Overtaxed?

Overtaxed?

Written By:

Tane - Date published:

9:57 am, October 12th, 2007 - 18 comments

Categories: economy -

Tags: economy

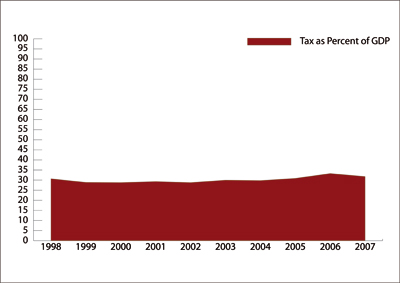

There’s a lot of talk on the right about the surplus being evidence of ‘overtaxation’. But where exactly is the Government’s huge tax grab? According to Treasury, tax as a percentage of GDP has barely moved since 1998 – when we had no Working for Families, no Cullen Fund, no Kiwisaver, virtually no investment in transport, no cheap doctor’s visits and prescriptions, no interest-free student loans, and no assistance for first-home buyers. That’s right, tax as a percentage of GDP has risen from 30.7% in 1998 to just 31.8% in 2007.

If there’s anything remarkable in these figures, it’s why a centre-left government hasn’t increased tax revenue even further as a percentage of GDP after eight years in power. One thing is certain – the surplus is not evidence we’re being overtaxed. So why aren’t National, the media and business crying out for more spending on public services instead?

Related Posts

18 comments on “Overtaxed? ”

- Comments are now closed

Links to post

- Comments are now closed

Recent Comments

- Muttonbird to AB on

- Ad on

- Kat on

- Muttonbird to Anne on

- Tabletennis to SPC on

- Anne on

- weasel on

- SPC to Darien Fenton on

- mickysavage on

- Tabletennis to Visubversa on

- AB to Muttonbird on

- francesca on

- Tabletennis to James Thrace on

- Karolyn_IS to weka on

- gsays to Darien Fenton on

- weka to Visubversa on

- weka to Karolyn_IS on

- Karolyn_IS to Karolyn_IS on

- Muttonbird on

- Karolyn_IS to SPC on

- Visubversa to James Thrace on

- Corey on

- Res Publica to Karolyn_IS on

- Karolyn_IS to Res Publica on

- joe90 to Res Publica on

- Karolyn_IS to SPC on

- Kay on

- Res Publica on

- Res Publica on

- SPC to Karolyn_IS on

- AB to Muttonbird on

- Kay to Karolyn_IS on

- Karolyn_IS to SPC on

- James Thrace to Karolyn_IS on

- SPC to Muttonbird on

- Karolyn_IS to Muttonbird on

- SPC to Karolyn_IS on

- joe90 on

- Bearded Git to Muttonbird on

- Muttonbird on

- Karolyn_IS on

- joe90 on

- Bearded Git to SPC on

- SPC on

- Tony Veitch on

- Karolyn_IS to weka on

Recent Posts

-

by eugenedoyle

-

by advantage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Incognito

-

by lprent

-

by Mountain Tui

-

by mickysavage

-

by Incognito

-

by Mountain Tui

-

by advantage

-

by Guest post

-

by mickysavage

-

by lprent

-

by weka

-

by advantage

-

by Guest post

-

by Incognito

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

- Is Mark Mitchell a racist?

The National Party’s Minister of Police, Corrections, and Ethnic Communities (irony alert) has stumbled into yet another racist quagmire, proving that when it comes to bigotry, the right wing’s playbook is as predictable as it is vile. This time, Mitchell’s office reposted an Instagram reel falsely claiming that Te Pāti ...2 hours ago

The National Party’s Minister of Police, Corrections, and Ethnic Communities (irony alert) has stumbled into yet another racist quagmire, proving that when it comes to bigotry, the right wing’s playbook is as predictable as it is vile. This time, Mitchell’s office reposted an Instagram reel falsely claiming that Te Pāti ...2 hours ago - Australian statecraft must restore the link between deterrence and non-proliferation to survive in t...

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Alex Bristow3 hours ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Alex Bristow3 hours ago - J.K. Rowling – Arsehole of the Week

In a world crying out for empathy, J.K. Rowling has once again proven she’s more interested in stoking division than building bridges. The once-beloved author of Harry Potter has cemented her place as this week’s Arsehole of the Week, a title earned through her relentless, tone-deaf crusade against transgender rights. ...3 hours ago

In a world crying out for empathy, J.K. Rowling has once again proven she’s more interested in stoking division than building bridges. The once-beloved author of Harry Potter has cemented her place as this week’s Arsehole of the Week, a title earned through her relentless, tone-deaf crusade against transgender rights. ...3 hours ago - The rotten, unaccountable crown

Between 1950 and 1993 the New Zealand government tortured and abused up to 250,000 children in residential care facilities. They then proceeded to cover it up in order to minimise their liability, dragging out cases, slandering their victims and ultimately denying redress. In its final report, the Inquiry into Abuse ...No Right TurnBy Idiot/Savant4 hours ago

Between 1950 and 1993 the New Zealand government tortured and abused up to 250,000 children in residential care facilities. They then proceeded to cover it up in order to minimise their liability, dragging out cases, slandering their victims and ultimately denying redress. In its final report, the Inquiry into Abuse ...No Right TurnBy Idiot/Savant4 hours ago - To prepare for future threats, treat health security as national security

Health security is often seen as a peripheral security domain, and as a problem that is difficult to address. These perceptions weaken our capacity to respond to borderless threats. With the wind back of Covid-19 ...The StrategistBy Susanne Casey4 hours ago

Health security is often seen as a peripheral security domain, and as a problem that is difficult to address. These perceptions weaken our capacity to respond to borderless threats. With the wind back of Covid-19 ...The StrategistBy Susanne Casey4 hours ago - What’s on the Label -vs- What’s in the Tin.

Would our political parties pass muster under the Fair Trading Act?WHAT IF OUR POLITICAL PARTIES were subject to the Fair Trading Act? What if they, like the nation’s businesses, were prohibited from misleading their consumers – i.e. the voters – about the nature, characteristics, suitability, or quantity of the products ...6 hours ago

Would our political parties pass muster under the Fair Trading Act?WHAT IF OUR POLITICAL PARTIES were subject to the Fair Trading Act? What if they, like the nation’s businesses, were prohibited from misleading their consumers – i.e. the voters – about the nature, characteristics, suitability, or quantity of the products ...6 hours ago - Simeon Brown Doesn’t Consider Abortion To Be Healthcare As Services Scaled Back

Rod EmmersonThank you to my subscribers and readers - you make it all possible. Tui.Subscribe nowSix updates today from around the world and locally here in Aoteaora New Zealand -1. RFK Jnr’s Autism CrusadeAmerica plans to create a registry of people with autism in the United States. RFK Jr’s department ...Mountain TuiBy Mountain Tūī7 hours ago

Rod EmmersonThank you to my subscribers and readers - you make it all possible. Tui.Subscribe nowSix updates today from around the world and locally here in Aoteaora New Zealand -1. RFK Jnr’s Autism CrusadeAmerica plans to create a registry of people with autism in the United States. RFK Jr’s department ...Mountain TuiBy Mountain Tūī7 hours ago - Another Munich crisis? Understanding the limits of policymaking by analogy

