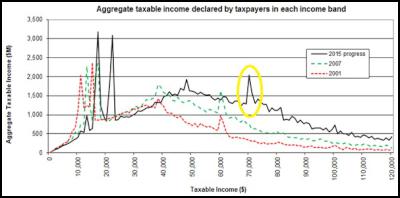

The above is a graph showing the distribution of declared taxable income in 2015. The Greens’ James Shaw points out that he spike just below $70,000 – the level the top tax rate kicks in – is awfully suspicious. It looks a lot like the rich are manipulating their incomes to dodge taxes. But Revenue Minister and former tax-cheat-enablerlawyer Judith Collins says its nothing of the sort. Apparently its just disbursements from trusts and companies. Which, entirely coincidentally, just happen to have tracked the top tax threshold every time it has shifted…

Yeah, right. How stupid does Collins think we are? It is clear that the wealthy are using corporate and trust vehicles to cheat on their taxes, just as they always have. And as Revenue Minister, Collins’ job is to stop that, not make excuses for it.

Melissa Lee – as may be discerned from the screenshot above – has not been demoted for doing something seriously wrong as Minister of ...

Melissa Lee – as may be discerned from the screenshot above – has not been demoted for doing something seriously wrong as Minister of ...

Isnt that why blinglush aligned the rates and they removed gift duty ?

Collins job is to defend the realm so expect some world class spin and bs from the minister for oravida.

If you have setting where the top personal tax rate is set at a level higher than the business or trust tax rate it is in no way surprising that this situation will occur.

It is neither cheating on taxes nor is it illegal.

Also to suggest that an income in NZ of anything under 150k makes one rich, let alone comfortable, unless they are mortgage free is risible.

“It is neither cheating on taxes nor is it illegal. ”

we dont really know that one – its likely a mixture of avoidance and evasion

Income from company or trust disbursements would still be taxable at the recipient’s personal rate, subject to an adjustment for tax paid by the company or trust on the recipient’s behalf.

Well, that’s just it – it is cheating on taxes and it shouldn’t be legal because it is unethical.

Which actually tells us that businesses should be on PAYE.

Draco

As mikesh has effectively pointed out the tax rate for trust income is the same as the top personal rate, that is 33%.

It is only if it is disbursed to beneficiaries in the year it is earned that tax will be paid at the tax rate of each particular beneficiary.

So Judith Collins has made a fair point. Tax is still being paid on the income, either at the company rate (28%), the Trustee rate (33%) or that tax rates applicable for the shareholders or beneficiaries.

Labour, for instance gives no indication that it will abolish dividend imputation, or that all trust income, whether distributed to beneficiaries in the same year should all be taxed at 33%.

CV, the spike at $22,000 will reflect the fact that a lot of beneficiaries of trusts earn less than $22,000, for instance children. If the trust earns $60,000 and there are three child beneficiaries (including university students), then each beneficiary would get $20,000 and be taxed at the 15% rate. This is provided the income is distributed in the year it is earned, otherwise it will be taxed at the trustee rate of 33%.

Where did I say anything about trusts?

Obviously other vehicles are being used to avoid paying tax.

I tend to be against personal income tax altogether. I’d rather see the business/trust taxed and the disbursements from them, including pay, untaxed. Profits and the taxes upon those profits would have to be calculated before those disbursements.

“I tend to be against personal income tax altogether. I’d rather see the business/trust taxed and the disbursements from them, including pay, untaxed. Profits and the taxes upon those profits would have to be calculated 6before those disbursements.”

This would mean that beneficiaries would be taxed at the top tax rate, even if they were children. Otherwise the end result would be the same as at present.

Since when have beneficiaries been either a trust or a business?

If National had a real crack at tax avoidance from the top .5% of this country, and put what they hoovered up into public services like health and NZSuper and education, my pen would waver in the election booth.

Who are the top 0.5%? Individual incomes over $250K pa?

More likely those just below the $70k income level that have sophisticated arrangements in place.

Have you seen the massive spikes on the chart at about $17,000 and $22,000 p.a.? Any idea what they are from?

The people with truly “sophisticated arrangements in place” do not pay any income tax. You cannot catch them with income tax. All their income is attributed to their company in the Caribbean or Channel islands or some other low tax jurisdiction.

I see the exact same spike has existed for almost 20 years.

They are from superannuation and benefit payments which are of same or similar amounts, hence the spike.

Ahhh thanks, Sacha

Can’t recall where I read that yesterday, sorry, but a source I trust. Probably a twitter discussion.

$250K is the super rich? I think you need to look at the turnover levels of $50 million plus individuals, trusts and companies. While probably legitimate and many contributing to NZ through job creation, it is the ones that seem to be routing the system that should be targeted. i.e. many $100 million dollar companies in Australian were found to be paying 0 taxes.

f anyone is to be considered rich that is what I consider wealth – not someone on $250k (likely to be a doctor with huge student debt where much of the money is already going in taxes)…

There needs to be the same treatment between individuals and companies and trusts tax wise for a start – at present there is too many loopholes for companies and trusts that individuals can’t access. Make it fair.

Is it election year yet?

If it is, has “the left” decided that telling the wannabe middle class that they need to pay more taxes is the winning strategy for this year?

OK, whatever, let’s go with that.

PS bet that same chart spike existed under Helen Clark/Michael Cullen.

It makes no sense and would likely loose the election therefore the ‘brains trust’ will likely go with it.

In that case, it seems like the Greens Brain Trust is all go

Come on now, the middle classes? Is that what you read from this? If so, we do need to clarify the message – the middle and bottom should get tax cuts at the considerable expense to the top who pay the least if at all.

The top pay nothing. I’d be surprised if they even registered $70,000 worth of annual income.

