Tax reform for everyone, not just the rich

Tax reform for everyone, not just the rich

Written By:

Marty G - Date published:

7:26 am, November 27th, 2009 - 42 comments

Categories: tax -

Tags:

Why is it that whenever you see discussion of introducing capital gains tax, land tax etc, the assumption is always that the money will be used to cut the top tax rates?

That seems completely misguided to me. Why should tax reform be all about taking tax burden off those most able to bear it? Taxes to disincentivise housing as an investment won’t only be borne by housing investors. In fact, the Tax Working Group says the effect of closing the tax breaks for housing will be regressive (ie take a higher portion of the incomes of people on low incomes than those on high incomes) because there will be pass-on to rents. So, if the new taxes, as desirable as they are, will be felt by a broad section of the population, why should the counteracting tax cuts only go to the wealthy elite?

Now, a lot of you out there will be saying ‘I earn over $70,000 and I’m not rich’. Two points:

1) relatively, you are. 91% of New Zealanders earn less than $70,000. The median income in New Zealand is $28,000, which means half of New Zealanders get by on less than that. The median wage is $41,000 and the median full-time wage is $45,000. So, yeah $70,000 is a bit. (see NZ Income Survey)

2) Sure, if you’re on $75,000 or $80,000 you get a little bit from a cut to the top tax rate but a 1% reduction in the top tax rate only gives you a dollar a week per $5,000 over $70,000 you earn. And consider: on $80,000 you get a whole $2 a week. But if you’re Rob Fyfe on $3.1 million you get $600 a week. Top bracket tax cuts aren’t only unfair to everyone earning below $70,000, they’re unfair to nearly everyone earning above $70,000 too.

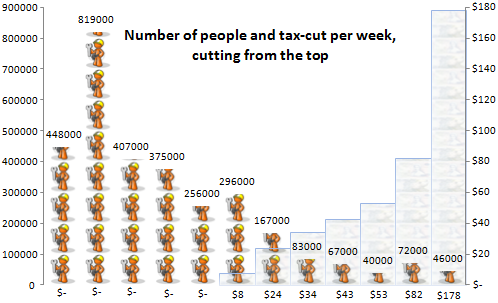

Serious consideration should be given using the revenue from new property-based taxes to pay for a tax-free income tax bracket. OK, let’s say the combination of new taxes brings in $2 billion a year. If that money is used to cut the upper tax rates the top tax rates could be cut to 26% but three out of four people would get nothing, most of the rest get less than $20 a week, and 1.5% of taxpayers make off with tax cuts averaging $178 a week.

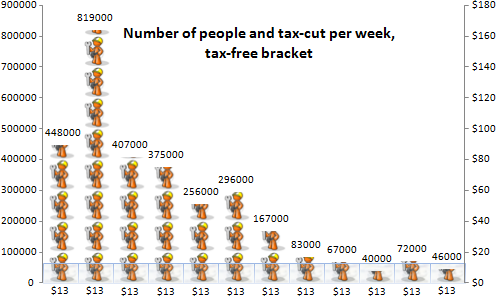

(in the graphs, one worker=100,000 taxpayers, each stack represents an income bracket $10,000 wide, the last two are $100K to $150K and $150K + the blue is the weekly tax cut)

A tax-free bracket up to about $5,300 would cost the same amount and would give everyone $13 a week.

Now, which sounds fair to you?

Related Posts

42 comments on “Tax reform for everyone, not just the rich ”

- Comments are now closed

Links to post

- Comments are now closed

Recent Comments

- adam on

- adam on

- Visubversa to weka on

- Phillip ure on

- joe90 on

- AB to Dennis Frank on

- Drowsy M. Kram to Traveller on

- weka to Visubversa on

- Visubversa to Dennis Frank on

- joe90 on

- Dennis Frank on

- Stephen D on

- Kat to Belladonna on

- SPC on

- SPC on

- SPC on

- SPC on

- joe90 on

- Traveller to Drowsy M. Kram on

- joe90 to I Feel Love on

- newsense to Phillip ure on

- newsense on

- I Feel Love to joe90 on

- Drowsy M. Kram to Traveller on

- joe90 on

- Traveller to Drowsy M. Kram on

- Drowsy M. Kram to Traveller on

- Shanreagh to Dennis Frank on

- Belladonna to Anne on

- Belladonna to Ffloyd on

- Dennis Frank to Shanreagh on

- Patricia Bremner to SPC on

- Patricia Bremner to Ffloyd on

- Shanreagh to Dennis Frank on

- joe90 on

- Phillip ure to observer on

- Dennis Frank to Traveller on

- Visubversa to mikesh on

- Obtrectator to Grey Area on

Recent Posts

-

by mickysavage

-

by mickysavage

-

by nickkelly

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by advantage

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

-

by mickysavage

-

by mickysavage

- A prerequisite for Vulture Capitalism.

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel1 hour ago

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel1 hour ago - Early evening, April 30

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack6 hours ago

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack6 hours ago - Do Newsroom’s staff think they’re culturally superior to the rest of us? Are they arguing that A...

