Really buffering climate change

Really buffering climate change

Written By:

lprent - Date published:

9:00 pm, January 14th, 2018 - 53 comments

Categories: climate change, disaster, Economy, Environment, ETS -

Tags: insurance, lobbying, reinsurance, The Economist

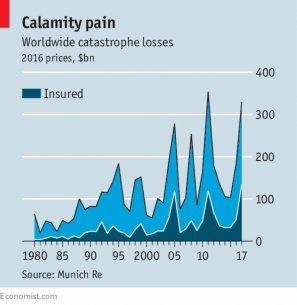

The recent 1 development of accident and disaster insurance over the last century, and its widespread non-commercial adoption across the world in the last 60 years is having a profound influence on buffering climate change. The Economist had a recent article with an excellent graph showing this.

THAT 2017 suffered from more than its fair share of natural catastrophes was known at the time. In the wake of Hurricane Harvey, the streets of Houston, Texas, were submerged under brown floodwater; Hurricane Irma razed buildings to the ground on some Caribbean islands. That the destruction was great enough for insurance losses to reach record levels has only just been confirmed. According to figures released on January 4th by Munich Re, a reinsurer, global, inflation-adjusted insured catastrophe losses reached an all-time high of $135bn in 2017 (see chart). Total losses (including uninsured ones) reached $330bn, second only to losses of $354bn in 2011.

Unlike 2011 with its expensive earthquakes in Japan (and here in Christchurch), last year it was 97% weather and climate related. This has been common and ever increasing trend.

If you look at the figures adjusted to a common 2016 base since the 1980s, this pattern becomes cyclically clear in recent decades

If you look at the figures adjusted to a common 2016 base since the 1980s, this pattern becomes cyclically clear in recent decades

If climate change brings more frequent extreme weather, as Munich Re and others expect, last year’s loss levels may become depressingly familiar. Already, the data show many more frequent high-loss events since 2000—lots of them weather-related—than in the two preceding decades.

The article points out that the modern basis for insurance, where insurance companies farm out the risk to reinsurance policies, has so far been standing up to increased risks.

For all the gloom, the 2017 losses were also proof of the resilience of the reinsurance industry. Insurers have long spread catastrophe risk by taking out reinsurance policies. This time, reinsurers had such ample capital buffers that they are expected to suffer only a small dent, of around 5-7% of capital. And 2017 was also the biggest test so far of reinsurance provided directly by investors, whether through catastrophe bonds or “collateralised reinsurance”, where a fund manager puts up collateral to cover potential claims. These forms of “alternative capital”, which reached $89bn in mid-2017, now make up around 14% of total reinsurance capital, up from 4% in 2006, according to Aon, a broker.

Their performance has been remarkably smooth. Investor demand has held up; many asset managers in the field have raised new money since the losses. Demand may yet grow further, says Paul Schultz, head of Aon’s capital-markets arm, since the yields on alternative capital are poised to rise because of growth in reinsurance premiums.

And that is the point. Unlike the ‘market’ abortions for trying to control greenhouse gases like the Emission Trading Scheme that National appears to have deliberately sabotaged for political reasons 2 , rising reinsurance premiums reflecting increased extreme weather risks actually impose a cost on dealing with climate change now.

In my view, New Zealand should just scrap the ETS as being a complete waste of time. Instead we probably need to treat climate a bit like we do with the Earthquake and War damages, with a few enhancements like mandatory insurance.

Legislatively insist that everyone in this country holding property, urban and rural, are required to have full coverage disaster insurance for extreme weather. I am pretty sure that this will provide an immediate political will to try to mitigate the cost of such insurance. The only way to do it is to move off risky land subject to flooding or reduce greenhouse gas emissions from polluters.

Sure, it doesn’t directly hit the polluters. But unlike the existing schemes which push the costs of climate change into the never never like the ETS does (and implicitly on to future taxpayers), calculations of risk and reinsurance premiums look forward from now and try to actually assess future risk costs to be paid now. Moreover it does so to make sure that there is profit to uncharitable investors wanting to make a profit.

Those paying increasing reinsurance premiums, and those investing to make a profit out of the misery of others will then have a direct vested interest in overcoming the lobby groups trying to get others to pay for their pollution – like the road transport lobby and farmers.

Now I’m sure that this will offend those who’d prefer more social responsibility from polluters. However I think that playing on simple greed to avoid paying the risk costs upfront for future events is more likely to induce some incentive to change now. After all those directly paying will be property owners rather than those polluting in a tragedy of the commons.

And anyway if we don’t deal with climate change at its root causes, it will provide a bloody great market price signal about what land is dangerous to build or farm on. That at least will start to reduce the costs to taxpayers for bailing out or trying fruitlessly to protect fools who like to live mere metres above sea level, drain swamps, live on flood plains or on coastal dunes.

- When I say recent, I mean from a historical perspective. Almost all of it happened within my grandparents lifetime. The bulk of the adoption of for non-commercial clients happened within my lifetime.

- National isn’t unique with this. Similar schemes have been tried across the world. They have proved to be an essentially useless amalgam between political will and market forces that to my eye appear to be designed to encourage unproductive cheating. They encourage politicians to reduce the costs to business and citizens through inflation and printing of carbon credits to the lowest common denominator – doing nothing.

Related Posts

53 comments on “Really buffering climate change ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Res Publica to bwaghorn on

- Incognito to Res Publica on

- Res Publica to Anne on

- Incognito to Champagne Socialist on

- bwaghorn to Res Publica on

- Ad on

- Incognito to Darien Fenton on

- Kay to Champagne Socialist on

- Bearded Git to Res Publica on

- Bearded Git to KJT on

- Anne on

- Ad to Res Publica on

- Res Publica on

- Res Publica on

- SPC on

- Jenny on

- weston on

- Incognito to PsyclingLeft.Always on

- SPC on

- adam on

- SPC on

- SPC to Obtrectator on

- joe90 on

- gsays on

- PsyclingLeft.Always to SPC on

- PsyclingLeft.Always to Incognito on

- joe90 on

- Graeme to Mike the Lefty on

- mpledger on

- SPC to PsyclingLeft.Always on

- SPC on

- Vivie on

- joe90 on

- SPC on

- Ad on

- Jenny on

Recent Posts

-

by Incognito

-

by mickysavage

-

by advantage

-

by advantage

-

by mickysavage

-

by KJT

-

by advantage

-

by mickysavage

-

by mickysavage

-

by lprent

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by Mountain Tui

-

by Mike Smith

-

by mickysavage

-

by mickysavage

-

by Mike Smith

-

by Incognito

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by Guest post

-

by mickysavage

-

by Mountain Tui

-

by Mike Smith

- If You Tolerate This

The future teaches you to be aloneThe present to be afraid and coldSo if I can shoot rabbits, then I can shoot fascists…And if you tolerate thisThen your children will be nextSongwriters: James Dean Bradfield / Sean Anthony Moore / Nicholas Allen Jones.Do you remember at school, studying the rise ...Nick’s KōreroBy Nick Rockel1 hour ago

The future teaches you to be aloneThe present to be afraid and coldSo if I can shoot rabbits, then I can shoot fascists…And if you tolerate thisThen your children will be nextSongwriters: James Dean Bradfield / Sean Anthony Moore / Nicholas Allen Jones.Do you remember at school, studying the rise ...Nick’s KōreroBy Nick Rockel1 hour ago - Elon Musk Adores Chris Luxon

When National won the New Zealand election in 2023, one of the first to congratulate Luxon was tech-billionaire and entrepreneur extraordinaire Elon Musk.And last year, after Luxon posted a video about a trip to Malaysia, Musk came forward again to heap praise on Christopher:So it was perhaps par for the ...Mountain TuiBy Mountain Tūī1 hour ago

When National won the New Zealand election in 2023, one of the first to congratulate Luxon was tech-billionaire and entrepreneur extraordinaire Elon Musk.And last year, after Luxon posted a video about a trip to Malaysia, Musk came forward again to heap praise on Christopher:So it was perhaps par for the ...Mountain TuiBy Mountain Tūī1 hour ago - American Carnage

Hi,Today’s Webworm features a new short film from documentary maker Giorgio Angelini. It’s about Luigi Mangione — but it’s also, really, about everything in America right now.Bear with me.Shortly after I sent out my last missive from the fires on Wednesday, one broke out a little too close to home ...David FarrierBy David Farrier1 hour ago

Hi,Today’s Webworm features a new short film from documentary maker Giorgio Angelini. It’s about Luigi Mangione — but it’s also, really, about everything in America right now.Bear with me.Shortly after I sent out my last missive from the fires on Wednesday, one broke out a little too close to home ...David FarrierBy David Farrier1 hour ago - Careless Memories

