tax

Categories under tax

- capital gains (104)

- gst (55)

Key the real target of Hobbit producers’ game

Written By: - Date published: 2:01 pm, October 24th, 2010 - 75 comments

The Hobbit ‘crisis’ is all about money. It’s about the producers of this long-troubled production, who are in financial difficulty, wanting to minimise their up-front costs. The mark in the con is the only one with cash to offer on the scale they need – the Prime Minister. He’s the one with the most to lose and the most ability to pay.

The Hobbit ‘crisis’: cui bono?

Written By: - Date published: 10:00 am, October 22nd, 2010 - 171 comments

Does anyone believe that a $660 million project moves countries over the ‘threat’ of a few actors wanting better standards? Would Jackson really betray NZ when Weta is based here, the casting is underway, and Hobbiton is built? Cui bono, this talk of ‘crisis’: how much will the Government fork over to appease the threat of foreign capital flight?

GST is going up today

Written By: - Date published: 1:23 pm, October 1st, 2010 - 62 comments

Remember how John Key used to talk about GST? Here is a video reminding everyone of the past before he did his usual flip-flop to favour the rich while increasing costs on most people. The GST increase and the consequent inflation will make almost everyone worse off unless they are wealthy enough to bribe the NACT’s.

The tax cut fizzer

Written By: - Date published: 9:05 am, October 1st, 2010 - 79 comments

For a long, time National and the Right have tried to convince us that all we need is tax cuts. You can understand why: their other policies are deeply unpopular, cutting taxes is a roundabout way of cutting public services, which they hate, and tax cuts deliver the most to their wealthy base. So will we see any actual benefits from the great tax swindle?

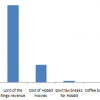

Tax Swindle Graph

Written By: - Date published: 8:34 am, September 30th, 2010 - 30 comments

Danyl over at DimPost has produced an excellent graph of the gains from National’s Tax Swindle. It uses the Government’s figures, it is generous in showing average rather than median incomes…

And it doesn’t look good for average kiwis.

No Right Turn on GST policy changes.

Written By: - Date published: 4:18 pm, September 27th, 2010 - 113 comments

No Right Turn has covered todays announcement about policy changes for GST on fruit and vegetables. Since it is pretty comprehensive we will reproduce the two posts here.

Spinning while the economy burns

Written By: - Date published: 1:12 pm, September 23rd, 2010 - 54 comments

The latest GDP figures are awful. the Reserve Bank had predicted 0.9% growth in the June Quarter. It came in at 0.2% – far worse than anyone expected and slower than population growth. The Key Government’s reaction? Deny there’s a problem and spin, spin, spin.

Neoliberalism bringing US to its knees

Written By: - Date published: 10:10 am, September 22nd, 2010 - 145 comments

A recent article in Canada’ MacLean’s magazine on the decline of public services in the US bears sobering links to what is happening in New Zealand. For three decades the neo-liberals have worked to starve public services to death with tax cuts for the rich. Now, the US is facing the consequences. New Zealand is on the same path just a little behind.

Key’s crocodile tears for teachers & doctors

Written By: - Date published: 9:59 am, September 20th, 2010 - 31 comments

John Key says he supports the teachers and junior doctors’ claims for a pay rise ‘but we simply don’t have the money’. Yet Key who is borrowing half a billion dollars this year for tax cuts for the wealthiest 9%. It isn’t a question of what the government can afford. It’s who matters to National – the rich do, teachers and doctors don’t.

Desperation from Banks team

Written By: - Date published: 12:29 pm, September 14th, 2010 - 32 comments

John Banks’ team really jumped the shark yesterday with their bizarre ‘poll tax’ attack on Len Brown. Banks claimed Brown was proposing a Thatcher-style poll tax to fund the Supercity instead of rates. Of course, Brown is proposing no such thing – he is saying we should look at replacing rates with income tax. Desperate, Banksie, desperate.

