National’s enormous tax hole problem

National’s enormous tax hole problem

Written By:

mickysavage - Date published:

8:19 am, September 14th, 2023 - 115 comments

Categories: Christopher Luxon, Economy, national, same old national, tax -

Tags:

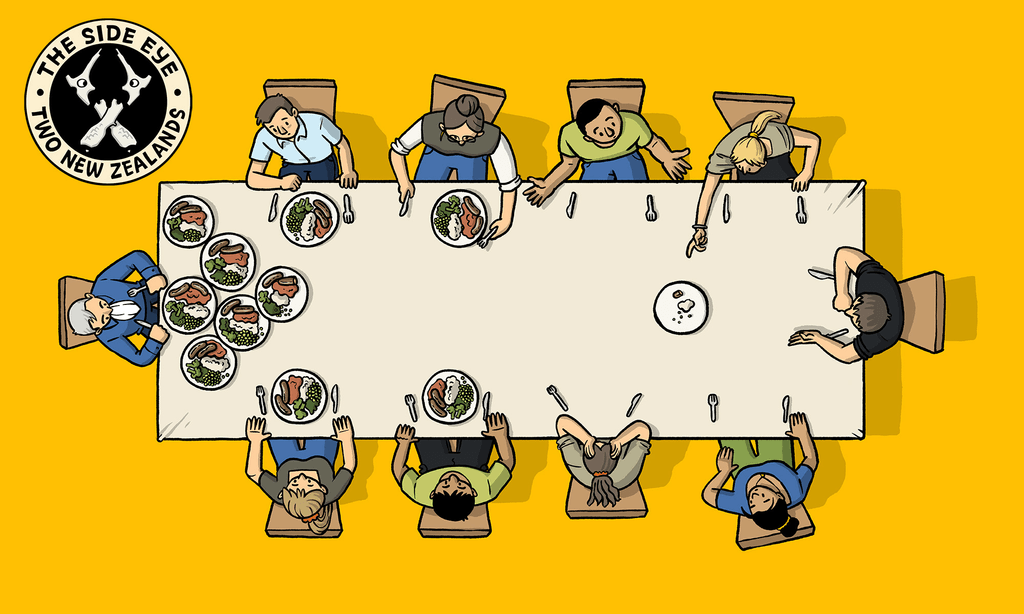

The right has this belief that they are economic geniuses. Their reason for being is that they will make the economy better. The eternal question is who for, the answer tends to be for the rich and the rest of us can get stuffed, but their world view is of extreme importance to them.

Not all of them are rich. But they all want to be rich.

Occasionally this belief is shown to be faulty. Check out what Liz Truss did to the UK economy or what Rob Muldoon did to ours if you need proof.

And locally there is a growing belief amongst the media that National’s Foreign Tax policy calculations are hopelessly optimistic.

The policy was released two weeks ago and the questioning of the figures continues and has not abated.

National leader Christopher Luxon has tried to put the issue to bed but his uber confidence has not persuaded journalists.

You should listen to this Radio New Zealand clip where Luxon the trained talking robot said that the policy is rock solid and that he is really, very, absolutely confident about National’s figures.

Radio New Zealand hired two economists to look at the figures. They concluded that about 700 sales at an average price of about $2.7 million could be achieved. They calculate the tax raised would be in the vicinity of$210 to $290 million a year, not the $715 million promised by National in the first year. And they point out the Costelia review of National’s figures appears to have been on the report itself which contains no calculations.

If National’s calculations are robust then National should release them. Otherwise it can expect this issue to dog it for the rest of the campaign.

And a second large hole has appeared in National’s calculations. It anticipated that $1.5 billion of the Carbon fund was immediately available to be reprioritised or squandered depending on your world view. This was the figure for the fund in the Budget documents but the amount actually available is $1 billion. Labour announced in August that $500 million would be applied to walking and cycling projects. National clearly must have missed the memo.

Further costing "hole" tidbit: National's $500m climate fund gap.

-After Budget 23, there was $1.5b in the climate fund.

-On Aug 17, the Govt announced $500m from the fund would go to walking & cycling.

-On Aug 30, National's tax plan assumed the $1.5b was still all there. pic.twitter.com/XzJ0ae4set

— Marc Daalder 😷 Wear a Mask (@marcdaalder) September 13, 2023

Half a billion here, half a billion there, pretty soon we are talking about real money.

This is important because a billion dollar hole in Government’s budget would mean either increased debt or some pretty savage cuts.

And it goes to the core of National’s claim to be economic geniuses. If they cannot get basic predictions right then they deserve to be roasted.

This issue is not going to go away. And National is damned either way. If it releases its calculations I anticipate that its inability to price policies will be laid bare. And if it doesn’t then a sense of mistrust in what it would actually do will grow.

Related Posts

115 comments on “National’s enormous tax hole problem ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Drowsy M. Kram to Traveller on

- Shanreagh to Belladonna on

- Drowsy M. Kram to AB on

- Bearded Git to SPC on

- tc to Adrian Thornton on

- gsays to Bearded Git on

- SPC to Belladonna on

- Belladonna to SPC on

- veutoviper to mikesh on

- Subliminal on

- Subliminal to newsense on

- SPC to Belladonna on

- weka to veutoviper on

- Shanreagh on

- SPC to Descendant Of Smith on

- Ffloyd on

- Traveller to Drowsy M. Kram on

- weka to veutoviper on

- Bearded Git to James Simpson on

- SPC to Bearded Git on

- alwyn on

- newsense on

- SPC to Drowsy M. Kram on

- SPC to Dennis Frank on

- David to Bearded Git on

- Jimmy to Dennis Frank on

- Drowsy M. Kram to Bearded Git on

- James Simpson to Bearded Git on

- Bearded Git to David on

- Anne on

- David to Bearded Git on

- Bearded Git to Dennis Frank on

- Dennis Frank to Bearded Git on

- ianmac on

- Drowsy M. Kram to Traveller on

- Ad on

- Traveller to Dennis Frank on

- Bearded Git to Dennis Frank on

- weka to Dennis Frank on

- Bearded Git to gsays on

- Dennis Frank on

- Traveller to Drowsy M. Kram on

- Tony Veitch to weka on

- weka to Tony Veitch on

- Tony Veitch on

- Drowsy M. Kram to Traveller on

- bwaghorn to Belladonna on

- gsays on

- Grant to Dolomedes III on

- weka to Res Publica on

- Res Publica to lprent on

- Traveller on

- Betty Bopper to weka on

- roblogic on

- Dolomedes III to Drowsy M. Kram on

- roblogic on

- gsays to Dolomedes III on

- gsays to Dolomedes III on

- Dolomedes III to weka on

- weka to Dolomedes III on

- Dolomedes III to Belladonna on

- Dolomedes III to weka on

- Janice on

- Dolomedes III to gsays on

- weka to Dolomedes III on

- gsays to Dolomedes III on

- observer on

Recent Posts

-

by weka

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by nickkelly

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by advantage

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

- The Song of Saqua: Volume VIII

Thus far May has followed on from a quiet April in the blogging department, but in fairness, it has been another case of doing what I am supposed to be doing, namely writing original fiction. Plus reading. So don’t worry – I have been productive. But in order to reassure ...A Phuulish FellowBy strda2211 hour ago

