privatisation

Categories under privatisation

Know when to fold ’em

Written By: - Date published: 1:34 pm, August 26th, 2012 - 26 comments

National’s asset sales programme is in crisis. Key has three options on asset sales – plow ahead, cut a deal with iwi, or call it quits. The smart thing to do, for the good of the country and for National’s own good, remains to drop the policy altogether. But they won’t. Instead, they’ll play the race card. But that old joker isn’t the trump it once was.

Just give it up

Written By: - Date published: 7:41 am, August 23rd, 2012 - 50 comments

The Nats’ asset sales are beset at all sides. The companies aren’t ready for sale. Their future revenue is too uncertain to attract investors. The Government would end up with more debt not less. New, hidden, fiscal costs keep on coming to light. Few New Zealanders want to buy the shares. Over 200,000 have signed a petition against the sales.

The wheels coming off

Written By: - Date published: 10:40 am, August 22nd, 2012 - 46 comments

The Nats are admitting the wheels are coming of their asset sales programme. Solid Energy’s revenue is in free-fall. So is AirNZ’s. Nobody can predict the impact the water rights issue will have on the power companies. And Meridian is playing chicken with its main customer, the country’s largest energy consumer.

Would you buy shares in…

Written By: - Date published: 9:28 am, August 18th, 2012 - 42 comments

Mighty River, when its water use rights are in doubt? Meridian, when its deal with its largest customer is in question? Solid Energy, when it is reviewing all its operations due to the high dollar? Genesis, when Meridian could flood the market with cheap power if its deal with Rio Tinto falls through, and a future government is likely to sharply increase the cost of its emissions from Huntly?

Sell assets to avoid debt; take on debt to build motorways – huh?

Written By: - Date published: 7:05 am, August 16th, 2012 - 76 comments

So, let me get this straight. Debt is bad. So bad, in fact, that the Government is willing to sell assets that produce higher returns than its cost of borrowing to free up money and avoid taking on more debt. But this same Government is now planning to borrow to fill a $5 billion hole in its transport budget caused by its unneeded motorway projects.

What if they threw an asset sale & nobody came?

Written By: - Date published: 7:58 am, August 13th, 2012 - 49 comments

A TVNZ poll matches the results of the TV3 poll on whether people would buy shares in the asset sales. Only 50% say they definitely have $1,000 to spare to buy what they already own. Only 13% say they would “very likely” use that money to buy those shares. Hardly the ‘vast majority’. Most of us would end up dispossessed.

Asset sales could be delayed a year or more

Written By: - Date published: 8:35 am, August 7th, 2012 - 52 comments

“Unusual and inappropriate” – that’s how the Waitangi Tribunal has described National’s ‘report by August 24th or we’ll ignore you’ ultimatum. Imagine if you or I were party to a court case and tried that! Now, the Tribunal is going to deliver a truncated report before that deadline and the full one in September. This is going to the courts. Injunctions will delay the sale.

Nats try to muscle the Waitangi Tribunal

Written By: - Date published: 7:29 am, August 3rd, 2012 - 67 comments

A stockmarket float can’t happen at just any time. It needs to be close to the annual report or late enough in the new year to allow new numbers to be made after the Christmas break. So 2 windows a year. 5 to the election. Treasury says the stockmarket can only handle 1 asset sale a window, preferably 1 a year. The Nats know they will lose the next election. So they can’t afford to lose this sales window if they’re to do all the sales by the election.

Waitangi Tribunal could exercise binding powers

Written By: - Date published: 8:05 am, August 1st, 2012 - 124 comments

If John Key chooses to ignore the Waitangi Tribunal and continue to foment racial division in a desperate bid to split opposition to asset sales, he may be in for a nasty surprise. The Waitangi Tribunal has noted it has the power to make binding recommendations over memoralised land. Key doesn’t think Mighty River has any memoralised land. Yes, it does.

