Will 2011 be a rerun of 2008?

Will 2011 be a rerun of 2008?

Written By:

Guest post - Date published:

12:20 pm, January 12th, 2011 - 22 comments

Categories: Economy -

Tags: peak oil, recession, the oil drum

This post has been borrowed from the excellent site theoildrum.com, after originally being published on ourfiniteworld.com.

We all remember the oil price run-up (and run back down) of 2008. Now, with prices similar to where they were in the fall of 2007, the question quite naturally arises as to whether we are headed for another similar scenario.

Of course, we know that the scenario cannot really be the same. World economies are now much weaker than in late 2007. Several countries are having problems with debt, even with oil at its current price. If the oil price rises by $20 or $30 or $40 barrel, we can be pretty sure that those countries will be in much worse financial condition. And while governments have learned to deal with collapsing banks, citizens have a “been there, done that” attitude. They may not be as willing to bail out banks that seem to be contributing to the problems of the day.

If we look back at what happened three years ago, there was a huge run up in the price of oil, but very little change in oil supply.

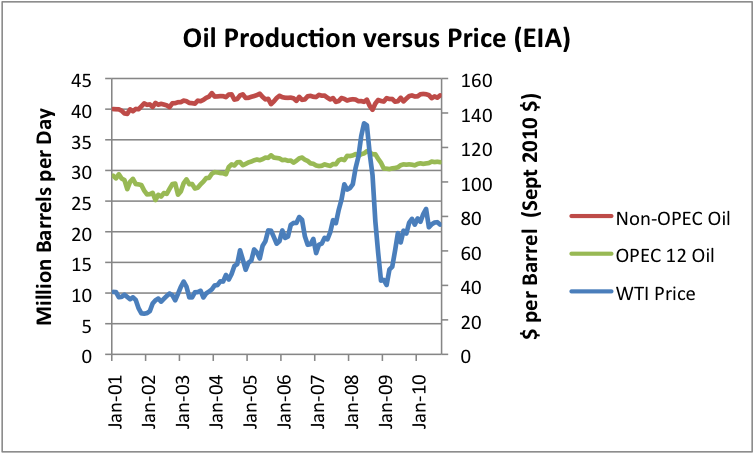

Figure 1. Production of oil (crude and condensate) for OPEC and Non-OPEC countries, compared to West Texas intermediate oil price, in September 2010$. Based on EIA data.

Oil price roughly corresponded to today’s price in October 2007. Between then and July 2008 (the peak in both prices and production), OPEC increased its oil supply by 1.3 million barrels. Non-OPEC actually decreased its supply by about 0.3 million barrels a day between October 2007 and July 2008, providing a net increase in oil supply of only about 1 million barrels a day, despite the huge run-up in prices.

It can be seen from the above graph that the supply of OPEC oil has tended to increase, as oil prices increase. Non-OPEC supply has been much less responsive to price. This is another way of graphing the relationship between oil price and oil production:

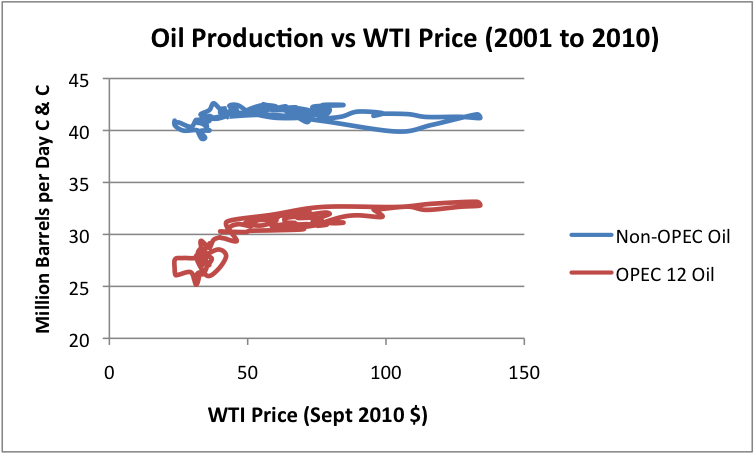

Figure 2. Relationship of oil production (crude and condensate) and West Texas Intermediate price, expressed in September 2010 $, based on monthly EIA data from January 2001 through September 2010.

In Figure 2, as oil price increases along the horizontal axis, we see that non-OPEC oil production remains virtually flat. As oil price increases for the OPEC 12, we see the kind of supply curve we might expect to see for a supplier that has a small amount of more expensive capacity that it can put on line when prices justify it. The catch is that the amount of supply added as prices rise isn’t really very much–as we just saw, 1.3 million barrels a day, between October 2007 and July 2008.

Eventually, the economy could not handle the high oil prices, and prices dropped. Credit availability began dropping and recession became a greater and greater issue.

Will this time be different? It seems to me that OPEC has done a good job of convincing the world that it has a lot of extra supply, but it is less than clear that it has much more excess capacity than it had in the 2007-2008 period. OPEC shows this image on its website, but this may just be a long-standing approach aimed at convincing the world that it has more oil (and power) than it really does.

Figure 3. OPEC’s view of its own spare capacity.

Spare capacity, like oil reserves, is not audited. The higher the numbers proclaimed to the world, the more powerful OPEC appears, both in the eyes of its own people, and in the eyes of people around the world. OPEC shows lists of new projects and investment amounts, but it is not clear that the new capacity being added is more than what is needed to offset declines in other fields. The new production amounts listed (shown separately by country–this is the one for Saudi Arabia) come to something like 6% of production – this could simply represent offsets to declines in fields elsewhere. The problem is we really don’t know, because no auditing is ever done. We are just expected to trust Saudi Arabia and OPEC on a matter of importance to the world.

OPEC tells us it is acting as a cartel, but when a person looks closely at the data, only three countries appear to be pumping at less than full capacity: Saudi Arabia, United Arab Emirates, and Kuwait. Production rises and falls with price for these countries. It is not all that difficult to coordinate the activities of three countries, especially when one of them–Saudi Arabia–is doing most of the adjustment to oil supply. So all of OPEC’s marvelous abilities may not be all that marvelous. If Saudi Arabia knows it can sell oil it withholds from the market at a higher price later, it is not a bad move to hold a bit of oil off the market, and claim that the amount being held off the market is much higher.

In the next year, there is a significant chance that oil demand may rise. While oil supplies are at this point adequate, if demand continues to grow, we could very well see another surge in oil prices, and another test as to whether there really is spare capacity. If the supply curves shown in Figure 2 are any indication, we won’t be getting much more oil, perhaps another 1.5 million barrels a day, even if prices spike.

The one possibility that would seem to postpone such a price run-up is if world economies in the very near term start heading into major recession. Such a recession might indicate that even the current oil price is too high for economies to handle, in their weakened state.

I believe the limit on how much oil will be supplied is not the amount of oil in the ground; rather the limit is how high a price economies can afford. This in turn is tied to the true value of the oil to society–whether oil can really be used to produce goods and services to justify its price. The problems we experienced in 2008, and may experience in the not-to-distant future, suggest that we may be reaching this limit.

