The end of the post war boom

The end of the post war boom

Written By:

nickkelly - Date published:

7:56 am, January 11th, 2023 - 87 comments

Categories: Austerity, Brexit, capitalism, Economy, economy, Keynes, social democracy, socialism, uk politics, Unions, workers' rights -

Tags: 4th labour government, Grenfell, hurricane katrina, karl marx, Keynesian economics, neo-liberalism, nick kelly, pike river, socialism, tendency of the rate of profit to fall

Originally published on Nick Kelly’s blog

Throughout my time being active in politics, people have discussed the rise of Neo-Liberalism and the free market that occurred throughout much of the world from the late 1970s onwards. Yet few seem to really understand the reasons for this significant shift in economic policy at that time, which continues to shape our society today.

Those less familiar with the works of Karl Marx may not be familiar with the concept of the tendency for the rate of profit to fall. One does not need to be a Marxist nor socialistically inclined to believe or understand this law of economics, which explains what has happened in the last half-century of economics. As Wikipedia explains:

The tendency of the rate of profit to fall (TRPF) is a hypothesis in the crisis theory of political economy, according to which the rate of profit—the ratio of the profit to the amount of invested capital—decreases over time. This hypothesis gained additional prominence from its discussion by Karl Marx in Chapter 13 of Capital, Volume III,[1] but economists as diverse as Adam Smith,[2]John Stuart Mill,[3]David Ricardo[4] and Stanley Jevons[5] referred explicitly to the TRPF as an empirical phenomenon that demanded a further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.[6]

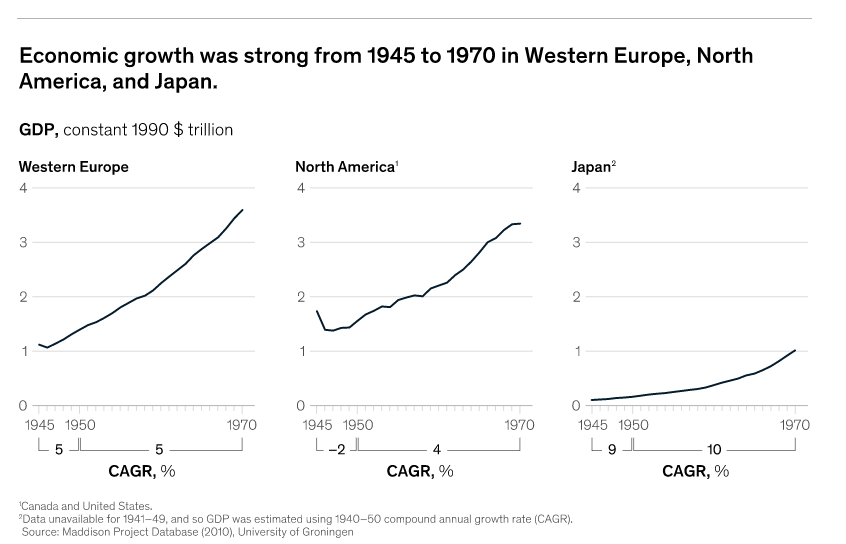

To simplify this concept in explaining what happened in the late twentieth century we simply need to understand that in response to the 1930s depression many nations and particularly developed nations invested in infrastructure to stimulate their economies and create employment. This was followed shortly by the Second World War where investment in industry was required. Then after the war, the Marshall Plan rebuilt Europe, whilst similar investment and rebuilding occurred throughout the late 1940s. This period of investment in response to the depression and war created the post-war boom resulting in significant economic growth.

Keynesian economics whereby government policy and intervention in the economy and significant levels of government spending are required to stimulate the economy and prevent depressions. This theory dominated government policy in economically well-off nations from Great Depression until the mid-1970s, when the post-war boom came to an end. The thing Keynesian economics was meant to prevent happening, did happen. So in 1979, Margaret Thatcher came to power in the UK, and the following year Ronald Reagan in the US, and with them came a sea change in economic policies not just in their own countries but internationally.

The Neo-Liberal project essentially was to move away from state intervention and allow the invisible hand to do its dirty work. Privatisation of state infrastructure such as rail or power companies, reducing spending on public services and increased user pay charges, and generally reducing the size of the state to try and stimulate the private sector. Part of this also included reducing employment rights including laws protecting the right to collectively organise, ultimately resulting in reduced earnings for most people. As my series of blog posts about the trade union movement suggested, the job of those wishing to attack union rights was often made much easier by the fact that most union leaders and a poor understanding of economics or how to respond to the end of the post-war boom.

New Zealand was peculiar in its transition to Neo-Liberalism in that it was the Labour Government of 1984 to 1990 that first introduced and championed these right-wing economic policies. At the time the big political issue in New Zealand was the Nuclear Free movement which successfully stopped US Nuclear ships from visiting New Zealand. Whilst this was a worthy campaign, it is strange to think that a government selling off state assets (often for less than their market price) and putting thousands out of work managed to win support based on a Nuclear shipping policy when their economic decisions were hurting so many.

Neo-Liberalism and reducing the size and expenditure of the state were meant to stimulate the economy. For whatever short-term gains were made in the 1980s and 1990s, which generally only benefited the 1% wealthy elite, it soon became clear that the fundamental problems in the economy still remained. Unregulated or self-regulating markets resulted in terrible outcomes including the Pike River mining disaster in New Zealand, the Grenfell Tower fire in London, and the levee failures in New Orleans during Hurricane Katrina all from lack of regulation and investment by the Government.

The 2008 crash ended the widely held belief that the market could correct itself or that wealth would trickle down. This crisis was due to a lack of financial regulation and was then made much worse by those countries who insisted on implementing austerity measures to restore public finances, instead of making the economic situation worse. Neo-Liberalism now is discredited and few governments either on the left or right really have an appetite for the types of policies Thatcher and Reagan promoted 40 years ago. As I will discuss in another blog post on Liz Truss’s brief time as Prime Minister, attempts to follow such a path now generally end in disaster very quickly.

After the fall of the Eastern Block Communist/Marxism ideology has been largely discredited. The end of the post-war boom saw an end to Keynesian economics and a shift to Neo-Liberalism, which is now also largely discredited. In 2021 economic policy is largely populist and a weird mix of Keynsian/Keynesian-lite interventionism with a sprinkling of laissez-faire rhetoric. So far in the 21st century, Capitalism has lacked any serious rivalry from any other theory or system. But capitalism has also run out of ideas. This is not just an abstract notion as the political upheavals in recent years stem from people feeling let down and angry by an economy that has not delivered. Yet, there is no clear alternative to the status quo. People were shocked in 2016 when the UK voted for Brexit and the US voted for Donald Trump as President. The increasingly polarised and challenging political world we live in can be blamed on many different factors. But at its core, I believe much of the trouble is caused by the lack of economic policy ideas that can address some of the great challenges we face.

We can learn much from mid-20th century Keynesian economics, but we also need to understand the limits of this theory and what caused the shift away from them from the late 1970s. Whilst the Neo-Liberal experiment also failed, we should also understand that bureaucratic and cumbersome regulation must have a purpose, and whilst state investment in public services can have real benefits we must be clear about what these actually are when this money is spent. Whilst I subscribed to socialist ideas in the past, it is clear that attempts to implement such a system to date have all ended in failure. However, we can still take Marx’s economic analysis (if not subscribing fully to his proposed remedy), specifically what he had to say about the tendency of the rate of profit to fall. Before we decide whether the current economic system can be reformed or needs to be completely replaced, we first need to improve the general understanding of how our economic system works.