No legal power for looters’ bonus

Written By: - Date published: 8:47 am, July 31st, 2012 - 56 comments

I missed this last week: Key is now conceding that he doesn’t have legal authority to give away shares for free in a looters’ bonus. In June, Key and English arrogantly dismissed questions from Russel Norman on the legal authority to give away hundreds of millions of dollars worth of shares to the looters. Last week, Key sheepishly admitted that Norman is right.

Key’s rock and hard place

Written By: - Date published: 7:15 am, July 31st, 2012 - 17 comments

Does Key respect the Waitangi Tribunal’s call for a temporary halt to asset sales and its likely call for a further delay when it presents its full findings in September? If he does, he looks weak, gives the Keep Our Assets petition more time. If he doesn’t, he picks a fight with Maori, resulting in court injunctions, again delaying the sales, hurting the sale price, making him look weak.

Why asset sales – it’s politics

Written By: - Date published: 5:06 pm, July 30th, 2012 - 20 comments

Finally the truth is out. Gaynor and Armstrong agree – National Party politics are the real reason for asset sales. They make no sense economically. They are not about debt reduction. Key’s asset sales are a political bribe – nothing more and nothing less.

Greens have 100,000 signatures to Keep Our Assets

Written By: - Date published: 5:54 pm, July 28th, 2012 - 39 comments

The Greens have collected 100,000 signatures for the Keep Our Assets Coalition petition to force a referendum on asset sales – in fact, my Asset Keeper email says they were up another thousand at the end of Friday. The Coalition’s total is rapidly approaching 200,000. That’s after just 3 months. Another 150,000 or so to go – with margin for invalid signatures. Play your part.

A good week for the opposition

Written By: - Date published: 10:20 am, July 27th, 2012 - 52 comments

3 opposition private members’ Bills passed – extended paid parental leave, Mondayisation, and lobbying disclosure – on Wednesday (moving a ban on land sales to foreigners up the list). Then, all 5 drawn from the ballot on Thursday opposition bills too: marriage equality, $15hr minimum wage, super-majority/referendum protection for asset sales, charging government agencies that pay access to info, and controlling water pollution.

Another looters’ bonus

Written By: - Date published: 6:57 am, July 26th, 2012 - 26 comments

John Key’s grasp of his own asset sales policy is being revealed to be shakier by the day. He doesn’t know how it would hurt the government books. He flips his position on water rights each day. He doesn’t know how much a looters’ bonus of free shares would cost. And, yesterday, he didn’t even realise that $56m is budgeted to cover sharebrokers’ fees for the looters.

Newsflash: Parker not secret reptilian shape-shifter

Written By: - Date published: 11:28 am, July 25th, 2012 - 49 comments

There’s been some talk around the ‘sphere about a speech where David Parker made comments that some (*cough* Chris ‘the Right’s favourite Leftie’ Trotter *cough*) thought meant he supported asset sales. That obviously caused confusion because Parker and Labour are clearly against asset sales. Now, someone’s taken the innovative step of asking Parker what he meant (spoiler: it’s not what Trotter thought).

Making it up as he goes along

Written By: - Date published: 7:10 am, July 25th, 2012 - 48 comments

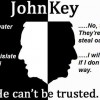

In the cartoon Calvin and Hobbes, they play a game called Calvinball. “The only consistent rule states that Calvinball may never be played with the same rules twice”. It’s a bit like that trying to call this government to account. One day they have legal authority to give away shares, next they don’t. One day they don’t know the cost, then they do, then they don’t again. Like Calvin, I’m getting the impression that Key is just making it up as he goes along.

Fiscal responsibility

Written By: - Date published: 6:45 am, July 24th, 2012 - 86 comments

John Key doesn’t want to go ahead with plain packaging of cigarettes. The cancer sellers would sue. It could cost a few million to beat them in the international courts (me, I would just create a law of corporate homicide and nationalise their NZ assets). Key baulks at the cost, the risk. But something in the hundreds of millions for free shares to looters? Key reckons that’s a great investment.