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam544323 hours ago

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam544323 hours ago - Fun minor grudges

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54431 day ago

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54431 day ago - Bernard’s dawn chorus for Saturday, May 4 and pick ‘n’ mix for the weekend

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey1 day ago

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey1 day ago - The Dark Side and the Rebel Alliance.

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel1 day ago

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel1 day ago - Imaginary mandate, imaginary leadership

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack1 day ago

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack1 day ago - Winston Peters delivers a speech about NZ’s relationship with China but media focus on Bob Carr’...

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin2 days ago

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin2 days ago - The Post-Covid Economy

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton2 days ago

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton2 days ago - An awkward coincidence!

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant2 days ago

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant2 days ago - The Israel/Palestinian metastasis.

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo2 days ago

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo2 days ago - 27,000

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant2 days ago

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant2 days ago - MPs’ salaries – when is the best time to increase them?

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54432 days ago

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54432 days ago - Genter under fire

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54432 days ago

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54432 days ago - New Treasury paper on the productivity slowdown supports the downgrading of forecasts

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin2 days ago

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin2 days ago - Bernard’s pick 'n' mix for Friday, May 3

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey2 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey2 days ago - Weekly Roundup 3-May-2024

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland2 days ago

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland2 days ago - The Hoon around the week to May 3The KakaBy Bernard Hickey2 days ago

- Pamphlets at Ten Paces.

These puppet strings don't pull themselvesYou're thinking thoughts from someone elseHow much time do you think you have?Are you prepared for what comes next?The debating chamber can be a trying place for an opposition MP. What with the person in charge, the speaker, typically being an MP from the governing ...Nick’s KōreroBy Nick Rockel2 days ago

These puppet strings don't pull themselvesYou're thinking thoughts from someone elseHow much time do you think you have?Are you prepared for what comes next?The debating chamber can be a trying place for an opposition MP. What with the person in charge, the speaker, typically being an MP from the governing ...Nick’s KōreroBy Nick Rockel2 days ago - A land without pier

The land around Lyme Regis, where Meryl Streep once stood, in a hood, on the Cobb, is falling into the sea.MerylThe land around Lyme Regis, around the Cobb that made it rich, has always been falling slowly but surely into the sea. Read more ...More Than A FeildingBy David Slack2 days ago

The land around Lyme Regis, where Meryl Streep once stood, in a hood, on the Cobb, is falling into the sea.MerylThe land around Lyme Regis, around the Cobb that made it rich, has always been falling slowly but surely into the sea. Read more ...More Than A FeildingBy David Slack2 days ago - Skeptical Science New Research for Week #18 2024

Open access notables Generative AI tools can enhance climate literacy but must be checked for biases and inaccuracies, Atkins et al., Communications Earth & Environment: In the face of climate change, climate literacy is becoming increasingly important. With wide access to generative AI tools, such as OpenAI’s ChatGPT, we explore the potential ...3 days ago

Open access notables Generative AI tools can enhance climate literacy but must be checked for biases and inaccuracies, Atkins et al., Communications Earth & Environment: In the face of climate change, climate literacy is becoming increasingly important. With wide access to generative AI tools, such as OpenAI’s ChatGPT, we explore the potential ...3 days ago - Ruckus over AUKUS – Labour demands Peters step down as Foreign Minister, but he still had the job ...

Buzz from the Beehive Foreign Affairs Minister Winston Peters was bound to win headlines when he set out his thinking about AUKUS in his speech to the New Zealand Institute of International Affairs. The headlines became bigger when – during an interview on RNZ’s Morning Report today – he criticised ...Point of OrderBy Bob Edlin3 days ago

Buzz from the Beehive Foreign Affairs Minister Winston Peters was bound to win headlines when he set out his thinking about AUKUS in his speech to the New Zealand Institute of International Affairs. The headlines became bigger when – during an interview on RNZ’s Morning Report today – he criticised ...Point of OrderBy Bob Edlin3 days ago - Secrecy undermines participation

The Post reports on how the government is refusing to release its advice on its corrupt Muldoonist fast-track law, instead using the "soon to be publicly available" refusal ground to hide it until after select committee submissions on the bill have closed. Fast-track Minister Chris Bishop's excuse? “It's not ...No Right TurnBy Idiot/Savant3 days ago

The Post reports on how the government is refusing to release its advice on its corrupt Muldoonist fast-track law, instead using the "soon to be publicly available" refusal ground to hide it until after select committee submissions on the bill have closed. Fast-track Minister Chris Bishop's excuse? “It's not ...No Right TurnBy Idiot/Savant3 days ago - Agribusiness following oil and gas playbookAs pressure on it grows, the livestock industry’s approach to the transition to Net Zero is increasingly being compared to that of fossil fuel interests. Photo: Lynn Grieveson / Getty ImagesTL;DR: Here’s the top five news items of note in climate news for Aotearoa-NZ this week, and a discussion above ...The KakaBy Bernard Hickey3 days ago