Thus far May has followed on from a quiet April in the blogging department, but in fairness, it has been another case of doing what I am supposed to be doing, namely writing original fiction. Plus reading. So don’t worry – I have been productive. But in order to reassure ...A Phuulish FellowBy strda2211 hour ago - Pretending to talk other people’s languages

Fakes can come in many forms.A Rolex, for instance.A tan can be fake. Read more ...More Than A FeildingBy David Slack3 hours ago

Fakes can come in many forms.A Rolex, for instance.A tan can be fake. Read more ...More Than A FeildingBy David Slack3 hours ago - What’s new? A social agency with an emphasis on “investment” instead of “wellbeing” – b...

Buzz from the Beehive A new government agency will open for business on July 1 – the Social Investment Agency. As a new standalone central agency effective from 1 July, it will lead the development of social investment across Government, helping ministers understand who they need to invest in, what ...Point of OrderBy Bob Edlin3 hours ago

Buzz from the Beehive A new government agency will open for business on July 1 – the Social Investment Agency. As a new standalone central agency effective from 1 July, it will lead the development of social investment across Government, helping ministers understand who they need to invest in, what ...Point of OrderBy Bob Edlin3 hours ago - Following the political money

Bryce Edwards writes – “Follow the money” is the classic directive to journalists trying to understand where power and influence lie in society. In terms of uncovering who influences various New Zealand political parties and governments, it therefore pays to look at who is funding them. The ...Point of OrderBy poonzteam54436 hours ago

Bryce Edwards writes – “Follow the money” is the classic directive to journalists trying to understand where power and influence lie in society. In terms of uncovering who influences various New Zealand political parties and governments, it therefore pays to look at who is funding them. The ...Point of OrderBy poonzteam54436 hours ago - Hipkins would rather no one remember that he was Minister of Education

Alwyn Poole writes – After being elected to Parliament in 2008 the maiden speech of Hipkins was substantially around education policy. He was Labour’s spokesperson for education 2011 – 2017. He was Minister for Education from 2017 until February 2023. This is approximately 88% of the time Labour ...Point of OrderBy poonzteam54436 hours ago

Alwyn Poole writes – After being elected to Parliament in 2008 the maiden speech of Hipkins was substantially around education policy. He was Labour’s spokesperson for education 2011 – 2017. He was Minister for Education from 2017 until February 2023. This is approximately 88% of the time Labour ...Point of OrderBy poonzteam54436 hours ago - Fashionable follies

Eric Crampton writes – A fashion industry group is lobbying for protections. They make the usual arguments and a newer one. None of it makes sense. An industry group says it pumped $7.8 billion into the economy last year – that’s 1.9 percent of New Zealand’s GDP. ...Point of OrderBy poonzteam54437 hours ago

Eric Crampton writes – A fashion industry group is lobbying for protections. They make the usual arguments and a newer one. None of it makes sense. An industry group says it pumped $7.8 billion into the economy last year – that’s 1.9 percent of New Zealand’s GDP. ...Point of OrderBy poonzteam54437 hours ago - Justice for Bainimarama!

In December 2006, Fiji's military leader Voreqe Bainimarama overthrew the elected government in a coup. He ruled Fiji for the next 16 years, first as dictator, then as "elected" Prime Minister. But now, he's finally been sent to jail where he belongs. Sadly, this isn't for his real crime of ...No Right TurnBy Idiot/Savant7 hours ago

In December 2006, Fiji's military leader Voreqe Bainimarama overthrew the elected government in a coup. He ruled Fiji for the next 16 years, first as dictator, then as "elected" Prime Minister. But now, he's finally been sent to jail where he belongs. Sadly, this isn't for his real crime of ...No Right TurnBy Idiot/Savant7 hours ago - March for Nature in June

Don't like National's corrupt Muldoonist "fast-track" law? Aotearoa's environmental NGO's - Greenpeace, Forest & Bird, WWF, Coromandel Watchdog, Coal Action Network Aotearoa, Kiwis Against Seabed Mining, and others - have announced a joint march against it in Auckland in June: When: 13:00, 8 June, 2024 Where: Aotea Square, Auckland You ...No Right TurnBy Idiot/Savant9 hours ago

Don't like National's corrupt Muldoonist "fast-track" law? Aotearoa's environmental NGO's - Greenpeace, Forest & Bird, WWF, Coromandel Watchdog, Coal Action Network Aotearoa, Kiwis Against Seabed Mining, and others - have announced a joint march against it in Auckland in June: When: 13:00, 8 June, 2024 Where: Aotea Square, Auckland You ...No Right TurnBy Idiot/Savant9 hours ago - Bernard’ s Dawn Chorus & Pick ‘n’ Mix for Thursday May 9

Seymour describes sushi as too woke for school meals. There are no fish sushi meals recommended by the School Lunches programme. Photo: Lynn Grieveson / Getty ImagesTL;DR: The Government will swap out hot meals for packaged sandwiches to save $107 million on school lunches for poor kids. MSD has pulled ...The KakaBy Bernard Hickey10 hours ago

Seymour describes sushi as too woke for school meals. There are no fish sushi meals recommended by the School Lunches programme. Photo: Lynn Grieveson / Getty ImagesTL;DR: The Government will swap out hot meals for packaged sandwiches to save $107 million on school lunches for poor kids. MSD has pulled ...The KakaBy Bernard Hickey10 hours ago - The non-woke $3 Lunch.

