GST up? It depends

GST up? It depends

Written By:

Marty G - Date published:

5:08 am, August 19th, 2009 - 40 comments

Categories: tax -

Tags:

The Government’s Tax Working Group has proposed increasing GST to 15-20% to pay for cuts to income tax. I’m not automatically against GST or even raising it, if it’s part of the right package. Here’s the issues as I see them:

Points in favour of increasing GST

Taxing spending is better than taxing income: generally, the government should tax things that it wants to discourage and not tax good things like work. That’s the logic behind implementing a capital gains tax, and the same logic can be applied to GST. We buy too much as a nation, our savings rate is too low, and that is a major contributor to our current account deficit. A higher GST might change that balance some what, and allow us to take some of the burden off income. By allowing cuts to income tax, raising GST would decrease the ‘tax wedge’ (the amount an employer must pay the government on top of net wages to employ someone), which is already one of the smallest in the OECD – this could lead to more jobs.

Taxing consumption is better than taxing work: this consumerist society is environmentally unsustainable, GST as a tax on consumption can discourage it. It’s not as good a tool as precise a tool as levies or quota for resource use but it’s something.

Points against it

Elasticity of GST expenditure: The wealthy are more able to reduce their spending on things that attract GST if the tax goes up – more on housing (you don’t pay GST on a house), less on plasma TVs. The poor can’t change their behaviour to avoid the tax because they’re spending most of their money on the basics.

Fuelling housing: GST up makes putting your money in houses even more attractive. The last thing we want to do is make housing a more attractive investment. We’ve just had one housing bubble resulting from over-invesmtent in housing and, before that one has even deflated, another one is getting underway. It’s all going to end in tears and if higher GST makes the bubble bigger it will just be harder on us in the end.

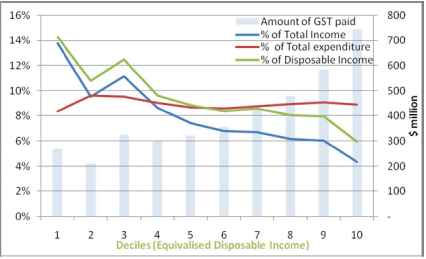

GST is regressive: the poor pay a higher portion of their income on a sales tax than the rich do.

(source: tax working group)

A tax system ought to be designed so that the cost of paying for a given level of government spending is shouldered principally by the well-off, not the poor who can barely make do as it is. That means it needs to be progressive – low on low incomes, higher on high incomes. GST does not meet that test.

The big question

Who benefits?: Any increase in GST would be revenue neutral, paying for tax cuts elsewhere. As GST works against the aim of a progressive tax system, any increase should be used to make the income tax system more progressive. Increased GST revenue shouldn’t be used to pay for cutting the top tax rates – that would just constitute a transfer of wealth from poor to rich. It should be used to cut the bottom rate or fund a tax-free bracket. The revenue from raising GST to 15% could fund a $6000 tax-free bracket benefiting everyone, or it could be used to cut the top tax rate to 27%, with most of the benefit flowing to the most wealthy 3% on $100,000+ and the 2.6 million taxpayers with incomes below $48,000 getting nothing. Which do you think Key’s Government would choose?

Reforming the tax system to put the burden on consumerism, rather than work is not bad in itself. As part of a package along with a bottom-end cut to income tax and a capital gains tax, it would be OK but my fear is that this government will just increase GST to pay for tax cuts for the rich. That would be nothing but a giant transfer of wealth from the poor to the already wealthy – something no decent person should support.

Related Posts

40 comments on “GST up? It depends ”

- Comments are now closed

- Comments are now closed

Recent Comments

- alwyn to Subliminal on

- Subliminal on

- Phillip ure to Phillip ure on

- Phillip ure to Traveller on

- Drowsy M. Kram to Traveller on

- Drowsy M. Kram to Traveller on

- adam on

- Obtrectator on

- Traveller to Drowsy M. Kram on

- weka to UncookedSelachimorpha on

- weka to James Simpson on

- Traveller to Drowsy M. Kram on

- James Simpson to weka on

- Phillip ure on

- That_guy to Tabletennis on

- Drowsy M. Kram to alwyn on

- Corey on

- woodart on

- woodart on

- alwyn to Tony Veitch on

- alwyn to Bearded Git on

- Shanreagh on

- Drowsy M. Kram to Traveller on

- Phillip ure on

- Phillip ure on

- Graeme to Belladonna on

- Traveller to Drowsy M. Kram on

- Drowsy M. Kram to Traveller on

- Tabletennis to That_guy on

- Obtrectator on

- Visubversa on

- Phillip ure on

- Phillip ure on

- Phillip ure to Bearded Git on

- SPC on

- Tabletennis to Tony Veitch on

- Bearded Git to Phillip urel on

- Rodel on

- SPC on

- Rosielee on

- bwaghorn on

- Phillip ure on

- Phillip ure on

- ianmac to Hunter Thompson II on

- Adders on

- That_guy on

- Phillip ure on

- Adders on

- That_guy on

- Phillip urel to Bearded Git on

- Phillip urel on

- weka on

- Kat on

- Jason on

- roblogic on

- Ffloyd on

- Rosielee on

- Ffloyd on

- weka on

- Michael on

- Kay on

- Kay on

- Gosman on

- Bearded Git to observer on

- Traveller on

- bwaghorn on

- Janice to pohutukawakid on

- thinker to James Simpson on

- thinker to Phillip urel on

- observer to Bearded Git on

- Tony Veitch to Ad on

- Bearded Git to Ad on

- Bearded Git to observer on

- mpledger to Belladonna on

- pohutukawakid to Anne on

- Nic the NZer to alwyn on

- Ad on

- observer on

- alwyn on

- SPC on

- Kat to Belladonna on

- observer on

- Ad on

- bwaghorn to pohutukawakid on

Recent Posts

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by advantage

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

- Your mandate is imaginary

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack1 hour ago

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack1 hour ago - 14,000 unemployed under National

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant4 hours ago

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant4 hours ago - Bryce Edwards: Discontent and gloom dominate NZ’s political mood

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards4 hours ago

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards4 hours ago - Taking Tea with 42 & 38.