- Here’s hoping they aren’t counting on a 100 per cent acceptance…

The New Zealand Herald reports – Stats NZ has offered a voluntary redundancy scheme to all of its workers as a way to give staff some control over their “future” amidst widespread job losses in the public sector. In an update to staff this morning, seen by the Herald, Statistics New Zealand ...Point of OrderBy Bob Edlin3 days ago

The New Zealand Herald reports – Stats NZ has offered a voluntary redundancy scheme to all of its workers as a way to give staff some control over their “future” amidst widespread job losses in the public sector. In an update to staff this morning, seen by the Herald, Statistics New Zealand ...Point of OrderBy Bob Edlin3 days ago - Gordon Campbell on unemployment, Winston Peters’ low boiling point and music criticism

On Werewolf/Scoop, I usually do two long form political columns a week. From now on, there will be an extra column each week about music and movies. But first, some late-breaking political events: The rise in unemployment numbers for the March quarter was bigger than expected – and especially sharp ...Gordon CampbellBy lyndon3 days ago

On Werewolf/Scoop, I usually do two long form political columns a week. From now on, there will be an extra column each week about music and movies. But first, some late-breaking political events: The rise in unemployment numbers for the March quarter was bigger than expected – and especially sharp ...Gordon CampbellBy lyndon3 days ago - TVNZ and poll resultsPoint of OrderBy poonzteam54433 days ago

- Mana or Money

Muriel Newman writes – When Meridian Energy was seeking resource consents for a West Coast hydro dam proposal in 2010, local Maori “strenuously” objected, claiming their mana was inextricably linked to ‘their’ river and could be damaged. After receiving a financial payment from the company, however, the Ngai Tahu ...Point of OrderBy poonzteam54433 days ago

Muriel Newman writes – When Meridian Energy was seeking resource consents for a West Coast hydro dam proposal in 2010, local Maori “strenuously” objected, claiming their mana was inextricably linked to ‘their’ river and could be damaged. After receiving a financial payment from the company, however, the Ngai Tahu ...Point of OrderBy poonzteam54433 days ago - Bernard’s pick 'n' mix for Thursday, May 2

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 11:10 am on Thursday, May 2:Scoop: Government sits on official advice on fast-track consent. The Ombudsman is investigating after official briefings on the contentious regime were held back despite requests from Forest ...The KakaBy Bernard Hickey3 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 11:10 am on Thursday, May 2:Scoop: Government sits on official advice on fast-track consent. The Ombudsman is investigating after official briefings on the contentious regime were held back despite requests from Forest ...The KakaBy Bernard Hickey3 days ago - The Art of taking no Responsibility

Alwyn Poole writes – “An SEP,’ he said, ‘is something that we can’t see, or don’t see, or our brain doesn’t let us see, because we think that it’s somebody else’s problem. That’s what SEP means. Somebody Else’s Problem. The brain just edits it out, it’s like a ...Point of OrderBy poonzteam54433 days ago

Alwyn Poole writes – “An SEP,’ he said, ‘is something that we can’t see, or don’t see, or our brain doesn’t let us see, because we think that it’s somebody else’s problem. That’s what SEP means. Somebody Else’s Problem. The brain just edits it out, it’s like a ...Point of OrderBy poonzteam54433 days ago - The shabby “Parliamentary urgency” ploy – shaky foundations and why our democracy needs trust

Our trust in our political institutions is fast eroding, according to a Maxim Institute discussion paper, Shaky Foundations: Why our democracy needs trust. The paper – released today – raises concerns about declining trust in New Zealand’s political institutions and democratic processes, and the role that the overuse of Parliamentary urgency ...Point of OrderBy poonzteam54433 days ago

Our trust in our political institutions is fast eroding, according to a Maxim Institute discussion paper, Shaky Foundations: Why our democracy needs trust. The paper – released today – raises concerns about declining trust in New Zealand’s political institutions and democratic processes, and the role that the overuse of Parliamentary urgency ...Point of OrderBy poonzteam54433 days ago - Jones has made plain he isn’t fond of frogs (not the dim-witted ones, at least) – and now we lea...

This article was prepared for publication yesterday. More ministerial announcements have been posted on the government’s official website since it was written. We will report on these later today …. Buzz from the Beehive There we were, thinking the environment is in trouble, when along came Jones. Shane Jones. ...Point of OrderBy Bob Edlin3 days ago

This article was prepared for publication yesterday. More ministerial announcements have been posted on the government’s official website since it was written. We will report on these later today …. Buzz from the Beehive There we were, thinking the environment is in trouble, when along came Jones. Shane Jones. ...Point of OrderBy Bob Edlin3 days ago - Infrastructure & home building slumping on Govt funding freezeThe KakaBy Bernard Hickey3 days ago

- Brainwashed People Think Everyone Else is Brainwashed

Hi,I am just going to state something very obvious: American police are fucking crazy.That was a photo gracing the New York Times this morning, showing New York City police “entering Columbia University last night after receiving a request from the school.”Apparently in America, protesting the deaths of tens of thousands ...David FarrierBy David Farrier3 days ago

Hi,I am just going to state something very obvious: American police are fucking crazy.That was a photo gracing the New York Times this morning, showing New York City police “entering Columbia University last night after receiving a request from the school.”Apparently in America, protesting the deaths of tens of thousands ...David FarrierBy David Farrier3 days ago - Peters’ real foreign policy threat is Helen Clark