I don't mind stealin' bread from the mouths of decadenceBut I can't feed on the powerless when my cup's already overfilled, yeahBut it's on the table, the fire's cookin'And they're farmin' babies, while slaves are workin'The blood is on the table and the mouths are chokin'But I'm goin' hungry, yeahSome ...Nick’s KōreroBy Nick Rockel11 hours ago

I don't mind stealin' bread from the mouths of decadenceBut I can't feed on the powerless when my cup's already overfilled, yeahBut it's on the table, the fire's cookin'And they're farmin' babies, while slaves are workin'The blood is on the table and the mouths are chokin'But I'm goin' hungry, yeahSome ...Nick’s KōreroBy Nick Rockel11 hours ago - Labour’s chickens come home to roost

The Ardern Government’s chickens came home to roost yesterday with the news that the country is short of natural gas. In 2018, Labour banned offshore petroleum exploration, and industry executives say that the attendant loss of confidence by the industry impacted overall investment in onshore gas fields. Energy Resources Minister ...PolitikBy Richard Harman14 hours ago

The Ardern Government’s chickens came home to roost yesterday with the news that the country is short of natural gas. In 2018, Labour banned offshore petroleum exploration, and industry executives say that the attendant loss of confidence by the industry impacted overall investment in onshore gas fields. Energy Resources Minister ...PolitikBy Richard Harman14 hours ago - Calvin Reviews Lord of The RingsDavid FarrierBy David Farrier15 hours ago

- Climate Adam: How to visualise Climate Change (ft. Katharine Hayhoe)

This video includes conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). Climate change is everywhere. And when something's everywhere it can feel like it's nowhere. So how do we get our heads ...1 day ago

This video includes conclusions of the creator climate scientist Dr. Adam Levy. It is presented to our readers as an informed perspective. Please see video description for references (if any). Climate change is everywhere. And when something's everywhere it can feel like it's nowhere. So how do we get our heads ...1 day ago - The wrong direction

Some good news on climate change today: the energy transition away from fossil fuels is picking up speed, and renewables now make up 30% of global electricity supply. Meanwhile, in Aotearoa, we're moving in the opposite direction, with Genesis Energy announcing that it will resume importing Indonesian coal. Their official ...No Right TurnBy Idiot/Savant1 day ago

Some good news on climate change today: the energy transition away from fossil fuels is picking up speed, and renewables now make up 30% of global electricity supply. Meanwhile, in Aotearoa, we're moving in the opposite direction, with Genesis Energy announcing that it will resume importing Indonesian coal. Their official ...No Right TurnBy Idiot/Savant1 day ago - National hates democracy

Its a law like gravity: whenever a right-wing government is elected, they start attacking democracy. And now, after talking to their Republican and Tory and Fidesz chums at the International Democracy Union forum in Wellington, National is doing it here, announcing plans to remove election-day enrolment. Or, to put it ...No Right TurnBy Idiot/Savant1 day ago

Its a law like gravity: whenever a right-wing government is elected, they start attacking democracy. And now, after talking to their Republican and Tory and Fidesz chums at the International Democracy Union forum in Wellington, National is doing it here, announcing plans to remove election-day enrolment. Or, to put it ...No Right TurnBy Idiot/Savant1 day ago - No Tikanga Please, We're Lawyers.

Yesterday Winston Peters focussed his attention on the important matter at hand. Tweeting. Like the former, and quite possibly next, orange POTUS, from whom he takes much of his political strategy, Winston is an avid X’er.His message didn’t resemble an historic address this time. In fact it was more reminiscent ...Nick’s KōreroBy Nick Rockel1 day ago

Yesterday Winston Peters focussed his attention on the important matter at hand. Tweeting. Like the former, and quite possibly next, orange POTUS, from whom he takes much of his political strategy, Winston is an avid X’er.His message didn’t resemble an historic address this time. In fact it was more reminiscent ...Nick’s KōreroBy Nick Rockel1 day ago - Member’s Day

Today is a Member's Day, and it seems we've entered the slowdown as things emerge from select committee. First up is the committee stage of Greg O'Connor's Child Protection (Child Sex Offender Government Agency Registration) (Overseas Travel Reporting) Amendment Bill, which will be followed by the second readings of Stuart ...No Right TurnBy Idiot/Savant1 day ago

Today is a Member's Day, and it seems we've entered the slowdown as things emerge from select committee. First up is the committee stage of Greg O'Connor's Child Protection (Child Sex Offender Government Agency Registration) (Overseas Travel Reporting) Amendment Bill, which will be followed by the second readings of Stuart ...No Right TurnBy Idiot/Savant1 day ago - Hurrah for coal – Shane Jones welcomes Genesis Energy’s import plans as natural gas production s...

Buzz from the Beehive A significant decline in natural gas production has given Resources Minister Shane Jones an opportunity to reiterate his enthusiasm for the mining and burning of coal. For good measure, he has praised an announcement from Genesis Energy that it will resume importing coal. He and Energy ...Point of OrderBy Bob Edlin1 day ago

Buzz from the Beehive A significant decline in natural gas production has given Resources Minister Shane Jones an opportunity to reiterate his enthusiasm for the mining and burning of coal. For good measure, he has praised an announcement from Genesis Energy that it will resume importing coal. He and Energy ...Point of OrderBy Bob Edlin1 day ago - Bryce Edwards: Following the political money

“Follow the money” is the classic directive to journalists trying to understand where power and influence lie in society. In terms of uncovering who influences various New Zealand political parties and governments, it therefore pays to look at who is funding them. The political parties are legally obliged to make ...Democracy ProjectBy bryce.edwards1 day ago

“Follow the money” is the classic directive to journalists trying to understand where power and influence lie in society. In terms of uncovering who influences various New Zealand political parties and governments, it therefore pays to look at who is funding them. The political parties are legally obliged to make ...Democracy ProjectBy bryce.edwards1 day ago - A Left-Right ranking of universities in NZ: a practical guide for students and parents

Rob MacCullough writes – Here is my subjective ranking on a “most-left” to “most-right” scale of most of our major NZ Universities, with some anecdotal (and at times amusing) evidence to back up the claim. Extreme Left Auckland University of Technology Evidence The ...Point of OrderBy poonzteam54431 day ago