Related Posts

22 comments on “Will 2011 be a rerun of 2008? ”

- Comments are now closed

- Comments are now closed

Recent Comments

- SPC on

- SPC on

- Patricia Bremner to tWig on

- Richard on

- Ad on

- SPC to Psycho Milt on

- Psycho Milt to SPC on

- Psycho Milt to Nic the NZer on

- KJT on

- lprent on

- tWig on

- SPC on

- Anne on

- Barfly on

- bwaghorn on

- SPC to Psycho Milt on

- Drowsy M. Kram to gsays on

- Francesca on

- Ad on

- Nic the NZer to Psycho Milt on

- SPC on

- Kay on

- weka on

- Ad on

- SPC to Tabletennis on

- gsays to Drowsy M. Kram on

- KJT on

- SPC on

- SPC on

- SPC on

- SPC on

- SPC on

- tWig on

- Jane Leaper to Ad on

- joe90 on

- Incognito to Psycho Milt on

- aj to Res Publica on

- KJT to Res Publica on

- Nigel Haworth to Shanreagh on

- Psycho Milt to Francesca on

- Bazza64 to Res Publica on

Recent Posts

-

by KJT

-

by Mike Smith

-

by eugenedoyle

-

by advantage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Incognito

-

by lprent

-

by Mountain Tui

-

by mickysavage

-

by Incognito

-

by Mountain Tui

-

by advantage

-

by Guest post

-

by mickysavage

-

by lprent

-

by weka

-

by advantage

-

by Guest post

-

by Incognito

-

by Mountain Tui

- EGU2025 – Presentation about our translation activities

As mentioned in the recently published prolog to EGU2025 article, I submitted an abstract to talk about some of our translation activities and the challenges we have been facing with those. This blog post is a "companion article" to that presentation in session EOS4.3 Geoethics and Global Anthropogenic Change: Geoscience for Policy, ...5 minutes ago

As mentioned in the recently published prolog to EGU2025 article, I submitted an abstract to talk about some of our translation activities and the challenges we have been facing with those. This blog post is a "companion article" to that presentation in session EOS4.3 Geoethics and Global Anthropogenic Change: Geoscience for Policy, ...5 minutes ago - The drums of war revisited

On 25 April 2021, I published an internal all-staff Anzac Day message. I did so as the Secretary of the Department of Home Affairs, which is responsible for Australia’s civil defence, and its resilience in ...The StrategistBy Michael Pezzullo5 hours ago

On 25 April 2021, I published an internal all-staff Anzac Day message. I did so as the Secretary of the Department of Home Affairs, which is responsible for Australia’s civil defence, and its resilience in ...The StrategistBy Michael Pezzullo5 hours ago - Cameron Slater’s New Website: Same Old Defamation

You’ve likely noticed that the disgraced blogger of Whale Oil Beef Hooked infamy, Cameron Slater, is still slithering around the internet, peddling his bile on a shiny new blogsite calling itself The Good Oil. If you thought bankruptcy, defamation rulings, and a near-fatal health scare would teach this idiot a ...6 hours ago

You’ve likely noticed that the disgraced blogger of Whale Oil Beef Hooked infamy, Cameron Slater, is still slithering around the internet, peddling his bile on a shiny new blogsite calling itself The Good Oil. If you thought bankruptcy, defamation rulings, and a near-fatal health scare would teach this idiot a ...6 hours ago - David Seymour’s Atlas Network Receiving Unwanted Attention

The Atlas Network, a sprawling web of libertarian think tanks funded by fossil fuel barons and corporate elites, has sunk its claws into New Zealand’s political landscape. At the forefront of this insidious influence is David Seymour, the ACT Party leader, whose ties to Atlas run deep.With the National Party’s ...7 hours ago

The Atlas Network, a sprawling web of libertarian think tanks funded by fossil fuel barons and corporate elites, has sunk its claws into New Zealand’s political landscape. At the forefront of this insidious influence is David Seymour, the ACT Party leader, whose ties to Atlas run deep.With the National Party’s ...7 hours ago - Nicola Willis To Blame For Family Boost Debacle

Nicola Willis, National’s supposed Finance Minister, has delivered another policy failure with the Family Boost scheme, a childcare rebate that was big on promises but has been very small on delivery. Only 56,000 families have signed up, a far cry from the 130,000 Willis personally championed in National’s campaign. This ...8 hours ago

Nicola Willis, National’s supposed Finance Minister, has delivered another policy failure with the Family Boost scheme, a childcare rebate that was big on promises but has been very small on delivery. Only 56,000 families have signed up, a far cry from the 130,000 Willis personally championed in National’s campaign. This ...8 hours ago - Editors’ pick: ‘On the value of military service’

This article was first published on 7 February 2025. In January, I crossed the milestone of 24 years of service in two militaries—the British and Australian armies. It is fair to say that I am ...The StrategistBy Tom McDermott9 hours ago

This article was first published on 7 February 2025. In January, I crossed the milestone of 24 years of service in two militaries—the British and Australian armies. It is fair to say that I am ...The StrategistBy Tom McDermott9 hours ago - Rest easy, my friend.

He shall grow not old, as we that are left grow old.Age shall not weary him, nor the years condemn.At the going down of the sun and in the morningI will remember him.My mate Keith died yesterday, peacefully in the early hours. My dear friend in Rotorua, whom I’ve been ...Nick’s KōreroBy Nick Rockel10 hours ago

He shall grow not old, as we that are left grow old.Age shall not weary him, nor the years condemn.At the going down of the sun and in the morningI will remember him.My mate Keith died yesterday, peacefully in the early hours. My dear friend in Rotorua, whom I’ve been ...Nick’s KōreroBy Nick Rockel10 hours ago - The Hoon around the week to April 25

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on news New Zealand abstained from a vote on a global shipping levy on climate emissions and downgraded the importance ...The KakaBy Bernard Hickey11 hours ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on news New Zealand abstained from a vote on a global shipping levy on climate emissions and downgraded the importance ...The KakaBy Bernard Hickey11 hours ago - The Men Commenting on Lorde

Hi,In case you missed it, New Zealand icon Lorde has a new single out. It’s called “What Was That”, and has a very low key music video that was filmed around her impromptu performance in New York’s Washington Square Park. When police shut down the initial popup, one of my ...David FarrierBy David Farrier13 hours ago

Hi,In case you missed it, New Zealand icon Lorde has a new single out. It’s called “What Was That”, and has a very low key music video that was filmed around her impromptu performance in New York’s Washington Square Park. When police shut down the initial popup, one of my ...David FarrierBy David Farrier13 hours ago - Skeptical Science New Research for Week #17 2025

Open access notables Internal variability effect doped by climate change drove the 2023 marine heat extreme in the North Atlantic, Guinaldo et al., Communications Earth & Environment The year 2023 shattered numerous heat records both globally and regionally. We here focus on the drivers of the unprecedented warm sea surface temperature (SST) anomalies which started in ...23 hours ago

Open access notables Internal variability effect doped by climate change drove the 2023 marine heat extreme in the North Atlantic, Guinaldo et al., Communications Earth & Environment The year 2023 shattered numerous heat records both globally and regionally. We here focus on the drivers of the unprecedented warm sea surface temperature (SST) anomalies which started in ...23 hours ago - Military denial: the basis of deterrence, and of response if deterrence fails

A strategy of denial is now the cornerstone concept for Australia’s National Defence Strategy. The term’s use as an overarching guide to defence policy, however, has led to some confusion on what it actually means ...The StrategistBy Iain MacGillivray24 hours ago

A strategy of denial is now the cornerstone concept for Australia’s National Defence Strategy. The term’s use as an overarching guide to defence policy, however, has led to some confusion on what it actually means ...The StrategistBy Iain MacGillivray24 hours ago - Fiscal failure

The IMF’s twice-yearly World Economic Outlook and Fiscal Monitor publications have come out in the last couple of days. If there is gloom in the GDP numbers (eg this chart for the advanced countries, and we don’t score a lot better on the comparable one for the 2019 to ...Croaking CassandraBy Michael Reddell1 day ago