We see it often enough. A democracy deals with an authoritarian state, and those who oppose concessions cite the lesson of Munich 1938: make none to dictators; take a firm stand. And so we hear ...The StrategistBy Linus Cohen and Chris Taylor9 hours ago

We see it often enough. A democracy deals with an authoritarian state, and those who oppose concessions cite the lesson of Munich 1938: make none to dictators; take a firm stand. And so we hear ...The StrategistBy Linus Cohen and Chris Taylor9 hours ago - Wednesday 23 April

370 perioperative nurses working at Auckland City Hospital, Starship Hospital and Greenlane Clinical Centre will strike for two hours on 1 May – the same day senior doctors are striking. This is part of nationwide events to mark May Day on 1 May, including rallies outside public hospitals, organised by ...NZCTUBy Jack McDonald10 hours ago

370 perioperative nurses working at Auckland City Hospital, Starship Hospital and Greenlane Clinical Centre will strike for two hours on 1 May – the same day senior doctors are striking. This is part of nationwide events to mark May Day on 1 May, including rallies outside public hospitals, organised by ...NZCTUBy Jack McDonald10 hours ago - Auckland character rules stop building on 20,000 sections

Character protections for Auckland’s villas have stymied past development. Now moves afoot to strip character protection from a bunch of inner-city villas. Photo: Lynn Grieveson / The KākāLong stories shortest from our political economy on Wednesday, April 23:Special Character Areas designed to protect villas are stopping 20,000 sites near Auckland’s ...The KakaBy Bernard Hickey11 hours ago

Character protections for Auckland’s villas have stymied past development. Now moves afoot to strip character protection from a bunch of inner-city villas. Photo: Lynn Grieveson / The KākāLong stories shortest from our political economy on Wednesday, April 23:Special Character Areas designed to protect villas are stopping 20,000 sites near Auckland’s ...The KakaBy Bernard Hickey11 hours ago - AI is changing Indo-Pacific naval operations

Artificial intelligence is poised to significantly transform the Indo-Pacific maritime security landscape. It offers unprecedented situational awareness, decision-making speed and operational flexibility. But without clear rules, shared norms and mechanisms for risk reduction, AI could ...The StrategistBy Jihoon Yu12 hours ago

Artificial intelligence is poised to significantly transform the Indo-Pacific maritime security landscape. It offers unprecedented situational awareness, decision-making speed and operational flexibility. But without clear rules, shared norms and mechanisms for risk reduction, AI could ...The StrategistBy Jihoon Yu12 hours ago - What is a Man?

For what is a man, what has he got?If not himself, then he has naughtTo say the things he truly feelsAnd not the words of one who kneelsThe record showsI took the blowsAnd did it my wayLyrics: Paul Anka.Morena folks, before we discuss Winston’s latest salvo in NZ First’s War ...Nick’s KōreroBy Nick Rockel13 hours ago

For what is a man, what has he got?If not himself, then he has naughtTo say the things he truly feelsAnd not the words of one who kneelsThe record showsI took the blowsAnd did it my wayLyrics: Paul Anka.Morena folks, before we discuss Winston’s latest salvo in NZ First’s War ...Nick’s KōreroBy Nick Rockel13 hours ago - Britain recasts AUKUS for a new era

Britain once risked a reputation as the weak link in the trilateral AUKUS partnership. But now the appointment of an empowered senior official to drive the project forward and a new burst of British parliamentary ...The StrategistBy Sophia Gaston1 day ago

Britain once risked a reputation as the weak link in the trilateral AUKUS partnership. But now the appointment of an empowered senior official to drive the project forward and a new burst of British parliamentary ...The StrategistBy Sophia Gaston1 day ago - Australia’s basic-metals problem: old plants and subsidised Chinese competition

Australia’s ability to produce basic metals, including copper, lead, zinc, nickel and construction steel, is in jeopardy, with ageing plants struggling against Chinese competition. The multinational commodities company Trafigura has put its Australian operations under ...The StrategistBy David Uren1 day ago

Australia’s ability to produce basic metals, including copper, lead, zinc, nickel and construction steel, is in jeopardy, with ageing plants struggling against Chinese competition. The multinational commodities company Trafigura has put its Australian operations under ...The StrategistBy David Uren1 day ago - Rob Campbell – Public Private Partnerships: What a Good Idea! OR ‘There will be no free...

There have been recent PPP debacles, both in New Zealand (think Transmission Gully) and globally, with numerous examples across both Australia and Britain of failed projects and extensive litigation by government agencies seeking redress for the failures.Rob Campbell is one of New Zealand’s sharpest critics of PPPs noting that; "There ...1 day ago

There have been recent PPP debacles, both in New Zealand (think Transmission Gully) and globally, with numerous examples across both Australia and Britain of failed projects and extensive litigation by government agencies seeking redress for the failures.Rob Campbell is one of New Zealand’s sharpest critics of PPPs noting that; "There ...1 day ago - RB spending: the Board and the Minister

On Twitter on Saturday I indicated that there had been a mistake in my post from last Thursday in which I attempted to step through the Reserve Bank Funding Agreement issues. Making mistakes (there are two) is annoying and I don’t fully understand how I did it (probably too much ...Croaking CassandraBy Michael Reddell1 day ago

On Twitter on Saturday I indicated that there had been a mistake in my post from last Thursday in which I attempted to step through the Reserve Bank Funding Agreement issues. Making mistakes (there are two) is annoying and I don’t fully understand how I did it (probably too much ...Croaking CassandraBy Michael Reddell1 day ago - Indonesia needs to rethink its approach to military drones

Indonesia’s armed forces still have a lot of work to do in making proper use of drones. Two major challenges are pilot training and achieving interoperability between the services. Another is overcoming a predilection for ...The StrategistBy Sandy Juda Pratama, Curie Maharani and Gautama Adi Kusuma1 day ago

Indonesia’s armed forces still have a lot of work to do in making proper use of drones. Two major challenges are pilot training and achieving interoperability between the services. Another is overcoming a predilection for ...The StrategistBy Sandy Juda Pratama, Curie Maharani and Gautama Adi Kusuma1 day ago - Help Stop the Gaza Genocide Through Activism

As a living breathing human being, you’ve likely seen the heart-wrenching images from Gaza...homes reduced to rubble, children burnt to cinders, families displaced, and a death toll that’s beyond comprehension. What is going on in Gaza is most definitely a genocide, the suffering is real, and it’s easy to feel ...1 day ago

As a living breathing human being, you’ve likely seen the heart-wrenching images from Gaza...homes reduced to rubble, children burnt to cinders, families displaced, and a death toll that’s beyond comprehension. What is going on in Gaza is most definitely a genocide, the suffering is real, and it’s easy to feel ...1 day ago - Willis ignores new Global Financial & Trade Crisis

Donald Trump, who has called the Chair of the Federal Reserve “a major loser”. Photo: Getty ImagesLong stories shortest from our political economy on Tuesday, April 22:US markets slump after Donald Trump threatens the Fed’s independence. China warns its trading partners not to side with the US. Trump says some ...The KakaBy Bernard Hickey1 day ago

Donald Trump, who has called the Chair of the Federal Reserve “a major loser”. Photo: Getty ImagesLong stories shortest from our political economy on Tuesday, April 22:US markets slump after Donald Trump threatens the Fed’s independence. China warns its trading partners not to side with the US. Trump says some ...The KakaBy Bernard Hickey1 day ago - One of the Good Ones

Nick’s KōreroBy Nick Rockel1 day ago

- AI is reshaping security, and the intelligence review sets good direction

The 2024 Independent Intelligence Review found the NIC to be highly capable and performing well. So, it is not a surprise that most of the 67 recommendations are incremental adjustments and small but nevertheless important ...The StrategistBy Miah Hammond-Errey2 days ago

The 2024 Independent Intelligence Review found the NIC to be highly capable and performing well. So, it is not a surprise that most of the 67 recommendations are incremental adjustments and small but nevertheless important ...The StrategistBy Miah Hammond-Errey2 days ago - A worse-than-current-policy world?