Rob MacCullough writes – Here is my subjective ranking on a “most-left” to “most-right” scale of most of our major NZ Universities, with some anecdotal (and at times amusing) evidence to back up the claim. Extreme Left Auckland University of Technology Evidence The ...Point of OrderBy poonzteam54431 day ago - Inflation and GST thresholds

Eric Crampton writes – I hadn’t thought about this one until a helpful email showed up in my inbox.It’s pretty obvious that income tax thresholds should automatically index with inflation – whether to anchor the thresholds in percentiles of the income distribution, or to anchor against a real ...Point of OrderBy poonzteam54431 day ago

Eric Crampton writes – I hadn’t thought about this one until a helpful email showed up in my inbox.It’s pretty obvious that income tax thresholds should automatically index with inflation – whether to anchor the thresholds in percentiles of the income distribution, or to anchor against a real ...Point of OrderBy poonzteam54431 day ago - Green Party grapples with persistent scandals

Jacqui Van Der Kaay writes – Parliament’s speaker had no option but to refer Green MP Julie Anne Genter to the Privileges Committee for her behaviour in the House last Wednesday evening. The incident, in which she crossed the floor to wave a book and yell at National ...Point of OrderBy poonzteam54431 day ago

Jacqui Van Der Kaay writes – Parliament’s speaker had no option but to refer Green MP Julie Anne Genter to the Privileges Committee for her behaviour in the House last Wednesday evening. The incident, in which she crossed the floor to wave a book and yell at National ...Point of OrderBy poonzteam54431 day ago - A law school to be avoided – Auckland University of Technology

Gary Judd writes – The Dean of the law school at the Auckland University of Technology is someone called Khylee Quince. I have been sent her social media posting in which she has, over the LawNews headline “Senior King’s Counsel files complaint about compulsory tikanga Maori studies for ...Point of OrderBy poonzteam54431 day ago

Gary Judd writes – The Dean of the law school at the Auckland University of Technology is someone called Khylee Quince. I have been sent her social media posting in which she has, over the LawNews headline “Senior King’s Counsel files complaint about compulsory tikanga Maori studies for ...Point of OrderBy poonzteam54431 day ago - 17 people in Malaita stand in way of China’s takeover of the Solomons

Cleo Paskal writes – WASHINGTON, D.C.: ‘Many of us have received phone calls from [the opposing camp] telling them if they join the camp they will be given projects for their wards and $300,000 [around US$35,000] each’, says former Malaita Premier Daniel Suidani. The elections in Solomon Islands aren’t ...Point of OrderBy Bob Edlin1 day ago

Cleo Paskal writes – WASHINGTON, D.C.: ‘Many of us have received phone calls from [the opposing camp] telling them if they join the camp they will be given projects for their wards and $300,000 [around US$35,000] each’, says former Malaita Premier Daniel Suidani. The elections in Solomon Islands aren’t ...Point of OrderBy Bob Edlin1 day ago - Gordon Campbell on the Hamas Ceasefire Offer, and Mark Mitchell’s Incompetence

With hindsight, it was inevitable that (a) Hamas would agree to the ceasefire deal brokered by Egypt and Qatar and that ( b) Israel would then immediately launch attacks on Rafah, regardless. We might have hoped the concessions made by Hamas would cause Israel to desist from slaughtering thousands more ...Gordon CampbellBy lyndon1 day ago

With hindsight, it was inevitable that (a) Hamas would agree to the ceasefire deal brokered by Egypt and Qatar and that ( b) Israel would then immediately launch attacks on Rafah, regardless. We might have hoped the concessions made by Hamas would cause Israel to desist from slaughtering thousands more ...Gordon CampbellBy lyndon1 day ago - Bernard’ s Dawn Chorus & Pick ‘n’ Mix for Wednesday May 8

Placards and mourners outside the Kilbirnie Mosque following the Christchurch terror attack: MSD has terminated the Kaiwhakaoranga service, which has been used by 415 families since the attacks. Photo: Lynn GrievesonTL;DR: The Government’s pledge to only cut ‘back office’ staff rather than ‘frontline’ services is on increasingly shaky ground, with ...The KakaBy Bernard Hickey1 day ago

Placards and mourners outside the Kilbirnie Mosque following the Christchurch terror attack: MSD has terminated the Kaiwhakaoranga service, which has been used by 415 families since the attacks. Photo: Lynn GrievesonTL;DR: The Government’s pledge to only cut ‘back office’ staff rather than ‘frontline’ services is on increasingly shaky ground, with ...The KakaBy Bernard Hickey1 day ago - A few PT announcements

There’s been a few smaller public transport announcements over the last week or so that I thought I’d cover in a single post. Fareshare I’ve long called for Auckland Transport to offer a way to enable employer-subsidised public transport options. The need for this took on even more importance ...Greater AucklandBy Matt L1 day ago

There’s been a few smaller public transport announcements over the last week or so that I thought I’d cover in a single post. Fareshare I’ve long called for Auckland Transport to offer a way to enable employer-subsidised public transport options. The need for this took on even more importance ...Greater AucklandBy Matt L1 day ago - Jacqui Van Der Kaay: Green Party grapples with persistent scandals

Parliament’s speaker had no option but to refer Green MP Julie Anne Genter to the Privileges Committee for her behaviour in the House last Wednesday evening. The incident, in which she crossed the floor to wave a book and yell at National Minister Matt Doocey, reflects poorly on Genter and ...Democracy ProjectBy bryce.edwards1 day ago

Parliament’s speaker had no option but to refer Green MP Julie Anne Genter to the Privileges Committee for her behaviour in the House last Wednesday evening. The incident, in which she crossed the floor to wave a book and yell at National Minister Matt Doocey, reflects poorly on Genter and ...Democracy ProjectBy bryce.edwards1 day ago - At a glance – Tree ring proxies and the divergence problem

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...2 days ago

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...2 days ago - Nothing to sneer at

Who likes being sneered at? Nobody. Worse yet, when the sneerer has their facts all wrong, and might well be an idiot.The sneer in question is The adults are in charge now, and it is a sneer offered in retort to criticism of this new Government, no matter how well ...More Than A FeildingBy David Slack2 days ago

Who likes being sneered at? Nobody. Worse yet, when the sneerer has their facts all wrong, and might well be an idiot.The sneer in question is The adults are in charge now, and it is a sneer offered in retort to criticism of this new Government, no matter how well ...More Than A FeildingBy David Slack2 days ago - Still on their bullshit