The IMF’s twice-yearly World Economic Outlook and Fiscal Monitor publications have come out in the last couple of days. If there is gloom in the GDP numbers (eg this chart for the advanced countries, and we don’t score a lot better on the comparable one for the 2019 to ...Croaking CassandraBy Michael Reddell1 day ago - Climate Change: Fucking the ETS again

For a while, it looked like the government had unfucked the ETS, at least insofar as unit settings were concerned. They had to be forced into it by a court case, but at least it got done, and when National came to power, it learned the lesson (and then fucked ...No Right TurnBy Idiot/Savant1 day ago

For a while, it looked like the government had unfucked the ETS, at least insofar as unit settings were concerned. They had to be forced into it by a court case, but at least it got done, and when National came to power, it learned the lesson (and then fucked ...No Right TurnBy Idiot/Savant1 day ago - What’s secret? When is it secret? Well, that’s complicated

The argument over US officials’ misuse of secure but non-governmental messaging platform Signal falls into two camps. Either it is a gross error that undermines national security, or it is a bit of a blunder ...The StrategistBy Kyle McCurdy1 day ago

The argument over US officials’ misuse of secure but non-governmental messaging platform Signal falls into two camps. Either it is a gross error that undermines national security, or it is a bit of a blunder ...The StrategistBy Kyle McCurdy1 day ago - Today’s Headlines: David Seymour’s ECE Risks & Coalition Government Lies

Cost of living ~1/3 of Kiwis needed help with food as cost of living pressures continue to increase - turning to friends, family, food banks or Work and Income in the past year, to find food. 40% of Kiwis also said they felt schemes offered little or no benefit, according ...Mountain TuiBy Mountain Tūī1 day ago

Cost of living ~1/3 of Kiwis needed help with food as cost of living pressures continue to increase - turning to friends, family, food banks or Work and Income in the past year, to find food. 40% of Kiwis also said they felt schemes offered little or no benefit, according ...Mountain TuiBy Mountain Tūī1 day ago - Is The NZ Media Awards Sponsored By a Conspiracy Theorist?

Hi,Perhaps in 2025 it shouldn’t come as a surprise that the CEO and owner of Voyager Internet — the major sponsor of the New Zealand Media Awards — has taken to sharing a variety of Anti-Muslim and anti-Jewish conspiracy theories to his 1.2 million followers.This included sharing a post from ...David FarrierBy David Farrier1 day ago

Hi,Perhaps in 2025 it shouldn’t come as a surprise that the CEO and owner of Voyager Internet — the major sponsor of the New Zealand Media Awards — has taken to sharing a variety of Anti-Muslim and anti-Jewish conspiracy theories to his 1.2 million followers.This included sharing a post from ...David FarrierBy David Farrier1 day ago - Australia-India defence cooperation should be about more than navies

In the sprint to deepen Australia-India defence cooperation, navy links have shot ahead of ties between the two countries’ air forces and armies. That’s largely a good thing: maritime security is at the heart of ...The StrategistBy Kim Heriot-Darragh and Gaurav Saini1 day ago

In the sprint to deepen Australia-India defence cooperation, navy links have shot ahead of ties between the two countries’ air forces and armies. That’s largely a good thing: maritime security is at the heart of ...The StrategistBy Kim Heriot-Darragh and Gaurav Saini1 day ago - When in Rome

'Cause you and me, were meant to be,Walking free, in harmony,One fine day, we'll fly away,Don't you know that Rome wasn't built in a day?Songwriters: Paul David Godfrey / Ross Godfrey / Skye Edwards.I was half expecting to see photos this morning of National Party supporters with wads of cotton ...Nick’s KōreroBy Nick Rockel1 day ago

'Cause you and me, were meant to be,Walking free, in harmony,One fine day, we'll fly away,Don't you know that Rome wasn't built in a day?Songwriters: Paul David Godfrey / Ross Godfrey / Skye Edwards.I was half expecting to see photos this morning of National Party supporters with wads of cotton ...Nick’s KōreroBy Nick Rockel1 day ago - Thursday 24 April

The PSA says a settlement with Health New Zealand over the agency’s proposed restructure of its Data and Digital and Pacific Health teams has saved around 200 roles from being cut. A third of New Zealanders have needed help accessing food in the past year, according to Consumer NZ, and ...NZCTUBy Jack McDonald1 day ago

The PSA says a settlement with Health New Zealand over the agency’s proposed restructure of its Data and Digital and Pacific Health teams has saved around 200 roles from being cut. A third of New Zealanders have needed help accessing food in the past year, according to Consumer NZ, and ...NZCTUBy Jack McDonald1 day ago - John Campbell Investigates Brian Tamaki’s Destiny Church

John Campbell’s Under His Command, a five-part TVNZ+ investigation series starting today, rips the veil off Destiny Church, exposing the rot festering under Brian Tamaki’s self-proclaimed apostolic throne. This isn’t just a church; it’s a fiefdom, built on fear, manipulation, and a trail of scandals that make your stomach churn. ...1 day ago

John Campbell’s Under His Command, a five-part TVNZ+ investigation series starting today, rips the veil off Destiny Church, exposing the rot festering under Brian Tamaki’s self-proclaimed apostolic throne. This isn’t just a church; it’s a fiefdom, built on fear, manipulation, and a trail of scandals that make your stomach churn. ...1 day ago - Decrypting tomorrow’s threats: critical infrastructure needs post-quantum protection today

Some argue we still have time, since quantum computing capable of breaking today’s encryption is a decade or more away. But breakthrough capabilities, especially in domains tied to strategic advantage, rarely follow predictable timelines. Just ...The StrategistBy Jason Van der Schyff1 day ago

Some argue we still have time, since quantum computing capable of breaking today’s encryption is a decade or more away. But breakthrough capabilities, especially in domains tied to strategic advantage, rarely follow predictable timelines. Just ...The StrategistBy Jason Van der Schyff1 day ago - Inside my quest for a climate-friendly bank

This is a re-post from Yale Climate Connections by Pearl Marvell (Photo credit: Pearl Marvell. Image credit: Samantha Harrington. Dollar bill vector image: by pch.vector on Freepik) Igrew up knowing that when you had extra money, you put it under a bed, stashed it in a book or a clock, or, ...1 day ago

This is a re-post from Yale Climate Connections by Pearl Marvell (Photo credit: Pearl Marvell. Image credit: Samantha Harrington. Dollar bill vector image: by pch.vector on Freepik) Igrew up knowing that when you had extra money, you put it under a bed, stashed it in a book or a clock, or, ...1 day ago - Winston Peters Has Lost The Plot

The political petrified piece of wood, Winston Peters, who refuses to retire gracefully, has had an eventful couple of weeks peddling transphobia, pushing bigoted policies, undertaking his unrelenting war on wokeness and slinging vile accusations like calling Green co-leader Chlöe Swarbrick a “groomer”.At 80, the hypocritical NZ First leader’s latest ...1 day ago

The political petrified piece of wood, Winston Peters, who refuses to retire gracefully, has had an eventful couple of weeks peddling transphobia, pushing bigoted policies, undertaking his unrelenting war on wokeness and slinging vile accusations like calling Green co-leader Chlöe Swarbrick a “groomer”.At 80, the hypocritical NZ First leader’s latest ...1 day ago - The one who left

It's raining in Cockermouth and we're following our host up the stairs. We’re telling her it’s a lovely building and she’s explaining that it used to be a pub and a nightclub and a backpackers, but no more.There were floods in 2009 and 2015 along the main street, huge floods, ...More Than A FeildingBy David Slack1 day ago

It's raining in Cockermouth and we're following our host up the stairs. We’re telling her it’s a lovely building and she’s explaining that it used to be a pub and a nightclub and a backpackers, but no more.There were floods in 2009 and 2015 along the main street, huge floods, ...More Than A FeildingBy David Slack1 day ago - Gordon Campbell On The Trump Upside, And Peters Persecution Of Trans People

A recurring aspect of the Trump tariff coverage is that it normalises – or even sanctifies – a status quo that in many respects has been a disaster for working class families. No doubt, Donald Trump is an uncertainty machine that is tanking the stock market and the growth prospects ...WerewolfBy ScoopEditor2 days ago

A recurring aspect of the Trump tariff coverage is that it normalises – or even sanctifies – a status quo that in many respects has been a disaster for working class families. No doubt, Donald Trump is an uncertainty machine that is tanking the stock market and the growth prospects ...WerewolfBy ScoopEditor2 days ago - Is Mark Mitchell a racist?