This is a re-post from The Climate Brink The world has made real progress toward tacking climate change in recent years, with spending on clean energy technologies skyrocketing from hundreds of billions to trillions of dollars globally over the past decade, and global CO2 emissions plateauing. This has contributed to a reassessment of ...2 days ago

This is a re-post from The Climate Brink The world has made real progress toward tacking climate change in recent years, with spending on clean energy technologies skyrocketing from hundreds of billions to trillions of dollars globally over the past decade, and global CO2 emissions plateauing. This has contributed to a reassessment of ...2 days ago - “An A-Grade Teacher’s Pet”

Hi,I’ve been having a peaceful month of what I’d call “existential dread”, even more aware than usual that — at some point — this all ends.It was very specifically triggered by watching Pantheon, an animated sci-fi show that I’m filing away with all-time greats like Six Feet Under, Watchmen and ...David FarrierBy David Farrier2 days ago

Hi,I’ve been having a peaceful month of what I’d call “existential dread”, even more aware than usual that — at some point — this all ends.It was very specifically triggered by watching Pantheon, an animated sci-fi show that I’m filing away with all-time greats like Six Feet Under, Watchmen and ...David FarrierBy David Farrier2 days ago - Gordon Campbell On Papal Picks, And India As A Defence Ally

Once the formalities of honouring the late Pope wrap up in two to three weeks time, the conclave of Cardinals will go into seclusion. Some 253 of the current College of Cardinals can take part in the debate over choosing the next Pope, but only 138 of them are below ...WerewolfBy ScoopEditor2 days ago

Once the formalities of honouring the late Pope wrap up in two to three weeks time, the conclave of Cardinals will go into seclusion. Some 253 of the current College of Cardinals can take part in the debate over choosing the next Pope, but only 138 of them are below ...WerewolfBy ScoopEditor2 days ago - The National Party’s Prison Pipeline Ruining New Zealand

The National Party government is doubling down on a grim, regressive vision for the future: more prisons, more prisoners, and a society fractured by policies that punish rather than heal. This isn’t just a misstep; it’s a deliberate lurch toward a dystopian future where incarceration is the answer to every ...2 days ago

The National Party government is doubling down on a grim, regressive vision for the future: more prisons, more prisoners, and a society fractured by policies that punish rather than heal. This isn’t just a misstep; it’s a deliberate lurch toward a dystopian future where incarceration is the answer to every ...2 days ago - Don Brash’s NZME Power Grab Must Be Rejected

2 days ago

- 2025 SkS Weekly Climate Change & Global Warming News Roundup #16

A listing of 28 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 13, 2025 thru Sat, April 19, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...3 days ago

A listing of 28 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 13, 2025 thru Sat, April 19, 2025. This week's roundup is again published by category and sorted by number of articles included in each. The formatting is a ...3 days ago - The “perfect storm” National can use to consolidate slash’n’burn policy is here…

“What I’d say to you is…” our Prime Minister might typically begin a sentence, when he’s about to obfuscate and attempt to derail the question you really, really want him to answer properly (even once would be okay, Christopher). Questions such as “Why is a literal election promise over ...exhALANtBy exhalantblog3 days ago

“What I’d say to you is…” our Prime Minister might typically begin a sentence, when he’s about to obfuscate and attempt to derail the question you really, really want him to answer properly (even once would be okay, Christopher). Questions such as “Why is a literal election promise over ...exhALANtBy exhalantblog3 days ago - Economic Futures – Climate Change and Modernity

Ruth IrwinExponential Economic growth is the driver of Ecological degradation. It is driven by CO2 greenhouse gas emissions through fossil fuel extraction and burning for the plethora of polluting industries. Extreme weather disasters and Climate change will continue to get worse because governments subscribe to the current global economic system, ...3 days ago

Ruth IrwinExponential Economic growth is the driver of Ecological degradation. It is driven by CO2 greenhouse gas emissions through fossil fuel extraction and burning for the plethora of polluting industries. Extreme weather disasters and Climate change will continue to get worse because governments subscribe to the current global economic system, ...3 days ago - Winning Together

A man on telly tries to tell me what is realBut it's alright, I like the way that feelsAnd everybody singsWe are evolving from night to morningAnd I wanna believe in somethingWriter: Adam Duritz.The world is changing rapidly, over the last year or so, it has been out with the ...Nick’s KōreroBy Nick Rockel3 days ago

A man on telly tries to tell me what is realBut it's alright, I like the way that feelsAnd everybody singsWe are evolving from night to morningAnd I wanna believe in somethingWriter: Adam Duritz.The world is changing rapidly, over the last year or so, it has been out with the ...Nick’s KōreroBy Nick Rockel3 days ago - My Food Bag’s Cecilia Robinson Courts Your Money For Health

MFB Co-Founder Cecilia Robinson runs Tend HealthcareSummary:Kieran McAnulty calls out National on healthcare lies and says Health Minister Simeon Brown is “dishonest and disingenuous” (video below)McAnulty says negotiation with doctors is standard practice, but this level of disrespect is not, especially when we need and want our valued doctors.National’s $20bn ...Mountain TuiBy Mountain Tūī3 days ago

MFB Co-Founder Cecilia Robinson runs Tend HealthcareSummary:Kieran McAnulty calls out National on healthcare lies and says Health Minister Simeon Brown is “dishonest and disingenuous” (video below)McAnulty says negotiation with doctors is standard practice, but this level of disrespect is not, especially when we need and want our valued doctors.National’s $20bn ...Mountain TuiBy Mountain Tūī3 days ago - The Case Against Chris Luxon Remaining PM

Chris Luxon’s tenure as New Zealand’s Prime Minister has been a masterclass in incompetence, marked by coalition chaos, economic lethargy, verbal gaffes, and a moral compass that seems to point wherever political expediency lies. The former Air New Zealand CEO (how could we forget?) was sold as a steady hand, ...3 days ago

Chris Luxon’s tenure as New Zealand’s Prime Minister has been a masterclass in incompetence, marked by coalition chaos, economic lethargy, verbal gaffes, and a moral compass that seems to point wherever political expediency lies. The former Air New Zealand CEO (how could we forget?) was sold as a steady hand, ...3 days ago - Cameron Slater’s Creepy Fixation On Jacinda Ardern

Has anybody else noticed Cameron Slater still obsessing over Jacinda Ardern? The disgraced Whale Oil blogger seems to have made it his life’s mission to shadow the former Prime Minister of New Zealand like some unhinged stalker lurking in the digital bushes.The man’s obsession with Ardern isn't just unhealthy...it’s downright ...4 days ago

Has anybody else noticed Cameron Slater still obsessing over Jacinda Ardern? The disgraced Whale Oil blogger seems to have made it his life’s mission to shadow the former Prime Minister of New Zealand like some unhinged stalker lurking in the digital bushes.The man’s obsession with Ardern isn't just unhealthy...it’s downright ...4 days ago - Fact brief – Is climate change a net benefit for society?

