Will 2011 be a rerun of 2008?

Will 2011 be a rerun of 2008?

Written By:

Guest post - Date published:

12:20 pm, January 12th, 2011 - 22 comments

Categories: Economy -

Tags: peak oil, recession, the oil drum

This post has been borrowed from the excellent site theoildrum.com, after originally being published on ourfiniteworld.com.

We all remember the oil price run-up (and run back down) of 2008. Now, with prices similar to where they were in the fall of 2007, the question quite naturally arises as to whether we are headed for another similar scenario.

Of course, we know that the scenario cannot really be the same. World economies are now much weaker than in late 2007. Several countries are having problems with debt, even with oil at its current price. If the oil price rises by $20 or $30 or $40 barrel, we can be pretty sure that those countries will be in much worse financial condition. And while governments have learned to deal with collapsing banks, citizens have a “been there, done that” attitude. They may not be as willing to bail out banks that seem to be contributing to the problems of the day.

If we look back at what happened three years ago, there was a huge run up in the price of oil, but very little change in oil supply.

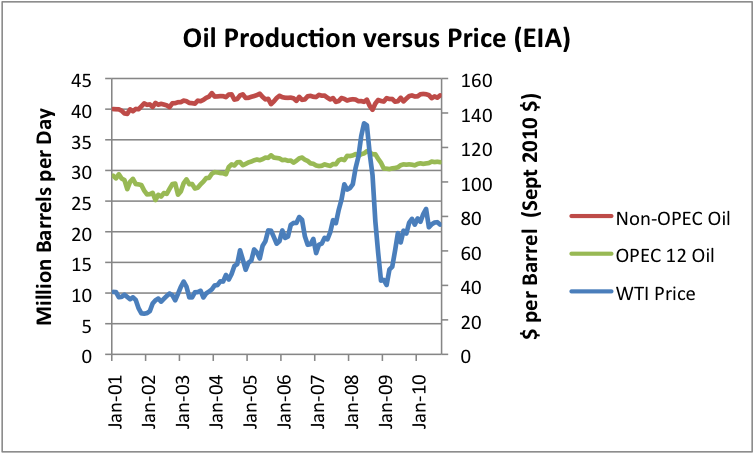

Figure 1. Production of oil (crude and condensate) for OPEC and Non-OPEC countries, compared to West Texas intermediate oil price, in September 2010$. Based on EIA data.

Oil price roughly corresponded to today’s price in October 2007. Between then and July 2008 (the peak in both prices and production), OPEC increased its oil supply by 1.3 million barrels. Non-OPEC actually decreased its supply by about 0.3 million barrels a day between October 2007 and July 2008, providing a net increase in oil supply of only about 1 million barrels a day, despite the huge run-up in prices.

It can be seen from the above graph that the supply of OPEC oil has tended to increase, as oil prices increase. Non-OPEC supply has been much less responsive to price. This is another way of graphing the relationship between oil price and oil production:

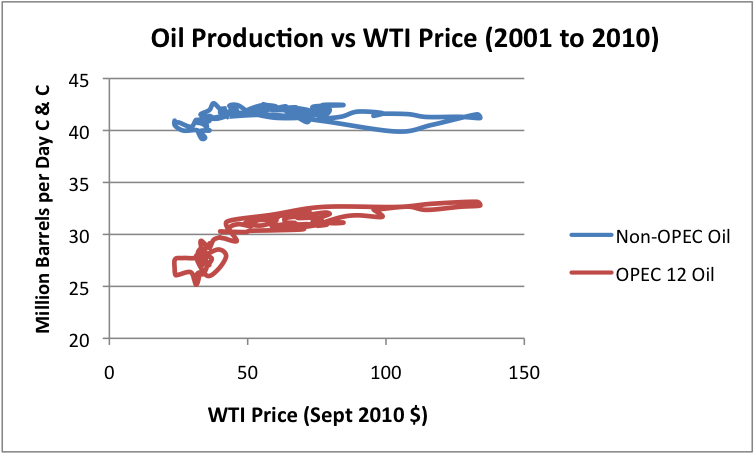

Figure 2. Relationship of oil production (crude and condensate) and West Texas Intermediate price, expressed in September 2010 $, based on monthly EIA data from January 2001 through September 2010.

In Figure 2, as oil price increases along the horizontal axis, we see that non-OPEC oil production remains virtually flat. As oil price increases for the OPEC 12, we see the kind of supply curve we might expect to see for a supplier that has a small amount of more expensive capacity that it can put on line when prices justify it. The catch is that the amount of supply added as prices rise isn’t really very much–as we just saw, 1.3 million barrels a day, between October 2007 and July 2008.

Eventually, the economy could not handle the high oil prices, and prices dropped. Credit availability began dropping and recession became a greater and greater issue.

Will this time be different? It seems to me that OPEC has done a good job of convincing the world that it has a lot of extra supply, but it is less than clear that it has much more excess capacity than it had in the 2007-2008 period. OPEC shows this image on its website, but this may just be a long-standing approach aimed at convincing the world that it has more oil (and power) than it really does.

Figure 3. OPEC’s view of its own spare capacity.

Spare capacity, like oil reserves, is not audited. The higher the numbers proclaimed to the world, the more powerful OPEC appears, both in the eyes of its own people, and in the eyes of people around the world. OPEC shows lists of new projects and investment amounts, but it is not clear that the new capacity being added is more than what is needed to offset declines in other fields. The new production amounts listed (shown separately by country–this is the one for Saudi Arabia) come to something like 6% of production – this could simply represent offsets to declines in fields elsewhere. The problem is we really don’t know, because no auditing is ever done. We are just expected to trust Saudi Arabia and OPEC on a matter of importance to the world.

OPEC tells us it is acting as a cartel, but when a person looks closely at the data, only three countries appear to be pumping at less than full capacity: Saudi Arabia, United Arab Emirates, and Kuwait. Production rises and falls with price for these countries. It is not all that difficult to coordinate the activities of three countries, especially when one of them–Saudi Arabia–is doing most of the adjustment to oil supply. So all of OPEC’s marvelous abilities may not be all that marvelous. If Saudi Arabia knows it can sell oil it withholds from the market at a higher price later, it is not a bad move to hold a bit of oil off the market, and claim that the amount being held off the market is much higher.

In the next year, there is a significant chance that oil demand may rise. While oil supplies are at this point adequate, if demand continues to grow, we could very well see another surge in oil prices, and another test as to whether there really is spare capacity. If the supply curves shown in Figure 2 are any indication, we won’t be getting much more oil, perhaps another 1.5 million barrels a day, even if prices spike.

The one possibility that would seem to postpone such a price run-up is if world economies in the very near term start heading into major recession. Such a recession might indicate that even the current oil price is too high for economies to handle, in their weakened state.

I believe the limit on how much oil will be supplied is not the amount of oil in the ground; rather the limit is how high a price economies can afford. This in turn is tied to the true value of the oil to society–whether oil can really be used to produce goods and services to justify its price. The problems we experienced in 2008, and may experience in the not-to-distant future, suggest that we may be reaching this limit.

Related Posts

22 comments on “Will 2011 be a rerun of 2008? ”

- Comments are now closed

- Comments are now closed

Recent Comments

- SPC on

- SPC on

- Bruce on

- Mac1 to Drowsy M. Kram on

- Ad on

- gsays on

- thinker on

- adam to Patricia Bremner on

- adam on

- Dennis Frank on

- aj on

- adam on

- SPC on

- Mountain Tui to Incognito on

- Pippa Coom to lprent on

- SPC on

- tWig to Obtrectator on

- Dennis Frank on

- Drowsy M. Kram to Mac1 on

- Incognito to Mountain Tui on

- lprent on

- Subliminal on

- Mountain Tui on

- Obtrectator to lprent on

- Ffloyd on

- Mike the Lefty to Nordy on

- Mac1 on

- Reality on

- Belladonna to Anne on

- Belladonna to Patricia Bremner on

- Belladonna to lprent on

- lprent on

- Belladonna to Patricia Bremner on

- lprent to Belladonna on

- bwaghorn on

- lprent to Obtrectator on

- Obtrectator to Dennis Frank on

- tWig on

- Dennis Frank to Muttonbird on

- tWig to Muttonbird on

- tWig to Dennis Frank on

- Mountain Tui to DS on

- Joe90 on

- SPC on

- SPC to Obtrectator on

- SPC to Dennis Frank on

- Muttonbird on

- SPC on

- Muttonbird to Dennis Frank on

- Dennis Frank on

- joe90 on

- Dennis Frank on

- Obtrectator on

- gsays to Subliminal on

Recent Posts

-

by lprent

-

by lprent

-

by Mountain Tui

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by Guest post

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by mickysavage

- No Enemies To The Left – Or The Right.

