Posts Tagged ‘banks’

Chloe Swarbrick: We don’t live in a game of Monopoly

Written By: - Date published: 10:04 am, March 10th, 2023 - 49 comments

The case for redistribution of wealth in New Zealand.

Greens: Tax the banks

Written By: - Date published: 8:25 am, March 1st, 2023 - 60 comments

Instead of creating an appeal fund and one-off lotto draw, the Labour Government could tax the billions of dollars banks have made in unearned, excess profits and use the money to support people.

Windfall tax on bank super-profits needed to help fund repair

Written By: - Date published: 3:57 pm, February 20th, 2023 - 69 comments

The repair bill for the recent cyclones will be similar to the direct cost to government of the Canterbury earthquakes, in the $13 billion region. Banks are currently making obscene profits. The time is right to impose a one-off banking windfall tax. If a conservative Margaret Thatcher can do it, it is pretty hard to argue why a Labour government can’t.

The background traffic is loud.

Written By: - Date published: 8:41 am, September 2nd, 2020 - 16 comments

Along with the grey weather, the weather around our local net is downright annoying at present. There are a massive increase in attempts to break into this site via backend systems and brute force front-end logins, a surge in scans from the search engine spider bots, and a lot of requests for putting up paid content. All of which have been ignored or dealt with. Good thing that we aren’t a target like the NZX, banks, mainstream media and the MetService are.

Gould explains how money works to Brash

Written By: - Date published: 12:06 pm, April 30th, 2017 - 157 comments

Interesting series of articles in The Herald, where Bryan Gould schools Don Brash on how money works.

Warren strips cross-selling bank CEO

Written By: - Date published: 2:02 pm, September 22nd, 2016 - 25 comments

Watch Elizabeth Warren strip Wells Fargo CEO John Stumpf alive at a Senate hearing on ‘cross-selling’ of bank products customers didn’t need. Wells Fargo, one of the US’ biggest banks, was fined $185million, and 5300 employees at branch and teller level were sacked. The senior executive in charge was allowed to retire with nearly $100million in stock benefits. Warren thinks the top management should be held accountable. See what you think.

Hollowing out the regions

Written By: - Date published: 10:58 am, August 28th, 2016 - 44 comments

The closure of 19 mostly rural Westpac branches is indicative of the ongoing hollowing out the regions. Neglecting Northland cost the Nats the last by election. Neglecting regional NZ as a whole might cost them the next general.

Banks act on housing affordability crisis (while National sits on its hands)

Written By: - Date published: 6:29 am, June 10th, 2016 - 144 comments

Despite Key’s barnstorming 2007 speech on the housing affordability crisis, National these days prefer to deny that it exists. Apparently fed up with waiting for the government to take action, banks are moving to reduce their risk and limit foreign buyers.

Interest rates and banks

Written By: - Date published: 9:43 am, March 16th, 2016 - 185 comments

Yesterday Andrew Little criticised the banks’ failure to pass on the cut in Official Cash Rate (OCR) to we the people via mortgage / interest rate cuts. Naturally the political right went ballistic.

As the economy stalls it’s a great time to be a bank!

Written By: - Date published: 10:18 am, June 24th, 2015 - 34 comments

Ho ho – what am I saying? It’s always a great time to be a bank.

Alternatives to banks

Written By: - Date published: 11:27 am, April 6th, 2015 - 96 comments

We need an alternative to fattening the coffers of Australian banks.

Local Bodies: Let’s Bring Our Banking Home!

Written By: - Date published: 10:45 am, June 30th, 2014 - 76 comments

In the 1980s and early 90s the wisdom of the day dictated that our Kiwi banks were unsustainable. The buyout by Aussie banks saw huge profits and dividends head across the ditch. Russel Norman revealed an unhealthy relationship between our Reserve Bank and Westpac in an ongoing relationship that hadn’t been tendered for. This will now be tendered for and now there is a possibility for kiwi bank to win the tender. It’s about time we restored some real competition and brought more of our banking home!

Real Monetary Reform

Written By: - Date published: 10:45 am, June 16th, 2014 - 142 comments

The most important thing that needs to be learned is that money is nothing. Or, to be more precise, money is a tool that can be used to distribute the resources available to a society. In and of itself it has no value nor does it have a physical representation. Specifically, money is not a medium of exchange but a symbol of exchange and because of this the cost of money, usually presented as interest, should be zero.

CANA: Bathurst hits its own “perfect storm”

Written By: - Date published: 3:35 pm, February 17th, 2014 - 22 comments

Coal Action Network Aotearoa has this characteristic story of the problems with the cost structure of opportunistic mining in NZ. The current world price of the coal found on the Denniston Plateau has sunk considerably below Bathurst Resources’ stated break-even price and shows no signs of rising. What is the bet that NZ is going to wind up with another unwanted hole in the ground as a shell company gets folded up?

Banks sued over exceptional bank fees

Written By: - Date published: 12:58 pm, March 11th, 2013 - 88 comments

New Zealand banks face a large class suit for over $1 billion in default fees over the past six years by three of NZ’s largest law firms in a case being announced today at 1pm. It is about time.

Positive Money & the Wizard of Oz

Written By: - Date published: 1:58 pm, July 7th, 2012 - 13 comments

In our current system, we give men like Bob Diamond the immense power to create money. Need it be so? The Positive Money movement wishes to change that, and give that power back to Government. The first Labour Government used the power to create a better NZ – we could do that again.

