Tax cuts for landlords will not reduce rents

Tax cuts for landlords will not reduce rents

Written By:

mickysavage - Date published:

11:23 am, March 11th, 2024 - 127 comments

Categories: Christopher Luxon, cost of living, national, politicans, same old national, tenants' rights -

Tags: trickle down

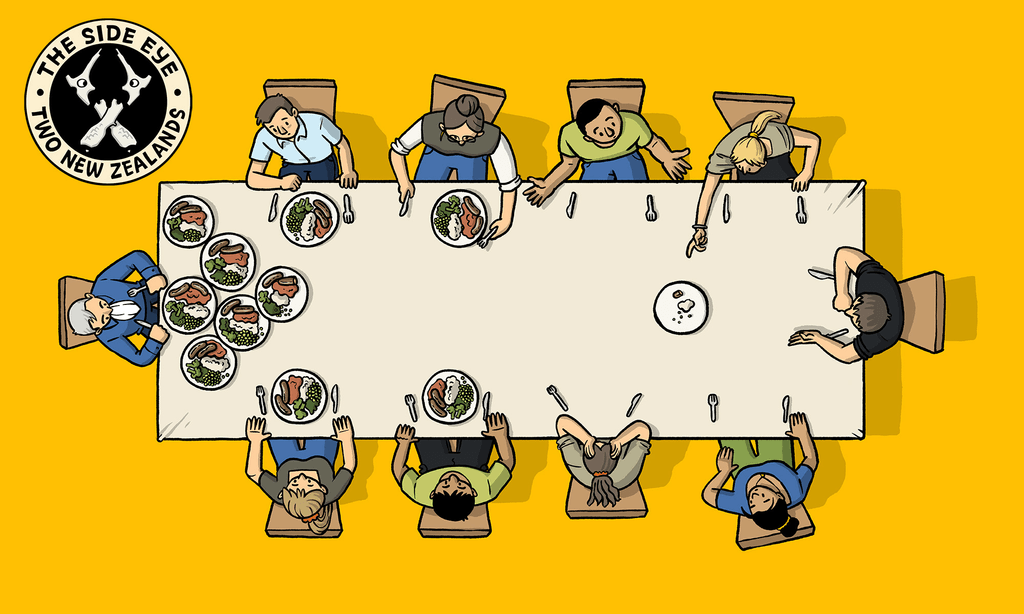

Recently the Government has been working out how to cut funding for school lunches for poor kids while at the same time it has also announced that it will restore interest deductibility for landlords.

The interest deductibility changes are being pushed through by tweaking an existing bill when it is reported back to Parliament. The ability for the public to make submissions and to point out how bad the policy is will not be there.

The Government claims that the tax change is a return to conventional tax treatment of the business of being a landlord and will also mean that rents will reduce.

As to the former claim there is one difference. Landlords almost inevitably get into the rental business with the expectation that after a while they will be able to sell their property and make a significant tax gain. Rental income is not the primary driver.

As to the latter claim there is precious little proof that this will actually occur. When interest rates reduced there was no discernible reduction in rents.

This Treasury paper concludes that wage inflation and relative supply and demand of dwellings are the two key drivers of rent inflation for new tenancies at the national level. The paper also said that “[m]ortgage interest rates positively affect rents but relatively little, and the relationship is not robust across model specifications”.

Let’s think about one recent example which shows why the Government’s assumptions are overly optimistic.

The subject person, who for present purposes will be called “Christopher” is the head of a large organisation. He also owns a property in Auckland that he rents out to his employer as an office. Rental for this property is determined by an independent valuation.

Along with five other properties he also owns a Wellington Apartment that is mortgage free. As part of his entitlements under his employment contract he also has the use of a large mansion in Wellington.

Instead of using the mansion he chose to maximise his return by electing to receive $1,000 a week so that he could continue to use his mortgage free apartment. Clearly maximising his wealth is more important than anything else.

Would giving him a tax return make him reduce the amount he claimed? This is unlikely as shown by his earlier behaviour.

And here is the thing, the tax rebate will not affect him at all as his apartment is mortgage free. Clearly he is maximised by personal gain and not by anything else. And he was asked if favourable tax treatment would cause him to reduce rentals on his properties and he said that he was not sure. I am confident that when push comes to shove he will rely on market forces to set rental levels for his properties, and not let some generally expressed desire to reduce his return

The group that are most likely to be affected by the change are the mega landlords. There are 346 in the country and they each own at least 200 properties. The CTU’s pre election analysis was that they would each save up to $1.3 million over five years thanks to this tax cut.

Ka Ching.

Can you imagine them agreeing to reduce the rentals they charge? Especially at a time that immigration is strong and there is increasing pressure on housing stock?

This is a classic example of the Government rewarding its funders. The policy will not work. All it will do is increase money for the wealthy and drive up house prices as landlords look to increase stock.

If you wanted to increase stock you would do what the last Government did, allow depreciation but only for new builds. Competing with first home buyers to purchase homes does not add one new house to existing housing stock. Offering incentives to landlords to buy new stock would, but that incentive will soon be gone.

This is yet more evidence free Government reckons. Clearly they think that trickle down works, and all that is needed is more, not less trickle down.

Related Posts

127 comments on “Tax cuts for landlords will not reduce rents ”

- Comments are now closed

- Comments are now closed

Recent Comments

- tWig on

- Vivie on

- Descendant Of Smith to AB on

- observer on

- Visubversa on

- joe90 on

- joe90 on

- powerman on

- Patricia Bremner to Adrian on

- Patricia Bremner to Bearded Git on

- aj to Bearded Git on

- Bearded Git to Stan on

- Bearded Git to SPC on

- Stan on

- Bearded Git to Tony Veitch on

- SPC to Muttonbird on

- Adrian on

- SPC on

- Tony Veitch on

- Muttonbird to SPC on

- Andrew R on

- ianmac on

- Bearded Git to Bearded Git on

- Muttonbird on

- SPC on

- Bearded Git on

- Kay on

- SPC on

- dv on

- KJT on

- SPC on

- SPC on

- bwaghorn on

- SPC on

- SPC to Muttonbird on

- SPC to Muttonbird on

- Bearded Git to Morrissey on

- Graeme to Mike the Lefty on

- Muttonbird on

- joe90 on

- Stephen D on

- tWig to Muttonbird on

- Mike the Lefty to Ad on

- Mike the Lefty to tWig on

- Stephen D on

- Morrissey to Bearded Git on

- adam on

- adam on

- Incognito on

- tWig on

- tWig on

- tWig to Belladonna on

- ianmac on

- tWig to mickysavage on

- tWig on

- Bearded Git to Morrissey on

- Bearded Git to Mountain Tui on

- Bearded Git to dv on

- SPC on

- Ad to Muttonbird on

- SPC on

- Morrissey on

- Ad to Muttonbird on

- SPC to Belladonna on

- Belladonna to tWig on

- mpledger to Mountain Tui on

- Louis to Bearded Git on

- satty to Muttonbird on

Recent Posts

-

by mickysavage

-

by Guest post

-

by mickysavage

-

by Mountain Tui

-

by Mike Smith

-

by Mountain Tui

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by advantage

-

by lprent

-

by mickysavage

-

by weka

-

by Mountain Tui

-

by weka

-

by mickysavage

-

by mickysavage

-

by Mountain Tui

-

by mickysavage

-

by advantage

-

by lprent

-

by mickysavage

-

by mickysavage

-

by mickysavage

- Luxon & Willis Double Down on Ferries Debacle

The day before today, Nicola Willis told the House that they would have to wait until the ferries announcement for the details about ferries cost etc. It was the same promise Luxon has been making in Parliament over the last weeks and months: the details are coming, the details are ...Mountain TuiBy Mountain Tui29 minutes ago

The day before today, Nicola Willis told the House that they would have to wait until the ferries announcement for the details about ferries cost etc. It was the same promise Luxon has been making in Parliament over the last weeks and months: the details are coming, the details are ...Mountain TuiBy Mountain Tui29 minutes ago - Luigi Mangione and Jury Nullification

Luigi Mangione, the shooter of the Ultimate Healthcare CEO, has been caught by the cops after a tip-off from a McDonalds worker. (A timely reminder, perhaps, that there is an official boycott against McDonalds for their profiting from and support of Israel’s occupation in Palestine, and it has been having ...Sapphi’s SubstackBy Sapphi2 hours ago

Luigi Mangione, the shooter of the Ultimate Healthcare CEO, has been caught by the cops after a tip-off from a McDonalds worker. (A timely reminder, perhaps, that there is an official boycott against McDonalds for their profiting from and support of Israel’s occupation in Palestine, and it has been having ...Sapphi’s SubstackBy Sapphi2 hours ago - Thursday 12 December

