tax

Categories under tax

- capital gains (104)

- gst (55)

Why We Need Universalism, Not Tax Cuts, To Solve The Cost-Of-Living Crisis

Written By: - Date published: 8:24 am, June 1st, 2023 - 64 comments

The pros & cons of tax cuts vs. universalism suggest that universalism might be universally better for New Zealand.

National's Policy Machine is a thing to behold

Written By: - Date published: 12:06 pm, May 16th, 2023 - 99 comments

National’s latest policy brainstorm is to print out and mail to every taxpayer information they could obtain by using Google and MyIRD.

Why a Capital Gains tax is necessary

Written By: - Date published: 8:09 am, April 27th, 2023 - 186 comments

With the release by David Parker of a report showing that the wealthiest New Zealanders pay tax at much less than half the rate of other Kiwis is it time to again debate the virtue of a comprehensive Capital Gains Tax.

Making s%*t up

Written By: - Date published: 8:02 am, March 15th, 2023 - 41 comments

Is it just me or is Mike Hosking becoming more unbalanced? The recent misrepresentation of a speech from Deborah Russell would suggest that he is getting worse.

Chloe Swarbrick: We don’t live in a game of Monopoly

Written By: - Date published: 10:04 am, March 10th, 2023 - 49 comments

The case for redistribution of wealth in New Zealand.

National’s childcare announcement

Written By: - Date published: 1:43 pm, March 6th, 2023 - 21 comments

National’s proposed child care subsidy policy is essentially an increase to existing grants that will fuel inflation and costs increases in the child care sector.

But How Do You Pay For It?

Written By: - Date published: 8:39 am, March 5th, 2023 - 27 comments

To pay for recent flood damage Grant Robertson has to decide on what proportion of this will be paid by new debt, what proportion by reallocation of expenditure, and what proportion by special tax levies. Is an Australian style levy under consideration?

Greens: Tax the banks

Written By: - Date published: 8:25 am, March 1st, 2023 - 60 comments

Instead of creating an appeal fund and one-off lotto draw, the Labour Government could tax the billions of dollars banks have made in unearned, excess profits and use the money to support people.

Windfall tax on bank super-profits needed to help fund repair

Written By: - Date published: 3:57 pm, February 20th, 2023 - 69 comments

The repair bill for the recent cyclones will be similar to the direct cost to government of the Canterbury earthquakes, in the $13 billion region. Banks are currently making obscene profits. The time is right to impose a one-off banking windfall tax. If a conservative Margaret Thatcher can do it, it is pretty hard to argue why a Labour government can’t.

Your Mindset and Your Money

Written By: - Date published: 1:29 pm, January 18th, 2023 - 48 comments

Mega property owning entrepreneur Graeme Fowler thinks we can all be rich if we just changed our attitude.

Trump’s tax returns

Written By: - Date published: 2:47 pm, January 2nd, 2023 - 18 comments

One of the mysteries of the ages has now been resolved. One of the great mysteries along with who killed JFK and is there life on Mars is how wealthy is the orange one. And now we know. And it appears that he is not as wealthy as he made out to be.

National’s relentless negativity

Written By: - Date published: 11:33 am, November 5th, 2022 - 86 comments

National’s recent press releases show that its approach to politics will be relentlessly negative, with no idea of what it will do as an alternative or how it will fund changes.

Greens: proposal to tax excess corporate profits

Written By: - Date published: 1:14 pm, October 30th, 2022 - 46 comments

“An excess profit tax would be a simple and effective way for large corporations to pay their fair share, unlocking the resources all of us need to live with dignity, put a roof over our heads and food on the table,” says Green Party Finance spokesperson, Julie Anne Genter.

“Today, we have released a discussion document exploring how an excess profit tax could be designed – and how the additional revenue should be spent. We are also considering the alternative of raising company tax rates so that all profits are taxed more.”

About the reversed GST Kiwisaver changes

Written By: - Date published: 8:51 pm, August 31st, 2022 - 63 comments

National’s attack on requiring banks to charge GST on the provision of Kiwisaver services the same as smaller services is deeply cynical when its attacks on Kiwisaver in the past are considered.

Labour’s “tenant tax” is neither a tax nor for tenants

Written By: - Date published: 10:16 am, August 22nd, 2022 - 33 comments

National’s media spin team is at it again claiming that removing interest rate deductibility for landlords is a “tenant tax” when it is neither a new tax nor for tenants.