True lies

Written By: - Date published: 7:42 am, July 23rd, 2012 - 207 comments

On Breakfast just now, Petra Bagust asked John Key what’s so great for the economy about listing our assets on the stockmarket. A good question. In his answer, Key tried to make out that floating these companies on the stockmarket would give them more cash to grow. But not a cent of the revenue will go to the companies and Key knows it.

Key confirms looters’ bonus

Written By: - Date published: 2:01 pm, July 22nd, 2012 - 173 comments

In front of a room full of rich people, John Key confirmed today that, when they buy our shares in our company they will also get a free hand out from the Government if they hold on to their plunder for 3 years. There’s no legislative authority for National to contract to make such a gift, of course. But, when you’re plundering the State, what do rules matter?

Asset sales policy burning up

Written By: - Date published: 8:47 am, July 18th, 2012 - 14 comments

Key says the odds of a delay in the sale of Mighty River are like the “chance a meteorite will hit the Earth this afternoon”. It turns out, that’s a near certainty. So, Key was accidentally, telling the truth – the odds of a delay in the asset sales are growing daily.

Key’s legacy

Written By: - Date published: 1:15 pm, July 16th, 2012 - 40 comments

Which will be remembered as the greater crime in Key’s legacy: selling off our strategically vital and profitable energy assets leading to higher power prices or standing by and doing nothing while another housing bubble fueled by cheap foreign credit leaves us more indebted and with lower home ownership? Or the smug, absent grin he wore throughout?

Day of action against asset sales

Written By: - Date published: 3:46 pm, July 14th, 2012 - 126 comments

Key’s comments a blank cheque for investors

Written By: - Date published: 9:32 am, July 13th, 2012 - 48 comments

Now, I’m no big city lawyer, but it seems to me that John Key may be walking on some mighty thin ice by telling prospective investors in Mighty River not to worry about the Maori Council’s water claim. If it goes wrong, isn’t he exposing himself (actually, us taxpayers) to some major law suits and very expensive damages payouts?

Dumb or dissing?

Written By: - Date published: 8:07 am, July 12th, 2012 - 46 comments

Some of the media reckon that Key slagging off the Waitangi Tribunal was an accident of honesty: he was just stating reality that the Tribunal’s findings aren’t binding, he didn’t realise it would provoke a firestorm of reaction. Others say he knew exactly what he was doing and provoked the firestorm to try to split the opposition to asset sales along racial lines.

Buyer beware

Written By: - Date published: 7:26 am, July 11th, 2012 - 70 comments

Are you keen to buy shares in Mighty River Power with a dividend return of 4% pre-tax? You can beat that in the bank, and paying off debt is a far better use of money. But say you’re still keen. What about the threat of Mighty River losing water rights or having to pay for them – will you buy in with that unresolved? Only nutters would take Key’s offer with that up in the air.

Asset sales & Brand Key becoming inextricably linked

Written By: - Date published: 7:08 am, July 10th, 2012 - 163 comments

It’s getting almost sad, how desperate John Key is to sell our assets. He’s preparing to overturn convention and ignore the Waitangi Tribunal. Meanwhile, something on the order of 3,000 people a day are signing the referendum petition on asset sales. Key is now spending every day fighting fires on a highly unpopular policy. It’ll make for a sad legacy.

Can iwi stop asset sales?

Written By: - Date published: 1:12 pm, July 9th, 2012 - 38 comments

someone will have explained to Key that Maori have a solid claim to ownership of water that could affect asset sales. But someone else will have been in his other ear pointing out that picking a fight with Maori over the Treaty could be a good way to win some votes back and wedge the opponents of asset sales. Guess who he listened to.

Can you afford to buy shares?

Written By: - Date published: 9:27 am, July 5th, 2012 - 106 comments

The median household has $1700 in the bank – you couldn’t really term that savings, it’s operating cash. The Nats want us to fork out at least a grand a time to participate in each share float. That just doesn’t add up. Labour and the Greens are right, this isn’t an opportunity for ordinary people to invest, it’s a wealth transfer to the elite.

The server will be getting hardware changes this evening starting at 10pm NZDT.

The site will be off line for some hours.

Recent Comments