Related Posts

87 comments on “The end of the post war boom ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Stephen D to Dennis Frank on

- joe90 on

- Drowsy M. Kram to Anne on

- Phillip ure to Res Publica on

- thebiggestfish to Ad on

- feijoa on

- Obtrectator to Visubversa on

- gsays to Visubversa on

- Anne on

- Dottie on

- Bearded Git to Phillip ure on

- Cricklewood to Ad on

- Phillip ure to Ad on

- tWig on

- weka to Karolyn_IS on

- weka to tsmithfield on

- weka to Res Publica on

- tsmithfield on

- tc to PsyclingLeft.Always on

- tWig on

- tc to Bearded Git on

- Res Publica to weka on

- Karolyn_IS on

- tWig to Phillip ure on

- Sanctuary on

- weka to Res Publica on

- Visubversa to gsays on

- gsays on

- Visubversa on

- mikesh to Phillip ure on

- Phillip ure to Joe90 on

- Res Publica to Dennis Frank on

- AB to PsyclingLeft.Always on

- Phillip ure to mikesh on

- Joe90 to Phillip ure on

- weka to Phillip ure on

- mikesh to Phillip ure on

- Dennis Frank on

- Phillip ure to alwyn on

- Nic the NZer to Phillip ure on

- Dennis Frank on

- tc to Bearded Git on

- weka on

- Ad on

- Phillip ure on

- Phillip ure to Bearded Git on

- Janice to Bearded Git on

- Bearded Git on

- Bearded Git to Patricia Bremner on

- weka to Bearded Git on

- Bearded Git on

- thinker to Bearded Git on

- Psycho Milt on

- Dennis Frank to Res Publica on

- Dennis Frank to Res Publica on

- Dennis Frank to lprent on

- Res Publica to lprent on

- Res Publica to weka on

- lprent to Dennis Frank on

- Paul Huggett to Phillip ure on

- Dennis Frank on

- weka to Res Publica on

- Ad to Phillip ure on

- joe90 on

- SPC to Res Publica on

- Richard on

- Dennis Frank to Nic the NZer on

- mikesh on

- Phillip ure on

- Nic the NZer to AB on

- SPC to Dennis Frank on

- mpledger to Belladonna on

- Dennis Frank to Ad on

- Dennis Frank to Incognito on

- Incognito to Dennis Frank on

- Dennis Frank to weka on

- Incognito to Dennis Frank on

- Ad on

- Dennis Frank to weka on

- Ad to Res Publica on

- Visubversa to weka on

- Res Publica to Ad on

- Cricklewood to Phillip ure on

- weka to Dennis Frank on

- weka to Dennis Frank on

- Ad to Res Publica on

- Res Publica to Joe90 on

- weka to Visubversa on

Recent Posts

-

by lprent

-

by weka

-

by advantage

-

by Guest post

-

by Incognito

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by Guest post

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by advantage

-

by Incognito

-

by mickysavage

-

by weka

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

- Centring people of colour to close the climate justice gap

Australia must do more to empower communities of colour in its response to climate change. In late February, the Multicultural Leadership Initiative hosted its Our Common Future summits in Sydney and Melbourne. These summits focused ...The StrategistBy Afeeya Akhand12 minutes ago

Australia must do more to empower communities of colour in its response to climate change. In late February, the Multicultural Leadership Initiative hosted its Our Common Future summits in Sydney and Melbourne. These summits focused ...The StrategistBy Afeeya Akhand12 minutes ago - Presidency of doom

Questions 1. In his godawful decree, what tariff rate was imposed by Trump upon the EU?a. 10% same as New Zealandb. 20%, along with a sneer about themc. 40%, along with an outright lie about France d. 69% except for the town Melania comes from2. The justice select committee has ...More Than A FeildingBy David Slack1 hour ago

Questions 1. In his godawful decree, what tariff rate was imposed by Trump upon the EU?a. 10% same as New Zealandb. 20%, along with a sneer about themc. 40%, along with an outright lie about France d. 69% except for the town Melania comes from2. The justice select committee has ...More Than A FeildingBy David Slack1 hour ago - The ideology of grovelling to Trump

Yesterday the Trump regime in America began a global trade war, imposing punitive tariffs in an effort to extort political and economic concessions from other countries and US companies and constituencies. Trump's tariffs will make kiwis nearly a billion dollars poorer every year, but Luxon has decided to do nothing ...No Right TurnBy Idiot/Savant1 hour ago

Yesterday the Trump regime in America began a global trade war, imposing punitive tariffs in an effort to extort political and economic concessions from other countries and US companies and constituencies. Trump's tariffs will make kiwis nearly a billion dollars poorer every year, but Luxon has decided to do nothing ...No Right TurnBy Idiot/Savant1 hour ago - $6m later, 90% against, 8% for, Treaty Principles Bill Committee recommends Bill be shelved

Here’s 7 updates from this morning’s news:90% of submissions opposed the TPBNZ’s EV market tanked by Coalition policies, down ~70% year on yearTrump showFossil fuel money driving conservative policiesSimeon Brown won’t say that abortion is healthcarePhil Goff stands by comments and makes a case for speaking upBrian Tamaki cleared of ...Mountain TuiBy Mountain Tūī3 hours ago

Here’s 7 updates from this morning’s news:90% of submissions opposed the TPBNZ’s EV market tanked by Coalition policies, down ~70% year on yearTrump showFossil fuel money driving conservative policiesSimeon Brown won’t say that abortion is healthcarePhil Goff stands by comments and makes a case for speaking upBrian Tamaki cleared of ...Mountain TuiBy Mountain Tūī3 hours ago - Thanks, Folks: Mountain Tūī Hits A Milesone

Mountain TuiBy Mountain Tūī3 hours ago

- The people have spoken

The Justice Committee has reported back on National's racist Principles of the Treaty of Waitangi Bill, and recommended by majority that it not proceed. So hopefully it will now rapidly go to second reading and be voted down. As for submissions, it turns out that around 380,000 people submitted on ...No Right TurnBy Idiot/Savant3 hours ago

The Justice Committee has reported back on National's racist Principles of the Treaty of Waitangi Bill, and recommended by majority that it not proceed. So hopefully it will now rapidly go to second reading and be voted down. As for submissions, it turns out that around 380,000 people submitted on ...No Right TurnBy Idiot/Savant3 hours ago - To fight disinformation, treat it as an insurgency

We need to treat disinformation as we deal with insurgencies, preventing the spreaders of lies from entrenching themselves in the host population through capture of infrastructure—in this case, the social media outlets. Combining targeted action ...The StrategistBy Jacob Ware3 hours ago

We need to treat disinformation as we deal with insurgencies, preventing the spreaders of lies from entrenching themselves in the host population through capture of infrastructure—in this case, the social media outlets. Combining targeted action ...The StrategistBy Jacob Ware3 hours ago - The surprise of the Independent Intelligence Review: economic security

After copping criticism for not releasing the report for nearly eight months, Prime Minister Anthony Albanese released the Independent Intelligence Review on 28 March. It makes for a heck of a read. The review makes ...The StrategistBy Brendan Walker-Munro5 hours ago

After copping criticism for not releasing the report for nearly eight months, Prime Minister Anthony Albanese released the Independent Intelligence Review on 28 March. It makes for a heck of a read. The review makes ...The StrategistBy Brendan Walker-Munro5 hours ago - The surprise of the Independent Intelligence Review: economic security

After copping criticism for not releasing the report for nearly eight months, Prime Minister Anthony Albanese released the Independent Intelligence Review on 28 March. It makes for a heck of a read. The review makes ...The StrategistBy Brendan Walker-Munro5 hours ago

After copping criticism for not releasing the report for nearly eight months, Prime Minister Anthony Albanese released the Independent Intelligence Review on 28 March. It makes for a heck of a read. The review makes ...The StrategistBy Brendan Walker-Munro5 hours ago - Bernard’s Picks ‘n’ Mixes for Friday, April 4

In short this morning in our political economy:Donald Trump has shocked the global economy and markets with the biggest tariffs since the Smoot Hawley Act of 1930, which worsened the Great Depression.Global stocks slumped 4-5% overnight and key US bond yields briefly fell below 4% as investors fear a recession ...The KakaBy Bernard Hickey6 hours ago

In short this morning in our political economy:Donald Trump has shocked the global economy and markets with the biggest tariffs since the Smoot Hawley Act of 1930, which worsened the Great Depression.Global stocks slumped 4-5% overnight and key US bond yields briefly fell below 4% as investors fear a recession ...The KakaBy Bernard Hickey6 hours ago - I Hope I Never Send This Webworm

Hi,I’ve been imagining a scenario where I am walking along the pavement in the United States. It’s dusk, I am off to get a dirty burrito from my favourite place, and I see three men in hoodies approaching.Anther two men appear from around a corner, and this whole thing feels ...David FarrierBy David Farrier7 hours ago

Hi,I’ve been imagining a scenario where I am walking along the pavement in the United States. It’s dusk, I am off to get a dirty burrito from my favourite place, and I see three men in hoodies approaching.Anther two men appear from around a corner, and this whole thing feels ...David FarrierBy David Farrier7 hours ago - Australia’s plan for acquiring nuclear-powered submarines is on track

Since the announcement in September 2021 that Australia intended to acquire nuclear-powered submarines in partnership with Britain and the United States, the plan has received significant media attention, scepticism and criticism. There are four major ...The StrategistBy Jennifer Parker8 hours ago