National tries to blame Labour for National’s tax flip flop flip

Written By: - Date published: 10:25 am, August 7th, 2022 - 13 comments

Chris Bishop has accused Labour of engaging in dirty politics for pointing out that this week National has changed its policy on income tax indexation twice.

National’s policies don’t add up

Written By: - Date published: 9:21 am, May 31st, 2022 - 48 comments

In 21 tweets Clint Smith has set out why National’s tax cut policies and its rhetoric are absurd and how the media is doing us a disservice by not asking the hard questions like what will be cut and how the promised tax cuts will be paid for.

Act’s scorched earth proposal

Written By: - Date published: 12:29 pm, May 11th, 2022 - 41 comments

Act has publicly released its proposal to decimate the state should it have a say in the next Government. Its Real Change Alternative Budget may be wet dream inducing for Ayn Rand acolytes but for the rest of us the proposals should instill a deep sense of dread.

What Can Be Saved?

Written By: - Date published: 7:12 am, April 29th, 2022 - 157 comments

The tide of this government is running out. There’s 18 months left in the term. What would you save?

Is Parker procrastinating or scene setting for fairer tax system?

Written By: - Date published: 3:40 pm, April 27th, 2022 - 49 comments

Is Revenue Minister David Parker’s plan to gather tax data on the wealthy just more procrastination by this Labour government on making the tax system fairer? Or is it recognition the public debate needs a long-term frame to get a capital gains, or wealth tax, over the line?

Tame shows media how to interview Luxon

Written By: - Date published: 8:05 am, April 26th, 2022 - 45 comments

Jack Tame’s interview of Chris Luxon on Q&A suggests that the post leadership change honeymoon may now be over and that Luxon does not really understand how difficult a job being Prime Minister would be.

Luxon thinks helping poor people is Bottom Feeding

Written By: - Date published: 11:38 am, March 22nd, 2022 - 81 comments

Chris Luxon has admitted in National media that provision of assistance to the poor is “bottom feeding”.

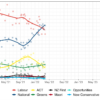

The difference between Labour and National

Written By: - Date published: 9:05 am, March 17th, 2022 - 141 comments

There has been the occasional criticism of Labour for not achieving enough progressive change by people who then propose supporting National. What are they thinking?

The empire strikes back

Written By: - Date published: 8:53 am, March 15th, 2022 - 146 comments

Labour’s announcement of a temporary reduction in fuel excise duties and a halving of public transport fares ups the ante on the debate on how to alleviate hardship caused by overseas induced inflation.

National’s advice to the poor – you are on your own

Written By: - Date published: 8:11 am, March 13th, 2022 - 125 comments

To help the poorest amongst us during the current times of International hyper inflation National has come up with a list of tips to help them. But no money.

National stuffs up its financial analysis – again

Written By: - Date published: 1:42 pm, March 9th, 2022 - 79 comments

For so called economic geniuses National sure struggles to understand how to properly cost fiscal policy. Its latest response to news that it proposed tax cuts would wipe out all discretionary spending in its first budget is to fudge the dates on which the cuts would be made.

National’s tax policy

Written By: - Date published: 8:14 am, March 7th, 2022 - 107 comments

National has proposed to reverse all tax changes implemented by Labour and claims that the cuts can be managed without damage to the state. But the figure it uses, $1.7 billion a year, includes income tax adjustments only and not the cost of the removal of other taxes.

In Tax we trust

Written By: - Date published: 11:20 am, January 24th, 2022 - 86 comments

In a welcome change Millionaires and billionaires worldwide are calling for governments to tax them more.

Astroturfers of the world unite

Written By: - Date published: 9:14 am, November 20th, 2021 - 52 comments

Two days before what is claimed will be the mother of all protests links between the Groundswell organisation and the Taxpayers Union have been discovered.

National’s plan – open and be damned

Written By: - Date published: 9:43 am, October 21st, 2021 - 71 comments

Yesterday National released what feels like take 16 of its Covid response plan, this one focussing on business interests and setting a hard timeline for reopening. But getting significant details wrong and rehashing failed policies previously tried in England has dampened its effect.

Pandora papers and NZ

Written By: - Date published: 8:42 am, October 9th, 2021 - 18 comments

While we have mainly been occupied with containing the current Covid-19 outbreak, world news has been looking at documents revealing probable dirty capital and tax dodging by the affluent. NZ has a delayed local problem with this. Warning was given. We should just terminate the supporting legislation and replace it with transparency. (Updated)

Recent Comments