Wrong Turn: Labour and National can only reduce the toxic influence of their electoral competitors by rejecting their extremism.“NO ENEMIES TO THE LEFT” has always been Labour’s rule-of-thumb. What, after all, does a moderate, left-of-centre party gain by allowing its electoral rivals to become repositories for every radical (i.e. congenitally dissatisfied) ...55 mins ago

Wrong Turn: Labour and National can only reduce the toxic influence of their electoral competitors by rejecting their extremism.“NO ENEMIES TO THE LEFT” has always been Labour’s rule-of-thumb. What, after all, does a moderate, left-of-centre party gain by allowing its electoral rivals to become repositories for every radical (i.e. congenitally dissatisfied) ...55 mins ago - All the tools we need

Off I went yesterday, me and my little ear robots, to a workshop.Did I hear every word? Reader, I most surely did. Did I have to ask anyone to repeat themselves? I did not, not one single time.Ironically, the subject of the workshop was one that prompts many to cover ...More Than A FeildingBy David Slack58 mins ago

Off I went yesterday, me and my little ear robots, to a workshop.Did I hear every word? Reader, I most surely did. Did I have to ask anyone to repeat themselves? I did not, not one single time.Ironically, the subject of the workshop was one that prompts many to cover ...More Than A FeildingBy David Slack58 mins ago - Join us for the weekly Hoon on YouTube Live at 5pm

The KakaBy Bernard Hickey1 hour ago

- An Unending Nightmare.

Hate Will Find A Way: Historians divide into those who see Zionism as the only sane answer to the Jews’ historic vulnerability; and those who regard the Zionist “entity” as a purely colonial construct, founded in racism and shrouded in mythology. The moralists of both camps, meanwhile, demonstrate a capacity for ...1 hour ago

Hate Will Find A Way: Historians divide into those who see Zionism as the only sane answer to the Jews’ historic vulnerability; and those who regard the Zionist “entity” as a purely colonial construct, founded in racism and shrouded in mythology. The moralists of both camps, meanwhile, demonstrate a capacity for ...1 hour ago - A Fast-Track Backwards.

Dubious Destination: What New Zealanders face in the National-Act-NZ First Coalition Government is an attempt to return the country to the policy settings of half-a-century ago. What Infrastructure Minister Chris Bishop’s fast-track legislation is designed to rehabilitate and revivify is the “national development” mindset of the 1970s and 80s.IT IS RARE ...2 hours ago

Dubious Destination: What New Zealanders face in the National-Act-NZ First Coalition Government is an attempt to return the country to the policy settings of half-a-century ago. What Infrastructure Minister Chris Bishop’s fast-track legislation is designed to rehabilitate and revivify is the “national development” mindset of the 1970s and 80s.IT IS RARE ...2 hours ago - Waiting By The River.

Looking Sideways: To the Peoples Republic of China, and its friends around the world, the United States must remind them of the flailing and failing Chinese Empire of 1900.WATCHING THE SCREEN in Oamaru’s Majestic picture theatre, I struggled to make sense of Fifty-Five Days At Peking. Yes, it was exciting, ...2 hours ago

Looking Sideways: To the Peoples Republic of China, and its friends around the world, the United States must remind them of the flailing and failing Chinese Empire of 1900.WATCHING THE SCREEN in Oamaru’s Majestic picture theatre, I struggled to make sense of Fifty-Five Days At Peking. Yes, it was exciting, ...2 hours ago - National’s fast-track fucks our future

A few years ago, we looked to be on-track to a decarbonised future, with an international consortium led by BlueFloat Energy announcing plans for huge offshore windfarms off Taranaki and Waikato. But National's corrupt fast-track law just fucked all that: Spanish offshore wind developer BlueFloat Energy is cancelling plans ...No Right TurnBy Idiot/Savant3 hours ago

A few years ago, we looked to be on-track to a decarbonised future, with an international consortium led by BlueFloat Energy announcing plans for huge offshore windfarms off Taranaki and Waikato. But National's corrupt fast-track law just fucked all that: Spanish offshore wind developer BlueFloat Energy is cancelling plans ...No Right TurnBy Idiot/Savant3 hours ago - NZCTU alarmed at further cuts to WorkSafe

WorkSafe’s announcement that it is planning even further restructuring and cuts just months after losing 15% of its staff has alarmed the NZCTU Te Kauae Kaimahi. “Our health and safety regulator is a critical component of our health and safety system, and we know it already has an undercooked capacity ...NZCTUBy Jeremiah Boniface4 hours ago

WorkSafe’s announcement that it is planning even further restructuring and cuts just months after losing 15% of its staff has alarmed the NZCTU Te Kauae Kaimahi. “Our health and safety regulator is a critical component of our health and safety system, and we know it already has an undercooked capacity ...NZCTUBy Jeremiah Boniface4 hours ago - Member’s morning

Today the House is in an extended sitting, devoted to Member's Business as a catch-up for time stolen by the government in urgency. First up was the second reading of the Restoring Citizenship Removed By Citizenship (Western Samoa) Act 1982 Bill, soon to be known as the Citizenship (Western Samoa) ...No Right TurnBy Idiot/Savant6 hours ago

Today the House is in an extended sitting, devoted to Member's Business as a catch-up for time stolen by the government in urgency. First up was the second reading of the Restoring Citizenship Removed By Citizenship (Western Samoa) Act 1982 Bill, soon to be known as the Citizenship (Western Samoa) ...No Right TurnBy Idiot/Savant6 hours ago - Thursday 24 October 2024

The CTU’s Fight Back Together hui received widespread coverage across national and local media, with consistent framing about the Government’s attacks on workers’ rights. In other union news, St John ambulance staff have accepted a pay offer following a Government back down on increased funding for the service. In other ...NZCTUBy Jeremiah Boniface7 hours ago

The CTU’s Fight Back Together hui received widespread coverage across national and local media, with consistent framing about the Government’s attacks on workers’ rights. In other union news, St John ambulance staff have accepted a pay offer following a Government back down on increased funding for the service. In other ...NZCTUBy Jeremiah Boniface7 hours ago - Maranga Ake – Fight Back Together

My newsletter took a bit longer than I thought yesterday. I sent it at 11 am, and the protest was starting in the city at midday. Bollocks, I can still make it, I thought. I kissed the dog goodbye, gave Mrs Rockel a pat on the head and headed out ...Nick’s KōreroBy Nick Rockel8 hours ago

My newsletter took a bit longer than I thought yesterday. I sent it at 11 am, and the protest was starting in the city at midday. Bollocks, I can still make it, I thought. I kissed the dog goodbye, gave Mrs Rockel a pat on the head and headed out ...Nick’s KōreroBy Nick Rockel8 hours ago - Health NZ eyed charging for ED visits

The KakaBy Bernard Hickey8 hours ago

- What if Instagram girlies planned Auckland?

Go to Instagram. Search posts tagged with Auckland. You’ll be flooded with: photos of the Skytower photos taken from the top of Mt Eden photos of the Skytower taken from the top of Mt Eden. So it shouldn’t be surprising that the residents of Tāmaki Makaurau deeply value ...Greater AucklandBy Scott Caldwell10 hours ago

Go to Instagram. Search posts tagged with Auckland. You’ll be flooded with: photos of the Skytower photos taken from the top of Mt Eden photos of the Skytower taken from the top of Mt Eden. So it shouldn’t be surprising that the residents of Tāmaki Makaurau deeply value ...Greater AucklandBy Scott Caldwell10 hours ago - 10,000 across the country push back against government actions(PHOTOS)

Mountain TuiBy Mountain Tui12 hours ago

- South Island population boom suggests it’s time for a larger Parliament

The South Island’s population is booming and is growing faster than the North and that suggests it may be time to increase the size of Parliament.. Yesterday’s announcement by Statistics NZ about the number and size of electorate seats for the next election confirms that. The announcement calculates seat size ...PolitikBy Richard Harman13 hours ago

The South Island’s population is booming and is growing faster than the North and that suggests it may be time to increase the size of Parliament.. Yesterday’s announcement by Statistics NZ about the number and size of electorate seats for the next election confirms that. The announcement calculates seat size ...PolitikBy Richard Harman13 hours ago - Gordon Campbell on dissing Wellington, and Porridge Radio

National has never forgiven Wellington – or its public servants – for voting for Labour and the Greens. (Red-blooded Kiwis work in the private sector.) No surprise then to find a right wing central government being willing to kick the Capital when it’s down. (See “Wellington is dying and we ...WerewolfBy ScoopEditor18 hours ago

National has never forgiven Wellington – or its public servants – for voting for Labour and the Greens. (Red-blooded Kiwis work in the private sector.) No surprise then to find a right wing central government being willing to kick the Capital when it’s down. (See “Wellington is dying and we ...WerewolfBy ScoopEditor18 hours ago - Why widening highways doesn’t reduce traffic congestion

