National: we’ll borrow for tax cuts for the rich

National: we’ll borrow for tax cuts for the rich

Written By:

Steve Pierson - Date published:

12:30 pm, May 19th, 2008 - 77 comments

Categories: kremlinology, national, tax -

Tags: inflation, interest rates

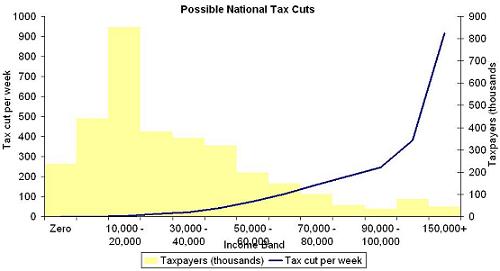

Discovering National’s policy is a bit like the old art of Kremlinology, when Western intelligence agencies would attempt to discover the inner workings of Soviet politics by looking at who stood next to whom in pictures, and what hand politburo members carried their briefcases in. The latest subtle signs from National regarding its tax policy are: they will average ‘north of $50‘ a week and will focus on the 14% of people with incomes over $60,000 a year. The only way to achieve those parameters (without a tax-free bracket or cut to GST both of which National oppose) is to create a flat tax of 16%. The average cut would be $50 a week, but it would be spread very unevenly: on $250,000 a year you would get $920 a week; on the median income of $27,000 you would get $12.50, half of New Zealand taxpayers, 1.6 million people, would get less than that.

$50 a week x 52 weeks x 3.2 million taxpayers means National’s tax cuts would cost over $8.6 billion a year, that would create a huge cash deficit of around $5 billion a year. The money can’t be found by silly little measures like capping the core public service that will deliver only $166 million a year by National’s own estimate. In fact, the only part of government spending to which National has not ruled out major cuts and is sufficiently large for cuts to fund such enormous tax cuts is superannuation. And even if it slashed superannuation, National would still need to borrow to fund the tax cuts. National has previously said it is prepared to increase gross government debt 50% (from 17% of GDP to 25%); it is now clear it would use that debt to fund tax cuts for the wealthy few.

A realistic projection of National’s tax cut plan sees most people worse off: they would get little or nothing from tax cuts, with most of the money going to the wealthy few. They would face a diminished social wage from less Government spending, and have to spend more of their income buying things that are now provided by the Government. And they would face skyrocketing inflation and interest rates resulting from National borrowing billions of dollars to fund irresponsible cuts. But, as we already know, Key and National will promise anything, anything, to win.

Related Posts

77 comments on “National: we’ll borrow for tax cuts for the rich ”

- Comments are now closed

Links to post

- Comments are now closed

Recent Comments

- SPC on

- SPC on

- SPC on

- Tony Veitch to Tony Veitch on

- Nigel Haworth to roblogic on

- SPC to Bearded Git on

- Jenny on

- SPC to Bearded Git on

- observer to Mike the Lefty on

- Cricklewood to thinker on

- joe90 on

- Betty Bopper to KJT on

- Jenny to Bearded Git on

- Obtrectator to Muttonbird on

- Obtrectator to observer on

- Matiri to Bearded Git on

- Bearded Git to Sanctuary on

- Bearded Git to James Simpson on

- James Simpson to Bearded Git on

- tWig on

- tWig on

- Bearded Git to Incognito on

- mikesh to Bearded Git on

- Nigel Haworth to Subliminal on

- koina on

- Sanctuary on

- Sanctuary on

- Ad on

- Ad to Bearded Git on

- Incognito to Mike the Lefty on

- Mike the Lefty to thinker on

- Incognito to Bearded Git on

- Tony Veitch to Bearded Git on

- thinker to Bearded Git on

- Bearded Git on

- Jenny on

- Bearded Git on

- Jenny on

- Jenny on

- Bearded Git to observer on

- Muttonbird to Incognito on

- Ad on

- Incognito to Muttonbird on

- SPC on

- Muttonbird on

- Anne to Muttonbird on

- Muttonbird to SPC on

- Muttonbird to Anne on

- SPC on

- Anne on

- Drowsy M. Kram to gsays on

- Muttonbird on

- Muttonbird to Anne on

- joe90 on

- Muttonbird to SPC on

- SPC to Muttonbird on

- observer on

- Muttonbird to gsays on

Recent Posts

-

by advantage

-

by lprent

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by Mountain Tui

-

by Guest post

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by lprent

-

by mickysavage

-

by Guest post

- Property Rights and the Treaty Principles Bill

Property rights – which enable decisions over tangible and intangible assets – are critical to an economy as Why Nations Fail pointed out. Not just private property rights for, as we shall see, they are more complicated than that. Neoliberals argue that private property rights lead to the maximum economic ...PunditBy Brian Easton2 hours ago

Property rights – which enable decisions over tangible and intangible assets – are critical to an economy as Why Nations Fail pointed out. Not just private property rights for, as we shall see, they are more complicated than that. Neoliberals argue that private property rights lead to the maximum economic ...PunditBy Brian Easton2 hours ago - The Hoon around the week to November 22

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with: on the US Presidential elections, Israel vs Gaza/Iran/Lebanon, Ukraine/Nato vs Russia/North Korea and whether NZ now joins AUKUS;Special guest Helen Clark on the issues above, ...The KakaBy Bernard Hickey3 hours ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with: on the US Presidential elections, Israel vs Gaza/Iran/Lebanon, Ukraine/Nato vs Russia/North Korea and whether NZ now joins AUKUS;Special guest Helen Clark on the issues above, ...The KakaBy Bernard Hickey3 hours ago - Justice in Brazil

Following the 2022 Brazilian general election, election loser Jair Bolsonaro tried to do a Trump, attempting a coup to overturn the election. It failed. But unlike his American friend, he hasn't been allowed to get away with it: The former Brazilian president Jair Bolsonaro and some of his closest ...No Right TurnBy Idiot/Savant3 hours ago

Following the 2022 Brazilian general election, election loser Jair Bolsonaro tried to do a Trump, attempting a coup to overturn the election. It failed. But unlike his American friend, he hasn't been allowed to get away with it: The former Brazilian president Jair Bolsonaro and some of his closest ...No Right TurnBy Idiot/Savant3 hours ago - Treasury warns deeper recession worsening Budget deficit

The gift that keeps giving: David Seymour has now opened a split in the coalition over the future of National’s promise to build a new medical school. Photo: Lynn Grieveson / TheKakaKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey10 hours ago

The gift that keeps giving: David Seymour has now opened a split in the coalition over the future of National’s promise to build a new medical school. Photo: Lynn Grieveson / TheKakaKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey10 hours ago - Weekly Roundup 22-November-2024

It’s another Friday and we’re inching closer to the end of the year. Here’s some of the stories that have caught our attention this week. This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our readers and ...Greater AucklandBy Greater Auckland11 hours ago

It’s another Friday and we’re inching closer to the end of the year. Here’s some of the stories that have caught our attention this week. This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our readers and ...Greater AucklandBy Greater Auckland11 hours ago - Beyond Question?

Record Numbers: The Hīkoi mō te Tiriti, which began at the tip of the North, and the tail of the South, on 11 November, culminated outside Parliament on Tuesday, 19 November 2024, in one of the largest demonstrations in New Zealand’s political history.ACCORDING TO TE ARA, the Ministry of Culture ...11 hours ago

Record Numbers: The Hīkoi mō te Tiriti, which began at the tip of the North, and the tail of the South, on 11 November, culminated outside Parliament on Tuesday, 19 November 2024, in one of the largest demonstrations in New Zealand’s political history.ACCORDING TO TE ARA, the Ministry of Culture ...11 hours ago - The Rush To Blame “The Activists”

Activists are such easy scapegoats. The right and center have been conditioned for decades to roll their eyes at all protests. The left are easily aggravated over students leading movements they see as belonging to grownups, who have more important concerns like the economy and whether the trains come on ...Sapphi’s SubstackBy Sapphi11 hours ago

Activists are such easy scapegoats. The right and center have been conditioned for decades to roll their eyes at all protests. The left are easily aggravated over students leading movements they see as belonging to grownups, who have more important concerns like the economy and whether the trains come on ...Sapphi’s SubstackBy Sapphi11 hours ago - Cutting Through An Inundation of Dipshit Racists

Hi,Watching New Zealand from afar offers a strange perspective. It can be a good thing — distance from Aotearoa helped keep me sane while I reported on abuse at New Zealand’s biggest megachurch over the course of a year. It helps fuel my silly podcast. But it can also be ...David FarrierBy David Farrier12 hours ago