So soon just after you've goneMy senses sharpenBut it always takes so damn longBefore I feel how much my eyes have darkenedFear hangs in a plane of gun smokeDrifting in our roomSo easy to disturb, with a thought, with a whisperWith a careless memorySongwriters: Andy Taylor / John Taylor / ...Nick’s KōreroBy Nick Rockel1 day ago

So soon just after you've goneMy senses sharpenBut it always takes so damn longBefore I feel how much my eyes have darkenedFear hangs in a plane of gun smokeDrifting in our roomSo easy to disturb, with a thought, with a whisperWith a careless memorySongwriters: Andy Taylor / John Taylor / ...Nick’s KōreroBy Nick Rockel1 day ago - A Bully of Billionaires

Can we trust the Trump cabinet to act in the public interest?Nine of Trump’s closest advisers are billionaires. Their total net worth is in excess of $US375b (providing there is not a share-market crash). In contrast, the total net worth of Trump’s first Cabinet was about $6b. (Joe Biden’s Cabinet ...PunditBy Brian Easton2 days ago

Can we trust the Trump cabinet to act in the public interest?Nine of Trump’s closest advisers are billionaires. Their total net worth is in excess of $US375b (providing there is not a share-market crash). In contrast, the total net worth of Trump’s first Cabinet was about $6b. (Joe Biden’s Cabinet ...PunditBy Brian Easton2 days ago - Weekly Roundup 10-January-2025

Welcome back to our weekly roundup. We hope you had a good break (if you had one). Here’s a few of the stories that caught our attention over the last few weeks. This holiday period on Greater Auckland Since our last roundup we’ve: Taken a look back at ...Greater AucklandBy Greater Auckland2 days ago

Welcome back to our weekly roundup. We hope you had a good break (if you had one). Here’s a few of the stories that caught our attention over the last few weeks. This holiday period on Greater Auckland Since our last roundup we’ve: Taken a look back at ...Greater AucklandBy Greater Auckland2 days ago - L.A. Burns

Nick’s KōreroBy Nick Rockel2 days ago

- Skeptical Science New Research for Week #2 2025

Open access notables Large emissions of CO2 and CH4 due to active-layer warming in Arctic tundra, Torn et al., Nature Communications: Climate warming may accelerate decomposition of Arctic soil carbon, but few controlled experiments have manipulated the entire active layer. To determine surface-atmosphere fluxes of carbon dioxide and ...3 days ago

Open access notables Large emissions of CO2 and CH4 due to active-layer warming in Arctic tundra, Torn et al., Nature Communications: Climate warming may accelerate decomposition of Arctic soil carbon, but few controlled experiments have manipulated the entire active layer. To determine surface-atmosphere fluxes of carbon dioxide and ...3 days ago - Local government in Wellington – what’s been achieved

It's election year for Wellington City Council and for the Regional Council. What have the progressive councillors achieved over the last couple of years. What were the blocks and failures? What's with the targeting of the mayor and city council by the Post and by central government? Why does the ...3 days ago

It's election year for Wellington City Council and for the Regional Council. What have the progressive councillors achieved over the last couple of years. What were the blocks and failures? What's with the targeting of the mayor and city council by the Post and by central government? Why does the ...3 days ago - 300,000!

Over the holidays, there was a rising tide of calls for people to submit on National's repulsive, white supremacist Principles of the Treaty of Waitangi Bill, along with a wave of advice and examples of what to say. And it looks like people rose to the occasion, with over 300,000 ...No Right TurnBy Idiot/Savant3 days ago

Over the holidays, there was a rising tide of calls for people to submit on National's repulsive, white supremacist Principles of the Treaty of Waitangi Bill, along with a wave of advice and examples of what to say. And it looks like people rose to the occasion, with over 300,000 ...No Right TurnBy Idiot/Savant3 days ago - Who’s Getting Annexed?

The lie is my expenseThe scope of my desireThe Party blessed me with its futureAnd I protect it with fireI am the Nina The Pinta The Santa MariaThe noose and the rapistAnd the fields overseerThe agents of orangeThe priests of HiroshimaThe cost of my desire…Sleep now in the fireSongwriters: Brad ...Nick’s KōreroBy Nick Rockel3 days ago

The lie is my expenseThe scope of my desireThe Party blessed me with its futureAnd I protect it with fireI am the Nina The Pinta The Santa MariaThe noose and the rapistAnd the fields overseerThe agents of orangeThe priests of HiroshimaThe cost of my desire…Sleep now in the fireSongwriters: Brad ...Nick’s KōreroBy Nick Rockel3 days ago - Exploring the drivers of modern global warming

This is a re-post from the Climate Brink Global surface temperatures have risen around 1.3C since the preindustrial (1850-1900) period as a result of human activity.1 However, this aggregate number masks a lot of underlying factors that contribute to global surface temperature changes over time. These include CO2, which is the primary ...3 days ago

This is a re-post from the Climate Brink Global surface temperatures have risen around 1.3C since the preindustrial (1850-1900) period as a result of human activity.1 However, this aggregate number masks a lot of underlying factors that contribute to global surface temperature changes over time. These include CO2, which is the primary ...3 days ago - Wayne Wright Jr Celebrates His Increasing Political Fortunes with Sean Plunket – Who Does Your...

Mountain TuiBy Mountain Tūī3 days ago

- Missive from the Fires

Hi,Right now the power is out, so I’m just relying on the laptop battery and tethering to my phone’s 5G which is dropping in and out. We’ll see how we go.First up — I’m fine. I can’t see any flames out the window. I live in the greater Hollywood area ...David FarrierBy David Farrier3 days ago

Hi,Right now the power is out, so I’m just relying on the laptop battery and tethering to my phone’s 5G which is dropping in and out. We’ll see how we go.First up — I’m fine. I can’t see any flames out the window. I live in the greater Hollywood area ...David FarrierBy David Farrier3 days ago - Mood of the Workforce Survey 2025

2024 was a tough year for working Kiwis. But together we’ve been able to fight back for a just and fair New Zealand and in 2025 we need to keep standing up for what’s right and having our voices heard. That starts with our Mood of the Workforce Survey. It’s your ...NZCTUBy Stella Whitfield4 days ago

2024 was a tough year for working Kiwis. But together we’ve been able to fight back for a just and fair New Zealand and in 2025 we need to keep standing up for what’s right and having our voices heard. That starts with our Mood of the Workforce Survey. It’s your ...NZCTUBy Stella Whitfield4 days ago - Pumpkin Day

Time is never time at allYou can never ever leaveWithout leaving a piece of youthAnd our lives are forever changedWe will never be the sameThe more you change, the less you feelSongwriter: William Patrick Corgan.Babinden - Baba’s DayToday, January 8th, 2025, is Babinden, “The Day of the baba” or “The ...Nick’s KōreroBy Nick Rockel4 days ago

Time is never time at allYou can never ever leaveWithout leaving a piece of youthAnd our lives are forever changedWe will never be the sameThe more you change, the less you feelSongwriter: William Patrick Corgan.Babinden - Baba’s DayToday, January 8th, 2025, is Babinden, “The Day of the baba” or “The ...Nick’s KōreroBy Nick Rockel4 days ago - How Do We Fight Back?

Hi,New Zealand multi-billionaire Nick Mowbray continues to tweet at me, seemingly still unhappy about my Webworm story covering his apparent enthusiasm for far right, anti-Islam campaigner Tommy Robinson.Mowbray can be a bit hard to follow at the best of times, but I think this is a billionaire sort of dangling ...David FarrierBy David Farrier4 days ago

Hi,New Zealand multi-billionaire Nick Mowbray continues to tweet at me, seemingly still unhappy about my Webworm story covering his apparent enthusiasm for far right, anti-Islam campaigner Tommy Robinson.Mowbray can be a bit hard to follow at the best of times, but I think this is a billionaire sort of dangling ...David FarrierBy David Farrier4 days ago - Submission on Treaty Principles Bill

..I/We wish to make the following comments:I oppose the Treaty Principles Bill."5. Act binds the CrownThis Act binds the Crown."How does this Act "bind the Crown" when Te Tiriti o Waitangi, which the Act refers to, has been violated by the Crown on numerous occassions, resulting in massive loss of ...Frankly SpeakingBy Frank Macskasy5 days ago

..I/We wish to make the following comments:I oppose the Treaty Principles Bill."5. Act binds the CrownThis Act binds the Crown."How does this Act "bind the Crown" when Te Tiriti o Waitangi, which the Act refers to, has been violated by the Crown on numerous occassions, resulting in massive loss of ...Frankly SpeakingBy Frank Macskasy5 days ago - Sabin 33 #10 – Will utility-scale solar farms destroy the value of nearby homes?