There has been widespread condemnation of the Government’s mishandling of the Cook Strait ferry replacements, including from unions, industry, and political parties. It has also led to public division among the coalition, with Winston Peters and David Seymour at odds regarding cost and privatisation. In other political news, Labour says ...NZCTUBy Jack McDonald4 hours ago

There has been widespread condemnation of the Government’s mishandling of the Cook Strait ferry replacements, including from unions, industry, and political parties. It has also led to public division among the coalition, with Winston Peters and David Seymour at odds regarding cost and privatisation. In other political news, Labour says ...NZCTUBy Jack McDonald4 hours ago - Foreshadowing HYEFU 2024

By way of prologue, the closest parallel to the current economic situation may be when Ruth Richardson became Minister of Finance in late 1990. The economy had been contracting, although there were signs of a fragile recovery. She was an Austerian and cut public spending savagely. The economy plunged a ...PunditBy Brian Easton4 hours ago

By way of prologue, the closest parallel to the current economic situation may be when Ruth Richardson became Minister of Finance in late 1990. The economy had been contracting, although there were signs of a fragile recovery. She was an Austerian and cut public spending savagely. The economy plunged a ...PunditBy Brian Easton4 hours ago - Nicky No Boats

I remember you by, thunderclap in the skyLightning flash, tempers flare'Round the horn if you dareI just spent six months in a leaky boatLucky just to keep afloatSongwriters: Brian Timothy FinnToday, a tale of such ineptitude, unwarranted confidence and underplanning that you will scarcely believe it. I can hear you ...Nick’s KōreroBy Nick Rockel5 hours ago

I remember you by, thunderclap in the skyLightning flash, tempers flare'Round the horn if you dareI just spent six months in a leaky boatLucky just to keep afloatSongwriters: Brian Timothy FinnToday, a tale of such ineptitude, unwarranted confidence and underplanning that you will scarcely believe it. I can hear you ...Nick’s KōreroBy Nick Rockel5 hours ago - Ferries delayed again, then handed to Peters, who hits out at Seymour

Willis wouldn’t give a cost estimate or confirm new ferries would be ‘rail enabled’ rather than ‘rail-compatible’, but Seymour has let slip the ferries and ‘landside’ development would cost around $1.5 billion. Photo: Lynn Grieveson / The KākāMōrena. Long stories short, the six things that matter in Aotearoa’s political economy ...The KakaBy Bernard Hickey6 hours ago

Willis wouldn’t give a cost estimate or confirm new ferries would be ‘rail enabled’ rather than ‘rail-compatible’, but Seymour has let slip the ferries and ‘landside’ development would cost around $1.5 billion. Photo: Lynn Grieveson / The KākāMōrena. Long stories short, the six things that matter in Aotearoa’s political economy ...The KakaBy Bernard Hickey6 hours ago - When Should You Consider Retreat? – The Sooner the Better

This is a guest post by Waitematā local board member Dr Alex Bonham, about the Auckland Council’s Shoreline Adaption Plans. Currently consultation is open for the Auckland Central & Ōrākei to Karaka Bay SAPs until December 18th. If the sea bowls through your front door, through the house and ...Greater AucklandBy Guest Post6 hours ago

This is a guest post by Waitematā local board member Dr Alex Bonham, about the Auckland Council’s Shoreline Adaption Plans. Currently consultation is open for the Auckland Central & Ōrākei to Karaka Bay SAPs until December 18th. If the sea bowls through your front door, through the house and ...Greater AucklandBy Guest Post6 hours ago - Shameless advertising: Two days only — 50% off subscriptions, forever

But wait!! If you would like to pay me LESS, on Friday the discount will be bigger. Subscription benefits include my endless gratitude, warm fuzzy feelings, bragging rights, and a slight spring in your step. ...Sapphi’s SubstackBy Sapphi9 hours ago

But wait!! If you would like to pay me LESS, on Friday the discount will be bigger. Subscription benefits include my endless gratitude, warm fuzzy feelings, bragging rights, and a slight spring in your step. ...Sapphi’s SubstackBy Sapphi9 hours ago - Toot, toot, here comes Winston

The big question hanging over yesterday’s ferry announcement press conference was why Winston Peters was there at all. Finance Minister Willis went out of her way to tell a press conference yesterday afternoon that the Government had not decided whether to have rail-enabled ferries or even whether KiwiRail should run ...PolitikBy Richard Harman9 hours ago

The big question hanging over yesterday’s ferry announcement press conference was why Winston Peters was there at all. Finance Minister Willis went out of her way to tell a press conference yesterday afternoon that the Government had not decided whether to have rail-enabled ferries or even whether KiwiRail should run ...PolitikBy Richard Harman9 hours ago - Channelling Madame Defarge: Of Lampposts and CEOs

The recent shooting of that Health Insurance CEO in the USA has sparked quite the online furor. On one hand, one is confronted with a violent murder… on the other hand, many, many people think the victim was such a monster, he got what was coming to him. The result ...A Phuulish FellowBy strda22115 hours ago

The recent shooting of that Health Insurance CEO in the USA has sparked quite the online furor. On one hand, one is confronted with a violent murder… on the other hand, many, many people think the victim was such a monster, he got what was coming to him. The result ...A Phuulish FellowBy strda22115 hours ago - Ranking the New Zealand Prime Ministers since 1893

The New Zealand Listener has a poll of historians ranking Prime Ministers since Seddon (1893-1906): https://www.nzherald.co.nz/the-listener/politics/the-real-power-list-nzs-prime-ministers-rated/UEHAIM2NQRDKNPWR3HNKBLKK6Q/#google_vignette Alas, it’s behind a paywall. Bastards. So I thought I’d provide my own list as an exercise: Peter Fraser Richard Seddon Helen Clark Keith Holyoake (second term) M.J. Savage Gordon Coates Norman Kirk ...A Phuulish FellowBy strda22121 hours ago

The New Zealand Listener has a poll of historians ranking Prime Ministers since Seddon (1893-1906): https://www.nzherald.co.nz/the-listener/politics/the-real-power-list-nzs-prime-ministers-rated/UEHAIM2NQRDKNPWR3HNKBLKK6Q/#google_vignette Alas, it’s behind a paywall. Bastards. So I thought I’d provide my own list as an exercise: Peter Fraser Richard Seddon Helen Clark Keith Holyoake (second term) M.J. Savage Gordon Coates Norman Kirk ...A Phuulish FellowBy strda22121 hours ago - Wednesday 11 December

The Government has kicked the can down the road on the replacement Interislander ferries, by setting up a company to begin a procurement process, rather than making a decision. But they have made a decision when it comes to greyhound racing, banning the sport over the next 20 months. The ...NZCTUBy Jack McDonald22 hours ago

The Government has kicked the can down the road on the replacement Interislander ferries, by setting up a company to begin a procurement process, rather than making a decision. But they have made a decision when it comes to greyhound racing, banning the sport over the next 20 months. The ...NZCTUBy Jack McDonald22 hours ago - It’s got to be good for you

One of my favourite Substackers had an intriguing question to ask this morning:Why was a British baby born after September 1953 significantly more likely to die from disease later in life than a British baby born before September 1953?I gave it a good try but I didn’t get it. Makes ...More Than A FeildingBy David Slack22 hours ago

One of my favourite Substackers had an intriguing question to ask this morning:Why was a British baby born after September 1953 significantly more likely to die from disease later in life than a British baby born before September 1953?I gave it a good try but I didn’t get it. Makes ...More Than A FeildingBy David Slack22 hours ago - NZCTU slams Government’s ferry fiasco

The NZCTU Te Kauae Kaimahi is slamming the Government for failing to show any leadership on infrastructure delivery after they revealed today that they have no plan to replace the Cook Strait ferries a year on from their decision to cancel the iReX project. “Today’s announcement by the Minister of ...NZCTUBy Stella Whitfield22 hours ago

The NZCTU Te Kauae Kaimahi is slamming the Government for failing to show any leadership on infrastructure delivery after they revealed today that they have no plan to replace the Cook Strait ferries a year on from their decision to cancel the iReX project. “Today’s announcement by the Minister of ...NZCTUBy Stella Whitfield22 hours ago - Climate Change: Hope is not a plan

One of the purposes of the Zero Carbon Act was to break the bad old cycle of announcing targets and then doing nothing to meet them. Instead, governments would have regular carbon budgets with relatively short deadlines - meaning any failure would happen on their watch - and be required ...No Right TurnBy Idiot/Savant23 hours ago

One of the purposes of the Zero Carbon Act was to break the bad old cycle of announcing targets and then doing nothing to meet them. Instead, governments would have regular carbon budgets with relatively short deadlines - meaning any failure would happen on their watch - and be required ...No Right TurnBy Idiot/Savant23 hours ago - A bad joke