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel5 hours ago

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel5 hours ago - Beware political propaganda: statistics are pointing to Grant Robertson never protecting “Lives an...

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54436 hours ago

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54436 hours ago - Winding back the hands of history’s clock

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54436 hours ago

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54436 hours ago - Paula Bennett’s political appointment will challenge public confidence

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry6 hours ago

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry6 hours ago - Business confidence sliding into winter of discontent

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey8 hours ago

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey8 hours ago - Gordon Campbell on the coalition’s awful, not good, very bad poll results

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon9 hours ago

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon9 hours ago - New HOP readers for future payment options

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L10 hours ago

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L10 hours ago - 2024 Reading Summary: April (+ Writing Update)

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda22122 hours ago

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda22122 hours ago - At a glance – Clearing up misconceptions regarding 'hide the decline'

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...1 day ago

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...1 day ago - Road photos

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack1 day ago

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack1 day ago - Bryce Edwards: Paula Bennett’s political appointment will challenge public confidence

The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill English, Simon Bridges, Steven Joyce, Roger Sowry, ...Democracy ProjectBy bryce.edwards1 day ago

The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill English, Simon Bridges, Steven Joyce, Roger Sowry, ...Democracy ProjectBy bryce.edwards1 day ago - NZDF is still hostile to oversight

Newsroom has a story today about National's (fortunately failed) effort to disestablish the newly-created Inspector-General of Defence. The creation of this agency was the key recommendation of the Inquiry into Operation Burnham, and a vital means of restoring credibility and social licence to an agency which had been caught lying ...No Right TurnBy Idiot/Savant1 day ago

Newsroom has a story today about National's (fortunately failed) effort to disestablish the newly-created Inspector-General of Defence. The creation of this agency was the key recommendation of the Inquiry into Operation Burnham, and a vital means of restoring credibility and social licence to an agency which had been caught lying ...No Right TurnBy Idiot/Savant1 day ago - Winding Back The Hands Of History’s Clock.

Holding On To The Present: The moment a political movement arises that attacks the whole idea of social progress, and announces its intention to wind back the hands of History’s clock, then democracy, along with its unwritten rules, is in mortal danger.IT’S A COMMONPLACE of political speeches, especially those delivered in ...1 day ago

Holding On To The Present: The moment a political movement arises that attacks the whole idea of social progress, and announces its intention to wind back the hands of History’s clock, then democracy, along with its unwritten rules, is in mortal danger.IT’S A COMMONPLACE of political speeches, especially those delivered in ...1 day ago - Sweet Moderation? What Christopher Luxon Could Learn From The Germans.1 day ago

- A clear warning

The unpopular coalition government is currently rushing to repeal section 7AA of the Oranga Tamariki Act. The clause is Oranga Tamariki's Treaty clause, and was inserted after its systematic stealing of Māori children became a public scandal and resulted in physical resistance to further abductions. The clause created clear obligations ...No Right TurnBy Idiot/Savant1 day ago

The unpopular coalition government is currently rushing to repeal section 7AA of the Oranga Tamariki Act. The clause is Oranga Tamariki's Treaty clause, and was inserted after its systematic stealing of Māori children became a public scandal and resulted in physical resistance to further abductions. The clause created clear obligations ...No Right TurnBy Idiot/Savant1 day ago - Poll results and Waitangi Tribunal report go unmentioned on the Beehive website – where racing tru...

Buzz from the Beehive The government’s official website – which Point of Order monitors daily – not for the first time has nothing much to say today about political happenings that are grabbing media headlines. It makes no mention of the latest 1News-Verian poll, for example. This shows National down ...Point of OrderBy Bob Edlin1 day ago

Buzz from the Beehive The government’s official website – which Point of Order monitors daily – not for the first time has nothing much to say today about political happenings that are grabbing media headlines. It makes no mention of the latest 1News-Verian poll, for example. This shows National down ...Point of OrderBy Bob Edlin1 day ago - Listening To The Traffic.1 day ago

- Comity Be Damned! The State’s Legislative Arm Is Flexing Its Constitutional Muscles.

Packing A Punch: The election of the present government, including in its ranks politicians dedicated to reasserting the rights of the legislature in shaping and determining the future of Māori and Pakeha in New Zealand, should have alerted the judiciary – including its anomalous appendage, the Waitangi Tribunal – that its ...1 day ago

Packing A Punch: The election of the present government, including in its ranks politicians dedicated to reasserting the rights of the legislature in shaping and determining the future of Māori and Pakeha in New Zealand, should have alerted the judiciary – including its anomalous appendage, the Waitangi Tribunal – that its ...1 day ago - Ending The Quest.

Dead Woman Walking: New Zealand’s media industry had been moving steadily towards disaster for all the years Melissa Lee had been National’s media and communications policy spokesperson, and yet, when the crisis finally broke, on her watch, she had nothing intelligent to offer. Christopher Luxon is a patient man - but he’s not ...1 day ago

Dead Woman Walking: New Zealand’s media industry had been moving steadily towards disaster for all the years Melissa Lee had been National’s media and communications policy spokesperson, and yet, when the crisis finally broke, on her watch, she had nothing intelligent to offer. Christopher Luxon is a patient man - but he’s not ...1 day ago - Will political polarisation intensify to the point where ‘normal’ government becomes impossible,...

