Yet more dodgy Nat numbers

Yet more dodgy Nat numbers

Written By:

Eddie - Date published:

6:56 pm, July 18th, 2011 - 61 comments

Categories: benefits, bill english, dpf, making shit up, national, tax -

Tags:

If you’re a blogosphere regular, you’ll have noticed that recently every monkey with a copy of The Fountainhead and a crush on John Key has been spouting the line that the top 10% of taxpayers pay 71% of net tax. Sounds incredible, eh? That’s because it’s not credible. It’s more cheap numbers tricks from the Nats.

Over at Pundit, Rob Salmond has explained the trick. I’ll take the highlights of his post.

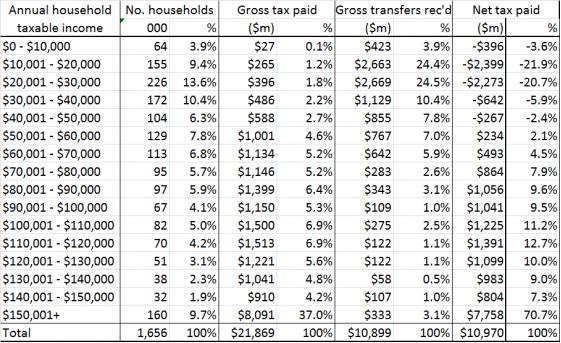

It all starts with Bill English’s table, let’s assume these basic numbers are right, although English hasn’t released his source data:

Net tax is the tax people pay minus benefits and tax credits like Working For Families that they get. This is where the 71% figure comes from. The top 9.7% paying $7.8 billion of net tax, which is 70.7% of the $11 billion total net tax. But wait:

Families earning over $150,000 paid net $7.8 billion. English and Farrar say that is 71% of the total. But when you use the same table and add up the amounts paid by families that earn above $80,000 but below $150,000, you find that those families also contribute a further net $7.6 billion, which is also around 70% of the total net tax.

What?! How the hell can two separate groups of families each pay 70% of the net tax?

The way English and Farrar put together this illusion is to assume that most of the “net tax paid” by middle-income families is not actually paid into “net tax.” Instead, it is put in a separate pool – “money for paying welfare transfers to net tax recipients.” Why use only middle class net taxes for this pool? Never mind why! Only when the “money for paying welfare transfers to net tax recipients” pool is full does “net tax paid” actually start paying towards “net tax.”

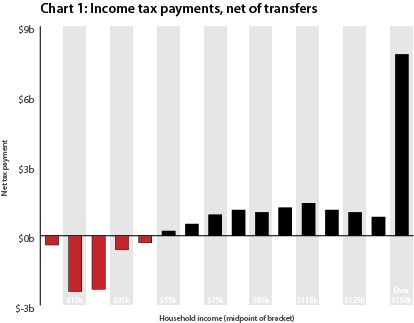

So, this is the trick: English and Farrar have offset the benefit transfers that the poorest families get against the net tax that middle income families pay. If you look it in graphical form, they’ve used the little black bars to fill in the red hole leaving the big black bar untouched:

Conveniently, that leaves nearly all the remaining tax being paid by the wealthy. But why do it that way, shouldn’t you just spread the cost of the transfers equally? Of course you should. Salmond points out one of the stupid results of English/Farrar’s magic numbers:

The list of silly conclusions that flow from their calculations is long. For example, under the English/Farrar counting rules, high-income families contribute absolutely nothing, not one cent, towards helping the needy with Working for Families payments, the DPB, or unemployment benefits. This is because their $7.8 billion goes into the “net tax” pool rather than the “paying for welfare transfers to net tax recipients” pool. That is, of course, an idiotic conclusion that is unfair to top-income earners, whose taxes do a great deal to support welfare programs.

It doesn’t make any sense to put all the benefit payments on to the middle incomes. If you and me pay $1000 each in tax and education is 10% of the budget, and we want to know what percentage of your tax went on defence spending, we wouldn’t pretend all my money had paid for other stuff, and say that you are paying for 100% of the education budget.

Salmond corrects English/Farrar’s numbers:

The correct way to calculate the percentage is to divide a group’s net contribution by the total of all net contributions. Correcting for this error in arithmetic, the net income tax contribution of $150,000+ households falls from 71% to 46%.

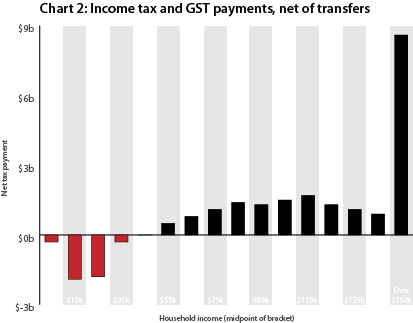

Salmond then points out that benefits aren’t funded entirely by income tax, there’s also other taxes like GST, which is regressive:

Using these more complete figures, the proportion of net tax paid by $150,000+ households drops further to 43%, a far cry from the 71% touted by English and Farrar.

But isn’t it still unfair that 10% of people by 43% of net tax?

To answer that, we need to remember that this is not some random slice of New Zealand families. This is the 10% with the highest incomes. That slice of New Zealand also has a lot in common with the richest 10% in terms of net wealth. What do we know about them?

- The 10% of top income-earning families earn 30% of the income. (Estimate from Stats NZ’s Household Economic Survey 2010)

- The wealthiest 10% of New Zealand families control roughly 50-60% of the wealth (Estimates from New Zealand Institute’s The Wealth of a Nation 2004)

This group earns 30% of the income, has 50% or more of the wealth, and pays 43% of the net tax. Is that an outrage?

I don’t think so. Even under a libertarian flat tax regime, this group would pay 30% of the tax. And our country is not a bunch of flat tax libertarians. We have always embraced progressive taxation, and been willing to lend a helping hand to those in need.

We have always known that when you help out people in need, other people pay more than their income share to fund it all.

The fortunate few paying 1.4 times their income share in tax is worthy of everyone’s gratitude. But it does not seem at all an unreasonable burden.

So, there we have it. More dodgy Nat numbers comprehensively demolished.

But I think we need to remember what is behind the dodgy numbers in the first place.

The Nats are desperately looking for an excuse as to why the highest 2% of earners shouldn’t have to go back to paying the 39% rate that they managed to pay for 9 years on income over the “stratospheric” threshold of $150,000 and why people making tax-free capital gains should still be subsidised by the rest of us. And the best they can come up with is ‘pity the poor rich guy’ and some drummed up numbers. Pitiful.