That's the only way to describe National's announcement today on replacement Cook Strait ferries. A year ago they cancelled iRex, which would have given us two new, rail-enabled ferries in January 2026 for $551 million (plus port costs). Today, they're promising two smaller, non-rail enabled ferries sometime in 2029, and ...No Right TurnBy Idiot/Savant1 day ago

That's the only way to describe National's announcement today on replacement Cook Strait ferries. A year ago they cancelled iRex, which would have given us two new, rail-enabled ferries in January 2026 for $551 million (plus port costs). Today, they're promising two smaller, non-rail enabled ferries sometime in 2029, and ...No Right TurnBy Idiot/Savant1 day ago - The Long Awaited Kiwirail Interislander Announcement

Complimentary:In July, Nicola Willis promised that her expensive Kiwirail Interislander “independent” advisory committee had finished their work - and an answer was due to the public imminently.That blew out to August, then September, October, November, before Winston Peters announced the government was definitely going to announce the decision on December ...Mountain TuiBy Mountain Tui1 day ago

Complimentary:In July, Nicola Willis promised that her expensive Kiwirail Interislander “independent” advisory committee had finished their work - and an answer was due to the public imminently.That blew out to August, then September, October, November, before Winston Peters announced the government was definitely going to announce the decision on December ...Mountain TuiBy Mountain Tui1 day ago - Does Luxon understand Keynesian economics?

Do our journalists? Do LabourDo we? John Maynard KeynesOh, I do so love New Zealand news, our left-leaning, deliberatively disinterested, striving-to-be-unbiased media. They are working so hard for us, doing the mundane jobs that I would hate to do. That’s why deliberatively never used my English degree to become a ...Sapphi’s SubstackBy Sapphi1 day ago

Do our journalists? Do LabourDo we? John Maynard KeynesOh, I do so love New Zealand news, our left-leaning, deliberatively disinterested, striving-to-be-unbiased media. They are working so hard for us, doing the mundane jobs that I would hate to do. That’s why deliberatively never used my English degree to become a ...Sapphi’s SubstackBy Sapphi1 day ago - Luigi Mangione’s Pain

This morning I followed a link to Luigi Mangione’s now defunct Substack He is the accused in the murder of US health insurance CEO Brian Thompson.And of course it must be noted that murder is not the right course of action, and there can only be condolences to Thompson’s family.But ...Mountain TuiBy Mountain Tui1 day ago

This morning I followed a link to Luigi Mangione’s now defunct Substack He is the accused in the murder of US health insurance CEO Brian Thompson.And of course it must be noted that murder is not the right course of action, and there can only be condolences to Thompson’s family.But ...Mountain TuiBy Mountain Tui1 day ago - Seymour’s Principles Rejected

Look inside, look inside your tiny mind, now look a bit harder'Cause we're so uninspiredSo sick and tired of all the hatred you harbourSo you say our treaty is not okay; well, I think you're just evilYou're just some racist who can't tie my lacesYour point of view is medievalFuck ...Nick’s KōreroBy Nick Rockel1 day ago

Look inside, look inside your tiny mind, now look a bit harder'Cause we're so uninspiredSo sick and tired of all the hatred you harbourSo you say our treaty is not okay; well, I think you're just evilYou're just some racist who can't tie my lacesYour point of view is medievalFuck ...Nick’s KōreroBy Nick Rockel1 day ago - Top 10: Ferries, $2.1 billion in fossil fuel related healthcare costs, Curia’s Problem & M...

1. Fast-Track projects: Speaker rules no private benefit in list (RNZ, Russell Palmer)In a fairly rare move, the Speaker of the House Garry Brownlee (National) overturned the ruling of the Clerk, David Wilson, and Assistant Speaker, Barbara Kuriger (National).The Clerk of the House of Representatives advises the speaker and members ...Mountain TuiBy Mountain Tui1 day ago

1. Fast-Track projects: Speaker rules no private benefit in list (RNZ, Russell Palmer)In a fairly rare move, the Speaker of the House Garry Brownlee (National) overturned the ruling of the Clerk, David Wilson, and Assistant Speaker, Barbara Kuriger (National).The Clerk of the House of Representatives advises the speaker and members ...Mountain TuiBy Mountain Tui1 day ago - Does AT misunderstand the government’s new PT targets?

A few weeks ago we revealed that a new policy from the NZTA is pushing for changes to the level of public transport costs covered by fares (and a few other things), which could potentially lead to fare hikes by as much as 70 percent or service cuts. While some ...Greater AucklandBy Matt L1 day ago

A few weeks ago we revealed that a new policy from the NZTA is pushing for changes to the level of public transport costs covered by fares (and a few other things), which could potentially lead to fare hikes by as much as 70 percent or service cuts. While some ...Greater AucklandBy Matt L1 day ago - When haste makes waste & is risky, dangerous & mean

Mōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and poverty on Wednesday, December 11 in The Kākā’s Dawn Chorus and Pick ‘n’ Mix are:The National-ACT-NZ First Coalition Government is set to announce today it will spend $900 million on new ferries to ...The KakaBy Bernard Hickey1 day ago

Mōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and poverty on Wednesday, December 11 in The Kākā’s Dawn Chorus and Pick ‘n’ Mix are:The National-ACT-NZ First Coalition Government is set to announce today it will spend $900 million on new ferries to ...The KakaBy Bernard Hickey1 day ago - Gordon Campbell on the government’s ongoing ferries disaster

The Interislander ferry Aratere approaching the entrance to Wellington Harbour after crossing Cook Strait on the final ferry sailing of the day, due to large swells. 12 July 2017 New Zealand Herald Photograph by Mark MitchellI wouldn’t have picked Nicola Willis to be a big AC/DC fan, but “Dirty Deeds ...WerewolfBy ScoopEditor1 day ago

The Interislander ferry Aratere approaching the entrance to Wellington Harbour after crossing Cook Strait on the final ferry sailing of the day, due to large swells. 12 July 2017 New Zealand Herald Photograph by Mark MitchellI wouldn’t have picked Nicola Willis to be a big AC/DC fan, but “Dirty Deeds ...WerewolfBy ScoopEditor1 day ago - Sabin 33 #6 – Are solar projects harming biodiversity?

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...2 days ago

On November 1, 2024 we announced the publication of 33 rebuttals based on the report "Rebutting 33 False Claims About Solar, Wind, and Electric Vehicles" written by Matthew Eisenson, Jacob Elkin, Andy Fitch, Matthew Ard, Kaya Sittinger & Samuel Lavine and published by the Sabin Center for Climate Change Law at Columbia ...2 days ago - Submission on the NZ Post Deed of Understanding 2024 review

Postal services enable individuals, businesses, and communities to build and maintain social connections, and to participate economically, culturally, and politically. The NZCTU is concerned that the proposed changes in this MBIE consultation on postal services will further undermine the provision of this essential public service and have major social and economic ...NZCTUBy Jeremiah Boniface2 days ago

Postal services enable individuals, businesses, and communities to build and maintain social connections, and to participate economically, culturally, and politically. The NZCTU is concerned that the proposed changes in this MBIE consultation on postal services will further undermine the provision of this essential public service and have major social and economic ...NZCTUBy Jeremiah Boniface2 days ago - What I saw, sort of, at the emergency eye clinic

In a moment, the latest instalment of Once Again Dave Finds Himself in Hospital Even Though He Looks Quite Fit and Healthy Really, but first, a little bit of an insight into the way Ministers like Chris Penk and Casey Costello use data.Allow me to illustrate, using my own personal ...More Than A FeildingBy David Slack2 days ago

In a moment, the latest instalment of Once Again Dave Finds Himself in Hospital Even Though He Looks Quite Fit and Healthy Really, but first, a little bit of an insight into the way Ministers like Chris Penk and Casey Costello use data.Allow me to illustrate, using my own personal ...More Than A FeildingBy David Slack2 days ago - Bringing the House into disrepute

Last month we all thrilled to see Hana-Rawhiti Maipi-Clarke's haka in parliament in response to National's racist, anti-constitutional Treaty "Principles" Bill. Of course, the targets of that haka did not like someone speaking so forcefully and well against them - so they had Maipi-Clarke named and suspended from Parliament for ...No Right TurnBy Idiot/Savant2 days ago

Last month we all thrilled to see Hana-Rawhiti Maipi-Clarke's haka in parliament in response to National's racist, anti-constitutional Treaty "Principles" Bill. Of course, the targets of that haka did not like someone speaking so forcefully and well against them - so they had Maipi-Clarke named and suspended from Parliament for ...No Right TurnBy Idiot/Savant2 days ago - NZCTU urges political parties to vote down extreme anti-worker bill

NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh is calling on political parties to vote down Brooke van Velden’s Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill, as it would undermine the ability of workers to engage in industrial action and may even lead to workers losing pay for ...NZCTUBy Jeremiah Boniface2 days ago

NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh is calling on political parties to vote down Brooke van Velden’s Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill, as it would undermine the ability of workers to engage in industrial action and may even lead to workers losing pay for ...NZCTUBy Jeremiah Boniface2 days ago - Atlas Network? Yawn.