This is a re-post from Yale Climate Connections by Sarah Wesseler California prides itself on its climate leadership. And the state’s work on transportation – its largest source of emissions – is no exception; its electric vehicle policies have been adopted by other states across the country. Sacramento lawmakers have also taken ambitious ...1 day ago

This is a re-post from Yale Climate Connections by Sarah Wesseler California prides itself on its climate leadership. And the state’s work on transportation – its largest source of emissions – is no exception; its electric vehicle policies have been adopted by other states across the country. Sacramento lawmakers have also taken ambitious ...1 day ago - Mild! she replies

Do you find it frustrating — exasperating even — when in conversation someone asks you to repeat yourself, and then says: sorry can you say that again?And then: really sorry, again? And then: once more?Do you find it frustrating — exasperating even — when it keeps happening all the way ...More Than A FeildingBy David Slack1 day ago

Do you find it frustrating — exasperating even — when in conversation someone asks you to repeat yourself, and then says: sorry can you say that again?And then: really sorry, again? And then: once more?Do you find it frustrating — exasperating even — when it keeps happening all the way ...More Than A FeildingBy David Slack1 day ago - Workers demonstrate strength of union power

NZCTU Te Kauae Kaimahi is celebrating a strong turnout of workers across the country who stood together in opposition to the Government’s anti-worker agenda, with more than 10,000 working people attending hui from Whangārei to Invercargill. “Today workers from a wide range of sectors and industries came together and demonstrated ...NZCTUBy Jeremiah Boniface1 day ago

NZCTU Te Kauae Kaimahi is celebrating a strong turnout of workers across the country who stood together in opposition to the Government’s anti-worker agenda, with more than 10,000 working people attending hui from Whangārei to Invercargill. “Today workers from a wide range of sectors and industries came together and demonstrated ...NZCTUBy Jeremiah Boniface1 day ago - Your Key Political Summary – PLUS: Luxon Defends Andrew Bayly in Parliament

1/ Proposed gun firearms law change will endanger publicA director of the Firearms Safety Authority says separating the Firearms Safety Authority from police - as the government is proposing - will be "horrible" and raise the risk to the public Note: ACT Party Associate Justice Minister Nicole McKee is a ...Mountain TuiBy Mountain Tui1 day ago

1/ Proposed gun firearms law change will endanger publicA director of the Firearms Safety Authority says separating the Firearms Safety Authority from police - as the government is proposing - will be "horrible" and raise the risk to the public Note: ACT Party Associate Justice Minister Nicole McKee is a ...Mountain TuiBy Mountain Tui1 day ago - The cooker government

We know that the current National government is basically a government of and for antivaxxers and cookers, the people who rioted at Parliament and burned the grounds. But so far they've generally avoided explicitly identifying themselves as such. Until today, when Workplace Relations Minister dropped (or rather refused to wear) ...No Right TurnBy Idiot/Savant1 day ago

We know that the current National government is basically a government of and for antivaxxers and cookers, the people who rioted at Parliament and burned the grounds. But so far they've generally avoided explicitly identifying themselves as such. Until today, when Workplace Relations Minister dropped (or rather refused to wear) ...No Right TurnBy Idiot/Savant1 day ago - Guilty

Take back those tears and turn your head around′Cause there's every reason to smile from ear to ear - YeahAll those tricks and devices you used to turn onThey make you guilty - Guilty through neglectLyrics: Dave Dobbyn.A few things happened yesterday. Darleen Tana finally became an ex-MP, and Andrew ...Nick’s KōreroBy Nick Rockel1 day ago

Take back those tears and turn your head around′Cause there's every reason to smile from ear to ear - YeahAll those tricks and devices you used to turn onThey make you guilty - Guilty through neglectLyrics: Dave Dobbyn.A few things happened yesterday. Darleen Tana finally became an ex-MP, and Andrew ...Nick’s KōreroBy Nick Rockel1 day ago - Notice: Protest Locations Today

Mountain TuiBy Mountain Tui1 day ago

- Woman of the Hour

2023, directed by Anna Kendrick Woman of the Hour is… such a weird movie. It’s based on the real life story of serial killer Rodney Alcala, but it’s not a documentary – it’s described as a crime thriller. It’s been criticised by one of his surviving victims as taking liberties ...The little pakehaBy chrismiller1 day ago

2023, directed by Anna Kendrick Woman of the Hour is… such a weird movie. It’s based on the real life story of serial killer Rodney Alcala, but it’s not a documentary – it’s described as a crime thriller. It’s been criticised by one of his surviving victims as taking liberties ...The little pakehaBy chrismiller1 day ago - Climate Risk

This is a re-post from And Then There's Physics I realise that I haven’t written anything for a while and am unlikely to become particularly prolific again anytime soon. However, there’s something I’ve been thinking about and thought that I would write a post. It relates to something Alex Trembath has ...1 day ago

This is a re-post from And Then There's Physics I realise that I haven’t written anything for a while and am unlikely to become particularly prolific again anytime soon. However, there’s something I’ve been thinking about and thought that I would write a post. It relates to something Alex Trembath has ...1 day ago - Is the Isthmus becoming a retirement village?

We’re continuing to look at the recently released census data. A few weeks ago I looked at how travel to work and education had changed and John looked at how our cities have grown over the last 130 years. Today I wanted to look some of that growth in a ...Greater AucklandBy Matt L1 day ago

We’re continuing to look at the recently released census data. A few weeks ago I looked at how travel to work and education had changed and John looked at how our cities have grown over the last 130 years. Today I wanted to look some of that growth in a ...Greater AucklandBy Matt L1 day ago - Fake Seizure Guy

Hi,When you make a documentary about Competitive Endurance Tickling, people tend to contact you about their strange encounters — which is how, eight months ago, I came upon Fake Seizure Guy.“So we’re standing there and I just notice this very thin, sort of gaunt looking younger gentleman who was clearly ...David FarrierBy David Farrier1 day ago

Hi,When you make a documentary about Competitive Endurance Tickling, people tend to contact you about their strange encounters — which is how, eight months ago, I came upon Fake Seizure Guy.“So we’re standing there and I just notice this very thin, sort of gaunt looking younger gentleman who was clearly ...David FarrierBy David Farrier1 day ago - Government stops water cleanup plans

Hostilities have resumed in one of politics’ longest-running battles. The question of how clean fresh waterways should be has occupied hours of political time as farmers and environmentalists have battled over the issue since back in the Key Government. Yesterday, the debate resumed in Parliament after the Government proposed a ...PolitikBy Richard Harman2 days ago

Hostilities have resumed in one of politics’ longest-running battles. The question of how clean fresh waterways should be has occupied hours of political time as farmers and environmentalists have battled over the issue since back in the Key Government. Yesterday, the debate resumed in Parliament after the Government proposed a ...PolitikBy Richard Harman2 days ago - Brighter days

Something exciting happened to me yesterday. Life-changing even. A few of you already know what it is, but I don't want to say too much too soon. I want to be sure it's as good as it appears to be on first impression. Perhaps tomorrow, then, perhaps later in the week. ...More Than A FeildingBy David Slack2 days ago

Something exciting happened to me yesterday. Life-changing even. A few of you already know what it is, but I don't want to say too much too soon. I want to be sure it's as good as it appears to be on first impression. Perhaps tomorrow, then, perhaps later in the week. ...More Than A FeildingBy David Slack2 days ago - Stomping on democracy

That's the only way to describe National's actions in appointing a crown observer to the Wellington City Council. Wellington didn't vote for National. They elected a council which supports public transport, housing intensification, and making Wellington a nicer place for people to live (rather than landlords and house hoarders to ...No Right TurnBy Idiot/Savant2 days ago

That's the only way to describe National's actions in appointing a crown observer to the Wellington City Council. Wellington didn't vote for National. They elected a council which supports public transport, housing intensification, and making Wellington a nicer place for people to live (rather than landlords and house hoarders to ...No Right TurnBy Idiot/Savant2 days ago - A violation of law, justice, and decency

This morning, in a desperate effort to distract attention from the suppurating sore of contempt that is Andrew Bayly, National announced that it would be bringing back its "three strikes" regime. The policy never worked and had no significant quantifiable benefits; but National doesn't care, despite a commitment in both ...No Right TurnBy Idiot/Savant2 days ago

This morning, in a desperate effort to distract attention from the suppurating sore of contempt that is Andrew Bayly, National announced that it would be bringing back its "three strikes" regime. The policy never worked and had no significant quantifiable benefits; but National doesn't care, despite a commitment in both ...No Right TurnBy Idiot/Savant2 days ago - What’s driving the exodus of workers to Australia