When in government, Labour pushed to extend the Parliamentary term to four years, to reduce accountability and our ability to vote out a bad government. And now, they're trying to do it through the member's ballot, with a Four-Year Parliamentary Term Legislation Bill. The bill at least requires a referendum ...No Right TurnBy Idiot/Savant2 days ago

When in government, Labour pushed to extend the Parliamentary term to four years, to reduce accountability and our ability to vote out a bad government. And now, they're trying to do it through the member's ballot, with a Four-Year Parliamentary Term Legislation Bill. The bill at least requires a referendum ...No Right TurnBy Idiot/Savant2 days ago - Drawn

A ballot for a single Member's Bill was held today, and the following bill was drawn: Public Works (Prohibition of Compulsory Acquisition of Māori Land) Amendment Bill (Hūhana Lyndon) The bill would prevent the government from stealing Māori land in breach of Te Tiriti o Waitangi. It ...No Right TurnBy Idiot/Savant2 days ago

A ballot for a single Member's Bill was held today, and the following bill was drawn: Public Works (Prohibition of Compulsory Acquisition of Māori Land) Amendment Bill (Hūhana Lyndon) The bill would prevent the government from stealing Māori land in breach of Te Tiriti o Waitangi. It ...No Right TurnBy Idiot/Savant2 days ago - A nod and a wink that will unnecessarily cost Aucklanders tens of millions per year

Simeon Brown, alongside Wayne Brown, is favouring a political figleaf now in exchange for loading up tens of millions in extra interest costs on Auckland ratepayers. Photo: Lynn GrievesonTL;DR: Ratings agency Standard & Poor’s is pushing back hard at suggestions from Local Government Minister Simeon Brown and Mayor Wayne Brown ...The KakaBy Bernard Hickey2 days ago

Simeon Brown, alongside Wayne Brown, is favouring a political figleaf now in exchange for loading up tens of millions in extra interest costs on Auckland ratepayers. Photo: Lynn GrievesonTL;DR: Ratings agency Standard & Poor’s is pushing back hard at suggestions from Local Government Minister Simeon Brown and Mayor Wayne Brown ...The KakaBy Bernard Hickey2 days ago - Correcting the Corrections announcement – a fiscal farce that should bother the OECD

Buzz from the Beehive One headline-grabber from the Beehive yesterday was the OECD’s advice that the government must bring the Budget deficit under control or face higher interest rates. Another was the announcement of a $1.9 billion “investment” in Corrections over the next four years. In the best interests of ...Point of OrderBy Bob Edlin2 days ago

Buzz from the Beehive One headline-grabber from the Beehive yesterday was the OECD’s advice that the government must bring the Budget deficit under control or face higher interest rates. Another was the announcement of a $1.9 billion “investment” in Corrections over the next four years. In the best interests of ...Point of OrderBy Bob Edlin2 days ago - Like it or not, the Kiwis are either going into ‘Pillar 2’ – or they are going to China

Chris Trotter writes – Had Zheng He’s fleet sailed east, not west, in the early Fifteenth Century, how different our world would be. There is little reason to suppose that the sea-going junks of the Ming Dynasty, among the largest and most sophisticated sailing vessels ever constructed, would have failed ...Point of OrderBy poonzteam54432 days ago

Chris Trotter writes – Had Zheng He’s fleet sailed east, not west, in the early Fifteenth Century, how different our world would be. There is little reason to suppose that the sea-going junks of the Ming Dynasty, among the largest and most sophisticated sailing vessels ever constructed, would have failed ...Point of OrderBy poonzteam54432 days ago - A balanced and an unbalanced article

David Farrar writes – Two articles give a useful contrast in balance. Both seek to be neutral explainer articles. This one in the Herald on Social Investment covers the pros and cons nicely. It links to critical pieces and talks about aspects that failed and aspects that are more ...Point of OrderBy poonzteam54432 days ago

David Farrar writes – Two articles give a useful contrast in balance. Both seek to be neutral explainer articles. This one in the Herald on Social Investment covers the pros and cons nicely. It links to critical pieces and talks about aspects that failed and aspects that are more ...Point of OrderBy poonzteam54432 days ago - Deeply unserious country

Every bit of this seems insane. And people wonder why productivity is falling through the floor. Energy News reports that the Environment Court finally threw out Allan Crafar’s appeal against a solar farm. From the story: Consent was granted in 2022. Crafar appealed November 2022. On what grounds? That ...Point of OrderBy poonzteam54432 days ago

Every bit of this seems insane. And people wonder why productivity is falling through the floor. Energy News reports that the Environment Court finally threw out Allan Crafar’s appeal against a solar farm. From the story: Consent was granted in 2022. Crafar appealed November 2022. On what grounds? That ...Point of OrderBy poonzteam54432 days ago - Senior King’s Counsel files complaint about compulsory tikanga Māori studies for law students

The tikanga regulations will compel law students to be taught that a system which does not conform with the rule of law is nevertheless law which should be observed and applied… Gary Judd KC writes – I have made a complaint to Parliament’s Regulation ...Point of OrderBy poonzteam54432 days ago

The tikanga regulations will compel law students to be taught that a system which does not conform with the rule of law is nevertheless law which should be observed and applied… Gary Judd KC writes – I have made a complaint to Parliament’s Regulation ...Point of OrderBy poonzteam54432 days ago - https://www.greaterauckland.org.nz/?p=77196

The future of Te Huia, the train between Hamilton and Auckland, has been getting a lot of attention recently as current funding for it is only in place till the end of June. The government initially agreed to a five year trial, through to April 2026, but that was subject ...Greater AucklandBy Matt L2 days ago

The future of Te Huia, the train between Hamilton and Auckland, has been getting a lot of attention recently as current funding for it is only in place till the end of June. The government initially agreed to a five year trial, through to April 2026, but that was subject ...Greater AucklandBy Matt L2 days ago - Bernard’s pick 'n' mix for Tuesday, May 7

TL;DR: Hamas has just agreed to Israel’s ceasefire plan. Nelson hospital’s rebuild has been cut back to save money. The OECD suggests New Zealand break up network monopolies, including in electricity. PM Christopher Luxon’s news conference on a prison expansion announcement last night was his messiest yet.Here’s my top six ...The KakaBy Bernard Hickey2 days ago

TL;DR: Hamas has just agreed to Israel’s ceasefire plan. Nelson hospital’s rebuild has been cut back to save money. The OECD suggests New Zealand break up network monopolies, including in electricity. PM Christopher Luxon’s news conference on a prison expansion announcement last night was his messiest yet.Here’s my top six ...The KakaBy Bernard Hickey2 days ago - HM Prison Aotearoa.