The National Party’s Minister of Police, Corrections, and Ethnic Communities (irony alert) has stumbled into yet another racist quagmire, proving that when it comes to bigotry, the right wing’s playbook is as predictable as it is vile. This time, Mitchell’s office reposted an Instagram reel falsely claiming that Te Pāti ...2 days ago

The National Party’s Minister of Police, Corrections, and Ethnic Communities (irony alert) has stumbled into yet another racist quagmire, proving that when it comes to bigotry, the right wing’s playbook is as predictable as it is vile. This time, Mitchell’s office reposted an Instagram reel falsely claiming that Te Pāti ...2 days ago - Australian statecraft must restore the link between deterrence and non-proliferation to survive in t...

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Alex Bristow2 days ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Alex Bristow2 days ago - J.K. Rowling – Arsehole of the Week

In a world crying out for empathy, J.K. Rowling has once again proven she’s more interested in stoking division than building bridges. The once-beloved author of Harry Potter has cemented her place as this week’s Arsehole of the Week, a title earned through her relentless, tone-deaf crusade against transgender rights. ...2 days ago

In a world crying out for empathy, J.K. Rowling has once again proven she’s more interested in stoking division than building bridges. The once-beloved author of Harry Potter has cemented her place as this week’s Arsehole of the Week, a title earned through her relentless, tone-deaf crusade against transgender rights. ...2 days ago - The rotten, unaccountable crown

Between 1950 and 1993 the New Zealand government tortured and abused up to 250,000 children in residential care facilities. They then proceeded to cover it up in order to minimise their liability, dragging out cases, slandering their victims and ultimately denying redress. In its final report, the Inquiry into Abuse ...No Right TurnBy Idiot/Savant2 days ago

Between 1950 and 1993 the New Zealand government tortured and abused up to 250,000 children in residential care facilities. They then proceeded to cover it up in order to minimise their liability, dragging out cases, slandering their victims and ultimately denying redress. In its final report, the Inquiry into Abuse ...No Right TurnBy Idiot/Savant2 days ago - To prepare for future threats, treat health security as national security

Health security is often seen as a peripheral security domain, and as a problem that is difficult to address. These perceptions weaken our capacity to respond to borderless threats. With the wind back of Covid-19 ...The StrategistBy Susanne Casey2 days ago

Health security is often seen as a peripheral security domain, and as a problem that is difficult to address. These perceptions weaken our capacity to respond to borderless threats. With the wind back of Covid-19 ...The StrategistBy Susanne Casey2 days ago - What’s on the Label -vs- What’s in the Tin.

Would our political parties pass muster under the Fair Trading Act?WHAT IF OUR POLITICAL PARTIES were subject to the Fair Trading Act? What if they, like the nation’s businesses, were prohibited from misleading their consumers – i.e. the voters – about the nature, characteristics, suitability, or quantity of the products ...2 days ago

Would our political parties pass muster under the Fair Trading Act?WHAT IF OUR POLITICAL PARTIES were subject to the Fair Trading Act? What if they, like the nation’s businesses, were prohibited from misleading their consumers – i.e. the voters – about the nature, characteristics, suitability, or quantity of the products ...2 days ago - Simeon Brown Doesn’t Consider Abortion To Be Healthcare As Services Scaled Back

Rod EmmersonThank you to my subscribers and readers - you make it all possible. Tui.Subscribe nowSix updates today from around the world and locally here in Aoteaora New Zealand -1. RFK Jnr’s Autism CrusadeAmerica plans to create a registry of people with autism in the United States. RFK Jr’s department ...Mountain TuiBy Mountain Tūī2 days ago

Rod EmmersonThank you to my subscribers and readers - you make it all possible. Tui.Subscribe nowSix updates today from around the world and locally here in Aoteaora New Zealand -1. RFK Jnr’s Autism CrusadeAmerica plans to create a registry of people with autism in the United States. RFK Jr’s department ...Mountain TuiBy Mountain Tūī2 days ago - Another Munich crisis? Understanding the limits of policymaking by analogy

We see it often enough. A democracy deals with an authoritarian state, and those who oppose concessions cite the lesson of Munich 1938: make none to dictators; take a firm stand. And so we hear ...The StrategistBy Linus Cohen and Chris Taylor2 days ago

We see it often enough. A democracy deals with an authoritarian state, and those who oppose concessions cite the lesson of Munich 1938: make none to dictators; take a firm stand. And so we hear ...The StrategistBy Linus Cohen and Chris Taylor2 days ago - Wednesday 23 April

370 perioperative nurses working at Auckland City Hospital, Starship Hospital and Greenlane Clinical Centre will strike for two hours on 1 May – the same day senior doctors are striking. This is part of nationwide events to mark May Day on 1 May, including rallies outside public hospitals, organised by ...NZCTUBy Jack McDonald2 days ago

370 perioperative nurses working at Auckland City Hospital, Starship Hospital and Greenlane Clinical Centre will strike for two hours on 1 May – the same day senior doctors are striking. This is part of nationwide events to mark May Day on 1 May, including rallies outside public hospitals, organised by ...NZCTUBy Jack McDonald2 days ago - Auckland character rules stop building on 20,000 sections

Character protections for Auckland’s villas have stymied past development. Now moves afoot to strip character protection from a bunch of inner-city villas. Photo: Lynn Grieveson / The KākāLong stories shortest from our political economy on Wednesday, April 23:Special Character Areas designed to protect villas are stopping 20,000 sites near Auckland’s ...The KakaBy Bernard Hickey2 days ago

Character protections for Auckland’s villas have stymied past development. Now moves afoot to strip character protection from a bunch of inner-city villas. Photo: Lynn Grieveson / The KākāLong stories shortest from our political economy on Wednesday, April 23:Special Character Areas designed to protect villas are stopping 20,000 sites near Auckland’s ...The KakaBy Bernard Hickey2 days ago - AI is changing Indo-Pacific naval operations

Artificial intelligence is poised to significantly transform the Indo-Pacific maritime security landscape. It offers unprecedented situational awareness, decision-making speed and operational flexibility. But without clear rules, shared norms and mechanisms for risk reduction, AI could ...The StrategistBy Jihoon Yu2 days ago

Artificial intelligence is poised to significantly transform the Indo-Pacific maritime security landscape. It offers unprecedented situational awareness, decision-making speed and operational flexibility. But without clear rules, shared norms and mechanisms for risk reduction, AI could ...The StrategistBy Jihoon Yu2 days ago - What is a Man?