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...5 days ago

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...5 days ago - Q&A with Nick

Everything is good and brownI'm here againWith a sunshine smile upon my faceMy friends are close at handAnd all my inhibitions have disappeared without a traceI'm glad, oh, that I found oohSomebody who I can rely onSongwriter: Jay KayGood morning, all you lovely people. Today, I’ve got nothing except a ...Nick’s KōreroBy Nick Rockel5 days ago

Everything is good and brownI'm here againWith a sunshine smile upon my faceMy friends are close at handAnd all my inhibitions have disappeared without a traceI'm glad, oh, that I found oohSomebody who I can rely onSongwriter: Jay KayGood morning, all you lovely people. Today, I’ve got nothing except a ...Nick’s KōreroBy Nick Rockel5 days ago - 2025 – The Year Ahead

Welcome to 2025. After wrapping up 2024, here’s a look at some of the things we can expect to see this year along with a few predictions. Council and Elections Elections One of the biggest things this year will be local body elections in October. Will Mayor Wayne Brown ...Greater AucklandBy Matt L5 days ago

Welcome to 2025. After wrapping up 2024, here’s a look at some of the things we can expect to see this year along with a few predictions. Council and Elections Elections One of the biggest things this year will be local body elections in October. Will Mayor Wayne Brown ...Greater AucklandBy Matt L5 days ago - Gordon Campbell On Justin Trudeau’s Demise, In A Global Context

Canadians can take a while to get angry – but when they finally do, watch out. Canada has been falling out of love with Justin Trudeau for years, and his exit has to be the least surprising news event of the New Year. On recent polling, Trudeau’s Liberal party has ...WerewolfBy ScoopEditor6 days ago

Canadians can take a while to get angry – but when they finally do, watch out. Canada has been falling out of love with Justin Trudeau for years, and his exit has to be the least surprising news event of the New Year. On recent polling, Trudeau’s Liberal party has ...WerewolfBy ScoopEditor6 days ago - Climate news to watch in 2025

This is a re-post from Yale Climate Connections Much like 2023, many climate and energy records were broken in 2024. It was Earth’s hottest year on record by a wide margin, breaking the previous record that was set just last year by an even larger margin. Human-caused climate-warming pollution and ...6 days ago

This is a re-post from Yale Climate Connections Much like 2023, many climate and energy records were broken in 2024. It was Earth’s hottest year on record by a wide margin, breaking the previous record that was set just last year by an even larger margin. Human-caused climate-warming pollution and ...6 days ago - Submitted!

Submissions on National's racist, white supremacist Principles of the Treaty of Waitangi Bill are due tomorrow! So today, after a good long holiday from all that bullshit, I finally got my shit together to submit on it. As I noted here, people should write their own submissions in their own ...No Right TurnBy Idiot/Savant6 days ago

Submissions on National's racist, white supremacist Principles of the Treaty of Waitangi Bill are due tomorrow! So today, after a good long holiday from all that bullshit, I finally got my shit together to submit on it. As I noted here, people should write their own submissions in their own ...No Right TurnBy Idiot/Savant6 days ago - The Treaty Principles Bill

My submission - made at the last moment because I'm a neurodivergent millennial - on David Seymour's terrible legislation. ...Boots TheoryBy Stephanie Rodgers6 days ago

My submission - made at the last moment because I'm a neurodivergent millennial - on David Seymour's terrible legislation. ...Boots TheoryBy Stephanie Rodgers6 days ago - Rich Opinions

Ooh, baby (ooh, baby)It's making me crazy (it's making me crazy)Every time I look around (look around)Every time I look around (every time I look around)Every time I look aroundIt's in my faceSongwriters: Alan Leo Jansson / Paul Lawrence L. Fuemana.Today, I’ll be talking about rich, middle-aged men who’ve made ...Nick’s KōreroBy Nick Rockel6 days ago

Ooh, baby (ooh, baby)It's making me crazy (it's making me crazy)Every time I look around (look around)Every time I look around (every time I look around)Every time I look aroundIt's in my faceSongwriters: Alan Leo Jansson / Paul Lawrence L. Fuemana.Today, I’ll be talking about rich, middle-aged men who’ve made ...Nick’s KōreroBy Nick Rockel6 days ago - 2025 SkS Weekly Climate Change & Global Warming News Roundup #01

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 29, 2024 thru Sat, January 4, 2025. This week's roundup is again published soleley by category. We are still interested in feedback to hone the categorization, so if ...7 days ago

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 29, 2024 thru Sat, January 4, 2025. This week's roundup is again published soleley by category. We are still interested in feedback to hone the categorization, so if ...7 days ago - “It’s Sad Watching Desperate Dave”

Hi,The thing that stood out at me while shopping for Christmas presents in New Zealand was how hard it was to avoid Zuru products. Toy manufacturer Zuru is a bit like Netflix, in that it has so much data on what people want they can flood the market with so ...David FarrierBy David Farrier1 week ago

Hi,The thing that stood out at me while shopping for Christmas presents in New Zealand was how hard it was to avoid Zuru products. Toy manufacturer Zuru is a bit like Netflix, in that it has so much data on what people want they can flood the market with so ...David FarrierBy David Farrier1 week ago - RIP Dame Tariana Turia

And when a child is born into this worldIt has no conceptOf the tone of skin it's living inAnd there's a million voicesAnd there's a million voicesTo tell you what you should be thinkingSong by Neneh Cherry and Youssou N'Dour.The moment you see that face, you can hear her voice; ...Nick’s KōreroBy Nick Rockel1 week ago

And when a child is born into this worldIt has no conceptOf the tone of skin it's living inAnd there's a million voicesAnd there's a million voicesTo tell you what you should be thinkingSong by Neneh Cherry and Youssou N'Dour.The moment you see that face, you can hear her voice; ...Nick’s KōreroBy Nick Rockel1 week ago - Quality Ministers

While we may not always have quality political leadership, a couple of recently published autobiographies indicate sometimes we strike it lucky. When ranking our prime ministers, retired professor of history Erik Olssen commented that ‘neither Holland nor Nash was especially effective as prime minister – even his private secretary thought ...PunditBy Brian Easton1 week ago

While we may not always have quality political leadership, a couple of recently published autobiographies indicate sometimes we strike it lucky. When ranking our prime ministers, retired professor of history Erik Olssen commented that ‘neither Holland nor Nash was especially effective as prime minister – even his private secretary thought ...PunditBy Brian Easton1 week ago - Tennis Court

Baby, be the class clownI'll be the beauty queen in tearsIt's a new art form, showin' people how little we care (yeah)We're so happy, even when we're smilin' out of fearLet's go down to the tennis court and talk it up like, yeah (yeah)Songwriters: Joel Little / Ella Yelich O ...Nick’s KōreroBy Nick Rockel1 week ago

Baby, be the class clownI'll be the beauty queen in tearsIt's a new art form, showin' people how little we care (yeah)We're so happy, even when we're smilin' out of fearLet's go down to the tennis court and talk it up like, yeah (yeah)Songwriters: Joel Little / Ella Yelich O ...Nick’s KōreroBy Nick Rockel1 week ago - Skeptical Science New Research for Week #1 2025

Open access notables Why Misinformation Must Not Be Ignored, Ecker et al., American Psychologist: Recent academic debate has seen the emergence of the claim that misinformation is not a significant societal problem. We argue that the arguments used to support this minimizing position are flawed, particularly if interpreted (e.g., by policymakers or the public) as suggesting ...1 week ago

Open access notables Why Misinformation Must Not Be Ignored, Ecker et al., American Psychologist: Recent academic debate has seen the emergence of the claim that misinformation is not a significant societal problem. We argue that the arguments used to support this minimizing position are flawed, particularly if interpreted (e.g., by policymakers or the public) as suggesting ...1 week ago - My Year In Recall

What I’ve Been Doing: I buried a close family member.What I’ve Been Watching: Andor, Jack Reacher, Xmas movies.What I’ve Been Reflecting On: The Usefulness of Writing and the Worthiness of Doing So — especially as things become more transparent on their own.I also hate competing on any day, and if ...Mountain TuiBy Mountain Tūī1 week ago

What I’ve Been Doing: I buried a close family member.What I’ve Been Watching: Andor, Jack Reacher, Xmas movies.What I’ve Been Reflecting On: The Usefulness of Writing and the Worthiness of Doing So — especially as things become more transparent on their own.I also hate competing on any day, and if ...Mountain TuiBy Mountain Tūī1 week ago - The forgotten story of Jimmy Carter’s White House solar panels