Winston Peters’ much anticipated foreign policy speech last night was a work of two halves. Much of it was a standard “boilerplate” Foreign Ministry overview of the state of the world. There was some hardening up of rhetoric with talk of “benign” becoming “malign” and old truths giving way to ...PolitikBy Richard Harman3 days ago

Winston Peters’ much anticipated foreign policy speech last night was a work of two halves. Much of it was a standard “boilerplate” Foreign Ministry overview of the state of the world. There was some hardening up of rhetoric with talk of “benign” becoming “malign” and old truths giving way to ...PolitikBy Richard Harman3 days ago - NZ’s trans lobby is fighting a rearguard action

Graham Adams assesses the fallout of the Cass Review — The press release last Thursday from the UN Special Rapporteur on violence against women and girls didn’t make the mainstream news in New Zealand but it really should have. The startling title of Reem Alsalem’s statement — “Implementation of ‘Cass ...Point of OrderBy gadams10004 days ago

Graham Adams assesses the fallout of the Cass Review — The press release last Thursday from the UN Special Rapporteur on violence against women and girls didn’t make the mainstream news in New Zealand but it really should have. The startling title of Reem Alsalem’s statement — “Implementation of ‘Cass ...Point of OrderBy gadams10004 days ago - Your mandate is imaginary

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack4 days ago

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack4 days ago - 14,000 unemployed under National

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant4 days ago

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant4 days ago - Bryce Edwards: Discontent and gloom dominate NZ’s political mood

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards4 days ago

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards4 days ago - Taking Tea with 42 & 38.

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel4 days ago

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel4 days ago - Beware political propaganda: statistics are pointing to Grant Robertson never protecting “Lives an...

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54434 days ago

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54434 days ago - Winding back the hands of history’s clock

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54434 days ago

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54434 days ago - Paula Bennett’s political appointment will challenge public confidence

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry4 days ago

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry4 days ago - Business confidence sliding into winter of discontent

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey4 days ago

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey4 days ago - Gordon Campbell on the coalition’s awful, not good, very bad poll results

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon4 days ago

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon4 days ago - New HOP readers for future payment options

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L4 days ago

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L4 days ago - 2024 Reading Summary: April (+ Writing Update)

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda2215 days ago

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda2215 days ago - At a glance – Clearing up misconceptions regarding 'hide the decline'

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...5 days ago

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...5 days ago - Road photos

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack5 days ago

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack5 days ago - Bryce Edwards: Paula Bennett’s political appointment will challenge public confidence

The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill English, Simon Bridges, Steven Joyce, Roger Sowry, ...Democracy ProjectBy bryce.edwards5 days ago

The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill English, Simon Bridges, Steven Joyce, Roger Sowry, ...Democracy ProjectBy bryce.edwards5 days ago - NZDF is still hostile to oversight

Newsroom has a story today about National's (fortunately failed) effort to disestablish the newly-created Inspector-General of Defence. The creation of this agency was the key recommendation of the Inquiry into Operation Burnham, and a vital means of restoring credibility and social licence to an agency which had been caught lying ...No Right TurnBy Idiot/Savant5 days ago

Newsroom has a story today about National's (fortunately failed) effort to disestablish the newly-created Inspector-General of Defence. The creation of this agency was the key recommendation of the Inquiry into Operation Burnham, and a vital means of restoring credibility and social licence to an agency which had been caught lying ...No Right TurnBy Idiot/Savant5 days ago - Winding Back The Hands Of History’s Clock.

Holding On To The Present: The moment a political movement arises that attacks the whole idea of social progress, and announces its intention to wind back the hands of History’s clock, then democracy, along with its unwritten rules, is in mortal danger.IT’S A COMMONPLACE of political speeches, especially those delivered in ...5 days ago

Holding On To The Present: The moment a political movement arises that attacks the whole idea of social progress, and announces its intention to wind back the hands of History’s clock, then democracy, along with its unwritten rules, is in mortal danger.IT’S A COMMONPLACE of political speeches, especially those delivered in ...5 days ago - Sweet Moderation? What Christopher Luxon Could Learn From The Germans.5 days ago

- A clear warning

The unpopular coalition government is currently rushing to repeal section 7AA of the Oranga Tamariki Act. The clause is Oranga Tamariki's Treaty clause, and was inserted after its systematic stealing of Māori children became a public scandal and resulted in physical resistance to further abductions. The clause created clear obligations ...No Right TurnBy Idiot/Savant5 days ago

The unpopular coalition government is currently rushing to repeal section 7AA of the Oranga Tamariki Act. The clause is Oranga Tamariki's Treaty clause, and was inserted after its systematic stealing of Māori children became a public scandal and resulted in physical resistance to further abductions. The clause created clear obligations ...No Right TurnBy Idiot/Savant5 days ago - Poll results and Waitangi Tribunal report go unmentioned on the Beehive website – where racing tru...