Related Posts

61 comments on “Yet more dodgy Nat numbers ”

- Comments are now closed

- Comments are now closed

Recent Comments

- Subliminal to bwaghorn on

- Drowsy M. Kram to Traveller on

- newsense on

- Belladonna to observer on

- Traveller to Drowsy M. Kram on

- James Simpson to Phillip ure on

- Ad on

- Drowsy M. Kram to Traveller on

- Phillip ure on

- Bearded Git to Grey Area on

- newsense on

- Stan on

- Obtrectator to bwaghorn on

- PB on

- Shanreagh to Drowsy M. Kram on

- Traveller to mickysavage on

- mickysavage to Traveller on

- SPC on

- SPC on

- Grey Area to Bearded Git on

- Grey Area to Phillip ure on

- Dolomedes III to Traveller on

- bwaghorn on

- Traveller to Drowsy M. Kram on

- Drowsy M. Kram to Tabletennis on

- Traveller to Tabletennis on

- Ad to Mike the Lefty on

- Phillip ure to Phillip ure on

- observer to Belladonna on

- Belladonna to observer on

- observer on

- Phillip ure to Tiger Mountain on

- Visubversa to tWig on

- Tabletennis to Drowsy M. Kram on

- Tabletennis to Traveller on

- roblogic on

- Traveller to Drowsy M. Kram on

- tWig to Dolomedes III on

- Drowsy M. Kram to Traveller on

Recent Posts

-

by mickysavage

-

by mickysavage

-

by mickysavage

-

by nickkelly

-

by mickysavage

-

by weka

-

by mickysavage

-

by mickysavage

-

by weka

-

by mickysavage

-

by advantage

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by Guest post

-

by advantage

-

by mickysavage

-

by mickysavage

-

by weka

-

by advantage

-

by weka

-

by nickkelly

-

by Guest post

-

by mickysavage

-

by mickysavage

-

by mickysavage

- A nod and a wink that will unnecessarily cost Aucklanders tens of millions per year

Simeon Brown, alongside Wayne Brown, is favouring a political figleaf now in exchange for loading up tens of millions in extra interest costs on Auckland ratepayers. Photo: Lynn GrievesonTL;DR: Ratings agency Standard & Poor’s is pushing back hard at suggestions from Local Government Minister Simeon Brown and Mayor Wayne Brown ...The KakaBy Bernard Hickey1 hour ago

Simeon Brown, alongside Wayne Brown, is favouring a political figleaf now in exchange for loading up tens of millions in extra interest costs on Auckland ratepayers. Photo: Lynn GrievesonTL;DR: Ratings agency Standard & Poor’s is pushing back hard at suggestions from Local Government Minister Simeon Brown and Mayor Wayne Brown ...The KakaBy Bernard Hickey1 hour ago - Correcting the Corrections announcement – a fiscal farce that should bother the OECD

Buzz from the Beehive One headline-grabber from the Beehive yesterday was the OECD’s advice that the government must bring the Budget deficit under control or face higher interest rates. Another was the announcement of a $1.9 billion “investment” in Corrections over the next four years. In the best interests of ...Point of OrderBy Bob Edlin2 hours ago

Buzz from the Beehive One headline-grabber from the Beehive yesterday was the OECD’s advice that the government must bring the Budget deficit under control or face higher interest rates. Another was the announcement of a $1.9 billion “investment” in Corrections over the next four years. In the best interests of ...Point of OrderBy Bob Edlin2 hours ago - Like it or not, the Kiwis are either going into ‘Pillar 2’ – or they are going to China

Chris Trotter writes – Had Zheng He’s fleet sailed east, not west, in the early Fifteenth Century, how different our world would be. There is little reason to suppose that the sea-going junks of the Ming Dynasty, among the largest and most sophisticated sailing vessels ever constructed, would have failed ...Point of OrderBy poonzteam54433 hours ago

Chris Trotter writes – Had Zheng He’s fleet sailed east, not west, in the early Fifteenth Century, how different our world would be. There is little reason to suppose that the sea-going junks of the Ming Dynasty, among the largest and most sophisticated sailing vessels ever constructed, would have failed ...Point of OrderBy poonzteam54433 hours ago - A balanced and an unbalanced article

David Farrar writes – Two articles give a useful contrast in balance. Both seek to be neutral explainer articles. This one in the Herald on Social Investment covers the pros and cons nicely. It links to critical pieces and talks about aspects that failed and aspects that are more ...Point of OrderBy poonzteam54434 hours ago

David Farrar writes – Two articles give a useful contrast in balance. Both seek to be neutral explainer articles. This one in the Herald on Social Investment covers the pros and cons nicely. It links to critical pieces and talks about aspects that failed and aspects that are more ...Point of OrderBy poonzteam54434 hours ago - Deeply unserious country

Every bit of this seems insane. And people wonder why productivity is falling through the floor. Energy News reports that the Environment Court finally threw out Allan Crafar’s appeal against a solar farm. From the story: Consent was granted in 2022. Crafar appealed November 2022. On what grounds? That ...Point of OrderBy poonzteam54434 hours ago

Every bit of this seems insane. And people wonder why productivity is falling through the floor. Energy News reports that the Environment Court finally threw out Allan Crafar’s appeal against a solar farm. From the story: Consent was granted in 2022. Crafar appealed November 2022. On what grounds? That ...Point of OrderBy poonzteam54434 hours ago - Senior King’s Counsel files complaint about compulsory tikanga Māori studies for law students

The tikanga regulations will compel law students to be taught that a system which does not conform with the rule of law is nevertheless law which should be observed and applied… Gary Judd KC writes – I have made a complaint to Parliament’s Regulation ...Point of OrderBy poonzteam54434 hours ago

The tikanga regulations will compel law students to be taught that a system which does not conform with the rule of law is nevertheless law which should be observed and applied… Gary Judd KC writes – I have made a complaint to Parliament’s Regulation ...Point of OrderBy poonzteam54434 hours ago - https://www.greaterauckland.org.nz/?p=77196

The future of Te Huia, the train between Hamilton and Auckland, has been getting a lot of attention recently as current funding for it is only in place till the end of June. The government initially agreed to a five year trial, through to April 2026, but that was subject ...Greater AucklandBy Matt L6 hours ago

The future of Te Huia, the train between Hamilton and Auckland, has been getting a lot of attention recently as current funding for it is only in place till the end of June. The government initially agreed to a five year trial, through to April 2026, but that was subject ...Greater AucklandBy Matt L6 hours ago - Bernard’s pick 'n' mix for Tuesday, May 7

TL;DR: Hamas has just agreed to Israel’s ceasefire plan. Nelson hospital’s rebuild has been cut back to save money. The OECD suggests New Zealand break up network monopolies, including in electricity. PM Christopher Luxon’s news conference on a prison expansion announcement last night was his messiest yet.Here’s my top six ...The KakaBy Bernard Hickey6 hours ago

TL;DR: Hamas has just agreed to Israel’s ceasefire plan. Nelson hospital’s rebuild has been cut back to save money. The OECD suggests New Zealand break up network monopolies, including in electricity. PM Christopher Luxon’s news conference on a prison expansion announcement last night was his messiest yet.Here’s my top six ...The KakaBy Bernard Hickey6 hours ago - HM Prison Aotearoa.