The KakaBy Bernard Hickey2 days ago

- Safer, Smarter, Sooner: about these concrete tim tams…

This is a cross-post from Bike Auckland, shared here with kind permission. It assesses progress on Auckland Transport’s November 2021 promise to install 70 km of quick, robust protection across 60 painted bike routes around Tāmaki Makaurau over a three-year time span. According to that original plan, right now ...Greater AucklandBy Guest Post2 days ago

This is a cross-post from Bike Auckland, shared here with kind permission. It assesses progress on Auckland Transport’s November 2021 promise to install 70 km of quick, robust protection across 60 painted bike routes around Tāmaki Makaurau over a three-year time span. According to that original plan, right now ...Greater AucklandBy Guest Post2 days ago - Money’s Just Cash

Money makes open case, closeMoney bend law, make war, make ghostsMoney gives a poor man hopeMoney saves lives, takes lives, money bothMoney is, money isn't, money's just thatMoney's just a concept people attractTax up the poor man, feed up the fatMoney's just, money's just, money's just cashSong: Ren GillIt’s money, ...Nick’s KōreroBy Nick Rockel2 days ago

Money makes open case, closeMoney bend law, make war, make ghostsMoney gives a poor man hopeMoney saves lives, takes lives, money bothMoney is, money isn't, money's just thatMoney's just a concept people attractTax up the poor man, feed up the fatMoney's just, money's just, money's just cashSong: Ren GillIt’s money, ...Nick’s KōreroBy Nick Rockel2 days ago - Luxon boasts a unique insight

Prime Minister Christopher Luxon confirmed yesterday that he is looking for big cuts in next year’s Budget. In part, that quest is driven by the Health NZ Budget blow-out plus what he claims is his own unique insight coming from outside the political process. To accommodate the cuts Finance Minister ...PolitikBy Richard Harman3 days ago

Prime Minister Christopher Luxon confirmed yesterday that he is looking for big cuts in next year’s Budget. In part, that quest is driven by the Health NZ Budget blow-out plus what he claims is his own unique insight coming from outside the political process. To accommodate the cuts Finance Minister ...PolitikBy Richard Harman3 days ago - Welcome to the world of personal air conditioning

This is a re-post from the Climate Brink by Andrew Dessler. This is part two of his series on air conditioning. Part one can be found here. Let’s look at Houston’s summertime temperatures: average summertime temperatures at Bush Intercontinental Airport in Houston Wow, Houston has warmed a lot in the ...3 days ago

This is a re-post from the Climate Brink by Andrew Dessler. This is part two of his series on air conditioning. Part one can be found here. Let’s look at Houston’s summertime temperatures: average summertime temperatures at Bush Intercontinental Airport in Houston Wow, Houston has warmed a lot in the ...3 days ago - Gordon Campbell on the Three Strikes cycle of failure

We all know the “tough on crime” approach is only a stop gap measure at best, and that a justice model based on incarceration doesn’t work. Our prisons are already overcrowded and under-staffed. More often than not, they function as training centres for young offenders, and as sites for gang ...WerewolfBy ScoopEditor3 days ago

We all know the “tough on crime” approach is only a stop gap measure at best, and that a justice model based on incarceration doesn’t work. Our prisons are already overcrowded and under-staffed. More often than not, they function as training centres for young offenders, and as sites for gang ...WerewolfBy ScoopEditor3 days ago - Luxon Shows The World Andrew Bayly Lied

In today’s press conference, Christopher Luxon re-affirmed his government’s commitment to bringing back the live animal export ban: claiming that National will do it to a “gold standard”.Heard of that term before?Well lobbyists spent $1m to help with the National-ACT-NZF reversal of Labour’s ban and the marketing term “gold standard” ...Mountain TuiBy Mountain Tui3 days ago

In today’s press conference, Christopher Luxon re-affirmed his government’s commitment to bringing back the live animal export ban: claiming that National will do it to a “gold standard”.Heard of that term before?Well lobbyists spent $1m to help with the National-ACT-NZF reversal of Labour’s ban and the marketing term “gold standard” ...Mountain TuiBy Mountain Tui3 days ago - Going West

Yesterday in the quiet of Sunday morning we went out West. Here you will find native rainforest, here you will find Kauri — and dieback, here you will find trails, beautiful trails, here you will find others out walking, here on the dusty road you will find a stream of ...More Than A FeildingBy David Slack3 days ago

Yesterday in the quiet of Sunday morning we went out West. Here you will find native rainforest, here you will find Kauri — and dieback, here you will find trails, beautiful trails, here you will find others out walking, here on the dusty road you will find a stream of ...More Than A FeildingBy David Slack3 days ago - The Enemy Within – Maire Leadbeater & Nicky Hager

Like so many others involved in social justice movements, Maire Leadbeater was subjected to state surveillance during a long life of activism. With the help of archival material, released SIS files, and other formerly secret material, she has been able to examine the depth of stateintrusion into the lives of ...3 days ago

Like so many others involved in social justice movements, Maire Leadbeater was subjected to state surveillance during a long life of activism. With the help of archival material, released SIS files, and other formerly secret material, she has been able to examine the depth of stateintrusion into the lives of ...3 days ago - Monday 21 October 2024

In union news, the Postal Workers Union is worried a scam that has conned New Zealanders out of millions of dollars is circulating for a fourth time, while FIRST are working with Woolworths to redeploy staff following the announced closure of a store in Tauranga. Latest SEEK data shows that ...NZCTUBy Jeremiah Boniface3 days ago

In union news, the Postal Workers Union is worried a scam that has conned New Zealanders out of millions of dollars is circulating for a fourth time, while FIRST are working with Woolworths to redeploy staff following the announced closure of a store in Tauranga. Latest SEEK data shows that ...NZCTUBy Jeremiah Boniface3 days ago - DTIs set to restrain housing-debt-led economic rebound

Many thanks to subscribers for your patience and support while I’ve been off work. My mum died in Melbourne last Sunday, and her funeral was held there on Friday. I appreciated being able to spend time with my mum before she died, and with my family and Lynn over the ...The KakaBy Bernard Hickey3 days ago

Many thanks to subscribers for your patience and support while I’ve been off work. My mum died in Melbourne last Sunday, and her funeral was held there on Friday. I appreciated being able to spend time with my mum before she died, and with my family and Lynn over the ...The KakaBy Bernard Hickey3 days ago - Time for a Transfer of Power in Entrust

What if I told you that if you pay for electricity in Auckland’s Isthmus, South Auckland, East Auckland, or Waiheke Island, you have a say in how a $3.76b company is run? What if I told you that one group has been in control of this resource on your behalf ...Greater AucklandBy Connor Sharp3 days ago

What if I told you that if you pay for electricity in Auckland’s Isthmus, South Auckland, East Auckland, or Waiheke Island, you have a say in how a $3.76b company is run? What if I told you that one group has been in control of this resource on your behalf ...Greater AucklandBy Connor Sharp3 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #42

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, October 13, 2024 thru Sat, October 19, 2024. Story of the week Here's another week of stories describing how our species has become a force of nature by creating ...4 days ago

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, October 13, 2024 thru Sat, October 19, 2024. Story of the week Here's another week of stories describing how our species has become a force of nature by creating ...4 days ago - Electrifying

I went on the radio this week to talk economic gloom. My starting point was this very good piece by Geoff Bertram in The Conversation exploring the question: Does the government know what it is doing? Answer: very possibly not. Their austerity measures, which they’ve touted as getting the car ...More Than A FeildingBy David Slack4 days ago

I went on the radio this week to talk economic gloom. My starting point was this very good piece by Geoff Bertram in The Conversation exploring the question: Does the government know what it is doing? Answer: very possibly not. Their austerity measures, which they’ve touted as getting the car ...More Than A FeildingBy David Slack4 days ago - Empire of the Ants

Windows, releasing 7 November 2024 After those first few super chill games I’ve had bad luck getting Next Fest demos to run on my Steam Deck (no shade – none of them claimed they would and they’re not even finished games yet) but of the couple that have I really ...The little pakehaBy chrismiller5 days ago

Windows, releasing 7 November 2024 After those first few super chill games I’ve had bad luck getting Next Fest demos to run on my Steam Deck (no shade – none of them claimed they would and they’re not even finished games yet) but of the couple that have I really ...The little pakehaBy chrismiller5 days ago - Why should Andrew Bayly get a pass?

Text within this block will maintain its original spacing when publishedCome in with the Big L sign plastered on your voice.Text within this block will maintain its original spacing when publishedMake fun of the worker doing his pace.Text within this block will maintain its original spacing when publishedWho am I?Text ...Mountain TuiBy Mountain Tui5 days ago

Text within this block will maintain its original spacing when publishedCome in with the Big L sign plastered on your voice.Text within this block will maintain its original spacing when publishedMake fun of the worker doing his pace.Text within this block will maintain its original spacing when publishedWho am I?Text ...Mountain TuiBy Mountain Tui5 days ago - Take This Bottle, Loser.

