the Māori economy went from strength to strength according to the latest report released by MBIE. ...2 weeks ago - 20 Years of Success Down the Drain: Govt Gut Whānau Ora

Te Pāti Māori extends our deepest aroha to the 500 plus Whānau Ora workers who have been advised today that the govt will be dismantling their contracts. For twenty years , Whānau Ora has been helping families, delivering life-changing support through a kaupapa Māori approach. It has built trust where ...3 weeks ago

Te Pāti Māori extends our deepest aroha to the 500 plus Whānau Ora workers who have been advised today that the govt will be dismantling their contracts. For twenty years , Whānau Ora has been helping families, delivering life-changing support through a kaupapa Māori approach. It has built trust where ...3 weeks ago - Green Party launches petition to allow Pacific whānau visa-free access

The Green Party is launching a petition calling on the Government to extend visa-free travel to visitors from Pacific Island nations. ...3 weeks ago

The Green Party is launching a petition calling on the Government to extend visa-free travel to visitors from Pacific Island nations. ...3 weeks ago - Release: Labour welcomes reinstatement of Heath NZ board

Labour welcomes Simeon Brown’s move to reinstate a board at Health New Zealand, bringing the destructive and secretive tenure of commissioner Lester Levy to an end. ...3 weeks ago

Labour welcomes Simeon Brown’s move to reinstate a board at Health New Zealand, bringing the destructive and secretive tenure of commissioner Lester Levy to an end. ...3 weeks ago - NZ’s Public Health system dealt yet another blow

This morning’s announcement by the Health Minister regarding a major overhaul of the public health sector levels yet another blow to the country’s essential services. ...3 weeks ago

This morning’s announcement by the Health Minister regarding a major overhaul of the public health sector levels yet another blow to the country’s essential services. ...3 weeks ago - Release: Chris Hipkins’ State of the Nation address

3 weeks ago

- NZ First Introduces Bill to Remove Woke ‘DEI’ Regulations from Public Service

New Zealand First has introduced a Member’s Bill that will ensure employment decisions in the public service are based on merit and not on forced woke ‘Diversity, Equity, and Inclusion’ targets. “This Bill would put an end to the woke left-wing social engineering and diversity targets in the public sector. ...3 weeks ago

New Zealand First has introduced a Member’s Bill that will ensure employment decisions in the public service are based on merit and not on forced woke ‘Diversity, Equity, and Inclusion’ targets. “This Bill would put an end to the woke left-wing social engineering and diversity targets in the public sector. ...3 weeks ago - Release: Labour outlines priorities of next Govt

The next Labour Government will prioritise jobs, health and homes so Kiwis and Kiwi businesses have the opportunity to thrive. ...3 weeks ago

The next Labour Government will prioritise jobs, health and homes so Kiwis and Kiwi businesses have the opportunity to thrive. ...3 weeks ago - Release: Refreshed team to drive Labour’s 2026 priorities

3 weeks ago

Related Posts

- New planning laws to end the culture of ‘no’

The Government’s new planning legislation to replace the Resource Management Act will make it easier to get things done while protecting the environment, say Minister Responsible for RMA Reform Chris Bishop and Under-Secretary Simon Court. “The RMA is broken and everyone knows it. It makes it too hard to build ...BeehiveBy beehive.govt.nz2 days ago

The Government’s new planning legislation to replace the Resource Management Act will make it easier to get things done while protecting the environment, say Minister Responsible for RMA Reform Chris Bishop and Under-Secretary Simon Court. “The RMA is broken and everyone knows it. It makes it too hard to build ...BeehiveBy beehive.govt.nz2 days ago - New Zealand & India Comprehensive FTA consultation begins