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is climate change a net benefit for society? Human-caused climate change has been a net detriment to society as measured by loss of ...4 days ago

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. You can submit claims you think need checking via the tipline. Is climate change a net benefit for society? Human-caused climate change has been a net detriment to society as measured by loss of ...4 days ago - National’s Water Done Well Will Cost Ratepayers More

When the National Party hastily announced its “Local Water Done Well” policy, they touted it as the great saviour of New Zealand’s crumbling water infrastructure. But as time goes by it's looking more and more like a planning and fiscal lame duck...and one that’s going to cost ratepayers far more ...4 days ago

When the National Party hastily announced its “Local Water Done Well” policy, they touted it as the great saviour of New Zealand’s crumbling water infrastructure. But as time goes by it's looking more and more like a planning and fiscal lame duck...and one that’s going to cost ratepayers far more ...4 days ago - Trump’s Tariff Tantrum Is Causing Economic Chaos

Donald Trump, the orange-hued oligarch, is back at it again, wielding tariffs like a mob boss swinging a lead pipe. His latest economic edict; slapping hefty tariffs on imports from China, Mexico, and Canada, has the stench of a protectionist shakedown, cooked up in the fevered minds of his sycophantic ...4 days ago

Donald Trump, the orange-hued oligarch, is back at it again, wielding tariffs like a mob boss swinging a lead pipe. His latest economic edict; slapping hefty tariffs on imports from China, Mexico, and Canada, has the stench of a protectionist shakedown, cooked up in the fevered minds of his sycophantic ...4 days ago - The ‘China’ challenge: now a multi-generational test for Australian strategy

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy James Corera and Bethany Allen5 days ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy James Corera and Bethany Allen5 days ago - White Rabbit

One pill makes you largerAnd one pill makes you smallAnd the ones that mother gives youDon't do anything at allGo ask AliceWhen she's ten feet tallSongwriter: Grace Wing Slick.Morena, all, and a happy Bicycle Day to you.Today is an unofficial celebration of the dawning of the psychedelic era, commemorating the ...Nick’s KōreroBy Nick Rockel5 days ago

One pill makes you largerAnd one pill makes you smallAnd the ones that mother gives youDon't do anything at allGo ask AliceWhen she's ten feet tallSongwriter: Grace Wing Slick.Morena, all, and a happy Bicycle Day to you.Today is an unofficial celebration of the dawning of the psychedelic era, commemorating the ...Nick’s KōreroBy Nick Rockel5 days ago - Why Has The World Forgotten About Hollywood?

It’s only been a few months since the Hollywood fires tore through Los Angeles, leaving a trail of devastation, numerous deaths, over 10,000 homes reduced to rubble, and a once glorious film industry on its knees. The Palisades and Eaton fires, fueled by climate-driven dry winds, didn’t just burn houses; ...5 days ago

It’s only been a few months since the Hollywood fires tore through Los Angeles, leaving a trail of devastation, numerous deaths, over 10,000 homes reduced to rubble, and a once glorious film industry on its knees. The Palisades and Eaton fires, fueled by climate-driven dry winds, didn’t just burn houses; ...5 days ago - Viennese Refugees Who Changed the Way We Think

Four eighty-year-old books which are still vitally relevant today. Between 1942 and 1945, four refugees from Vienna each published a ground-breaking – seminal – book.* They left their country after Austria was taken over by fascists in 1934 and by Nazi Germany in 1938. Previously they had lived in ‘Red ...PunditBy Brian Easton5 days ago

Four eighty-year-old books which are still vitally relevant today. Between 1942 and 1945, four refugees from Vienna each published a ground-breaking – seminal – book.* They left their country after Austria was taken over by fascists in 1934 and by Nazi Germany in 1938. Previously they had lived in ‘Red ...PunditBy Brian Easton5 days ago - Disputationes adversus astrologiam divinatricem, by Giovanni Pico della Mirandola (1496): A Complete...

Good Friday, 18th April, 2025: I can at last unveil the Secret Non-Fiction Project. The first complete Latin-to-English translation of Giovanni Pico della Mirandola’s twelve-book Disputationes adversus astrologiam divinatricem (Disputations Against Divinatory Astrology). Amounting to some 174,000 words, total. Some context is probably in order. Giovanni Pico della Mirandola (1463-1494) ...A Phuulish FellowBy strda2215 days ago

Good Friday, 18th April, 2025: I can at last unveil the Secret Non-Fiction Project. The first complete Latin-to-English translation of Giovanni Pico della Mirandola’s twelve-book Disputationes adversus astrologiam divinatricem (Disputations Against Divinatory Astrology). Amounting to some 174,000 words, total. Some context is probably in order. Giovanni Pico della Mirandola (1463-1494) ...A Phuulish FellowBy strda2215 days ago - Hamish Campbell Lied About His Links With Two By Twos Cult

National MP Hamish Campbell's pathetic attempt to downplay his deep ties to and involvement in the Two by Twos...a secretive religious sect under FBI and NZ Police investigation for child sexual abuse...isn’t just a misstep; it’s a calculated lie that insults the intelligence of every Kiwi voter.Campbell’s claim of being ...5 days ago

National MP Hamish Campbell's pathetic attempt to downplay his deep ties to and involvement in the Two by Twos...a secretive religious sect under FBI and NZ Police investigation for child sexual abuse...isn’t just a misstep; it’s a calculated lie that insults the intelligence of every Kiwi voter.Campbell’s claim of being ...5 days ago - Is Shane Jones The Most Corrupt Politician in New Zealand?

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...5 days ago

New Zealand First’s Shane Jones has long styled himself as the “Prince of the Provinces,” a champion of regional development and economic growth. But beneath the bluster lies a troubling pattern of behaviour that reeks of cronyism and corruption, undermining the very democracy he claims to serve. Recent revelations and ...5 days ago - Good Friday

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel5 days ago

Give me one reason to stay hereAnd I'll turn right back aroundGive me one reason to stay hereAnd I'll turn right back aroundSaid I don't want to leave you lonelyYou got to make me change my mindSongwriters: Tracy Chapman.Morena, and Happy Easter, whether that means to you. Hot cross buns, ...Nick’s KōreroBy Nick Rockel5 days ago - Luxon Turns A Blind Eye to Homelessness

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...5 days ago

New Zealand’s housing crisis is a sad indictment on the failures of right wing neoliberalism, and the National Party, under Chris Luxon’s shaky leadership, is trying to simply ignore it. The numbers don’t lie: Census data from 2023 revealed 112,496 Kiwis were severely housing deprived...couch-surfing, car-sleeping, or roughing it on ...5 days ago - The Hoon around the week to April 18

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey6 days ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: on a global survey of over 3,000 economists and scientists showing a significant divide in views on green growth; and ...The KakaBy Bernard Hickey6 days ago - Simeon Brown Has Caused The Doctor’s Strike

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...6 days ago

Simeon Brown, the National Party’s poster child for hubris, consistently over-promises and under-delivers. His track record...marked by policy flip-flops and a dismissive attitude toward expert advice, reveals a politician driven by personal ambition rather than evidence. From transport to health, Brown’s focus seems fixed on protecting National's image, not addressing ...6 days ago - Skeptical Science New Research for Week #16 2025

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...6 days ago

Open access notables Recent intensified riverine CO2 emission across the Northern Hemisphere permafrost region, Mu et al., Nature Communications: Global warming causes permafrost thawing, transferring large amounts of soil carbon into rivers, which inevitably accelerates riverine CO2 release. However, temporally and spatially explicit variations of riverine CO2 emissions remain unclear, limiting the ...6 days ago - Whatever Happened to Cactus Kate?