A homicide in Ponsonby, a manhunt with a killer on the run. The nation’s leader stands before a press conference reassuring a frightened nation that he’ll sort it out, he’ll keep them safe, he’ll build some new prison spaces.Sorry what? There’s a scary dude on the run with a gun ...Nick’s KōreroBy Nick Rockel6 hours ago

A homicide in Ponsonby, a manhunt with a killer on the run. The nation’s leader stands before a press conference reassuring a frightened nation that he’ll sort it out, he’ll keep them safe, he’ll build some new prison spaces.Sorry what? There’s a scary dude on the run with a gun ...Nick’s KōreroBy Nick Rockel6 hours ago - Get Your Webworm Merch!

Hi,I know it’s been awhile since there’s been any Webworm merch — and today that all changes!Over the last four months, I’ve been working with New Zealand artist Jess Johnson to create a series of t-shirts, caps and stickers that are infused with Webworm DNA — and as of right ...David FarrierBy David Farrier6 hours ago

Hi,I know it’s been awhile since there’s been any Webworm merch — and today that all changes!Over the last four months, I’ve been working with New Zealand artist Jess Johnson to create a series of t-shirts, caps and stickers that are infused with Webworm DNA — and as of right ...David FarrierBy David Farrier6 hours ago - Top OECD economist puts Willis between a rock and a hard place

The OECD’s chief economist yesterday laid it on the line for the new Government: bring the deficit under control or face higher Reserve Bank interest rates for longer. And to bring the deficit under control, she meant not borrowing for tax cuts. But there was more. Without policy changes—introducing a ...PolitikBy Richard Harman9 hours ago

The OECD’s chief economist yesterday laid it on the line for the new Government: bring the deficit under control or face higher Reserve Bank interest rates for longer. And to bring the deficit under control, she meant not borrowing for tax cuts. But there was more. Without policy changes—introducing a ...PolitikBy Richard Harman9 hours ago - Media Link: “A View from Afar” on the moment of friction, and more.

After a hiatus of over four months Selwyn Manning and I finally got it together to re-start the “A View from Afar” podcast series. We shall see how we go but aim to do 2 episodes per month if possible. … Continue reading → ...KiwipoliticoBy Pablo21 hours ago

After a hiatus of over four months Selwyn Manning and I finally got it together to re-start the “A View from Afar” podcast series. We shall see how we go but aim to do 2 episodes per month if possible. … Continue reading → ...KiwipoliticoBy Pablo21 hours ago - Preposterous priorities – politicians preferred pastry

Newsroom writer Aaron Smale, in an article triggered by the High Court’s ruling on whether a sitting MP must respond to a summons to appear before the Waitangi Tribunal, reports on issues underpinning the tribunal’s urgent inquiry into the Government’s intention to remove Section 7AA from the Oranga Tamariki ...Point of OrderBy Bob Edlin21 hours ago

Newsroom writer Aaron Smale, in an article triggered by the High Court’s ruling on whether a sitting MP must respond to a summons to appear before the Waitangi Tribunal, reports on issues underpinning the tribunal’s urgent inquiry into the Government’s intention to remove Section 7AA from the Oranga Tamariki ...Point of OrderBy Bob Edlin21 hours ago - Climate Change: Forcing accountability in the UK

In 2008, the UK Parliament passed the Climate Change Act 2008. The law established a system of targets, budgets, and plans, with inbuilt accountability mechanisms; the aim was to break the cycle of empty promises and replace it with actual progress towards emissions reduction. The law was passed with near-universal ...No Right TurnBy Idiot/Savant23 hours ago

In 2008, the UK Parliament passed the Climate Change Act 2008. The law established a system of targets, budgets, and plans, with inbuilt accountability mechanisms; the aim was to break the cycle of empty promises and replace it with actual progress towards emissions reduction. The law was passed with near-universal ...No Right TurnBy Idiot/Savant23 hours ago - Other councils are keen to be next to strike a water deal with govt

Buzz from the Beehive Local Water Done Well – let’s be blunt – is a silly name, but the first big initiative to put it into practice has gone done well. This success is reflected in the headline on an RNZ report: District mayors welcome Auckland’s new water deal with ...Point of OrderBy Bob Edlin23 hours ago

Buzz from the Beehive Local Water Done Well – let’s be blunt – is a silly name, but the first big initiative to put it into practice has gone done well. This success is reflected in the headline on an RNZ report: District mayors welcome Auckland’s new water deal with ...Point of OrderBy Bob Edlin23 hours ago - Why India is key to heading off climate catastrophe

This is a re-post from Yale Climate Connections A farmworker cleans the solar panels of a solar water pump in the village of Jagadhri, Haryana Country, India. (Photo credit: Prashanth Vishwanathan/ IWMI) Decisions made in India over the next few years will play a key role in global ...1 day ago

This is a re-post from Yale Climate Connections A farmworker cleans the solar panels of a solar water pump in the village of Jagadhri, Haryana Country, India. (Photo credit: Prashanth Vishwanathan/ IWMI) Decisions made in India over the next few years will play a key role in global ...1 day ago - Meanwhile “… the disturbing trend of increasing violence towards children continues to worsen”

Lindsay Mitchell writes – The Children’s Minister, Karen Chhour, intends to repeal Section 7AA from the Oranga Tamariki Act 1989 because it creates conflict between claimed Crown Treaty obligations and the child’s best interests. In her words, “Oranga Tamariki’s governing principles and its act should be colour ...Point of OrderBy poonzteam54431 day ago

Lindsay Mitchell writes – The Children’s Minister, Karen Chhour, intends to repeal Section 7AA from the Oranga Tamariki Act 1989 because it creates conflict between claimed Crown Treaty obligations and the child’s best interests. In her words, “Oranga Tamariki’s governing principles and its act should be colour ...Point of OrderBy poonzteam54431 day ago - New Zealand’s geopolitical friendly fire has its limits

Geoffrey Miller writes – The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. ...Point of OrderBy poonzteam54431 day ago

Geoffrey Miller writes – The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. ...Point of OrderBy poonzteam54431 day ago - The post-Covid economy: is it in another long stagnation – and if so, why?

Brian Easton writes – This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be (I will report on them ...Point of OrderBy poonzteam54431 day ago

Brian Easton writes – This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be (I will report on them ...Point of OrderBy poonzteam54431 day ago - On the LTP 2024 Feedback

A few weeks ago Auckland Council released the results of consultation on the Long Term Plan (LTP) that occurred in March. With almost 28,000 submissions, it received the most feedback of any LTP in Auckland. It covered a wide range of topics soliciting feedback on different areas of council funded ...Greater AucklandBy Connor Sharp1 day ago

A few weeks ago Auckland Council released the results of consultation on the Long Term Plan (LTP) that occurred in March. With almost 28,000 submissions, it received the most feedback of any LTP in Auckland. It covered a wide range of topics soliciting feedback on different areas of council funded ...Greater AucklandBy Connor Sharp1 day ago - Bernard’s pick 'n' mix for Monday, May 6

TL;DR: Winston Peters is reported to have won a budget increase for MFAT. David Seymour wanted his Ministry of Regulation to be three times bigger than the Productivity Commission. Simeon Brown is appointing a Crown Monitor to Watercare to protect the Claytons Crown Guarantee he had to give ratings agencies ...The KakaBy Bernard Hickey1 day ago

TL;DR: Winston Peters is reported to have won a budget increase for MFAT. David Seymour wanted his Ministry of Regulation to be three times bigger than the Productivity Commission. Simeon Brown is appointing a Crown Monitor to Watercare to protect the Claytons Crown Guarantee he had to give ratings agencies ...The KakaBy Bernard Hickey1 day ago - Geoffrey Miller: New Zealand’s geopolitical friendly fire has its limits

The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. Carr had made highly ...Democracy ProjectBy Geoffrey Miller1 day ago

The gloves are off. That might seem to be the undertone of surprisingly tough talk from New Zealand’s foreign and trade ministers. Winston Peters, the foreign minister, may be facing legal action after making allegations about former Australian foreign minister Bob Carr on Radio New Zealand. Carr had made highly ...Democracy ProjectBy Geoffrey Miller1 day ago - I could be a Florist.