One of the most compelling articles I’ve read about Atlas Network is from The Guardian columnist George Monbiot. His article is titled: “What links Rishi Sunak, Javier Milei and Donald Trump? The shadowy network behind their policies.”It’s an excellent summation outlining the strategies and modus operandi of the Atlas Network, ...Mountain TuiBy Mountain Tui2 days ago

One of the most compelling articles I’ve read about Atlas Network is from The Guardian columnist George Monbiot. His article is titled: “What links Rishi Sunak, Javier Milei and Donald Trump? The shadowy network behind their policies.”It’s an excellent summation outlining the strategies and modus operandi of the Atlas Network, ...Mountain TuiBy Mountain Tui2 days ago - Tuesday 10 December

Government has introduced legislation under urgency to allow employers to deduct workers pay for engaging in partial strikes, which will give further power to bosses to intimidate workers and will lead to the escalation of industrial disputes. NZNO workers begin rolling strikes in Auckland today, in their latest round of ...NZCTUBy Jack McDonald2 days ago

Government has introduced legislation under urgency to allow employers to deduct workers pay for engaging in partial strikes, which will give further power to bosses to intimidate workers and will lead to the escalation of industrial disputes. NZNO workers begin rolling strikes in Auckland today, in their latest round of ...NZCTUBy Jack McDonald2 days ago - As renewables rise, the world may be nearing a climate turning point

This is a re-post from Yale Climate Connections Climate pollution caused by burning fossil fuels hit a record 37.4 billion metric tons in 2024, marking a 0.8% rise from the previous year – and dashing hopes that a peak in global emissions might occur this year. That’s according to ...2 days ago

This is a re-post from Yale Climate Connections Climate pollution caused by burning fossil fuels hit a record 37.4 billion metric tons in 2024, marking a 0.8% rise from the previous year – and dashing hopes that a peak in global emissions might occur this year. That’s according to ...2 days ago - Govt eyes ‘PPP-lite’ for health centres

Wellington’s Children’s Hospital under construction in 2018, largely funding by a philanthropic donation. Now there are fears of a type of creeping privatisation within the health system, starting with buildings. Photo: Lynn Grieveson Mōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey2 days ago

Wellington’s Children’s Hospital under construction in 2018, largely funding by a philanthropic donation. Now there are fears of a type of creeping privatisation within the health system, starting with buildings. Photo: Lynn Grieveson Mōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and ...The KakaBy Bernard Hickey2 days ago - Book Review: The Future Embraced

This is a guest post by George Weeks, reviewing a book called The Future Embraced by Kobus Mentz The Future Embraced is more than a book. It is an accumulation of 50 years of work, 13 years in the making. It takes the tone of a mentor, reflecting the accumulated ...Greater AucklandBy Guest Post2 days ago

This is a guest post by George Weeks, reviewing a book called The Future Embraced by Kobus Mentz The Future Embraced is more than a book. It is an accumulation of 50 years of work, 13 years in the making. It takes the tone of a mentor, reflecting the accumulated ...Greater AucklandBy Guest Post2 days ago - Dream Scenario

2023, directed by Kristoffer Borgli Dream Scenario is a movie about a mild-mannered (read: kind of pathetic and outright whiny) professor played by a nigh on unrecognisable to me Nicolas Cage who suddenly starts appearing in people’s dreams. At first he’s not doing anything other than just watching, failing to ...The little pakehaBy chrismiller2 days ago

2023, directed by Kristoffer Borgli Dream Scenario is a movie about a mild-mannered (read: kind of pathetic and outright whiny) professor played by a nigh on unrecognisable to me Nicolas Cage who suddenly starts appearing in people’s dreams. At first he’s not doing anything other than just watching, failing to ...The little pakehaBy chrismiller2 days ago - How Fed Farmers is driving Willis’s campaign against the banks

The pressure on the retail banks might only be just starting.Finance Minister Nicola Willis yesterday announced that she was changing the Reserve Bank remit to make it more pro-active in encouraging competition within the retail bank sector.And, Federated Farmers, who have been a major prod in the government’s side over ...PolitikBy Richard Harman2 days ago

The pressure on the retail banks might only be just starting.Finance Minister Nicola Willis yesterday announced that she was changing the Reserve Bank remit to make it more pro-active in encouraging competition within the retail bank sector.And, Federated Farmers, who have been a major prod in the government’s side over ...PolitikBy Richard Harman2 days ago - Poll number 4: Dead Govt Walking

..Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work.RNZ reports the latest TVNZ/Verian Poll results:National: 37%, n/c (46 seats)Labour: 29%, n/c (36 seats)Greens: 10%, -2% points (12 seats)ACT: 8%, n/c (10 seats)Te Pāti Māori: 7%, up 3% (9 seats)NZ First: 6%, -1% ...Frankly SpeakingBy Frank Macskasy3 days ago

..Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work.RNZ reports the latest TVNZ/Verian Poll results:National: 37%, n/c (46 seats)Labour: 29%, n/c (36 seats)Greens: 10%, -2% points (12 seats)ACT: 8%, n/c (10 seats)Te Pāti Māori: 7%, up 3% (9 seats)NZ First: 6%, -1% ...Frankly SpeakingBy Frank Macskasy3 days ago - Guest post!

David has, unfortunately, been losing pieces of himself and turns out it’s a bit hard to write a column when the affected parts are your eyeballs and it’s painful to read, so I offered to add to his pain by writing a guest column for him and the fool said ...More Than A FeildingBy David Slack3 days ago

David has, unfortunately, been losing pieces of himself and turns out it’s a bit hard to write a column when the affected parts are your eyeballs and it’s painful to read, so I offered to add to his pain by writing a guest column for him and the fool said ...More Than A FeildingBy David Slack3 days ago - Climate Change: An alternative plan

The government is supposed to release its second Emissions Reduction Plan any day now, and if its anything like the draft, it will be a pile of false accounting and wishful thinking, which will do nothing to actually reduce emissions. The central problem here is that national is legally required ...No Right TurnBy Idiot/Savant3 days ago

The government is supposed to release its second Emissions Reduction Plan any day now, and if its anything like the draft, it will be a pile of false accounting and wishful thinking, which will do nothing to actually reduce emissions. The central problem here is that national is legally required ...No Right TurnBy Idiot/Savant3 days ago - Monday 9 December

The families of two workers killed in the forestry industry are pushing for a boss connected to both deaths to be pushed out of the industry, highlighting the need for corporate manslaughter legislation. Politicians are heading to Tokoroa to attend the Save Our Mill meeting regarding the significant proposed job ...NZCTUBy Jack McDonald3 days ago

The families of two workers killed in the forestry industry are pushing for a boss connected to both deaths to be pushed out of the industry, highlighting the need for corporate manslaughter legislation. Politicians are heading to Tokoroa to attend the Save Our Mill meeting regarding the significant proposed job ...NZCTUBy Jack McDonald3 days ago - Climate Change: Sabotaging the Climate Commission

Throughout its term in government National has been annoyed by repeated unwelcome advice from He Pou a Rangi Climate Change Commission to move faster, do more, or even just do something. But Rod Carr's term as commission chair expired over the weekend, as did those of two other board members. ...No Right TurnBy Idiot/Savant3 days ago

Throughout its term in government National has been annoyed by repeated unwelcome advice from He Pou a Rangi Climate Change Commission to move faster, do more, or even just do something. But Rod Carr's term as commission chair expired over the weekend, as did those of two other board members. ...No Right TurnBy Idiot/Savant3 days ago - I Put A Spell On You

You know I can't stand itYou're running aroundYou know better, daddyI can't stand it 'cause you put me downOh, noI put a spell on youBecause you're mineSongwriter: Jay Hawkins.Please note that there is a paywall later in this newsletter, so before I begin, a reminder of my current offers and ...Nick’s KōreroBy Nick Rockel3 days ago

You know I can't stand itYou're running aroundYou know better, daddyI can't stand it 'cause you put me downOh, noI put a spell on youBecause you're mineSongwriter: Jay Hawkins.Please note that there is a paywall later in this newsletter, so before I begin, a reminder of my current offers and ...Nick’s KōreroBy Nick Rockel3 days ago - A Confession

Hi,I have a confession to make — I have been on holiday. I don’t really do holidays. They fill me with guilt. I need to be making something, or trying to make something. It’s all tied in with my sense of self worth, but we’ll get to that another day.I’ve ...David FarrierBy David Farrier3 days ago

