privatisation

Categories under privatisation

Asset sales: No Dunne deal

Written By: - Date published: 7:37 am, February 22nd, 2012 - 71 comments

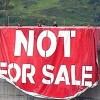

Asset sales will only happen if Peter Dunne votes for them. It is his choice whether we keep our strategic assets, or lose control of them forever. So, constituents in Dunne’s electorate of Ohariu have established the Citizens’ Select Committee to hear the arguments that the Government will not and a report to Parliament. Make your submission.

Crowd-sourcin’: asset sales question

Written By: - Date published: 11:37 am, February 21st, 2012 - 47 comments

Economic sovereignty is suddenly the hot issue with the vast majority of Kiwis opposed to more foreign ownership and asset sales. The Nats are in a spin: Key is desperately trying to upgrade English’s ‘guess’ on the fiscal impact of asset sales to a “best estimate”. Time for that asset sales referendum petition. Maybe you can help draft the question.

How low will they go?

Written By: - Date published: 11:53 am, February 20th, 2012 - 11 comments

The Nats are looking to Queensland for lessons in privatisation. They want to see how incentives for locals to hold on to their shares work. But you don’t pay for incentives with magic beans. Any incentives for the few locals who can afford to buy shares just means a diminished return to the government, making the economic and fiscal rationale for selling even weaker.

Nats want more expensive ACC so private insurers can profit

Written By: - Date published: 10:48 am, February 18th, 2012 - 127 comments

Private sector competition brings market disciplines and efficiencies to bloated publicly-owned monopolies. That’s the mantra, eh? That’s the indisputable truth… right? So, how come the Nats are planning to make ACC raise its levies and pay a dividend – for the first time ever – so that private insurers can compete? And how does that benefit NZ?

Even English’s made-up asset sales numbers don’t add up

Written By: - Date published: 10:59 am, February 17th, 2012 - 20 comments

Bill English admitted yesterday that his new estimate that asset sales will net $6b in revenue, $800m above book value, is just a guess – the midpoint of the previous guess of $5-7b. And that’s not all that’s made up. The forecast foregone profits are way under-estimated. Even with these fiscal frauds, English still can’t get asset sales to make economic sense.

Key’s ‘sell, sell, sell’ mantra out of touch with NZ

Written By: - Date published: 7:47 am, February 16th, 2012 - 77 comments

The Crafar Farms decision is sensible and a correct interpretation of the law. Foreign buyers must add something that a local buyer can’t, other than a higher purchase price. Otherwise, our farmers will continue to be out-bid for our land by foreign government-backed companies that can afford a lower rate of return, and NZ will gain nothing. So, why is National rushing to change the law?

Selling asset sales to [insert region here]

Written By: - Date published: 11:09 am, February 13th, 2012 - 19 comments

Not everyone in the Beehive is thrilled that National is throwing away its chance at a third term for the sake of asset sales which make no sense, economically or politically. The Standard has obtained a copy of the generic column that National MPs are meant to add some ‘local flavour’ to and have published in their regional papers. It shows how cynical and shallow their position really is.

The circling vultures

Written By: - Date published: 10:59 am, February 11th, 2012 - 105 comments

People are waking up to National’s plan to remove the democratically-elected Christchurch City Council and replace it with its own hand-picked commissioners, who will then give a green light to Brownlee’s developer mates and the sale of council assets. You can already see the vultures circling – waiting for the chance to seize more public wealth for themselves.

Opposition parties hammer Key on asset sales

Written By: - Date published: 12:11 pm, February 9th, 2012 - 32 comments

Yesterday, the opposition parties worked together to hammer John Key on asset sales. He faced questions from four parties during one question; the breadth of opposition showed, and Key was stumbling. Some say Shearer should be taking a more leading role but, for mine, this was far more effective than Goff uselessly slogging out a primary and half a dozen sups without landing a blow. How’s that anti-asset sales coalition coming?

Time for an anti-asset sales coalition

Written By: - Date published: 1:50 pm, February 7th, 2012 - 128 comments

Mana, NZF, the Greens, and even the Maori Party, are suddenly grabbing the asset sales issue from Labour, just when it actually started to be a really valuable issue to lead on. Shearer should stop playing pundit on whether the Maori Party will go and how ‘unstable’ that makes the government. Instead, realise the broad base of opposition to asset sales and build a coalition to stop them.

Don’t dream it’s over

Written By: - Date published: 7:42 am, February 1st, 2012 - 76 comments

The Maori Party is threatening to leave the government over the asset sales legislation removing the companies’ Treaty obligations. Key knows their threat is hollow. He just got away for 3 years of insulting Maori and worsening Maori statistics. Why would Sharples and Turia take a pay cut and lose their limos for their last few months working before retirement?

Maori Party to quit Govt?

Written By: - Date published: 2:04 pm, January 31st, 2012 - 86 comments

News in on the Herald says the Maori party are talking the talk over National’s latest insult to Maori.

Will they quit the Government? Or will the smell of those limo seats mean another backdown in a couple of weeks?

Local board members support wharfies

Written By: - Date published: 7:24 am, January 18th, 2012 - 6 comments

The travesty of the Port of Auckland dispute is that we have a publicly-owned company trying to slash its workers’ pay so that it can try to undercut another majority publicly owned company that has already slashed wages, the only winners being the foreign shipping lines. Well, here’s some of our representatives standing up for Auckland workers.

Report shows ports not to blame for freight costs

Written By: - Date published: 10:19 am, January 13th, 2012 - 5 comments

The Productivity Commission reports that freight costs are 25% higher here than in Australia and freight costs as a % of cargo value has risen in recent years. Their solution? Make the public and port workers poorer by privatisation and casualisation. Of course, those are ideological goals, not solutions to the freight cost issue, which has nothing to do with ports.