I could be a florist'Round the corner from Rye LaneI'll be giving daisies to craziesBut, baby, I'll wrap you up real safe Oh, I can give you flowers At the end of every dayFor the center of your table, a rainbowIn case you have people 'round to stay Depending on ...Nick’s KōreroBy Nick Rockel1 day ago

I could be a florist'Round the corner from Rye LaneI'll be giving daisies to craziesBut, baby, I'll wrap you up real safe Oh, I can give you flowers At the end of every dayFor the center of your table, a rainbowIn case you have people 'round to stay Depending on ...Nick’s KōreroBy Nick Rockel1 day ago - The Kaka’s diary for the week to May 12 and beyond

TL;DR: The six key events to watch in Aotearoa-NZ’s political economy in the week to May 12 include:PM Christopher Luxon is scheduled to hold a post-Cabinet news conference at 4 pm today. Finance Minister Nicola Willis will give a pre-budget speech on Thursday.Parliament sits from Question Time at 2pm on ...The KakaBy Bernard Hickey1 day ago

TL;DR: The six key events to watch in Aotearoa-NZ’s political economy in the week to May 12 include:PM Christopher Luxon is scheduled to hold a post-Cabinet news conference at 4 pm today. Finance Minister Nicola Willis will give a pre-budget speech on Thursday.Parliament sits from Question Time at 2pm on ...The KakaBy Bernard Hickey1 day ago - Willis on defence

The price of the foreign affairs “reset” is now becoming apparent, with Defence set to get a funding boost in the Budget. Finance Minister Nicola Willis has confirmed that it will be one of the few votes, apart from Health and Education and possibly Police, which will get an increase ...PolitikBy Richard Harman1 day ago

The price of the foreign affairs “reset” is now becoming apparent, with Defence set to get a funding boost in the Budget. Finance Minister Nicola Willis has confirmed that it will be one of the few votes, apart from Health and Education and possibly Police, which will get an increase ...PolitikBy Richard Harman1 day ago - 2024 SkS Weekly Climate Change & Global Warming News Roundup #18

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 28, 2024 thru Sat, May 4, 2024. Story of the week "It’s straight out of Big Tobacco’s playbook. In fact, research by John Cook and his colleagues ...2 days ago

A listing of 26 news and opinion articles we found interesting and shared on social media during the past week: Sun, April 28, 2024 thru Sat, May 4, 2024. Story of the week "It’s straight out of Big Tobacco’s playbook. In fact, research by John Cook and his colleagues ...2 days ago - A prerequisite for Vulture Capitalism.

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel2 days ago

Yesterday I received come lovely feedback following my Star Wars themed newsletter. A few people mentioned they’d enjoyed reading the personal part at the beginning.I often begin newsletters with some memories, or general thoughts, before commencing the main topic. This hopefully sets the mood and provides some context in which ...Nick’s KōreroBy Nick Rockel2 days ago - Early evening, April 30

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack2 days ago

April 30 was going to be the day we’d be calling Mum from London to wish her a happy birthday. Then it became the day we would be going to St. Paul's at Evensong to remember her. The aim of the cathedral builders was to find a way to make their ...More Than A FeildingBy David Slack2 days ago - Do Newsroom’s staff think they’re culturally superior to the rest of us? Are they arguing that A...

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam54433 days ago

Rob MacCulloch writes – Can’t remember the last book by a Kiwi author you read? Think the NZ government should spend less on the arts in favor of helping the homeless? If so, as far as Newsroom is concerned, you probably deserve to be called a cultural ignoramus ...Point of OrderBy poonzteam54433 days ago - Fun minor grudges

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54433 days ago

Eric Crampton writes – Grudges are bad. Better to move on. But it can be fun to keep a couple of really trivial ones, so you’re not tempted to have other ones. For example, because of the rootkit fiasco of 2005, no Sony products in our household. ...Point of OrderBy poonzteam54433 days ago - Bernard’s dawn chorus for Saturday, May 4 and pick ‘n’ mix for the weekend

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey3 days ago

A new report warns an estimated third of the adult population have unmet need for health care. Photo: Lynn Grieveson / The KākāHere’s the six key things I learned about Aotaroa’s political economy this week around housing, climate and poverty:Politics - Three opinion polls confirmed support for PM Christopher Luxon ...The KakaBy Bernard Hickey3 days ago - The Dark Side and the Rebel Alliance.

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel3 days ago

Today is May the fourth. Which was just a regular day when my mother took me to see the newly released Star Wars at the Odeon in Rotorua. The queue was right around the corner. Some years later this day became known as Star Wars Day, the date being a ...Nick’s KōreroBy Nick Rockel3 days ago - Imaginary mandate, imaginary leadership

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack3 days ago

Hello! Here comes the Saturday edition of More Than A Feilding, catching you up on the past week’s editions.ShareVerity, Ilfracombe ...More Than A FeildingBy David Slack3 days ago - Winston Peters delivers a speech about NZ’s relationship with China but media focus on Bob Carr’...

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin4 days ago

Buzz from the Beehive Much more media attention is being paid to something Winston Peters said about former Australian Foreign Minister Bob Carr than to a speech he delivered to the New Zealand China Council. One word is missing from the speech: AUKUS. But AUKUS loomed large in his considerations ...Point of OrderBy Bob Edlin4 days ago - The Post-Covid Economy

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton4 days ago

Is the economy in another long stagnation? If so, why?This is about the time that the Treasury will be locking up its economic forecasts to be published in the 2024 Budget Economic and Fiscal Update (BEFU) on budget day, 30 May. I am not privy to what they will be ...PunditBy Brian Easton4 days ago - An awkward coincidence!

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant4 days ago

The annual list of who's been bribing our politicians is out, and journalists will no doubt be poring over it to find the juiciest and dirtiest bribes. The government's fast-track invite list is likely to be a particular focus, and we already know of one company on the list which ...No Right TurnBy Idiot/Savant4 days ago - The Israel/Palestinian metastasis.