Hi,Watching New Zealand from afar offers a strange perspective. It can be a good thing — distance from Aotearoa helped keep me sane while I reported on abuse at New Zealand’s biggest megachurch over the course of a year. It helps fuel my silly podcast. But it can also be ...David FarrierBy David Farrier12 hours ago - This is bad news

The speech yesterday by Treasury’s Chief Economic Advisor warning that the books are in worse shape than forecasted looks like it’s part of a softening-up process for either more cuts or a longer wait to get back into surplus. The speech was a highly unusual public preview of Treasury’s Half-Yearly ...PolitikBy Richard Harman14 hours ago

The speech yesterday by Treasury’s Chief Economic Advisor warning that the books are in worse shape than forecasted looks like it’s part of a softening-up process for either more cuts or a longer wait to get back into surplus. The speech was a highly unusual public preview of Treasury’s Half-Yearly ...PolitikBy Richard Harman14 hours ago - Skeptical Science New Research for Week #47 2024

Open access notables Projected increase in the frequency of extremely active Atlantic hurricane seasons, Lopez et al., Science Advances: Future changes to the year-to-year swings between active and inactive North Atlantic tropical cyclone (TC) seasons have received little attention, yet may have great societal implications in areas prone to hurricane ...23 hours ago

Open access notables Projected increase in the frequency of extremely active Atlantic hurricane seasons, Lopez et al., Science Advances: Future changes to the year-to-year swings between active and inactive North Atlantic tropical cyclone (TC) seasons have received little attention, yet may have great societal implications in areas prone to hurricane ...23 hours ago - Chicken Kiev

Chatting in the supermarket this morning, I found I needed to lunge for the chicken drumsticks.Coping mechanisms: who hasn’t felt a greater need for them lately?When it all gets too much, I turn to demonstrating handy butchery hacks.It wasn’t that she’d said anything wrong, our friend, not at all. We ...More Than A FeildingBy David Slack1 day ago

Chatting in the supermarket this morning, I found I needed to lunge for the chicken drumsticks.Coping mechanisms: who hasn’t felt a greater need for them lately?When it all gets too much, I turn to demonstrating handy butchery hacks.It wasn’t that she’d said anything wrong, our friend, not at all. We ...More Than A FeildingBy David Slack1 day ago - The year is 2024 and it’s 1984

This is written in response to the highly significant open letter from a group of economists that was today addressed to Christopher Luxon. The year is 2024, and it’s 1984. The country is reeling from a record Olympic medal gold haul, while the globe grapples with the choice of the ...Sapphi’s SubstackBy Sapphi1 day ago

This is written in response to the highly significant open letter from a group of economists that was today addressed to Christopher Luxon. The year is 2024, and it’s 1984. The country is reeling from a record Olympic medal gold haul, while the globe grapples with the choice of the ...Sapphi’s SubstackBy Sapphi1 day ago - The IPCA has failed

Back in 2022, RNZ took an in-depth look at the "Independent" Police Conduct Authority and its handling of killings by police. These are the most serious test of oversight, and you would expect the police's use of lethal force to receive the most severe scrutiny. But despite the police regularly ...No Right TurnBy Idiot/Savant1 day ago

Back in 2022, RNZ took an in-depth look at the "Independent" Police Conduct Authority and its handling of killings by police. These are the most serious test of oversight, and you would expect the police's use of lethal force to receive the most severe scrutiny. But despite the police regularly ...No Right TurnBy Idiot/Savant1 day ago - Thursday 21 November 2024

The Hīkoi mō Te Tiriti arrived at Parliament on Tuesday – the size is being debated but estimates range from 42,000 to 100,000. The Prime Minister is defending not attending due to some of the organisers being affiliated with Te Pāti Māori. The national gang patch ban came into force ...NZCTUBy Jeremiah Boniface1 day ago

The Hīkoi mō Te Tiriti arrived at Parliament on Tuesday – the size is being debated but estimates range from 42,000 to 100,000. The Prime Minister is defending not attending due to some of the organisers being affiliated with Te Pāti Māori. The national gang patch ban came into force ...NZCTUBy Jeremiah Boniface1 day ago - ‘These budget cuts are counter-productive and make no sense’

I spoke to former Productivity Chair Nana this morning about the letter he and a group of other economists sent to PM Christopher Luxon to urge the Government to urgently suspend cuts to spending and investment for the sake of the economy, struggling businesses and the wellbeing of vulnerable ...The KakaBy Bernard Hickey1 day ago

I spoke to former Productivity Chair Nana this morning about the letter he and a group of other economists sent to PM Christopher Luxon to urge the Government to urgently suspend cuts to spending and investment for the sake of the economy, struggling businesses and the wellbeing of vulnerable ...The KakaBy Bernard Hickey1 day ago - ACT’s Astroturfing & A Co-ordinated Attack on Te Pati Māori

Unity on the Streets / Unity at the TableAfter the Hīkoi, all three right wing Coalition leaders came together to push the idea that the 42,000 - 50,000 + strong Hikoi was somehow less potent and brave, and more illegitimate than the energy and crowd displayed.Prime Minister Christopher Luxon 20-November: ...Mountain TuiBy Mountain Tui1 day ago

Unity on the Streets / Unity at the TableAfter the Hīkoi, all three right wing Coalition leaders came together to push the idea that the 42,000 - 50,000 + strong Hikoi was somehow less potent and brave, and more illegitimate than the energy and crowd displayed.Prime Minister Christopher Luxon 20-November: ...Mountain TuiBy Mountain Tui1 day ago - Durability of carbon dioxide removal is critical for stabilizing temperatures

This is a re-post from the Climate Brink The world is emitting over 40 gigatons of CO2 per year, contributing to an accelerating warming of the planet. The world needs to cut emissions rapidly to be remotely on track to meet our Paris Agreement goals of limiting warming to well-below 2C, and we ...1 day ago

This is a re-post from the Climate Brink The world is emitting over 40 gigatons of CO2 per year, contributing to an accelerating warming of the planet. The world needs to cut emissions rapidly to be remotely on track to meet our Paris Agreement goals of limiting warming to well-below 2C, and we ...1 day ago - I Love My Leather Jacket

I wear my leather jacket like a great big hugRadiating charm - a living cloak of luckIt's the only concrete link with an absent friendIt's a symbol I can wear 'till we meet againOr it's a weight around my neck while the owner's freeBoth protector and reminder of mortalityIt's a ...Nick’s KōreroBy Nick Rockel1 day ago

I wear my leather jacket like a great big hugRadiating charm - a living cloak of luckIt's the only concrete link with an absent friendIt's a symbol I can wear 'till we meet againOr it's a weight around my neck while the owner's freeBoth protector and reminder of mortalityIt's a ...Nick’s KōreroBy Nick Rockel1 day ago - Throwback Thursday: Will “Auckland Transport” Survive?

With Auckland Transport’s future up in the air under Mayor Wayne Brown’s proposed CCO reform, we’ve dug way back into the archives, to unearth this post originally published in March 2010. As you’ll see, many of the debates that were being had when AT was first proposed continue to ...Greater AucklandBy Greater Auckland1 day ago

With Auckland Transport’s future up in the air under Mayor Wayne Brown’s proposed CCO reform, we’ve dug way back into the archives, to unearth this post originally published in March 2010. As you’ll see, many of the debates that were being had when AT was first proposed continue to ...Greater AucklandBy Greater Auckland1 day ago - Economists call on PM to suspend budget cuts for the sake of the economy

Nicola Willis’ budget cuts are under fire from economists for having no clear rationale and worsening the recession. Photo: Lynn Grieveson / The KākāKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, November 21: The news at ...The KakaBy Bernard Hickey1 day ago

Nicola Willis’ budget cuts are under fire from economists for having no clear rationale and worsening the recession. Photo: Lynn Grieveson / The KākāKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, November 21: The news at ...The KakaBy Bernard Hickey1 day ago - The end of policing by consent

National has appointed a new police commissioner. And he explicitly rejects policing by consent: Asked if he subscribed to policing by consent, he said he did not. “I don’t talk about policing by consent. I talk about trust and confidence, and it is fundamentally important that the police have ...No Right TurnBy Idiot/Savant2 days ago