For what is a man, what has he got?If not himself, then he has naughtTo say the things he truly feelsAnd not the words of one who kneelsThe record showsI took the blowsAnd did it my wayLyrics: Paul Anka.Morena folks, before we discuss Winston’s latest salvo in NZ First’s War ...Nick’s KōreroBy Nick Rockel2 days ago

For what is a man, what has he got?If not himself, then he has naughtTo say the things he truly feelsAnd not the words of one who kneelsThe record showsI took the blowsAnd did it my wayLyrics: Paul Anka.Morena folks, before we discuss Winston’s latest salvo in NZ First’s War ...Nick’s KōreroBy Nick Rockel2 days ago - Britain recasts AUKUS for a new era

Britain once risked a reputation as the weak link in the trilateral AUKUS partnership. But now the appointment of an empowered senior official to drive the project forward and a new burst of British parliamentary ...The StrategistBy Sophia Gaston3 days ago

Britain once risked a reputation as the weak link in the trilateral AUKUS partnership. But now the appointment of an empowered senior official to drive the project forward and a new burst of British parliamentary ...The StrategistBy Sophia Gaston3 days ago - Australia’s basic-metals problem: old plants and subsidised Chinese competition

Australia’s ability to produce basic metals, including copper, lead, zinc, nickel and construction steel, is in jeopardy, with ageing plants struggling against Chinese competition. The multinational commodities company Trafigura has put its Australian operations under ...The StrategistBy David Uren3 days ago

Australia’s ability to produce basic metals, including copper, lead, zinc, nickel and construction steel, is in jeopardy, with ageing plants struggling against Chinese competition. The multinational commodities company Trafigura has put its Australian operations under ...The StrategistBy David Uren3 days ago - Rob Campbell – Public Private Partnerships: What a Good Idea! OR ‘There will be no free...

There have been recent PPP debacles, both in New Zealand (think Transmission Gully) and globally, with numerous examples across both Australia and Britain of failed projects and extensive litigation by government agencies seeking redress for the failures.Rob Campbell is one of New Zealand’s sharpest critics of PPPs noting that; "There ...3 days ago

There have been recent PPP debacles, both in New Zealand (think Transmission Gully) and globally, with numerous examples across both Australia and Britain of failed projects and extensive litigation by government agencies seeking redress for the failures.Rob Campbell is one of New Zealand’s sharpest critics of PPPs noting that; "There ...3 days ago - RB spending: the Board and the Minister

On Twitter on Saturday I indicated that there had been a mistake in my post from last Thursday in which I attempted to step through the Reserve Bank Funding Agreement issues. Making mistakes (there are two) is annoying and I don’t fully understand how I did it (probably too much ...Croaking CassandraBy Michael Reddell3 days ago

On Twitter on Saturday I indicated that there had been a mistake in my post from last Thursday in which I attempted to step through the Reserve Bank Funding Agreement issues. Making mistakes (there are two) is annoying and I don’t fully understand how I did it (probably too much ...Croaking CassandraBy Michael Reddell3 days ago - Indonesia needs to rethink its approach to military drones

Indonesia’s armed forces still have a lot of work to do in making proper use of drones. Two major challenges are pilot training and achieving interoperability between the services. Another is overcoming a predilection for ...The StrategistBy Sandy Juda Pratama, Curie Maharani and Gautama Adi Kusuma3 days ago

Indonesia’s armed forces still have a lot of work to do in making proper use of drones. Two major challenges are pilot training and achieving interoperability between the services. Another is overcoming a predilection for ...The StrategistBy Sandy Juda Pratama, Curie Maharani and Gautama Adi Kusuma3 days ago - Help Stop the Gaza Genocide Through Activism

As a living breathing human being, you’ve likely seen the heart-wrenching images from Gaza...homes reduced to rubble, children burnt to cinders, families displaced, and a death toll that’s beyond comprehension. What is going on in Gaza is most definitely a genocide, the suffering is real, and it’s easy to feel ...3 days ago

As a living breathing human being, you’ve likely seen the heart-wrenching images from Gaza...homes reduced to rubble, children burnt to cinders, families displaced, and a death toll that’s beyond comprehension. What is going on in Gaza is most definitely a genocide, the suffering is real, and it’s easy to feel ...3 days ago - Willis ignores new Global Financial & Trade Crisis

Donald Trump, who has called the Chair of the Federal Reserve “a major loser”. Photo: Getty ImagesLong stories shortest from our political economy on Tuesday, April 22:US markets slump after Donald Trump threatens the Fed’s independence. China warns its trading partners not to side with the US. Trump says some ...The KakaBy Bernard Hickey3 days ago

Donald Trump, who has called the Chair of the Federal Reserve “a major loser”. Photo: Getty ImagesLong stories shortest from our political economy on Tuesday, April 22:US markets slump after Donald Trump threatens the Fed’s independence. China warns its trading partners not to side with the US. Trump says some ...The KakaBy Bernard Hickey3 days ago - One of the Good Ones

Nick’s KōreroBy Nick Rockel3 days ago

- AI is reshaping security, and the intelligence review sets good direction

The 2024 Independent Intelligence Review found the NIC to be highly capable and performing well. So, it is not a surprise that most of the 67 recommendations are incremental adjustments and small but nevertheless important ...The StrategistBy Miah Hammond-Errey3 days ago

The 2024 Independent Intelligence Review found the NIC to be highly capable and performing well. So, it is not a surprise that most of the 67 recommendations are incremental adjustments and small but nevertheless important ...The StrategistBy Miah Hammond-Errey3 days ago - A worse-than-current-policy world?

This is a re-post from The Climate Brink The world has made real progress toward tacking climate change in recent years, with spending on clean energy technologies skyrocketing from hundreds of billions to trillions of dollars globally over the past decade, and global CO2 emissions plateauing. This has contributed to a reassessment of ...3 days ago

This is a re-post from The Climate Brink The world has made real progress toward tacking climate change in recent years, with spending on clean energy technologies skyrocketing from hundreds of billions to trillions of dollars globally over the past decade, and global CO2 emissions plateauing. This has contributed to a reassessment of ...3 days ago - “An A-Grade Teacher’s Pet”

Hi,I’ve been having a peaceful month of what I’d call “existential dread”, even more aware than usual that — at some point — this all ends.It was very specifically triggered by watching Pantheon, an animated sci-fi show that I’m filing away with all-time greats like Six Feet Under, Watchmen and ...David FarrierBy David Farrier3 days ago

Hi,I’ve been having a peaceful month of what I’d call “existential dread”, even more aware than usual that — at some point — this all ends.It was very specifically triggered by watching Pantheon, an animated sci-fi show that I’m filing away with all-time greats like Six Feet Under, Watchmen and ...David FarrierBy David Farrier3 days ago - Gordon Campbell On Papal Picks, And India As A Defence Ally

Once the formalities of honouring the late Pope wrap up in two to three weeks time, the conclave of Cardinals will go into seclusion. Some 253 of the current College of Cardinals can take part in the debate over choosing the next Pope, but only 138 of them are below ...WerewolfBy ScoopEditor4 days ago

Once the formalities of honouring the late Pope wrap up in two to three weeks time, the conclave of Cardinals will go into seclusion. Some 253 of the current College of Cardinals can take part in the debate over choosing the next Pope, but only 138 of them are below ...WerewolfBy ScoopEditor4 days ago - The National Party’s Prison Pipeline Ruining New Zealand

The National Party government is doubling down on a grim, regressive vision for the future: more prisons, more prisoners, and a society fractured by policies that punish rather than heal. This isn’t just a misstep; it’s a deliberate lurch toward a dystopian future where incarceration is the answer to every ...4 days ago