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo4 days ago

In the weeks after the October 7 Hamas attacks on Southern Israel I wrote about the possible 2nd, 3rd and even 4th order effects of the conflict. These included new fronts being opened in the West Bank (with Hamas), Golan … Continue reading → ...KiwipoliticoBy Pablo4 days ago - 27,000

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant4 days ago

That's the number of submissions received on National's corrupt Muldoonist fast-track legislation. Except its higher than that, because the number doesn't include form submissions, such as the 15,000 people who supported Forest & Bird's submission, or the 14,000 who supported Greenpeace. And so many people want to appear in person ...No Right TurnBy Idiot/Savant4 days ago - MPs’ salaries – when is the best time to increase them?

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54434 days ago

Peter Dunne writes – It is one of the oldest truisms that there is never a good time for MPs to get a pay rise. This week’s announcement of pay raises of around 2.8% backdated to last October could hardly have come at a worse time, with the ...Point of OrderBy poonzteam54434 days ago - Genter under fire

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54434 days ago

David Farrar writes – Newshub reports: Newshub can reveal a fresh allegation of intimidation against Green MP Julie-Anne Genter. Genter is subject to a disciplinary process for aggressively waving a book in the face of National Minister Matt Doocey in the House – but it’s not the first time ...Point of OrderBy poonzteam54434 days ago - New Treasury paper on the productivity slowdown supports the downgrading of forecasts

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin4 days ago

The Treasury has published a paper today on the global productivity slowdown and how it is playing out in New Zealand: The productivity slowdown: implications for the Treasury’s forecasts and projections. The Treasury Paper examines recent trends in productivity and the potential drivers of the slowdown. Productivity for the whole economy ...Point of OrderBy Bob Edlin4 days ago - Bernard’s pick 'n' mix for Friday, May 3

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey4 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 9:26 am on Friday, May 3:Climate 'Ministerial override must go' - Hearings begin over fast-track bill RNZ Kate GreenPopulation: Labour hire firm struggling to find staff as Australia lures away workers. HireStaff ...The KakaBy Bernard Hickey4 days ago - Weekly Roundup 3-May-2024

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland4 days ago

Here we are in May already! And here are a few of the stories that caught our eye this week. This Week on Greater Auckland On Monday, Matt highlighted that it’s been a decade since Auckland’s rail system was electrified. On Wednesday, Matt looked at AT’s rollout of new ways ...Greater AucklandBy Greater Auckland4 days ago - The Hoon around the week to May 3The KakaBy Bernard Hickey4 days ago

- Pamphlets at Ten Paces.

These puppet strings don't pull themselvesYou're thinking thoughts from someone elseHow much time do you think you have?Are you prepared for what comes next?The debating chamber can be a trying place for an opposition MP. What with the person in charge, the speaker, typically being an MP from the governing ...Nick’s KōreroBy Nick Rockel4 days ago

These puppet strings don't pull themselvesYou're thinking thoughts from someone elseHow much time do you think you have?Are you prepared for what comes next?The debating chamber can be a trying place for an opposition MP. What with the person in charge, the speaker, typically being an MP from the governing ...Nick’s KōreroBy Nick Rockel4 days ago - A land without pier

The land around Lyme Regis, where Meryl Streep once stood, in a hood, on the Cobb, is falling into the sea.MerylThe land around Lyme Regis, around the Cobb that made it rich, has always been falling slowly but surely into the sea. Read more ...More Than A FeildingBy David Slack4 days ago

The land around Lyme Regis, where Meryl Streep once stood, in a hood, on the Cobb, is falling into the sea.MerylThe land around Lyme Regis, around the Cobb that made it rich, has always been falling slowly but surely into the sea. Read more ...More Than A FeildingBy David Slack4 days ago - Skeptical Science New Research for Week #18 2024

Open access notables Generative AI tools can enhance climate literacy but must be checked for biases and inaccuracies, Atkins et al., Communications Earth & Environment: In the face of climate change, climate literacy is becoming increasingly important. With wide access to generative AI tools, such as OpenAI’s ChatGPT, we explore the potential ...5 days ago

Open access notables Generative AI tools can enhance climate literacy but must be checked for biases and inaccuracies, Atkins et al., Communications Earth & Environment: In the face of climate change, climate literacy is becoming increasingly important. With wide access to generative AI tools, such as OpenAI’s ChatGPT, we explore the potential ...5 days ago - Ruckus over AUKUS – Labour demands Peters step down as Foreign Minister, but he still had the job ...

Buzz from the Beehive Foreign Affairs Minister Winston Peters was bound to win headlines when he set out his thinking about AUKUS in his speech to the New Zealand Institute of International Affairs. The headlines became bigger when – during an interview on RNZ’s Morning Report today – he criticised ...Point of OrderBy Bob Edlin5 days ago

Buzz from the Beehive Foreign Affairs Minister Winston Peters was bound to win headlines when he set out his thinking about AUKUS in his speech to the New Zealand Institute of International Affairs. The headlines became bigger when – during an interview on RNZ’s Morning Report today – he criticised ...Point of OrderBy Bob Edlin5 days ago - Secrecy undermines participation

The Post reports on how the government is refusing to release its advice on its corrupt Muldoonist fast-track law, instead using the "soon to be publicly available" refusal ground to hide it until after select committee submissions on the bill have closed. Fast-track Minister Chris Bishop's excuse? “It's not ...No Right TurnBy Idiot/Savant5 days ago

The Post reports on how the government is refusing to release its advice on its corrupt Muldoonist fast-track law, instead using the "soon to be publicly available" refusal ground to hide it until after select committee submissions on the bill have closed. Fast-track Minister Chris Bishop's excuse? “It's not ...No Right TurnBy Idiot/Savant5 days ago - Agribusiness following oil and gas playbookAs pressure on it grows, the livestock industry’s approach to the transition to Net Zero is increasingly being compared to that of fossil fuel interests. Photo: Lynn Grieveson / Getty ImagesTL;DR: Here’s the top five news items of note in climate news for Aotearoa-NZ this week, and a discussion above ...The KakaBy Bernard Hickey5 days ago

- Here’s hoping they aren’t counting on a 100 per cent acceptance…

The New Zealand Herald reports – Stats NZ has offered a voluntary redundancy scheme to all of its workers as a way to give staff some control over their “future” amidst widespread job losses in the public sector. In an update to staff this morning, seen by the Herald, Statistics New Zealand ...Point of OrderBy Bob Edlin5 days ago

The New Zealand Herald reports – Stats NZ has offered a voluntary redundancy scheme to all of its workers as a way to give staff some control over their “future” amidst widespread job losses in the public sector. In an update to staff this morning, seen by the Herald, Statistics New Zealand ...Point of OrderBy Bob Edlin5 days ago - Gordon Campbell on unemployment, Winston Peters’ low boiling point and music criticism

On Werewolf/Scoop, I usually do two long form political columns a week. From now on, there will be an extra column each week about music and movies. But first, some late-breaking political events: The rise in unemployment numbers for the March quarter was bigger than expected – and especially sharp ...Gordon CampbellBy lyndon5 days ago