Chris Trotter writes – New Zealand politics is remarkably easy-going: dangerously so, one might even say. With the notable exception of John Key’s flat ruling-out of the NZ First Party in 2008, all parties capable of clearing MMP’s five-percent threshold, or winning one or more electorate seats, tend ...Point of OrderBy poonzteam54431 day ago

Chris Trotter writes – New Zealand politics is remarkably easy-going: dangerously so, one might even say. With the notable exception of John Key’s flat ruling-out of the NZ First Party in 2008, all parties capable of clearing MMP’s five-percent threshold, or winning one or more electorate seats, tend ...Point of OrderBy poonzteam54431 day ago - Bernard’s pick 'n' mix for Tuesday, April 30

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:30am on Tuesday, May 30:Scoop: NZ 'close to the tipping point' of measles epidemic, health experts warn NZ Herald Benjamin PlummerHealth: 'Absurd and totally unacceptable': Man has to wait a year for ...The KakaBy Bernard Hickey1 day ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:30am on Tuesday, May 30:Scoop: NZ 'close to the tipping point' of measles epidemic, health experts warn NZ Herald Benjamin PlummerHealth: 'Absurd and totally unacceptable': Man has to wait a year for ...The KakaBy Bernard Hickey1 day ago - Why Tory Whanau has the lowest approval rating in the country

Bryce Edwards writes – Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is ...Point of OrderBy poonzteam54431 day ago

Bryce Edwards writes – Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is ...Point of OrderBy poonzteam54431 day ago - Worst poll result for a new Government in MMP historyThe KakaBy Bernard Hickey1 day ago

- Pinning down climate change's role in extreme weather

This is a re-post from The Climate Brink by Andrew Dessler In the wake of any unusual weather event, someone inevitably asks, “Did climate change cause this?” In the most literal sense, that answer is almost always no. Climate change is never the sole cause of hurricanes, heat waves, droughts, or ...1 day ago

This is a re-post from The Climate Brink by Andrew Dessler In the wake of any unusual weather event, someone inevitably asks, “Did climate change cause this?” In the most literal sense, that answer is almost always no. Climate change is never the sole cause of hurricanes, heat waves, droughts, or ...1 day ago - Serving at Seymour's pleasure.

Something odd happened yesterday, and I’d love to know if there’s more to it. If there was something which preempted what happened, or if it was simply a throwaway line in response to a journalist.Yesterday David Seymour was asked at a press conference what the process would be if the ...Nick’s KōreroBy Nick Rockel1 day ago

Something odd happened yesterday, and I’d love to know if there’s more to it. If there was something which preempted what happened, or if it was simply a throwaway line in response to a journalist.Yesterday David Seymour was asked at a press conference what the process would be if the ...Nick’s KōreroBy Nick Rockel1 day ago - Webworm LA Pop-Up

Hi,From time to time, I want to bring Webworm into the real world. We did it last year with the Jurassic Park event in New Zealand — which was a lot of fun!And so on Saturday May 11th, in Los Angeles, I am hosting a lil’ Webworm pop-up! I’ve been ...David FarrierBy David Farrier2 days ago

Hi,From time to time, I want to bring Webworm into the real world. We did it last year with the Jurassic Park event in New Zealand — which was a lot of fun!And so on Saturday May 11th, in Los Angeles, I am hosting a lil’ Webworm pop-up! I’ve been ...David FarrierBy David Farrier2 days ago - “Feel good” school is out

Education Minister Erica Standford yesterday unveiled a fundamental reform of the way our school pupils are taught. She would not exactly say so, but she is all but dismantling the so-called “inquiry” “feel good” method of teaching, which has ruled in our classrooms since a major review of the New ...PolitikBy Richard Harman2 days ago

Education Minister Erica Standford yesterday unveiled a fundamental reform of the way our school pupils are taught. She would not exactly say so, but she is all but dismantling the so-called “inquiry” “feel good” method of teaching, which has ruled in our classrooms since a major review of the New ...PolitikBy Richard Harman2 days ago - 6 Months in, surely our Report Card is “Ignored all warnings: recommend dismissal ASAP”?

Exactly where are we seriously going with this government and its policies? That is, apart from following what may as well be a Truss-Lite approach on the purported economic “plan“, and Victorian-era regression when it comes to social policy. Oh it’ll work this time of course, we’re basically assured, “the ...exhALANtBy exhalantblog2 days ago

Exactly where are we seriously going with this government and its policies? That is, apart from following what may as well be a Truss-Lite approach on the purported economic “plan“, and Victorian-era regression when it comes to social policy. Oh it’ll work this time of course, we’re basically assured, “the ...exhALANtBy exhalantblog2 days ago - Bread, and how it gets buttered

Hey Uncle Dave, When the Poms joined the EEC, I wasn't one of those defeatists who said, Well, that’s it for the dairy job. And I was right, eh? The Chinese can’t get enough of our milk powder and eventually, the Poms came to their senses and backed up the ute ...More Than A FeildingBy David Slack2 days ago

Hey Uncle Dave, When the Poms joined the EEC, I wasn't one of those defeatists who said, Well, that’s it for the dairy job. And I was right, eh? The Chinese can’t get enough of our milk powder and eventually, the Poms came to their senses and backed up the ute ...More Than A FeildingBy David Slack2 days ago - Bryce Edwards: Why Tory Whanau has the lowest approval rating in the country

Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is higher than for any other mayor ...Democracy ProjectBy bryce.edwards2 days ago

Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is higher than for any other mayor ...Democracy ProjectBy bryce.edwards2 days ago - Justice for Gaza?

The New York Times reports that the International Criminal Court is about to issue arrest warrants for Israeli officials, including Prime Minister Benjamin Netanyahu, over their genocide in Gaza: Israeli officials increasingly believe that the International Criminal Court is preparing to issue arrest warrants for senior government officials on ...No Right TurnBy Idiot/Savant2 days ago

The New York Times reports that the International Criminal Court is about to issue arrest warrants for Israeli officials, including Prime Minister Benjamin Netanyahu, over their genocide in Gaza: Israeli officials increasingly believe that the International Criminal Court is preparing to issue arrest warrants for senior government officials on ...No Right TurnBy Idiot/Savant2 days ago - If there has been any fiddling with Pharmac’s funding, we can count on Paula to figure out the fis...