Hi,I have a confession to make — I have been on holiday. I don’t really do holidays. They fill me with guilt. I need to be making something, or trying to make something. It’s all tied in with my sense of self worth, but we’ll get to that another day.I’ve ...David FarrierBy David Farrier3 days ago - Simeon Brown alienates another National electorate

Brown’s abrupt and ideological rulings have overturned locally driven plans and expectations and angered locals in yet another National electorate. Photo: Lynn GrievesonMōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and poverty on Monday, December 9 are:Warkworth residents are angry that Transport ...The KakaBy Bernard Hickey3 days ago

Brown’s abrupt and ideological rulings have overturned locally driven plans and expectations and angered locals in yet another National electorate. Photo: Lynn GrievesonMōrena. Long stories short, the six things that matter in Aotearoa’s political economy around housing, climate and poverty on Monday, December 9 are:Warkworth residents are angry that Transport ...The KakaBy Bernard Hickey3 days ago - Monday Wrap Up: Politics News

1. Anti-red tape ministry advises against anti-red tape bill (The Post, Andrea Vance)David Seymour's anti-red tape ministry says his new bill to slash red tape is unnecessary.An interim regulatory impact statement from [The Ministry of Regulation] said while it supports the overall objectives [of Seymour’s bill], it says the legislation ...Mountain TuiBy Mountain Tui3 days ago

1. Anti-red tape ministry advises against anti-red tape bill (The Post, Andrea Vance)David Seymour's anti-red tape ministry says his new bill to slash red tape is unnecessary.An interim regulatory impact statement from [The Ministry of Regulation] said while it supports the overall objectives [of Seymour’s bill], it says the legislation ...Mountain TuiBy Mountain Tui3 days ago - Simeon Brown’s fanaticism kills Warkworth intersection fix

I grew up in Warkworth, and the infamous Hill Street intersection has been an issue not just my whole life, but for decades before I was even born. My dad told me stories of how, back in the 80s, he’d set up seats overlooking the intersection and sit watching the ...Greater AucklandBy Connor Sharp3 days ago

I grew up in Warkworth, and the infamous Hill Street intersection has been an issue not just my whole life, but for decades before I was even born. My dad told me stories of how, back in the 80s, he’d set up seats overlooking the intersection and sit watching the ...Greater AucklandBy Connor Sharp3 days ago - Gordon Campbell on the fall of Assad, and the new Dylan movie

Hold the champagne. Ugly and brutal as it was, the Assad regime may have been the lesser evil for Syria, the Middle East region and the rest of the world. The last time an extremist Sunni fighting force – called Islamic State (IS) – exerted control over large swathes of ...WerewolfBy ScoopEditor4 days ago

Hold the champagne. Ugly and brutal as it was, the Assad regime may have been the lesser evil for Syria, the Middle East region and the rest of the world. The last time an extremist Sunni fighting force – called Islamic State (IS) – exerted control over large swathes of ...WerewolfBy ScoopEditor4 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #49

A listing of 24 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 1, 2024 thru Sat, December 7, 2024. Alternative listing prototype Instead of a "Story of the Week" we added a listing by assigned category, so this installment will ...4 days ago

A listing of 24 news and opinion articles we found interesting and shared on social media during the past week: Sun, December 1, 2024 thru Sat, December 7, 2024. Alternative listing prototype Instead of a "Story of the Week" we added a listing by assigned category, so this installment will ...4 days ago - Mokopuna Thinking

Because the sky is blueIt makes me crySongwriters: Paul McCartney / John Lennon.This morning, I went along to the launch of the Greens’ alternative plan for emissions reduction. Contrasting the coalition’s approach of burying their head in the sand and glowering “thou shalt not” at others who try to stop ...Nick’s KōreroBy Nick Rockel4 days ago

Because the sky is blueIt makes me crySongwriters: Paul McCartney / John Lennon.This morning, I went along to the launch of the Greens’ alternative plan for emissions reduction. Contrasting the coalition’s approach of burying their head in the sand and glowering “thou shalt not” at others who try to stop ...Nick’s KōreroBy Nick Rockel4 days ago - Are Lester Levy and Shane Reti “cooking the books?”

This news piece is important enough it serves as a recap of events:Please consider supporting my work if you can afford to.In July, after most Health NZ Board members had already resigned – many without notice and it was starting to look embarrassing for the sitting Government - Shane Reti ...Mountain TuiBy Mountain Tui5 days ago

This news piece is important enough it serves as a recap of events:Please consider supporting my work if you can afford to.In July, after most Health NZ Board members had already resigned – many without notice and it was starting to look embarrassing for the sitting Government - Shane Reti ...Mountain TuiBy Mountain Tui5 days ago - Watching the Tide

So I'm just gonna sit on the dock of the bayWatching the tide roll awayI'm sittin' on the dock of the bayWastin' timeSongwriters: Stephen Lee Cropper / Otis ReddingChristmas PartiesAs you might recall from yesterday’s newsletter, last night was Christmas Party time for the Rockels.One of the younger members of ...Nick’s KōreroBy Nick Rockel5 days ago

So I'm just gonna sit on the dock of the bayWatching the tide roll awayI'm sittin' on the dock of the bayWastin' timeSongwriters: Stephen Lee Cropper / Otis ReddingChristmas PartiesAs you might recall from yesterday’s newsletter, last night was Christmas Party time for the Rockels.One of the younger members of ...Nick’s KōreroBy Nick Rockel5 days ago - My Saturday Soliloquy for Dec 7

Mōrena. Long stories short, the six things that mattered in Aotearoa’s political economy around housing, climate and poverty in this week were:PM Christopher Luxon said his Goverment was ‘re-learning’ the austerity-infused economic lessons taught by former National Finance Minister Ruth Richardson in 1991, when she slashed spending to reduce public ...The KakaBy Bernard Hickey5 days ago

Mōrena. Long stories short, the six things that mattered in Aotearoa’s political economy around housing, climate and poverty in this week were:PM Christopher Luxon said his Goverment was ‘re-learning’ the austerity-infused economic lessons taught by former National Finance Minister Ruth Richardson in 1991, when she slashed spending to reduce public ...The KakaBy Bernard Hickey5 days ago - TKP 26/50 solutions: A new home without a power bill

As part of The Kākā Project of 2026 for 2050 (TKP 26/50) and When The Facts Change ,I interviewed Octopus Energy Zero Bills Technical Director Nigel Banks from the UK about this week's launch in New Zealand of a partnership with Classic Homes to build new homes in Auckland1 with ...The KakaBy Bernard Hickey5 days ago

As part of The Kākā Project of 2026 for 2050 (TKP 26/50) and When The Facts Change ,I interviewed Octopus Energy Zero Bills Technical Director Nigel Banks from the UK about this week's launch in New Zealand of a partnership with Classic Homes to build new homes in Auckland1 with ...The KakaBy Bernard Hickey5 days ago - A wellbeing economy is the only option!

I recently attended a conference organised by WEALL (Wellbeing Economy Alliance) Aotearoa. WEALL defines 'economy' differently from the current neoliberal approach and that is simply 'the way that we produce and provide for one another'. Attending this conference made me even more aware of how far we have drifted away ...6 days ago

I recently attended a conference organised by WEALL (Wellbeing Economy Alliance) Aotearoa. WEALL defines 'economy' differently from the current neoliberal approach and that is simply 'the way that we produce and provide for one another'. Attending this conference made me even more aware of how far we have drifted away ...6 days ago - Interview with John Cook about misinformation and artificial intelligence

In March, John Cook met with Adam Ford from Science, Technology & the Future to talk about his work researching misinformation and how to counter it. The interview - published on October 10 - explored the complex and evolving landscape of climate misinformation, covering a range of topics including the different types ...6 days ago

In March, John Cook met with Adam Ford from Science, Technology & the Future to talk about his work researching misinformation and how to counter it. The interview - published on October 10 - explored the complex and evolving landscape of climate misinformation, covering a range of topics including the different types ...6 days ago - Economic Progress May Not Add To Wellbeing

How the Prospect Theory of Behavioural Economics Makes Economic Analysis DifficultBehavioural economics has been described as the most revolutionary thing which has happened to economics for ages. The notion that people do not behave like ‘rational economic men’ (women are mainly ignored) undermines the microeconomic foundations of the subject. Not ...PunditBy Brian Easton6 days ago

How the Prospect Theory of Behavioural Economics Makes Economic Analysis DifficultBehavioural economics has been described as the most revolutionary thing which has happened to economics for ages. The notion that people do not behave like ‘rational economic men’ (women are mainly ignored) undermines the microeconomic foundations of the subject. Not ...PunditBy Brian Easton6 days ago - National finds out