On Werewolf/Scoop, I usually do two long form political columns a week. From now on, there will be an extra column each week about music and movies. But first, some late-breaking political events: The rise in unemployment numbers for the March quarter was bigger than expected – and especially sharp ...Gordon CampbellBy lyndon5 days ago - TVNZ and poll resultsPoint of OrderBy poonzteam54435 days ago

- Mana or Money

Muriel Newman writes – When Meridian Energy was seeking resource consents for a West Coast hydro dam proposal in 2010, local Maori “strenuously” objected, claiming their mana was inextricably linked to ‘their’ river and could be damaged. After receiving a financial payment from the company, however, the Ngai Tahu ...Point of OrderBy poonzteam54435 days ago

Muriel Newman writes – When Meridian Energy was seeking resource consents for a West Coast hydro dam proposal in 2010, local Maori “strenuously” objected, claiming their mana was inextricably linked to ‘their’ river and could be damaged. After receiving a financial payment from the company, however, the Ngai Tahu ...Point of OrderBy poonzteam54435 days ago - Bernard’s pick 'n' mix for Thursday, May 2

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 11:10 am on Thursday, May 2:Scoop: Government sits on official advice on fast-track consent. The Ombudsman is investigating after official briefings on the contentious regime were held back despite requests from Forest ...The KakaBy Bernard Hickey5 days ago

TL;DR: Here’s my top 10 ‘pick ‘n’ mix of links to news, analysis and opinion articles as of 11:10 am on Thursday, May 2:Scoop: Government sits on official advice on fast-track consent. The Ombudsman is investigating after official briefings on the contentious regime were held back despite requests from Forest ...The KakaBy Bernard Hickey5 days ago - The Art of taking no Responsibility

Alwyn Poole writes – “An SEP,’ he said, ‘is something that we can’t see, or don’t see, or our brain doesn’t let us see, because we think that it’s somebody else’s problem. That’s what SEP means. Somebody Else’s Problem. The brain just edits it out, it’s like a ...Point of OrderBy poonzteam54435 days ago

Alwyn Poole writes – “An SEP,’ he said, ‘is something that we can’t see, or don’t see, or our brain doesn’t let us see, because we think that it’s somebody else’s problem. That’s what SEP means. Somebody Else’s Problem. The brain just edits it out, it’s like a ...Point of OrderBy poonzteam54435 days ago - The shabby “Parliamentary urgency” ploy – shaky foundations and why our democracy needs trust

Our trust in our political institutions is fast eroding, according to a Maxim Institute discussion paper, Shaky Foundations: Why our democracy needs trust. The paper – released today – raises concerns about declining trust in New Zealand’s political institutions and democratic processes, and the role that the overuse of Parliamentary urgency ...Point of OrderBy poonzteam54435 days ago

Our trust in our political institutions is fast eroding, according to a Maxim Institute discussion paper, Shaky Foundations: Why our democracy needs trust. The paper – released today – raises concerns about declining trust in New Zealand’s political institutions and democratic processes, and the role that the overuse of Parliamentary urgency ...Point of OrderBy poonzteam54435 days ago - Jones has made plain he isn’t fond of frogs (not the dim-witted ones, at least) – and now we lea...

This article was prepared for publication yesterday. More ministerial announcements have been posted on the government’s official website since it was written. We will report on these later today …. Buzz from the Beehive There we were, thinking the environment is in trouble, when along came Jones. Shane Jones. ...Point of OrderBy Bob Edlin5 days ago

This article was prepared for publication yesterday. More ministerial announcements have been posted on the government’s official website since it was written. We will report on these later today …. Buzz from the Beehive There we were, thinking the environment is in trouble, when along came Jones. Shane Jones. ...Point of OrderBy Bob Edlin5 days ago - Infrastructure & home building slumping on Govt funding freezeThe KakaBy Bernard Hickey5 days ago

- Brainwashed People Think Everyone Else is Brainwashed

Hi,I am just going to state something very obvious: American police are fucking crazy.That was a photo gracing the New York Times this morning, showing New York City police “entering Columbia University last night after receiving a request from the school.”Apparently in America, protesting the deaths of tens of thousands ...David FarrierBy David Farrier5 days ago

Hi,I am just going to state something very obvious: American police are fucking crazy.That was a photo gracing the New York Times this morning, showing New York City police “entering Columbia University last night after receiving a request from the school.”Apparently in America, protesting the deaths of tens of thousands ...David FarrierBy David Farrier5 days ago - Peters’ real foreign policy threat is Helen Clark

Winston Peters’ much anticipated foreign policy speech last night was a work of two halves. Much of it was a standard “boilerplate” Foreign Ministry overview of the state of the world. There was some hardening up of rhetoric with talk of “benign” becoming “malign” and old truths giving way to ...PolitikBy Richard Harman5 days ago

Winston Peters’ much anticipated foreign policy speech last night was a work of two halves. Much of it was a standard “boilerplate” Foreign Ministry overview of the state of the world. There was some hardening up of rhetoric with talk of “benign” becoming “malign” and old truths giving way to ...PolitikBy Richard Harman5 days ago - NZ’s trans lobby is fighting a rearguard action

Graham Adams assesses the fallout of the Cass Review — The press release last Thursday from the UN Special Rapporteur on violence against women and girls didn’t make the mainstream news in New Zealand but it really should have. The startling title of Reem Alsalem’s statement — “Implementation of ‘Cass ...Point of OrderBy gadams10006 days ago

Graham Adams assesses the fallout of the Cass Review — The press release last Thursday from the UN Special Rapporteur on violence against women and girls didn’t make the mainstream news in New Zealand but it really should have. The startling title of Reem Alsalem’s statement — “Implementation of ‘Cass ...Point of OrderBy gadams10006 days ago - Your mandate is imaginary

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack6 days ago

This open-for-business, under-new-management cliché-pockmarked government of Christopher Luxon is not the thing of beauty he imagines it to be. It is not the powerful expression of the will of the people that he asserts it to be. It is not a soaring eagle, it is a malodorous vulture. This newest poll should make ...More Than A FeildingBy David Slack6 days ago - 14,000 unemployed under National

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant6 days ago

The latest labour market statistics, showing a rise in unemployment. There are now 134,000 unemployed - 14,000 more than when the National government took office. Which is I guess what happens when the Reserve Bank causes a recession in an effort to Keep Wages Low. The previous government saw a ...No Right TurnBy Idiot/Savant6 days ago - Bryce Edwards: Discontent and gloom dominate NZ’s political mood

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards6 days ago

Three opinion polls have been released in the last two days, all showing that the new government is failing to hold their popular support. The usual honeymoon experienced during the first year of a first term government is entirely absent. The political mood is still gloomy and discontented, mainly due ...Democracy ProjectBy bryce.edwards6 days ago - Taking Tea with 42 & 38.