And so it begins

Written By: - Date published: 10:47 pm, December 15th, 2011 - 218 comments

Mighty River Power is first on the block, to be sold in the third quarter of next year (weather conditions permitting).

The big win

Written By: - Date published: 11:22 am, December 12th, 2011 - 41 comments

The new government comprises the same parties as the previous one: National, ACT, United Future, and the Maori Party but with 64 votes, not 69. The governing parties’ total vote fell from 51.84% to 50.41%. Even the narrower Nat+ACT bloc fell. National’s ‘big win’ was just one more seat. And the most powerful man in the country now? Peter Dunne.

Right-wing Herald element goes OTT

Written By: - Date published: 8:29 pm, December 10th, 2011 - 61 comments

John Armstrong’s column today – not yet on website – is extraordinary. “Elements on the left cried wolf about National having a secret agenda” Armstrong’s faux outrage is generated by the fact that National’s charter schools policy was not part of any election mandate, and some people have pointed this out. Funny how people on the left are always “elements” – couldn’t possibly have a mind of their own.

Buying back the assets

Written By: - Date published: 9:26 am, December 5th, 2011 - 216 comments

David Cunliffe has said that, if he is Labour leader, he will look to buy back any assets National sells once he is PM. Under the existing Takeovers Code, that wouldn’t be too hard. But why not go a step further and make it clear to any potential investor that our energy sector won’t be their cash cow? A bit of regulatory reform would sink the assets’ share value.

A vote for Key is a vote for asset sales

Written By: - Date published: 11:00 pm, November 25th, 2011 - 66 comments

76% of Kiwis are against National’s plan to sell our assets. We know it just doesn’t make sense. We know privatisation leads to higher prices, under-investment, asset-stripping, and profits going overseas rather than into public services. Make no mistake: the only way to stop asset sales is to vote Green, Mana, Labour, or New Zealand First.

Will Key sign pledge not to sell Kiwibank?

Written By: - Date published: 11:42 am, November 23rd, 2011 - 97 comments

Phil Goff has signed a pledge that Labour will not sell Kiwibank if it becomes government. Other party leaders have been invited as well. I expect the Greens, New Zealand First, Mana, and the Conservatives will (who knows about the Maori Party). But will Key sign? National is secretly itching to sell Kiwibank, Bill English got caught out admitting as much.

Nat asset sales lies

Written By: - Date published: 7:07 am, November 23rd, 2011 - 53 comments

Last night TV1 revealed National’s lies on the explosive topic of asset sales. The Nats have no official advice to back up their asset sales claims, and information is being withheld from the public. Not good enough – vote them out.

Nats fail own asset sales tests

Written By: - Date published: 6:29 am, November 14th, 2011 - 67 comments

Labour’s David Cunliffe put out a press release judging National’s proposed asset sales programme by the 5 tests that Key laid down in an effort to reassure us that sales would only go ahead if they made sense and were good for the country. Cunliffe’s analysis shows asset sales clearly fail the Nats’ own tests. The only reason to go ahead is blind ideology.

Privatisation N Z Style

Written By: - Date published: 8:03 pm, November 13th, 2011 - 8 comments

Economist Dr Rhema Vaithianathan from Auckland University will discuss Privatisation New Zealand Style, looking at the economic logic and evidence on privatisation of utilities and ask whether it will alleviate New Zealand’s current economic problems. St John’s Church, cnr Willis and Dixon, Wellington, Monday 14th Nov 5:30pm. All welcome. Register at Fabian Society www.fabians.org.nz.

Who really benefits from asset sales

Written By: - Date published: 4:35 pm, November 12th, 2011 - 25 comments

Brent Sheather assesses the case for asset sales in today’s Herald. He cuts through the crap and concludes “selling the SOEs doesn’t look all that clever, particularly from the perspective of young people and those other sectors of society who won’t be able to participate in the offers in any material way. This is likely to be at least half the population.” He looks at who really benefits, and it’s the fortunate few once again.

Key would sell it all, eventually

Written By: - Date published: 6:46 am, November 11th, 2011 - 100 comments

John Key’s promising new capital spending projects left, right, and centre that would be funded by asset sales. But, with the European debt crisis spreading, the odds of getting $5-$7 billion for slices of our energy companies and Air NZ are worsening. So what’s the plan when they need more money for Key’s promises? What do you think?

Show me the policy

Written By: - Date published: 12:05 pm, November 7th, 2011 - 51 comments

We’re three weeks out from the election, and there’s something funny going on. National has hardly any policy out. Parties typically go into an election with a pretty comprehensive lineup of policy covering a very wide range of issues. Do the Nats really not have any plans, or are they just keeping them quiet to win a second term?

Nats’ $11b budget hole

Written By: - Date published: 10:52 am, November 6th, 2011 - 160 comments

Last year and the year before, the portions of the assets National wants to sell paid over $400 million in dividends. Labour estimates lost dividends from those assets would total $11 billion by 2026. That’s an $11 billion hole in National’s budgets they haven’t accounted for. When will National front up and show us the money?

Time for Nats to front up over lost dividends

Written By: - Date published: 9:58 am, November 5th, 2011 - 69 comments

Labour’s fiscal strategy takes National’s projections and adds or subtracts money for its policies. The clever thing is they alter the Nats’ projections to remove all the dividend revenue from assets they want to sell. How much is taken off National doesn’t affect if Labour gets back to surplus in 2014 – but it makes National’s projections more accurate. The Nats are complaining.

The server will be getting hardware changes this evening starting at 10pm NZDT.

The site will be off line for some hours.

Recent Comments