Since coming to power last year, National has viciously cut the public service, sacking nearly 10,000 public servants (to date). Those people weren't just doing nothing, and it was obviously going to have an impact on something other than the government's books. But while National's over-paid, privately-insured, and DPS-guarded Ministers ...No Right TurnBy Idiot/Savant6 days ago

Since coming to power last year, National has viciously cut the public service, sacking nearly 10,000 public servants (to date). Those people weren't just doing nothing, and it was obviously going to have an impact on something other than the government's books. But while National's over-paid, privately-insured, and DPS-guarded Ministers ...No Right TurnBy Idiot/Savant6 days ago - Lockout of disability workers before Christmas unacceptable

NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh is condemning the actions of disability support provider Te Roopu Taurima o Manukau Trust in deciding to respond to legitimate strike action by locking out their workers with just a few weeks before Christmas. “The actions of Te Roopu Taurima are totally ...NZCTUBy Jeremiah Boniface6 days ago

NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh is condemning the actions of disability support provider Te Roopu Taurima o Manukau Trust in deciding to respond to legitimate strike action by locking out their workers with just a few weeks before Christmas. “The actions of Te Roopu Taurima are totally ...NZCTUBy Jeremiah Boniface6 days ago - Friday 6 December

In another blow to the media landscape, Māori TV’s daily news service is set to end after 20 years, following the announcement that they have cut 27 jobs. PSA members at MBIE have voted to initiate industrial action, after rejecting a pay offer because it failed to keep up with ...NZCTUBy Jack McDonald6 days ago

In another blow to the media landscape, Māori TV’s daily news service is set to end after 20 years, following the announcement that they have cut 27 jobs. PSA members at MBIE have voted to initiate industrial action, after rejecting a pay offer because it failed to keep up with ...NZCTUBy Jack McDonald6 days ago - An experiment and our Christmas offer to subscribe to The Kākā

Photo: Lynn Grieveson / The KākāIt’s that time of the year when we offer 50% off for a year to new subscribers for the next fortnight until December 21, which is ‘Gravy Day’1. It’s our version of a Christmas/Black Monday/Cyber Monday/Singles Day/Boxing Day offer. We call it the ‘Gravy Day ...The KakaBy Bernard Hickey6 days ago

Photo: Lynn Grieveson / The KākāIt’s that time of the year when we offer 50% off for a year to new subscribers for the next fortnight until December 21, which is ‘Gravy Day’1. It’s our version of a Christmas/Black Monday/Cyber Monday/Singles Day/Boxing Day offer. We call it the ‘Gravy Day ...The KakaBy Bernard Hickey6 days ago - The State of David Seymour’s Shameless Condescension and Unbridled Arrogance

.Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..Setting the stageQuestion: How does one make money, when something stands in the way?Answer: Get rid of that thing. Or at least dilute it.Present Day, Aotearoa New ZealandIn his Beehive media statement, Seymour recently ...Frankly SpeakingBy Frank Macskasy6 days ago

.Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..Setting the stageQuestion: How does one make money, when something stands in the way?Answer: Get rid of that thing. Or at least dilute it.Present Day, Aotearoa New ZealandIn his Beehive media statement, Seymour recently ...Frankly SpeakingBy Frank Macskasy6 days ago - Weekly Roundup 06-December-2024

It’s another Friday and it has been a big week in Auckland. We hope everyone’s excited to be in the final stretch of the year! Here’s some of the stories that have caught our attention this week. This post, like all our work, is brought to you by a largely ...Greater AucklandBy Greater Auckland6 days ago

It’s another Friday and it has been a big week in Auckland. We hope everyone’s excited to be in the final stretch of the year! Here’s some of the stories that have caught our attention this week. This post, like all our work, is brought to you by a largely ...Greater AucklandBy Greater Auckland6 days ago - The Days Go By

It must be your skin, I'm sinkin' inIt must be for real, 'cause now I can feelAnd I didn't mind, it's not my kindIt's not my time to wonder whySongwriter: Gavin Rossdale.As the year winds up, I’m feeling a bit mentally drained, so today’s newsletter is one of reminiscing. Today, ...Nick’s KōreroBy Nick Rockel6 days ago

It must be your skin, I'm sinkin' inIt must be for real, 'cause now I can feelAnd I didn't mind, it's not my kindIt's not my time to wonder whySongwriter: Gavin Rossdale.As the year winds up, I’m feeling a bit mentally drained, so today’s newsletter is one of reminiscing. Today, ...Nick’s KōreroBy Nick Rockel6 days ago - The Hoon around the week to December 6

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with: on Trade and Agriculture Minister Todd McClay saying New Zealand would not buy emissions credits overseas, effectively admitting we’ll renege on our Paris commitments. (RNZ) ...The KakaBy Bernard Hickey6 days ago

The podcast above of the weekly ‘Hoon’ webinar for paying subscribers on Thursday night features co-hosts & talking about the week’s news with: on Trade and Agriculture Minister Todd McClay saying New Zealand would not buy emissions credits overseas, effectively admitting we’ll renege on our Paris commitments. (RNZ) ...The KakaBy Bernard Hickey6 days ago - Paying for National’s roads

The Government has promised 17 Roads of National Significance, but the brutal truth is that it cannot afford them. So Transport Minister Simeon Brown yesterday announced that from now on, tolls and other user charges will be the way New Zealand pays for new roading infrastructure. Tolls are likely ...PolitikBy Richard Harman6 days ago

The Government has promised 17 Roads of National Significance, but the brutal truth is that it cannot afford them. So Transport Minister Simeon Brown yesterday announced that from now on, tolls and other user charges will be the way New Zealand pays for new roading infrastructure. Tolls are likely ...PolitikBy Richard Harman6 days ago - Confession: Why Shane Reti & Ayesha Verrall’s Performance Helps Me

Video above. These videos are also designed for those not versed in the detailed subject matter so excuse any repeats of Health NZ facts you are aware of from reading Mountain Tui for too long!Recently, I read a Substack article which, on my brief skim, lamented the rise of critiquing ...Mountain TuiBy Mountain Tui6 days ago

Video above. These videos are also designed for those not versed in the detailed subject matter so excuse any repeats of Health NZ facts you are aware of from reading Mountain Tui for too long!Recently, I read a Substack article which, on my brief skim, lamented the rise of critiquing ...Mountain TuiBy Mountain Tui6 days ago - Skeptical Science New Research for Week #49 2024

Open access notables Global emergence of regional heatwave hotspots outpaces climate model simulations, Kornhuber et al., Proceedings of the National Academy of Sciences: Multiple recent record-shattering weather events raise questions about the adequacy of climate models to effectively predict and prepare for unprecedented climate impacts on human life, infrastructure, and ecosystems. Here, we ...7 days ago

Open access notables Global emergence of regional heatwave hotspots outpaces climate model simulations, Kornhuber et al., Proceedings of the National Academy of Sciences: Multiple recent record-shattering weather events raise questions about the adequacy of climate models to effectively predict and prepare for unprecedented climate impacts on human life, infrastructure, and ecosystems. Here, we ...7 days ago - The Bewildering World of Chris Luxon – Three Bad Polls – Three Strikes for National?

.Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..As I wrote on 3 December:“One bad poll for a government can be dismissed as “rogue”. Two? That’s damaging.”Three bad polls? That is when Red Alert lights start flashing; klaxons start to blare; and ...Frankly SpeakingBy Frank Macskasy7 days ago

.Thanks for reading Frankly Speaking ! Subscribe for free to receive new posts and support my work..As I wrote on 3 December:“One bad poll for a government can be dismissed as “rogue”. Two? That’s damaging.”Three bad polls? That is when Red Alert lights start flashing; klaxons start to blare; and ...Frankly SpeakingBy Frank Macskasy7 days ago - Climate Change: More unwelcome advice

He Pou a Rangi / Climate Change Commission has just released its Review of the 2050 emissions target including whether emissions from international shipping and aviation should be included. After noting that there have been significant changes since the target was originally set in 2019 - stronger evidence that we ...No Right TurnBy Idiot/Savant7 days ago

He Pou a Rangi / Climate Change Commission has just released its Review of the 2050 emissions target including whether emissions from international shipping and aviation should be included. After noting that there have been significant changes since the target was originally set in 2019 - stronger evidence that we ...No Right TurnBy Idiot/Savant7 days ago - Join us at 5pm for The Hoon

The KakaBy Bernard Hickey7 days ago

- No sweat

Let's say I want to run a marathon, but I’m not keen on all that running.At the registration desk I say, I want to start at the last kilometre. What's the fee for that?They tell me,We don't offer that option. You have to do the whole race.I reply,Yeah but I ...More Than A FeildingBy David Slack7 days ago