Since the announcement in September 2021 that Australia intended to acquire nuclear-powered submarines in partnership with Britain and the United States, the plan has received significant media attention, scepticism and criticism. There are four major ...The StrategistBy Jennifer Parker8 hours ago - Weekly Roundup 04-April-2025

On a very wet Friday, we hope you have somewhere nice and warm and dry to sit and catch up on our roundup of some of this week’s top stories in transport and urbanism. The header image shows Northcote Intermediate Students strolling across the Te Ara Awataha Greenway Bridge in ...Greater AucklandBy Greater Auckland8 hours ago

On a very wet Friday, we hope you have somewhere nice and warm and dry to sit and catch up on our roundup of some of this week’s top stories in transport and urbanism. The header image shows Northcote Intermediate Students strolling across the Te Ara Awataha Greenway Bridge in ...Greater AucklandBy Greater Auckland8 hours ago - Weekly Roundup 04-April-2025

On a very wet Friday, we hope you have somewhere nice and warm and dry to sit and catch up on our roundup of some of this week’s top stories in transport and urbanism. The header image shows Northcote Intermediate Students strolling across the Te Ara Awataha Greenway Bridge in ...Greater AucklandBy Greater Auckland8 hours ago

On a very wet Friday, we hope you have somewhere nice and warm and dry to sit and catch up on our roundup of some of this week’s top stories in transport and urbanism. The header image shows Northcote Intermediate Students strolling across the Te Ara Awataha Greenway Bridge in ...Greater AucklandBy Greater Auckland8 hours ago - The Hoon around the week to April 4

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: and Elaine Monaghan on the week in geopolitics and climate, including Donald Trump’s tariff shock yesterday; and,Labour’s Disarmament and Associate ...The KakaBy Bernard Hickey8 hours ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with regular and special guests, including: and Elaine Monaghan on the week in geopolitics and climate, including Donald Trump’s tariff shock yesterday; and,Labour’s Disarmament and Associate ...The KakaBy Bernard Hickey8 hours ago - Stranger Days

I'm gonna try real goodSwear that I'm gonna try from now on and for the rest of my lifeI'm gonna power on, I'm gonna enjoy the highsAnd the lows will come and goAnd may your dreamsAnd may your dreamsAnd may your dreams never dieSongwriters: Ben Reed.These are Stranger Days than ...Nick’s KōreroBy Nick Rockel9 hours ago

I'm gonna try real goodSwear that I'm gonna try from now on and for the rest of my lifeI'm gonna power on, I'm gonna enjoy the highsAnd the lows will come and goAnd may your dreamsAnd may your dreamsAnd may your dreams never dieSongwriters: Ben Reed.These are Stranger Days than ...Nick’s KōreroBy Nick Rockel9 hours ago - Skeptical Science New Research for Week #14 2025

Open access notables A pronounced decline in northern vegetation resistance to flash droughts from 2001 to 2022, Zhang et al., Nature Communications: Here we show that vegetation resistance to flash droughts declines by up to 27% (±5%) over the Northern Hemisphere hotspots during 2001-2022, including eastern Asia, western North America, ...20 hours ago

Open access notables A pronounced decline in northern vegetation resistance to flash droughts from 2001 to 2022, Zhang et al., Nature Communications: Here we show that vegetation resistance to flash droughts declines by up to 27% (±5%) over the Northern Hemisphere hotspots during 2001-2022, including eastern Asia, western North America, ...20 hours ago - Trump’s tariffs: Australia’s worry is the effect on its trading partners

With the execution of global reciprocal tariffs, US President Donald Trump has issued his ‘declaration of economic independence for America’. The immediate direct effect on the Australian economy will likely be small, with more risk ...The StrategistBy Jacqueline Gibson, Nerida King and Ned Talbot21 hours ago

With the execution of global reciprocal tariffs, US President Donald Trump has issued his ‘declaration of economic independence for America’. The immediate direct effect on the Australian economy will likely be small, with more risk ...The StrategistBy Jacqueline Gibson, Nerida King and Ned Talbot21 hours ago - In national security, governments still struggle to work with startups

AUKUS governments began 25 years ago trying to draw in a greater range of possible defence suppliers beyond the traditional big contractors. It is an important objective, and some progress has been made, but governments ...The StrategistBy Kyle McCurdy23 hours ago

AUKUS governments began 25 years ago trying to draw in a greater range of possible defence suppliers beyond the traditional big contractors. It is an important objective, and some progress has been made, but governments ...The StrategistBy Kyle McCurdy23 hours ago - What I saw at liberation day

I approach fresh Trump news reluctantly. It never holds the remotest promise of pleasure. I had the very, very least of expectations for his Rumble in the Jungle, his Thriller in Manila, his Liberation Day.God May 1945 is becoming the bitterest of jokes isn’t it?Whatever. Liberation Day he declared it ...More Than A FeildingBy David Slack24 hours ago

I approach fresh Trump news reluctantly. It never holds the remotest promise of pleasure. I had the very, very least of expectations for his Rumble in the Jungle, his Thriller in Manila, his Liberation Day.God May 1945 is becoming the bitterest of jokes isn’t it?Whatever. Liberation Day he declared it ...More Than A FeildingBy David Slack24 hours ago - Open Australia versus closed United States

Beyond trade and tariff turmoil, Donald Trump pushes at the three core elements of Australia’s international policy: the US alliance, the region and multilateralism. What Kevin Rudd called the ‘three fundamental pillars’ are the heart ...The StrategistBy Graeme Dobell1 day ago

Beyond trade and tariff turmoil, Donald Trump pushes at the three core elements of Australia’s international policy: the US alliance, the region and multilateralism. What Kevin Rudd called the ‘three fundamental pillars’ are the heart ...The StrategistBy Graeme Dobell1 day ago - The fix is in

So, having broken its promise to the nation, and dumped 85% of submissions on the Treaty Principles Bill in the trash, National's stooges on the Justice Committee have decided to end their "consideration" of the bill, and report back a full month early: Labour says the Justice Select Committee ...No Right TurnBy Idiot/Savant1 day ago

So, having broken its promise to the nation, and dumped 85% of submissions on the Treaty Principles Bill in the trash, National's stooges on the Justice Committee have decided to end their "consideration" of the bill, and report back a full month early: Labour says the Justice Select Committee ...No Right TurnBy Idiot/Savant1 day ago - Intelligence review is strong on workforce issues. Implementation may be harder

The 2024 Independent Intelligence Review offers a mature and sophisticated understanding of workforce challenges facing Australia’s National Intelligence Community (NIC). It provides a thoughtful roadmap for modernising that workforce and enhancing cross-agency and cross-sector collaboration. ...The StrategistBy Meg Tapia1 day ago

The 2024 Independent Intelligence Review offers a mature and sophisticated understanding of workforce challenges facing Australia’s National Intelligence Community (NIC). It provides a thoughtful roadmap for modernising that workforce and enhancing cross-agency and cross-sector collaboration. ...The StrategistBy Meg Tapia1 day ago - Corruption Tsunami

OPINION AND ANALYSIS:Chief Ombudsman Peter Boshier’s comments singling out Health NZ for “acting contrary to the law” couldn’t be clearer. If you find my work of value, do consider subscribing and/or supporting me. Thank you.Health NZ has been acting a law unto itself. That includes putting its management under extraordinary ...Mountain TuiBy Mountain Tūī1 day ago

OPINION AND ANALYSIS:Chief Ombudsman Peter Boshier’s comments singling out Health NZ for “acting contrary to the law” couldn’t be clearer. If you find my work of value, do consider subscribing and/or supporting me. Thank you.Health NZ has been acting a law unto itself. That includes putting its management under extraordinary ...Mountain TuiBy Mountain Tūī1 day ago - Sharing security interests, ASEAN’s big three step up cooperation

Southeast Asia’s three most populous countries are tightening their security relationships, evidently in response to China’s aggression in the South China Sea. This is most obvious in increased cooperation between the coast guards of the ...The StrategistBy Ridvan Kilic1 day ago

Southeast Asia’s three most populous countries are tightening their security relationships, evidently in response to China’s aggression in the South China Sea. This is most obvious in increased cooperation between the coast guards of the ...The StrategistBy Ridvan Kilic1 day ago - Technology can make Team Australia fit for strategic competition

In the late 1970s Australian sport underwent institutional innovation propelling it to new heights. Today, Australia must urgently adapt to a contested and confronting strategic environment. Contributing to this, a new ASPI research project will ...The StrategistBy Chris Taylor1 day ago