House Price Inflation

Written By: - Date published: 10:58 am, May 6th, 2012 - 59 comments

Land prices rising much faster than wages. Shares, derivatives, hedge funds or other financial instruments are designed so that banks can gamble with our money. Win or lose they always get a cut. Loss comes out of our pensions and other savings. Or, if they really stuff it up, taxpayers are expected to borrow more from them to pay for it. Banks following their own self interest and are compounding economies to oblivion. The “invisible hand” has failed..

Foreign banks bleeding us dry

Written By: - Date published: 6:47 am, February 14th, 2012 - 340 comments

The Bankers’ Crisis is hurting people all over the world. From the deepest, darkest austerity in Greece, to the continuing foreclosure tsunami in the US, to cutbacks and job losses here, it’s the ordinary people suffering the hangover for the bankers’ wild decades of unbridled excess and profit. But at least the banks are suffering too, eh? Yeah, nah.

Crisis? What Crisis?

Written By: - Date published: 4:26 pm, August 6th, 2011 - 31 comments

Cuts are good for you.

Eye on the Banks

Written By: - Date published: 8:10 am, March 29th, 2011 - 25 comments

The next Fabian Seminar at Connolly Hall Thursday 31 March at 5:30pm will feature economist Geoff Bertram examine how the high level of New Zealand’s overseas debt that figures prominently in much policy discourse is largely an increase in foreign-currency liabilities voluntarily taken on by mainly Australian-owned banks in pursuit of private profit. It will be interesting – all are welcome to attend.

Key still wants to be Ireland

Written By: - Date published: 10:30 am, December 2nd, 2010 - 64 comments

The other week, Lynn and I made fun of John Key’s dream that New Zealand would become the Ireland of the South Seas. Does he still believe we should emulate the Irish? The answer is yes. Key wants to abandon proper process and speed up work on an international financial centre for New Zealand, just like the one that helped get Ireland where it is today.

OMG! ING! WTF?

Written By: - Date published: 1:33 pm, November 18th, 2010 - 60 comments

Last year, over 13,000 New Zealanders got some measure of satisfaction from ANZ’s part-owned ING in New Zealand. For over a year, half a billion dollars in investors’ funds had been locked up, during a nasty dispute between ING/ANZ and their investors. How has ANZ made things right for everyone who was hurt? They’ve renamed ING as ‘One Path’

House prices show double-dip

Written By: - Date published: 12:00 pm, November 12th, 2010 - 14 comments

House prices are a good indication of how the economy is going. They rose rapidly in the 2000s, stalled in 2007, plummeted in 2008, and made a slight recovery in 2009. Now they’re heading down again. The median house price is over 16% below the peak in late 2007 and I reckon they’ve got a long down way to go yet.

World Cup according to genius bankers

Written By: - Date published: 3:15 pm, July 6th, 2010 - 14 comments

Economists, bankers, Treasury officials, financial wizards of various kinds, they like to pretend that they know what they’re talking about. All too often they don’t. Predicting the behaviour of complex systems is hard. Consider for example, the big banks’ predictions on the winner of the Football World Cup…

Battlers vs billion dollar banks

Written By: - Date published: 11:56 pm, April 21st, 2010 - 33 comments

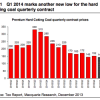

Finsec’s Andrew Campbell introduces the union’s Better Banking, a trans-Tasman campaign they’re running with their Aussie counterparts to get a better deal for bank workers and bank customers. Campbell notes the banks’ $1 billion profit in the last 3 months alone and asks “Have your fees gone down? Has your mortgage payment become more manageable?”

Copying Iceland & Ireland bad idea for NZ

Written By: - Date published: 10:30 am, February 16th, 2010 - 53 comments

You know how the world has been through the worst financial crisis in decades? You know how countries like Ireland and Iceland who had made themselves into financial hubs via tax breaks for banks are now deep in the crap with burgeoning debt and unemployment? Why don’t we do what they did?

$400 mln xmas gift for banks

Written By: - Date published: 10:30 am, December 24th, 2009 - 21 comments

The banks, who tried to rip us off to the tune of $2.6 billion, have agreed to pay us $2.2 billion. I don’t get it. We’ve spent tens of millions so far on court cases to get our money. We’ve won every case. The judgments have been damning of the banks. So, why did the IRD agree […]

Key endorses Banks

Written By: - Date published: 2:20 pm, June 8th, 2009 - 59 comments

As if denying Aucklanders the chance to have their say on the super city wasn’t enough National now seems determined to tell them who their mayor’s going to be too. It’s absolutely unacceptable for the PM to be endorsing John Banks as the mayor of the super city.

Finsec petition: Make jobs a condition of bank guarantees

Written By: - Date published: 5:00 am, April 28th, 2009 - 4 comments

Does it strike anyone else as odd that at a time when taxpayers are guaranteeing the banking system with public funds, banks have made no such guarantee to their staff about job security? While the banks made combined profits in excess of $2.5 billion and CEOs recieve salary packages of more than $2 million each, […]

As predicted

Written By: - Date published: 11:30 am, April 15th, 2009 - 8 comments

Last week, John Key was bouncing on a new cloud. The Australian Government had teamed up with banks to help stop homeowners defaulting on their mortgages. Key publicly mused that ‘his’ government could do the same here. We said it was only a matter of time until English quietly killed the idea. Sure enough: “The […]

Recent Comments