This is a re-post from Yale Climate Connections by John Wihbey. A version of this article first appeared on Yale Climate Connections on Nov. 11, 2008. (Image credits: The White House, Jonathan Cutrer / CC BY 2.0; President Jimmy Carter, Trikosko/Library of Congress; Solar dedication, Bill Fitz-Patrick / Jimmy Carter Library; Solar ...1 week ago

This is a re-post from Yale Climate Connections by John Wihbey. A version of this article first appeared on Yale Climate Connections on Nov. 11, 2008. (Image credits: The White House, Jonathan Cutrer / CC BY 2.0; President Jimmy Carter, Trikosko/Library of Congress; Solar dedication, Bill Fitz-Patrick / Jimmy Carter Library; Solar ...1 week ago - Medley

Morena folks,We’re having a good break, recharging the batteries. Hope you’re enjoying the holiday period. I’m not feeling terribly inspired by much at the moment, I’m afraid—not from a writing point of view, anyway.So, today, we’re travelling back in time. You’ll have to imagine the wavy lines and sci-fi sound ...Nick’s KōreroBy Nick Rockel1 week ago

Morena folks,We’re having a good break, recharging the batteries. Hope you’re enjoying the holiday period. I’m not feeling terribly inspired by much at the moment, I’m afraid—not from a writing point of view, anyway.So, today, we’re travelling back in time. You’ll have to imagine the wavy lines and sci-fi sound ...Nick’s KōreroBy Nick Rockel1 week ago - 2024 Reading Summary: The List

Completed reads for 2024: Oration on the Dignity of Man, by Giovanni Pico della Mirandola A Platonic Discourse Upon Love, by Giovanni Pico della Mirandola Of Being and Unity, by Giovanni Pico della Mirandola The Life of Pico della Mirandola, by Giovanni Francesco Pico Three Letters Written by Pico ...A Phuulish FellowBy strda2211 week ago

Completed reads for 2024: Oration on the Dignity of Man, by Giovanni Pico della Mirandola A Platonic Discourse Upon Love, by Giovanni Pico della Mirandola Of Being and Unity, by Giovanni Pico della Mirandola The Life of Pico della Mirandola, by Giovanni Francesco Pico Three Letters Written by Pico ...A Phuulish FellowBy strda2211 week ago - New Year Resolution: 2025 cannot simply be a repeat of what made 2024 an intolerable farce.

Welcome to 2025, Aotearoa. Well… what can one really say? 2024 was a story of a bad beginning, an infernal middle and an indescribably farcical end. But to chart a course for a real future, it does pay to know where we’ve been… so we know where we need ...exhALANtBy exhalantblog2 weeks ago

Welcome to 2025, Aotearoa. Well… what can one really say? 2024 was a story of a bad beginning, an infernal middle and an indescribably farcical end. But to chart a course for a real future, it does pay to know where we’ve been… so we know where we need ...exhALANtBy exhalantblog2 weeks ago - 2024 – Blog views by country

Welcome to the official half-way point of the 2020s. Anyway, as per my New Years tradition, here’s where A Phuulish Fellow’s blog traffic came from in 2024: United States United Kingdom New Zealand Canada Sweden Australia Germany Spain Brazil Finland The top four are the same as 2023, ...A Phuulish FellowBy strda2212 weeks ago

Welcome to the official half-way point of the 2020s. Anyway, as per my New Years tradition, here’s where A Phuulish Fellow’s blog traffic came from in 2024: United States United Kingdom New Zealand Canada Sweden Australia Germany Spain Brazil Finland The top four are the same as 2023, ...A Phuulish FellowBy strda2212 weeks ago - 2024 Reading Summary: December (+ Writing Update)

Completed reads for December: Be A Wolf!, by Brian Strickland The Magic Flute [libretto], by Wolfgang Amadeus Mozart and Emanuel Schikaneder The Invisible Eye, by Erckmann-Chatrian The Owl’s Ear, by Erckmann-Chatrian The Waters of Death, by Erckmann-Chatrian The Spider, by Hanns Heinz Ewers Who Knows?, by Guy de Maupassant ...A Phuulish FellowBy strda2212 weeks ago

Completed reads for December: Be A Wolf!, by Brian Strickland The Magic Flute [libretto], by Wolfgang Amadeus Mozart and Emanuel Schikaneder The Invisible Eye, by Erckmann-Chatrian The Owl’s Ear, by Erckmann-Chatrian The Waters of Death, by Erckmann-Chatrian The Spider, by Hanns Heinz Ewers Who Knows?, by Guy de Maupassant ...A Phuulish FellowBy strda2212 weeks ago - 2024 – A Year in Review

Well, it’s the last day of the year, so it’s time for a quick wrap-up of the most important things that happened in 2024 for urbanism and transport in our city. A huge thank you to everyone who has visited the blog and supported us in our mission to make ...Greater AucklandBy Matt L2 weeks ago

Well, it’s the last day of the year, so it’s time for a quick wrap-up of the most important things that happened in 2024 for urbanism and transport in our city. A huge thank you to everyone who has visited the blog and supported us in our mission to make ...Greater AucklandBy Matt L2 weeks ago - Nick’s Awards – 2024

Leave your office, run past your funeralLeave your home, car, leave your pulpitJoin us in the streets where weJoin us in the streets where weDon't belong, don't belongHere under the starsThrowing light…Song: Jeffery BuckleyToday, I’ll discuss the standout politicians of the last 12 months. Each party will receive three awards, ...Nick’s KōreroBy Nick Rockel2 weeks ago

Leave your office, run past your funeralLeave your home, car, leave your pulpitJoin us in the streets where weJoin us in the streets where weDon't belong, don't belongHere under the starsThrowing light…Song: Jeffery BuckleyToday, I’ll discuss the standout politicians of the last 12 months. Each party will receive three awards, ...Nick’s KōreroBy Nick Rockel2 weeks ago - Webworm’s 2024 Year In Review

Hi,A lot’s happened this year in the world of Webworm, and as 2024 comes to an end I thought I’d look back at a few of the things that popped. Maybe you missed them, or you might want to revisit some of these essay and podcast episodes over your break ...David FarrierBy David Farrier2 weeks ago

Hi,A lot’s happened this year in the world of Webworm, and as 2024 comes to an end I thought I’d look back at a few of the things that popped. Maybe you missed them, or you might want to revisit some of these essay and podcast episodes over your break ...David FarrierBy David Farrier2 weeks ago - Those Metal Motherfuckers: Cinema in the Year of AI

Hi,I wanted to share this piece by film editor Dan Kircher about what cinema has been up to in 2024.Dan edited my documentary Mister Organ, as well as this year’s excellent crowd-pleasing Bookworm.Dan adores movies. He gets the language of cinema, he knows what he loves, and writes accordingly. And ...David FarrierBy David Farrier2 weeks ago

Hi,I wanted to share this piece by film editor Dan Kircher about what cinema has been up to in 2024.Dan edited my documentary Mister Organ, as well as this year’s excellent crowd-pleasing Bookworm.Dan adores movies. He gets the language of cinema, he knows what he loves, and writes accordingly. And ...David FarrierBy David Farrier2 weeks ago - Xmas then and now.

Without delving into personal details but in order to give readers a sense of the year that was, I thought I would offer the study in contrasts that are Xmas 2023 and Xmas 2024: Xmas 2023 in Starship Children’s Hospital (after third of four surgeries). Even opening presents was an ...KiwipoliticoBy Pablo2 weeks ago

Without delving into personal details but in order to give readers a sense of the year that was, I thought I would offer the study in contrasts that are Xmas 2023 and Xmas 2024: Xmas 2023 in Starship Children’s Hospital (after third of four surgeries). Even opening presents was an ...KiwipoliticoBy Pablo2 weeks ago - a/b/o and worldbuilding

Heavy disclaimer: Alpha/beta/omega dynamics is a popular trope that’s used in a wide range of stories and my thoughts on it do not apply to all cases. I’m most familiar with it through the lens of male-focused fanfic, typically m/m but sometimes also featuring m/f and that’s the situation I’m ...The little pakehaBy chrismiller2 weeks ago

Heavy disclaimer: Alpha/beta/omega dynamics is a popular trope that’s used in a wide range of stories and my thoughts on it do not apply to all cases. I’m most familiar with it through the lens of male-focused fanfic, typically m/m but sometimes also featuring m/f and that’s the situation I’m ...The little pakehaBy chrismiller2 weeks ago - YouTube’s Biggest Star “Mr Beast” Has Made a Massive Turd

Hi,Webworm has been pretty heavy this year — mainly because the world is pretty heavy. But as we sprint (or limp, you choose) through the final days of 2024, I wanted to keep Webworm a little lighter.So today I wanted to look at one of the biggest and weirdest elements ...David FarrierBy David Farrier2 weeks ago