In the late 1970s Australian sport underwent institutional innovation propelling it to new heights. Today, Australia must urgently adapt to a contested and confronting strategic environment. Contributing to this, a new ASPI research project will ...The StrategistBy Chris Taylor1 day ago - Bernard’s Picks ‘n’ Mixes for Thursday, April 3

In short this morning in our political economy:The Nelson Hospital waiting list crisis just gets worse, including compelling interviews with an over-worked surgeon who is leaving, and a patient who discovered after 19 months of waiting for a referral that her bowel and ovaries were fused together with scar tissue ...The KakaBy Bernard Hickey1 day ago

In short this morning in our political economy:The Nelson Hospital waiting list crisis just gets worse, including compelling interviews with an over-worked surgeon who is leaving, and a patient who discovered after 19 months of waiting for a referral that her bowel and ovaries were fused together with scar tissue ...The KakaBy Bernard Hickey1 day ago - Gordon Campbell On The Clash Between Auckland Airport And Air New Zealand

Plainly, the claims being tossed around in the media last year that the new terminal envisaged by Auckland International Airport was a gold-plated “Taj Mahal” extravagance were false. With one notable exception, the Commerce Commission’s comprehensive investigation has ended up endorsing every other aspect of the airport’s building programme (and ...WerewolfBy ScoopEditor2 days ago

Plainly, the claims being tossed around in the media last year that the new terminal envisaged by Auckland International Airport was a gold-plated “Taj Mahal” extravagance were false. With one notable exception, the Commerce Commission’s comprehensive investigation has ended up endorsing every other aspect of the airport’s building programme (and ...WerewolfBy ScoopEditor2 days ago - Just what does drive so much of this global, Right-wing populism we all see at present?

Movements clustered around the Right, and Far Right as well, are rising globally. Despite the recent defeats we’ve seen in the last day or so with the win of a Democrat-backed challenger, Dane County Judge Susan Crawford, over her Republican counterpart, Waukesha County Judge Brad Schimel, in the battle for ...exhALANtBy exhalantblog2 days ago

Movements clustered around the Right, and Far Right as well, are rising globally. Despite the recent defeats we’ve seen in the last day or so with the win of a Democrat-backed challenger, Dane County Judge Susan Crawford, over her Republican counterpart, Waukesha County Judge Brad Schimel, in the battle for ...exhALANtBy exhalantblog2 days ago - Two-part webinar about the scientific consensus on human-caused global warming

In February 2025, John Cook gave two webinars for republicEN explaining the scientific consensus on human-caused climate change. 20 February 2025: republicEN webinar part 1 - BUST or TRUST? The scientific consensus on climate change In the first webinar, Cook explained the history of the 20-year scientific consensus on climate change. How do ...2 days ago

In February 2025, John Cook gave two webinars for republicEN explaining the scientific consensus on human-caused climate change. 20 February 2025: republicEN webinar part 1 - BUST or TRUST? The scientific consensus on climate change In the first webinar, Cook explained the history of the 20-year scientific consensus on climate change. How do ...2 days ago - Bookshelf: ‘Vampire state: The rise and fall of the Chinese economy’

After three decades of record-breaking growth, at about the same time as Xi Jinping rose to power in 2012, China’s economy started the long decline to its current state of stagnation. The Chinese Communist Party ...The StrategistBy Robert Wihtol2 days ago

After three decades of record-breaking growth, at about the same time as Xi Jinping rose to power in 2012, China’s economy started the long decline to its current state of stagnation. The Chinese Communist Party ...The StrategistBy Robert Wihtol2 days ago - Too complacent, too greedy

The Pike River Coal mine was a ticking time bomb.Ventilation systems designed to prevent methane buildup were incomplete or neglected.Gas detectors that might warn of danger were absent or broken.Rock bolting was skipped, old tunnels left unsealed, communication systems failed during emergencies.Employees and engineers kept warning management about the … ...More Than A FeildingBy David Slack2 days ago

The Pike River Coal mine was a ticking time bomb.Ventilation systems designed to prevent methane buildup were incomplete or neglected.Gas detectors that might warn of danger were absent or broken.Rock bolting was skipped, old tunnels left unsealed, communication systems failed during emergencies.Employees and engineers kept warning management about the … ...More Than A FeildingBy David Slack2 days ago - It’s time to imagine how China would act as regional hegemon

Regional hegemons come in different shapes and sizes. Australia needs to think about what kind of hegemon China would be, and become, should it succeed in displacing the United States in Asia. It’s time to ...The StrategistBy Andrew Forrest2 days ago

Regional hegemons come in different shapes and sizes. Australia needs to think about what kind of hegemon China would be, and become, should it succeed in displacing the United States in Asia. It’s time to ...The StrategistBy Andrew Forrest2 days ago - We don’t need the fast track to kill fossil fuels

RNZ has a story this morning about the expansion of solar farms in Aotearoa, driven by today's ground-breaking ceremony at the Tauhei solar farm in Te Aroha: From starting out as a tiny player in the electricity system, solar power generated more electricity than coal and gas combined for ...No Right TurnBy Idiot/Savant2 days ago

RNZ has a story this morning about the expansion of solar farms in Aotearoa, driven by today's ground-breaking ceremony at the Tauhei solar farm in Te Aroha: From starting out as a tiny player in the electricity system, solar power generated more electricity than coal and gas combined for ...No Right TurnBy Idiot/Savant2 days ago - How world order changes

After the Berlin Wall came down in 1989, and almost a year before the Soviet Union collapsed in late 1991, US President George H W Bush proclaimed a ‘new world order’. Now, just two months ...The StrategistBy Joseph S Nye Jr2 days ago

After the Berlin Wall came down in 1989, and almost a year before the Soviet Union collapsed in late 1991, US President George H W Bush proclaimed a ‘new world order’. Now, just two months ...The StrategistBy Joseph S Nye Jr2 days ago - Social Contracts Are Breaking

Warning: Some images may be distressing. Thank you for those who support my work. It means a lot.A shopfront in Australia shows Liberal leader Peter Dutton and mining magnate Gina Rinehart depicted with Nazi imageryUS Government Seeks Death Penalty for Luigi MangioneMangione was publicly walked in front of media in ...Mountain TuiBy Mountain Tūī2 days ago

Warning: Some images may be distressing. Thank you for those who support my work. It means a lot.A shopfront in Australia shows Liberal leader Peter Dutton and mining magnate Gina Rinehart depicted with Nazi imageryUS Government Seeks Death Penalty for Luigi MangioneMangione was publicly walked in front of media in ...Mountain TuiBy Mountain Tūī2 days ago - Wednesday 2 April

Aged care workers rallying against potential roster changes say Bupa, which runs retirement homes across the country, needs to focus on care instead of money. More than half of New Zealand workers wish they had chosen a different career according to a new survey. Consumers are likely to see a ...NZCTUBy Jack McDonald2 days ago

Aged care workers rallying against potential roster changes say Bupa, which runs retirement homes across the country, needs to focus on care instead of money. More than half of New Zealand workers wish they had chosen a different career according to a new survey. Consumers are likely to see a ...NZCTUBy Jack McDonald2 days ago - The Green’s Identity Bubble Problem.

The scurrilous attacks on Benjamin Doyle, a list Green MP, over his supposed inappropriate behaviour towards children has dominated headlines and social media this past week, led by frothing Rightwing agitators clutching their pearls and fanning the flames of moral panic over pedophiles and and perverts. Winston Peter decided that ...KiwipoliticoBy Pablo2 days ago

The scurrilous attacks on Benjamin Doyle, a list Green MP, over his supposed inappropriate behaviour towards children has dominated headlines and social media this past week, led by frothing Rightwing agitators clutching their pearls and fanning the flames of moral panic over pedophiles and and perverts. Winston Peter decided that ...KiwipoliticoBy Pablo2 days ago - Fabian Fundraiser – Twilight Time

Twilight Time Lighthouse Cuba, Wigan Street, Wellington, Sunday 6 April, 5:30pm for 6pm start. Twilight Time looks at the life and work of Desmond Ball, (1947-2016), a barefooted academic from ‘down under’ who was hailed by Jimmy Carter as “the man who saved the world”, as he proved the fallacy ...2 days ago

Twilight Time Lighthouse Cuba, Wigan Street, Wellington, Sunday 6 April, 5:30pm for 6pm start. Twilight Time looks at the life and work of Desmond Ball, (1947-2016), a barefooted academic from ‘down under’ who was hailed by Jimmy Carter as “the man who saved the world”, as he proved the fallacy ...2 days ago - That’s Democracy?