A homicide in Ponsonby, a manhunt with a killer on the run. The nation’s leader stands before a press conference reassuring a frightened nation that he’ll sort it out, he’ll keep them safe, he’ll build some new prison spaces.Sorry what? There’s a scary dude on the run with a gun ...Nick’s KōreroBy Nick Rockel3 days ago

A homicide in Ponsonby, a manhunt with a killer on the run. The nation’s leader stands before a press conference reassuring a frightened nation that he’ll sort it out, he’ll keep them safe, he’ll build some new prison spaces.Sorry what? There’s a scary dude on the run with a gun ...Nick’s KōreroBy Nick Rockel3 days ago - Get Your Webworm Merch!

Hi,I know it’s been awhile since there’s been any Webworm merch — and today that all changes!Over the last four months, I’ve been working with New Zealand artist Jess Johnson to create a series of t-shirts, caps and stickers that are infused with Webworm DNA — and as of right ...David FarrierBy David Farrier3 days ago

Hi,I know it’s been awhile since there’s been any Webworm merch — and today that all changes!Over the last four months, I’ve been working with New Zealand artist Jess Johnson to create a series of t-shirts, caps and stickers that are infused with Webworm DNA — and as of right ...David FarrierBy David Farrier3 days ago - Top OECD economist puts Willis between a rock and a hard place

The OECD’s chief economist yesterday laid it on the line for the new Government: bring the deficit under control or face higher Reserve Bank interest rates for longer. And to bring the deficit under control, she meant not borrowing for tax cuts. But there was more. Without policy changes—introducing a ...PolitikBy Richard Harman3 days ago

The OECD’s chief economist yesterday laid it on the line for the new Government: bring the deficit under control or face higher Reserve Bank interest rates for longer. And to bring the deficit under control, she meant not borrowing for tax cuts. But there was more. Without policy changes—introducing a ...PolitikBy Richard Harman3 days ago - Media Link: “A View from Afar” on the moment of friction, and more.

After a hiatus of over four months Selwyn Manning and I finally got it together to re-start the “A View from Afar” podcast series. We shall see how we go but aim to do 2 episodes per month if possible. … Continue reading → ...KiwipoliticoBy Pablo3 days ago

After a hiatus of over four months Selwyn Manning and I finally got it together to re-start the “A View from Afar” podcast series. We shall see how we go but aim to do 2 episodes per month if possible. … Continue reading → ...KiwipoliticoBy Pablo3 days ago - Preposterous priorities – politicians preferred pastry

Newsroom writer Aaron Smale, in an article triggered by the High Court’s ruling on whether a sitting MP must respond to a summons to appear before the Waitangi Tribunal, reports on issues underpinning the tribunal’s urgent inquiry into the Government’s intention to remove Section 7AA from the Oranga Tamariki ...Point of OrderBy Bob Edlin3 days ago

Newsroom writer Aaron Smale, in an article triggered by the High Court’s ruling on whether a sitting MP must respond to a summons to appear before the Waitangi Tribunal, reports on issues underpinning the tribunal’s urgent inquiry into the Government’s intention to remove Section 7AA from the Oranga Tamariki ...Point of OrderBy Bob Edlin3 days ago - Climate Change: Forcing accountability in the UK

In 2008, the UK Parliament passed the Climate Change Act 2008. The law established a system of targets, budgets, and plans, with inbuilt accountability mechanisms; the aim was to break the cycle of empty promises and replace it with actual progress towards emissions reduction. The law was passed with near-universal ...No Right TurnBy Idiot/Savant3 days ago

In 2008, the UK Parliament passed the Climate Change Act 2008. The law established a system of targets, budgets, and plans, with inbuilt accountability mechanisms; the aim was to break the cycle of empty promises and replace it with actual progress towards emissions reduction. The law was passed with near-universal ...No Right TurnBy Idiot/Savant3 days ago - Other councils are keen to be next to strike a water deal with govt

Buzz from the Beehive Local Water Done Well – let’s be blunt – is a silly name, but the first big initiative to put it into practice has gone done well. This success is reflected in the headline on an RNZ report: District mayors welcome Auckland’s new water deal with ...Point of OrderBy Bob Edlin3 days ago

Buzz from the Beehive Local Water Done Well – let’s be blunt – is a silly name, but the first big initiative to put it into practice has gone done well. This success is reflected in the headline on an RNZ report: District mayors welcome Auckland’s new water deal with ...Point of OrderBy Bob Edlin3 days ago - Why India is key to heading off climate catastrophe

This is a re-post from Yale Climate Connections A farmworker cleans the solar panels of a solar water pump in the village of Jagadhri, Haryana Country, India. (Photo credit: Prashanth Vishwanathan/ IWMI) Decisions made in India over the next few years will play a key role in global ...3 days ago

This is a re-post from Yale Climate Connections A farmworker cleans the solar panels of a solar water pump in the village of Jagadhri, Haryana Country, India. (Photo credit: Prashanth Vishwanathan/ IWMI) Decisions made in India over the next few years will play a key role in global ...3 days ago - Meanwhile “… the disturbing trend of increasing violence towards children continues to worsen”

Lindsay Mitchell writes – The Children’s Minister, Karen Chhour, intends to repeal Section 7AA from the Oranga Tamariki Act 1989 because it creates conflict between claimed Crown Treaty obligations and the child’s best interests. In her words, “Oranga Tamariki’s governing principles and its act should be colour ...Point of OrderBy poonzteam54433 days ago

Lindsay Mitchell writes – The Children’s Minister, Karen Chhour, intends to repeal Section 7AA from the Oranga Tamariki Act 1989 because it creates conflict between claimed Crown Treaty obligations and the child’s best interests. In her words, “Oranga Tamariki’s governing principles and its act should be colour ...Point of OrderBy poonzteam54433 days ago - New Zealand’s geopolitical friendly fire has its limits

Geoffrey Miller writes – The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. ...Point of OrderBy poonzteam54433 days ago

Geoffrey Miller writes – The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. ...Point of OrderBy poonzteam54433 days ago - The post-Covid economy: is it in another long stagnation – and if so, why?