Hi,Webworm has been pretty heavy this year — mainly because the world is pretty heavy. But as we sprint (or limp, you choose) through the final days of 2024, I wanted to keep Webworm a little lighter.So today I wanted to look at one of the biggest and weirdest elements ...David FarrierBy David Farrier2 weeks ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #52

A listing of 23 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 22, 2024 thru Sat, December 28, 2024. This week's roundup is the second one published soleley by category. We are still interested in feedback to hone the categorization, ...2 weeks ago

A listing of 23 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 22, 2024 thru Sat, December 28, 2024. This week's roundup is the second one published soleley by category. We are still interested in feedback to hone the categorization, ...2 weeks ago - The End of the Horrifying Chris Luxon Painting Saga

Hi,Webworm has been following occasional artist (and Webworm writer) Josh Drummond’s unnerving portrait of New Zealand Prime Minister Christopher Luxon since he first listed it on TradeMe.Back on October 1, Webworm broke the news that the painting had been removed from online auction site TradeMe for reasons that included not ...David FarrierBy David Farrier2 weeks ago

Hi,Webworm has been following occasional artist (and Webworm writer) Josh Drummond’s unnerving portrait of New Zealand Prime Minister Christopher Luxon since he first listed it on TradeMe.Back on October 1, Webworm broke the news that the painting had been removed from online auction site TradeMe for reasons that included not ...David FarrierBy David Farrier2 weeks ago - Climate Change Christmas

We’ll have a climate change ChristmasFrom now until foreverWarming our hearts and mindsAnd planet all togetherSpirits high and oceans higherChestnuts roast on wildfiresIf coal is on your wishlistMerry Climate Change ChristmasSong by Ian McConnellReindeer emissions are not something I’d thought about in terms of climate change. I guess some significant ...Nick’s KōreroBy Nick Rockel2 weeks ago

We’ll have a climate change ChristmasFrom now until foreverWarming our hearts and mindsAnd planet all togetherSpirits high and oceans higherChestnuts roast on wildfiresIf coal is on your wishlistMerry Climate Change ChristmasSong by Ian McConnellReindeer emissions are not something I’d thought about in terms of climate change. I guess some significant ...Nick’s KōreroBy Nick Rockel2 weeks ago - KP 2024 year end review.

KP continues to putt-putt along as a tiny niche blog that offers a NZ perspective on international affairs with a few observations about NZ domestic politics thrown in. In 2024 there was also some personal posts given that my son was in the last four months of a nine month ...KiwipoliticoBy Pablo2 weeks ago

KP continues to putt-putt along as a tiny niche blog that offers a NZ perspective on international affairs with a few observations about NZ domestic politics thrown in. In 2024 there was also some personal posts given that my son was in the last four months of a nine month ...KiwipoliticoBy Pablo2 weeks ago - Madman Across the Water

I can see very wellThere's a boat on the reef with a broken backAnd I can see it very wellThere's a joke and I know it very wellIt's one of those that I told you long agoTake my word I'm a madman, don't you knowSongwriters: Bernie Taupin / Elton JohnIt ...Nick’s KōreroBy Nick Rockel2 weeks ago

I can see very wellThere's a boat on the reef with a broken backAnd I can see it very wellThere's a joke and I know it very wellIt's one of those that I told you long agoTake my word I'm a madman, don't you knowSongwriters: Bernie Taupin / Elton JohnIt ...Nick’s KōreroBy Nick Rockel2 weeks ago - Nikki Noboats adrift – have the wheels finally fallen off this inept government?

.Acknowledgement: Tim PrebbleThanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..With each passing day of bad headlines, squandering tax revenue to enrich the rich, deep cuts to our social services and a government struggling to keep the lipstick on its neo-liberal pig ...Frankly SpeakingBy Frank Macskasy2 weeks ago

.Acknowledgement: Tim PrebbleThanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..With each passing day of bad headlines, squandering tax revenue to enrich the rich, deep cuts to our social services and a government struggling to keep the lipstick on its neo-liberal pig ...Frankly SpeakingBy Frank Macskasy2 weeks ago - A turn to the Big Stick.

This is from the 36th Parallel social media account (as brief food for thought). We know that Trump is ahistorical at best but he seems to think that he is Teddy Roosevelt and can use the threat of invoking the Monroe Doctrine and “Big Stick” gunboat diplomacy against Panama and ...KiwipoliticoBy Pablo2 weeks ago

This is from the 36th Parallel social media account (as brief food for thought). We know that Trump is ahistorical at best but he seems to think that he is Teddy Roosevelt and can use the threat of invoking the Monroe Doctrine and “Big Stick” gunboat diplomacy against Panama and ...KiwipoliticoBy Pablo2 weeks ago - Time is an illusion

Don't you cry tonightI still love you, babyAnd don't you cry tonightDon't you cry tonightThere's a heaven above you, babyAnd don't you cry tonightSong: Axl Rose and Izzy Stradlin“Time is an illusion. Lunchtime doubly so”, said possibly the greatest philosopher ever to walk this earth, Douglas Adams.We have entered the ...Nick’s KōreroBy Nick Rockel2 weeks ago

Don't you cry tonightI still love you, babyAnd don't you cry tonightDon't you cry tonightThere's a heaven above you, babyAnd don't you cry tonightSong: Axl Rose and Izzy Stradlin“Time is an illusion. Lunchtime doubly so”, said possibly the greatest philosopher ever to walk this earth, Douglas Adams.We have entered the ...Nick’s KōreroBy Nick Rockel2 weeks ago - Skeptical Science New Research for Week #52 2024

Open access notables Trends in Oceanic Precipitation Characteristics Inferred From Shipboard Present-Weather Reports, 1950–2019, Tran & Petty, Journal of Geophysical Research: Atmospheres: Although ship reports are susceptible to subjective interpretation, the inferred distributions of these phenomena are consistent with observations from other platforms such as satellites and coastal surface stations. ...2 weeks ago

Open access notables Trends in Oceanic Precipitation Characteristics Inferred From Shipboard Present-Weather Reports, 1950–2019, Tran & Petty, Journal of Geophysical Research: Atmospheres: Although ship reports are susceptible to subjective interpretation, the inferred distributions of these phenomena are consistent with observations from other platforms such as satellites and coastal surface stations. ...2 weeks ago - Todd Stephenson and Stephen Rainbow: David Farrar’s Ideological Plant In The Human Rights Commissi...

In 2018, David Farrar wrote a series of suggestions on Kiwiblog as to how the far right might best promote freedom of speech as a method of limiting other civil rights (in this particular case, academic freedom, a campaign that has just paid off this this month as David Seymour ...Sapphi’s SubstackBy Sapphi2 weeks ago

In 2018, David Farrar wrote a series of suggestions on Kiwiblog as to how the far right might best promote freedom of speech as a method of limiting other civil rights (in this particular case, academic freedom, a campaign that has just paid off this this month as David Seymour ...Sapphi’s SubstackBy Sapphi2 weeks ago - A Magical Time of Year

Because you're magicYou're magic people to meSong: Dave Para/Molly Para.Morena all, I hope you had a good day yesterday, however you spent it. Today, a few words about our celebration and a look at the various messages from our politicians.A Rockel XmasChristmas morning was spent with the five of us ...Nick’s KōreroBy Nick Rockel2 weeks ago

Because you're magicYou're magic people to meSong: Dave Para/Molly Para.Morena all, I hope you had a good day yesterday, however you spent it. Today, a few words about our celebration and a look at the various messages from our politicians.A Rockel XmasChristmas morning was spent with the five of us ...Nick’s KōreroBy Nick Rockel2 weeks ago - Climate Adam: 2024 Through the Eyes of a Climate Scientist

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). 2024 has been a series of bad news for climate change. From scorching global temperatures leading to devastating ...3 weeks ago

This video includes personal musings and conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). 2024 has been a series of bad news for climate change. From scorching global temperatures leading to devastating ...3 weeks ago - Merry Christmas To All Bowalley Road Readers.