Buzz from the Beehive Pharmac has been given a financial transfusion and a new chair to oversee its spending in the pharmaceutical business. Associate Health Minister David Seymour described the funding for Pharmac as “its largest ever budget of $6.294 billion over four years, fixing a $1.774 billion fiscal cliff”. ...Point of OrderBy Bob Edlin2 days ago

Buzz from the Beehive Pharmac has been given a financial transfusion and a new chair to oversee its spending in the pharmaceutical business. Associate Health Minister David Seymour described the funding for Pharmac as “its largest ever budget of $6.294 billion over four years, fixing a $1.774 billion fiscal cliff”. ...Point of OrderBy Bob Edlin2 days ago - FastTrackWatch – The case for the Government’s Fast Track Bill

Bryce Edwards writes – Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its ...Point of OrderBy poonzteam54432 days ago

Bryce Edwards writes – Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its ...Point of OrderBy poonzteam54432 days ago - Bernard’s pick 'n' mix for Monday, April 29

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:10am on Monday, April 29:Scoop: The children's ward at Rotorua Hospital will be missing a third of its beds as winter hits because Te Whatu Ora halted an upgrade partway through to ...The KakaBy Bernard Hickey2 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:10am on Monday, April 29:Scoop: The children's ward at Rotorua Hospital will be missing a third of its beds as winter hits because Te Whatu Ora halted an upgrade partway through to ...The KakaBy Bernard Hickey2 days ago - Gordon Campbell on Iran killing its rappers, and searching for the invisible Dr. Reti

span class=”dropcap”>As hideous as David Seymour can be, it is worth keeping in mind occasionally that there are even worse political figures (and regimes) out there. Iran for instance, is about to execute the country’s leading hip hop musician Toomaj Salehi, for writing and performing raps that “corrupt” the nation’s ...Gordon CampbellBy lyndon2 days ago

span class=”dropcap”>As hideous as David Seymour can be, it is worth keeping in mind occasionally that there are even worse political figures (and regimes) out there. Iran for instance, is about to execute the country’s leading hip hop musician Toomaj Salehi, for writing and performing raps that “corrupt” the nation’s ...Gordon CampbellBy lyndon2 days ago - Auckland Rail Electrification 10 years old

Yesterday marked 10 years since the first electric train carried passengers in Auckland so it’s a good time to look back at it and the impact it has had. A brief history The first proposals for rail electrification in Auckland came in the 1920’s alongside the plans for earlier ...Greater AucklandBy Matt L2 days ago

Yesterday marked 10 years since the first electric train carried passengers in Auckland so it’s a good time to look back at it and the impact it has had. A brief history The first proposals for rail electrification in Auckland came in the 1920’s alongside the plans for earlier ...Greater AucklandBy Matt L2 days ago - Coalition's dirge of austerity and uncertainty is driving the economy into a deeper recessionThe KakaBy Bernard Hickey2 days ago

- Disability Funding or Tax Cuts.

You make people evil to punish the paststuck inside a sequel with a rotating castThe following photos haven’t been generated with AI, or modified in any way. They are flesh and blood, human beings. On the left is Galatea Young, a young mum, and her daughter Fiadh who has Angelman ...Nick’s KōreroBy Nick Rockel2 days ago

You make people evil to punish the paststuck inside a sequel with a rotating castThe following photos haven’t been generated with AI, or modified in any way. They are flesh and blood, human beings. On the left is Galatea Young, a young mum, and her daughter Fiadh who has Angelman ...Nick’s KōreroBy Nick Rockel2 days ago - Of the Goodness of Tolkien’s Eru

April has been a quiet month at A Phuulish Fellow. I have had an exceptionally good reading month, and a decently productive writing month – for original fiction, anyway – but not much has caught my eye that suggested a blog article. It has been vaguely frustrating, to be honest. ...A Phuulish FellowBy strda2213 days ago

April has been a quiet month at A Phuulish Fellow. I have had an exceptionally good reading month, and a decently productive writing month – for original fiction, anyway – but not much has caught my eye that suggested a blog article. It has been vaguely frustrating, to be honest. ...A Phuulish FellowBy strda2213 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #17

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 21, 2024 thru Sat, April 27, 2024. Story of the week Anthropogenic climate change may be the ultimate shaggy dog story— but with a twist, because here ...3 days ago

A listing of 31 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 21, 2024 thru Sat, April 27, 2024. Story of the week Anthropogenic climate change may be the ultimate shaggy dog story— but with a twist, because here ...3 days ago - Pastor Who Abused People, Blames People

Hi,I spent about a year on Webworm reporting on an abusive megachurch called Arise, and it made me want to stab my eyes out with a fork.I don’t regret that reporting in 2022 and 2023 — I am proud of it — but it made me angry.Over three main stories ...David FarrierBy David Farrier3 days ago

Hi,I spent about a year on Webworm reporting on an abusive megachurch called Arise, and it made me want to stab my eyes out with a fork.I don’t regret that reporting in 2022 and 2023 — I am proud of it — but it made me angry.Over three main stories ...David FarrierBy David Farrier3 days ago - Vic Uni shows how under threat free speech is

The new Victoria University Vice-Chancellor decided to have a forum at the university about free speech and academic freedom as it is obviously a topical issue, and the Government is looking at legislating some carrots or sticks for universities to uphold their obligations under the Education and Training Act. They ...Point of OrderBy poonzteam54433 days ago

The new Victoria University Vice-Chancellor decided to have a forum at the university about free speech and academic freedom as it is obviously a topical issue, and the Government is looking at legislating some carrots or sticks for universities to uphold their obligations under the Education and Training Act. They ...Point of OrderBy poonzteam54433 days ago - Winston remembers Gettysburg.