The landedAnd the wealthyAnd the piousAnd the healthyAnd the straight onesAnd the pale onesAnd we only mean the male ones!If you're all of the above, then you're ok!As we build a new tomorrow here today!Lyrics Glenn Slater and Allan Menken.Ah, Democracy - can you smell it?It's presently a sulphurous odour, ...Nick’s KōreroBy Nick Rockel2 days ago

The landedAnd the wealthyAnd the piousAnd the healthyAnd the straight onesAnd the pale onesAnd we only mean the male ones!If you're all of the above, then you're ok!As we build a new tomorrow here today!Lyrics Glenn Slater and Allan Menken.Ah, Democracy - can you smell it?It's presently a sulphurous odour, ...Nick’s KōreroBy Nick Rockel2 days ago - Think laterally: government air and shipping services can boost Australian defence

US President Donald Trump’s unconventional methods of conducting international relations will compel the next federal government to reassess whether the United States’ presence in the region and its security assurances provide a reliable basis for ...The StrategistBy Michael Webster2 days ago

US President Donald Trump’s unconventional methods of conducting international relations will compel the next federal government to reassess whether the United States’ presence in the region and its security assurances provide a reliable basis for ...The StrategistBy Michael Webster2 days ago - Reserve Bank, bank capital etc

Things seem to be at a pretty low ebb in and around the Reserve Bank. There was, in particular, the mysterious, sudden, and as-yet unexplained resignation of the Governor (we’ve had four Governors since the Bank was given its operational autonomy 35 years ago, and only two have completed their ...Croaking CassandraBy Michael Reddell2 days ago

Things seem to be at a pretty low ebb in and around the Reserve Bank. There was, in particular, the mysterious, sudden, and as-yet unexplained resignation of the Governor (we’ve had four Governors since the Bank was given its operational autonomy 35 years ago, and only two have completed their ...Croaking CassandraBy Michael Reddell2 days ago - Luxon’s ‘going for growth’ actually means ‘going for debt reduction’

Long story short: PM Christopher Luxon said in January his Government was ‘going for growth’ and he wanted New Zealanders to develop a ‘culture of yes.’ Yet his own Government is constantly saying no, or not yet, to anchor investments that would unleash real private business investment and GDP growth. ...The KakaBy Bernard Hickey2 days ago

Long story short: PM Christopher Luxon said in January his Government was ‘going for growth’ and he wanted New Zealanders to develop a ‘culture of yes.’ Yet his own Government is constantly saying no, or not yet, to anchor investments that would unleash real private business investment and GDP growth. ...The KakaBy Bernard Hickey2 days ago - Luxon’s ‘going for growth’ actually means ‘going for debt reduction’

Long story short: PM Christopher Luxon said in January his Government was ‘going for growth’ and he wanted New Zealanders to develop a ‘culture of yes.’ Yet his own Government is constantly saying no, or not yet, to anchor investments that would unleash real private business investment and GDP growth. ...The KakaBy Bernard Hickey2 days ago

Long story short: PM Christopher Luxon said in January his Government was ‘going for growth’ and he wanted New Zealanders to develop a ‘culture of yes.’ Yet his own Government is constantly saying no, or not yet, to anchor investments that would unleash real private business investment and GDP growth. ...The KakaBy Bernard Hickey2 days ago - Life after D-notices: Australia can learn from Britain’s updated system

For decades, Britain and Australia had much the same process for regulating media handling of defence secrets. It was the D-notice system, under which media would be asked not to publish. The two countries diverged ...The StrategistBy Rebecca Ananian-Welsh2 days ago

For decades, Britain and Australia had much the same process for regulating media handling of defence secrets. It was the D-notice system, under which media would be asked not to publish. The two countries diverged ...The StrategistBy Rebecca Ananian-Welsh2 days ago - Life after D-notices: Australia can learn from Britain’s updated system

For decades, Britain and Australia had much the same process for regulating media handling of defence secrets. It was the D-notice system, under which media would be asked not to publish. The two countries diverged ...The StrategistBy Rebecca Ananian-Welsh2 days ago

For decades, Britain and Australia had much the same process for regulating media handling of defence secrets. It was the D-notice system, under which media would be asked not to publish. The two countries diverged ...The StrategistBy Rebecca Ananian-Welsh2 days ago - Should Auckland demolish Spaghetti Junction?

This post by Nicolas Reid was originally published on Linked in. It is republished here with permission. In this article, I make a not-entirely-serious case for ripping out Spaghetti Junction in Auckland, replacing it with a motorway tunnel, and redeveloping new city streets and neighbourhoods above it instead. What’s ...Greater AucklandBy Guest Post2 days ago

This post by Nicolas Reid was originally published on Linked in. It is republished here with permission. In this article, I make a not-entirely-serious case for ripping out Spaghetti Junction in Auckland, replacing it with a motorway tunnel, and redeveloping new city streets and neighbourhoods above it instead. What’s ...Greater AucklandBy Guest Post2 days ago - Should Auckland demolish Spaghetti Junction?

This post by Nicolas Reid was originally published on Linked in. It is republished here with permission. In this article, I make a not-entirely-serious case for ripping out Spaghetti Junction in Auckland, replacing it with a motorway tunnel, and redeveloping new city streets and neighbourhoods above it instead. What’s ...Greater AucklandBy Guest Post2 days ago

This post by Nicolas Reid was originally published on Linked in. It is republished here with permission. In this article, I make a not-entirely-serious case for ripping out Spaghetti Junction in Auckland, replacing it with a motorway tunnel, and redeveloping new city streets and neighbourhoods above it instead. What’s ...Greater AucklandBy Guest Post2 days ago - Bernard’s Picks ‘n’ Mixes for Wednesday, April 2

In short this morning in our political economy:The Nelson Hospital crisis revealed by 1News’ Jessica Roden dominates the political agenda today. Yet again, population growth wasn’t planned for, or funded.Kāinga Ora is planning up to 900 house sales, including new ones, Jonathan Milne reports for Newsroom.One of New Zealand’s biggest ...The KakaBy Bernard Hickey2 days ago

In short this morning in our political economy:The Nelson Hospital crisis revealed by 1News’ Jessica Roden dominates the political agenda today. Yet again, population growth wasn’t planned for, or funded.Kāinga Ora is planning up to 900 house sales, including new ones, Jonathan Milne reports for Newsroom.One of New Zealand’s biggest ...The KakaBy Bernard Hickey2 days ago - Bernard’s Picks ‘n’ Mixes for Wednesday, April 2

In short this morning in our political economy:The Nelson Hospital crisis revealed by 1News’ Jessica Roden dominates the political agenda today. Yet again, population growth wasn’t planned for, or funded.Kāinga Ora is planning up to 900 house sales, including new ones, Jonathan Milne reports for Newsroom.One of New Zealand’s biggest ...The KakaBy Bernard Hickey2 days ago

In short this morning in our political economy:The Nelson Hospital crisis revealed by 1News’ Jessica Roden dominates the political agenda today. Yet again, population growth wasn’t planned for, or funded.Kāinga Ora is planning up to 900 house sales, including new ones, Jonathan Milne reports for Newsroom.One of New Zealand’s biggest ...The KakaBy Bernard Hickey2 days ago - Diplomacy is the newest front in the Russia-Ukraine war

The war between Russia and Ukraine continues unabated. Neither side is in a position to achieve its stated objectives through military force. But now there is significant diplomatic activity as well. Ukraine has agreed to ...The StrategistBy Richard Haass3 days ago

The war between Russia and Ukraine continues unabated. Neither side is in a position to achieve its stated objectives through military force. But now there is significant diplomatic activity as well. Ukraine has agreed to ...The StrategistBy Richard Haass3 days ago - The wettest choppiest part

This was my first thought about yesterday's announcement from Winston Peters, ferry-whisperer. Read more ...More Than A FeildingBy David Slack3 days ago

This was my first thought about yesterday's announcement from Winston Peters, ferry-whisperer. Read more ...More Than A FeildingBy David Slack3 days ago - How to deal with a kangaroo court

In November last year, Te Pāti Māori's Hana-Rawhiti Maipi-Clarke spoke for all of us when she led a haka against National's racist Treaty Principles Bill. National and its parliamentary patsies did not like that, so after kicking her out of the house for a day, they sought to drag her ...No Right TurnBy Idiot/Savant3 days ago