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel6 days ago

National's Finance Minister once met a poor person.A scornful interview with National's finance guru who knows next to nothing about economics or people.There might have been something a bit familiar if that was the headline I’d gone with today. It would of course have been in tribute to the article ...Nick’s KōreroBy Nick Rockel6 days ago - Beware political propaganda: statistics are pointing to Grant Robertson never protecting “Lives an...

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54436 days ago

Rob MacCulloch writes – Throughout the pandemic, the new Vice-Chancellor-of-Otago-University-on-$629,000 per annum-Can-you-believe-it-and-Former-Finance-Minister Grant Robertson repeated the mantra over and over that he saved “lives and livelihoods”. As we update how this claim is faring over the course of time, the facts are increasingly speaking differently. NZ ...Point of OrderBy poonzteam54436 days ago - Winding back the hands of history’s clock

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54436 days ago

Chris Trotter writes – IT’S A COMMONPLACE of political speeches, especially those delivered in acknowledgement of electoral victory: “We’ll govern for all New Zealanders.” On the face of it, the pledge is a strange one. Why would any political leader govern in ways that advantaged the huge ...Point of OrderBy poonzteam54436 days ago - Paula Bennett’s political appointment will challenge public confidence

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry6 days ago

Bryce Edwards writes – The list of former National Party Ministers being given plum and important roles got longer this week with the appointment of former Deputy Prime Minister Paula Bennett as the chair of Pharmac. The Christopher Luxon-led Government has now made key appointments to Bill ...Point of OrderBy xtrdnry6 days ago - Business confidence sliding into winter of discontent

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey6 days ago

TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 10:06am on Wednesday, May 1:The Lead: Business confidence fell across the board in April, falling in some areas to levels last seen during the lockdowns because of a collapse in ...The KakaBy Bernard Hickey6 days ago - Gordon Campbell on the coalition’s awful, not good, very bad poll results

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon6 days ago

Over the past 36 hours, Christopher Luxon has been dong his best to portray the centre-right’s plummeting poll numbers as a mark of virtue. Allegedly, the negative verdicts are the result of hard economic times, and of a government bravely set out on a perilous rescue mission from which not ...Gordon CampbellBy lyndon6 days ago - New HOP readers for future payment options

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L6 days ago

Auckland Transport have started rolling out new HOP card readers around the network and over the next three months, all of them on buses, at train stations and ferry wharves will be replaced. The change itself is not that remarkable, with the new readers looking similar to what is already ...Greater AucklandBy Matt L6 days ago - 2024 Reading Summary: April (+ Writing Update)

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda2217 days ago

Completed reads for April: The Difference Engine, by William Gibson and Bruce Sterling Carnival of Saints, by George Herman The Snow Spider, by Jenny Nimmo Emlyn’s Moon, by Jenny Nimmo The Chestnut Soldier, by Jenny Nimmo Death Comes As the End, by Agatha Christie Lord of the Flies, by ...A Phuulish FellowBy strda2217 days ago - At a glance – Clearing up misconceptions regarding 'hide the decline'

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...7 days ago

On February 14, 2023 we announced our Rebuttal Update Project. This included an ask for feedback about the added "At a glance" section in the updated basic rebuttal versions. This weekly blog post series highlights this new section of one of the updated basic rebuttal versions and serves as a ...7 days ago - Road photos

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack7 days ago

Have a story to share about St Paul’s, but today just picturesPopular novels written at this desk by a young man who managed to bootstrap himself out of father’s imprisonment and his own young life in a workhouse Read more ...More Than A FeildingBy David Slack7 days ago

Related Posts

- Release: National won’t commit to full Nelson Hospital upgrade

The Government needs to be clear with the people of the Nelson Marlborough region about the changes it is considering for the Nelson Hospital rebuild, Labour health spokesperson Ayesha Verrall said. ...5 hours ago

The Government needs to be clear with the people of the Nelson Marlborough region about the changes it is considering for the Nelson Hospital rebuild, Labour health spokesperson Ayesha Verrall said. ...5 hours ago - Release: Labour calls for fast track list to be released

Ministers must front up about which projects it will push through under its Fast Track Approvals legislation, Labour environment spokesperson Rachel Brooking said today. ...1 day ago

Ministers must front up about which projects it will push through under its Fast Track Approvals legislation, Labour environment spokesperson Rachel Brooking said today. ...1 day ago - Release: National gaslights women fighting for equal pay

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...5 days ago

National has scrapped the pay equity taskforce that fights for equal pay for women and looks at ethnic pay gaps. ...5 days ago - Release: More job cuts, fewer houses under National

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...5 days ago

The Government is again adding to New Zealand’s growing unemployment, this time cutting jobs at the agencies responsible for urban development and growing much needed housing stock. ...5 days ago - Release: Children fall deeper through the cracks in Govt cuts

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...5 days ago

With Minister Karen Chhour indicating in the House today that she either doesn’t know or care about the frontline cuts she’s making to Oranga Tamariki, we risk seeing more and more of our children falling through the cracks. ...5 days ago - Release: Labour honours memory of Sir Robert Martin

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...5 days ago

The Labour Party is saddened to learn of the death of Sir Robert Martin, a globally renowned disability advocate who led the way for disability rights both in New Zealand and internationally. ...5 days ago - Release: 130,000 cattle saved from live export

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...6 days ago

Labour is calling for the Government to urgently rethink its coalition commitment to restart live animal exports, Labour animal welfare spokesperson Rachel Boyack said. ...6 days ago - Central Bank makes clear Government is pouring fuel on housing crisis fire

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...6 days ago

Today’s Financial Stability Report has once again highlighted that poverty and deep inequality are political choices - and this Government is choosing to make them worse. ...6 days ago - New unemployment figures paint bleak picture

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...6 days ago

The Green Party is calling on the Government to do more for our households in most need as unemployment rises and the cost of living crisis endures. ...6 days ago - Release: National’s job cuts already starting to bite as unemployment rises

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...6 days ago

Unemployment is on the rise and it’s only going to get worse under this Government, Labour finance spokesperson Barbara Edmonds said. Stats NZ figures show the unemployment rate grew to 4.3 percent in the March quarter from 4 percent in the December quarter. “This is the second rise in unemployment ...6 days ago - Release: National hiking transport costs for families and young New Zealanders

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...7 days ago

Weekly expenses will grow for more than 1.6 million New Zealanders as the Government ends free and half price public transport fares tomorrow. ...7 days ago - Release: Labour welcomes EU free trade agreement

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...7 days ago

The New Zealand Labour Party welcomes the entering into force of the European Union and New Zealand free trade agreement. This agreement opens the door for a huge increase in trade opportunities with a market of 450 million people who are high value discerning consumers of New Zealand goods and ...7 days ago - Surprise: Landlord tax cuts don’t trickle down

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 week ago

The Green Party is renewing its call for rent controls following reports of rental prices hitting an all-time high. ...1 week ago - Release: $1.7b for no increase in access to medicine