Ríu Ríu ChíuRíu Ríu Chíu is a Spanish Christmas song from the 16th Century. The traditional carol would likely have passed unnoticed by the English-speaking world had the made-for-television American band The Monkees not performed the song as part of their special Christmas show back in 1967. The show's ...3 weeks ago

Ríu Ríu ChíuRíu Ríu Chíu is a Spanish Christmas song from the 16th Century. The traditional carol would likely have passed unnoticed by the English-speaking world had the made-for-television American band The Monkees not performed the song as part of their special Christmas show back in 1967. The show's ...3 weeks ago - Merry Christmas: 2024

Dunedin’s summer thus far has been warm and humid… and it looks like we’re in for a grey Christmas. But it is now officially Christmas Day in this time zone, so never mind. This year, I’ve stumbled across an Old English version of God Rest Ye Merry Gentlemen: It has a population of just under 3.5 million inhabitants, produces nearly 550,000 tons of beef per year, and boasts a glorious soccer reputation with two World ...3 weeks ago

Dunedin’s summer thus far has been warm and humid… and it looks like we’re in for a grey Christmas. But it is now officially Christmas Day in this time zone, so never mind. This year, I’ve stumbled across an Old English version of God Rest Ye Merry Gentlemen: It has a population of just under 3.5 million inhabitants, produces nearly 550,000 tons of beef per year, and boasts a glorious soccer reputation with two World ...3 weeks ago - Meri Kirihimete 2024

Morena all,In my paywalled newsletter yesterday, I signed off for Christmas and wished readers well, but I thought I’d send everyone a quick note this morning.This hasn’t been a good year for our small country. The divisions caused by the Treaty Principles Bill, the cuts to our public sector, increased ...Nick’s KōreroBy Nick Rockel3 weeks ago

Morena all,In my paywalled newsletter yesterday, I signed off for Christmas and wished readers well, but I thought I’d send everyone a quick note this morning.This hasn’t been a good year for our small country. The divisions caused by the Treaty Principles Bill, the cuts to our public sector, increased ...Nick’s KōreroBy Nick Rockel3 weeks ago - Bernard’s Pick ‘n’ Mix for Tues, Dec 24

This morning’s six standouts for me at 6.30 am include:Kāinga Ora is quietly planning to sell over $1 billion worth of state-owned land under 300 state homes in Auckland’s wealthiest suburbs, including around Bastion Point, to give the Government more fiscal room to pay for tax cuts and reduce borrowing.A ...The KakaBy Bernard Hickey3 weeks ago

This morning’s six standouts for me at 6.30 am include:Kāinga Ora is quietly planning to sell over $1 billion worth of state-owned land under 300 state homes in Auckland’s wealthiest suburbs, including around Bastion Point, to give the Government more fiscal room to pay for tax cuts and reduce borrowing.A ...The KakaBy Bernard Hickey3 weeks ago - A Birthday Wish!

Hi,It’s my birthday on Christmas Day, and I have a favour to ask.A birthday wish.I would love you to share one Webworm story you’ve liked this year.The simple fact is: apart from paying for a Webworm membership (thank you!), sharing and telling others about this place is the most important ...David FarrierBy David Farrier3 weeks ago

Hi,It’s my birthday on Christmas Day, and I have a favour to ask.A birthday wish.I would love you to share one Webworm story you’ve liked this year.The simple fact is: apart from paying for a Webworm membership (thank you!), sharing and telling others about this place is the most important ...David FarrierBy David Farrier3 weeks ago - Love, happiness, blur

The last few days have been a bit too much of a whirl for me to manage a fresh edition each day. It's been that kind of year. Hope you don't mind.I’ve been coming around to thinking that it doesn't really matter if you don't have something to say every ...More Than A FeildingBy David Slack3 weeks ago

The last few days have been a bit too much of a whirl for me to manage a fresh edition each day. It's been that kind of year. Hope you don't mind.I’ve been coming around to thinking that it doesn't really matter if you don't have something to say every ...More Than A FeildingBy David Slack3 weeks ago

Related Posts

- Greens welcome deadline extension but reiterate call for Bill to be binned

The Green Party welcomes the extension of the deadline for Treaty Principles Bill submissions but continues to call on the Government to abandon the Bill. ...3 days ago

The Green Party welcomes the extension of the deadline for Treaty Principles Bill submissions but continues to call on the Government to abandon the Bill. ...3 days ago

Related Posts

- KO disruptive tenants’ easy ride over

Complaints about disruptive behaviour now handled in around 13 days (down from around 60 days a year ago) 553 Section 55A notices issued by Kāinga Ora since July 2024, up from 41 issued during the same period in the previous year. Of that 553, first notices made up around 83 ...BeehiveBy beehive.govt.nz2 days ago

Complaints about disruptive behaviour now handled in around 13 days (down from around 60 days a year ago) 553 Section 55A notices issued by Kāinga Ora since July 2024, up from 41 issued during the same period in the previous year. Of that 553, first notices made up around 83 ...BeehiveBy beehive.govt.nz2 days ago - 80% reduction in building determination wait times

The time it takes to process building determinations has improved significantly over the last year which means fewer delays in homes being built, Building and Construction Minister Chris Penk says. “New Zealand has a persistent shortage of houses. Making it easier and quicker for new homes to be built will ...BeehiveBy beehive.govt.nz4 days ago

The time it takes to process building determinations has improved significantly over the last year which means fewer delays in homes being built, Building and Construction Minister Chris Penk says. “New Zealand has a persistent shortage of houses. Making it easier and quicker for new homes to be built will ...BeehiveBy beehive.govt.nz4 days ago - Top baby names for 2024

Minister of Internal Affairs Brooke van Velden is pleased to announce the annual list of New Zealand’s most popular baby names for 2024. “For the second consecutive year, Noah has claimed the top spot for boys with 250 babies sharing the name, while Isla has returned to the most popular ...BeehiveBy beehive.govt.nz4 days ago

Minister of Internal Affairs Brooke van Velden is pleased to announce the annual list of New Zealand’s most popular baby names for 2024. “For the second consecutive year, Noah has claimed the top spot for boys with 250 babies sharing the name, while Isla has returned to the most popular ...BeehiveBy beehive.govt.nz4 days ago - Enabling works to begin on Westgate Bus Station

Work is set to get underway on a new bus station at Westgate this week. A contract has been awarded to HEB Construction to start a package of enabling works to get the site ready in advance of main construction beginning in mid-2025, Transport Minister Simeon Brown says.“A new Westgate ...BeehiveBy beehive.govt.nz5 days ago

Work is set to get underway on a new bus station at Westgate this week. A contract has been awarded to HEB Construction to start a package of enabling works to get the site ready in advance of main construction beginning in mid-2025, Transport Minister Simeon Brown says.“A new Westgate ...BeehiveBy beehive.govt.nz5 days ago - A nationwide shift towards acting together to stop family and sexual violence

Minister for Children and for Prevention of Family and Sexual Violence Karen Chhour is encouraging people to use the resources available to them to get help, and to report instances of family and sexual violence amongst their friends, families, and loved ones who are in need. “The death of a ...BeehiveBy beehive.govt.nz5 days ago

Minister for Children and for Prevention of Family and Sexual Violence Karen Chhour is encouraging people to use the resources available to them to get help, and to report instances of family and sexual violence amongst their friends, families, and loved ones who are in need. “The death of a ...BeehiveBy beehive.govt.nz5 days ago - He poroporoaki ki a Kahurangi Tariana Turia

Uia te pō, rangahaua te pō, whakamāramatia mai he aha tō tango, he aha tō kāwhaki? Whitirere ki te ao, tirotiro kau au, kei hea taku rātā whakamarumaru i te au o te pakanga mo te mana motuhake? Au te pō, ngū te pō, ue hā! E te kahurangi māreikura, ...BeehiveBy beehive.govt.nz1 week ago

Uia te pō, rangahaua te pō, whakamāramatia mai he aha tō tango, he aha tō kāwhaki? Whitirere ki te ao, tirotiro kau au, kei hea taku rātā whakamarumaru i te au o te pakanga mo te mana motuhake? Au te pō, ngū te pō, ue hā! E te kahurangi māreikura, ...BeehiveBy beehive.govt.nz1 week ago - New qualification a step forward for diabetes care

Health Minister Dr Shane Reti says people with diabetes and other painful conditions will benefit from a significant new qualification to boost training in foot care. “It sounds simple, but quality and regular foot and nail care is vital in preventing potentially serious complications from diabetes, like blisters or sores, which can take a long time to heal ...BeehiveBy beehive.govt.nz1 week ago

Health Minister Dr Shane Reti says people with diabetes and other painful conditions will benefit from a significant new qualification to boost training in foot care. “It sounds simple, but quality and regular foot and nail care is vital in preventing potentially serious complications from diabetes, like blisters or sores, which can take a long time to heal ...BeehiveBy beehive.govt.nz1 week ago - New year, new medicines

Associate Health Minister with responsibility for Pharmac David Seymour is pleased to see Pharmac continue to increase availability of medicines for Kiwis with the government’s largest ever investment in Pharmac. “Pharmac operates independently, but it must work within the budget constraints set by the government,” says Mr Seymour. “When this government assumed ...BeehiveBy beehive.govt.nz2 weeks ago