The National Party government is doubling down on a grim, regressive vision for the future: more prisons, more prisoners, and a society fractured by policies that punish rather than heal. This isn’t just a misstep; it’s a deliberate lurch toward a dystopian future where incarceration is the answer to every ...4 days ago - Don Brash’s NZME Power Grab Must Be Rejected

4 days ago

- 2025 SkS Weekly Climate Change & Global Warming News Roundup #16

A listing of 28 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 13, 2025 thru Sat, April 19, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...5 days ago

A listing of 28 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 13, 2025 thru Sat, April 19, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...5 days ago - The “perfect storm” National can use to consolidate slash’n’burn policy is here…

“What I’d say to you is…” our Prime Minister might typically begin a sentence, when he’s about to obfuscate and attempt to derail the question you really, really want him to answer properly (even once would be okay, Christopher). Questions such as “Why is a literal election promise over ...exhALANtBy exhalantblog5 days ago

“What I’d say to you is…” our Prime Minister might typically begin a sentence, when he’s about to obfuscate and attempt to derail the question you really, really want him to answer properly (even once would be okay, Christopher). Questions such as “Why is a literal election promise over ...exhALANtBy exhalantblog5 days ago - Economic Futures – Climate Change and Modernity

Ruth IrwinExponential Economic growth is the driver of Ecological degradation. It is driven by CO2 greenhouse gas emissions through fossil fuel extraction and burning for the plethora of polluting industries. Extreme weather disasters and Climate change will continue to get worse because governments subscribe to the current global economic system, ...5 days ago

Ruth IrwinExponential Economic growth is the driver of Ecological degradation. It is driven by CO2 greenhouse gas emissions through fossil fuel extraction and burning for the plethora of polluting industries. Extreme weather disasters and Climate change will continue to get worse because governments subscribe to the current global economic system, ...5 days ago - Winning Together

A man on telly tries to tell me what is realBut it's alright, I like the way that feelsAnd everybody singsWe are evolving from night to morningAnd I wanna believe in somethingWriter: Adam Duritz.The world is changing rapidly, over the last year or so, it has been out with the ...Nick’s KōreroBy Nick Rockel5 days ago

A man on telly tries to tell me what is realBut it's alright, I like the way that feelsAnd everybody singsWe are evolving from night to morningAnd I wanna believe in somethingWriter: Adam Duritz.The world is changing rapidly, over the last year or so, it has been out with the ...Nick’s KōreroBy Nick Rockel5 days ago - My Food Bag’s Cecilia Robinson Courts Your Money For Health

MFB Co-Founder Cecilia Robinson runs Tend HealthcareSummary:Kieran McAnulty calls out National on healthcare lies and says Health Minister Simeon Brown is “dishonest and disingenuous” (video below)McAnulty says negotiation with doctors is standard practice, but this level of disrespect is not, especially when we need and want our valued doctors.National’s $20bn ...Mountain TuiBy Mountain Tūī5 days ago

MFB Co-Founder Cecilia Robinson runs Tend HealthcareSummary:Kieran McAnulty calls out National on healthcare lies and says Health Minister Simeon Brown is “dishonest and disingenuous” (video below)McAnulty says negotiation with doctors is standard practice, but this level of disrespect is not, especially when we need and want our valued doctors.National’s $20bn ...Mountain TuiBy Mountain Tūī5 days ago - The Case Against Chris Luxon Remaining PM

Chris Luxon’s tenure as New Zealand’s Prime Minister has been a masterclass in incompetence, marked by coalition chaos, economic lethargy, verbal gaffes, and a moral compass that seems to point wherever political expediency lies. The former Air New Zealand CEO (how could we forget?) was sold as a steady hand, ...5 days ago

Chris Luxon’s tenure as New Zealand’s Prime Minister has been a masterclass in incompetence, marked by coalition chaos, economic lethargy, verbal gaffes, and a moral compass that seems to point wherever political expediency lies. The former Air New Zealand CEO (how could we forget?) was sold as a steady hand, ...5 days ago - Cameron Slater’s Creepy Fixation On Jacinda Ardern

Has anybody else noticed Cameron Slater still obsessing over Jacinda Ardern? The disgraced Whale Oil blogger seems to have made it his life’s mission to shadow the former Prime Minister of New Zealand like some unhinged stalker lurking in the digital bushes.The man’s obsession with Ardern isn't just unhealthy...it’s downright ...5 days ago

Has anybody else noticed Cameron Slater still obsessing over Jacinda Ardern? The disgraced Whale Oil blogger seems to have made it his life’s mission to shadow the former Prime Minister of New Zealand like some unhinged stalker lurking in the digital bushes.The man’s obsession with Ardern isn't just unhealthy...it’s downright ...5 days ago - Fact brief – Is climate change a net benefit for society?

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is climate change a net benefit for society? Human-caused climate change has been a net detriment to society as measured by loss of ...6 days ago

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is climate change a net benefit for society? Human-caused climate change has been a net detriment to society as measured by loss of ...6 days ago - National’s Water Done Well Will Cost Ratepayers More

When the National Party hastily announced its “Local Water Done Well” policy, they touted it as the great saviour of New Zealand’s crumbling water infrastructure. But as time goes by it's looking more and more like a planning and fiscal lame duck...and one that’s going to cost ratepayers far more ...6 days ago

When the National Party hastily announced its “Local Water Done Well” policy, they touted it as the great saviour of New Zealand’s crumbling water infrastructure. But as time goes by it's looking more and more like a planning and fiscal lame duck...and one that’s going to cost ratepayers far more ...6 days ago - Trump’s Tariff Tantrum Is Causing Economic Chaos

Donald Trump, the orange-hued oligarch, is back at it again, wielding tariffs like a mob boss swinging a lead pipe. His latest economic edict; slapping hefty tariffs on imports from China, Mexico, and Canada, has the stench of a protectionist shakedown, cooked up in the fevered minds of his sycophantic ...6 days ago

Donald Trump, the orange-hued oligarch, is back at it again, wielding tariffs like a mob boss swinging a lead pipe. His latest economic edict; slapping hefty tariffs on imports from China, Mexico, and Canada, has the stench of a protectionist shakedown, cooked up in the fevered minds of his sycophantic ...6 days ago - The ‘China’ challenge: now a multi-generational test for Australian strategy

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy James Corera and Bethany Allen6 days ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy James Corera and Bethany Allen6 days ago - White Rabbit

One pill makes you largerAnd one pill makes you smallAnd the ones that mother gives youDon't do anything at allGo ask AliceWhen she's ten feet tallSongwriter: Grace Wing Slick.Morena, all, and a happy Bicycle Day to you.Today is an unofficial celebration of the dawning of the psychedelic era, commemorating the ...Nick’s KōreroBy Nick Rockel6 days ago

One pill makes you largerAnd one pill makes you smallAnd the ones that mother gives youDon't do anything at allGo ask AliceWhen she's ten feet tallSongwriter: Grace Wing Slick.Morena, all, and a happy Bicycle Day to you.Today is an unofficial celebration of the dawning of the psychedelic era, commemorating the ...Nick’s KōreroBy Nick Rockel6 days ago - Why Has The World Forgotten About Hollywood?