In November last year, Te Pāti Māori's Hana-Rawhiti Maipi-Clarke spoke for all of us when she led a haka against National's racist Treaty Principles Bill. National and its parliamentary patsies did not like that, so after kicking her out of the house for a day, they sought to drag her ...No Right TurnBy Idiot/Savant3 days ago - AusAID can take USAID’s place in the Pacific islands

One of the first aims of the United States’ new Department of Government Efficiency was shutting down USAID. By 6 February, the agency was functionally dissolved, its seal missing from its Washington headquarters. Amid the ...The StrategistBy Nicholas Weising3 days ago

One of the first aims of the United States’ new Department of Government Efficiency was shutting down USAID. By 6 February, the agency was functionally dissolved, its seal missing from its Washington headquarters. Amid the ...The StrategistBy Nicholas Weising3 days ago - The US alliance is precious, but Australia should plan for more self-reliance

If our strategic position was already challenging, it just got worse. Reliability of the US as an ally is in question, amid such actions by the Trump administration as calling for annexation of Canada, threating ...The StrategistBy John Frewen3 days ago

If our strategic position was already challenging, it just got worse. Reliability of the US as an ally is in question, amid such actions by the Trump administration as calling for annexation of Canada, threating ...The StrategistBy John Frewen3 days ago - Monday 1 April

Small businesses will be exempt from complying with some of the requirements of health and safety legislation under new reforms proposed by the Government. The living wage will be increased to $28.95 per hour from September, a $1.15 increase from the current $27.80. A poll has shown large opposition to ...NZCTUBy Jack McDonald3 days ago

Small businesses will be exempt from complying with some of the requirements of health and safety legislation under new reforms proposed by the Government. The living wage will be increased to $28.95 per hour from September, a $1.15 increase from the current $27.80. A poll has shown large opposition to ...NZCTUBy Jack McDonald3 days ago - Not Aprils’ Fools: Government Prioritises Road Cones Over Health & Safety, 6 Nelson Senior...

Summary A group of senior doctors in Nelson have spoken up, specifically stating that hospitals have never been as bad as in the last year.Patients are waiting up to 50 hours and 1 death is directly attributable to the situation: "I've never seen that number of patients waiting to be ...Mountain TuiBy Mountain Tūī3 days ago

Summary A group of senior doctors in Nelson have spoken up, specifically stating that hospitals have never been as bad as in the last year.Patients are waiting up to 50 hours and 1 death is directly attributable to the situation: "I've never seen that number of patients waiting to be ...Mountain TuiBy Mountain Tūī3 days ago - The US has many chip vulnerabilities

Although semiconductor chips are ubiquitous nowadays, their production is concentrated in just a few countries, and this has left the US economy and military highly vulnerable at a time of rising geopolitical tensions. While the ...The StrategistBy Edoardo Campanella and John Haigh3 days ago

Although semiconductor chips are ubiquitous nowadays, their production is concentrated in just a few countries, and this has left the US economy and military highly vulnerable at a time of rising geopolitical tensions. While the ...The StrategistBy Edoardo Campanella and John Haigh3 days ago - Health and Safety changes driven by ACT party ideology

Health and Safety changes driven by ACT party ideology, not evidence said NZCTU Te Kauae Kaimahi President Richard Wagstaff. Changes to health and safety legislation proposed by the Minister for Workplace Relations and Safety Brooke van Velden today comply with ACT party ideology, ignores the evidence, and will compound New ...NZCTUBy Jeremiah Boniface3 days ago

Health and Safety changes driven by ACT party ideology, not evidence said NZCTU Te Kauae Kaimahi President Richard Wagstaff. Changes to health and safety legislation proposed by the Minister for Workplace Relations and Safety Brooke van Velden today comply with ACT party ideology, ignores the evidence, and will compound New ...NZCTUBy Jeremiah Boniface3 days ago - Bernard’s Picks ‘n’ Mixes for Tuesday, April 1

In short in our political economy this morning:Fletcher Building is closing its pre-fabricated house-building factory in Auckland due to a lack of demand, particularly from the Government.Health NZ is sending a crisis management team to Nelson Hospital after a 1News investigation exposed doctors’ fears that nearly 500 patients are overdue ...The KakaBy Bernard Hickey3 days ago

In short in our political economy this morning:Fletcher Building is closing its pre-fabricated house-building factory in Auckland due to a lack of demand, particularly from the Government.Health NZ is sending a crisis management team to Nelson Hospital after a 1News investigation exposed doctors’ fears that nearly 500 patients are overdue ...The KakaBy Bernard Hickey3 days ago - Looking back to look forward, 10 years after the First Principles Review

Exactly 10 years ago, the then minister for defence, Kevin Andrews, released the First Principles Review: Creating One Defence (FPR). With increasing talk about the rising possibility of major power-conflict, calls for Defence funding to ...The StrategistBy Marc Ablong3 days ago

Exactly 10 years ago, the then minister for defence, Kevin Andrews, released the First Principles Review: Creating One Defence (FPR). With increasing talk about the rising possibility of major power-conflict, calls for Defence funding to ...The StrategistBy Marc Ablong3 days ago - The Government accidentally added us to their group chat

In events eerily similar to what happened in the USA last week, Greater Auckland was recently accidentally added to a group chat between government ministers on the topic of transport. We have no idea how it happened, but luckily we managed to transcribe most of what transpired. We share it ...Greater AucklandBy Greater Auckland3 days ago

In events eerily similar to what happened in the USA last week, Greater Auckland was recently accidentally added to a group chat between government ministers on the topic of transport. We have no idea how it happened, but luckily we managed to transcribe most of what transpired. We share it ...Greater AucklandBy Greater Auckland3 days ago - Dylan Attempts to Stop a Pig Butchering

Hi,When I look back at my history with Dylan Reeve, it’s pretty unusual. We first met in the pool at Kim Dotcom’s mansion, as helicopters buzzed overhead and secret service agents flung themselves off the side of his house, abseiling to the ground with guns drawn.Kim Dotcom was a German ...David FarrierBy David Farrier3 days ago

Hi,When I look back at my history with Dylan Reeve, it’s pretty unusual. We first met in the pool at Kim Dotcom’s mansion, as helicopters buzzed overhead and secret service agents flung themselves off the side of his house, abseiling to the ground with guns drawn.Kim Dotcom was a German ...David FarrierBy David Farrier3 days ago - Luxon Calls Snap Election!

Come around for teaDance me round and round the kitchenBy the light of my T.VOn the night of the electionAncient stars will fall into the seaAnd the ocean floor sings her sympathySongwriter: Bic Runga.The Prime Minister stared into the camera, hot and flustered despite the predawn chill. He looked sadly ...Nick’s KōreroBy Nick Rockel3 days ago

Come around for teaDance me round and round the kitchenBy the light of my T.VOn the night of the electionAncient stars will fall into the seaAnd the ocean floor sings her sympathySongwriter: Bic Runga.The Prime Minister stared into the camera, hot and flustered despite the predawn chill. He looked sadly ...Nick’s KōreroBy Nick Rockel3 days ago - Gordon Campbell On The Government’s Latest Ferries Scam

Has Winston Peters got a ferries deal for you! (Buyer caution advised.) Unfortunately, the vision that Peters has been busily peddling for the past 24 hours – of several shipyards bidding down the price of us getting smaller, narrower, rail-enabled ferries – looks more like a science fiction fantasy. One ...WerewolfBy ScoopEditor4 days ago

Has Winston Peters got a ferries deal for you! (Buyer caution advised.) Unfortunately, the vision that Peters has been busily peddling for the past 24 hours – of several shipyards bidding down the price of us getting smaller, narrower, rail-enabled ferries – looks more like a science fiction fantasy. One ...WerewolfBy ScoopEditor4 days ago - 2025 Reading List: March

Completed reads for March: The Heart of the Antarctic [1907-1909], by Ernest Shackleton South [1914-1917], by Ernest Shackleton Aurora Australis (collection), edited by Ernest Shackleton The Book of Urizen (poem), by William Blake The Book of Ahania (poem), by William Blake The Book of Los (poem), by William Blake ...A Phuulish FellowBy strda2214 days ago

Completed reads for March: The Heart of the Antarctic [1907-1909], by Ernest Shackleton South [1914-1917], by Ernest Shackleton Aurora Australis (collection), edited by Ernest Shackleton The Book of Urizen (poem), by William Blake The Book of Ahania (poem), by William Blake The Book of Los (poem), by William Blake ...A Phuulish FellowBy strda2214 days ago - The Attacks on Benjamin Doyle are Depraved