National has appointed a new police commissioner. And he explicitly rejects policing by consent: Asked if he subscribed to policing by consent, he said he did not. “I don’t talk about policing by consent. I talk about trust and confidence, and it is fundamentally important that the police have ...No Right TurnBy Idiot/Savant2 days ago - The Treaty Principles Bill: A Who’s Who

David Horatio Waterbed SeymourFringe politician and dweeb transformed successfully by ThinkTank money into a well-oiled soundbite robot.Currently programmed to say: Equal rights for all New Zealanders Equal rights for all New Zealanders Equal rights for all New Zealanders Was previously programmed to say:I am a proud libertarian andI am a ...More Than A FeildingBy David Slack2 days ago

David Horatio Waterbed SeymourFringe politician and dweeb transformed successfully by ThinkTank money into a well-oiled soundbite robot.Currently programmed to say: Equal rights for all New Zealanders Equal rights for all New Zealanders Equal rights for all New Zealanders Was previously programmed to say:I am a proud libertarian andI am a ...More Than A FeildingBy David Slack2 days ago - Kinleith mill closure shows need for industrial strategy

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to deliver an economic and industrial strategy for regional manufacturing, rather than just expressing sympathy for job losses, following the announced closure of Kinleith mill in Tokoroa. “The closure Kinleith mill in Tokoroa is not just devastating for ...NZCTUBy Jeremiah Boniface2 days ago

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to deliver an economic and industrial strategy for regional manufacturing, rather than just expressing sympathy for job losses, following the announced closure of Kinleith mill in Tokoroa. “The closure Kinleith mill in Tokoroa is not just devastating for ...NZCTUBy Jeremiah Boniface2 days ago - 27% of kids going hungry, up from 21% in a year

One in four Kiwi children live in households where food runs out often or sometimes. Photo: Getty ImagesKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Wednesday, November 20: The lead: The official annual Health Survey found sharp ...The KakaBy Bernard Hickey2 days ago

One in four Kiwi children live in households where food runs out often or sometimes. Photo: Getty ImagesKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Wednesday, November 20: The lead: The official annual Health Survey found sharp ...The KakaBy Bernard Hickey2 days ago - Transport modelling is an illusion

This guest post by Tim Adriaansen, an advocate for accessibility and sustainable transport, originally published on LinkedIn and cross posted here with permission. People prefer cars, right? Probably not. Here’s why. Granted, most people in English-speaking countries use a car to get around. This simple reality underpins our transport ...Greater AucklandBy Guest Post2 days ago

This guest post by Tim Adriaansen, an advocate for accessibility and sustainable transport, originally published on LinkedIn and cross posted here with permission. People prefer cars, right? Probably not. Here’s why. Granted, most people in English-speaking countries use a car to get around. This simple reality underpins our transport ...Greater AucklandBy Guest Post2 days ago - Young Maori take over

Neither Wellington nor Parliament has ever seen anything like it before. The Police said there were more than 40,000 but however many there were, yesterday’s Hikoi to Parliament was a monumental event. It was almost three times the Foreshore and Seabed martch of 2004 and many,many times bigger than ...PolitikBy Richard Harman3 days ago

Neither Wellington nor Parliament has ever seen anything like it before. The Police said there were more than 40,000 but however many there were, yesterday’s Hikoi to Parliament was a monumental event. It was almost three times the Foreshore and Seabed martch of 2004 and many,many times bigger than ...PolitikBy Richard Harman3 days ago - Gordon Campbell On The Hikoi Aftermath

The euphoria from yesterday’s hikoi may be transitory, but is no less valuable for that. It is pretty rare for the left to feel itself to be in the overwhelming majority, and speaking as the voice of the people. Lest that momentum be lost, the organisers will no doubt be ...WerewolfBy ScoopEditor3 days ago

The euphoria from yesterday’s hikoi may be transitory, but is no less valuable for that. It is pretty rare for the left to feel itself to be in the overwhelming majority, and speaking as the voice of the people. Lest that momentum be lost, the organisers will no doubt be ...WerewolfBy ScoopEditor3 days ago - Sabin 33 #3 – Solar panels generate too much waste and will overwhelm landfills

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...3 days ago

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...3 days ago - What’s the time Mr Seymour?

Mr David Seymour crawling up to the ceilingThe sun don't shine the sun don't shine the sun don't shine at allMamma Pappa say you should go to school, I don't know what forNow that I've grown up and seen the world and all its liesSong: Southside of Bombay"Ake, ake, ake" ...Nick’s KōreroBy Nick Rockel3 days ago

Mr David Seymour crawling up to the ceilingThe sun don't shine the sun don't shine the sun don't shine at allMamma Pappa say you should go to school, I don't know what forNow that I've grown up and seen the world and all its liesSong: Southside of Bombay"Ake, ake, ake" ...Nick’s KōreroBy Nick Rockel3 days ago - Submit to defend te Tiriti!

The Justice Committee has called for submissions on National's racist and constitutionally radical Principles of the Treaty of Waitangi Bill. Submissions can be made at the link above or by post, and are due by Tuesday, 7 January 2025. But I'd get in quick, in case National grows a spine ...No Right TurnBy Idiot/Savant3 days ago

The Justice Committee has called for submissions on National's racist and constitutionally radical Principles of the Treaty of Waitangi Bill. Submissions can be made at the link above or by post, and are due by Tuesday, 7 January 2025. But I'd get in quick, in case National grows a spine ...No Right TurnBy Idiot/Savant3 days ago - We need to talk about Kevin

All happy families are alike; each unhappy family has a Drunk Uncle Kevin in there somewhere. If your Kevin is anything like the ones I know, he was getting along happily enough without having to think too much about the Treaty Principles Bill apart from bloody good job, onya guys ...More Than A FeildingBy David Slack3 days ago

All happy families are alike; each unhappy family has a Drunk Uncle Kevin in there somewhere. If your Kevin is anything like the ones I know, he was getting along happily enough without having to think too much about the Treaty Principles Bill apart from bloody good job, onya guys ...More Than A FeildingBy David Slack3 days ago - The hikoi

Like everyone else (everyone who wasn't there, anyway), I've spent the morning watching the hikoi march on Parliament. The pictures are astounding: parliament grounds and the surrounding streets are full, and there are still people backed up along Lambton Quay. The police are estimating 35,000 people, and that's a floor ...No Right TurnBy Idiot/Savant3 days ago

Like everyone else (everyone who wasn't there, anyway), I've spent the morning watching the hikoi march on Parliament. The pictures are astounding: parliament grounds and the surrounding streets are full, and there are still people backed up along Lambton Quay. The police are estimating 35,000 people, and that's a floor ...No Right TurnBy Idiot/Savant3 days ago - Why Govt & NZ Inc should boycott & regulate Facebook

The KakaBy Bernard Hickey3 days ago

- How should we talk about change?

A better world isn’t just possible, it’s desirable. And that’s how we should frame a lot of our conversations around making a greater Auckland. As an example take urban climate action. A climate friendly Auckland: Is free from congestion Enables people to travel how they choose Is filled with ...Greater AucklandBy Connor Sharp3 days ago

A better world isn’t just possible, it’s desirable. And that’s how we should frame a lot of our conversations around making a greater Auckland. As an example take urban climate action. A climate friendly Auckland: Is free from congestion Enables people to travel how they choose Is filled with ...Greater AucklandBy Connor Sharp3 days ago - AMA + Holiday Webworm Merch!

David FarrierBy David Farrier3 days ago

- Discount Code for Webworm Merch!

Hi,So there’s a bunch of new stuff on the Webworm store (www.webworm.store) — just in time for the Holidays. Read more ...David FarrierBy David Farrier3 days ago

Hi,So there’s a bunch of new stuff on the Webworm store (www.webworm.store) — just in time for the Holidays. Read more ...David FarrierBy David Farrier3 days ago - Trying to defuse the tension

There were urgent moves yesterday at Parliament to try and defuse the tension building up over ACT’s Treaty Principles Bill. The Bill’s author, ACT leader David Seymour, told reporters that he understood the Justice Select Committee met yesterday to discuss how long it should take to consider submissions on the ...PolitikBy Richard Harman4 days ago

There were urgent moves yesterday at Parliament to try and defuse the tension building up over ACT’s Treaty Principles Bill. The Bill’s author, ACT leader David Seymour, told reporters that he understood the Justice Select Committee met yesterday to discuss how long it should take to consider submissions on the ...PolitikBy Richard Harman4 days ago - An Irritable NZ Pawn – David Seymour Admits Treaty Principles Bill will clear the way for deve...