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...6 days ago

Once a venomous thorn in New Zealand’s blogosphere, Cathy Odgers, aka Cactus Kate, has slunk into the shadows, her once-sharp quills dulled by the fallout of Dirty Politics.The dishonest attack-blogger, alongside her vile accomplices such as Cameron Slater, were key players in the National Party’s sordid smear campaigns, exposed by Nicky ...6 days ago - Sovereign capability can benefit Australia—up to a point

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah6 days ago

Once upon a time, not so long ago, those who talked of Australian sovereign capability, especially in the technology sector, were generally considered an amusing group of eccentrics. After all, technology ecosystems are global and ...The StrategistBy Rajiv Shah6 days ago - David Seymour’s Charter School Rort

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...6 days ago

The ACT Party leader’s latest pet project is bleeding taxpayers dry, with $10 million funneled into seven charter schools for just 215 students. That’s a jaw-dropping $46,500 per student, compared to roughly $9,000 per head in state schools.You’d think Seymour would’ve learned from the last charter school fiasco, but apparently, ...6 days ago - Flexibility and awareness will help India deal with Trump (again)

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan6 days ago

India navigated relations with the United States quite skilfully during the first Trump administration, better than many other US allies did. Doing so a second time will be more difficult, but India’s strategic awareness and ...The StrategistBy Rajeswari Pillai Rajagopalan6 days ago - Inflation data confirms real terms minimum wage cut

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield6 days ago

The NZCTU Te Kauae Kaimahi is concerned for low-income workers given new data released by Stats NZ that shows inflation was 2.5% for the year to March 2025, rising from 2.2% in December last year. “The prices of things that people can’t avoid are rising – meaning inflation is rising ...NZCTUBy Stella Whitfield6 days ago - Climate Change: Kicking the can down the road again

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant6 days ago

Last week, the Parliamentary Commissioner for the Environment recommended that forestry be removed from the Emissions Trading Scheme. Its an unfortunate but necessary move, required to prevent the ETS's total collapse in a decade or so. So naturally, National has told him to fuck off, and that they won't be ...No Right TurnBy Idiot/Savant6 days ago - The Spirit for Australia: why Canberra should pursue the B-2 bomber

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen6 days ago

China’s recent naval circumnavigation of Australia has highlighted a pressing need to defend Australia’s air and sea approaches more effectively. Potent as nuclear submarines are, the first Australian boats under AUKUS are at least seven ...The StrategistBy Euan Graham and Linus Cohen6 days ago - A bit more unpicking of RB spending and the Funding Agreement

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell6 days ago

In yesterday’s post I tried to present the Reserve Bank Funding Agreement for 2025-30, as approved by the Minister of Finance and the Bank’s Board, in the context of the previous agreement, and the variation to that agreement signed up to by Grant Robertson a few weeks before the last ...Croaking CassandraBy Michael Reddell6 days ago - A successful COP31 needs Pacific countries at the table

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson6 days ago

Australia’s bid to co-host the 31st international climate negotiations (COP31) with Pacific island countries in late 2026 is directly in our national interest. But success will require consultation with the Pacific. For that reason, no ...The StrategistBy Mike Copage and Blake Johnson6 days ago - Brown unveils unfunded health plan for small NZ

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey6 days ago

Old and outdated buildings being demolished at Wellington Hospital in 2018. The new infrastructure being funded today will not be sufficient for future population size and some will not be built by 2035. File photo: Lynn GrievesonLong stories short from our political economy on Thursday, April 17:Simeon Brown has unveiled ...The KakaBy Bernard Hickey6 days ago - Thursday 17 April

Thousands of senior medical doctors have voted to go on strike for 24 hours overpay at the beginning of next month. Callaghan Innovation has confirmed dozens more jobs are on the chopping block as the organisation disestablishes. Palmerston North hospital staff want improved security after a gun-wielding man threatened their ...NZCTUBy Jack McDonald6 days ago

Thousands of senior medical doctors have voted to go on strike for 24 hours overpay at the beginning of next month. Callaghan Innovation has confirmed dozens more jobs are on the chopping block as the organisation disestablishes. Palmerston North hospital staff want improved security after a gun-wielding man threatened their ...NZCTUBy Jack McDonald6 days ago - Artificial Intelligence in the Workplace

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield6 days ago

The introduction of AI in workplaces can create significant health and safety risks for workers (such as intensification of work, and extreme surveillance) which can significantly impact workers’ mental and physical wellbeing. It is critical that unions and workers are involved in any decision to introduce AI so that ...NZCTUBy Stella Whitfield6 days ago - NZ Must Undertake a Peacekeeping Role in Trump’s Wars

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...6 days ago

Donald Trump’s return to the White House and aggressive posturing is undermining global diplomacy, and New Zealand must stand firm in rejecting his reckless, fascist-driven policies that are dragging the world toward chaos.As a nation with a proud history of peacekeeping and principled foreign policy, we should limit our role ...6 days ago - Donald Trump’s first three months: rude, raucous and rogue

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell7 days ago

Sunday marks three months since Donald Trump’s inauguration as US president. What a ride: the style rude, language raucous, and the results rogue. Beyond manners, rudeness matters because tone signals intent as well as personality. ...The StrategistBy Graeme Dobell7 days ago - Gordon Campbell On The Left’s Electability Crisis, And The Abundance Ecotopia

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor7 days ago

There are any number of reasons why anyone thinking of heading to the United States for a holiday should think twice. They would be giving their money to a totalitarian state where political dissenters are being rounded up and imprisoned here and here, where universities are having their funds for ...WerewolfBy ScoopEditor7 days ago - Taiwan: the sponge that soaks up Chinese power

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill1 week ago

Taiwan has an inadvertent, rarely acknowledged role in global affairs: it’s a kind of sponge, soaking up much of China’s political, military and diplomatic efforts. Taiwan soaks up Chinese power of persuasion and coercion that ...The StrategistBy Nathan Attrill1 week ago - Women in combat roles strengthen our defence force

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker1 week ago

The Ukraine war has been called the bloodiest conflict since World War II. As of July 2024, 10,000 women were serving in frontline combat roles. Try telling them—from the safety of an Australian lounge room—they ...The StrategistBy Jennifer Parker1 week ago - China targets Canada’s election—and may be targeting Australia’s