Do you remember when Melania Trump got caught out using a speech that sounded awfully like one Michelle Obama had given? Uncannily so.Well it turns out that Abraham Lincoln is to Winston Peters as Michelle was to Melania. With the ANZAC speech Uncle Winston gave at Gallipoli having much in ...Nick’s KōreroBy Nick Rockel3 days ago

Do you remember when Melania Trump got caught out using a speech that sounded awfully like one Michelle Obama had given? Uncannily so.Well it turns out that Abraham Lincoln is to Winston Peters as Michelle was to Melania. With the ANZAC speech Uncle Winston gave at Gallipoli having much in ...Nick’s KōreroBy Nick Rockel3 days ago - 25

She was born 25 years ago today in North Shore hospital. Her eyes were closed tightly shut, her mouth was silently moving. The whole theatre was all quiet intensity as they marked her a 2 on the APGAR test. A one-minute eternity later, she was an 8. The universe was ...More Than A FeildingBy David Slack3 days ago

She was born 25 years ago today in North Shore hospital. Her eyes were closed tightly shut, her mouth was silently moving. The whole theatre was all quiet intensity as they marked her a 2 on the APGAR test. A one-minute eternity later, she was an 8. The universe was ...More Than A FeildingBy David Slack3 days ago - Fact Brief – Is Antarctica gaining land ice?

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. This fact brief was written by Sue Bin Park in collaboration with members from our Skeptical Science team. You can submit claims you think need checking via the tipline. Is Antarctica gaining land ice? ...4 days ago

Skeptical Science is partnering with Gigafact to produce fact briefs — bite-sized fact checks of trending claims. This fact brief was written by Sue Bin Park in collaboration with members from our Skeptical Science team. You can submit claims you think need checking via the tipline. Is Antarctica gaining land ice? ...4 days ago - Policing protests.

Images of US students (and others) protesting and setting up tent cities on US university campuses have been broadcast world wide and clearly demonstrate the growing rifts in US society caused by US policy toward Israel and Israel’s prosecution of … Continue reading → ...KiwipoliticoBy Pablo4 days ago

Images of US students (and others) protesting and setting up tent cities on US university campuses have been broadcast world wide and clearly demonstrate the growing rifts in US society caused by US policy toward Israel and Israel’s prosecution of … Continue reading → ...KiwipoliticoBy Pablo4 days ago - Open letter to Hon Paul Goldsmith

Barrie Saunders writes – Dear Paul As the new Minister of Media and Communications, you will be inundated with heaps of free advice and special pleading, all in the national interest of course. For what it’s worth here is my assessment: Traditional broadcasting free to air content through ...Point of OrderBy poonzteam54434 days ago

Barrie Saunders writes – Dear Paul As the new Minister of Media and Communications, you will be inundated with heaps of free advice and special pleading, all in the national interest of course. For what it’s worth here is my assessment: Traditional broadcasting free to air content through ...Point of OrderBy poonzteam54434 days ago - Bryce Edwards: FastTrackWatch – The Case for the Government’s Fast Track Bill

Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its arguments for such a bold reform. ...Democracy ProjectBy bryce.edwards4 days ago

Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its arguments for such a bold reform. ...Democracy ProjectBy bryce.edwards4 days ago - Luxon gets out his butcher’s knife – briefly

Peter Dunne writes – The great nineteenth British Prime Minister, William Gladstone, once observed that “the first essential for a Prime Minister is to be a good butcher.” When a later British Prime Minister, Harold Macmillan, sacked a third of his Cabinet in July 1962, in what became ...Point of OrderBy poonzteam54434 days ago

Peter Dunne writes – The great nineteenth British Prime Minister, William Gladstone, once observed that “the first essential for a Prime Minister is to be a good butcher.” When a later British Prime Minister, Harold Macmillan, sacked a third of his Cabinet in July 1962, in what became ...Point of OrderBy poonzteam54434 days ago - More tax for less

Ele Ludemann writes – New Zealanders had the OECD’s second highest tax increase last year: New Zealanders faced the second-biggest tax raises in the developed world last year, the Organisation for Economic Cooperation and Development (OECD) says. The intergovernmental agency said the average change in personal income tax ...Point of OrderBy poonzteam54434 days ago

Ele Ludemann writes – New Zealanders had the OECD’s second highest tax increase last year: New Zealanders faced the second-biggest tax raises in the developed world last year, the Organisation for Economic Cooperation and Development (OECD) says. The intergovernmental agency said the average change in personal income tax ...Point of OrderBy poonzteam54434 days ago - Real News vs Fake News.

We all know something’s not right with our elections. The spread of misinformation, people being targeted with soundbites and emotional triggers that ignore the facts, even the truth, and influence their votes.The use of technology to produce deep fakes. How can you tell if something is real or not? Can ...Nick’s KōreroBy Nick Rockel4 days ago

We all know something’s not right with our elections. The spread of misinformation, people being targeted with soundbites and emotional triggers that ignore the facts, even the truth, and influence their votes.The use of technology to produce deep fakes. How can you tell if something is real or not? Can ...Nick’s KōreroBy Nick Rockel4 days ago - Another way to roll

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.Share ...More Than A FeildingBy David Slack4 days ago

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.Share ...More Than A FeildingBy David Slack4 days ago - Simon Clark: The climate lies you'll hear this year

This video includes conclusions of the creator climate scientist Dr. Simon Clark. It is presented to our readers as an informed perspective. Please see video description for references (if any). This year you will be lied to! Simon Clark helps prebunk some misleading statements you'll hear about climate. The video includes ...5 days ago

This video includes conclusions of the creator climate scientist Dr. Simon Clark. It is presented to our readers as an informed perspective. Please see video description for references (if any). This year you will be lied to! Simon Clark helps prebunk some misleading statements you'll hear about climate. The video includes ...5 days ago - Cutting the Public Service

It is all very well cutting the backrooms of public agencies but it may compromise the frontlines. One of the frustrations of the Productivity Commission’s 2017 review of universities is that while it observed that their non-academic staff were increasing faster than their academic staff, it did not bother to ...PunditBy Brian Easton5 days ago

It is all very well cutting the backrooms of public agencies but it may compromise the frontlines. One of the frustrations of the Productivity Commission’s 2017 review of universities is that while it observed that their non-academic staff were increasing faster than their academic staff, it did not bother to ...PunditBy Brian Easton5 days ago - Luxon’s demoted ministers might take comfort from the British politician who bounced back after th...