Mountain TuiBy Mountain Tui4 days ago

- Gordon Campbell On The Hikoi Arrival, And Tyler Childers

Politicians like to bang on all about the need to heal society’s racial/economic divisions, but in their actions they’re more keen on stoking those divisions, with the Treaty Principles Bill being the classic example. The Bill seeks to dilute the Crown’s responsibilities to Māori at the same time as it ...WerewolfBy ScoopEditor4 days ago

Politicians like to bang on all about the need to heal society’s racial/economic divisions, but in their actions they’re more keen on stoking those divisions, with the Treaty Principles Bill being the classic example. The Bill seeks to dilute the Crown’s responsibilities to Māori at the same time as it ...WerewolfBy ScoopEditor4 days ago - Socially Backwards and Fiscally Forwards: the False Ideological Divide and the “Conservative” Li...

Sapphi’s SubstackBy Sapphi4 days ago

- Kaamos: Accepted

I appreciate that A Phuulish Fellow has been fairly quiet recently. That’s a combination of two things – comparatively little in the way of relevant material to discuss (at least until The War of the Rohirrim comes out next month), and my general work on The Secret Non-Fiction Writing Project. ...A Phuulish FellowBy strda2214 days ago

I appreciate that A Phuulish Fellow has been fairly quiet recently. That’s a combination of two things – comparatively little in the way of relevant material to discuss (at least until The War of the Rohirrim comes out next month), and my general work on The Secret Non-Fiction Writing Project. ...A Phuulish FellowBy strda2214 days ago - Here’s how governments could fix their Paris climate commitment failures

This is a re-post from Yale Climate Connections Governments around the world face a conundrum. Virtually none are on track to meet their Paris climate commitments. That includes the United States, which committed to cut its emissions at least 50% below 2005 levels by 2030 but is only on track for 32-43% cuts ...4 days ago

This is a re-post from Yale Climate Connections Governments around the world face a conundrum. Virtually none are on track to meet their Paris climate commitments. That includes the United States, which committed to cut its emissions at least 50% below 2005 levels by 2030 but is only on track for 32-43% cuts ...4 days ago - Unstoppable.

4 days ago

- Katherine Trebeck – An Alternative Economic Narrative

The era of neoliberalism has been destructive on so many levels, with a huge growth in wealth and privilege for the one percent. A hollowing out of the state; fraying of the safety net; inadequate government investment in infrastructure; and continued environmental degradation has resulted in damage on a vast ...4 days ago

The era of neoliberalism has been destructive on so many levels, with a huge growth in wealth and privilege for the one percent. A hollowing out of the state; fraying of the safety net; inadequate government investment in infrastructure; and continued environmental degradation has resulted in damage on a vast ...4 days ago - In a Manner of Speaking

In a manner of speakingI just want to sayThat I could never forget the wayYou told me everythingBy saying nothingOh, give me the wordsGive me the wordsThat tell me nothingOh, give me the wordsGive me the wordsThat tell me everythingSongwriter: Winston TongNext Tuesday, the subscription price for Nick’s Kōrero will ...Nick’s KōreroBy Nick Rockel4 days ago

In a manner of speakingI just want to sayThat I could never forget the wayYou told me everythingBy saying nothingOh, give me the wordsGive me the wordsThat tell me nothingOh, give me the wordsGive me the wordsThat tell me everythingSongwriter: Winston TongNext Tuesday, the subscription price for Nick’s Kōrero will ...Nick’s KōreroBy Nick Rockel4 days ago - Monday 18 November 2024

The NZNO have announced a nationwide strike for December over its pay dispute with Health NZ, who have put a 1 per cent cap on pay rises. The Hīkoi mō Te Tiriti and Treaty Principles Bill remain front and centre in the media, with the impacts of the Hana-Rawhiti Maipi-Clarke-led ...NZCTUBy Jeremiah Boniface4 days ago

The NZNO have announced a nationwide strike for December over its pay dispute with Health NZ, who have put a 1 per cent cap on pay rises. The Hīkoi mō Te Tiriti and Treaty Principles Bill remain front and centre in the media, with the impacts of the Hana-Rawhiti Maipi-Clarke-led ...NZCTUBy Jeremiah Boniface4 days ago - Shipley warns Seymour’s bill is ‘inviting civil war’

The divisive Treaty Principles Bill is not just a risk for the National Party, it’s a risk to civil order and unity, warns a National Party grandee. Photo: Getty ImagesKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on ...The KakaBy Bernard Hickey4 days ago

The divisive Treaty Principles Bill is not just a risk for the National Party, it’s a risk to civil order and unity, warns a National Party grandee. Photo: Getty ImagesKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on ...The KakaBy Bernard Hickey4 days ago - A clearer network for the City Rail Link?

This post was originally published on Linked In by Nicolas Reid. It is republished here with permission. Auckland is now just a year or so away from having the keystone of its urban rail network complete. As I wrote about here, the City Rail Link will be a literal game changer for ...Greater AucklandBy Guest Post4 days ago

This post was originally published on Linked In by Nicolas Reid. It is republished here with permission. Auckland is now just a year or so away from having the keystone of its urban rail network complete. As I wrote about here, the City Rail Link will be a literal game changer for ...Greater AucklandBy Guest Post4 days ago - National’s support base is wobbling

If ACT leader David Seymour intended the Treaty Principles Bill to drive a wedge into National’s support base, he may well already be succeeding. By midnight on Thursday after the Maori Party haka in Parliament, National MPs were being deluged with emails and messages from their members calling them out ...PolitikBy Richard Harman5 days ago

If ACT leader David Seymour intended the Treaty Principles Bill to drive a wedge into National’s support base, he may well already be succeeding. By midnight on Thursday after the Maori Party haka in Parliament, National MPs were being deluged with emails and messages from their members calling them out ...PolitikBy Richard Harman5 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #46

A listing of 33 news and opinion articles we found interesting and shared on social media during the past week: Sun, November 10, 2024 thru Sat, November 16, 2024. Story of the week Our Story of the Week is completely "meta" (no, not that Meta). It's about our exploring how ...5 days ago

A listing of 33 news and opinion articles we found interesting and shared on social media during the past week: Sun, November 10, 2024 thru Sat, November 16, 2024. Story of the week Our Story of the Week is completely "meta" (no, not that Meta). It's about our exploring how ...5 days ago - Grifter Eftpos Tamaki at it again

..Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work.Self-appointed “Bishop” and proto-fascist, Brian Tamaki was at it again on 16 November, blocking Auckland’s southern motorway, SH1.This time, the target of his ire wasn’t the Civil Unions Act; covid lock-downs; mask mandates; or ...Frankly SpeakingBy Frank Macskasy5 days ago

..Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work.Self-appointed “Bishop” and proto-fascist, Brian Tamaki was at it again on 16 November, blocking Auckland’s southern motorway, SH1.This time, the target of his ire wasn’t the Civil Unions Act; covid lock-downs; mask mandates; or ...Frankly SpeakingBy Frank Macskasy5 days ago - Rip up a bill, lead a haka are words to live by

I cannot stop grabbing people by the lapels, or shoulders, or similar, and raving at them about the tiny miracles in my ears.I can hear again! There could not be a more satisfied customer in all the world.In a noisy cafe I am even catching words that Karren cannot, she ...More Than A FeildingBy David Slack6 days ago

I cannot stop grabbing people by the lapels, or shoulders, or similar, and raving at them about the tiny miracles in my ears.I can hear again! There could not be a more satisfied customer in all the world.In a noisy cafe I am even catching words that Karren cannot, she ...More Than A FeildingBy David Slack6 days ago - Unintended Consequences

Take the baitYou pay the priceIt's much too lateFor good adviceYou know and I know that our good things' throughBecause there's consequences for what we doConsequences for me and youWriters: Kevin Robert Hayes, David Nagier, Bonnie Adele Hayes.Fallout from the first readingOne News began last night by saying that tens ...Nick’s KōreroBy Nick Rockel6 days ago

Take the baitYou pay the priceIt's much too lateFor good adviceYou know and I know that our good things' throughBecause there's consequences for what we doConsequences for me and youWriters: Kevin Robert Hayes, David Nagier, Bonnie Adele Hayes.Fallout from the first readingOne News began last night by saying that tens ...Nick’s KōreroBy Nick Rockel6 days ago - Thank you, driver!