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn1 week ago

Following Canadian authorities’ discovery of a Chinese information operation targeting their country’s election, Australians, too, should beware such risks. In fact, there are already signs that Beijing is interfering in campaigning for the Australian election ...The StrategistBy Fitriani and Nira Calwyn1 week ago - Climate Adam: Climate Scientist Reacts to Elon Musk

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...1 week ago

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). From "founder" of Tesla and the OG rocket man with SpaceX, and rebranding twitter as X, Musk has ...1 week ago - Rattus Interneticus: Otago’s Internet Saga

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2211 week ago

Back in February 2024, a rat infestation attracted a fair few headlines in the South Dunedin Countdown supermarket. Today, the rats struck again. They took out the Otago-Southland region’s internet connection. https://www.stuff.co.nz/nz-news/360656230/internet-outage-hits-otago-and-southland Strictly, it was just a coincidence – rats decided to gnaw through one fibre cable, while some hapless ...A Phuulish FellowBy strda2211 week ago - Spin (and obfuscation)

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell1 week ago

I came in this morning after doing some chores and looked quickly at Twitter before unpacking the groceries. Someone was retweeting a Radio NZ story with the headline “Reserve Bank’s budget to be slashed by 25%”. Wow, I thought, the Minister of Finance has really delivered this time. And then ...Croaking CassandraBy Michael Reddell1 week ago - Little’s pitch

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant1 week ago

So, having teased it last week, Andrew Little has announced he will run for mayor of Wellington. On RNZ, he's saying its all about services - "fixing the pipes, making public transport cheaper, investing in parks, swimming pools and libraries, and developing more housing". Meanwhile, to the readers of the ...No Right TurnBy Idiot/Savant1 week ago - Our Rough Beast.

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...1 week ago

And what rough beast, its hour come round at last,Slouches towards Bethlehem to be born?W.B. Yeats, The Second Coming, 1921ALL OVER THE WORLD, devout Christians will be reaching for their bibles, reading and re-reading Revelation 13:16-17. For the benefit of all you non-Christians out there, these are the verses describing ...1 week ago - What does India Want? What is New Zealand willing to give?

1 week ago

- President Trump is redefining America’s international role, and Australia has influence

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King1 week ago

In the week of Australia’s 3 May election, ASPI will release Agenda for Change 2025: preparedness and resilience in an uncertain world, a report promoting public debate and understanding on issues of strategic importance to ...The StrategistBy Nerida King1 week ago - Simeon Brown Gaslights Doctors

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī1 week ago

Yesterday, 5,500 senior doctors across Aotearoa New Zealand voted overwhelmingly to strike for a day.This is the first time in New Zealand ASMS members have taken strike action for 24 hours.They are asking the government to fund them and account for resource shortfalls.Vacancies are critical - 45-50% in some regions.The ...Mountain TuiBy Mountain Tūī1 week ago - ACT’s “Tough on Crime” Facade Crumbles with Jago’s Appeal

1 week ago

Related Posts

- Release: Govt funding needed to combat invasive seaweed

The Government must support Northland hapū who have resorted to rakes and buckets to try to control a devastating invasive seaweed that threatens the local economy and environment. ...1 day ago

The Government must support Northland hapū who have resorted to rakes and buckets to try to control a devastating invasive seaweed that threatens the local economy and environment. ...1 day ago - New Zealand First Introduces Bill Defining ‘Woman’ and ‘Man’ in Law

New Zealand First has today introduced a Member’s Bill that would ensure the biological definition of a woman and man are defined in law. “This is not about being anti-anyone or anti-anything. This is about ensuring we as a country focus on the facts of biology and protect the ...1 day ago

New Zealand First has today introduced a Member’s Bill that would ensure the biological definition of a woman and man are defined in law. “This is not about being anti-anyone or anti-anything. This is about ensuring we as a country focus on the facts of biology and protect the ...1 day ago - Release: Labour marks the passing of Pope Francis

2 days ago

- Release: Boot camps blog post fails to provide clarity

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...6 days ago

After stonewalling requests for information on boot camps, the Government has now offered up a blog post right before Easter weekend rather than provide clarity on the pilot. ...6 days ago - Release: Inflation rises and families feel the squeeze

6 days ago

- Release: Govt doesn’t know how to fund new hospitals

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 week ago

The Government’s health infrastructure plan is big on promises but coy on where the money is coming from. ...1 week ago - Release: $10 million for only 215 students in charter schools

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 week ago

David Seymour is pouring $10 million into charter schools that only have 215 students enrolled. ...1 week ago - Release: Food prices further stretching the family budget

Families already stretched by rising costs will struggle with the news food prices are going up again. ...1 week ago

Families already stretched by rising costs will struggle with the news food prices are going up again. ...1 week ago - Release: Mental health staff and patients at risk without plan

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...1 week ago

More people could be harmed if Minister for Mental Health Matt Doocey does not guarantee to protect patients and workers as the Police withdraw from supporting mental health call outs. ...1 week ago - Release: Driver licensing proposal doesn’t put safety first

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...1 week ago

The Government’s proposal to change driver licensing rules is a mixed bag of sensible and careless. ...1 week ago - Release: Students struggling as Govt sits on hands

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...2 weeks ago

The Government is continuing to sit on its hands as students struggle to pay rent due to delays with StudyLink. ...2 weeks ago - Release: More must be done to stop children going hungry

More children are going hungry and statistics showing children in material hardship continue to get worse. ...2 weeks ago

More children are going hungry and statistics showing children in material hardship continue to get worse. ...2 weeks ago - Greens continue to call for Pacific Visa Waiver

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...2 weeks ago

The Green Party recognises the extension of visa allowances for our Pacific whānau as a step in the right direction but continues to call for a Pacific Visa Waiver. ...2 weeks ago - More children going hungry under Coalition govt

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...2 weeks ago

The Government yesterday released its annual child poverty statistics, and by its own admission, more tamariki across Aotearoa are now living in material hardship. ...2 weeks ago - Release: Longer wait for treatment under National

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...2 weeks ago

New Zealanders have waited longer to get an appointment with a specialist and to get elective surgery under the National Government. ...2 weeks ago - Ka mate te Pire- Ka ora te mana o Te Tiriti o Waitangi me te iwi Māori

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...2 weeks ago

Today, Te Pāti Māori join the motu in celebration as the Treaty Principles Bill is voted down at its second reading. “From the beginning, this Bill was never welcome in this House,” said Te Pāti Māori Co-Leader, Rawiri Waititi. “Our response to the first reading was one of protest: protesting ...2 weeks ago - Chris Hipkins speech: Treaty Principles Bill second reading

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...2 weeks ago

Normally, when I rise in this House to speak on a bill, I say it's a great privilege to speak on the bill. That is not the case today. ...2 weeks ago - Release: End to the Treaty Principles Bill, but challenges remain ahead for Aotearoa

2 weeks ago

- Ka mate te Pire, ka ora Te Tiriti o Waitangi – Treaty Principles Bill dead, Te Tiriti o Waitangi m...

