capital gains

Categories under capital gains

- No categories

National’s Tax review strategy

Written By: - Date published: 11:22 am, March 5th, 2019 - 107 comments

The Government is not due to announce its response to the Tax Working Group’s recommendations for a few more weeks. It appears that National using outrageous assumptions will take the opportunity to raise horror stories in the media on how bad the tax could be.

MAFS National Style*

Written By: - Date published: 10:32 am, March 3rd, 2019 - 61 comments

National is grooming the voters for another dirty ACT.

Lies damn lies and tax analysis

Written By: - Date published: 1:21 pm, March 2nd, 2019 - 67 comments

National’s claim that a capital gains tax would reduce the value of an average worker’s Kiwisaver account by $64,000 over a 45 year working life seems to be as valid as Steven Joyce’s claim there was an $11.5 billion dollar hole in Labour’s draft budget.

CGT as a Charitable Donation

Written By: - Date published: 12:44 pm, March 2nd, 2019 - 31 comments

Treat CGT like a semi-voluntary donation and give people a say in how it is spent.

Why New Zealand needs a capital gains tax

Written By: - Date published: 9:16 am, February 27th, 2019 - 249 comments

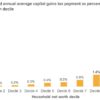

Expert comment suggests that a capital gains tax will redress inequality, improve the economy and make housing more affordable.

‘Taxpayers union’ – too ‘stupid’ to understand tax?

Written By: - Date published: 9:30 am, February 26th, 2019 - 59 comments

There is a classic piece of waffle in the NZ Herald about when capital gains tax will apply to the family home. But the conditions when this applies are extremely simple and obvious. However professed experts on taxation like the so-called ‘taxpayers union’ can’t understand them. Probably because they are paid not to.

Spare a thought for our poor impoverished landlords

Written By: - Date published: 8:17 am, February 25th, 2019 - 225 comments

Spare a thought for poor landlords who are aghast at the thought that they should have to share capital gains on properties they have purchased with no intent of making a capital gain.

It’s the kiwi way

Written By: - Date published: 8:41 am, February 22nd, 2019 - 74 comments

National is engaging in hysterical levels of hyperbole in its response to the Tax Working Group’s reform package.

In defense of taxing the family home

Written By: - Date published: 7:53 pm, February 21st, 2019 - 129 comments

Let’s talk about why houses, art, and basically everything should be in the new Capital Gains Tax that Labour and New Zealand First should get onboard with, contrary to their reservations.

The Tax Working Group proposals

Written By: - Date published: 12:38 pm, February 21st, 2019 - 339 comments

The Tax Party working group’s recommendations have been released.

National and its no tax promises

Written By: - Date published: 1:51 pm, November 27th, 2018 - 38 comments

National have got out the old “no new taxes” songbook and are singing it as loudly as they can.

Tax Working Group report depressing reading

Written By: - Date published: 6:10 pm, September 21st, 2018 - 66 comments

The Tax Working Group says the gaping holes in our tax system make it unfair and undermine its integrity, but the prospect of the electorate embracing even its limited recommendations on taxing capital gains make for depressing contemplation.

Cullen says 2020 election effectively a referendum on tax

Written By: - Date published: 1:20 pm, March 7th, 2018 - 32 comments

Don’t hold your breath for recommendations of radical tax reform from the Tax Working Group. Chair Sir Michael Cullen says the 2020 election will be a referendum on tax and he is already kicking for touch

Tumbleweeds from National on the Tax Working Group

Written By: - Date published: 12:37 pm, December 21st, 2017 - 40 comments

A month ago Labour announced that Sir Michael Cullen would chair the tax working group and the National Party was cock-a-hoop! Steven Joyce said: “Sir Michael is many things but a politically independent voice on taxation policy he is not,” Judith Collins had fun with it too, in her regular spot on Newshub she dubbed […]

IMF: higher taxes for rich will cut inequality and won’t hurt growth

Written By: - Date published: 12:30 pm, October 14th, 2017 - 104 comments

The International Monetary Fund (IMF) says it now favours higher taxes on the rich and has demolished the myth this might adversely affect economic growth. The authoritative Washington-based think tank in its influential half-yearly monitor also argued for taxes on capital, suggesting a wealth and/or land taxes should be considered, something that will make Gareth […]

Labour won’t regain power until it wins the tax debate

Written By: - Date published: 4:36 pm, September 25th, 2017 - 178 comments

Labour didn’t deserve to win on Saturday because, firstly, because it failed to bring a fully-fleshed tax policy to voters, and, secondly, it never attempted to win the ideological battle over tax. To succeed at the next election, Labour must begin work today to frame this debate.