Today, Saturday 16th of November, is Auckland Transport’s Bus Driver Appreciation Day! Saturday 16 November marks the third annual Auckland Transport (AT) ‘Bus Driver Appreciation Day’, and this year we are encouraging all of New Zealand to thank their driver or let the bus go first if you are in ...Greater AucklandBy Greater Auckland6 days ago

Today, Saturday 16th of November, is Auckland Transport’s Bus Driver Appreciation Day! Saturday 16 November marks the third annual Auckland Transport (AT) ‘Bus Driver Appreciation Day’, and this year we are encouraging all of New Zealand to thank their driver or let the bus go first if you are in ...Greater AucklandBy Greater Auckland6 days ago - Totally Normal: Holiday Edition

Hi,If I was to accurately sum up my mental state over the week, I’d just say that I got a huge fright from my own shadow.I’d nipped out for an 11pm neighborhood stroll, just to calm down after a day of stress and screens. The Cure and Fazerdaze’s new record ...David FarrierBy David Farrier6 days ago

Hi,If I was to accurately sum up my mental state over the week, I’d just say that I got a huge fright from my own shadow.I’d nipped out for an 11pm neighborhood stroll, just to calm down after a day of stress and screens. The Cure and Fazerdaze’s new record ...David FarrierBy David Farrier6 days ago - We Are Not Listening

The current rise of populism challenges the way we think about people’s relationship to the economy.We seem to be entering an era of populism, in which leadership in a democracy is based on preferences of the population which do not seem entirely rational nor serving their longer interests. ...

PunditBy Brian Easton1 week ago - More lawlessness from National

On Tuesday, sick of government stonewalling, the Waitangi Tribunal issued a rare court order, ordering the Minister of Health to release unredacted documents within 48 hours showing its reasoning for disestablishing Te Aka Whai Ora, the Māori Health Authority. The government's response to the lawful order of a court? Yeah, ...No Right TurnBy Idiot/Savant1 week ago

On Tuesday, sick of government stonewalling, the Waitangi Tribunal issued a rare court order, ordering the Minister of Health to release unredacted documents within 48 hours showing its reasoning for disestablishing Te Aka Whai Ora, the Māori Health Authority. The government's response to the lawful order of a court? Yeah, ...No Right TurnBy Idiot/Savant1 week ago - National’s tyrannical “foreign interference” law

Yesterday, under cover the the biggest political fight of the year, National quietly - covertly, even - introduced anti-foreign interference legislation. The bill is the product of a years-long work-program aimed at countering shit like this and this, and there's unquestionably a need to do something to counter foreign states' ...No Right TurnBy Idiot/Savant1 week ago

Yesterday, under cover the the biggest political fight of the year, National quietly - covertly, even - introduced anti-foreign interference legislation. The bill is the product of a years-long work-program aimed at countering shit like this and this, and there's unquestionably a need to do something to counter foreign states' ...No Right TurnBy Idiot/Savant1 week ago - The Haka Represents The Best Of Us

A few months ago, I was in an audience watching a Haka-Kapa and as I watched children dance and sing and sway and shout and beat, I couldn’t help but think “The Haka represents the best of us.”Yes, yes - there will be a thousand voices that rush forth to ...Mountain TuiBy Mountain Tui1 week ago

A few months ago, I was in an audience watching a Haka-Kapa and as I watched children dance and sing and sway and shout and beat, I couldn’t help but think “The Haka represents the best of us.”Yes, yes - there will be a thousand voices that rush forth to ...Mountain TuiBy Mountain Tui1 week ago - Adding up the climate cost

St Mary’s Bay housing left hanging: Climate risk is systemically underestimated in the climate scenarios used by central banks, and a new report warns 10,000 houses are set to become uninsurable in Aotearoa. Photo: Lynn Grieveson / The KākāLong stories short, here’s the top six news items of note in ...The KakaBy Bernard Hickey1 week ago

St Mary’s Bay housing left hanging: Climate risk is systemically underestimated in the climate scenarios used by central banks, and a new report warns 10,000 houses are set to become uninsurable in Aotearoa. Photo: Lynn Grieveson / The KākāLong stories short, here’s the top six news items of note in ...The KakaBy Bernard Hickey1 week ago - Auckland chafing at Bishop’s housing intensification orders

One of the major problems the Government has in implementing its ‘going for housing growth’ strategy is that it isn’t giving much funding help to councils. Photo: Lynn Grieveson / The KākāKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey1 week ago

One of the major problems the Government has in implementing its ‘going for housing growth’ strategy is that it isn’t giving much funding help to councils. Photo: Lynn Grieveson / The KākāKia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey1 week ago - Friday 15 November 2024

The Treaty Principles Bill continues to dominate political news, with it passing its first reading in the House. Parliament was briefly suspended and Te Pāti Māori MP Hana-Rawhiti Maipi-Clarke suspended for 24 hours after leading a haka that was joined by opposition MPs and the public in the gallery. Willie ...NZCTUBy Jeremiah Boniface1 week ago

The Treaty Principles Bill continues to dominate political news, with it passing its first reading in the House. Parliament was briefly suspended and Te Pāti Māori MP Hana-Rawhiti Maipi-Clarke suspended for 24 hours after leading a haka that was joined by opposition MPs and the public in the gallery. Willie ...NZCTUBy Jeremiah Boniface1 week ago - Weekly Roundup 15-November-2024

Happy Friday, welcome to another round-up of interesting stories about what’s happening in Auckland and other cities. Feel free to add your links in the comments! This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our readers ...Greater AucklandBy Greater Auckland1 week ago

Happy Friday, welcome to another round-up of interesting stories about what’s happening in Auckland and other cities. Feel free to add your links in the comments! This post, like all our work, is brought to you by a largely volunteer crew and made possible by generous donations from our readers ...Greater AucklandBy Greater Auckland1 week ago - Are We The Waiting?

And screamingAre we we are, are we we are the waitingAnd screamingAre we we are, are we we are the waitingForget me nots, second thoughts live in isolationHeads or tails and fairy tales in my mindAre we we are, are we we are the waiting unknownThe rage and love, the ...Nick’s KōreroBy Nick Rockel1 week ago

And screamingAre we we are, are we we are the waitingAnd screamingAre we we are, are we we are the waitingForget me nots, second thoughts live in isolationHeads or tails and fairy tales in my mindAre we we are, are we we are the waiting unknownThe rage and love, the ...Nick’s KōreroBy Nick Rockel1 week ago - The Hoon around the week to November 15

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with:The Kākā’s climate correspondent on the latest climate news, including from COP29 this week; on the US Presidential elections, Israel vs Gaza/Iran/Lebanon, Ukraine/Nato vs Russia/North ...The KakaBy Bernard Hickey1 week ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with:The Kākā’s climate correspondent on the latest climate news, including from COP29 this week; on the US Presidential elections, Israel vs Gaza/Iran/Lebanon, Ukraine/Nato vs Russia/North ...The KakaBy Bernard Hickey1 week ago - First Tea and Toast, now Milo — why do NZ’s best beverages need so much defending?

Only two months ago, Nicola Willis had to step in to stop Health New Zealand cutting tea and toast for post-birth parents, and now Lester Levy is riding to the rescue with a welcome message for all: our health workers can once again drink Milo, and will no longer need ...Sapphi’s SubstackBy Sapphi1 week ago

Only two months ago, Nicola Willis had to step in to stop Health New Zealand cutting tea and toast for post-birth parents, and now Lester Levy is riding to the rescue with a welcome message for all: our health workers can once again drink Milo, and will no longer need ...Sapphi’s SubstackBy Sapphi1 week ago - Gordon Campbell on the folly of making apologies in a social vacuum.