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...2 weeks ago

The Green Party is proud to have voted down the Coalition Government’s Treaty Principles Bill, an archaic piece of legislation that sought to attack the nation’s founding agreement. ...2 weeks ago - Member’s Bill an opportunity for climate action

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...2 weeks ago

A Member’s Bill in the name of Green Party MP Julie Anne Genter which aims to stop coal mining, the Crown Minerals (Prohibition of Mining) Amendment Bill, has been pulled from Parliament’s ‘biscuit tin’ today. ...2 weeks ago - Release: Bill to make trading laws fairer passes first hurdle

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...2 weeks ago

Labour MP Kieran McAnulty’s Members Bill to make the law simpler and fairer for businesses operating on Easter, Anzac and Christmas Days has passed its first reading after a conscience vote in Parliament. ...2 weeks ago - Release: Reserve Bank acts while Govt shrugs

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...2 weeks ago

Nicola Willis continues to sit on her hands amid a global economic crisis, leaving the Reserve Bank to act for New Zealanders who are worried about their jobs, mortgages, and KiwiSaver. ...2 weeks ago - Release: Property Law Amendment Bill pulled from ballot

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...2 weeks ago

A Bill to protect first home buyers and others from bad faith property vendors has been drawn from the Member’s Ballot. ...2 weeks ago - Release: More children at risk of losing family connections

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...2 weeks ago

Karen Chhour is proposing to scrap Oranga Tamariki targets which aim to connect more children under state care with family and their culture. ...2 weeks ago - Release: David Parker made a difference – Hipkins

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...2 weeks ago

The Labour Leader today acknowledged and celebrated David Parker’s 23-year contribution to the Labour Party and to Parliament. ...2 weeks ago - Release: David Parker to step down from Parliament

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...2 weeks ago

Long-serving Labour MP and former Minister David Parker has today announced his intention to leave Parliament. ...2 weeks ago - Release: Flaws in Govt’s climate strategy will cost us money

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...2 weeks ago

The Government’s plan to achieve our climate goals falls short, and will cost New Zealanders money and jobs. ...2 weeks ago - Green Party differing view on the Treaty Principles Bill

2 weeks ago

- Te Pāti Māori Urges Governor-General to Block Repeal of 7AA

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...3 weeks ago

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...3 weeks ago

Related Posts

- Sniping koalas from helicopters: here’s what’s wrong with Victoria’s unprecedented cull

Source: The Conversation (Au and NZ) – By Liz Hicks, Lecturer in Law, The University of Melbourne Roberto La Rosa/Shutterstock Snipers in helicopters have shot more than 700 koalas in the Budj Bim National Park in western Victoria in recent weeks. It’s believed to be the first time koalas ...Evening ReportBy The Conversation2 hours ago

Source: The Conversation (Au and NZ) – By Liz Hicks, Lecturer in Law, The University of Melbourne Roberto La Rosa/Shutterstock Snipers in helicopters have shot more than 700 koalas in the Budj Bim National Park in western Victoria in recent weeks. It’s believed to be the first time koalas ...Evening ReportBy The Conversation2 hours ago - Rather than short-term fixes, communities need flexible plans to prepare for a range of likely clima...

Source: The Conversation (Au and NZ) – By Tom Logan, Senior Lecturer Above the Bar of Civil Systems Engineering, University of Canterbury Dave Rowland/Getty Images As New Zealanders clean up after ex-Cyclone Tam which left thousands without power and communities once again facing flooding, it’s tempting to seek immediate ...Evening ReportBy The Conversation3 hours ago

Source: The Conversation (Au and NZ) – By Tom Logan, Senior Lecturer Above the Bar of Civil Systems Engineering, University of Canterbury Dave Rowland/Getty Images As New Zealanders clean up after ex-Cyclone Tam which left thousands without power and communities once again facing flooding, it’s tempting to seek immediate ...Evening ReportBy The Conversation3 hours ago - ‘Me tū, me haka!’: Te Pāti Māori MPs defend haka in Privileges Committee written subm...

5 hours ago

- Why do Labor and the Coalition have so many similar policies? It’s simple mathematics

Source: The Conversation (Au and NZ) – By Gabriele Gratton, Professor of Politics and Economics and ARC Future Fellow, UNSW Sydney Pundits and political scientists like to repeat that we live in an age of political polarisation. But if you sat through the second debate between Prime Minister Anthony Albanese ...Evening ReportBy The Conversation5 hours ago

Source: The Conversation (Au and NZ) – By Gabriele Gratton, Professor of Politics and Economics and ARC Future Fellow, UNSW Sydney Pundits and political scientists like to repeat that we live in an age of political polarisation. But if you sat through the second debate between Prime Minister Anthony Albanese ...Evening ReportBy The Conversation5 hours ago - Feeling mad? New research suggests mindfulness could help manage anger and aggression

Source: The Conversation (Au and NZ) – By Siobhan O’Dean, Research Fellow, The Matilda Centre for Research in Mental Health and Substance Use, University of Sydney Kaboompics.com/Pexels There’s no shortage of things to feel angry about these days. Whether it’s politics, social injustice, climate change or the cost-of-living crisis, ...Evening ReportBy The Conversation5 hours ago

Source: The Conversation (Au and NZ) – By Siobhan O’Dean, Research Fellow, The Matilda Centre for Research in Mental Health and Substance Use, University of Sydney Kaboompics.com/Pexels There’s no shortage of things to feel angry about these days. Whether it’s politics, social injustice, climate change or the cost-of-living crisis, ...Evening ReportBy The Conversation5 hours ago - Who will the next pope be? Here are some top contenders

Source: The Conversation (Au and NZ) – By Darius von Guttner Sporzynski, Historian, Australian Catholic University The death of Pope Francis this week marks the end of a historic papacy and the beginning of a significant transition for the Catholic Church. As the faithful around the world mourn his passing, ...Evening ReportBy The Conversation5 hours ago

Source: The Conversation (Au and NZ) – By Darius von Guttner Sporzynski, Historian, Australian Catholic University The death of Pope Francis this week marks the end of a historic papacy and the beginning of a significant transition for the Catholic Church. As the faithful around the world mourn his passing, ...Evening ReportBy The Conversation5 hours ago - Mentoring Crucial For Success Of Overseas And New Secondary Teachers

A recent survey, carried out by PPTA Te Wehengarua, of establishing and overseas trained secondary teachers found that 90% of respondents agreed that mentoring had helped their development. ...5 hours ago

A recent survey, carried out by PPTA Te Wehengarua, of establishing and overseas trained secondary teachers found that 90% of respondents agreed that mentoring had helped their development. ...5 hours ago - Chris Bishop makes announcement on Auckland’s Northwest Rapid Transit

5 hours ago

- Investitures At Government House Wellington

Other Honours recipients include country singer Suzanne Prentice, most capped All Black Samuel Whitelock, and Māori language educator and academic Professor Rawinia Higgins. ...5 hours ago

Other Honours recipients include country singer Suzanne Prentice, most capped All Black Samuel Whitelock, and Māori language educator and academic Professor Rawinia Higgins. ...5 hours ago - ER Report: A Roundup of Significant Articles on EveningReport.nz for April 23, 2025