Brian Easton writes – This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be (I will report on them ...Point of OrderBy poonzteam54433 days ago

Brian Easton writes – This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be (I will report on them ...Point of OrderBy poonzteam54433 days ago - On the LTP 2024 Feedback

A few weeks ago Auckland Council released the results of consultation on the Long Term Plan (LTP) that occurred in March. With almost 28,000 submissions, it received the most feedback of any LTP in Auckland. It covered a wide range of topics soliciting feedback on different areas of council funded ...Greater AucklandBy Connor Sharp3 days ago

A few weeks ago Auckland Council released the results of consultation on the Long Term Plan (LTP) that occurred in March. With almost 28,000 submissions, it received the most feedback of any LTP in Auckland. It covered a wide range of topics soliciting feedback on different areas of council funded ...Greater AucklandBy Connor Sharp3 days ago - Bernard’s pick 'n' mix for Monday, May 6

TL;DR: Winston Peters is reported to have won a budget increase for MFAT. David Seymour wanted his Ministry of Regulation to be three times bigger than the Productivity Commission. Simeon Brown is appointing a Crown Monitor to Watercare to protect the Claytons Crown Guarantee he had to give ratings agencies ...The KakaBy Bernard Hickey3 days ago

TL;DR: Winston Peters is reported to have won a budget increase for MFAT. David Seymour wanted his Ministry of Regulation to be three times bigger than the Productivity Commission. Simeon Brown is appointing a Crown Monitor to Watercare to protect the Claytons Crown Guarantee he had to give ratings agencies ...The KakaBy Bernard Hickey3 days ago - Geoffrey Miller: New Zealand’s geopolitical friendly fire has its limits

The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. Carr had made highly ...Democracy ProjectBy Geoffrey Miller4 days ago

The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. Carr had made highly ...Democracy ProjectBy Geoffrey Miller4 days ago - I could be a Florist.

I could be a florist'Round the corner from Rye LaneI'll be giving daisies to craziesBut, baby, I'll wrap you up real safe Oh, I can give you flowers At the end of every dayFor the center of your table, a rainbowIn case you have people 'round to stay Depending on ...Nick’s KōreroBy Nick Rockel4 days ago

I could be a florist'Round the corner from Rye LaneI'll be giving daisies to craziesBut, baby, I'll wrap you up real safe Oh, I can give you flowers At the end of every dayFor the center of your table, a rainbowIn case you have people 'round to stay Depending on ...Nick’s KōreroBy Nick Rockel4 days ago - The Kaka’s diary for the week to May 12 and beyond

TL;DR: The six key events to watch in Aotearoa-NZ’s political economy in the week to May 12 include:PM Christopher Luxon is scheduled to hold a post-Cabinet news conference at 4 pm today. Finance Minister Nicola Willis will give a pre-budget speech on Thursday.Parliament sits from Question Time at 2pm on ...The KakaBy Bernard Hickey4 days ago

TL;DR: The six key events to watch in Aotearoa-NZ’s political economy in the week to May 12 include:PM Christopher Luxon is scheduled to hold a post-Cabinet news conference at 4 pm today. Finance Minister Nicola Willis will give a pre-budget speech on Thursday.Parliament sits from Question Time at 2pm on ...The KakaBy Bernard Hickey4 days ago - Willis on defence

The price of the foreign affairs “reset” is now becoming apparent, with Defence set to get a funding boost in the Budget. Finance Minister Nicola Willis has confirmed that it will be one of the few votes, apart from Health and Education and possibly Police, which will get an increase ...PolitikBy Richard Harman4 days ago

The price of the foreign affairs “reset” is now becoming apparent, with Defence set to get a funding boost in the Budget. Finance Minister Nicola Willis has confirmed that it will be one of the few votes, apart from Health and Education and possibly Police, which will get an increase ...PolitikBy Richard Harman4 days ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #18

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 28, 2024 thru Sat, May 4, 2024. Story of the week "It’s straight out of Big Tobacco’s playbook. In fact, research by John Cook and his colleagues ...4 days ago

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 28, 2024 thru Sat, May 4, 2024. Story of the week "It’s straight out of Big Tobacco’s playbook. In fact, research by John Cook and his colleagues ...4 days ago - A prerequisite for Vulture Capitalism.

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel4 days ago

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel4 days ago - Early evening, April 30

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack5 days ago

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack5 days ago - Do Newsroom’s staff think they’re culturally superior to the rest of us? Are they arguing that A...

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam54435 days ago

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam54435 days ago - Fun minor grudges

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54435 days ago

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54435 days ago - Bernard’s dawn chorus for Saturday, May 4 and pick ‘n’ mix for the weekend

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey5 days ago

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey5 days ago - The Dark Side and the Rebel Alliance.

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel5 days ago

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel5 days ago - Imaginary mandate, imaginary leadership

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack6 days ago

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack6 days ago - Winston Peters delivers a speech about NZ’s relationship with China but media focus on Bob Carr’...

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin6 days ago

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin6 days ago - The Post-Covid Economy

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton6 days ago

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton6 days ago - An awkward coincidence!

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant6 days ago

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant6 days ago - The Israel/Palestinian metastasis.

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo6 days ago

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo6 days ago - 27,000

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant6 days ago

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant6 days ago - MPs’ salaries – when is the best time to increase them?