Associate Health Minister with responsibility for Pharmac David Seymour is pleased to see Pharmac continue to increase availability of medicines for Kiwis with the government’s largest ever investment in Pharmac. “Pharmac operates independently, but it must work within the budget constraints set by the government,” says Mr Seymour. “When this government assumed ...BeehiveBy beehive.govt.nz2 weeks ago - Māori excel in New Year Honours 2025

Mā mua ka kite a muri, mā muri ka ora e mua - Those who lead give sight to those who follow, those who follow give life to those who lead. Māori recipients in the New Year 2025 Honours list show comprehensive dedication to improving communities across the motu that ...BeehiveBy beehive.govt.nz2 weeks ago

Mā mua ka kite a muri, mā muri ka ora e mua - Those who lead give sight to those who follow, those who follow give life to those who lead. Māori recipients in the New Year 2025 Honours list show comprehensive dedication to improving communities across the motu that ...BeehiveBy beehive.govt.nz2 weeks ago - Stay fire safe this summer in 2025

Minister of Internal Affairs Brooke van Velden is wishing all New Zealanders a great holiday season as Kiwis prepare for gatherings with friends and families to see in the New Year. It is a great time of year to remind everyone to stay fire safe over the summer. “I know ...BeehiveBy beehive.govt.nz2 weeks ago

Minister of Internal Affairs Brooke van Velden is wishing all New Zealanders a great holiday season as Kiwis prepare for gatherings with friends and families to see in the New Year. It is a great time of year to remind everyone to stay fire safe over the summer. “I know ...BeehiveBy beehive.govt.nz2 weeks ago - Final-year Fees Free kicks off 1 January 2025

From 1 January 2025, first-time tertiary learners will have access to a new Fees Free entitlement of up to $12,000 for their final year of provider-based study or final two years of work-based learning, Tertiary Education and Skills Minister Penny Simmonds says. “Targeting funding to the final year of study ...BeehiveBy beehive.govt.nz2 weeks ago

From 1 January 2025, first-time tertiary learners will have access to a new Fees Free entitlement of up to $12,000 for their final year of provider-based study or final two years of work-based learning, Tertiary Education and Skills Minister Penny Simmonds says. “Targeting funding to the final year of study ...BeehiveBy beehive.govt.nz2 weeks ago - Act on family violence and sexual violence over the summer season

“As we head into one of the busiest times of the year for Police, and family violence and sexual violence response services, it’s a good time to remind everyone what to do if they experience violence or are worried about others,” Minister for the Prevention of Family and Sexual Violence ...BeehiveBy beehive.govt.nz2 weeks ago

“As we head into one of the busiest times of the year for Police, and family violence and sexual violence response services, it’s a good time to remind everyone what to do if they experience violence or are worried about others,” Minister for the Prevention of Family and Sexual Violence ...BeehiveBy beehive.govt.nz2 weeks ago

Related Posts

- Tennis is facing an existential crisis over doping. How will it respond?

Source: The Conversation (Au and NZ) – By Richard Vaughan, PhD Researcher Sport Integrity, University of Canberra As the Australian Open gets under way in Melbourne, the sport is facing a crisis over positive doping tests involving two of the biggest stars in tennis. Last March, the top-ranked men’s player, ...Evening ReportBy The Conversation2 hours ago

Source: The Conversation (Au and NZ) – By Richard Vaughan, PhD Researcher Sport Integrity, University of Canberra As the Australian Open gets under way in Melbourne, the sport is facing a crisis over positive doping tests involving two of the biggest stars in tennis. Last March, the top-ranked men’s player, ...Evening ReportBy The Conversation2 hours ago - Rainbow warmth and garish colours: When did stripy polyprop disappear?

Summer reissue: New Zealand used to be a country of vibrant synthetic striped polyprop. Then we got boring – and discovered merino. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to ...The SpinoffBy Shanti Mathias6 hours ago

Summer reissue: New Zealand used to be a country of vibrant synthetic striped polyprop. Then we got boring – and discovered merino. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to ...The SpinoffBy Shanti Mathias6 hours ago - A door-knock and the death of the Official Secrets Act

It was a mild, cloudy morning in May 1974 when Oliver Sutherland and his wife, Ulla Sköld, were confronted, on their doorstep, by one of the country’s top cops.The couple were key members of the group Auckland Committee on Racism and Discrimination (Acord), which had been pushing the government to ...NewsroomBy David Williams7 hours ago

It was a mild, cloudy morning in May 1974 when Oliver Sutherland and his wife, Ulla Sköld, were confronted, on their doorstep, by one of the country’s top cops.The couple were key members of the group Auckland Committee on Racism and Discrimination (Acord), which had been pushing the government to ...NewsroomBy David Williams7 hours ago - ‘All our rabbits are dead’: 10 moments of national insignificance from the NZ Archives

Summer reissue: With funding ending for Archives New Zealand’s digitisation programme, Hera Lindsay Bird shares a taste of what’s being lost – because history isn’t just about the big-ticket items. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please ...The SpinoffBy Hera Lindsay Bird7 hours ago

Summer reissue: With funding ending for Archives New Zealand’s digitisation programme, Hera Lindsay Bird shares a taste of what’s being lost – because history isn’t just about the big-ticket items. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please ...The SpinoffBy Hera Lindsay Bird7 hours ago - NZ can strengthen global solidarity over Afghanistan

Since the dramatic scenes at Kabul Airport in 2021 of thousands of Afghans desperately seeking to escape, fearful of what a new Taliban regime would mean for their lives and livelihoods, the focus on Afghanistan in New Zealand has predictably waned. New crises have emerged, with the conflicts in Ukraine ...NewsroomBy Evan Jones7 hours ago

Since the dramatic scenes at Kabul Airport in 2021 of thousands of Afghans desperately seeking to escape, fearful of what a new Taliban regime would mean for their lives and livelihoods, the focus on Afghanistan in New Zealand has predictably waned. New crises have emerged, with the conflicts in Ukraine ...NewsroomBy Evan Jones7 hours ago - The remarkable pie shop hidden in a Porirua industrial estate

Summer reissue: Pāua, canned spaghetti, povi masima and taro: Pepe’s Cafe understands the nature of food as love and community. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a ...The SpinoffBy Nick Iles8 hours ago

Summer reissue: Pāua, canned spaghetti, povi masima and taro: Pepe’s Cafe understands the nature of food as love and community. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a ...The SpinoffBy Nick Iles8 hours ago - What happens when Rachel Hunter sells out a Christchurch school hall?

Summer reissue: Rachel Hunter sold out a Christchurch school hall for a mysterious sounding ‘Community Event’. Alex Casey went along to find out what it was all about. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our ...The SpinoffBy Alex Casey8 hours ago

Summer reissue: Rachel Hunter sold out a Christchurch school hall for a mysterious sounding ‘Community Event’. Alex Casey went along to find out what it was all about. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our ...The SpinoffBy Alex Casey8 hours ago - The Sunday Essay: Lush and lost on Ponsonby Road

Summer reissue: Drinking wasn’t just a pastime, it was my profession – and it got way out of control. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a member ...The SpinoffBy Becs Tetley8 hours ago

Summer reissue: Drinking wasn’t just a pastime, it was my profession – and it got way out of control. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a member ...The SpinoffBy Becs Tetley8 hours ago - Daily crossword, Sunday 12 January

The post Daily crossword, Sunday 12 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles8 hours ago

The post Daily crossword, Sunday 12 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles8 hours ago - Newsroom daily quiz, Sunday 12 January

Loading…(function(i,s,o,g,r,a,m){var ql=document.querySelectorAll('A[data-quiz],DIV[data-quiz]'); if(ql){if(ql.length){for(var k=0;k<ql.length;k++){ql[k].id='quiz-embed-'+k;ql[k].href="javascript:var i=document.getElementById('quiz-embed-"+k+"');try{qz.startQuiz(i)}catch(e){i.start=1;i.style.cursor='wait';i.style.opacity='0.5'};void(0);"}}};i['QP']=r;i[r]=i[r]||function(){(i[r].q=i[r].q||[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)})(window,document,'script','https://take.quiz-maker.com/3012/CDN/quiz-embed-v1.js','qp');Got a good quiz question? Send Newsroom your questions.The post Newsroom daily quiz, Sunday 12 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles8 hours ago

Loading…(function(i,s,o,g,r,a,m){var ql=document.querySelectorAll('A[data-quiz],DIV[data-quiz]'); if(ql){if(ql.length){for(var k=0;k<ql.length;k++){ql[k].id='quiz-embed-'+k;ql[k].href="javascript:var i=document.getElementById('quiz-embed-"+k+"');try{qz.startQuiz(i)}catch(e){i.start=1;i.style.cursor='wait';i.style.opacity='0.5'};void(0);"}}};i['QP']=r;i[r]=i[r]||function(){(i[r].q=i[r].q||[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)})(window,document,'script','https://take.quiz-maker.com/3012/CDN/quiz-embed-v1.js','qp');Got a good quiz question? Send Newsroom your questions.The post Newsroom daily quiz, Sunday 12 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles8 hours ago - Palestinian solidarity activists call for ‘action’ in BDS boycott over Gaza