Cuz I've done wrongAnd I'm a little afraidAnd I ain't too strongAnd this ain't easy to say:Take this bottleTake this bottleAnd just walk away - the both of youAnd let me feel the pain - I've done to youSongwriters: Michael Allen Patton / Bill Gould / Michael Andrew BordinIn case ...Nick’s KōreroBy Nick Rockel5 days ago

Cuz I've done wrongAnd I'm a little afraidAnd I ain't too strongAnd this ain't easy to say:Take this bottleTake this bottleAnd just walk away - the both of youAnd let me feel the pain - I've done to youSongwriters: Michael Allen Patton / Bill Gould / Michael Andrew BordinIn case ...Nick’s KōreroBy Nick Rockel5 days ago - The hospital that still should have been, set on fire.

Sapphi’s SubstackBy Sapphi5 days ago

- Still giving it a go

More Than A FeildingBy David Slack5 days ago

- The Major Conspiracy Theories of This Election Cycle

Hi,It seems like a very, very long time ago now — but Webworm basically started as a newsletter about conspiracy theories (tending to debunk rather than spread, don’t worry). It’s almost alarming how much I wrote about them, a look through the archive the weirdest trip down memory lane.Today, with ...David FarrierBy David Farrier6 days ago

Hi,It seems like a very, very long time ago now — but Webworm basically started as a newsletter about conspiracy theories (tending to debunk rather than spread, don’t worry). It’s almost alarming how much I wrote about them, a look through the archive the weirdest trip down memory lane.Today, with ...David FarrierBy David Farrier6 days ago - Healthcare is Not in Crisis; Financing it Is.

Healthcare sector management needs to break away from its obsession with financial information and focus on funding for access. Health New Zealand recently ‘proactively released’ 454 pages about its financial performance to July 2024. Here is a letter it did not release. Hon Dr Shane Reti, Minister of Health. Dear ...PunditBy Brian Easton6 days ago

Healthcare sector management needs to break away from its obsession with financial information and focus on funding for access. Health New Zealand recently ‘proactively released’ 454 pages about its financial performance to July 2024. Here is a letter it did not release. Hon Dr Shane Reti, Minister of Health. Dear ...PunditBy Brian Easton6 days ago - What National thinks of us

A "what the fuck" moment for National: Andrew Bayly went round calling a worker a "loser" on an official visit: The worker explained their interaction with Bayly, and said once the pair were introduced, Bayly asked them why they were still at work. “Take a bottle of wine and ...No Right TurnBy Idiot/Savant6 days ago

A "what the fuck" moment for National: Andrew Bayly went round calling a worker a "loser" on an official visit: The worker explained their interaction with Bayly, and said once the pair were introduced, Bayly asked them why they were still at work. “Take a bottle of wine and ...No Right TurnBy Idiot/Savant6 days ago - Give New Zealand a go!

1. Who was the first woman to serve as Governor-General of New Zealand?a. Mother of the Nation Judy Bailey b. Vivacious and astute Cath Tizardc. Calm and perceptive Sylvia Cartwright d. Sovereign Citizen Liz “Unloaded” Gunn2. The formation of the National Party in 1936 was a merger of the United and Reform ...More Than A FeildingBy David Slack6 days ago

1. Who was the first woman to serve as Governor-General of New Zealand?a. Mother of the Nation Judy Bailey b. Vivacious and astute Cath Tizardc. Calm and perceptive Sylvia Cartwright d. Sovereign Citizen Liz “Unloaded” Gunn2. The formation of the National Party in 1936 was a merger of the United and Reform ...More Than A FeildingBy David Slack6 days ago - Government must support workers following Smithfield closure

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to show leadership following the announced closure of the Smithfield meat works, and the continued loss of regional manufacturing jobs, by putting in place policies to support workers with retraining and income insurance. “The loss of 600 jobs ...NZCTUBy Jeremiah Boniface6 days ago

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to show leadership following the announced closure of the Smithfield meat works, and the continued loss of regional manufacturing jobs, by putting in place policies to support workers with retraining and income insurance. “The loss of 600 jobs ...NZCTUBy Jeremiah Boniface6 days ago - Aotearoa’s Big Lie

OPINIONWhen I first wrote about David Seymour’s ties to the Atlas Network this year, I came across a fellow called Trotter who argued that - although Atlas Network wasn’t a conspiracy - as David Farrar, David Seymour, and Chris Bishop all claimed - it really wasn’t worth the left’s time ...Mountain TuiBy Mountain Tui6 days ago

OPINIONWhen I first wrote about David Seymour’s ties to the Atlas Network this year, I came across a fellow called Trotter who argued that - although Atlas Network wasn’t a conspiracy - as David Farrar, David Seymour, and Chris Bishop all claimed - it really wasn’t worth the left’s time ...Mountain TuiBy Mountain Tui6 days ago - Fast Track Stupidity

Ten years from now, I will almost certainly be dead. But, if I were to live that long, I would be constantly challenged with the question, “Why did you not warn us about what was surely already apparent – that the globe was heating at an ever-increasing rate, and that ...Bryan GouldBy Bryan Gould6 days ago

Ten years from now, I will almost certainly be dead. But, if I were to live that long, I would be constantly challenged with the question, “Why did you not warn us about what was surely already apparent – that the globe was heating at an ever-increasing rate, and that ...Bryan GouldBy Bryan Gould6 days ago - Dr Strange in the Multiverse of Madness

2022, directed by Sam Raimi It’s a bold artistic choice on Marvel’s part to spend the entire two hour runtime of the guy’s own movie telling us how literally every version of him is fucking terrible and this one’s only the hero because Wanda managed to be even worse. I’d ...The little pakehaBy chrismiller6 days ago

2022, directed by Sam Raimi It’s a bold artistic choice on Marvel’s part to spend the entire two hour runtime of the guy’s own movie telling us how literally every version of him is fucking terrible and this one’s only the hero because Wanda managed to be even worse. I’d ...The little pakehaBy chrismiller6 days ago - Train in Vain

You must explain why this must beDid you lie when you spoke to meDid you stand by meNo, not at allWriters: Paul Simonon, Topper Headon, Mick Jones, Joe StrummerGood morning, all. Since it's Friday, I’ll take a quick look at a few of the stories from the week. There’s also ...Nick’s KōreroBy Nick Rockel6 days ago

You must explain why this must beDid you lie when you spoke to meDid you stand by meNo, not at allWriters: Paul Simonon, Topper Headon, Mick Jones, Joe StrummerGood morning, all. Since it's Friday, I’ll take a quick look at a few of the stories from the week. There’s also ...Nick’s KōreroBy Nick Rockel6 days ago - Weekly Roundup 18-October-2024

Happy Friday, and welcome to another round-up of interesting stories about what’s happening in Auckland and other cities. Feel free to add your links in the comments! This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our ...Greater AucklandBy Greater Auckland6 days ago

Happy Friday, and welcome to another round-up of interesting stories about what’s happening in Auckland and other cities. Feel free to add your links in the comments! This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our ...Greater AucklandBy Greater Auckland6 days ago - Skeptical Science New Research for Week #42 2024

Open access notables The influence of partisan news on climate mitigation support: An investigation into the mediating role of perceived risk and efficacy, Choi & Hart, Risk Analysis: Perceptions of efficacy play a central role in motivating people to engage in climate actions. However, there has been little investigation into how different climate efficacy ...7 days ago

Open access notables The influence of partisan news on climate mitigation support: An investigation into the mediating role of perceived risk and efficacy, Choi & Hart, Risk Analysis: Perceptions of efficacy play a central role in motivating people to engage in climate actions. However, there has been little investigation into how different climate efficacy ...7 days ago - The usual suspect

Economic woes for Wellington continued today with news that yet more longstanding enterprises were going out of business. Capital One Hour Photos; Courtenay Place Video Rentals; CDs on Cuba and Kumar’s Smokefree No-Cigarettes Dairy all said they would be closed by the end of the month, and they all had ...More Than A FeildingBy David Slack1 week ago

Economic woes for Wellington continued today with news that yet more longstanding enterprises were going out of business. Capital One Hour Photos; Courtenay Place Video Rentals; CDs on Cuba and Kumar’s Smokefree No-Cigarettes Dairy all said they would be closed by the end of the month, and they all had ...More Than A FeildingBy David Slack1 week ago - Unexpected support

When the Education and Workforce Committee reported back on Camilla Belich's Crimes (Theft by Employer) Amendment Bill and recommended that it not be passed, I'd assumed it was doomed. The right-wing coalition government supports employer exploitation of workers, and certainly doesn't see why intentionally and systematically conspiring to not pay ...No Right TurnBy Idiot/Savant1 week ago