First - A ReminderBenjamin Doyle Doesn’t Deserve ThisI’ve been following posts regarding Green MP Benjamin Doyle over the last few days, but didn’t want to amplify the abject nonsense.This morning, Winston Peters, New Zealand’s Deputy Prime Minister, answered the alt-right’s prayers - guaranteeing amplification of the topic, by going on ...Mountain TuiBy Mountain Tūī4 days ago

First - A ReminderBenjamin Doyle Doesn’t Deserve ThisI’ve been following posts regarding Green MP Benjamin Doyle over the last few days, but didn’t want to amplify the abject nonsense.This morning, Winston Peters, New Zealand’s Deputy Prime Minister, answered the alt-right’s prayers - guaranteeing amplification of the topic, by going on ...Mountain TuiBy Mountain Tūī4 days ago - The world can still keep Trump in check

US President Donald Trump has shown a callous disregard for the checks and balances that have long protected American democracy. As the self-described ‘king’ makes a momentous power grab, much of the world watches anxiously, ...The StrategistBy Anne-Marie Slaughter4 days ago

US President Donald Trump has shown a callous disregard for the checks and balances that have long protected American democracy. As the self-described ‘king’ makes a momentous power grab, much of the world watches anxiously, ...The StrategistBy Anne-Marie Slaughter4 days ago - Febrile elaborate fantasies

They can be the very same words. And yet their meaning can vary very much.You can say I'll kill him about your colleague who accidentally deleted your presentation the day before a big meeting.You can say I'll kill him to — or, for that matter, about — Tony Soprano.They’re the ...More Than A FeildingBy David Slack4 days ago

They can be the very same words. And yet their meaning can vary very much.You can say I'll kill him about your colleague who accidentally deleted your presentation the day before a big meeting.You can say I'll kill him to — or, for that matter, about — Tony Soprano.They’re the ...More Than A FeildingBy David Slack4 days ago - National’s ghost ships

Back in 2020, the then-Labour government signed contracted for the construction and purchase of two new rail-enabled Cook Strait ferries, to be operational from 2026. But when National took power in 2023, they cancelled them in a desperate effort to make the books look good for a year. And now ...No Right TurnBy Idiot/Savant4 days ago

Back in 2020, the then-Labour government signed contracted for the construction and purchase of two new rail-enabled Cook Strait ferries, to be operational from 2026. But when National took power in 2023, they cancelled them in a desperate effort to make the books look good for a year. And now ...No Right TurnBy Idiot/Savant4 days ago - Red tape that tears us apart: regulation fragments Indo-Pacific cyber resilience

The fragmentation of cyber regulation in the Indo-Pacific is not just inconvenient; it is a strategic vulnerability. In recent years, governments across the Indo-Pacific, including Australia, have moved to reform their regulatory frameworks for cyber ...The StrategistBy Ravi Nayyar4 days ago

The fragmentation of cyber regulation in the Indo-Pacific is not just inconvenient; it is a strategic vulnerability. In recent years, governments across the Indo-Pacific, including Australia, have moved to reform their regulatory frameworks for cyber ...The StrategistBy Ravi Nayyar4 days ago - Economic Bulletin March 2025

Welcome to the March 2025 Economic Bulletin. The feature article examines what public private partnerships (PPPs) are. PPPs have been a hot topic recently, with the coalition government signalling it wants to use them to deliver infrastructure. However, experience with PPPs, both here and overseas, indicates we should be wary. ...NZCTUBy Jeremiah Boniface4 days ago

Welcome to the March 2025 Economic Bulletin. The feature article examines what public private partnerships (PPPs) are. PPPs have been a hot topic recently, with the coalition government signalling it wants to use them to deliver infrastructure. However, experience with PPPs, both here and overseas, indicates we should be wary. ...NZCTUBy Jeremiah Boniface4 days ago - Politics of Grievances A Tidal Wave

Willis announces more plans of plans for supermarketsYesterday’s much touted supermarket competition announcement by Nicola Willis amounted to her telling us she was issuing a 6 week RFI1 that will solicit advice from supermarket players.In short, it was an announcement of a plan - but better than her Kiwirail Interislander ...Mountain TuiBy Mountain Tūī4 days ago

Willis announces more plans of plans for supermarketsYesterday’s much touted supermarket competition announcement by Nicola Willis amounted to her telling us she was issuing a 6 week RFI1 that will solicit advice from supermarket players.In short, it was an announcement of a plan - but better than her Kiwirail Interislander ...Mountain TuiBy Mountain Tūī4 days ago - Not much parliamentary scrutiny

This was the post I was planning to write this morning to mark Orr’s final day. That said, if the underlying events – deliberate attempts to mislead Parliament – were Orr’s doing, the post is more about the apparent uselessness of Parliament (specifically the Finance and Expenditure Committee) in holding ...Croaking CassandraBy Michael Reddell4 days ago

This was the post I was planning to write this morning to mark Orr’s final day. That said, if the underlying events – deliberate attempts to mislead Parliament – were Orr’s doing, the post is more about the apparent uselessness of Parliament (specifically the Finance and Expenditure Committee) in holding ...Croaking CassandraBy Michael Reddell4 days ago - TSMC’s $100 billion bet: strengthening ties or weakening Taiwan’s leverage?

Taiwanese chipmaking giant TSMC’s plan to build a plant in the United States looks like a move made at the behest of local officials to solidify US support for Taiwan. However, it may eventually lessen ...The StrategistBy Meng Kit Tang4 days ago

Taiwanese chipmaking giant TSMC’s plan to build a plant in the United States looks like a move made at the behest of local officials to solidify US support for Taiwan. However, it may eventually lessen ...The StrategistBy Meng Kit Tang4 days ago

Related Posts

- Te Pāti Māori Urges Governor-General to Block Repeal of 7AA

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...18 hours ago

Today, the Oranga Tamariki (Repeal of Section 7AA) Amendment Bill has passed its third and final reading, but there is one more stage before it becomes law. The Governor-General must give their ‘Royal assent’ for any bill to become legally enforceable. This means that, even if a bill gets voted ...18 hours ago - Release: Abortion care quietly shelved amid staff shortage

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...1 day ago

Abortion care at Whakatāne Hospital has been quietly shelved, with patients told they will likely have to travel more than an hour to Tauranga to get the treatment they need. ...1 day ago - Release: Govt guts Kāinga Ora, third of workforce under axe

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...1 day ago

The gutting of Kāinga Ora shows public housing is not a priority for this Government as it removes a third of the roles at the housing agency. ...1 day ago - Release: Thousands of submissions excluded from Treaty Principles Bill report

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...1 day ago

Thousands of New Zealanders’ submissions are missing from the official parliamentary record because the National-dominated Justice Select Committee has rushed work on the Treaty Principles Bill. ...1 day ago - Release: Uncertainty remains over the impact of tariffs

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...1 day ago

Today’s announcement of 10 percent tariffs for New Zealand goods entering the United States is disappointing for exporters and consumers alike, with the long-lasting impact on prices and inflation still unknown. ...1 day ago - Release: Worst February for building consents in over a decade

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 days ago

The National Government’s choices have contributed to a slow-down in the building sector, as thousands of people have lost their jobs in construction. ...2 days ago - Release: Labour supports Willie Apiata’s selfless act

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 days ago

Willie Apiata’s decision to hand over his Victoria Cross to the Minister for Veterans is a powerful and selfless act, made on behalf of all those who have served our country. ...2 days ago - Te Pāti Māori MPs Denied Fundamental Rights in Privileges Committee Hearing

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...3 days ago

The Privileges Committee has denied fundamental rights to Debbie Ngarewa-Packer, Rawiri Waititi and Hana-Rawhiti Maipi-Clarke, breaching their own standing orders, breaching principles of natural justice, and highlighting systemic prejudice and discrimination within our parliamentary processes. The three MPs were summoned to the privileges committee following their performance of a haka ...3 days ago - Release: Govt health and safety changes put workers at risk

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...4 days ago

Changes to New Zealand’s health and safety laws will strip back key protections for small businesses and put working Kiwis at greater risk. ...4 days ago - Release: Kiwis worse off this April thanks to Govt choices

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...4 days ago

April 1 used to be a day when workers could count on a pay rise with stronger support for those doing it tough, but that’s not the case under this Government. ...4 days ago - Release: Three more years for Interislander ferries

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...4 days ago

Winston Peters is shopping for smaller ferries after Nicola Willis torpedoed the original deal, which would have delivered new rail enabled ferries next year. ...4 days ago - Release: Myanmar junta must stop the airstrikes