Buzz from the Beehive The government’s official website – which Point of Order monitors daily – not for the first time has nothing much to say today about political happenings that are grabbing media headlines. It makes no mention of the latest 1News-Verian poll, for example. This shows National down ...Point of OrderBy Bob Edlin5 days ago

Buzz from the Beehive The government’s official website – which Point of Order monitors daily – not for the first time has nothing much to say today about political happenings that are grabbing media headlines. It makes no mention of the latest 1News-Verian poll, for example. This shows National down ...Point of OrderBy Bob Edlin5 days ago - Listening To The Traffic.5 days ago

- Comity Be Damned! The State’s Legislative Arm Is Flexing Its Constitutional Muscles.

Packing A Punch: The election of the present government, including in its ranks politicians dedicated to reasserting the rights of the legislature in shaping and determining the future of Māori and Pakeha in New Zealand, should have alerted the judiciary – including its anomalous appendage, the Waitangi Tribunal – that its ...5 days ago

Packing A Punch: The election of the present government, including in its ranks politicians dedicated to reasserting the rights of the legislature in shaping and determining the future of Māori and Pakeha in New Zealand, should have alerted the judiciary – including its anomalous appendage, the Waitangi Tribunal – that its ...5 days ago - Ending The Quest.

Dead Woman Walking: New Zealand’s media industry had been moving steadily towards disaster for all the years Melissa Lee had been National’s media and communications policy spokesperson, and yet, when the crisis finally broke, on her watch, she had nothing intelligent to offer. Christopher Luxon is a patient man - but he’s not ...5 days ago

Dead Woman Walking: New Zealand’s media industry had been moving steadily towards disaster for all the years Melissa Lee had been National’s media and communications policy spokesperson, and yet, when the crisis finally broke, on her watch, she had nothing intelligent to offer. Christopher Luxon is a patient man - but he’s not ...5 days ago - Will political polarisation intensify to the point where ‘normal’ government becomes impossible,...

Chris Trotter writes – New Zealand politics is remarkably easy-going: dangerously so, one might even say. With the notable exception of John Key’s flat ruling-out of the NZ First Party in 2008, all parties capable of clearing MMP’s five-percent threshold, or winning one or more electorate seats, tend ...Point of OrderBy poonzteam54435 days ago

Chris Trotter writes – New Zealand politics is remarkably easy-going: dangerously so, one might even say. With the notable exception of John Key’s flat ruling-out of the NZ First Party in 2008, all parties capable of clearing MMP’s five-percent threshold, or winning one or more electorate seats, tend ...Point of OrderBy poonzteam54435 days ago - Bernard’s pick 'n' mix for Tuesday, April 30

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:30am on Tuesday, May 30:Scoop: NZ 'close to the tipping point' of measles epidemic, health experts warn NZ Herald Benjamin PlummerHealth: 'Absurd and totally unacceptable': Man has to wait a year for ...The KakaBy Bernard Hickey5 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:30am on Tuesday, May 30:Scoop: NZ 'close to the tipping point' of measles epidemic, health experts warn NZ Herald Benjamin PlummerHealth: 'Absurd and totally unacceptable': Man has to wait a year for ...The KakaBy Bernard Hickey5 days ago - Why Tory Whanau has the lowest approval rating in the country

Bryce Edwards writes – Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is ...Point of OrderBy poonzteam54435 days ago

Bryce Edwards writes – Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is ...Point of OrderBy poonzteam54435 days ago - Worst poll result for a new Government in MMP historyThe KakaBy Bernard Hickey5 days ago

- Pinning down climate change's role in extreme weather

This is a re-post from The Climate Brink by Andrew Dessler In the wake of any unusual weather event, someone inevitably asks, “Did climate change cause this?” In the most literal sense, that answer is almost always no. Climate change is never the sole cause of hurricanes, heat waves, droughts, or ...5 days ago

This is a re-post from The Climate Brink by Andrew Dessler In the wake of any unusual weather event, someone inevitably asks, “Did climate change cause this?” In the most literal sense, that answer is almost always no. Climate change is never the sole cause of hurricanes, heat waves, droughts, or ...5 days ago - Serving at Seymour's pleasure.

Something odd happened yesterday, and I’d love to know if there’s more to it. If there was something which preempted what happened, or if it was simply a throwaway line in response to a journalist.Yesterday David Seymour was asked at a press conference what the process would be if the ...Nick’s KōreroBy Nick Rockel5 days ago

Something odd happened yesterday, and I’d love to know if there’s more to it. If there was something which preempted what happened, or if it was simply a throwaway line in response to a journalist.Yesterday David Seymour was asked at a press conference what the process would be if the ...Nick’s KōreroBy Nick Rockel5 days ago - Webworm LA Pop-Up

Hi,From time to time, I want to bring Webworm into the real world. We did it last year with the Jurassic Park event in New Zealand — which was a lot of fun!And so on Saturday May 11th, in Los Angeles, I am hosting a lil’ Webworm pop-up! I’ve been ...David FarrierBy David Farrier5 days ago