When the Education and Workforce Committee reported back on Camilla Belich's Crimes (Theft by Employer) Amendment Bill and recommended that it not be passed, I'd assumed it was doomed. The right-wing coalition government supports employer exploitation of workers, and certainly doesn't see why intentionally and systematically conspiring to not pay ...No Right TurnBy Idiot/Savant1 week ago - Your Thursday Politics Roundup

For paid subscribers1. Tory Whanau says “No thanks” to Local Government Minister Simeon Brown (RNZ)Wellington Mayor Tory Whanau says there was no talk of government intervention during her talk this morning with the Local Government Minister.Following the meeting, Whanau said the conversation was polite and friendly and was mainly about ...Mountain TuiBy Mountain Tui1 week ago

For paid subscribers1. Tory Whanau says “No thanks” to Local Government Minister Simeon Brown (RNZ)Wellington Mayor Tory Whanau says there was no talk of government intervention during her talk this morning with the Local Government Minister.Following the meeting, Whanau said the conversation was polite and friendly and was mainly about ...Mountain TuiBy Mountain Tui1 week ago - Inspiration and Gratitude

You grew on me like a tumourAnd you spread through me like malignant melanomaAnd now you’re in my heartI should’ve cut you out back at the startSong by Tim MinchinTim Minchin has a song about cheese; one clever dick in the audience yelled it out to him last night. I ...Nick’s KōreroBy Nick Rockel1 week ago

You grew on me like a tumourAnd you spread through me like malignant melanomaAnd now you’re in my heartI should’ve cut you out back at the startSong by Tim MinchinTim Minchin has a song about cheese; one clever dick in the audience yelled it out to him last night. I ...Nick’s KōreroBy Nick Rockel1 week ago - Thursday 17 October 2024

Inflation has fallen to its lowest point in the last 3.5 years, but many costs remain high, and unemployment is expected to get worse. An OIA response received by the Green Party has revealed that Brooke van Velden’s contractor proposals are almost word for word from an Uber proposal. TEU ...NZCTUBy Jeremiah Boniface1 week ago

Inflation has fallen to its lowest point in the last 3.5 years, but many costs remain high, and unemployment is expected to get worse. An OIA response received by the Green Party has revealed that Brooke van Velden’s contractor proposals are almost word for word from an Uber proposal. TEU ...NZCTUBy Jeremiah Boniface1 week ago - Wanted: Better housing to help people stay cool on a hotter planet

This is a re-post from Yale Climate Connections by Peter Graham and Mili Majumdar Apartments on the outskirts of New Delhi, India. (Photo credit: Adam Cohn / CC BY-NC 2.0) It was 117 degrees Fahrenheit (47°C) in Tunisia in July, yet our colleague Manel Ben Khelifa could not turn on ...1 week ago

This is a re-post from Yale Climate Connections by Peter Graham and Mili Majumdar Apartments on the outskirts of New Delhi, India. (Photo credit: Adam Cohn / CC BY-NC 2.0) It was 117 degrees Fahrenheit (47°C) in Tunisia in July, yet our colleague Manel Ben Khelifa could not turn on ...1 week ago - Why are economists giving this government the benefit of the doubt?

This National government came to power on the promise of tax cuts it hadn’t costed out and immediately scrapped an essential infrastructure project ten years in the making with no backup plan because global cost inflation pushed the price into mildly uncomfortable territory. It would be only a matter of ...Sapphi’s SubstackBy Sapphi1 week ago

This National government came to power on the promise of tax cuts it hadn’t costed out and immediately scrapped an essential infrastructure project ten years in the making with no backup plan because global cost inflation pushed the price into mildly uncomfortable territory. It would be only a matter of ...Sapphi’s SubstackBy Sapphi1 week ago - Auckland Harbour Bridge is collapsing*

This guest post by Tim Adriaansen, an advocate for accessibility and sustainable transport, is an expanded version of a recent post on LinkedIn. Auckland Harbour Bridge is collapsing.* A new report investigating the health of the bridge shows that without rapid and significant changes to how the asset is managed, ...Greater AucklandBy Guest Post1 week ago

This guest post by Tim Adriaansen, an advocate for accessibility and sustainable transport, is an expanded version of a recent post on LinkedIn. Auckland Harbour Bridge is collapsing.* A new report investigating the health of the bridge shows that without rapid and significant changes to how the asset is managed, ...Greater AucklandBy Guest Post1 week ago - The battle over Tikanga in the courts, a contemporary challenge

As Parliament girds itself for the introduction next month of David Seymour’s Treaty Principles’ Bill, a Select Committee yesterday grappled with another collision between Te Ao Maori and our British-based legal system. This time, it was ostensibly about whether University law schools should compel students to study Tikanga Maori. But ...PolitikBy Richard Harman1 week ago

As Parliament girds itself for the introduction next month of David Seymour’s Treaty Principles’ Bill, a Select Committee yesterday grappled with another collision between Te Ao Maori and our British-based legal system. This time, it was ostensibly about whether University law schools should compel students to study Tikanga Maori. But ...PolitikBy Richard Harman1 week ago - Gordon Campbell on the language of healthcare, and Mink DeVille

So far, the Great Multi-lingual Healthcare Crisis has passed by without any damage to life, or to limbs. To date, no-one appears to have mistaken the Hindi word for “lunch-break” for the Filipino word for “tracheotomy.” But then, the risk of bad clinical outcomes was never really the point, was ...WerewolfBy ScoopEditor1 week ago

So far, the Great Multi-lingual Healthcare Crisis has passed by without any damage to life, or to limbs. To date, no-one appears to have mistaken the Hindi word for “lunch-break” for the Filipino word for “tracheotomy.” But then, the risk of bad clinical outcomes was never really the point, was ...WerewolfBy ScoopEditor1 week ago - The Why ACC’s $7.2 billion deficit is not what it seems

The revelation of ACC’s $7.2 billion dollar deficit is coming at an amazing time for Luxon, Seymour, and Winnie. To start with, two of the three of them are engaging in a subtle war with the judiciary, in which ACT and New Zealand First have decided to prey on the ...Sapphi’s SubstackBy Sapphi1 week ago

The revelation of ACC’s $7.2 billion dollar deficit is coming at an amazing time for Luxon, Seymour, and Winnie. To start with, two of the three of them are engaging in a subtle war with the judiciary, in which ACT and New Zealand First have decided to prey on the ...Sapphi’s SubstackBy Sapphi1 week ago - Three chill games

Once again it’s Steam’s Next Fest, the regularly occurring event that highlights demos for upcoming games. It’s always a favourite of mine and I try to always participate by playing through several interesting looking titles. Today I tried three that were all extremely relaxed with no real time pressures involved. ...The little pakehaBy chrismiller1 week ago

Once again it’s Steam’s Next Fest, the regularly occurring event that highlights demos for upcoming games. It’s always a favourite of mine and I try to always participate by playing through several interesting looking titles. Today I tried three that were all extremely relaxed with no real time pressures involved. ...The little pakehaBy chrismiller1 week ago - We fixed it for youse

To the garage, to get a WOF. I think the tires might need replacing, you say.Leave it with us, they say.When you return, you notice the tyres are the same.In fact nothing appears to have been done.We fixed your birdshit problem, they tell you.My what, now? you ask.Your birdshit problem. ...More Than A FeildingBy David Slack1 week ago

To the garage, to get a WOF. I think the tires might need replacing, you say.Leave it with us, they say.When you return, you notice the tyres are the same.In fact nothing appears to have been done.We fixed your birdshit problem, they tell you.My what, now? you ask.Your birdshit problem. ...More Than A FeildingBy David Slack1 week ago - Vijay Prashad – New Zealand’s Role in US Military Imperialism: NATO, AUKUS & 5 Eyes

Vijay Prashad is an Indian historian and journalist. Prashad is the author of forty books, including Washington Bullets, Red Star Over the Third World, The Darker Nations: A People's History of the Third World. His latest book The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power (2022) was ...1 week ago

Vijay Prashad is an Indian historian and journalist. Prashad is the author of forty books, including Washington Bullets, Red Star Over the Third World, The Darker Nations: A People's History of the Third World. His latest book The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power (2022) was ...1 week ago

Related Posts

- Another step towards Pasifika justice

The Green Party acknowledges the historical importance of MP Teanau Tuiono’s Member’s Bill, Restoring Citizenship Removed By Citizenship (Western Samoa) Act 1982 Bill, passing its second reading in Parliament today. ...6 hours ago

The Green Party acknowledges the historical importance of MP Teanau Tuiono’s Member’s Bill, Restoring Citizenship Removed By Citizenship (Western Samoa) Act 1982 Bill, passing its second reading in Parliament today. ...6 hours ago - Sanctions Soar, Jobs Vanish – National’s Cruelty Exposed