It’s only been a few months since the Hollywood fires tore through Los Angeles, leaving a trail of devastation, numerous deaths, over 10,000 homes reduced to rubble, and a once glorious film industry on its knees. The Palisades and Eaton fires, fueled by climate-driven dry winds, didn’t just burn houses; ...7 days ago

It’s only been a few months since the Hollywood fires tore through Los Angeles, leaving a trail of devastation, numerous deaths, over 10,000 homes reduced to rubble, and a once glorious film industry on its knees. The Palisades and Eaton fires, fueled by climate-driven dry winds, didn’t just burn houses; ...7 days ago - Viennese Refugees Who Changed the Way We Think

Four eighty-year-old books which are still vitally relevant today. Between 1942 and 1945, four refugees from Vienna each published a ground-breaking – seminal – book.* They left their country after Austria was taken over by fascists in 1934 and by Nazi Germany in 1938. Previously they had lived in ‘Red ...PunditBy Brian Easton7 days ago

Four eighty-year-old books which are still vitally relevant today. Between 1942 and 1945, four refugees from Vienna each published a ground-breaking – seminal – book.* They left their country after Austria was taken over by fascists in 1934 and by Nazi Germany in 1938. Previously they had lived in ‘Red ...PunditBy Brian Easton7 days ago - Disputationes adversus astrologiam divinatricem, by Giovanni Pico della Mirandola (1496): A Complete...

Good Friday, 18th April, 2025: I can at last unveil the Secret Non-Fiction Project. The first complete Latin-to-English translation of Giovanni Pico della Mirandola’s twelve-book Disputationes adversus astrologiam divinatricem (Disputations Against Divinatory Astrology). Amounting to some 174,000 words, total. Some context is probably in order. Giovanni Pico della Mirandola (1463-1494) ...A Phuulish FellowBy strda2211 week ago

Good Friday, 18th April, 2025: I can at last unveil the Secret Non-Fiction Project. The first complete Latin-to-English translation of Giovanni Pico della Mirandola’s twelve-book Disputationes adversus astrologiam divinatricem (Disputations Against Divinatory Astrology). Amounting to some 174,000 words, total. Some context is probably in order. Giovanni Pico della Mirandola (1463-1494) ...A Phuulish FellowBy strda2211 week ago - Hamish Campbell Lied About His Links With Two By Twos Cult

National MP Hamish Campbell's pathetic attempt to downplay his deep ties to and involvement in the Two by Twos...a secretive religious sect under FBI and NZ Police investigation for child sexual abuse...isn’t just a misstep; it’s a calculated lie that insults the intelligence of every Kiwi voter.Campbell’s claim of being ...1 week ago

National MP Hamish Campbell's pathetic attempt to downplay his deep ties to and involvement in the Two by Twos...a secretive religious sect under FBI and NZ Police investigation for child sexual abuse...isn’t just a misstep; it’s a calculated lie that insults the intelligence of every Kiwi voter.Campbell’s claim of being ...1 week ago - Is Shane Jones The Most Corrupt Politician in New Zealand?

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...1 week ago

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...1 week ago - Good Friday

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel1 week ago

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel1 week ago - Luxon Turns A Blind Eye to Homelessness

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...1 week ago

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...1 week ago - The Hoon around the week to April 18

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey1 week ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey1 week ago - Simeon Brown Has Caused The Doctor’s Strike

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...1 week ago

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...1 week ago - Skeptical Science New Research for Week #16 2025

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...1 week ago

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...1 week ago - Whatever Happened to Cactus Kate?

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...1 week ago

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...1 week ago - Sovereign capability can benefit Australia—up to a point

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah1 week ago

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah1 week ago

Related Posts

- Education Should be Led by Experts-Not Economists

Te Pāti Māori are appalled by Cabinet's decision to agree to 15 recommendations to the Early Childhood Education (ECE) sector following the regulatory review by the Ministry of Regulation. We emphasise the need to prioritise tamariki Māori in Early Childhood Education, conducted by education experts- not economists. “Our mokopuna deserve ...23 hours ago

Te Pāti Māori are appalled by Cabinet's decision to agree to 15 recommendations to the Early Childhood Education (ECE) sector following the regulatory review by the Ministry of Regulation. We emphasise the need to prioritise tamariki Māori in Early Childhood Education, conducted by education experts- not economists. “Our mokopuna deserve ...23 hours ago - Release: Govt’s flagship cost of living policy a failure

After promising $250 a fortnight to many families, the Government has been forced to admit just a couple hundred families are receiving it. ...1 day ago

After promising $250 a fortnight to many families, the Government has been forced to admit just a couple hundred families are receiving it. ...1 day ago - Release: Transparency needed on changes to early childhood education

The Government is putting children at risk in early childhood education (ECE) by proposing to loosen the requirement for qualified teachers. ...1 day ago

The Government is putting children at risk in early childhood education (ECE) by proposing to loosen the requirement for qualified teachers. ...1 day ago - Release: Govt funding needed to combat invasive seaweed

The Government must support Northland hapū who have resorted to rakes and buckets to try to control a devastating invasive seaweed that threatens the local economy and environment. ...3 days ago

The Government must support Northland hapū who have resorted to rakes and buckets to try to control a devastating invasive seaweed that threatens the local economy and environment. ...3 days ago - New Zealand First Introduces Bill Defining ‘Woman’ and ‘Man’ in Law

New Zealand First has today introduced a Member’s Bill that would ensure the biological definition of a woman and man are defined in law. “This is not about being anti-anyone or anti-anything. This is about ensuring we as a country focus on the facts of biology and protect the ...3 days ago

New Zealand First has today introduced a Member’s Bill that would ensure the biological definition of a woman and man are defined in law. “This is not about being anti-anyone or anti-anything. This is about ensuring we as a country focus on the facts of biology and protect the ...3 days ago - Release: Labour marks the passing of Pope Francis

4 days ago

- Release: Boot camps blog post fails to provide clarity

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...1 week ago

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...1 week ago - Release: Inflation rises and families feel the squeeze

1 week ago

- Release: Govt doesn’t know how to fund new hospitals

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 week ago

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 week ago - Release: $10 million for only 215 students in charter schools

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 week ago

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 week ago - Release: Food prices further stretching the family budget

Families already stretched by rising costs will struggle with the news food prices are going up again. ...1 week ago

Families already stretched by rising costs will struggle with the news food prices are going up again. ...1 week ago - Release: Mental health staff and patients at risk without plan

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...2 weeks ago

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...2 weeks ago - Release: Driver licensing proposal doesn’t put safety first

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...2 weeks ago

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...2 weeks ago - Release: Students struggling as Govt sits on hands

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...2 weeks ago

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...2 weeks ago - Release: More must be done to stop children going hungry

More children are going hungry and statistics showing children in material hardship continue to get worse. ...2 weeks ago

More children are going hungry and statistics showing children in material hardship continue to get worse. ...2 weeks ago - Greens continue to call for Pacific Visa Waiver

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...2 weeks ago

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...2 weeks ago - More children going hungry under Coalition govt

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...2 weeks ago

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...2 weeks ago - Release: Longer wait for treatment under National

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...2 weeks ago

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...2 weeks ago - Ka mate te Pire- Ka ora te mana o Te Tiriti o Waitangi me te iwi Māori

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...2 weeks ago

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...2 weeks ago - Chris Hipkins speech: Treaty Principles Bill second reading

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...2 weeks ago

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...2 weeks ago - Release: End to the Treaty Principles Bill, but challenges remain ahead for Aotearoa

2 weeks ago

- Ka mate te Pire, ka ora Te Tiriti o Waitangi – Treaty Principles Bill dead, Te Tiriti o Waitangi m...