Lets talk about tax policy

Written By: - Date published: 8:29 am, September 14th, 2017 - 283 comments

Tax is emerging as the big issue of this campaign. How valid are National’s claims that Labour will introduce a variety of new taxes and what has National’s record been like? Update: in a smart tactical move Labour has promised no new taxes will be introduced until after the next election.

The actual implications of a Capital Gains Tax

Written By: - Date published: 1:38 pm, September 4th, 2017 - 109 comments

Matthew Whitehead looks at what the Greens, Labour and National really mean when they talk about a CGT.

Ardern cautious on capital gains tax

Written By: - Date published: 7:04 am, August 23rd, 2017 - 146 comments

Jacinda Ardern will not campaign on a capital gains tax, but will seek advice and will not rule it out in a first term. The Nats have introduced a week form of CGT already. A more robust version needs serious consideration.

Greens will finally close property speculators’ tax loophole

Written By: - Date published: 11:24 am, August 22nd, 2017 - 71 comments

The Green Party in government will end the tax advantages property speculators currently enjoy under National by implementing a comprehensive tax on capital gains

More thoughts on the Labour-Greens Budget Responsibility Rules

Written By: - Date published: 8:39 am, March 25th, 2017 - 111 comments

The Labour-Green Budget Responsibility Rules announcement this week ought to dispel the notion that Labour and the Greens cannot work together.

Bloomberg warns world of New Zealand’s toxic trusts

Written By: - Date published: 7:56 am, February 12th, 2017 - 21 comments

Bloomberg magazine has highlighted how foreign trusts are damaging New Zealand’s reputation and are being used for criminal activity.

Foreign buyers estimated at 29%

Written By: - Date published: 7:03 am, August 25th, 2016 - 75 comments

Most of the media has reported the Government’s “3%” spin on the extent of residential property purchases in NZ going to foreign buyers pretty uncritically. There have been honourable exceptions, and yesterday property editor Anne Gibson in The Herald joined them.

Financial capital is crazy OP. Time to strip it back to basics.

Written By: - Date published: 12:08 pm, August 8th, 2016 - 72 comments

Financial capital is way over powered in our current political economic system. Every aspect of our lives has been financialised and securitised, from our homes to our educations. From our drinking water to our power supply.

Key’s Blind Trust vs Our Blind Faith

Written By: - Date published: 4:19 pm, April 29th, 2016 - 29 comments

So Key’s lawyer reckons the PM directly requested that trust industry leaders lobby the Revenue Minister. On the other hand, PM DunnoKeyo reckons he did no such thing. That leaves some really big questions …

Key’s land tax – too weak

Written By: - Date published: 7:11 am, April 28th, 2016 - 76 comments

Reaction to Key’s land tax has been luke warm at best, with strong calls for more effective action. Labour is promising “a ‘tidal wave’ of big housing reforms”…

Key prepares to backflip on Auckland housing

Written By: - Date published: 8:18 am, April 26th, 2016 - 126 comments

John Key is preparing the ground for a reversal on National’s refusal to do anything about Auckland’s housing crisis.

The problem with free market capitalism

Written By: - Date published: 11:16 am, January 9th, 2016 - 249 comments

This morning’s Herald contains a story about a young man who with a family gift has managed to purchase eleven houses over the past five years and can afford to pay World of Warcraft all day.

Parasite Drive; the NBR Rich List

Written By: - Date published: 10:50 am, July 31st, 2015 - 98 comments

The NBR’s annual list of the one percent is out. No surprises that the growing inequality in New Zealand is working well for the parasites at the top of the hill.

NRT: This is wrong

Written By: - Date published: 1:44 pm, July 13th, 2015 - 49 comments

“Auckland’s median house price rising a record 26 per cent to $755,000 over the past year..”. This is what a bubble looks like: when your house “earns” a top-end salary just by existing. And its a perfect example of why we need a capital gains tax.

Rushed policy is bad policy

Written By: - Date published: 7:10 am, May 19th, 2015 - 24 comments

National’s policy opens the door to more effective capital gains tax, thus irritating investors and their base, while probably not achieving anything in practice. The worst of both worlds. Bonus question – does this policy effectively underwrite losses when the property bubble bursts? Plus another bonus John Key lie!

Recent Comments