Day One of the Treaty Principles Bill…and everyone got what they wanted, and did what they liked. Heated words were exchanged. Culturally appropriate acts of outrage were performed. David Seymour got to play the victim card. Willie Jackson got kicked out of class. A comically red-faced Mr Speaker bellowed “Order, ...WerewolfBy ScoopEditor1 week ago

Day One of the Treaty Principles Bill…and everyone got what they wanted, and did what they liked. Heated words were exchanged. Culturally appropriate acts of outrage were performed. David Seymour got to play the victim card. Willie Jackson got kicked out of class. A comically red-faced Mr Speaker bellowed “Order, ...WerewolfBy ScoopEditor1 week ago - Skeptical Science New Research for Week #46 2024

Open access notables Microbial solutions must be deployed against climate catastrophe, Peixoto et al., Nature Communications [comment]: The climate crisis is escalating. A multitude of microbe-based solutions have been proposed, and these technologies hold great promise and could be deployed along with other climate mitigation strategies. However, these solutions have ...1 week ago

Open access notables Microbial solutions must be deployed against climate catastrophe, Peixoto et al., Nature Communications [comment]: The climate crisis is escalating. A multitude of microbe-based solutions have been proposed, and these technologies hold great promise and could be deployed along with other climate mitigation strategies. However, these solutions have ...1 week ago - The PM gets some extremely valuable legal advice for free

You can pay a great deal of money for the services of a KC. So just what would some peerless legal writing from 40 or so of them be worth, do you reckon?Priceless, that’s what. It’s not even the half of it, but this is my favourite part of the ...More Than A FeildingBy David Slack1 week ago

You can pay a great deal of money for the services of a KC. So just what would some peerless legal writing from 40 or so of them be worth, do you reckon?Priceless, that’s what. It’s not even the half of it, but this is my favourite part of the ...More Than A FeildingBy David Slack1 week ago - D-day for the government

The government's Treaty Principles Bill is up for its first reading today - bought forward in a rush in a desperate effort to avoid the hikoi which is currently marching on Wellington. But the Prime Minister won’t be there for it – he’s literally running away to Peru! But he ...No Right TurnBy Idiot/Savant1 week ago

The government's Treaty Principles Bill is up for its first reading today - bought forward in a rush in a desperate effort to avoid the hikoi which is currently marching on Wellington. But the Prime Minister won’t be there for it – he’s literally running away to Peru! But he ...No Right TurnBy Idiot/Savant1 week ago - 97% of submissions did not want no-cause evictions, Trump chooses a Russian spy for US Intelligence ...

Good morning, and I’m sorry I’ve been away for a couple of days.I’ve been focusing on the Hikoi, and also testing out sentiment on the Treaty Principles Bill. It’s complicated, and the Treaty Principles Bill will be debated in the House today. The Government’s own lawyers have told them the ...Mountain TuiBy Mountain Tui1 week ago

Good morning, and I’m sorry I’ve been away for a couple of days.I’ve been focusing on the Hikoi, and also testing out sentiment on the Treaty Principles Bill. It’s complicated, and the Treaty Principles Bill will be debated in the House today. The Government’s own lawyers have told them the ...Mountain TuiBy Mountain Tui1 week ago - Government must vote down ACT Members Bill that would undermine workers’ rights

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to vote down an ACT Party Members Bill that would undermine workers’ rights by making it easier for employers to fire workers. Last week ACT MP Laura Trask’s Employment Relations (Termination of Employment by Agreement) Amendment Bill was ...NZCTUBy Jeremiah Boniface1 week ago

NZCTU Te Kauae Kaimahi President Richard Wagstaff is calling on the Government to vote down an ACT Party Members Bill that would undermine workers’ rights by making it easier for employers to fire workers. Last week ACT MP Laura Trask’s Employment Relations (Termination of Employment by Agreement) Amendment Bill was ...NZCTUBy Jeremiah Boniface1 week ago - Seymour causes thousands of unjustified absences by forcing kids to fight for their rights instead o...

The State would like to remind you that they are in control. They manage your employment prospects, and can destroy the job market you and yours rely on by mass-cancelling construction projects, cutting funding, and firing a good chunk of our public servants. They wield the mechanisms that provide scrutiny ...Sapphi’s SubstackBy Sapphi1 week ago

The State would like to remind you that they are in control. They manage your employment prospects, and can destroy the job market you and yours rely on by mass-cancelling construction projects, cutting funding, and firing a good chunk of our public servants. They wield the mechanisms that provide scrutiny ...Sapphi’s SubstackBy Sapphi1 week ago - The Weight of the World

As the weight of the world Hangs on your shoulders The weight of the world Starts to take over again And over again All that you once loved, now you hate So slowly relearn how to meditate To have and to hold And never let go Can you feel it ...Nick’s KōreroBy Nick Rockel1 week ago

As the weight of the world Hangs on your shoulders The weight of the world Starts to take over again And over again All that you once loved, now you hate So slowly relearn how to meditate To have and to hold And never let go Can you feel it ...Nick’s KōreroBy Nick Rockel1 week ago - Thursday 14 November 2024

The Treaty Principles Bill is set to have its First Reading in the House today, as the Hīkoi mō Te Tiriti continues. More than 40 KCs have written to the Prime Minister and Attorney-General outlining their “grave concerns” about the substance of the Treaty Principles Bill, while an academic and ...NZCTUBy Jeremiah Boniface1 week ago

The Treaty Principles Bill is set to have its First Reading in the House today, as the Hīkoi mō Te Tiriti continues. More than 40 KCs have written to the Prime Minister and Attorney-General outlining their “grave concerns” about the substance of the Treaty Principles Bill, while an academic and ...NZCTUBy Jeremiah Boniface1 week ago

Related Posts

- Release: Government should be transparent on live exports

Targeted consultation on reinstating live cattle exports by sea won’t allow the New Zealand public to have their say. ...10 hours ago

Targeted consultation on reinstating live cattle exports by sea won’t allow the New Zealand public to have their say. ...10 hours ago - NZ’s global climate rankings plummet as Govt removes agriculture from ETS

The Government has passed legislation to remove agriculture from the Emissions Trading Scheme (ETS) while Aotearoa’s reputation on climate action plummets. ...1 day ago

The Government has passed legislation to remove agriculture from the Emissions Trading Scheme (ETS) while Aotearoa’s reputation on climate action plummets. ...1 day ago - Failed boot camp experiment must end

As legislation to set up boot camps passed its first reading, the Green Party urged the Government to abandon this failed policy experiment for the good of our rangatahi. ...1 day ago

As legislation to set up boot camps passed its first reading, the Green Party urged the Government to abandon this failed policy experiment for the good of our rangatahi. ...1 day ago - Gender-affirming care must centre evidence and health needs, not political posturing

The Ministry of Health has today released an evidence brief regarding the use of puberty blockers in gender-affirming healthcare, amid moves by the government to limit access. ...1 day ago

The Ministry of Health has today released an evidence brief regarding the use of puberty blockers in gender-affirming healthcare, amid moves by the government to limit access. ...1 day ago - Release: National doesn’t care about manufacturing

The National Government is walking away from our manufacturing sector with constant reports of closures and job losses. ...1 day ago

The National Government is walking away from our manufacturing sector with constant reports of closures and job losses. ...1 day ago - Release: David Parker speech – Piketty, Inequality and Climate Change

David Parker's speech from the University of Auckland's forum on Piketty, Inequality and Climate Change in September 2024. ...1 day ago

David Parker's speech from the University of Auckland's forum on Piketty, Inequality and Climate Change in September 2024. ...1 day ago - Release: Youth mental wellbeing no longer a priority for Child Poverty Minister

Louise Upston has revealed her diminished vision for vulnerable youth against a backdrop of snubbed advice, scrapped priorities, shifted goal posts and thousands more children projected to fall into poverty. ...1 day ago

Louise Upston has revealed her diminished vision for vulnerable youth against a backdrop of snubbed advice, scrapped priorities, shifted goal posts and thousands more children projected to fall into poverty. ...1 day ago - Release: National’s lack of climate action taking NZ backwards

National Government’s backward-looking climate policy has seen New Zealand fall seven places on the Climate Change Performance Index to 41 out of 63 countries measured. ...1 day ago

National Government’s backward-looking climate policy has seen New Zealand fall seven places on the Climate Change Performance Index to 41 out of 63 countries measured. ...1 day ago - Release: Simple reason for drop in emergency housing

When the Government says it has reduced the number of people in emergency housing, what it means is it is stopping people from accessing it in the first place. ...1 day ago

When the Government says it has reduced the number of people in emergency housing, what it means is it is stopping people from accessing it in the first place. ...1 day ago - Govt’s child wellbeing strategy ‘shallow and shameful’

The Government is turning its back on children by not only weakening child poverty reduction targets, but also removing child mental wellbeing as a priority focus in their Child and Youth Wellbeing Strategy. ...1 day ago

The Government is turning its back on children by not only weakening child poverty reduction targets, but also removing child mental wellbeing as a priority focus in their Child and Youth Wellbeing Strategy. ...1 day ago - Release: A historic win for Samoan communities

Labour warmly welcomes the Restoring Samoan Citizenship Bill as it passes its third reading, before becoming law. ...1 day ago

Labour warmly welcomes the Restoring Samoan Citizenship Bill as it passes its third reading, before becoming law. ...1 day ago - Government plan to reinstate live animal exports a “national disgrace”

