assets

Categories under assets

- privatisation (512)

Buyer beware

Written By: - Date published: 7:26 am, July 11th, 2012 - 70 comments

Are you keen to buy shares in Mighty River Power with a dividend return of 4% pre-tax? You can beat that in the bank, and paying off debt is a far better use of money. But say you’re still keen. What about the threat of Mighty River losing water rights or having to pay for them – will you buy in with that unresolved? Only nutters would take Key’s offer with that up in the air.

Asset sales & Brand Key becoming inextricably linked

Written By: - Date published: 7:08 am, July 10th, 2012 - 163 comments

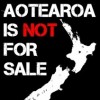

It’s getting almost sad, how desperate John Key is to sell our assets. He’s preparing to overturn convention and ignore the Waitangi Tribunal. Meanwhile, something on the order of 3,000 people a day are signing the referendum petition on asset sales. Key is now spending every day fighting fires on a highly unpopular policy. It’ll make for a sad legacy.

Can iwi stop asset sales?

Written By: - Date published: 1:12 pm, July 9th, 2012 - 38 comments

someone will have explained to Key that Maori have a solid claim to ownership of water that could affect asset sales. But someone else will have been in his other ear pointing out that picking a fight with Maori over the Treaty could be a good way to win some votes back and wedge the opponents of asset sales. Guess who he listened to.

Can you afford to buy shares?

Written By: - Date published: 9:27 am, July 5th, 2012 - 106 comments

The median household has $1700 in the bank – you couldn’t really term that savings, it’s operating cash. The Nats want us to fork out at least a grand a time to participate in each share float. That just doesn’t add up. Labour and the Greens are right, this isn’t an opportunity for ordinary people to invest, it’s a wealth transfer to the elite.

Even Bob Jones against asset sales

Written By: - Date published: 11:33 am, July 3rd, 2012 - 13 comments

Bob Jones may be a facetious old bugger but he knows a rort when he sees one. And asset sales are a rort: “Since the advent of the industrial revolution every business has sought the bliss of a monopoly. The competitive market economy denies that, except in unique situations, such as for example with our hydro electricity generating dams. So why sell them?”

When spin backfires

Written By: - Date published: 7:46 am, June 28th, 2012 - 41 comments

John Key has this weird defence when challenged over the number of Kiwis who will buy and retain shares in his asset sales, given that shareholders in Contact have plummeted from 225,000 at point of listing to 78,000 now. He cites a single article by a single journalist that says Contact is widely-held. Yesterday, Key quoted at length from the year-old article. And walked straight into David Shearer’s trap.

It’s for efficiency

Written By: - Date published: 8:58 am, June 26th, 2012 - 10 comments

Now we learn that directors’ fees are set to double after National sells or assets. Who pays for the fat-cats to get twice the cream for the same work? We do. Through higher power prices. It’s just another cost of privatisation that we all pay – despite the fact that Treasury reckons 95% of us won’t buy shares. No wonder 100,000 of us have signed the referendum petition already.

About that mandate

Written By: - Date published: 9:34 am, June 25th, 2012 - 156 comments

The Right would have us believe that the election was a referendum on asset sales and nothing else. Well, let’s take a closer look at the results of that ‘referendum’. Yeah, there’s no mandate there.

Nats order ACC to cut claimants

Written By: - Date published: 8:25 am, June 25th, 2012 - 54 comments

There is a sociopathic policy of the leadership at ACC, which sees staff financially incentivised to push long-term claimants off ACC leading to many of them going on the benefit rather than getting rehabilitation. Now, we have proof that this policy came right from the top. National ministers set arbitrary targets for the number of long-term claimants to be booted.

Bye bye Local Government

Written By: - Date published: 7:02 am, June 25th, 2012 - 42 comments

National’s record on local government is horrific: the lack of consultation as they rammed through the Supercity, the canning of ECAN, and continued suspension of democracy in Canterbury, the pushing of asset sales on an unwilling Christchurch.

And their latest attack – the Local Government Act 2002 Amendment Bill – will do significant damage to local democracy.

Nats’ pollster reveals asset sale plan

Written By: - Date published: 9:34 am, June 23rd, 2012 - 250 comments

National pollster and Herald columnist (I know!) David Farrar has revealed what National has up its sleeve for asset sales. No, I’m not talking about how they would put ‘mums and dads’ at the ‘front of the queue’, or any such nonsense. I’m talking about how they will attempt to de-legitimise the referendum or, alternatively, try to slam the sales through before it happens.

51% swindle averted

Written By: - Date published: 12:43 pm, June 21st, 2012 - 31 comments

It looks like the Nats’ attempt to pull a swindle on the meaning of “51% ownership” has been averted.

Nats’ unconstitutional looters’ bonus

Written By: - Date published: 7:42 am, June 21st, 2012 - 101 comments

So, National expects 200,000 people to buy shares when it hocks off our assets. Call me simple but there’s 4.4 million of us, 3.3 million adults. Seems like nearly all of us won’t buy shares. But here’s the real rub: they’re talking about a bonus for the elite who can afford to buy shares and hold on to them. A gift from us to them. And National’s got no legal right to do it.

Lose our assets, get higher power prices

Written By: - Date published: 1:41 pm, June 20th, 2012 - 48 comments

Darkhorse: Subsidising “capital markets” through asset sales

Written By: - Date published: 12:16 pm, June 20th, 2012 - 26 comments

Darkhorse writes amazingly insightful economic pieces on his ‘How Daft’ blog (the title gives you a clue as to what he thinks of the current state of affairs). The neoliberal experiment has been an abject failure by any rational measure. And there are alternatives. Darkhorse has given us permission to syndicate his posts, the originals are here.