Hi,From time to time, I want to bring Webworm into the real world. We did it last year with the Jurassic Park event in New Zealand — which was a lot of fun!And so on Saturday May 11th, in Los Angeles, I am hosting a lil’ Webworm pop-up! I’ve been ...David FarrierBy David Farrier5 days ago - “Feel good” school is out

Education Minister Erica Standford yesterday unveiled a fundamental reform of the way our school pupils are taught. She would not exactly say so, but she is all but dismantling the so-called “inquiry” “feel good” method of teaching, which has ruled in our classrooms since a major review of the New ...PolitikBy Richard Harman5 days ago

Education Minister Erica Standford yesterday unveiled a fundamental reform of the way our school pupils are taught. She would not exactly say so, but she is all but dismantling the so-called “inquiry” “feel good” method of teaching, which has ruled in our classrooms since a major review of the New ...PolitikBy Richard Harman5 days ago - 6 Months in, surely our Report Card is “Ignored all warnings: recommend dismissal ASAP”?

Exactly where are we seriously going with this government and its policies? That is, apart from following what may as well be a Truss-Lite approach on the purported economic “plan“, and Victorian-era regression when it comes to social policy. Oh it’ll work this time of course, we’re basically assured, “the ...exhALANtBy exhalantblog6 days ago

Exactly where are we seriously going with this government and its policies? That is, apart from following what may as well be a Truss-Lite approach on the purported economic “plan“, and Victorian-era regression when it comes to social policy. Oh it’ll work this time of course, we’re basically assured, “the ...exhALANtBy exhalantblog6 days ago - Bread, and how it gets buttered

Hey Uncle Dave, When the Poms joined the EEC, I wasn't one of those defeatists who said, Well, that’s it for the dairy job. And I was right, eh? The Chinese can’t get enough of our milk powder and eventually, the Poms came to their senses and backed up the ute ...More Than A FeildingBy David Slack6 days ago

Hey Uncle Dave, When the Poms joined the EEC, I wasn't one of those defeatists who said, Well, that’s it for the dairy job. And I was right, eh? The Chinese can’t get enough of our milk powder and eventually, the Poms came to their senses and backed up the ute ...More Than A FeildingBy David Slack6 days ago - Bryce Edwards: Why Tory Whanau has the lowest approval rating in the country

Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is higher than for any other mayor ...Democracy ProjectBy bryce.edwards6 days ago

Polling shows that Wellington Mayor Tory Whanau has the lowest approval rating of any mayor in the country. Siting at -12 per cent, the proportion of constituents who disapprove of her performance outweighs those who give her the thumbs up. This negative rating is higher than for any other mayor ...Democracy ProjectBy bryce.edwards6 days ago - Justice for Gaza?

The New York Times reports that the International Criminal Court is about to issue arrest warrants for Israeli officials, including Prime Minister Benjamin Netanyahu, over their genocide in Gaza: Israeli officials increasingly believe that the International Criminal Court is preparing to issue arrest warrants for senior government officials on ...No Right TurnBy Idiot/Savant6 days ago

The New York Times reports that the International Criminal Court is about to issue arrest warrants for Israeli officials, including Prime Minister Benjamin Netanyahu, over their genocide in Gaza: Israeli officials increasingly believe that the International Criminal Court is preparing to issue arrest warrants for senior government officials on ...No Right TurnBy Idiot/Savant6 days ago - If there has been any fiddling with Pharmac’s funding, we can count on Paula to figure out the fis...

Buzz from the Beehive Pharmac has been given a financial transfusion and a new chair to oversee its spending in the pharmaceutical business. Associate Health Minister David Seymour described the funding for Pharmac as “its largest ever budget of $6.294 billion over four years, fixing a $1.774 billion fiscal cliff”. ...Point of OrderBy Bob Edlin6 days ago

Buzz from the Beehive Pharmac has been given a financial transfusion and a new chair to oversee its spending in the pharmaceutical business. Associate Health Minister David Seymour described the funding for Pharmac as “its largest ever budget of $6.294 billion over four years, fixing a $1.774 billion fiscal cliff”. ...Point of OrderBy Bob Edlin6 days ago - FastTrackWatch – The case for the Government’s Fast Track Bill

Bryce Edwards writes – Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its ...Point of OrderBy poonzteam54436 days ago

Bryce Edwards writes – Many criticisms are being made of the Government’s Fast Track Approvals Bill, including by this writer. But as with everything in politics, every story has two sides, and both deserve attention. It’s important to understand what the Government is trying to achieve and its ...Point of OrderBy poonzteam54436 days ago - Bernard’s pick 'n' mix for Monday, April 29

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:10am on Monday, April 29:Scoop: The children's ward at Rotorua Hospital will be missing a third of its beds as winter hits because Te Whatu Ora halted an upgrade partway through to ...The KakaBy Bernard Hickey6 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 10:10am on Monday, April 29:Scoop: The children's ward at Rotorua Hospital will be missing a third of its beds as winter hits because Te Whatu Ora halted an upgrade partway through to ...The KakaBy Bernard Hickey6 days ago - Gordon Campbell on Iran killing its rappers, and searching for the invisible Dr. Reti

span class=”dropcap”>As hideous as David Seymour can be, it is worth keeping in mind occasionally that there are even worse political figures (and regimes) out there. Iran for instance, is about to execute the country’s leading hip hop musician Toomaj Salehi, for writing and performing raps that “corrupt” the nation’s ...Gordon CampbellBy lyndon6 days ago

span class=”dropcap”>As hideous as David Seymour can be, it is worth keeping in mind occasionally that there are even worse political figures (and regimes) out there. Iran for instance, is about to execute the country’s leading hip hop musician Toomaj Salehi, for writing and performing raps that “corrupt” the nation’s ...Gordon CampbellBy lyndon6 days ago - Auckland Rail Electrification 10 years old