If you want to get them, you have to implement property taxes, financial asset taxes and financial transaction taxes. Not more income tax.

@ Roy, the way our tax system is worked those on $70k or less are already probably accessing benefits like working for families, accommodation supplement and community services card.

It’s those above that who are currently pay the top tax rate but also do not qualify for any other benefits that end up paying more than their share. Bizarrely they seem to be the ones most targeted by Labour/Greens for more taxes. To many that does not seem fair.

It also allows National to get back in, the same person who was complaining about half her taxes going in Student allowances, Kiwisaver and income tax thought the beneficiaries were the ones to blame..

Clearly I don’t believe in that, just as I don’t believe that the people on income taxes above $70k or even $250k are the issue, I think the 50 million plus and new residents who have no jobs or jobs with low turnovers who have million dollar houses and flash cars on this apparent low income who should be the ones who seem to be doing the best out of the current system….

Gee CV

Postulating the left is going to do something.

Then saying it is a bad idea and they are a bunch of losers anyway.

You have spent too much time with Trump …

…not to mention snorting nanothermite. The rot set in long before Herr Uberlugenfarter came on the scene.

Where big corporate money really is, profits stashed overseas until they get special deals on taxes…

Big corporate taxation is a bigger issue than individual taxation because that is what is stopping job creation as well as monopolising the local markets.

If companies are paying real taxes locally they are at a big disadvantage to companies using all the loopholes to avoid paying the same rates.

The government in NZ spent more advertising with Google for example than Google paid in taxes in NZ. So we have a system that is designed not to work or be fair.

https://theintercept.com/2017/01/05/corporations-prepare-to-gorge-on-tax-cuts-trump-claims-will-create-jobs/

BOOOOOOM

You are on to it. Not to mention expanding out our current account deficit.

But it’s simpler and less politically risky to hit at wannabe middle class individuals (let’s call them incomes of under $200K pa) rather than struggle with the headache of taking on Apple, Google and Face Book, not to mention the big banks and big corporates.

I’d say that is Labour and Greens problem – they seem to frame everything in hitting wannabe middle class individuals for more taxes… voters don’t want to vote hence last three election results…. NZ with their ‘user pays’ have more taxes on anything if ridiculous charges are not going to the government it goes to their cronies, such as when you go to your ‘free’ hospital in Auckland, you then have to pay $4 per hour for the privilege for parking….

Someone was listing to me yesterday that half their pay packet was already gone in taxes, Student loans, Kiwisaver, income taxes…. then there is all the user pays charges like public transport and parking…. that is just to get to work and if you have a job…

If governments want to catch taxes from the richest then they need to implement a transaction tax type system.

Let’s see if Labour is bringing out gutsy new ideas around this

Labour expect voters to elect them into power before they formulate a detailed tax plan.

And that leads us to where our taxes are now being diverted to…. political lobbyist ‘charities’…

NZ taxpayers’ money used to fund Clinton Foundation

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11780169

While homeless families are being forced to sleep in dingy hotels and pay back the $1000 p/w rent (forced debt levels) our taxes are siphoned off to pay for Hillary’s foundation or foreign aid to Scenic Hotels to build conference enters to enrich their company.

We have a very rotten system here!

Don’t worry mate I have it on good account that all that money paid to the Clinton Foundation found its way to charitable causes, and not holidays and weddings for the Clintons

Further nations like NZ didn’t pay into the Clinton Foundation to try and get into the Clintons’ “good books” (as it were).

In short beating up the ‘rich’ $70k plus ‘tax dodgers’ is an election disaster than bothering to wonder where the billions are being diverted too and why we have such a narrow job market in NZ…..

If you want to make taxes fair in a global economy you have to start to tax as you avoid system… catch the money as it is being populated around on paper or in electronic transactions…. it has the added advantage of taxing all the non residents speculating here as well..

Our tax system is essentially a form of legalised theft used by the rich to steal from the rest of us. The government has been enabling this theft.

🙄

If people are using the system to avoid paying the taxes that they owe then it’s theft that’s been enabled by government legislation.

😂😂

I wrote about exactly this problem for the Dom Post a few years ago.

Tax avoidance by well-off a rort – Dom Post 12/April/2013

It’s been a known problem for quite some time.

Thanks Deborah. I particularly like your last paragraph:

“Paying tax is part of the social compact. It’s the way we fund the basics of a decent society, including health, education and welfare. Looking for any means whatsoever to avoid contributing a fair share undercuts that social contact, just as much if not more than people who take welfare benefits but do not seek employment when they are able to.”

Thanks, MickyS. I think at the time there was a discussion going on about welfare, and the usual wretched beneficiary bashing rhetoric was in full cry. It thoroughly annoyed me, because I knew that the data showed there was a whole group of people rorting the system through the tax thresholds, and nothing was being said about it at all. Hence the comparisons with beneficiaries in the 2013 piece.

@ Deborah articles like this miss the point. It is legal to avoid taxes. I’m more worried about someone with turnovers of 100 million buying up the country or squeezing out other operators and paying nothing. Or those paying paying zero taxes here but accessing full welfare, seem to have millions of dollars around, than targeting some Doctor or Dentist on PAYE that helps society but now pays 33% not 39% less 10% student loan fees (now on 43% taxes) – at least they are paying 33 – 43% – what about those turnover millions paying 0% – why are they not talked about or targeted in tax articles?

The thing is most people will shrug their shoulders and think/say i’d do it to if i could.

Gareth Morgans full frontal approach to telling people to stop being greedy and pay your share is more likely to have an effect , than having a go at crooks like collins

Also notice the smaller spikes at 14000 and 48000, which are the other two income tax thresholds.