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54436 days ago

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54436 days ago - Genter under fire

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54436 days ago

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54436 days ago - New Treasury paper on the productivity slowdown supports the downgrading of forecasts

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin6 days ago

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin6 days ago - Bernard’s pick 'n' mix for Friday, May 3

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey6 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey6 days ago - Weekly Roundup 3-May-2024

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland6 days ago

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland6 days ago

Related Posts

- Release: Sexual violence prevention among hundreds of job cuts at ACC

The National Government plans to cut 390 jobs at ACC, including roles in the areas of prevention of sexual violence, road safety and workplace safety. ...4 hours ago

The National Government plans to cut 390 jobs at ACC, including roles in the areas of prevention of sexual violence, road safety and workplace safety. ...4 hours ago - Government shows allergy to evidence in benefits crackdown

The Government has been caught in opposition to evidence once again as it looks to usher in tried, tested and failed work seminar obligations for job-seeking beneficiaries. ...8 hours ago

The Government has been caught in opposition to evidence once again as it looks to usher in tried, tested and failed work seminar obligations for job-seeking beneficiaries. ...8 hours ago - Minister of Finance reheats austerity politics

This morning’s pre-Budget speech from the Minister of Finance offered no “meaningful” news on the Government’s trickle-down economics based plans. ...10 hours ago

This morning’s pre-Budget speech from the Minister of Finance offered no “meaningful” news on the Government’s trickle-down economics based plans. ...10 hours ago - A win for Wellington – Greens welcome more housing

The Green Party is welcoming the announcement by the Minister Responsible for RMA Reform Chris Bishop to approve most of the Wellington City Council’s District Plan recommendations. ...1 day ago

The Green Party is welcoming the announcement by the Minister Responsible for RMA Reform Chris Bishop to approve most of the Wellington City Council’s District Plan recommendations. ...1 day ago - Release: Backtrack on school lunches a win for Kiwi kids

David Seymour has failed to get the sweeping cuts he wanted to the free and healthy school lunch programme, Labour education spokesperson Jan Tinetti said. ...1 day ago

David Seymour has failed to get the sweeping cuts he wanted to the free and healthy school lunch programme, Labour education spokesperson Jan Tinetti said. ...1 day ago - Release: Hon Willie Jackson to debate at the Prestigious Oxford Union

Hon Willie Jackson has been invited by the Oxford Union to debate the motion “This House Believes British Museums are not Very British’ on May 23rd. ...1 day ago

Hon Willie Jackson has been invited by the Oxford Union to debate the motion “This House Believes British Museums are not Very British’ on May 23rd. ...1 day ago - Members Bill will prevent Māori land confiscations

Green Party MP Hūhana Lyndon says her Public Works (Prohibition of Compulsory Acquisition of Māori Land) Amendment Bill is an opportunity to right some past wrongs around the alienation of Māori land. ...2 days ago

Green Party MP Hūhana Lyndon says her Public Works (Prohibition of Compulsory Acquisition of Māori Land) Amendment Bill is an opportunity to right some past wrongs around the alienation of Māori land. ...2 days ago - TIKANGA IS NOT LAW. IT IS CULTURAL INDOCTRINATION.

A senior, highly respected King’s Counsel with decades of experience in our law courts, Gary Judd KC, has filed a complaint about compulsory tikanga Māori studies for law students - highlighting the utter depths of absurdity this woke cultural madness has taken our society. The tikanga regulations will compel law ...2 days ago

A senior, highly respected King’s Counsel with decades of experience in our law courts, Gary Judd KC, has filed a complaint about compulsory tikanga Māori studies for law students - highlighting the utter depths of absurdity this woke cultural madness has taken our society. The tikanga regulations will compel law ...2 days ago - Release: National won’t commit to full Nelson Hospital upgrade

The Government needs to be clear with the people of the Nelson Marlborough region about the changes it is considering for the Nelson Hospital rebuild, Labour health spokesperson Ayesha Verrall said. ...2 days ago

The Government needs to be clear with the people of the Nelson Marlborough region about the changes it is considering for the Nelson Hospital rebuild, Labour health spokesperson Ayesha Verrall said. ...2 days ago - Release: Labour calls for fast track list to be released

Ministers must front up about which projects it will push through under its Fast Track Approvals legislation, Labour environment spokesperson Rachel Brooking said today. ...3 days ago

Ministers must front up about which projects it will push through under its Fast Track Approvals legislation, Labour environment spokesperson Rachel Brooking said today. ...3 days ago - Release: National gaslights women fighting for equal pay

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...1 week ago

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...1 week ago - Release: More job cuts, fewer houses under National

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...1 week ago

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...1 week ago - Release: Children fall deeper through the cracks in Govt cuts

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...1 week ago

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...1 week ago - Release: Labour honours memory of Sir Robert Martin

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...1 week ago

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...1 week ago - Release: 130,000 cattle saved from live export

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...1 week ago

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...1 week ago - Central Bank makes clear Government is pouring fuel on housing crisis fire

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...1 week ago

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...1 week ago - New unemployment figures paint bleak picture

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...1 week ago

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...1 week ago - Release: National’s job cuts already starting to bite as unemployment rises

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...1 week ago

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...1 week ago - Release: National hiking transport costs for families and young New Zealanders

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...1 week ago

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...1 week ago - Release: Labour welcomes EU free trade agreement

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...1 week ago

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...1 week ago - Surprise: Landlord tax cuts don’t trickle down

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 week ago

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 week ago - Release: $1.7b for no increase in access to medicine

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 week ago

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 week ago - Release: National should heed Tribunal warning and scrap coalition commitment with ACT

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...1 week ago

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...1 week ago - Release: More accountability for preventable workplace deaths this Workers’ Memorial Day

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...1 week ago

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...1 week ago - Gaza: Aotearoa Must Support Independent Investigation into Mass Graves

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...2 weeks ago

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...2 weeks ago - Release: Working together on consistent support for veterans this Anzac Day

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago - Release: Penny drops – but what about Seymour and Peters?

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago - Another ‘Stolen Generation’ enabled by court ruling on Waitangi Tribunal summons

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago - Release: Budget blunder shows Nicola Willis could cut recovery funding

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago - Further environmental mismanagement on the cards

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago - Release: RMA changes will be a disaster for environment

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago - Release: Labour supports urgent changes to emergency management system

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago - Release: Labour calls for New Zealand to recognise Palestine

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago - Release: Three strikes law political posturing of worst kind

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago - Release: Government cuts unbelievably target child exploitation, violent extremism, ports and airpor...

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago - Three strikes has failed before and will fail again

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago - Release: Environmental protection vital, not ‘onerous’

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago - Ferris – Three Strikes targets those ‘too brown to be white’

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago - Release: Govt cuts doctors and nurses in hiring freeze

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...3 weeks ago

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...3 weeks ago

Related Posts

- Getting new job seekers on the pathway to work

Jobseeker beneficiaries who have work obligations must now meet with MSD within two weeks of their benefit starting to determine their next step towards finding a job, Social Development and Employment Minister Louise Upston says. “A key part of the coalition Government’s plan to have 50,000 fewer people on Jobseeker ...BeehiveBy beehive.govt.nz9 hours ago