Let's say I want to run a marathon, but I’m not keen on all that running.At the registration desk I say, I want to start at the last kilometre. What's the fee for that?They tell me,We don't offer that option. You have to do the whole race.I reply,Yeah but I ...More Than A FeildingBy David Slack7 days ago - Climate Change: National wants to cheat on Paris II

Back in September, Climate Change Minister Simon Watts shocked us by suggesting that New Zealand could refuse to meet its international commitments under the Paris Agreement. Now Forestry Minister Todd McClay has echoed that position: Minister for Agriculture and Forestry Todd McClay says the Government won't be buying carbon ...No Right TurnBy Idiot/Savant7 days ago

Back in September, Climate Change Minister Simon Watts shocked us by suggesting that New Zealand could refuse to meet its international commitments under the Paris Agreement. Now Forestry Minister Todd McClay has echoed that position: Minister for Agriculture and Forestry Todd McClay says the Government won't be buying carbon ...No Right TurnBy Idiot/Savant7 days ago - Marsden Fund changes will undermine prosperity and social cohesion

The Government’s rewrite of the Marsden Fund’s investment plan and terms of reference demonstrates a complete lack of understanding and risks undermining the breadth of research that is essential for the wellbeing and prosperity of New Zealanders, said NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh. “Humanities and social science ...NZCTUBy Jeremiah Boniface1 week ago

The Government’s rewrite of the Marsden Fund’s investment plan and terms of reference demonstrates a complete lack of understanding and risks undermining the breadth of research that is essential for the wellbeing and prosperity of New Zealanders, said NZCTU Te Kauae Kaimahi Acting President Rachel Mackintosh. “Humanities and social science ...NZCTUBy Jeremiah Boniface1 week ago - Thursday 5 December

The Government has announced further changes to the personal grievance regime that will make it even tougher for workers, and changes to the Marsden Fund investment plan to stop funding for humanities and social sciences research. Workers at Kinleith mill are worried that they will lose even more jobs. A ...NZCTUBy Jack McDonald1 week ago

The Government has announced further changes to the personal grievance regime that will make it even tougher for workers, and changes to the Marsden Fund investment plan to stop funding for humanities and social sciences research. Workers at Kinleith mill are worried that they will lose even more jobs. A ...NZCTUBy Jack McDonald1 week ago - Can desalination quench agriculture’s thirst?

This article by Lela Nargi originally appeared in Knowable Magazine, a nonprofit publication dedicated to making scientific knowledge accessible to all. Sign up for Knowable Magazine’s newsletter. Ralph Loya was pretty sure he was going to lose the corn. His farm had been scorched by El Paso’s hottest-ever June and ...1 week ago

This article by Lela Nargi originally appeared in Knowable Magazine, a nonprofit publication dedicated to making scientific knowledge accessible to all. Sign up for Knowable Magazine’s newsletter. Ralph Loya was pretty sure he was going to lose the corn. His farm had been scorched by El Paso’s hottest-ever June and ...1 week ago

Related Posts

- Release: National Party urged to support modern slavery legislation

Labour is urging the Prime Minister to walk the talk and support legislation combating modern slavery. ...6 hours ago

Labour is urging the Prime Minister to walk the talk and support legislation combating modern slavery. ...6 hours ago - Release: Labour has lost confidence in the Speaker

The Speaker of the New Zealand Parliament made an unprecedented decision on the government amendment to the Fast Track Approvals Bill last night. ...6 hours ago

The Speaker of the New Zealand Parliament made an unprecedented decision on the government amendment to the Fast Track Approvals Bill last night. ...6 hours ago - One year on, still no progress on new ferries

Today’s announcement from the Government on its plan for new ferries throws more uncertainty on the future of the country’s rail network. ...1 day ago

Today’s announcement from the Government on its plan for new ferries throws more uncertainty on the future of the country’s rail network. ...1 day ago - Release: Nicola Willis’ smaller ferries will cost more

After wasting a year, Nicola Willis has delivered a worse deal for the Cook Strait ferries that will end up being more expensive and take longer to arrive. ...1 day ago

After wasting a year, Nicola Willis has delivered a worse deal for the Cook Strait ferries that will end up being more expensive and take longer to arrive. ...1 day ago - Bill to sanction unlawful occupation of Palestine

Green Party co-leader Chlöe Swarbrick has today launched a Member’s Bill to sanction Israel for its unlawful presence in the Occupied Palestinian Territory, as the All Out For Gaza rally reaches Parliament. ...1 day ago

Green Party co-leader Chlöe Swarbrick has today launched a Member’s Bill to sanction Israel for its unlawful presence in the Occupied Palestinian Territory, as the All Out For Gaza rally reaches Parliament. ...1 day ago - Release: Labour fully supports greyhound racing ban

2 days ago

- Greyhound racing industry ban marks new era for animal welfare

After years of advocacy, the Green Party is very happy to hear the Government has listened to our collective voices and announced the closure of the greyhound racing industry, by 1 August 2026. ...2 days ago

After years of advocacy, the Green Party is very happy to hear the Government has listened to our collective voices and announced the closure of the greyhound racing industry, by 1 August 2026. ...2 days ago - Rangatahi voices must be centred in Government’s Relationship and Sexuality Education refresh

In response to a new report from ERO, the Government has acknowledged the urgent need for consistency across the curriculum for Relationship and Sexuality Education (RSE) in schools. ...2 days ago

In response to a new report from ERO, the Government has acknowledged the urgent need for consistency across the curriculum for Relationship and Sexuality Education (RSE) in schools. ...2 days ago - Govt introduces archaic anti-worker legislation

The Green Party is appalled at the Government introducing legislation that will make it easier to penalise workers fighting for better pay and conditions. ...3 days ago

The Green Party is appalled at the Government introducing legislation that will make it easier to penalise workers fighting for better pay and conditions. ...3 days ago - Winston Peters – Kinleith Mill Speech

Thank you for the invitation to speak with you tonight on behalf of the political party I belong to - which is New Zealand First. As we have heard before this evening the Kinleith Mill is proposing to reduce operations by focusing on pulp and discontinuing “lossmaking paper production”. They say that they are currently consulting on the plan to permanently shut ...3 days ago

Thank you for the invitation to speak with you tonight on behalf of the political party I belong to - which is New Zealand First. As we have heard before this evening the Kinleith Mill is proposing to reduce operations by focusing on pulp and discontinuing “lossmaking paper production”. They say that they are currently consulting on the plan to permanently shut ...3 days ago - Swarbrick calls on Auckland Mayor to end delay of revival of St James Theatre

Auckland Central MP, Chlöe Swarbrick, has written to Mayor Wayne Brown requesting he stop the unnecessary delays on St James Theatre’s restoration. ...4 days ago

Auckland Central MP, Chlöe Swarbrick, has written to Mayor Wayne Brown requesting he stop the unnecessary delays on St James Theatre’s restoration. ...4 days ago - He Ara Anamata: Greens launch Emissions Reduction Plan

Today, the Green Party of Aotearoa proudly unveils its new Emissions Reduction Plan–He Ara Anamata–a blueprint reimagining our collective future. ...4 days ago

Today, the Green Party of Aotearoa proudly unveils its new Emissions Reduction Plan–He Ara Anamata–a blueprint reimagining our collective future. ...4 days ago - Fossil fuel lobbyist appointment to EECA board called out

The Green Party condemns the Government’s appointment of a fossil fuel lobbyist to the Energy Efficiency & Conservation Authority Board. ...6 days ago

The Green Party condemns the Government’s appointment of a fossil fuel lobbyist to the Energy Efficiency & Conservation Authority Board. ...6 days ago - Release: Boot camps must be shut down today

The Prime Minister has committed to shut down his government’s boot camps if there is evidence of harm to children – so he must do that today. ...6 days ago

The Prime Minister has committed to shut down his government’s boot camps if there is evidence of harm to children – so he must do that today. ...6 days ago - Greens echo OECD call for electricity market reform

The Green Party has welcomed the OECD urging the Government to re-examine separating ‘gentailers’ to make a fairer electricity market for New Zealanders. ...6 days ago

The Green Party has welcomed the OECD urging the Government to re-examine separating ‘gentailers’ to make a fairer electricity market for New Zealanders. ...6 days ago - Release: Govt breaks Auckland housing promise

1 week ago

- Government smokescreen to downgrade climate ambition

Today the ACT-National Coalition Agreement pet project’s findings on “no additional warming” were released. ...1 week ago

Today the ACT-National Coalition Agreement pet project’s findings on “no additional warming” were released. ...1 week ago - Release: Health NZ admits errors led to claimed deficit

1 week ago

- Release: More cuts to research, science and innovation sector

The Government’s latest round of cuts to research and innovation targets the long-established and successful Marsden Fund. ...1 week ago