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...2 weeks ago

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...2 weeks ago - Member’s Bill an opportunity for climate action

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...2 weeks ago

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...2 weeks ago - Release: Bill to make trading laws fairer passes first hurdle

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...2 weeks ago

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...2 weeks ago - Release: Reserve Bank acts while Govt shrugs

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...2 weeks ago

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...2 weeks ago - Release: Property Law Amendment Bill pulled from ballot

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...2 weeks ago

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...2 weeks ago - Release: More children at risk of losing family connections

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...2 weeks ago

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...2 weeks ago - Release: David Parker made a difference – Hipkins

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...2 weeks ago

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...2 weeks ago - Release: David Parker to step down from Parliament

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...2 weeks ago

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...2 weeks ago - Release: Flaws in Govt’s climate strategy will cost us money

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...3 weeks ago

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...3 weeks ago - Green Party differing view on the Treaty Principles Bill

3 weeks ago

Related Posts

- ER Report: A Roundup of Significant Articles on EveningReport.nz for April 25, 2025

ER Report: Here is a summary of significant articles published on EveningReport.nz on April 25, 2025. Labor takes large leads in YouGov and Morgan polls as surge continuesSource: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and ...Evening ReportBy Evening Report2 hours ago

ER Report: Here is a summary of significant articles published on EveningReport.nz on April 25, 2025. Labor takes large leads in YouGov and Morgan polls as surge continuesSource: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and ...Evening ReportBy Evening Report2 hours ago - Labor takes large leads in YouGov and Morgan polls as surge continues

Source: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and Statistics, The University of Melbourne With just eight days until the May 3 federal election, and with in-person early voting well under way, Labor has taken a ...Evening ReportBy The Conversation3 hours ago

Source: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and Statistics, The University of Melbourne With just eight days until the May 3 federal election, and with in-person early voting well under way, Labor has taken a ...Evening ReportBy The Conversation3 hours ago - The Unity Books bestseller chart for the week ending April 25

The only published and available best-selling indie book chart in New Zealand is the top 10 sales list recorded every week at Unity Books’ stores in High St, Auckland, and Willis St, Wellington. AUCKLAND 1 Butter by Asako Yuzuki (Fourth Estate, $35) Fictionalised true crime for foodies. 2 Sunrise on ...The SpinoffBy The Spinoff Review of Books3 hours ago

The only published and available best-selling indie book chart in New Zealand is the top 10 sales list recorded every week at Unity Books’ stores in High St, Auckland, and Willis St, Wellington. AUCKLAND 1 Butter by Asako Yuzuki (Fourth Estate, $35) Fictionalised true crime for foodies. 2 Sunrise on ...The SpinoffBy The Spinoff Review of Books3 hours ago - Beating malaria: what can be done with shrinking funds and rising threats

Source: The Conversation (Au and NZ) – By Taneshka Kruger, UP ISMC: Project Manager and Coordinator, University of Pretoria Healthcare in Africa faces a perfect storm: high rates of infectious diseases like malaria and HIV, a rise in non-communicable diseases, and dwindling foreign aid. In 2021, nearly half of ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Taneshka Kruger, UP ISMC: Project Manager and Coordinator, University of Pretoria Healthcare in Africa faces a perfect storm: high rates of infectious diseases like malaria and HIV, a rise in non-communicable diseases, and dwindling foreign aid. In 2021, nearly half of ...Evening ReportBy The Conversation6 hours ago - The best things from Australia and Aotearoa to watch this weekend

Australia and New Zealand join forces once more to bring you the best films and TV shows to watch this weekend. This Anzac Day, our free-to-air TV channels will screen a variety of commemorative coverage. At 11am, TVNZ1 has live coverage of the Anzac Day National Commemorative Service in Wellington. ...The SpinoffBy Group Think7 hours ago

Australia and New Zealand join forces once more to bring you the best films and TV shows to watch this weekend. This Anzac Day, our free-to-air TV channels will screen a variety of commemorative coverage. At 11am, TVNZ1 has live coverage of the Anzac Day National Commemorative Service in Wellington. ...The SpinoffBy Group Think7 hours ago - Lest we forget? The shame of our two-tier veteran system

Our laws are leaving many veterans who served after 1974 out in the cold. I know, because I’m one of them. This Sunday Essay was made possible thanks to the support of Creative New Zealand. First published in 2024. As I write this story, I am in constant pain. My hands ...The SpinoffBy James Graham8 hours ago

Our laws are leaving many veterans who served after 1974 out in the cold. I know, because I’m one of them. This Sunday Essay was made possible thanks to the support of Creative New Zealand. First published in 2024. As I write this story, I am in constant pain. My hands ...The SpinoffBy James Graham8 hours ago - Cross-party hope for anti-trafficking legislation

An MP fighting for anti-trafficking legislation says it is hard for prosecutors to take cases to court - but he is hopeful his bill will turn the tide. ...8 hours ago

An MP fighting for anti-trafficking legislation says it is hard for prosecutors to take cases to court - but he is hopeful his bill will turn the tide. ...8 hours ago - Bestselling books at Anzac weekend

NONFICTION1 No Words for This by Ali Mau (HarperCollins, $39.99)

NONFICTION1 No Words for This by Ali Mau (HarperCollins, $39.99) 2 Everyday Comfort Food by Vanya Insull (Allen & Unwin, $39.99)

2 Everyday Comfort Food by Vanya Insull (Allen & Unwin, $39.99) 3 Three Wee Bookshops at the End of the World by Ruth Shaw (Allen & Unwin, $39.99)NewsroomBy Steve Braunias10 hours ago

3 Three Wee Bookshops at the End of the World by Ruth Shaw (Allen & Unwin, $39.99)NewsroomBy Steve Braunias10 hours ago - Governor-General’s Anzac Day Dawn Service Address

This Anzac Day marks 110 years since the Gallipoli landings by soldiers in the Australian and New Zealand Army Corps - the ANZACS. It signalled the beginning of a campaign that was to take the lives of so many of our young men - and would devastate the ...10 hours ago

This Anzac Day marks 110 years since the Gallipoli landings by soldiers in the Australian and New Zealand Army Corps - the ANZACS. It signalled the beginning of a campaign that was to take the lives of so many of our young men - and would devastate the ...10 hours ago - New Zealand’s role in the mass deportation of Koreans from post-WWII Japan

The violent deportation of migrants is not new, and New Zealand forces had a hand in such a regime after World War II, writes historian Scott Hamilton. The world is watching the new Trump government wage a war against migrants it deems illegal. Immigration and Customs Enforcement (ICE) officials and ...The SpinoffBy Scott Hamilton12 hours ago

The violent deportation of migrants is not new, and New Zealand forces had a hand in such a regime after World War II, writes historian Scott Hamilton. The world is watching the new Trump government wage a war against migrants it deems illegal. Immigration and Customs Enforcement (ICE) officials and ...The SpinoffBy Scott Hamilton12 hours ago - David Hill: Seize the day

While Anzac Day has experienced a resurgence in recent years, our other day of remembrance has slowly faded from view. This Sunday Essay was made possible thanks to the support of Creative New Zealand. Original illustrations by Hope McConnell. First published in 2022. The high school’s head girl and ...The SpinoffBy David Hill12 hours ago

While Anzac Day has experienced a resurgence in recent years, our other day of remembrance has slowly faded from view. This Sunday Essay was made possible thanks to the support of Creative New Zealand. Original illustrations by Hope McConnell. First published in 2022. The high school’s head girl and ...The SpinoffBy David Hill12 hours ago - The Friday Poem: ‘Te Hono ki Īhipa’ by Aperahama Hurihanganui