2 days ago

- Pasifika justice as Member’s Bill passes final reading

Teanau Tuiono’s Member’s Bill, the Citizenship (Western Samoa Restoration) Amendment Bill, has passed its third reading and will become law. ...2 days ago

Teanau Tuiono’s Member’s Bill, the Citizenship (Western Samoa Restoration) Amendment Bill, has passed its third reading and will become law. ...2 days ago - Release: Minister of Education thinks New Zealand ends at the Bombay Hills

The Minister of Education has shown complete disregard for rural communities and their school bus routes in Question Time today. ...2 days ago

The Minister of Education has shown complete disregard for rural communities and their school bus routes in Question Time today. ...2 days ago - Economists sound alarm on Government’s slash-and-burn approach

A group of prominent economists has released an open letter to the Government, raising grave concerns about the far-reaching consequences of its fiscal policy. ...2 days ago

A group of prominent economists has released an open letter to the Government, raising grave concerns about the far-reaching consequences of its fiscal policy. ...2 days ago - Release: Smoking numbers up under Costello’s watch

National’s repeal of Labour’s smokefree legislation has taken New Zealand further away from achieving a Smokefree 2025 and a smokefree generation. ...2 days ago

National’s repeal of Labour’s smokefree legislation has taken New Zealand further away from achieving a Smokefree 2025 and a smokefree generation. ...2 days ago - Release: Call for Palestine recognition by NZ, Australian and Canadian MPs

Parliamentarians from Australia, Canada and New Zealand have written an open letter to their respective Prime Ministers calling on them to recognise Palestine. ...2 days ago

Parliamentarians from Australia, Canada and New Zealand have written an open letter to their respective Prime Ministers calling on them to recognise Palestine. ...2 days ago - Justice Select Committee opens floor for Treaty Principles submissions

Today, the Justice Select Committee has decided to officially open submissions for the controversial Treaty Principles Bill. ...3 days ago

Today, the Justice Select Committee has decided to officially open submissions for the controversial Treaty Principles Bill. ...3 days ago - Power of the people on full display as hīkoi approaches Parliament

Today, Hīkoi mō te Tiriti arrived in Wellington, with thousands gathering to march in unity against the divisive Treaty Principles Bill. ...3 days ago

Today, Hīkoi mō te Tiriti arrived in Wellington, with thousands gathering to march in unity against the divisive Treaty Principles Bill. ...3 days ago - Hypocrisy as Te Whatu Ora contractor bill balloons

Te Whatu Ora’s bill for contracting and consulting staff has ballooned by nearly 20 percent under the National Government, breaking a promise they made during the election campaign to cut contractors. ...4 days ago

Te Whatu Ora’s bill for contracting and consulting staff has ballooned by nearly 20 percent under the National Government, breaking a promise they made during the election campaign to cut contractors. ...4 days ago - Release: Growing pressure to scrap Section 7AA Repeal Bill

The newly released Section 7AA Repeal Bill's select committee report is further evidence that the Government should scrap it. ...5 days ago

The newly released Section 7AA Repeal Bill's select committee report is further evidence that the Government should scrap it. ...5 days ago - Government’s move to monetise access to nature a slippery slope

The Green Party is voicing serious concerns over the Government’s proposal to charge for access to public conservation land, released today. ...1 week ago

The Green Party is voicing serious concerns over the Government’s proposal to charge for access to public conservation land, released today. ...1 week ago - Green Party condemns the passage of Treaty Principles Bill

The Green Party condemns the passing of the Treaty Principles Bill at first reading, and is clear that the fight is not over. ...1 week ago

The Green Party condemns the passing of the Treaty Principles Bill at first reading, and is clear that the fight is not over. ...1 week ago - Stand Up for Te Tiriti

Te Tiriti o Waitangi is our country’s founding document. It forms the basis of the relationship between Māori and the Crown – and the Aotearoa New Zealand we live in today. ...1 week ago

Te Tiriti o Waitangi is our country’s founding document. It forms the basis of the relationship between Māori and the Crown – and the Aotearoa New Zealand we live in today. ...1 week ago - Release: Over 15,000 sign Labour’s open letter to Luxon

As the hīkoi to Parliament continues, Labour has sent an open letter to Prime Minister Christopher Luxon in a last-ditch attempt to get him to kill the Treaty Principles Bill. ...1 week ago

As the hīkoi to Parliament continues, Labour has sent an open letter to Prime Minister Christopher Luxon in a last-ditch attempt to get him to kill the Treaty Principles Bill. ...1 week ago - Fast Track Bill threatens environment, climate and reputation

The fast-track legislation passing its second reading in Parliament is another step towards environmental ruin. ...1 week ago

The fast-track legislation passing its second reading in Parliament is another step towards environmental ruin. ...1 week ago - Greens join King’s Counsel in calling for Treaty Principles Bill to be abandoned

The Prime Minister must answer the call from a group of senior lawyers of the King’s Counsel to abandon the divisive Treaty Principles Bill. ...1 week ago

The Prime Minister must answer the call from a group of senior lawyers of the King’s Counsel to abandon the divisive Treaty Principles Bill. ...1 week ago - Chris Hipkins’ apology statement to state and faith-based care survivors

1 week ago

- Release: Labour formally apologises to state and faith-based care survivors

Labour joins with the Government in unreservedly apologising for the abuse, neglect and trauma including torture in state and faith-based care and for ignoring the voices of survivors for too long. ...1 week ago

Labour joins with the Government in unreservedly apologising for the abuse, neglect and trauma including torture in state and faith-based care and for ignoring the voices of survivors for too long. ...1 week ago - Green Party stands in support of survivors of abuse in care

Today, the Green Party stands alongside the survivors of abuse in state care and faith-based care as the Government issues an historic apology. ...1 week ago

Today, the Green Party stands alongside the survivors of abuse in state care and faith-based care as the Government issues an historic apology. ...1 week ago - Green Party calls for conscience vote on Treaty Principles Bill

The Green Party has written to the Speaker of the House requesting he enable a personal vote on the Treaty Principles Bill. ...2 weeks ago

The Green Party has written to the Speaker of the House requesting he enable a personal vote on the Treaty Principles Bill. ...2 weeks ago - Govt move to exclude journalist risks chilling effect

The Green Party is alarmed by the Government’s move to exclude a journalist from covering this week’s apology for the survivors of abuse in state and faith-based care. ...2 weeks ago

The Green Party is alarmed by the Government’s move to exclude a journalist from covering this week’s apology for the survivors of abuse in state and faith-based care. ...2 weeks ago - Without action, an apology will be empty air

For tomorrow’s apology to survivors of abuse in state and faith-based care to hold any water, the Government must not pursue the same policies that drove the abuse in the first place. ...2 weeks ago

For tomorrow’s apology to survivors of abuse in state and faith-based care to hold any water, the Government must not pursue the same policies that drove the abuse in the first place. ...2 weeks ago - Release: Concerns remain over tobacco interference

Concerns about the tobacco industry’s ability to interfere in government policy making remain, despite the inability of the Office of the Auditor-General to investigate the Government’s decision to halve the excise tax on heated tobacco products. ...2 weeks ago

Concerns about the tobacco industry’s ability to interfere in government policy making remain, despite the inability of the Office of the Auditor-General to investigate the Government’s decision to halve the excise tax on heated tobacco products. ...2 weeks ago - Urgent wake-up call on climate

The Climate Change Commission’s latest advice indicates Aotearoa needs to be stepping up on climate action. ...2 weeks ago

The Climate Change Commission’s latest advice indicates Aotearoa needs to be stepping up on climate action. ...2 weeks ago - Green MP’s Meme-ber’s Bill set to save the world

Break out the punchlines and dust off your meme folder: Green Party MP Kahurangi Carter’s Copyright (Parody and Satire) Amendment Bill was pulled from the Ballot yesterday. ...2 weeks ago

Break out the punchlines and dust off your meme folder: Green Party MP Kahurangi Carter’s Copyright (Parody and Satire) Amendment Bill was pulled from the Ballot yesterday. ...2 weeks ago - Release: Poroporoaki: Ta Robert (Bom) Gillies

Kua hinga te manawa kairākau o Te Rua Tekau Ma Waru Tiwhatiwha te po! Kakarauru i te po! Ka rapuhia kei hea koe kua riro! Haere e te Ika a Whiro ki o tini hoa kua ngaro atu ki te Pō ...2 weeks ago

Kua hinga te manawa kairākau o Te Rua Tekau Ma Waru Tiwhatiwha te po! Kakarauru i te po! Ka rapuhia kei hea koe kua riro! Haere e te Ika a Whiro ki o tini hoa kua ngaro atu ki te Pō ...2 weeks ago - Labour, Greens and Te Pāti Māori call on the Prime Minister to block the Treaty Principles Bill

The opposition parties stand united for an Aotearoa that honours Te Tiriti, rather than seeking to rewrite it. Labour, the Greens and Te Pāti Māori are working together against the Government’s divisive Treaty Principles Bill. ...2 weeks ago

The opposition parties stand united for an Aotearoa that honours Te Tiriti, rather than seeking to rewrite it. Labour, the Greens and Te Pāti Māori are working together against the Government’s divisive Treaty Principles Bill. ...2 weeks ago - Release: Labour, Greens and Te Pāti Māori call on the Prime Minister to block the Treaty Principle...