Buzz from the Beehive Two speeches delivered by Foreign Affairs Minister Winston Peters at Anzac Day ceremonies in Turkey are the only new posts on the government’s official website since the PM announced his Cabinet shake-up. In one of the speeches, Peters stated the obvious: we live in a troubled ...Point of OrderBy Bob Edlin5 days ago

Buzz from the Beehive Two speeches delivered by Foreign Affairs Minister Winston Peters at Anzac Day ceremonies in Turkey are the only new posts on the government’s official website since the PM announced his Cabinet shake-up. In one of the speeches, Peters stated the obvious: we live in a troubled ...Point of OrderBy Bob Edlin5 days ago - This is how I roll over

1. Which of these would you not expect to read in The Waikato Invader?a. Luxon is here to do business, don’t you worry about thatb. Mr KPI expects results, and you better believe itc. This decisive man of action is getting me all hot and excitedd. Melissa Lee is how ...More Than A FeildingBy David Slack5 days ago

1. Which of these would you not expect to read in The Waikato Invader?a. Luxon is here to do business, don’t you worry about thatb. Mr KPI expects results, and you better believe itc. This decisive man of action is getting me all hot and excitedd. Melissa Lee is how ...More Than A FeildingBy David Slack5 days ago - The Waitangi Tribunal is not “a roving Commission”…

…it has a restricted jurisdiction which must not be abused: it is not an inquisition NOTE – this article was published before the High Court ruled that Karen Chhour does not have to appear before the Waitangi Tribunal Gary Judd writes – The High Court ...Point of OrderBy poonzteam54435 days ago

…it has a restricted jurisdiction which must not be abused: it is not an inquisition NOTE – this article was published before the High Court ruled that Karen Chhour does not have to appear before the Waitangi Tribunal Gary Judd writes – The High Court ...Point of OrderBy poonzteam54435 days ago - Is Oranga Tamariki guilty of neglect?

Lindsay Mitchell writes – One of reasons Oranga Tamariki exists is to prevent child neglect. But could the organisation itself be guilty of the same? Oranga Tamariki’s statistics show a decrease in the number and age of children in care. “There are less children ...Point of OrderBy Bob Edlin5 days ago

Lindsay Mitchell writes – One of reasons Oranga Tamariki exists is to prevent child neglect. But could the organisation itself be guilty of the same? Oranga Tamariki’s statistics show a decrease in the number and age of children in care. “There are less children ...Point of OrderBy Bob Edlin5 days ago - Three Strikes saw lower reoffending

David Farrar writes: Graeme Edgeler wrote in 2017: In the first five years after three strikes came into effect 5248 offenders received a ‘first strike’ (that is, a “stage-1 conviction” under the three strikes sentencing regime), and 68 offenders received a ‘second strike’. In the five years prior to ...Point of OrderBy poonzteam54435 days ago

David Farrar writes: Graeme Edgeler wrote in 2017: In the first five years after three strikes came into effect 5248 offenders received a ‘first strike’ (that is, a “stage-1 conviction” under the three strikes sentencing regime), and 68 offenders received a ‘second strike’. In the five years prior to ...Point of OrderBy poonzteam54435 days ago - Luxon’s ruthless show of strength is perfect for our angry era

Bryce Edwards writes – Prime Minister Christopher Luxon has surprised everyone with his ruthlessness in sacking two of his ministers from their crucial portfolios. Removing ministers for poor performance after only five months in the job just doesn’t normally happen in politics. That’s refreshing and will be extremely ...Point of OrderBy poonzteam54435 days ago

Bryce Edwards writes – Prime Minister Christopher Luxon has surprised everyone with his ruthlessness in sacking two of his ministers from their crucial portfolios. Removing ministers for poor performance after only five months in the job just doesn’t normally happen in politics. That’s refreshing and will be extremely ...Point of OrderBy poonzteam54435 days ago - 'Lacks attention to detail and is creating double-standards.'

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy in the two days to 6:06am on Thursday, April 25:Politics: PM Christopher Luxon has set up a dual standard for ministerial competence by demoting two National Cabinet ministers while leaving also-struggling ...The KakaBy Bernard Hickey5 days ago

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy in the two days to 6:06am on Thursday, April 25:Politics: PM Christopher Luxon has set up a dual standard for ministerial competence by demoting two National Cabinet ministers while leaving also-struggling ...The KakaBy Bernard Hickey5 days ago - One Night Only!Hi,Today I mainly want to share some of your thoughts about the recent piece I wrote about success and failure, and the forces that seemingly guide our lives. But first, a quick bit of housekeeping: I am doing a Webworm popup in Los Angeles on Saturday May 11 at 2pm. ...David FarrierBy David Farrier6 days ago

- What did Melissa Lee do?

It is hard to see what Melissa Lee might have done to “save” the media. National went into the election with no public media policy and appears not to have developed one subsequently. Lee claimed that she had prepared a policy paper before the election but it had been decided ...PolitikBy Richard Harman6 days ago

It is hard to see what Melissa Lee might have done to “save” the media. National went into the election with no public media policy and appears not to have developed one subsequently. Lee claimed that she had prepared a policy paper before the election but it had been decided ...PolitikBy Richard Harman6 days ago - Skeptical Science New Research for Week #17 2024

Open access notables Ice acceleration and rotation in the Greenland Ice Sheet interior in recent decades, Løkkegaard et al., Communications Earth & Environment: In the past two decades, mass loss from the Greenland ice sheet has accelerated, partly due to the speedup of glaciers. However, uncertainty in speed derived from satellite products ...6 days ago

Open access notables Ice acceleration and rotation in the Greenland Ice Sheet interior in recent decades, Løkkegaard et al., Communications Earth & Environment: In the past two decades, mass loss from the Greenland ice sheet has accelerated, partly due to the speedup of glaciers. However, uncertainty in speed derived from satellite products ...6 days ago - Maori Party (with “disgust”) draws attention to Chhour’s race after the High Court rules on Wa...