Asia Pacific Report A Palestine solidarity advocate today appealed to New Zealanders to shed their feelings of powerlessness over the Gaza genocide and “take action” in support of an effective global strategy of boycott, divestment and sanctions. “Many of us have become addicted to ‘doom scrolling’ — reading or watching ...Evening ReportBy Asia Pacific Report11 hours ago

Asia Pacific Report A Palestine solidarity advocate today appealed to New Zealanders to shed their feelings of powerlessness over the Gaza genocide and “take action” in support of an effective global strategy of boycott, divestment and sanctions. “Many of us have become addicted to ‘doom scrolling’ — reading or watching ...Evening ReportBy Asia Pacific Report11 hours ago - Govt accused of withholding info on Dunedin hospital

The government has been accused of a "blatant disregard for transparency" as unanswered questions continue to mount on Dunedin hospital. ...19 hours ago

The government has been accused of a "blatant disregard for transparency" as unanswered questions continue to mount on Dunedin hospital. ...19 hours ago - MP accuses govt accused of withholding info on Dunedin hospital

The government has been accused of a "blatant disregard for transparency" as unanswered questions continue to mount on Dunedin hospital. ...19 hours ago

The government has been accused of a "blatant disregard for transparency" as unanswered questions continue to mount on Dunedin hospital. ...19 hours ago - Giuliani held in contempt for repeating false claims about 2020 election workers

A former lawyer for President-elect Donald Trump was found to have violated a court agreement after he suggested on a podcast in November two election workers were quadruple counting ballots and using a computer hard drive to fix the machines. ...22 hours ago

A former lawyer for President-elect Donald Trump was found to have violated a court agreement after he suggested on a podcast in November two election workers were quadruple counting ballots and using a computer hard drive to fix the machines. ...22 hours ago - ‘Sometimes I’ll get a free drink’: Bubbah’s double life as Tina from Turners

Summer reissue: The comedian takes us through her life in television, including her favourite Kardashian tiff, Taskmaster task, and the best thing about being Tina from Turners. Sieni Tiana Leo’o Olo, aka Bubbah, is used to being approached by men in bars – but not for the reasons you might ...The SpinoffBy My Life in TV1 day ago

Summer reissue: The comedian takes us through her life in television, including her favourite Kardashian tiff, Taskmaster task, and the best thing about being Tina from Turners. Sieni Tiana Leo’o Olo, aka Bubbah, is used to being approached by men in bars – but not for the reasons you might ...The SpinoffBy My Life in TV1 day ago - Gone By Lunchtime Live: A trip to 1980s New Zealand with Kim Hill

Summer reissue: A special live edition of the Spinoff politics podcast, revisiting the turbulent Lange years with very special guest Kim Hill. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to ...The SpinoffBy The Spinoff1 day ago

Summer reissue: A special live edition of the Spinoff politics podcast, revisiting the turbulent Lange years with very special guest Kim Hill. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to ...The SpinoffBy The Spinoff1 day ago - The mana of digging a grave

Summer reissue: On learning an underappreciated but vitally important skill. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a member today. It has been almost a decade since I ...The SpinoffBy Liam Rātana1 day ago

Summer reissue: On learning an underappreciated but vitally important skill. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be a member today. It has been almost a decade since I ...The SpinoffBy Liam Rātana1 day ago - I survived in another country without a smartphone – this is my story

Summer reissue: Alex Casey spends the weekend in a new city without her trusty iPhone, and lives to tell the tale. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be ...The SpinoffBy Alex Casey1 day ago

Summer reissue: Alex Casey spends the weekend in a new city without her trusty iPhone, and lives to tell the tale. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be ...The SpinoffBy Alex Casey1 day ago - Why young women like me are rotting in our bedrooms

Summer reissue: It’s become an internet trope, but the art of girl rotting dates back at least to the 19th century. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be ...The SpinoffBy Maya Field1 day ago

Summer reissue: It’s become an internet trope, but the art of girl rotting dates back at least to the 19th century. The Spinoff needs to double the number of paying members we have to continue telling these kinds of stories. Please read our open letter and sign up to be ...The SpinoffBy Maya Field1 day ago - Daily crossword, Saturday 11 January

The post Daily crossword, Saturday 11 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles1 day ago

The post Daily crossword, Saturday 11 January appeared first on Newsroom. ...NewsroomBy Newsroom Puzzles1 day ago - Newsroom daily quiz, Saturday 11 January

Loading…(function(i,s,o,g,r,a,m){var ql=document.querySelectorAll('A[data-quiz],DIV[data-quiz]'); if(ql){if(ql.length){for(var k=0;k<ql.length;k++){ql[k].id='quiz-embed-'+k;ql[k].href="javascript:var i=document.getElementById('quiz-embed-"+k+"');try{qz.startQuiz(i)}catch(e){i.start=1;i.style.cursor='wait';i.style.opacity='0.5'};void(0);"}}};i['QP']=r;i[r]=i[r]||function(){(i[r].q=i[r].q||[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)})(window,document,'script','https://take.quiz-maker.com/3012/CDN/quiz-embed-v1.js','qp');Got a good quiz question? Send Newsroom your questions. .wp-block-newspack-blocks-homepage-articles article .entry-title { font-size: 1.2em; } .wp-block-newspack-blocks-homepage-articles .entry-meta { display: flex; flex-wrap: wrap; align-items: center; margin-top: 0.5em; } .wp-block-newspack-blocks-homepage-articles article .entry-meta { font-size: 0.8em; } .wp-block-newspack-blocks-homepage-articles article .avatar { height: 25px; width: ...NewsroomBy Newsroom Puzzles1 day ago

Loading…(function(i,s,o,g,r,a,m){var ql=document.querySelectorAll('A[data-quiz],DIV[data-quiz]'); if(ql){if(ql.length){for(var k=0;k<ql.length;k++){ql[k].id='quiz-embed-'+k;ql[k].href="javascript:var i=document.getElementById('quiz-embed-"+k+"');try{qz.startQuiz(i)}catch(e){i.start=1;i.style.cursor='wait';i.style.opacity='0.5'};void(0);"}}};i['QP']=r;i[r]=i[r]||function(){(i[r].q=i[r].q||[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)})(window,document,'script','https://take.quiz-maker.com/3012/CDN/quiz-embed-v1.js','qp');Got a good quiz question? Send Newsroom your questions. .wp-block-newspack-blocks-homepage-articles article .entry-title { font-size: 1.2em; } .wp-block-newspack-blocks-homepage-articles .entry-meta { display: flex; flex-wrap: wrap; align-items: center; margin-top: 0.5em; } .wp-block-newspack-blocks-homepage-articles article .entry-meta { font-size: 0.8em; } .wp-block-newspack-blocks-homepage-articles article .avatar { height: 25px; width: ...NewsroomBy Newsroom Puzzles1 day ago - Vanuatu election 2025: Earthquake aftershocks expose high cost of democracy

COMMENTARY: By Anna Naupa Out of the rubble of last year’s 7.3 magnitude earthquake that hit Vanuatu’s capital Port Vila on December 17 and the snap election due next week on January 16, a new leadership is required to reset the country’s developmental trajectory. Persistent political turmoil has hampered the ...Evening ReportBy Asia Pacific Report1 day ago

COMMENTARY: By Anna Naupa Out of the rubble of last year’s 7.3 magnitude earthquake that hit Vanuatu’s capital Port Vila on December 17 and the snap election due next week on January 16, a new leadership is required to reset the country’s developmental trajectory. Persistent political turmoil has hampered the ...Evening ReportBy Asia Pacific Report1 day ago - Parkinson’s only affects older people? Think again

Parkinson’s disease is the fastest-growing chronic neurological disorder in the world. Currently, 10 million people have Parkinson’s disease, and the number of people receiving diagnoses is increasing year on year. The proportion of early-onset Parkinson’s disease, where people get a diagnosis before age 50, is rising even faster. Some patients ...NewsroomBy Dr Victor Dieriks2 days ago

Parkinson’s disease is the fastest-growing chronic neurological disorder in the world. Currently, 10 million people have Parkinson’s disease, and the number of people receiving diagnoses is increasing year on year. The proportion of early-onset Parkinson’s disease, where people get a diagnosis before age 50, is rising even faster. Some patients ...NewsroomBy Dr Victor Dieriks2 days ago - The Secret Diary of .. horoscopes