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 week ago

The National-led Government continues its fiscal jiggery pokery with its Pharmac announcement today, Labour Health spokesperson Ayesha Verrall says. “The government has increased Pharmac funding but conceded it will only make minimal increases in access to medicine”, said Ayesha Verrall “This is far from the bold promises made to fund ...1 week ago - Release: National should heed Tribunal warning and scrap coalition commitment with ACT

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...1 week ago

This afternoon’s interim Waitangi Tribunal report must be taken seriously as it affects our most vulnerable children, Labour children’s spokesperson Willow-Jean Prime. ...1 week ago - Release: More accountability for preventable workplace deaths this Workers’ Memorial Day

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...1 week ago

Labour is calling for more accountability for preventable workplace deaths because everybody who goes to work deserves to come home safely. ...1 week ago - Gaza: Aotearoa Must Support Independent Investigation into Mass Graves

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...2 weeks ago

Te Pāti Māori are demanding the New Zealand Government support an international independent investigation into mass graves that have been uncovered at two hospitals on the Gaza strip, following weeks of assault by Israeli troops. Among the 392 bodies that have been recovered, are children and elderly civilians. Many of ...2 weeks ago - Release: Working together on consistent support for veterans this Anzac Day

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago

Our two-tiered system for veterans’ support is out of step with our closest partners, and all parties in Parliament should work together to fix it, Labour veterans’ affairs spokesperson Greg O’Connor said. ...2 weeks ago - Release: Penny drops – but what about Seymour and Peters?

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago

Stripping two Ministers of their portfolios just six months into the job shows Christopher Luxon’s management style is lacking, Labour Leader Chris Hipkins said. ...2 weeks ago - Another ‘Stolen Generation’ enabled by court ruling on Waitangi Tribunal summons

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago

Tonight’s court decision to overturn the summons of the Children’s Minister has enabled the Crown to continue making decisions about Māori without evidence, says Te Pāti Māori spokesperson for Children, Mariameno Kapa-Kingi. “The judicial system has this evening told the nation that this government can do whatever they want when ...2 weeks ago - Release: Budget blunder shows Nicola Willis could cut recovery funding

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago

It appears Nicola Willis is about to pull the rug out from under the feet of local communities still dealing with the aftermath of last year’s severe weather, and local councils relying on funding to build back from these disasters. ...2 weeks ago - Further environmental mismanagement on the cards

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago

The Government’s resource management reforms will add to the heavy and ever-growing burden this Government is loading on to our environment. ...2 weeks ago - Release: RMA changes will be a disaster for environment

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago

The Government is making short-sighted changes to the Resource Management Act (RMA) that will take away environmental protection in favour of short-term profits, Labour’s environment spokesperson Rachel Brooking said today. ...2 weeks ago - Release: Labour supports urgent changes to emergency management system

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago

Labour welcomes the release of the report into the North Island weather events and looks forward to working with the Government to ensure that New Zealand is as prepared as it can be for the next natural disaster. ...2 weeks ago - Release: Labour calls for New Zealand to recognise Palestine

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago

The Labour Party has called for the New Zealand Government to recognise Palestine, as a material step towards progressing the two-State solution needed to achieve a lasting peace in the region. ...2 weeks ago - Release: Three strikes law political posturing of worst kind

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago

The Government is bringing back a law that has little evidential backing just to look tough, Labour justice spokesperson Duncan Webb said. ...2 weeks ago - Release: Government cuts unbelievably target child exploitation, violent extremism, ports and airpor...

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago

Some of our country’s most important work, stopping the sexual exploitation of children and violent extremism could go along with staff on the frontline at ports and airports. ...2 weeks ago - Three strikes has failed before and will fail again

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago

Resurrecting the archaic three-strikes legislation is an unwelcome return to a failed American-style approach to justice. ...2 weeks ago - Release: Environmental protection vital, not ‘onerous’

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago

The Government’s Fast Track Approvals Bill will give projects such as new coal mines a ‘get out of jail free’ card to wreak havoc on the environment, Labour Leader Chris Hipkins said today. ...2 weeks ago - Ferris – Three Strikes targets those ‘too brown to be white’

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago

The government's decision to reintroduce Three Strikes is a destructive and ineffective piece of law-making that will only exacerbate an inherently biased and racist criminal justice system, said Te Pāti Māori Justice Spokesperson, Tākuta Ferris, today. During the time Three Strikes was in place in Aotearoa, Māori and Pasifika received ...2 weeks ago - Release: Govt cuts doctors and nurses in hiring freeze

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...3 weeks ago

Cuts to frontline hospital staff are not only a broken election promise, it shows the reckless tax cuts have well and truly hit the frontline of the health system, says Labour Health spokesperson Ayesha Verrall. ...3 weeks ago - Fast-track submissions period must be extended

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...3 weeks ago

The Green Party has joined the call for public submissions on the fast-track legislation to be extended after the Ombudsman forced the Government to release the list of organisations invited to apply just hours before submissions close. ...3 weeks ago - Release: Progress on climate will be undone by Govt

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...3 weeks ago

New Zealand’s good work at reducing climate emissions for three years in a row will be undone by the National government’s lack of ambition and scrapping programmes that were making a difference, Labour Party climate spokesperson Megan Woods said today. ...3 weeks ago - Release: Dark day for Kiwi kids as a third of Govt cuts affect them

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 weeks ago

News that 1000 jobs at the Ministry of Education and Oranga Tamariki could go is devastating for future generations of New Zealanders. ...3 weeks ago

Related Posts

- Ceasefire agreement needed now: Peters

New Zealand is urging both Israel and Hamas to agree to an immediate ceasefire to avoid the further humanitarian catastrophe that military action in Rafah would unleash, Foreign Minister Winston Peters says. “The immense suffering in Gaza cannot be allowed to worsen further. Both sides have a responsibility to ...BeehiveBy beehive.govt.nz7 mins ago

New Zealand is urging both Israel and Hamas to agree to an immediate ceasefire to avoid the further humanitarian catastrophe that military action in Rafah would unleash, Foreign Minister Winston Peters says. “The immense suffering in Gaza cannot be allowed to worsen further. Both sides have a responsibility to ...BeehiveBy beehive.govt.nz7 mins ago - Daily school attendance data now available

A new online data dashboard released today as part of the Government’s school attendance action plan makes more timely daily attendance data available to the public and parents, says Associate Education Minister David Seymour. The interactive dashboard will be updated once a week to show a national average of how ...BeehiveBy beehive.govt.nz29 mins ago

A new online data dashboard released today as part of the Government’s school attendance action plan makes more timely daily attendance data available to the public and parents, says Associate Education Minister David Seymour. The interactive dashboard will be updated once a week to show a national average of how ...BeehiveBy beehive.govt.nz29 mins ago - Ambassador to United States appointed

Foreign Minister Winston Peters has announced Rosemary Banks will be New Zealand’s next Ambassador to the United States of America. “Our relationship with the United States is crucial for New Zealand in strategic, security and economic terms,” Mr Peters says. “New Zealand and the United States have a ...BeehiveBy beehive.govt.nz4 hours ago