The opposition parties stand united for an Aotearoa that honours Te Tiriti, rather than seeking to rewrite it. Labour, the Greens and Te Pāti Māori are working together against the Government’s divisive Treaty Principles Bill. ...2 weeks ago

The opposition parties stand united for an Aotearoa that honours Te Tiriti, rather than seeking to rewrite it. Labour, the Greens and Te Pāti Māori are working together against the Government’s divisive Treaty Principles Bill. ...2 weeks ago - NZ must pursue independent foreign policy

The Green Party says the need is greater than ever for Aotearoa New Zealand to pursue an independent foreign policy. ...2 weeks ago

The Green Party says the need is greater than ever for Aotearoa New Zealand to pursue an independent foreign policy. ...2 weeks ago

Related Posts

- Child Protection Investigation Unit established

A new Child Protection Investigation Unit is being established to ensure the safety and wellbeing of children in care, Minister for Children Karen Chhour says. “The report released by the Royal Commission into abuse in state care shows us all the risk of not acting immediately when there are serious ...BeehiveBy beehive.govt.nz5 hours ago

A new Child Protection Investigation Unit is being established to ensure the safety and wellbeing of children in care, Minister for Children Karen Chhour says. “The report released by the Royal Commission into abuse in state care shows us all the risk of not acting immediately when there are serious ...BeehiveBy beehive.govt.nz5 hours ago - Speech at United States Business Summit 2024

Ka nui te mihi kia koutou. Ka mihi ki te mana whenua ko Ngāti Whātua Ōrākei. Kia ora and good morning everyone. Thank you Fran and Simon for inviting me here today, and importantly your leadership of this forum over several years now. I want to acknowledge David Gehrenbeck, Deputy ...BeehiveBy beehive.govt.nz5 hours ago

Ka nui te mihi kia koutou. Ka mihi ki te mana whenua ko Ngāti Whātua Ōrākei. Kia ora and good morning everyone. Thank you Fran and Simon for inviting me here today, and importantly your leadership of this forum over several years now. I want to acknowledge David Gehrenbeck, Deputy ...BeehiveBy beehive.govt.nz5 hours ago - Record number of submissions received on granny flat proposal

Nearly 2,000 submissions have been received on the Government’s proposals aimed at making it easier to build a granny flat of up to 60 square metres without a resource or building consent, RMA Reform Minister Chris Bishop and Building and Construction Minister Chris Penk say. “This is the highest number ...BeehiveBy beehive.govt.nz7 hours ago

Nearly 2,000 submissions have been received on the Government’s proposals aimed at making it easier to build a granny flat of up to 60 square metres without a resource or building consent, RMA Reform Minister Chris Bishop and Building and Construction Minister Chris Penk say. “This is the highest number ...BeehiveBy beehive.govt.nz7 hours ago - District Court Judge appointed

Attorney-General Judith Collins today announced the appointment of Rebecca Guthrie as a District Court Judge. Judge Guthrie was admitted to the bar in 1997 following her graduation from the University of Canterbury in 1996 (LLB, BA). She commenced her legal career in Hastings in 1997 before moving to London in ...BeehiveBy beehive.govt.nz7 hours ago

Attorney-General Judith Collins today announced the appointment of Rebecca Guthrie as a District Court Judge. Judge Guthrie was admitted to the bar in 1997 following her graduation from the University of Canterbury in 1996 (LLB, BA). She commenced her legal career in Hastings in 1997 before moving to London in ...BeehiveBy beehive.govt.nz7 hours ago - Appointments strengthen Predator Free 2050

The latest Predator Free 2050 Board appointments will help to strengthen biodiversity efforts across Aotearoa New Zealand, Conservation Minister Tama Potaka says. Mr Potaka today announced two appointments to the Board of Directors of Predator Free 2050 Limited, a key player in the wider Predator Free 2050 Programme. “The Predator ...BeehiveBy beehive.govt.nz9 hours ago

The latest Predator Free 2050 Board appointments will help to strengthen biodiversity efforts across Aotearoa New Zealand, Conservation Minister Tama Potaka says. Mr Potaka today announced two appointments to the Board of Directors of Predator Free 2050 Limited, a key player in the wider Predator Free 2050 Programme. “The Predator ...BeehiveBy beehive.govt.nz9 hours ago - New facility in Christchurch will improve the lives of young New Zealanders

Mental Health Minister Matt Doocey today opened Kahurangi, an innovative and much-needed facility for Canterbury’s Child, Adolescent, and Family Mental Health Services. “The new state of the art outpatient facility opened today will be a gamechanger for the way mental health is delivered for young people in Canterbury,” says Mr ...BeehiveBy beehive.govt.nz9 hours ago

Mental Health Minister Matt Doocey today opened Kahurangi, an innovative and much-needed facility for Canterbury’s Child, Adolescent, and Family Mental Health Services. “The new state of the art outpatient facility opened today will be a gamechanger for the way mental health is delivered for young people in Canterbury,” says Mr ...BeehiveBy beehive.govt.nz9 hours ago - Driver safety screens to be installed on Auckland buses

Transport Minister Simeon Brown has welcomed news from the NZ Transport Agency (NZTA) that bus driver protection screens will be installed across Auckland’s bus fleet by 2026.“The Government is committed to improving the safety of working environments for bus drivers, and Budget 2024 allocated $15 million of Crown funding over ...BeehiveBy beehive.govt.nz9 hours ago

Transport Minister Simeon Brown has welcomed news from the NZ Transport Agency (NZTA) that bus driver protection screens will be installed across Auckland’s bus fleet by 2026.“The Government is committed to improving the safety of working environments for bus drivers, and Budget 2024 allocated $15 million of Crown funding over ...BeehiveBy beehive.govt.nz9 hours ago - Government action provides Southland farmers more time to meet plan requirements

The Government is taking action to ensure Southland farmers and growers are not affected by unreasonable regional farm plan deadlines, Agriculture Minister Todd McClay, Environment Minister Penny Simmonds and Associate Environment Minister Andrew Hoggard say.“Cabinet has agreed to provide more time for farmers and growers to comply with regional rules ...BeehiveBy beehive.govt.nz1 day ago

The Government is taking action to ensure Southland farmers and growers are not affected by unreasonable regional farm plan deadlines, Agriculture Minister Todd McClay, Environment Minister Penny Simmonds and Associate Environment Minister Andrew Hoggard say.“Cabinet has agreed to provide more time for farmers and growers to comply with regional rules ...BeehiveBy beehive.govt.nz1 day ago - Bill reaffirms Government’s commitment to crack down on serious youth offending

The Oranga Tamariki (Responding to Serious Youth Offending) Bill had its first reading at Parliament today. The Bill reaffirms the Government’s commitment to crack down on serious youth offending, Minister for Children Karen Chhour says. “In recent years we have seen an unacceptable spike in youth offending. “This Bill makes ...BeehiveBy beehive.govt.nz1 day ago

The Oranga Tamariki (Responding to Serious Youth Offending) Bill had its first reading at Parliament today. The Bill reaffirms the Government’s commitment to crack down on serious youth offending, Minister for Children Karen Chhour says. “In recent years we have seen an unacceptable spike in youth offending. “This Bill makes ...BeehiveBy beehive.govt.nz1 day ago - Critical milestones for earthquake buildings review

Fairer, more sensible rules about managing earthquake risks are a step closer with the passing of legislation and the appointment of an independent chair to provide expert advice, Minister for Building and Construction Chris Penk says. “The Government is committed to reinvigorating our cities and regions to support economic growth, ...BeehiveBy beehive.govt.nz1 day ago