The art of the possible

Written By: - Date published: 10:19 am, June 20th, 2012 - 60 comments

The Nats’ latest defence of asset sales is ‘if Labour doesn’t say they’ll buy them back,then they secretly agree with the sales’. Well, we would all like Labour to be able to make that commitment but, in the real world, that would be irresponsible . The incoming government is going to have to know how the bad a states the Nats leave the books in first.

Government wastewatch: PPPs

Written By: - Date published: 8:58 am, June 20th, 2012 - 4 comments

So, National is using a Public Private Partnership to build a school in Hobsonville. You’ve heard of PPPs. They, like all privatisation, are billed as somehow unleashing the magic of the market to reduce costs. But the reality is they turn the taxpayer into a dairy cow to be milked by private profiteers. And this school is no different: it’s costing us more, and the profiteers are racking it in.

Efficient market hypothesis

Written By: - Date published: 7:15 am, June 20th, 2012 - 87 comments

Bill English has attacked the MED numbers showing that private electricity companies are 12% more expensive than public ones saying that argument assumes “that hundreds of thousands of New Zealanders are systematically paying more for electricity than they could?”. Um… Has English heard of Powerswitch? That multi-million dollar government campaign is based on exactly that premise.

Remember when….

Written By: - Date published: 7:13 am, June 20th, 2012 - 67 comments

National put out a couple of bizarre press releases saying “remember when…” and recounting the asset sales under the 4th Labour Government. Apparently, the fact that they fucked up is reason for National to fuck up now. Well, remember when asset sales earned Labour a landslide defeat and nearly destroyed it in 1990, resulting in nine years in the wilderness?

Quarter of the way there

Written By: - Date published: 6:49 am, June 17th, 2012 - 66 comments

The Keep Our Assets Coalition has collected a phenomenal 80,000 signatures already, quarter of the way there. The signatures are pouring in. Collecting will get harder closer to the end but we’re going to get our referendum – if we all play our part. If you haven’t signed, or your friends and family haven’t, download the form and send it in.

How much will you pay for a assets ‘loyalty scheme’?

Written By: - Date published: 8:45 am, June 15th, 2012 - 17 comments

Most Kiwis won’t be able to afford to pay to buy what we already own when National sells our assets. When they sold Contact, only 5% of us got shares. You know who will buy the shares. Not your working families. Not Key’s new army of the unemployed. It’ll be the people who won big from National’s tax cuts. Now, to add insult to injury, Key is looking at making you and me pay a bonus to these people.

No asset sales without a referendum!

Written By: - Date published: 6:45 am, June 15th, 2012 - 137 comments

Peter Dunne would be really, really smart to back the Green amendment. He could still vote for the asset sales law but claim some moral high ground in saying ‘no sales until after the referendum’. Then, when the result is overwhelming opposition, he can do the commonsense shuffle and switch to opposing asset sales. It would be too late to stop the law passing but it might just save Dunne’s skin in 2014.

Asset sales – windfall capital gain for some, higher prices for the rest of us

Written By: - Date published: 5:04 pm, June 14th, 2012 - 33 comments

National rushed its Asset Sales Bill back into the House today. Stephen Joyce argued that it was to reduce debt, deepen capital markets, and invest in schools etc. One-off asset sales asset increase debt and if schools depend on flogging off more assets, we won’t get many more before the assets run out. The real reason for the sale is the middle one. Asset sales produce huge windfall capital gains for the buyers. They should be taxed.

Update: Bill went through 61-59 – 2 opposed from Maori Party. Cushion?

Nats to slam through asset sales

Written By: - Date published: 10:44 am, June 8th, 2012 - 59 comments

After hearing 150 oral submissions and receiving thousands more written ones, National’s members of the Finance and Select Committee shut down the Committee’s consideration of the evidence they had heard on the asset sales bill after just 1 hour. And why not? They had had Treasury write the Committee’s report before the submitters were even heard. Now, the legislation goes back to the House 6 weeks early to be slammed through its final stages.

Serco incompetence should put a halt to Wiri

Written By: - Date published: 9:00 am, June 7th, 2012 - 10 comments

A year in to its 10-year, $300 million contract, and Serco is making a real hash of running Mt Eden Prison. A second escape this week, along with two late releases, failure to meet drug testing targets and failure to report as agreed. And this is dealing with mostly only remand prisoners. Why are we spending $900m on an unneeded prison at Wiri for these clowns to run?

The beam in your eye

Written By: - Date published: 11:39 am, June 1st, 2012 - 53 comments

A tattered few on the Right are attempting to stir up an issue over the Greens using a bit of their leaders’ office budget on the citizens’-initiated referendum petition. The use of the $78,000 is completely within the rules and approved by the Speaker. The Greens, and the coalition, are helping us to keep our assets. Meanwhile, the Nats have budgeted $120 million to sell them. Who’s in the wrong?

Falling prison numbers

Written By: - Date published: 11:18 am, May 22nd, 2012 - 13 comments

It’s an interesting fact that the one area in which National is going against its traditional approach and moving towards what the experts advocate is prisons. And I think I know why. In education, health, welfare etc National’s ideological positions correspond with cutting spending. But ‘lock em up and throw away the key’ costs. When Bill English called prisons a “moral and fiscal failure” his emphasis was on “fiscal”.

Insult to injury

Written By: - Date published: 10:33 am, May 20th, 2012 - 37 comments

Not content with selling your assets off, National has put aside $120,000,000 of your money to tell you that you should like it.

And, just to add more salt to the wound, Bill English has described the cost as “low by market standards”.

The server will be getting hardware changes this evening starting at 10pm NZDT.

The site will be off line for some hours.

Recent Comments