Buzz from the Beehive A statement from Children’s Minister Karen Chhour – yet to be posted on the Government’s official website – arrived in Point of Order’s email in-tray last night. It welcomes the High Court ruling on whether the Waitangi Tribunal can demand she appear before it. It does ...Point of OrderBy Bob Edlin6 days ago

Buzz from the Beehive A statement from Children’s Minister Karen Chhour – yet to be posted on the Government’s official website – arrived in Point of Order’s email in-tray last night. It welcomes the High Court ruling on whether the Waitangi Tribunal can demand she appear before it. It does ...Point of OrderBy Bob Edlin6 days ago - Who’s Going Up The Media Mountain?

Mr Bombastic: Ironically, the media the academic experts wanted is, in many ways, the media they got. In place of the tyrannical editors of yesteryear, advancing without fear or favour the interests of the ruling class; the New Zealand news media of today boasts a troop of enlightened journalists dedicated to ...6 days ago

Mr Bombastic: Ironically, the media the academic experts wanted is, in many ways, the media they got. In place of the tyrannical editors of yesteryear, advancing without fear or favour the interests of the ruling class; the New Zealand news media of today boasts a troop of enlightened journalists dedicated to ...6 days ago - “That's how I roll”

It's hard times try to make a livingYou wake up every morning in the unforgivingOut there somewhere in the cityThere's people living lives without mercy or pityI feel good, yeah I'm feeling fineI feel better then I have for the longest timeI think these pills have been good for meI ...Nick’s KōreroBy Nick Rockel6 days ago

It's hard times try to make a livingYou wake up every morning in the unforgivingOut there somewhere in the cityThere's people living lives without mercy or pityI feel good, yeah I'm feeling fineI feel better then I have for the longest timeI think these pills have been good for meI ...Nick’s KōreroBy Nick Rockel6 days ago - “Comity” versus the rule of law

In 1974, the US Supreme Court issued its decision in United States v. Nixon, finding that the President was not a King, but was subject to the law and was required to turn over the evidence of his wrongdoing to the courts. It was a landmark decision for the rule ...No Right TurnBy Idiot/Savant7 days ago

In 1974, the US Supreme Court issued its decision in United States v. Nixon, finding that the President was not a King, but was subject to the law and was required to turn over the evidence of his wrongdoing to the courts. It was a landmark decision for the rule ...No Right TurnBy Idiot/Savant7 days ago - Aotearoa: a live lab for failed Right-wing socio-economic zombie experiments once more…

Every day now just seems to bring in more fresh meat for the grinder. In their relentlessly ideological drive to cut back on the “excessive bloat” (as they see it) of the previous Labour-led government, on the mountains of evidence accumulated in such a short period of time do not ...exhALANtBy exhalantblog7 days ago

Every day now just seems to bring in more fresh meat for the grinder. In their relentlessly ideological drive to cut back on the “excessive bloat” (as they see it) of the previous Labour-led government, on the mountains of evidence accumulated in such a short period of time do not ...exhALANtBy exhalantblog7 days ago - Water is at the heart of farmers’ struggle to survive in Benin

This is a re-post from Yale Climate Connections by Megan Valére Sosou Market gardening site of the Itchèléré de Itagui agricultural cooperative in Dassa-Zoumè (Image credit: Megan Valère Sossou) For the residents of Dassa-Zoumè, a city in the West African country of Benin, choosing between drinking water and having enough ...7 days ago

This is a re-post from Yale Climate Connections by Megan Valére Sosou Market gardening site of the Itchèléré de Itagui agricultural cooperative in Dassa-Zoumè (Image credit: Megan Valère Sossou) For the residents of Dassa-Zoumè, a city in the West African country of Benin, choosing between drinking water and having enough ...7 days ago - At a time of media turmoil, Melissa had nothing to proclaim as Minister – and now she has been dem...

Buzz from the Beehive

Buzz from the Beehive Melissa Lee – as may be discerned from the screenshot above – has not been demoted for doing something seriously wrong as Minister of ... Point of OrderBy Bob Edlin1 week ago

Melissa Lee – as may be discerned from the screenshot above – has not been demoted for doing something seriously wrong as Minister of ... Point of OrderBy Bob Edlin1 week ago - These people are not our friends

Morning in London Mother hugs beloved daughter outside the converted shoe factory in which she is living.Afternoon in London Travelling writer takes himself and his wrist down to A&E, just to be sure. Read more ...More Than A FeildingBy David Slack1 week ago

Morning in London Mother hugs beloved daughter outside the converted shoe factory in which she is living.Afternoon in London Travelling writer takes himself and his wrist down to A&E, just to be sure. Read more ...More Than A FeildingBy David Slack1 week ago

Related Posts

- Release: 130,000 cattle saved from live export

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...3 hours ago

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...3 hours ago - Central Bank makes clear Government is pouring fuel on housing crisis fire

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...4 hours ago

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...4 hours ago - New unemployment figures paint bleak picture

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...6 hours ago

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...6 hours ago - Release: National’s job cuts already starting to bite as unemployment rises

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...6 hours ago

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...6 hours ago - Release: National hiking transport costs for families and young New Zealanders

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...1 day ago

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...1 day ago - Release: Labour welcomes EU free trade agreement

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...1 day ago

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...1 day ago - Surprise: Landlord tax cuts don’t trickle down

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 day ago

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 day ago - Release: $1.7b for no increase in access to medicine

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 day ago

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 day ago - Release: National should heed Tribunal warning and scrap coalition commitment with ACT

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...2 days ago

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...2 days ago - Release: More accountability for preventable workplace deaths this Workers’ Memorial Day

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...2 days ago

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...2 days ago - Gaza: Aotearoa Must Support Independent Investigation into Mass Graves

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...5 days ago

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...5 days ago - Release: Working together on consistent support for veterans this Anzac Day

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...1 week ago

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...1 week ago - Release: Penny drops – but what about Seymour and Peters?