Te Pāti Māori is enraged at the National government’s ruthless punishment of beneficiaries, all while jobs are disappearing. MSD data shows a 133% increase in sanctions over the past year, with over 14,000 sanctions in just three months. The kicker? The jobs this government insists people should find are nowhere ...1 day ago

Te Pāti Māori is enraged at the National government’s ruthless punishment of beneficiaries, all while jobs are disappearing. MSD data shows a 133% increase in sanctions over the past year, with over 14,000 sanctions in just three months. The kicker? The jobs this government insists people should find are nowhere ...1 day ago - Police Perpetuate Siege on Ōpōtiki

Te Pāti Māori MP for Waiariki, Rawiri Waititi, says today’s police-sponsored terrorism in Ōpōtiki is a continuation of the State’s predatory behaviour towards the iwi of Te Whakatōhea. "Ōpōtiki is once again being intentionally targeted and is the direct byproduct of this Government’s 'tough on crime' legislative changes,” said MP ...1 day ago

Te Pāti Māori MP for Waiariki, Rawiri Waititi, says today’s police-sponsored terrorism in Ōpōtiki is a continuation of the State’s predatory behaviour towards the iwi of Te Whakatōhea. "Ōpōtiki is once again being intentionally targeted and is the direct byproduct of this Government’s 'tough on crime' legislative changes,” said MP ...1 day ago - Release: Govt cuts school lunches even further

The Government has gone back on its word and cut the full school lunch programme in primary schools after saying it wouldn’t. ...2 days ago

The Government has gone back on its word and cut the full school lunch programme in primary schools after saying it wouldn’t. ...2 days ago - Time to shut down failed Youth Justice Residences

The Green Party is calling for Youth Justice Residences to close, following a protest in which a group of young people spent the night on the roof of an Oranga Tamariki justice facility. ...2 days ago

The Green Party is calling for Youth Justice Residences to close, following a protest in which a group of young people spent the night on the roof of an Oranga Tamariki justice facility. ...2 days ago - Release: Appalling process on three strikes law

The Government is subverting parliamentary process on laws the evidence already shows don’t work. ...2 days ago

The Government is subverting parliamentary process on laws the evidence already shows don’t work. ...2 days ago - Release: Labour calls for investigation into tobacco tax cut

The Government’s decision to award a $216 million tax break for Philip Morris’ heated tobacco products reeks of tobacco industry interference and needs to be thoroughly investigated. ...2 days ago

The Government’s decision to award a $216 million tax break for Philip Morris’ heated tobacco products reeks of tobacco industry interference and needs to be thoroughly investigated. ...2 days ago - Release: Delay to retirement village review won’t help residents

The National Government is treading water on a much-needed review of the Retirement Villages Act, kicking any amendments down the road till the next parliamentary term in 2027. ...3 days ago

The National Government is treading water on a much-needed review of the Retirement Villages Act, kicking any amendments down the road till the next parliamentary term in 2027. ...3 days ago - Release: Serious concerns ignored in Govt’s fast track bill

National’s fast track bill enables the most radical and unbalanced consenting regime in living memory. ...6 days ago

National’s fast track bill enables the most radical and unbalanced consenting regime in living memory. ...6 days ago - Fast-Track, off the rails: Submitters show strong opposition to Bill

Despite resounding public opposition, the fast-track legislation is being pushed through Parliament with provisions that could have real consequences for people and planet. ...6 days ago

Despite resounding public opposition, the fast-track legislation is being pushed through Parliament with provisions that could have real consequences for people and planet. ...6 days ago - Release: Labour supports continuing fight for dairy access

Labour welcomes the National Government’s decision to further pursue our access to the Canadian dairy market under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) ...6 days ago

Labour welcomes the National Government’s decision to further pursue our access to the Canadian dairy market under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) ...6 days ago - Release: Job losses devastating for Timaru

Confirmed news that the Smithfield meatworks will close is devastating for the hundreds of people who work there, Timaru and the wider region. ...6 days ago

Confirmed news that the Smithfield meatworks will close is devastating for the hundreds of people who work there, Timaru and the wider region. ...6 days ago - New Zealand First Member’s Bill to Improve Access to Palliative Care

New Zealand First has introduced a Member’s Bill which aims to improve access to palliative care for all New Zealanders, ensuring kiwis have better access to the compassionate palliative support they may need. The ‘Improving Access to Palliative Care Bill’ seeks to guarantee that every New Zealander has the right ...6 days ago

New Zealand First has introduced a Member’s Bill which aims to improve access to palliative care for all New Zealanders, ensuring kiwis have better access to the compassionate palliative support they may need. The ‘Improving Access to Palliative Care Bill’ seeks to guarantee that every New Zealander has the right ...6 days ago - Release: Further uncertainty for Kiwirail as jobs set to go

KiwiRail offering voluntary redundancy to all its staff is hugely concerning given the future of New Zealand’s rail system is under threat. ...1 week ago

KiwiRail offering voluntary redundancy to all its staff is hugely concerning given the future of New Zealand’s rail system is under threat. ...1 week ago - ASA Declares Hobson’s Pledge Advertising Misleading and Socially Irresponsible

Te Pāti Māori Co-leaders Rawiri Waititi and Debbie Ngarewa-Packer welcome today’s ruling from the Advertising Standards Authority (ASA), which found that a Hobson's Pledge advertisement regarding customary marine titles was misleading and socially irresponsible. The two-page wraparound ad, published in The New Zealand Herald, suggested that nearly the entire coastline ...1 week ago

Te Pāti Māori Co-leaders Rawiri Waititi and Debbie Ngarewa-Packer welcome today’s ruling from the Advertising Standards Authority (ASA), which found that a Hobson's Pledge advertisement regarding customary marine titles was misleading and socially irresponsible. The two-page wraparound ad, published in The New Zealand Herald, suggested that nearly the entire coastline ...1 week ago - Release: Benefit numbers continue to soar under National

National’s all pain approach to beneficiaries has yielded no gain as benefit numbers continue to surge past projected figures. ...1 week ago

National’s all pain approach to beneficiaries has yielded no gain as benefit numbers continue to surge past projected figures. ...1 week ago - Soaring benefit sanctions push more into poverty

Sanctions on beneficiaries have sky-rocketed since the Coalition Government came to power, pushing more families into poverty. ...1 week ago

Sanctions on beneficiaries have sky-rocketed since the Coalition Government came to power, pushing more families into poverty. ...1 week ago - International Energy Agency issues wake-up call on climate action

Today’s report from the International Energy Agency highlights how far this Government’s actions are dragging us backwards in the fight against climate change. ...1 week ago

Today’s report from the International Energy Agency highlights how far this Government’s actions are dragging us backwards in the fight against climate change. ...1 week ago - Release: Lack of funding puts pressure on frontline Police

1 week ago

- Release: Bipartisan agreement on outdated marriage law

Changes to outdated relationships legislation has passed its third reading giving family violence survivors the power to quickly dissolve abusive marriages. ...1 week ago

Changes to outdated relationships legislation has passed its third reading giving family violence survivors the power to quickly dissolve abusive marriages. ...1 week ago - Release: Cuts to Apprenticeship Boost will fail future NZ

The Government’s cuts to the Apprenticeship Boost programme will leave New Zealand without the workforce it needs to build homes, schools and hospitals. ...1 week ago

The Government’s cuts to the Apprenticeship Boost programme will leave New Zealand without the workforce it needs to build homes, schools and hospitals. ...1 week ago - Release: Sluggish economy means struggles ahead for Kiwis

While today’s inflation numbers are good news for Kiwis, there are still struggles ahead with rising rents, rates, insurance and high unemployment. ...1 week ago

While today’s inflation numbers are good news for Kiwis, there are still struggles ahead with rising rents, rates, insurance and high unemployment. ...1 week ago - CPI figures show rents continuing to soar

Stats NZ has confirmed that higher rent prices were the biggest contributor to the annual inflation rate. Almost a fifth of the 2.2 per cent annual increase in the CPI was due to rent prices. ...1 week ago

Stats NZ has confirmed that higher rent prices were the biggest contributor to the annual inflation rate. Almost a fifth of the 2.2 per cent annual increase in the CPI was due to rent prices. ...1 week ago - Release: Govt changes threaten depleted Hauraki Gulf

The National Government has sneakily reneged on protecting the Hauraki Gulf, reducing the protected area of the marine park and inviting commercial fishing in the depleted seascape. ...2 weeks ago

The National Government has sneakily reneged on protecting the Hauraki Gulf, reducing the protected area of the marine park and inviting commercial fishing in the depleted seascape. ...2 weeks ago - Govt’s shameful backtrack on marine conservation

The Green Party has condemned the Government’s late change to allow commercial fishing in protected areas in the Hauraki Gulf. ...2 weeks ago

The Green Party has condemned the Government’s late change to allow commercial fishing in protected areas in the Hauraki Gulf. ...2 weeks ago - Release: No time to slow-down on disaster response

Labour welcomes the release of the Government’s response to the report into the North Island weather events but urges it to push forward with legislative change this term. ...2 weeks ago

Labour welcomes the release of the Government’s response to the report into the North Island weather events but urges it to push forward with legislative change this term. ...2 weeks ago - Release: Where are the 100,000 families?