Yesterday marked 10 years since the first electric train carried passengers in Auckland so it’s a good time to look back at it and the impact it has had. A brief history The first proposals for rail electrification in Auckland came in the 1920’s alongside the plans for earlier ...Greater AucklandBy Matt L6 days ago

Yesterday marked 10 years since the first electric train carried passengers in Auckland so it’s a good time to look back at it and the impact it has had. A brief history The first proposals for rail electrification in Auckland came in the 1920’s alongside the plans for earlier ...Greater AucklandBy Matt L6 days ago

Related Posts

- Release: National gaslights women fighting for equal pay

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...3 days ago

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...3 days ago - Release: More job cuts, fewer houses under National

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...3 days ago

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...3 days ago - Release: Children fall deeper through the cracks in Govt cuts

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...3 days ago

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...3 days ago - Release: Labour honours memory of Sir Robert Martin

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...3 days ago

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...3 days ago - Release: 130,000 cattle saved from live export

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...4 days ago

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...4 days ago - Central Bank makes clear Government is pouring fuel on housing crisis fire

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...4 days ago

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...4 days ago - New unemployment figures paint bleak picture

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...4 days ago

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...4 days ago - Release: National’s job cuts already starting to bite as unemployment rises

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...4 days ago

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...4 days ago - Release: National hiking transport costs for families and young New Zealanders

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...5 days ago

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...5 days ago - Release: Labour welcomes EU free trade agreement

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...5 days ago

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...5 days ago - Surprise: Landlord tax cuts don’t trickle down

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...5 days ago

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...5 days ago - Release: $1.7b for no increase in access to medicine

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...5 days ago

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...5 days ago - Release: National should heed Tribunal warning and scrap coalition commitment with ACT

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...6 days ago

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...6 days ago - Release: More accountability for preventable workplace deaths this Workers’ Memorial Day

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...6 days ago

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...6 days ago - Gaza: Aotearoa Must Support Independent Investigation into Mass Graves

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...1 week ago

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...1 week ago - Release: Working together on consistent support for veterans this Anzac Day

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago - Release: Penny drops – but what about Seymour and Peters?

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago - Another ‘Stolen Generation’ enabled by court ruling on Waitangi Tribunal summons

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago - Release: Budget blunder shows Nicola Willis could cut recovery funding

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago - Further environmental mismanagement on the cards

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago - Release: RMA changes will be a disaster for environment

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago - Release: Labour supports urgent changes to emergency management system

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago - Release: Labour calls for New Zealand to recognise Palestine

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago - Release: Three strikes law political posturing of worst kind

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago - Release: Government cuts unbelievably target child exploitation, violent extremism, ports and airpor...

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago - Three strikes has failed before and will fail again

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago - Release: Environmental protection vital, not ‘onerous’

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago - Ferris – Three Strikes targets those ‘too brown to be white’

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago - Release: Govt cuts doctors and nurses in hiring freeze

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...2 weeks ago

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...2 weeks ago - Fast-track submissions period must be extended

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...2 weeks ago

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...2 weeks ago - Release: Progress on climate will be undone by Govt

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...2 weeks ago

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...2 weeks ago - Release: Dark day for Kiwi kids as a third of Govt cuts affect them

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 weeks ago

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 weeks ago - Release: Alarm as Government signals further blow to school lunches

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...3 weeks ago

More essential jobs could be on the chopping block, this time Ministry of Education staff on the school lunches team are set to find out whether they're in line to lose their jobs. ...3 weeks ago - Oranga Tamariki cuts commit tamariki to state abuse

Te Pāti Māori is disgusted at the confirmation that hundreds are set to lose their jobs at Oranga Tamariki, and the disestablishment of the Treaty Response Unit. “This act of absolute carelessness and out of touch decision making is committing tamariki to state abuse.” Said Te Pāti Māori Oranga Tamariki ...3 weeks ago

Te Pāti Māori is disgusted at the confirmation that hundreds are set to lose their jobs at Oranga Tamariki, and the disestablishment of the Treaty Response Unit. “This act of absolute carelessness and out of touch decision making is committing tamariki to state abuse.” Said Te Pāti Māori Oranga Tamariki ...3 weeks ago - Release: Quick, submit – stop Govt’s dodgy approvals bill

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...3 weeks ago

The Government is trying to bring in a law that will allow Ministers to cut corners and kill off native species, Labour environment spokesperson Rachel Brooking said. ...3 weeks ago - Government throws coal on the climate crisis fire