An economic plan for Christchurch

Written By: - Date published: 8:34 am, September 7th, 2010 - 59 comments

Christchurch needs a more ambitious rescue package than has been announced. Relying on EQC and insurance payouts is not enough. I would cancel the top bracket tax cuts due to come into force in a month saving half a billion dollars for a real economic revival plan The first step would be to grant emergency bridging funding to businesses closed by the quake so that they can continue to pay their workers

Lies, damn lies and desperation

Written By: - Date published: 7:45 am, August 26th, 2010 - 43 comments

It is time we got away from Mr Key’s focus on individual greed and got back to a focus on better hospital, schools and care for those who are struggling. David Clark argues that Key’s tax cuts are going to actually drive away our high-achievers while Mr Key is telling us it’s going to bring them home.

Income splitting – all bad?

Written By: - Date published: 11:41 am, August 25th, 2010 - 26 comments

Can income splitting be made to work? Funding people to stay at home with children isn’t such a bad idea…

Failure by the numbers

Written By: - Date published: 1:19 pm, August 24th, 2010 - 2 comments

Average number of people on the dole in the 21 months before Paula Bennett came to office – 22600

Average number of people on the dole in the 21 months since Paula Bennett came to office – 52200

Fiscal cost of extra people on the dole (welfare payments and lost tax) – approximately $1 billion

Money in this year’s budget for jobs initiatives – $31 million

Dunne: 80% of families will pay for income splitting & get nothing

Written By: - Date published: 9:28 am, August 17th, 2010 - 41 comments

Peter Dunne admits that income splitting will be available to only 310,000 families. The other 1.3 million will get nothing and be left to pick up the bill. Even of the lucky 19%, only a fraction will get big tax cuts. Most will get squat but a few families with big disparities between the partners’ incomes win big. Key has voted himself $22K of tax cuts so far, this would be another $9K. Will he be tempted?

More tax cuts for the elite coming

Written By: - Date published: 10:13 am, August 14th, 2010 - 42 comments

The Government is set to announce income splitting. Effectively, it allows a taxpayer to assign part of their income for taxation purposes to their partner on a lower income, the transferred income will be taxed at a lower rate. This will benefit a select group: wealthy nuclear families, especially those with a stay at home parent. An unaffordable, unfair, unnecessary policy.

I’m So Dizzy

Written By: - Date published: 8:00 am, August 9th, 2010 - 44 comments

The rate at which National have been spinning of late is giving me nausea. It can’t be long until they get to the Hitch-Hiker’s Guide scenario of declaring black to be white and getting run over on the nearest zebra crossing.

Brash blows budget on 2025 taskforce

Written By: - Date published: 9:21 am, July 16th, 2010 - 32 comments

I wonder if Dr Brash thought close scrutiny would have faded once he left the political limelight? He certainly sounds entirely comfortable with spending the tax taskforce’s entire three-year budget for his meeting fees as chairman in just one year, reported in today’s Dom Post: Dr Brash was paid $1200 a day to chair the […]

Money for tax cuts for rich, none for doctors’ pay

Written By: - Date published: 12:22 pm, June 21st, 2010 - 9 comments

Tony Ryall, like Anne Tolley, is facing a big fight over wages. The health budget is chock-full of cuts as it is and Ryall says there simply isn’t any money to give doctors pay rises as they and other workers face nearly 6% inflation next year. The government can find billions for tax cuts for the rich but not to pay doctors and teachers. Priorities.

Capital Fair Gains

Written By: - Date published: 8:54 am, June 15th, 2010 - 17 comments

At the moment the UK is debating a rise in Capital Gains Tax, from 18% to 40 or 50%. The debate is largely going on within the ruling Tory party, as their coalition partners the Liberal Democrats won several tax concessions so that they could create a GBP10,000 income tax free band. The proposed tax rise is to treat earned and unearned income the same.

From the ‘that’s never going to fly’ file

Written By: - Date published: 5:49 pm, June 11th, 2010 - 13 comments

Press release by Te Matarahurahu Hapu. A Ngapuhi tribal leader will be insisting at the Waitangi Tribunal hearings next week that a special tribal tax be imposed on all residents living within Ngapuhi boundaries. David Rankin, the Chairman of the Matarahurahu hapu…is proposing a flat tax rate of 9 % be applied to every person living within Ngapuhi’s tribal territory.