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...1 week ago

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...1 week ago - Another ‘Stolen Generation’ enabled by court ruling on Waitangi Tribunal summons

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...1 week ago

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...1 week ago - Release: Budget blunder shows Nicola Willis could cut recovery funding

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...1 week ago

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...1 week ago - Further environmental mismanagement on the cards

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...1 week ago

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...1 week ago - Release: RMA changes will be a disaster for environment

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...1 week ago

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...1 week ago - Release: Labour supports urgent changes to emergency management system

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...1 week ago

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...1 week ago - Release: Labour calls for New Zealand to recognise Palestine

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...1 week ago

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...1 week ago - Release: Three strikes law political posturing of worst kind

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...1 week ago

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...1 week ago - Release: Government cuts unbelievably target child exploitation, violent extremism, ports and airpor...

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...1 week ago

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...1 week ago - Three strikes has failed before and will fail again

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...1 week ago

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...1 week ago - Release: Environmental protection vital, not ‘onerous’

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...1 week ago

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...1 week ago - Ferris – Three Strikes targets those ‘too brown to be white’

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...1 week ago

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...1 week ago - Release: Govt cuts doctors and nurses in hiring freeze

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...2 weeks ago

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...2 weeks ago - Fast-track submissions period must be extended

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...2 weeks ago

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...2 weeks ago - Release: Progress on climate will be undone by Govt

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...2 weeks ago

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...2 weeks ago - Release: Dark day for Kiwi kids as a third of Govt cuts affect them

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...2 weeks ago

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...2 weeks ago - Release: Alarm as Government signals further blow to school lunches

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...2 weeks ago

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...2 weeks ago - Oranga Tamariki cuts commit tamariki to state abuse

Te Pāti Māori is disgusted at the confirmation that hundreds are set to lose their jobs at Oranga Tamariki, and the disestablishment of the Treaty Response Unit. “This act of absolute carelessness and out of touch decision making is committing tamariki to state abuse.” Said Te Pāti Māori Oranga Tamariki ...2 weeks ago

Te Pāti Māori is disgusted at the confirmation that hundreds are set to lose their jobs at Oranga Tamariki, and the disestablishment of the Treaty Response Unit. “This act of absolute carelessness and out of touch decision making is committing tamariki to state abuse.” Said Te Pāti Māori Oranga Tamariki ...2 weeks ago - Release: Quick, submit – stop Govt’s dodgy approvals bill

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...2 weeks ago

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...2 weeks ago - Government throws coal on the climate crisis fire

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...2 weeks ago

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...2 weeks ago - Release: Public transport costs to double as National looks at unaffordable roading project instead

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...2 weeks ago

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...2 weeks ago - Release: Cost of living in Auckland still not a priority

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...2 weeks ago

A laundry list of additional costs for Tāmaki Makarau Auckland shows the Minister for the city is not delivering for the people who live there, says Labour Auckland Issues spokesperson Shanan Halbert. ...2 weeks ago - Te Pāti Māori to visit Queensland to strengthen ties with Māori in Australia

Te Pāti Māori co-leader Rawiri Waititi, and Mema Paremata mō Tāmaki-Makaurau, Takutai Tarsh Kemp, will travel to the Gold Coast to strengthen ties with Māori in Australia next week (15-21 April). The visit, in the lead-up to the 9th Australian National Kapa haka Festival, will be an opportunity for both ...2 weeks ago

Te Pāti Māori co-leader Rawiri Waititi, and Mema Paremata mō Tāmaki-Makaurau, Takutai Tarsh Kemp, will travel to the Gold Coast to strengthen ties with Māori in Australia next week (15-21 April). The visit, in the lead-up to the 9th Australian National Kapa haka Festival, will be an opportunity for both ...2 weeks ago - Greens look to fast-track submissions on harmful law

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...3 weeks ago

The Green Party has today launched a step-by-step guide to help New Zealanders make their voice heard on the Government’s democracy dodging and anti-environment fast track legislation. ...3 weeks ago

Related Posts

- Accelerating airport security lines

From today, passengers travelling internationally from Auckland Airport will be able to keep laptops and liquids in their carry-on bags for security screening thanks to new technology, Transport Minister Simeon Brown says. “Creating a more efficient and seamless travel experience is important for holidaymakers and businesses, enabling faster movement through ...BeehiveBy beehive.govt.nz3 hours ago

From today, passengers travelling internationally from Auckland Airport will be able to keep laptops and liquids in their carry-on bags for security screening thanks to new technology, Transport Minister Simeon Brown says. “Creating a more efficient and seamless travel experience is important for holidaymakers and businesses, enabling faster movement through ...BeehiveBy beehive.govt.nz3 hours ago - Community hui to talk about kina barrens

People with an interest in the health of Northland’s marine ecosystems are invited to a public meeting to discuss how to deal with kina barrens, Oceans and Fisheries Minister Shane Jones says. Mr Jones will lead the discussion, which will take place on Friday, 10 May, at Awanui Hotel in ...BeehiveBy beehive.govt.nz8 hours ago

People with an interest in the health of Northland’s marine ecosystems are invited to a public meeting to discuss how to deal with kina barrens, Oceans and Fisheries Minister Shane Jones says. Mr Jones will lead the discussion, which will take place on Friday, 10 May, at Awanui Hotel in ...BeehiveBy beehive.govt.nz8 hours ago - Kiwi exporters win as NZ-EU FTA enters into force

Kiwi exporters are $100 million better off today with the NZ EU FTA entering into force says Trade Minister Todd McClay. “This is all part of our plan to grow the economy. New Zealand's prosperity depends on international trade, making up 60 per cent of the country’s total economic activity. ...BeehiveBy beehive.govt.nz8 hours ago

Kiwi exporters are $100 million better off today with the NZ EU FTA entering into force says Trade Minister Todd McClay. “This is all part of our plan to grow the economy. New Zealand's prosperity depends on international trade, making up 60 per cent of the country’s total economic activity. ...BeehiveBy beehive.govt.nz8 hours ago - Mining resurgence a welcome sign

There are heartening signs that the extractive sector is once again becoming an attractive prospect for investors and a source of economic prosperity for New Zealand, Resources Minister Shane Jones says. “The beginnings of a resurgence in extractive industries are apparent in media reports of the sector in the past ...BeehiveBy beehive.govt.nz10 hours ago