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...3 weeks ago

The Government’s policy announced today to ease consenting for coal mining will have a lasting impact across generations. ...3 weeks ago - Release: Public transport costs to double as National looks at unaffordable roading project instead

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...3 weeks ago

Cancelling urgently needed new Cook Strait ferries and hiking the cost of public transport for many Kiwis so that National can announce the prospect of another tunnel for Wellington is not making good choices, Labour Transport Spokesperson Tangi Utikere said. ...3 weeks ago

Related Posts

- Gaza and the Pacific on the agenda with Germany

Foreign Minister Winston Peters discussed the need for an immediate ceasefire in Gaza, and enhanced cooperation in the Pacific with German Foreign Minister Annalena Baerbock during her first official visit to New Zealand today. "New Zealand and Germany enjoy shared interests and values, including the rule of law, democracy, respect for the international system ...BeehiveBy beehive.govt.nz23 hours ago

Foreign Minister Winston Peters discussed the need for an immediate ceasefire in Gaza, and enhanced cooperation in the Pacific with German Foreign Minister Annalena Baerbock during her first official visit to New Zealand today. "New Zealand and Germany enjoy shared interests and values, including the rule of law, democracy, respect for the international system ...BeehiveBy beehive.govt.nz23 hours ago - Decision allows for housing growth in Western Bay of Plenty

The Minister Responsible for RMA Reform, Chris Bishop today released his decision on four recommendations referred to him by the Western Bay of Plenty District Council, opening the door to housing growth in the area. The Council’s Plan Change 92 allows more homes to be built in existing and new ...BeehiveBy beehive.govt.nz2 days ago

The Minister Responsible for RMA Reform, Chris Bishop today released his decision on four recommendations referred to him by the Western Bay of Plenty District Council, opening the door to housing growth in the area. The Council’s Plan Change 92 allows more homes to be built in existing and new ...BeehiveBy beehive.govt.nz2 days ago - Speech to New Zealand China Council

Thank you, John McKinnon and the New Zealand China Council for the invitation to speak to you today. Thank you too, all members of the China Council. Your effort has played an essential role in helping to build, shape, and grow a balanced and resilient relationship between our two ...BeehiveBy beehive.govt.nz2 days ago

Thank you, John McKinnon and the New Zealand China Council for the invitation to speak to you today. Thank you too, all members of the China Council. Your effort has played an essential role in helping to build, shape, and grow a balanced and resilient relationship between our two ...BeehiveBy beehive.govt.nz2 days ago - Modern insurance law will protect Kiwi households

The Government is modernising insurance law to better protect Kiwis and provide security in the event of a disaster, Commerce and Consumer Affairs Minister Andrew Bayly announced today. “These reforms are long overdue. New Zealand’s insurance law is complicated and dated, some of which is more than 100 years old. ...BeehiveBy beehive.govt.nz3 days ago

The Government is modernising insurance law to better protect Kiwis and provide security in the event of a disaster, Commerce and Consumer Affairs Minister Andrew Bayly announced today. “These reforms are long overdue. New Zealand’s insurance law is complicated and dated, some of which is more than 100 years old. ...BeehiveBy beehive.govt.nz3 days ago - Government recommits to equal pay

The coalition Government is refreshing its approach to supporting pay equity claims as time-limited funding for the Pay Equity Taskforce comes to an end, Public Service Minister Nicola Willis says. “Three years ago, the then-government introduced changes to the Equal Pay Act to support pay equity bargaining. The changes were ...BeehiveBy beehive.govt.nz3 days ago

The coalition Government is refreshing its approach to supporting pay equity claims as time-limited funding for the Pay Equity Taskforce comes to an end, Public Service Minister Nicola Willis says. “Three years ago, the then-government introduced changes to the Equal Pay Act to support pay equity bargaining. The changes were ...BeehiveBy beehive.govt.nz3 days ago - Transforming how our children learn to read

Structured literacy will change the way New Zealand children learn to read - improving achievement and setting students up for success, Education Minister Erica Stanford says. “Being able to read and write is a fundamental life skill that too many young people are missing out on. Recent data shows that ...BeehiveBy beehive.govt.nz3 days ago

Structured literacy will change the way New Zealand children learn to read - improving achievement and setting students up for success, Education Minister Erica Stanford says. “Being able to read and write is a fundamental life skill that too many young people are missing out on. Recent data shows that ...BeehiveBy beehive.govt.nz3 days ago - NZ not backing down in Canada dairy dispute

Trade Minister Todd McClay says Canada’s refusal to comply in full with a CPTPP trade dispute ruling in our favour over dairy trade is cynical and New Zealand has no intention of backing down. Mr McClay said he has asked for urgent legal advice in respect of our ‘next move’ ...BeehiveBy beehive.govt.nz3 days ago

Trade Minister Todd McClay says Canada’s refusal to comply in full with a CPTPP trade dispute ruling in our favour over dairy trade is cynical and New Zealand has no intention of backing down. Mr McClay said he has asked for urgent legal advice in respect of our ‘next move’ ...BeehiveBy beehive.govt.nz3 days ago - Stronger oversight for our most vulnerable children