The Government’s latest round of cuts to research and innovation targets the long-established and successful Marsden Fund. ...1 week ago - Govt guts funding for social sciences and humanities

The Government’s decision to axe all Humanities and Social Science research funding through the Marsden Fund is a massive step backwards. ...1 week ago

The Government’s decision to axe all Humanities and Social Science research funding through the Marsden Fund is a massive step backwards. ...1 week ago - You can’t bank on pine trees in a climate crisis

Today’s Government announcement to limit farm forestry conversions tinkers around the edges, instead of focusing on the real problem and stopping pollution at the source. ...1 week ago

Today’s Government announcement to limit farm forestry conversions tinkers around the edges, instead of focusing on the real problem and stopping pollution at the source. ...1 week ago - Release: Nicola Willis being sneaky with new taxes

1 week ago

- Release: Govt benefit target even further out of reach

Christopher Luxon has once again failed to read the room and claimed success while life gets harder for everyday Kiwis. ...1 week ago

Christopher Luxon has once again failed to read the room and claimed success while life gets harder for everyday Kiwis. ...1 week ago - Govt continues to punch down

The Government’s new initiative to get people off the benefit won’t address the core drivers of poverty such as low incomes, lack of access to adequate housing and lack of employment opportunities. ...1 week ago

The Government’s new initiative to get people off the benefit won’t address the core drivers of poverty such as low incomes, lack of access to adequate housing and lack of employment opportunities. ...1 week ago - Release: Labour urges ACC to pull investments in Israel’s illegal settlements

Labour is urging ACC to divest from companies identified by the United Nations as complicit in the building and maintenance of Israel’s illegal settlements in the Occupied Palestinian Territories. ...1 week ago

Labour is urging ACC to divest from companies identified by the United Nations as complicit in the building and maintenance of Israel’s illegal settlements in the Occupied Palestinian Territories. ...1 week ago - Release: Further evidence to stop school lunch cuts

A new report provides further proof that David Seymour should not be messing with the free school lunch programme. ...1 week ago

A new report provides further proof that David Seymour should not be messing with the free school lunch programme. ...1 week ago - Jamie Arbuckle: Inquiry into Banking Competition

This week was the start of the bank inquiry hearings into banking competition. The inquiry was confirmed in the NZ First/National Coalition agreement. 140 submissions were received on the inquiry, and we will hear from over 60 submitters including all the major banks. ANZ, New Zealand's largest bank, was first ...1 week ago

This week was the start of the bank inquiry hearings into banking competition. The inquiry was confirmed in the NZ First/National Coalition agreement. 140 submissions were received on the inquiry, and we will hear from over 60 submitters including all the major banks. ANZ, New Zealand's largest bank, was first ...1 week ago - Casey Costello: What Once Was…

Entering politics is a privilege afforded to very few and, as the saying goes, with great power comes great responsibility. Being an MP is a call to service. Whatever your politics you have a duty to show up. Whatever your party's policy, you have made a promise to those who ...1 week ago

Entering politics is a privilege afforded to very few and, as the saying goes, with great power comes great responsibility. Being an MP is a call to service. Whatever your politics you have a duty to show up. Whatever your party's policy, you have made a promise to those who ...1 week ago - Casey Costello: International Day of Older Persons

Throughout New Zealand it is difficult to think of a sports club, charity, church group, festival, foundation, or service organisation that does not owe its existence, effectiveness, or success to the contribution of older New Zealanders. October 1st is International Day of Older Persons so please take a moment to consider ...1 week ago

Throughout New Zealand it is difficult to think of a sports club, charity, church group, festival, foundation, or service organisation that does not owe its existence, effectiveness, or success to the contribution of older New Zealanders. October 1st is International Day of Older Persons so please take a moment to consider ...1 week ago - NZ First Member’s Bill To Disestablish Auckland Transport

Today New Zealand First has introduced a Member’s Bill that will restore democratic control over transport management in Auckland City by disestablishing Auckland Transport (AT) and returning control to Auckland Council. The ‘Local Government (Auckland Council) (Disestablishment of Auckland Transport) Amendment Bill’ intends to restore democratic oversight, control, and accountability ...1 week ago

Today New Zealand First has introduced a Member’s Bill that will restore democratic control over transport management in Auckland City by disestablishing Auckland Transport (AT) and returning control to Auckland Council. The ‘Local Government (Auckland Council) (Disestablishment of Auckland Transport) Amendment Bill’ intends to restore democratic oversight, control, and accountability ...1 week ago - Mark Patterson: Farmers understand we have their backs

Spring is here which means the start of the A&P show season. Those treasured community days where town meets country. There's no rural-urban divide here, just a chance to meet up with family and old friends and celebrate all things that make rural New Zealand so special. I'm embarking on ...1 week ago

Spring is here which means the start of the A&P show season. Those treasured community days where town meets country. There's no rural-urban divide here, just a chance to meet up with family and old friends and celebrate all things that make rural New Zealand so special. I'm embarking on ...1 week ago - Tanya Unkovich: It’s time to start the debate on palliative care as a ‘right’

There is one topic that is the great human leveller, and that is of death and dying. One day, we will all have to face it, and I am of the belief that being able to pass away with grace and dignity is a vital, basic, human right. How we ...1 week ago

There is one topic that is the great human leveller, and that is of death and dying. One day, we will all have to face it, and I am of the belief that being able to pass away with grace and dignity is a vital, basic, human right. How we ...1 week ago - Release: A Labour Government will not join AUKUS

New Zealand will not sign up to the nuclear-powered pillar one, or the pillar two of AUKUS under a Labour Government. ...2 weeks ago

New Zealand will not sign up to the nuclear-powered pillar one, or the pillar two of AUKUS under a Labour Government. ...2 weeks ago - Release: Labour will build Dunedin Hospital

2 weeks ago

- Chris Hipkins: Speech to Labour Party Conference 2024

2 weeks ago

- Luxon Folds on ACT’s Treaty Principles Bill

Te Pāti Māori Co-Leader, Debbie Ngarewa-Packer, is calling Luxon’s leadership a joke after it was revealed this morning on Q+A that ACT’s Treaty Principles Bill was not a bottom line. "New Zealand officially has a laughing-stock Prime Minister whose leadership folded as he trades away the rights of tangata whenua ...2 weeks ago

Te Pāti Māori Co-Leader, Debbie Ngarewa-Packer, is calling Luxon’s leadership a joke after it was revealed this morning on Q+A that ACT’s Treaty Principles Bill was not a bottom line. "New Zealand officially has a laughing-stock Prime Minister whose leadership folded as he trades away the rights of tangata whenua ...2 weeks ago - Prime Minister shirks responsibility on global climate commitment

In an interview with Q&A this morning, the Prime Minister refused to say whether he would commit to meeting the Paris Agreement, the international climate agreement which commits all countries to act locally to keep global warming below 1.5 degrees. ...2 weeks ago

In an interview with Q&A this morning, the Prime Minister refused to say whether he would commit to meeting the Paris Agreement, the international climate agreement which commits all countries to act locally to keep global warming below 1.5 degrees. ...2 weeks ago - Release: All workers deserve fair treatment

The Government’s latest change to the Employment Relations Act has no justification apart from making it easier to sack employees without having to follow due process. ...2 weeks ago

The Government’s latest change to the Employment Relations Act has no justification apart from making it easier to sack employees without having to follow due process. ...2 weeks ago - COURT OF APPEAL RULING: SFO METHODS “OVERREACH, UNLAWFUL, OPPRESSIVE”

Today the Court of Appeal has found the Serious Fraud Office has been acting indiscriminately and unlawfully throughout an eight year long investigation. The SFO has shown their incompetence and arrogance and shown to be abusing their authority to conduct its own overreaching and unlawful fishing expeditions. The Court of Appeal said the SFO has relied on its misuse of compulsory interview ...2 weeks ago

Today the Court of Appeal has found the Serious Fraud Office has been acting indiscriminately and unlawfully throughout an eight year long investigation. The SFO has shown their incompetence and arrogance and shown to be abusing their authority to conduct its own overreaching and unlawful fishing expeditions. The Court of Appeal said the SFO has relied on its misuse of compulsory interview ...2 weeks ago - Covid Inquiry report underlines need to invest in Health

The Green Party says the report from the Royal Commission of Inquiry into the Covid-19 Response underlines the need for proper investment in our health system so we are prepared for future pandemics. ...2 weeks ago

The Green Party says the report from the Royal Commission of Inquiry into the Covid-19 Response underlines the need for proper investment in our health system so we are prepared for future pandemics. ...2 weeks ago

Related Posts

- Karen Walker and Keven Mealamu join CNZ Board