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...4 days ago

The Government should work with other countries to press the Myanmar military regime to stop its bombing campaign especially while the country recovers from the devastating earthquake. ...4 days ago - Release: National failing to deliver on supermarkets

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...4 days ago

National is paying lip service to its promises to bring down the cost of living, failing to make any meaningful change in the grocery sector. ...4 days ago - Release: Labour backs farmers’ call for better process on GE

1 week ago

- Release: Bar still too high for small mental health providers

Small mental health providers will still be locked out of co-funding from the Mental Health Innovation Fund despite a lower threshold. ...1 week ago

Small mental health providers will still be locked out of co-funding from the Mental Health Innovation Fund despite a lower threshold. ...1 week ago - Greens call for Govt to scrap proposed ECE changes

The Green Party is calling for the Government to scrap proposed changes to Early Childhood Care, after attending a petition calling for the Government to ‘Put tamariki at the heart of decisions about ECE’. ...1 week ago

The Green Party is calling for the Government to scrap proposed changes to Early Childhood Care, after attending a petition calling for the Government to ‘Put tamariki at the heart of decisions about ECE’. ...1 week ago - NZ First Introduces Bill That Gives Democracy Back To The People

New Zealand First has introduced a Member’s Bill today that will remove the power of MPs conscience votes and ensure mandatory national referendums are held before any conscience issues are passed into law. “We are giving democracy and power back to the people”, says New Zealand First Leader Winston Peters. ...1 week ago

New Zealand First has introduced a Member’s Bill today that will remove the power of MPs conscience votes and ensure mandatory national referendums are held before any conscience issues are passed into law. “We are giving democracy and power back to the people”, says New Zealand First Leader Winston Peters. ...1 week ago - Speech: Navigating the New World (Dis)order in Turbulent Times

Welcome to members of the diplomatic corp, fellow members of parliament, the fourth estate, foreign affairs experts, trade tragics, ladies and gentlemen. ...1 week ago

Welcome to members of the diplomatic corp, fellow members of parliament, the fourth estate, foreign affairs experts, trade tragics, ladies and gentlemen. ...1 week ago - Te Pāti Māori Call for Mandatory Police Body Cameras

In recent weeks, disturbing instances of state-sanctioned violence against Māori have shed light on the systemic racism permeating our institutions. An 11-year-old autistic Māori child was forcibly medicated at the Henry Bennett Centre, a 15-year-old had his jaw broken by police in Napier, kaumātua Dean Wickliffe went on a hunger ...1 week ago

In recent weeks, disturbing instances of state-sanctioned violence against Māori have shed light on the systemic racism permeating our institutions. An 11-year-old autistic Māori child was forcibly medicated at the Henry Bennett Centre, a 15-year-old had his jaw broken by police in Napier, kaumātua Dean Wickliffe went on a hunger ...1 week ago - Release: Kiwis lose faith in job market

Confidence in the job market has continued to drop to its lowest level in five years as more New Zealanders feel uncertain about finding work, keeping their jobs, and getting decent pay, according to the latest Westpac-McDermott Miller Employment Confidence Index. ...1 week ago

Confidence in the job market has continued to drop to its lowest level in five years as more New Zealanders feel uncertain about finding work, keeping their jobs, and getting decent pay, according to the latest Westpac-McDermott Miller Employment Confidence Index. ...1 week ago - Greens question Govt commitment to environmental protection with RMA reform

The Greens are calling on the Government to follow through on their vague promises of environmental protection in their Resource Management Act (RMA) reform. ...2 weeks ago

The Greens are calling on the Government to follow through on their vague promises of environmental protection in their Resource Management Act (RMA) reform. ...2 weeks ago - Release: Govt must tackle meth use crisis

New data shows methamphetamine use is spiralling out of control while the Government sits on its hands. ...2 weeks ago

New data shows methamphetamine use is spiralling out of control while the Government sits on its hands. ...2 weeks ago - “Make New Zealand First Again”

“Make New Zealand First Again” Ladies and gentlemen, First of all, thank you for being here today. We know your lives are busy and you are working harder and longer than you ever have, and there are many calls on your time, so thank you for the chance to speak ...2 weeks ago

“Make New Zealand First Again” Ladies and gentlemen, First of all, thank you for being here today. We know your lives are busy and you are working harder and longer than you ever have, and there are many calls on your time, so thank you for the chance to speak ...2 weeks ago - Release: Govt’s continued lack of action on Gaza condemned

Hundreds more Palestinians have died in recent days as Israel’s assault on Gaza continues and humanitarian aid, including food and medicine, is blocked. ...2 weeks ago

Hundreds more Palestinians have died in recent days as Israel’s assault on Gaza continues and humanitarian aid, including food and medicine, is blocked. ...2 weeks ago - Release: National at sea over Defence jobs

National is looking to cut hundreds of jobs at New Zealand’s Defence Force, while at the same time it talks up plans to increase focus and spending in Defence. ...2 weeks ago

National is looking to cut hundreds of jobs at New Zealand’s Defence Force, while at the same time it talks up plans to increase focus and spending in Defence. ...2 weeks ago - Release: National standards returning by stealth

It’s been revealed that the Government is secretly trying to bring back a ‘one-size fits all’ standardised test – a decision that has shocked school principals. ...2 weeks ago

It’s been revealed that the Government is secretly trying to bring back a ‘one-size fits all’ standardised test – a decision that has shocked school principals. ...2 weeks ago - Release: Kiwis still struggling as economy stumbles along

Kiwis aren’t feeling any better off despite figures showing a very slight growth in GDP in the December quarter. ...2 weeks ago

Kiwis aren’t feeling any better off despite figures showing a very slight growth in GDP in the December quarter. ...2 weeks ago - Greens call for compassionate release of Dean Wickliffe

The Green Party is calling for the compassionate release of Dean Wickliffe, a 77-year-old kaumātua on hunger strike at the Spring Hill Corrections Facility, after visiting him at the prison. ...2 weeks ago

The Green Party is calling for the compassionate release of Dean Wickliffe, a 77-year-old kaumātua on hunger strike at the Spring Hill Corrections Facility, after visiting him at the prison. ...2 weeks ago - Another failed ETS auction, another indictment on the Govt’s climate credibility

The ETS auction’s failure today is yet another clear sign that the Government is failing us all on climate action. ...2 weeks ago

The ETS auction’s failure today is yet another clear sign that the Government is failing us all on climate action. ...2 weeks ago - Release: Luxon quick to give away principled position on nukes

Christopher Luxon seems to have thrown New Zealand’s principled anti-nuclear advocacy under a bus. ...2 weeks ago

Christopher Luxon seems to have thrown New Zealand’s principled anti-nuclear advocacy under a bus. ...2 weeks ago - NZ must act on Israel’s slaughter of children

The Green Party is calling on Government MPs to support Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence and illegal actions in Palestine, following another day of appalling violence against civilians in Gaza. ...2 weeks ago

The Green Party is calling on Government MPs to support Chlöe Swarbrick’s Member’s Bill to sanction Israel for its unlawful presence and illegal actions in Palestine, following another day of appalling violence against civilians in Gaza. ...2 weeks ago - Release: Still no certainty for disability communities

One year on from the Government’s abrupt and callous changes to disability funding, the community still has no idea what the future holds. ...2 weeks ago

One year on from the Government’s abrupt and callous changes to disability funding, the community still has no idea what the future holds. ...2 weeks ago - Green Party backs volunteer firefighters in their call for ACC recognition

The Green Party stands in support of volunteer firefighters petitioning the Government to step up and change legislation to provide volunteers the same ACC coverage and benefits as their paid counterparts. ...2 weeks ago

The Green Party stands in support of volunteer firefighters petitioning the Government to step up and change legislation to provide volunteers the same ACC coverage and benefits as their paid counterparts. ...2 weeks ago - Stand Up for Palestine: A Call to Action Against Israels Treacherous Attack

At 2.30am local time, Israel launched a treacherous attack on Gaza killing more than 300 defenceless civilians while they slept. Many of them were children. This followed a more than 2 week-long blockade by Israel on the entry of all goods and aid into Gaza. Israel deliberately targeted densely populated ...2 weeks ago

At 2.30am local time, Israel launched a treacherous attack on Gaza killing more than 300 defenceless civilians while they slept. Many of them were children. This followed a more than 2 week-long blockade by Israel on the entry of all goods and aid into Gaza. Israel deliberately targeted densely populated ...2 weeks ago - MP Views: Living Strong, The Economy, Servicing Our Nation, The Golden Egg, and 4 Year Terms