ER Report: Here is a summary of significant articles published on EveningReport.nz on April 23, 2025. The ‘responsible gambling’ mantra does nothing to prevent harm. It probably makes things worseSource: The Conversation (Au and NZ) – By Charles Livingstone, Associate Professor, School of Public Health and Preventive Medicine, Monash University ...Evening ReportBy Evening Report5 hours ago

ER Report: Here is a summary of significant articles published on EveningReport.nz on April 23, 2025. The ‘responsible gambling’ mantra does nothing to prevent harm. It probably makes things worseSource: The Conversation (Au and NZ) – By Charles Livingstone, Associate Professor, School of Public Health and Preventive Medicine, Monash University ...Evening ReportBy Evening Report5 hours ago - Labour wants Christopher Luxon to step in over Winston Peters’ comments on RNZ funding

"Threatening to cut funding is a form of censorship. It is totally and utterly wrong," Chris Hipkins says. ...5 hours ago

"Threatening to cut funding is a form of censorship. It is totally and utterly wrong," Chris Hipkins says. ...5 hours ago - The ‘responsible gambling’ mantra does nothing to prevent harm. It probably makes things worse

Source: The Conversation (Au and NZ) – By Charles Livingstone, Associate Professor, School of Public Health and Preventive Medicine, Monash University Haelen Haagen/Shutterstock Recent royal commissions and inquiries into Crown and Star casino groups attracted much media attention. Most of this was focused on money laundering and other ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Charles Livingstone, Associate Professor, School of Public Health and Preventive Medicine, Monash University Haelen Haagen/Shutterstock Recent royal commissions and inquiries into Crown and Star casino groups attracted much media attention. Most of this was focused on money laundering and other ...Evening ReportBy The Conversation6 hours ago - This election, Gen Z and Millennials hold most of the voting power. How might they wield it?

Source: The Conversation (Au and NZ) – By Intifar Chowdhury, Lecturer in Government, Flinders University The centre of gravity of Australian politics has shifted. Millennials and Gen Z voters, now comprising 47% of the electorate, have taken over as the dominant voting bloc. But this generational shift isn’t just ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Intifar Chowdhury, Lecturer in Government, Flinders University The centre of gravity of Australian politics has shifted. Millennials and Gen Z voters, now comprising 47% of the electorate, have taken over as the dominant voting bloc. But this generational shift isn’t just ...Evening ReportBy The Conversation6 hours ago - Only a third of Australians support increasing defence spending: new research

Source: The Conversation (Au and NZ) – By Richard Dunley, Senior Lecturer in History and Maritime Strategy, UNSW Sydney National security issues have been a constant feature of this federal election campaign. Both major parties have spruiked their national security credentials by promising additional defence spending. The Coalition has ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Richard Dunley, Senior Lecturer in History and Maritime Strategy, UNSW Sydney National security issues have been a constant feature of this federal election campaign. Both major parties have spruiked their national security credentials by promising additional defence spending. The Coalition has ...Evening ReportBy The Conversation6 hours ago - After stunning comeback, centre-left Liberals likely to win majority of seats at Canadian election

Source: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and Statistics, The University of Melbourne In Canada, the governing centre-left Liberals had trailed the Conservatives by more than 20 points in January, but now lead by five ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Adrian Beaumont, Election Analyst (Psephologist) at The Conversation; and Honorary Associate, School of Mathematics and Statistics, The University of Melbourne In Canada, the governing centre-left Liberals had trailed the Conservatives by more than 20 points in January, but now lead by five ...Evening ReportBy The Conversation6 hours ago - The Greens are hoping for another ‘greenslide’ election. What do the polls say?

Source: The Conversation (Au and NZ) – By Narelle Miragliotta, Associate Professor in Politics, Murdoch University Election talk is inevitably focused on Labor and the Coalition because they are the parties that customarily form government. But a minor party like the Greens is consequential, regardless of whether the election ...Evening ReportBy The Conversation6 hours ago

Source: The Conversation (Au and NZ) – By Narelle Miragliotta, Associate Professor in Politics, Murdoch University Election talk is inevitably focused on Labor and the Coalition because they are the parties that customarily form government. But a minor party like the Greens is consequential, regardless of whether the election ...Evening ReportBy The Conversation6 hours ago - Victory for US press freedom and workers – court grants injunction in VOA media case

Asia Pacific Report The US District Court for the District of Columbia has granted a preliminary injunction in Widakuswara v Lake, affirming the US Agency for Global Media (USAGM) was unlawfully shuttered by the Trump administration, Acting Director Victor Morales and Special Adviser Kari Lake. The decision enshrines that USAGM ...Evening ReportBy Asia Pacific Report7 hours ago

Asia Pacific Report The US District Court for the District of Columbia has granted a preliminary injunction in Widakuswara v Lake, affirming the US Agency for Global Media (USAGM) was unlawfully shuttered by the Trump administration, Acting Director Victor Morales and Special Adviser Kari Lake. The decision enshrines that USAGM ...Evening ReportBy Asia Pacific Report7 hours ago - Gone By Lunchtime: Christopher, champion of the free trade world

As the PM talks trade with Keir Starmer, his deputy is busy, busy, busy. A prime ministerial speech and free-trade phone tree with like-minded leaders in response to Trump’s tarrif binge impressed many commentators, but not all of them: leading pundit and deputy prime minister Winston Peters was indignant ...The SpinoffBy The Spinoff7 hours ago

As the PM talks trade with Keir Starmer, his deputy is busy, busy, busy. A prime ministerial speech and free-trade phone tree with like-minded leaders in response to Trump’s tarrif binge impressed many commentators, but not all of them: leading pundit and deputy prime minister Winston Peters was indignant ...The SpinoffBy The Spinoff7 hours ago - PSA Forces Changes To Restructure Of Data & Digital And Pacific Health

The settlement relates to proposed restructures of the Data and Digital and Pacific Health teams at Health New Zealand Te Whatu Ora which were subject to litigation before the Employment Relations Authority set down for 22 April 2025. ...7 hours ago

The settlement relates to proposed restructures of the Data and Digital and Pacific Health teams at Health New Zealand Te Whatu Ora which were subject to litigation before the Employment Relations Authority set down for 22 April 2025. ...7 hours ago - Scientists claim to have found evidence of alien life. But ‘biosignatures’ might hide more than ...

Source: The Conversation (Au and NZ) – By Campbell Rider, PhD Candidate in Philosophy – Philosophy of Biology, University of Sydney Artist’s impression of the exoplanet K2-18b A. Smith/N. Madhusudhan (University of Cambridge) Whether or not we’re alone in the universe is one of the biggest questions in science. A ...Evening ReportBy The Conversation7 hours ago

Source: The Conversation (Au and NZ) – By Campbell Rider, PhD Candidate in Philosophy – Philosophy of Biology, University of Sydney Artist’s impression of the exoplanet K2-18b A. Smith/N. Madhusudhan (University of Cambridge) Whether or not we’re alone in the universe is one of the biggest questions in science. A ...Evening ReportBy The Conversation7 hours ago - Defence Ministry puts out tender for help strengthening systems ‘increasingly vulnerable’...

Its new Defence Capability Plan envisages spending between $100 million and $300 million on cyber upgrades in the next four years. ...8 hours ago