Nicola Willis has once again shown her promises are based on ghost families, with less than half registering for the FamilyBoost payments. ...2 weeks ago

Nicola Willis has once again shown her promises are based on ghost families, with less than half registering for the FamilyBoost payments. ...2 weeks ago - Significant step forward for Pasifika justice in Aotearoa

The Green Party has welcomed news that MP Teanau Tuiono’s Member’s Bill has moved forward with unanimous support from the select committee. ...2 weeks ago

The Green Party has welcomed news that MP Teanau Tuiono’s Member’s Bill has moved forward with unanimous support from the select committee. ...2 weeks ago - Release: Bill restoring Samoan Citizenship progresses

Labour is pleased the Samoan Citizenship Bill has unanimous support as it enters second reading. ...2 weeks ago

Labour is pleased the Samoan Citizenship Bill has unanimous support as it enters second reading. ...2 weeks ago - Release: National bent the rules to keep coalition commitment

The National Government bent all sorts of rules to give $24 million to Gumboot Friday just to fulfil a coalition agreement. ...2 weeks ago

The National Government bent all sorts of rules to give $24 million to Gumboot Friday just to fulfil a coalition agreement. ...2 weeks ago - Greens support call for divestment from illegal Israeli settlements

The Green Party echoes a call for banks to divest from entities linked to Israel’s illegal settlements in Palestine, and says Crown Financial Institutions should follow suit. ...2 weeks ago

The Green Party echoes a call for banks to divest from entities linked to Israel’s illegal settlements in Palestine, and says Crown Financial Institutions should follow suit. ...2 weeks ago - Release: National’s deficit stories don’t hold up

Te Whatu Ora’s finances have deteriorated under the National Government, turning a surplus into a deficit, and breaking promises made to New Zealanders to pay for it. ...2 weeks ago

Te Whatu Ora’s finances have deteriorated under the National Government, turning a surplus into a deficit, and breaking promises made to New Zealanders to pay for it. ...2 weeks ago - Release: Politics over police safety puts shame on PM

The Prime Minister’s decision to back his firearms minister on gun law changes despite multiple warnings shows his political judgement has failed him yet again. ...2 weeks ago

The Prime Minister’s decision to back his firearms minister on gun law changes despite multiple warnings shows his political judgement has failed him yet again. ...2 weeks ago - Govt Gambling Safety of our Moana

Yesterday the government announced the list of 149 projects selected for fast-tracking across Aotearoa. Trans-Tasman Resources’ plan to mine the seabed off the coast of Taranaki was one of these projects. “We are disgusted but not surprised with the government’s decision to fast-track the decimation of our seabed,” said Te ...2 weeks ago

Yesterday the government announced the list of 149 projects selected for fast-tracking across Aotearoa. Trans-Tasman Resources’ plan to mine the seabed off the coast of Taranaki was one of these projects. “We are disgusted but not surprised with the government’s decision to fast-track the decimation of our seabed,” said Te ...2 weeks ago - Release: Govt takes the scalpel to regional health budgets

At Labour’s insistence, Te Whatu Ora financial documents have been released by the Health Select Committee today showing more cuts are on the way for our health system. ...2 weeks ago

At Labour’s insistence, Te Whatu Ora financial documents have been released by the Health Select Committee today showing more cuts are on the way for our health system. ...2 weeks ago - Trojan Horse approach to fast-track projects threatens environment

The Government’s fast-track list is another example of its reckless approach to the environment and disregard for due process. ...2 weeks ago

The Government’s fast-track list is another example of its reckless approach to the environment and disregard for due process. ...2 weeks ago - Release: Fast track list reveals Govt’s backroom deals

The coalition Government’s backroom deals with coal and ironsands mining companies have finally been revealed – and it’s not pretty. ...2 weeks ago

The coalition Government’s backroom deals with coal and ironsands mining companies have finally been revealed – and it’s not pretty. ...2 weeks ago - Release: Nicole McKee unfit for firearms portfolio

Fresh questions have been raised about the conduct of the Firearms Minister after revelations she misled New Zealanders about her role in stopping gun reforms prior to the mosque shootings. ...2 weeks ago

Fresh questions have been raised about the conduct of the Firearms Minister after revelations she misled New Zealanders about her role in stopping gun reforms prior to the mosque shootings. ...2 weeks ago

Related Posts

- New members appointed to the Waitangi Tribunal

Māori Development Minister Tama Potaka today confirmed the appointment of two new members to the Waitangi Tribunal, as well as the reappointment of Kevin Prime. The members appointed and reappointed are: Hon Richard Prebble (CBE). Mr Prebble is a former Cabinet Minister where he held a broad range of portfolios. ...BeehiveBy beehive.govt.nz58 mins ago

Māori Development Minister Tama Potaka today confirmed the appointment of two new members to the Waitangi Tribunal, as well as the reappointment of Kevin Prime. The members appointed and reappointed are: Hon Richard Prebble (CBE). Mr Prebble is a former Cabinet Minister where he held a broad range of portfolios. ...BeehiveBy beehive.govt.nz58 mins ago - New appointments to the Local Government Commission

Local Government Minister Simeon Brown has today announced the reappointment of the current Chair and the appointment of a temporary member to the Local Government Commission.Current Chair Brendan Duffy ONZM has been reappointed as Chair for a one-year term ending 23 October 2025, while Gwen Bull CNZM will be joining ...BeehiveBy beehive.govt.nz2 hours ago

Local Government Minister Simeon Brown has today announced the reappointment of the current Chair and the appointment of a temporary member to the Local Government Commission.Current Chair Brendan Duffy ONZM has been reappointed as Chair for a one-year term ending 23 October 2025, while Gwen Bull CNZM will be joining ...BeehiveBy beehive.govt.nz2 hours ago - New Electoral Commission Chair appointed

Today the House agreed to Justice Simon Moore KC being appointed chair of the Electoral Commission, Justice Minister Paul Goldsmith says. “Justice Moore brings with him a high level of legal acumen and decision-making ability, strategic planning skills and unquestionable personal integrity and independence. “He retired from the High Court ...BeehiveBy beehive.govt.nz2 hours ago

Today the House agreed to Justice Simon Moore KC being appointed chair of the Electoral Commission, Justice Minister Paul Goldsmith says. “Justice Moore brings with him a high level of legal acumen and decision-making ability, strategic planning skills and unquestionable personal integrity and independence. “He retired from the High Court ...BeehiveBy beehive.govt.nz2 hours ago - Education Minister attending conference in Australia

The Education Minister is travelling to Australia today to attend the 23rd edition of public policy conference, Consilium. “New Zealand and Australia share common challenges and aspirations for education. New South Wales has recently introduced a new curriculum that is explicit, sequenced and knowledge based while Victoria is requiring structured ...BeehiveBy beehive.govt.nz4 hours ago

The Education Minister is travelling to Australia today to attend the 23rd edition of public policy conference, Consilium. “New Zealand and Australia share common challenges and aspirations for education. New South Wales has recently introduced a new curriculum that is explicit, sequenced and knowledge based while Victoria is requiring structured ...BeehiveBy beehive.govt.nz4 hours ago - Launching VisAble to enable safer lives

The launch of new community advocacy group VisAble signals an important development in community advocacy to achieve more focus on the needs and rights of disabled people in the family violence and sexual violence system. Minister for the Prevention of Family and Sexual Violence, Karen Chhour, and Disabilities Issues Minister, ...BeehiveBy beehive.govt.nz4 hours ago

The launch of new community advocacy group VisAble signals an important development in community advocacy to achieve more focus on the needs and rights of disabled people in the family violence and sexual violence system. Minister for the Prevention of Family and Sexual Violence, Karen Chhour, and Disabilities Issues Minister, ...BeehiveBy beehive.govt.nz4 hours ago - $100m NZ-Brazil trade boost through 13 key partnerships

Minister for Trade Todd McClay, today announced the signing of 13 Memorandums of Understanding (MOUs) between New Zealand and Brazilian companies as part of the New Zealand Trade Mission to São Paulo this week. “These partnerships mark a significant step in strengthening the trade relationship between the two nations and are ...BeehiveBy beehive.govt.nz5 hours ago