National: Irresponsible Economists and Liars

Written By: - Date published: 1:46 pm, June 10th, 2010 - 21 comments

National’s budget broke a number of economic promises. One that’s not been emphasised enough is their commitment to be fiscally neutral. Labour got New Zealand to $0 net government debt. Now we are headed back into the red again and National is making it worse, not to create jobs to help ordinary Kiwis through the recession, but to fund tax cuts for their rich mates.

Clamping down on trusts

Written By: - Date published: 10:55 pm, June 7th, 2010 - 33 comments

One of the most popular uses of trusts is to hide income for tax avoidance or evasion. So, I was happy to read about the IRD’s success in a recent court case against two surgeons. The court found these two very rich men had used trusts to avoid tax to the tune of $168,000. The case will have big ramifications, potentially shutting down one of the biggest tax rorts in the country.

Funnily enough, it really was about trust

Written By: - Date published: 11:47 pm, June 2nd, 2010 - 39 comments

I am ruling out selling Kiwibank at any point in the future/Asset sales are on the table for a second term

We won’t be raising GST/We’re raising GST

My trust is so blind I have no idea what’s in it/Owning a vineyard is great fun

Anyone else seeing a pattern?

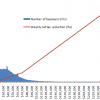

The tax swindle, visualised

Written By: - Date published: 11:13 pm, May 25th, 2010 - 75 comments

Here’s a graph of tax week’s tax swindle. I can’t do the property tax/rent increase part but here’s the net weekly effect of the income tax changes and the GST hike. These numbers match up with those provided by Treasury. The first 1.2 million taxpayers get less than a dollar a week. The first 3 million (of 3.4 million) get an average of $4.24 a week. The top 100,000 average $105 a week.

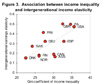

Nats floundering on inequality

Written By: - Date published: 7:16 am, May 25th, 2010 - 35 comments

Pointing out that a “rich get richer” budget is going to increase inequality in NZ seems to be making the Nats uncomfortable. Bill English tries to simply deny the facts. DPF tries to divert attention to “social mobility”. Lame efforts in both cases. The truth is that inequality isn’t on the Nats radar. They simply don’t care.

Tax cuts don’t cause growth

Written By: - Date published: 6:51 am, May 24th, 2010 - 30 comments

Tories claim that tax cuts “cause growth” in the economy – they “grow the pie”. But it’s rubbish. No honest review of the long term historical picture can sustain the claim. Tax cuts don’t cause growth.

The borrowed bunny

Written By: - Date published: 11:56 am, May 22nd, 2010 - 41 comments

It’s interesting to see how Irish’s ‘rabbit from a hat’ metaphor has taken off for describing this Budget. Some, like Tracey Watkins, are even using it positively. She needs to have a bit more of a think about what the rabbit from a hat is. The rabbit itself is nothing special. In fact, in this case it’s a borrowed bunny, despite the media’s tendency to portray tax cut as costless.

Domesticated

Written By: - Date published: 6:27 am, May 22nd, 2010 - 38 comments

Amongst all the budget reaction, there is a group of people that I don’t understand. They are the small group who are very well off, and who are nevertheless exulting about tax cuts that give them a few tens of dollars a week. Is your allegiance really purchased so cheaply?

Did the tax agenda deliver?

Written By: - Date published: 2:00 pm, May 21st, 2010 - 11 comments

In what it seems to think is an act of benevolence and economic genius, National has decided to borrow a pile of money, cut key public services, put up GST, and give me an extra $1000 a year. Will it make me work harder? Hell no. My partner and I are already paid plenty. If anything it will make us look at ways to reduce the amount we work.

Government Propaganda: Corrected

Written By: - Date published: 12:30 pm, May 21st, 2010 - 20 comments

There’s some useful scenarios to look at on the beehive’s tax site. They show how we all pay less tax, even after GST, and somehow the government also gets more tax. I love maths like that. But some of them seem to have something missing, so I thought I’d correct a couple of them…

Recent Comments